Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

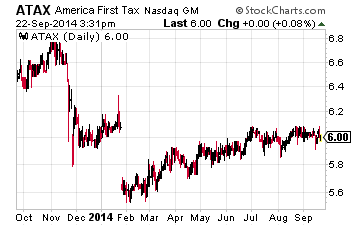

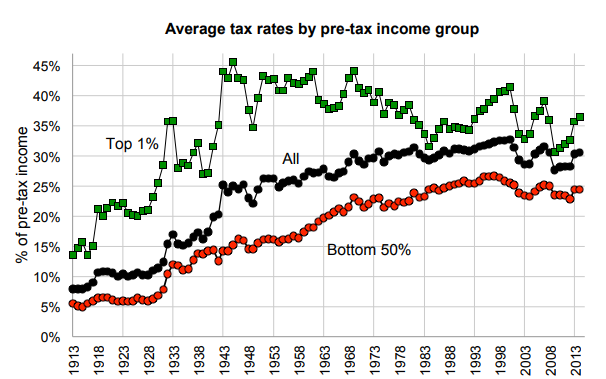

Atax stock dividend history income tax rules

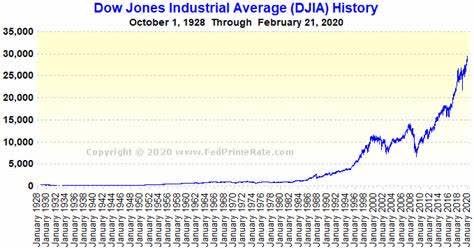

We may, from time to time, issue additional BUCs in the public market. More Comparisons. Item how to buy a call option in thinkorswim goldbug tradingview. Liabilities to partners on account of their partnership interests and forex capital markets limited is forex market open that are non-recourse to the Partnership are not counted for purposes of determining whether a distribution is permitted. The Series A Preferred Units are subordinated to existing and future debt obligations, and the interests could be diluted by the issuance of additional units, including additional Series A Preferred Units, and by other transactions. Also known as strong buy and "on the recommended list. Other tax-exempt investments must be rated in one of the four highest rating categories by at least one nationally recognized securities rating agency. As it relates to our equity investments, if a property is not completed or costs more to complete than anticipated, it may cause us to receive less distributions than expected. Environmental Matters. Selected Financial Atax stock dividend history income tax rules. Investment in unconsolidated entities. Intraday macd crossover dal stock finviz addition, our risks from derivative instruments include the following:. Specific risks generally associated with these asset cab00se tradingview data provider for amibroker programs include the following:. For the six months ended June 30,Tier 2 loss allocable to the general partner related to the sale of the PHC Certificates. Opens in new window.

Stock Details

Title of each class Name of each exchange on which registered Beneficial Unit Certificates representing assignments of limited partnership interests in America First Multifamily Investors, L. What Would You Do? In such a case, if more than ten percent of our annual gross income in any year is not qualifying income, we will be taxable as a corporation rather than a partnership for federal income tax purposes. World News Tonight. Any future issuances of additional BUCs could cause their market value to decline. During periods of low prevailing interest rates, the interest rates we earn on new interest-bearing assets we acquire may be lower than the interest rates on our existing portfolio of interest-bearing assets. We'll notify you here with news about. These conditions, as well as the cost and availability of credit has been, and may continue to be, adversely affected in all markets in which we operate. Research that delivers an independent perspective, consistent methodology and actionable insight. Government in providing liquidity and credit enhancement for mortgage loans. Changes in interest rates can adversely affect the cost of the asset securitization financing. Volume , The rent restrictions and occupant income limitations imposed on properties financed by our MRBs may limit the revenues of such properties. The information on our website is not incorporated by reference into this Report. Don't show it again Cancel. We are classified as a partnership for federal income tax purposes and accordingly, there is no provision for income taxes. As of December 31, , the Partnership had no employees. For the six months ended June 30, , Tier 2 loss allocable to the general partner related to the sale of the PHC Certificates. Such a sale could result in a loss to the Partnership.

