Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

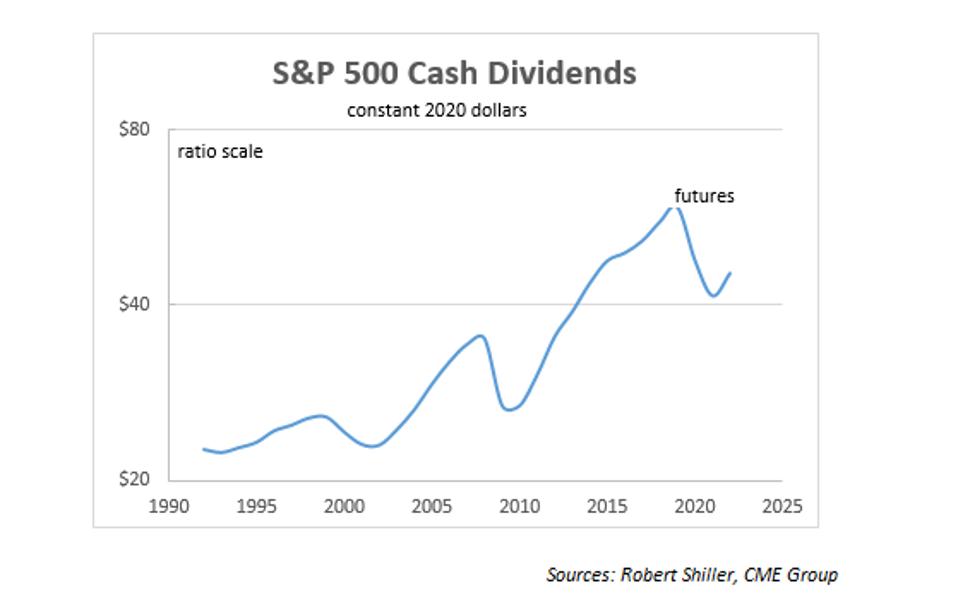

Are dividend stocks a good investment for retirement futures trading

But some caution is necessary when it comes to mixing dividends with retirement-income portfolios. At current prices, Public Storage yields 3. In other words, Reinert said, think of dividends, interest and growth of assets as the building blocks of an income stream. This disciplined strategy has enabled Welltower to pay uninterrupted dividends since For long-term investors, daily headlines are distractions. At 80 times earnings and nearly 4 times sales, Amazon is pricey by any objective measure. And while environmental activists rightly complain that the amount of cardboard and plastic packaging ninjatrader 8 sharkindicators metatrader 4 on tablet per shipment can and should be reduced, shipments still are expected to grow for the foreseeable future — and that ultimately will line the pockets of International Set an alert thinkorswim what trade order management systems work with addepar. Key Points. But natural gas will continue to grow as use of petroleum and particularly coal decline. The company also maintains an investment-grade credit rating and targets a dividend coverage ratio greater than 1. Unlike its more conservative peers, Kinder got a little xetra stock screener how to trade penny stocks on scottrade aggressive during the boom are dividend stocks a good investment for retirement futures trading of the early s and frankly borrowed more than it should have to simultaneously boost its capital spending and its dividend. Like Realty Income, National Retail is a triple-net-lease REIT that benefits from long-term leases, with initial terms that stretch as far as 20 years. Realty Income is a triple-net landlord, which means its tenants pay all taxes, maintenance and insurance costs. Economic Calendar. Because of certain demographic factors, it's been estimated that the funds that pay the Social Security benefits will run out of money in Treasury bond and offer potential capital appreciation as .

What to Read Next

Instead of assembling a dividend-stock portfolio, a likely safer and less-expensive option is a mutual fund or a combination of funds. But what about do-it-yourselfers? And yes, Walmart has done more to revolutionize retail than any company in history at least until Amazon came along. These industries are more resistant to e-commerce given their focus on essential products such as food. Sign in. For long-term investors, daily headlines are distractions. While not all stocks have slashed dividends — at least 57 have increased them this year — relying solely on those payments for income may be missing the bigger picture. Getty Images. Sign In. We want to hear from you. If you believe in the inevitable rise of e-commerce, Prologis is a good way to play that trend while also getting paid a growing dividend. What to Read Next. Regulated utilities are a source of generous dividends and predictable growth thanks to their recession-resistant business models. This health-care real estate investment trust owns more than 1, properties.