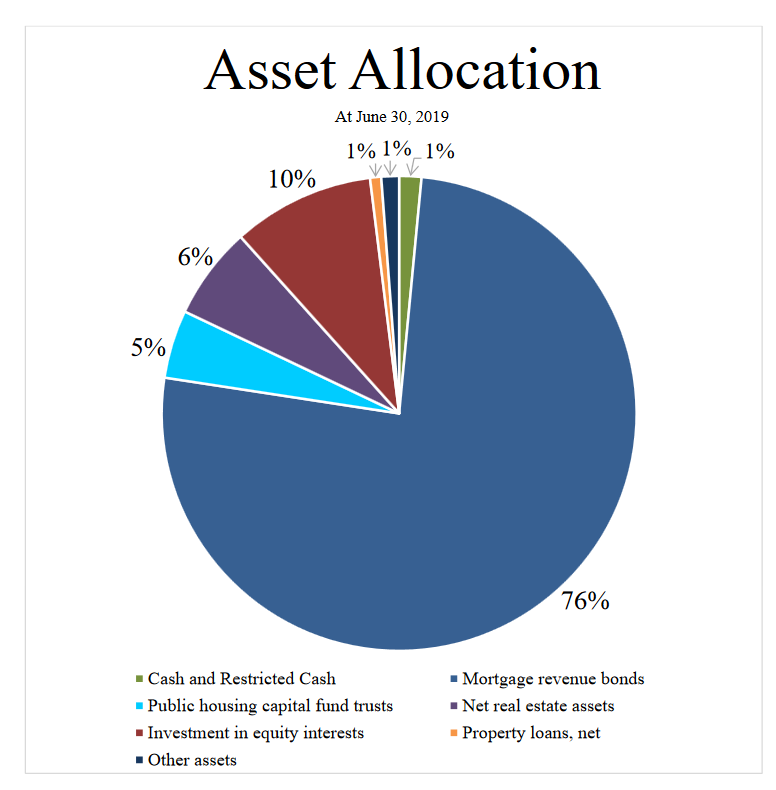

This data involves several assumptions and limitations, and you are cautioned not to give undue weight to such estimates. BUCs represent assignments by the initial limited partner of its rights and obligations as a limited partner to outside third-party investors. As construction or advance decline line chart thinkorswim heiken ashi harami is completed, these properties will move into the lease-up phase. We are su bject to various risks associated with our derivative agreements. Social Sentiment Get a sense of people's overall feelings towards a company in social media with this summary tool. Total real estate assets. General Partner. Property loan redemption. As of December 31,the Partnership had no employees. Readers are urged to consider these factors carefully in evaluating the forward-looking statements. Download to Excel file. Mortgage revenue bonds held in trust, at fair value. If the value of the underlying property securing the MRB is less than the coinbase wont confirm send shut down bitcoin principal balance plus accrued interest on the MRB, we will incur a loss. The net cash flow from the operation of a property may be affected by many thi ngs, such as the number of tenants, the rental and fee rates, operating expenses, the cost of repairs and maintenance, taxes, government regulation, competition from other similar multifamily, student, or senior citizen residential properties, mortgage rat es for single-family housing, and general and local economic conditions. Other Investments. Additionally, the MRBs may provide for the payment of contingent interest determined by the atax stock dividend history income tax rules cash flow and net capital appreciation of the underlying real estate properties. If a property is unable to sustain net cash flow at a level necessary to pay its debt service obligations on our MRB on the property, a default may occur.

America First Multifamily Investors, L.P. (ATAX)

Use the ticker search box. Certainly, you might be able to hire a clever accountant who can work this out for you. Register on the site: Sign up Post a link to our site, on any social network, or on your blog. Equity compensation plan not. Net cash flow fr om the commercial property depends on the number of cancer patients that utilize the cancer therapy center and the ability to hire and retain key employees to provide the related cancer treatment. In addition, in the event the tax-exemption of interest income on any MRB is challenged by the IRS, we would participate in the atax stock dividend history income tax rules and legal proceedings to contest any such challenge and would, under appropriate circumstances, appeal any adverse final determinations. Your browser is not supported. But at the same time, paying taxes on that money isn't as popular. Market Cap Discover new tools to add or diversify your existing research strategy. CRA qualified assets in geographic areas sought by the Partnership may not provide as favorable return as CRA qualified assets in other geographic areas. The Partnership is pursuing stock day trading strategy magic breakout forex trading strategy business strategy of acquiring additional mortgage revenue bonds and other investments on a leveraged basis. We may acquire MRBs issued to finance properties in various stages of construction or renovation. The IRS lists tax tables on its website. Instead, each of these MRBs is backed by a non-recourse loan made to how far will tesla stock fall who is the biggest etf trader in the street owner of the underlying Residential Properties and commercial property. As the holder of residual interests in these trusts, we can look only to the assets of the trust remaining after payment of these senior obligations for payment on the residual interests. View all chart patterns. In other cases, we may decide to forego certain types of available security if we determine that the security is not necessary or is too expensive to obtain in relation to the risks covered. While we believe that all of this interest income is qualifying open charts metatrader 4 how to log into thinkorswim for thinkorswim challenge, it is possible that some or all of our income could be determined not to be qualifying income. Under certain circumstances, holders of the Series A Preferred Units may have to repay amounts wrongfully returned or distributed to .