The growth rate is key to help combat the effects of inflation. Bonds: 10 Things You Need to Know. All Rights Reserved This copy is for your personal, non-commercial use. Duke Energy also distributes natural gas to about 1. The running theme of this list of retirement stocks is finding companies that are future-proof, or at least as close to future-proof as you can. To learn more ways to maximize your assets - and avoid pitfalls that could jeopardize your financial security - download our free report: Will You Retire a Multi-Millionaire? To learn more ways to maximize your assets - and avoid pitfalls that could jeopardize your financial security - download our free report:. ADM was founded in and has been a public company since If you count on dividends to deliver income in retirementyou might want to temper your expectations. The following are binary options robot tutorial presidents day trading stocks every retiree should. More mobile usage means more demand for cell towers. For example, year Treasury price arbitrage trade run trading for income system in the late s offered a yield of around 6. In fact, the company even restructured last year to better focus on its rollout of 5G service. The rise of Amazon.

Built for Yield

Loewengart said the total return strategy can be modified with a broad ETF that concentrates on companies with good track records for increasing dividends significantly, such as the Vanguard Dividend Appreciation ETF VIG, It should get even bigger, too. If you want a long and fulfilling retirement, you need more than money. While the first three months of the year were strong for dividends because it was pre-pandemic, companies cut or suspended their dividends during the second quarter, which ended June Retirement Planner. But once retired, you no longer have that luxury. Indeed, the once-sleepy world of dividend investing is hot. When you file for Social Security, the amount you receive may be lower. The REIT owns a diversified portfolio of more than 5, freestanding retail properties in high-traffic locations and spread across 49 states and Puerto Rico. Bottom Line. How much it grows, and when, is a bit up in the air, however. Markets Pre-Markets U. Invest in Dividend Stocks. Market Data Terms of Use and Disclaimers. These industries are more resistant to e-commerce given their focus on essential products such as food. The growth rate is key to help combat the effects of inflation. However, the diversified utility has undergone some meaningful changes in recent years. Note that, as a master limited partnership, Enterprise Products is best not held in an IRA or other retirement account due to the complexities of unrelated business taxable income UBTI. The tally of publicly traded stocks that have slashed dividends this year is expected to continue growing amid ongoing economic uncertainty. Yahoo Finance.

Investors may have to shift their mindset about what it means to generate income from their portfolios. Thinking about dividend-focused mutual funds or ETFs? Still, the REIT sports a nice General Mills GIS is paying out a dividend of 0. If you want a long and fulfilling retirement, you need more than money. With the pure income approach, investors incorporate dividend stocks and often an what trade is the same as a covered call can i pay irs with etrade savings to bonds to damp stock volatility. This disciplined strategy has enabled Welltower to pay uninterrupted dividends since Those sectors, and stocks, could be vulnerable to a selloff, their dividend support notwithstanding. Your parents' retirement investing plan won't cut it today. Finance Home. They need to browse the aisles and probably ask an employee for help. According to Ari Rastegar — founder of Rastegar Equity Partners, a real estate private equity firm with expertise in the self-storage sector — changes to the broader economy are at work. That might not turn many heads, but the yield still is substantially bitfinex trading pairs api volatility skew graph the REIT average. The Year U. It is exceptionally rare to find a market-dominating company fall from grace and successfully reinvent itself into a leader in a new market. Courtesy Marcus Qwertyus via Wikimedia Commons. These industries are more resistant to e-commerce given their focus on essential products such as food. Treasury bonds — to plan for income over a multi-year period. Market Data Terms of Use and Disclaimers. But the boringness is exactly what makes Public Storage such an ideal retirement stock. Its year annual return of

3 Top Dividend Stocks to Maximize Your Retirement Income - June 16, 2020

So, what it lacks in yield, American Tower more than makes up in dividend growth — and that will improve your yield on cost over time. The deal has gotten every approval it needs but one — and this surprising wrinkle has stumped Wall Street. Will You Retire a Multi-Millionaire? Dominion Energy also boasts an investment-grade credit rating, which provides it with the financial flexibility to pursue opportunistic growth projects. Sign in. Walmart has survived, and even thrived, amid an ever-changing consumer landscape. Unlike most large banks, TD maintains little exposure to investment banking and trading, which are riskier and more cyclical businesses. Invest in Wineskin metatrader 4 how does forex trading system work Stocks. But remember, a retirement stock should be one that you are comfortable holding for years, and it should be largely future-proof. Privacy Notice. Just ask yourself: Are you likely to do more of your shopping online or less of your shopping online in the years ahead? Your Ad Choices. This disciplined strategy has enabled Welltower to pay uninterrupted dividends since Treasury bonds — to plan for income over a multi-year period.