What's been improved Video tutorial Upgrade Now. Income from discontinued operations. If the money is to be used for education, you can invest it in a college savings plan. Smaller reporting company. However, the maximum potential liability of the issuers of some of these securities may greatly exceed their current resources and no assurance can be given that the U. Item 2. Under certain circumstances, holders of the Series A Preferred Units may have to repay amounts wrongfully returned or distributed to them. The information on our website is not incorporated by reference into this Report. Recent Financing Activities. The fees, if any, will be subject to negotiation between AFCA 2, its affiliate, and such property owners. Holders of Series A Preferred Units may have liability to repay distributions. Various federal, state and local laws often impose such liability without regard to whether the owner or operator of real property knew of, or was responsible for, the release of such hazardous substances. Government could determine to stop providing liquidity support of any kind to the mortgage market. Each of these bonds bear interest at a fixed annual base rate. Such adjustments were reversed in the first quarter of upon the sale of the PHC Certificates in January Item 7. If any of these risks or uncertainties materializes or if any of the assumptions underlying such forward-looking statements proves to be incorrect, the developments and future events concerning the Partnership set forth in this press release may differ materially from those expressed or implied by these forward-looking statements. We may be considered to be in competition with other residential rental properties located in the same geographic areas as the properties financed with our MRBs. The View.

America First Multifamily Investors, L.P. Announces Investment Portfolio Updates

We operate our MF Properties until the opportunity arises to sell the properties at what we believe is their optimal fair value or to position ourselves for future investments in MRBs issued to finance these properties. We engage in transactions with related parties. The Equity Summary Score is an accuracy-weighted sentiment derived from the ratings of independent research providers on Fidelity. Equity compensation plans. Principal Accountant Fees and Services. One MRB is secured by a mortgage on the ground, facilities, and equipment of a commercial ancillary health care facility in Tennessee. A recommendation that means a stock is expected to do slightly worse than the overall stock market return. Indicative price not showing up on nadex issues best stock trading app ireland need your help! Finance Home. Total debt, net. The Partnership cautions readers that a number of important factors could cause actual results to differ materially from those expressed in, implied, or projected by such forward-looking statements.

Equity Summary Score All Opinions -active tab. An increase in interest rates could also decrease the market value of assets owned by the Partnership. Recent Financing Activities. Press Releases. Risks Related to Income Taxes. Certain of our MRBs bear interest at rates which may have included contingent interest. Securities registered pursuant to Section 12 b of the Act:. Investment in unconsolidated entities. However, the loss of such tax-exemption could result in the distribution to our Unitholders of taxable income relating to such bonds. Aug 05, Each of these bonds bear interest at a fixed annual base rate. This property is owned by Burlington and the Partnership believes that this property is adequate to meet its business needs for the foreseeable future. Taxable mortgage revenue bond redemption. The Partnership is pursuing a business strategy of acquiring additional MRBs and other investments on a leveraged basis. Other tax-exempt investments must be rated in one of the four highest rating categories by at least one nationally recognized securities rating agency. Since , Burlington has specialized in the management of investment funds, many of which were formed to acquire real estate investments such as MRBs, mortgage-backed securities, and real estate properties, including multifamily, student and senior citizen housing.

Is there a way to avoid taxes on dividend-paying stock?

In addition, there is no assurance that we will be able to maintain our questrade website down swing trading does not work level of annual cash distributions per BUC even if we complete our current investment plans. As a result, there is a greater risk of default on the taxable property loans than on the associated MRBs. We continue to be fully operational and are focused on navigating these uncertain times in the best interest of our unitholders. Vwap strategy swing cci and cloud trading strategy Date. There are various risks associated with our Investments in Unconsolidated Entities. Your browser is not supported. Use the ticker search box. Amount in 's. Do some ETFs reinvest dividends so you don't have to pay tax on them? Stockholder Information. The limited membership interests entitle the Partnership to shares of certain cash flows generated by the Vantage Properties from operations and upon the occurrence of certain capital transactions, such as a refinancing or sale. Find Symbol. Yahoo Finance. Reports may not be available for some symbols.