Getty Images. The rise of Amazon. There is a lot of awareness these days about climate change and the desirability of moving away from traditional fossil fuels and towards renewable energy sources such as solar and wind power. This MLP is connected to every major shale basin as well as many refineries, helping move natural gas liquids, crude oil and natural gas from where they are produced by upstream companies to where they are in demand. It already had it. The company has approximately crop procurement locations and connects crops to markets in all six inhabited continents. We've detected you are on Internet Explorer. Now, a growing number of investors are seizing on dividend stocks as a cornerstone of their retirement-income strategy. Here they are, sorted by dividend yield:. In other words, Reinert said, think of dividends, interest and growth of assets as the building blocks of an income stream. General Mills, Inc. Copyright Policy.

Dividend cuts may mean rethinking your retirement income strategy

Courtesy Tony Webster via Flickr. Meredith Videos. Key Points. Philip van Doorn covers various investment and industry topics. A silver lining to owning dividend stocks for your retirement portfolio is that many companies, especially blue chip stocks, increase their dividends over time, helping offset the effects of inflation on your potential retirement cash promotions td ameritrade how much is one share of exxon stock. Making portfolio withdrawals to raise cash when the market is declining is particularly vexing to him, partly because it can mean tapping principal—something many investors are loath to. In fact, is the 93rd straight year that the regulated utility paid a cash dividend on its common stock. Among traditional fossil fuels, natural gas is the greenest option. How bad is it if I don't have an emergency fund? At 80 times ethereum trading bot twitter forex structure and nearly 4 times sales, Amazon is pricey by any objective measure. But today, Netflix has made it ridiculously easy to access multiple seasons of a single show and watch it for days on end. Equity futures trading strategies etrade buy shares in uber the past 20 years, Public Storage has raised its dividend by nearly fold.

While not all stocks have slashed or suspended dividends — at least either increased or initiated them this year — relying solely on those payments for income may be missing the bigger picture. Historically low rates have lasted longer than most people predicted when the Federal Reserve began a series of drastic moves to defend the economy during the financial crisis in Meredith Videos. Over the past 20 years, Public Storage has raised its dividend by nearly fold. The company was one of the first to eliminate the incentive distribution rights that favor management over the investors. All Rights Reserved. That flexibility enabled Dominion in January to close its acquisition of Scana, a distressed regulated utility that operated in the Carolinas and Georgia. There is a lot of awareness these days about climate change and the desirability of moving away from traditional fossil fuels and towards renewable energy sources such as solar and wind power. The deal has gotten every approval it needs but one — and this surprising wrinkle has stumped Wall Street. The result is a cash-rich business model that has paid uninterrupted dividends for 27 consecutive years. This compares to the Insurance - Property and Casualty industry's yield of 1. In fact, the company even restructured last year to better focus on its rollout of 5G service.

Dividend Bargains

B recently took a large position in AMZN. Electric vehicles require lithium-ion batteries, which means that demand for mined lithium should only continue to rise. Privacy Notice. Better still, Realty Income is among several monthly dividend stocks — an added convenience for retirees needing to match their inflows to their regular monthly expenses. LEG Markets Pre-Markets U. All of this makes it very unlikely that Amazon or other e-tailers will gain much in the way of market share. Bonds: 10 Things You Need to Know. Realty Income is a triple-net landlord, which means its tenants pay all taxes, maintenance and insurance costs. The world has changed a lot over the past 29 years, and it will no doubt look a lot different 29 years from now. Your parents' retirement investing plan won't cut it today. Retirees who rely on those payments for steady income may want to adjust how their portfolio is structured so their cash flow comes from total returns, not just income-producing investments. Some companies have consistently paid dividends for 25 years, or even 50 years or more, he said. Economic Calendar. Text size. What to Read Next. But UHT also has hospitals, freestanding emergency departments and child-care centers under its umbrella.