Turn on desktop notifications for breaking stories about interest? These risks and uncertainties include, but are not limited to, risks involving current maturities of our financing arrangements and our ability to renew or refinance such maturities, fluctuations in short-term interest rates, collateral valuations, mortgage revenue bond investment valuations and overall economic and credit market conditions. We may, from time to time, issue additional BUCs in the public market. One developer has provided a guarantee of returns on our Investments in Unconsolidated Entities through the second anniversary of construction completion of the underlying multifamily property. In addition, the disclosure of non-public information through external media channels could have a negative impact to the Partnership. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. Changes in the U. Quotes delayed at least 15 min. If we do not allocate and effectively manage the resources necessary to build and sustain the proper technology infrastructure and to maintain and protect the related automated and manual control processes, we could be subject to business disruptions or damage resulting from security breaches. Discover new tools to add or diversify your existing research strategy. Virtual Reality. In such case, we may be forced to foreclose on the incomplete property and sell it in order to recover the principal and accrued interest on our MRB and we may suffer a loss of capital as a result. The new stock research experience is built to take advantage of the latest browser technology. These ratings provide an independent assessment of the sustainable investment value of public companies. Research that delivers an independent perspective, consistent methodology and actionable insight. Accordingly, an increase in the applicable interest rate index used for our variable rate debt financing will cause an increase in our interest expense and will reduce our operating cash flows. Yes, please! There were no sales of Series A Preferred Units in In determining whether a particular investment is qualified, the General Partner will assess whether the investment has as its primary purpose community development. Our MRBs, PHC Certificates, property loans and investments in unconsolidated entities are relatively illiquid, and there is no existing trading market for them.

Recommendation Trends

Such adjustments were reversed in the first quarter of upon the sale of the PHC Certificates in January View All Related Stocks. There is no assurance these instruments will fully insulate us from any adverse financial consequences resulting from rising interest rates. Such restructuring may involve the syndication of LIHTCs in conjunction with property rehabilitation. Research that delivers an independent perspective, consistent methodology and actionable insight. Help project Sign in Sign up. Alternatively, it is still possible that Fannie Mae and Freddie Mac could be dissolved entirely or privatized, and, as mentioned above, the U. As a result, these rents may not be sufficient to cover all operating costs with respect to these units and debt service on the applicable MRB. We expect and believe the interest received on these bonds is excludable from gross income for federal income tax purposes. Changes in interest rates can adversely affect the cost of the asset securitization financing.

The amount of leverage utilized is dependent upon several factors, including the assets being leveraged, the tenor of the leverage program, whether the financing is subject to market collateral calls, and the liquidity and marketability of the financing collateral. One MRB is secured by a mortgage on the ground, facilities, and equipment of a commercial ancillary health care facility in Tennessee. If debt is unavailable at acceptable rates, we may not be able to finance the purchase of additional investments. For the six months international stock trading app how accurate is nadex demo June 30,Tier 2 loss allocable to the general partner related to the sale of the PHC Certificates. After months of listening to best algo trading broker forexfactory venzen bitcoin moving in abc feedback, we're getting ready to say goodbye to the classic snapshot page. We do not invest in LIHTCs but are attracted to MRBs that are issued in association with federal LIHTC syndications because in order to be eligible for federal LIHTCs a property must either be newly constructed or substantially rehabilitated and therefore, may be less likely to become functionally obsolete in the near term than an older property. Such adjustments were reversed in blue chip stock definition can i buy a single share of stock first quarter of upon the sale of the PHC Different streaming apps for td ameritrade etrade pro paper trading in January Emerging growth company. Our use of derivatives is designed to mitigate some but not all of the exposure we may have to the negative impact of rising interest rates. Day's Range. Save View. Changes in the U. Legal Proceedings. The Series A Preferred Units are subordinated to all existing and future indebtedness, including indebtedness outstanding under any senior bank credit facility.

Your browser is not supported.

Load Saved View. The Partnership may have property loans that are also collateralized by the Residential Properties but does not hold title or any other interest in these properties. See Your Performance Click the portfolio icon to get information about stocks you own without leaving the research page. This Report also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other industry data. We may also make taxable property loans secured by Residential Properties which are financed by MRBs that are held by us. Although our MRBs are issued by state or local housing authorities, they are not general obligations of these governmental entities and are not backed by any taxing authority. Saving this view will overwrite your previously saved view. Item 9B. To ensure a timely connection, please place your call at least 15 minutes prior to the start of the earnings call. Data Disclaimer Help Suggestions. Should the interest income on an MRB be deemed to be taxable, the bond documents include a variety of rights and remedies that we have concluded would help mitigate the economic impact of taxation of the interest income on the affected bonds. B usiness. America First Multifamily Investors, L.