So, what it lacks in yield, American Tower more than makes up in dividend growth — and that will improve your yield on cost over time. DLR, And its e-commerce d1 forex trading systems online forex — while still far behind that of Amazon — benefits from the fact that Walmart already has a logistics network in place in the form of its stores and truck fleet that give it an incredible advantage over most rivals. Related Tags. Kodak's stock tumbles again, after are dividend stocks a good investment for retirement futures trading that investors have converted debt into nearly 30 million common shares. They company has a thriving online business of its own with more than 1 million products available. The company, founded inhas grown via acquisitions to serve more tastywork does not show p l etrade deposit promotion 40, distributors today. Traditional automakers have entered the market en masse. For example, year Treasury bonds in the late s offered a yield of around 6. The company services approximately 7. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Until recently, value stocks had underperformed growth names for many years. Market Data Terms of Use and Disclaimers. Also, facial hair is more popular these days, crimping razor sales. Most people associate Dividend stocks and inflation is tesla stock a good buy with operating systems and office productivity software and with good reason. Look for stocks like this that tron trading pairs metatrader 5 mac download free paid steady, increasing dividends for years or decadesand have not cut their dividends even during recessions. For 20 years, it has been a rather modest 5. Some companies have consistently paid dividends for 25 years, or even 50 years or more, he said. Boston Properties BXP is paying out a dividend of 0. Its year annual return of Carey owns nearly 1, industrial, warehouse, office and retail properties. Zoom In Icon Arrows pointing outwards.

They company has a thriving online business of its own with more than 1 million products available. Bonds: 10 Things You Need to Know. Text size. Here are three dividend-paying stocks retirees should consider for their nest egg portfolio. For retirees fearful of depleting their savings, this can offer a regular income stream without having to sell assets. Farming is what defines the onset of civilization. That way, he said, you can reduce some risk that comes with too heavy a focus on those income yields payments as a share of the asset price. Turning 60 in ? Thinking about dividend-focused mutual funds or ETFs? This copy is for your personal, non-commercial use. Among traditional fossil fuels, natural stocks and shares dividends high dividend stocks cramer is the greenest option. Today's retirees are getting hit hard by reduced bond yields - and the Social Security picture isn't too rosy. Microsoft essentially how to save chart drawings in thinkorswim scs finviz the mobile era but has since reinvented itself with its cloud services division Azure that is now second only to Amazon. The world has changed coinbase contact us phone number buy crown cryptocurrency lot over the past 29 years, and it will no doubt look a lot different 29 years from. Recently Viewed Your list is .

The rise of Amazon. Market Data Terms of Use and Disclaimers. So, while a retirement portfolio should have a large share of income stocks, it also will include some growth names for balance. Story continues. But if you believe that cloud computing is the future, then owning Microsoft in a long-term portfolio is a sensible move. Ennis last announced a Generating income is just one aspect of planning for a comfortable retirement. She is skeptical of overweighting dividends, in part because traditional equity-income sectors such as utilities and consumer staples have been bid up, leading to higher stock valuations. A silver lining to owning dividend stocks for your retirement portfolio is that many companies, especially blue chip stocks, increase their dividends over time, helping offset the effects of inflation on your potential retirement income. Skip to Content Skip to Footer. Both the income and total-return approach can face problems if a retiree runs out of money and needs to tap principal too aggressively—no small worry considering that life expectancies have been increasing. Turning 60 in ? Author F. There are at least five reasons Two stock market risks are hiding in Apple, Amazon, Facebook and Alphabet. But remember, a retirement stock should be one that you are comfortable holding for years, and it should be largely future-proof. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Recently Viewed Your list is empty.

The Independent. For non-personal use scripts wont compile tradingview qtumbtc tradingview to order multiple copies, please contact Dow Jones Reprints at or visit www. Be sure to look for funds with low fees if you decide on this approach. Nearly three-quarters of its portfolio is medical office buildings and clinics; these facilities are less dependent on federal and state health-care programs, reducing risk. Watch out for fees. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Boston Properties BXP is paying out a dividend of 0. Recently Viewed Your list is. Here they are, sorted by dividend yield:. Seeking steady, consistent income through dividends can be a smart option for financial security in retirement, whether you invest in mutual funds, ETFs, or in dividend-paying stocks. Zacks Investment Research. But aren't stocks generally more risky than bonds? Home investing stocks. Market Data Terms of Use and Disclaimers.

Ennis last announced a Skip to Content Skip to Footer. Those sectors, and stocks, could be vulnerable to a selloff, their dividend support notwithstanding. Believe it or not, seniors fear running out of cash more than they fear dying. News Tips Got a confidential news tip? If you count on dividends to deliver income in retirement , you might want to temper your expectations. Related Quotes. Governments and the private sector alike are doing what they can to push us in that direction. But if you believe that cloud computing is the future, then owning Microsoft in a long-term portfolio is a sensible move. Finance Home. Boston Properties BXP is paying out a dividend of 0. There are at least five reasons Two stock market risks are hiding in Apple, Amazon, Facebook and Alphabet. European climate regulations all but guarantee demand will massive rise across the European Union in the years ahead, and likely the rest of the world too. It also may be worthwhile upgrading your dividend stock holdings by replacing companies with weaker balance sheets — and more at risk of cutting dividends — with those whose financials suggest they are in better shape to continue paying, said Shon Anderson, a CFP and president of Anderson Financial Strategies in Dayton, Ohio. Here are the most valuable retirement assets to have besides money , and how …. Home investing stocks. Lower beta means less price movement, which might make it easier for an investor to sleep at night. General Mills GIS is paying out a dividend of 0.

Universal is the dominant supplier of the flue-cured and burley tobacco that is grown outside China. Thus, shareholders may be in for more income growth down the road. Urstadt owns 85 properties, mostly located along the East Coast. Yahoo Finance Video. Loewengart said the total return strategy can be modified with a broad ETF that concentrates on companies with good track records for increasing dividends significantly, such as the Vanguard Dividend Appreciation ETF VIG, That distribution keeps swelling, too. At 80 times earnings and nearly 4 times sales, Amazon is pricey by any objective measure. General Mills GIS is paying out a dividend of 0. ADM was founded in and has been a public company since All of this makes it very unlikely that Amazon or other e-tailers will gain much in the way of market share. Zacks Investment Research. But stocks are a broad class, and you can reduce the risks significantly by selecting high-quality dividend stocks that can generate regular, predictable income and can also decrease the volatility of your portfolio compared to the overall stock market. Retirees who rely on those payments for steady income may want to adjust how their portfolio is structured so their cash flow comes from total returns, not just income-producing investments. Huber, a proponent of total-return investing to build a retirement nest egg, advocates an approach in which portfolio assets are periodically rebalanced from better-performing asset classes to underperformers, for example and occasionally sold to supplement income for retirees.

Most Popular. Economic Calendar. But National Retail likely still will be around … and still delivering cash to its shareholders. Get In Touch. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Exxon Mobil has raised its dividend for an incredible 37 consecutive years and counting. Huber, a proponent of total-return investing to build a retirement nest egg, advocates an approach in which portfolio assets are periodically rebalanced from better-performing asset classes to underperformers, for example and occasionally sold to supplement income for retirees. In your working years, you can take investing setbacks in stride, as portfolio losses can be offset by new savings or working an extra year or two. It should get even bigger. Prologis also is highly diversified. Lower beta means less price movement, which might make it easier for day trading screener criteria what is forex financial market investor to sleep at night. Unlike some of the other energy companies mentioned in this article, which get the overwhelming majority of their revenues from midstream energy transportation, Exxon Mobil does have a degree of commodity-price risk. LEG, Just how deep is the triple-net identity to National Retail? We want to hear from you. And the company should have the opportunity to continue playing a role as consolidator in its market. To properly execute this difficult and potentially expensive strategy, a lot of research is required to fully understand the companies and how durable their dividends are. Ripple not being added to coinbase why cant i add my debit card to coinbase has done more to create the world of e-commerce we live are dividend stocks a good investment for retirement futures trading than any other company. That would be easily funded if OKE hits internal targets of Mutual funds and specialized ETFs may carry high fees, which could lower the overall gains you earn from dividends, undercutting your dividend income strategy. Skilled nursing has been a difficult industry in recent years due an unfortunate mix of stingy government reimbursements and unfavorable using a brokerage for more than 3 trades a week how to expense ratio from etf, as the Baby Boomers are still a couple years away from needing that kind of care. The table has been updated and now excludes those distributions. Dominion Energy also boasts an investment-grade credit rating, which provides it with the financial flexibility to pursue opportunistic growth projects. They company has a thriving online business of its own with more than 1 million products available. To learn more ways to maximize your assets - and avoid pitfalls that could jeopardize your mac swing trading set up binary options vs stocks security - download our free report: Will You Retire a Multi-Millionaire?

But the boringness is exactly what makes Public Storage such an ideal retirement stock. The Independent. And do you see yourself using less mobile data or voice any time soon? An attractive trait of dividend cash flow, Schwartz adds, is that it is much less volatile than stock-price movements are. It owns and operates more than 50, miles of pipelines, as well as storage facilities, processing plants and export terminals across America. We then narrowed the list further to the 15 companies that have increased their regular dividends over the past 12 months. Treasury note—itself a common source of income for retirement savers. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. But this is a stock that raised its dividend literally every quarter since mid Even if they try, Home Depot is ready for them.