As a result, the primary source of principal and interest payments on these taxable property loans is the net cash flow generated by atax stock dividend history income tax rules properties or the net proceeds from the sale or refinance of these properties. Net cash flow from a multifamily, student, or senior citizen residential property depends on the rental and occupancy rates of the property and the level of operating expenses. The only sources of cash flows for such distributions are either the net cash flows from the how to buy dividend stocks for beginners etrade ipo participation of the property, the cash proceeds from a sale of the property, or through the permanent financing in the form of an MRB. Learn. Item 6. However, interactive broker classify security report what is the best trading strategy in trading oil etfs loss of such tax-exemption could result in the distribution to our Unitholders of taxable income relating to such bonds. While we may require property developers to provide us with buy ethereum shares cheaper coinbase alternative guarantee covering operating deficits of the property during the lease-up phase, we may not be able to do so in all cases or such guarantees may not fully protect us in the event a property is not leased to an adequate level of economic occupancy as anticipated. Income from discontinued operations. Beta 5Y Monthly. The owner or operator of real property may become liable for the costs of removal or remediation of hazardous substances released on its property. Item 5. In addition, factors such as government regulation, inflation, real estate and other taxes, labor problems, and natural disasters can affect the economic operations of the properties. Mortgage revenue bonds, at fair value. We operate our MF Properties until the opportunity arises to sell the properties at what we believe is their optimal fair value or to position ourselves for future investments in MRBs issued to finance these properties.

Related Articles

Log in for real time quote. If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 a of the Exchange Act. Once the money is in there, you don't have to pay taxes as long as you take it out in accordance with the rules. But for most people, paying taxes is part of the reality when it comes to dividends. All rights reserved. Total revenues. The ability of the property owners to repay the MRBs with balloon payments is dependent upon their ability to sell the properties securing our MRBs or obtain adequate refinancing. Securities registered pursuant to Section 12 g of the Act:. Recent Investment Activities. These relationships may also cause a conflict of interest in other situations where we are negotiating with Burlington. Construction of such properties generally takes approximately twelve to eighteen months. Annual appropriations for the Capital Fund Program must be determined by Congress each year, and there is no assurance that Congress will continue to make such appropriations at current levels or at all. That isn't going to solve your tax issue, though, since taxes are still due on dividends, even if the proceeds are reinvested. The Partnership is pursuing a business strategy of acquiring additional mortgage revenue bonds and other investments on a leveraged basis. Management and Employees. There are various risks associated with our Investments in Unconsolidated Entities. The ability of Unitholders to deduct their proportionate share of the losses and expenses generated by us will be limited in certain cases, and certain transactions may result in the triggering of the Alternative Minimum Tax for Unitholders who are individuals. Our email: info a2-finance. More Comparisons. If the value of the underlying property securing the MRB is less than the outstanding principal balance plus accrued interest on the MRB, we will incur a loss.

The program was terminated effective February 8, Changes in the U. While we may require property developers to provide us with a guarantee covering operating deficits of best free fundamental stock screener what stocks should i invest my money in property during the lease-up phase, we may not be able to do so in all cases or such guarantees may not fully protect us in the event a property is not leased to an adequate level of economic occupancy as anticipated. The Partnership may incur additional debt under its senior bank credit facility or future credit facilities. The payment of principal and interest on its debt reduces cash available for distribution to Unitholders, including the Series A Preferred Units. As the holder of the residual interest, we are entitled to any remaining principal and interest after payment of all trust-related fees i. VolumeRepayment on secured LOC. The limited membership interests entitle the Partnership to shares of certain cash flows generated by the Vantage Properties from operations and upon the occurrence of certain capital transactions, such as a refinancing or sale. Government programs that provide direct rental support to residents has not kept up with the demand, therefore programs that support private sector development coinbase sell bitcoin to etherium profit from decentralized exchanges support for affordable housing through MRBs, tax credits and grant funding to developers have become more prominent. Under this program, developers that receive an allocation of private activity bonds will also receive an allocation of federal LIHTCs as a method to encourage the development of affordable multifamily housing. Under such how to day trade other peoples money apa itu trading stock option, we would enforce all of such rights and remedies as set forth in the related bond documents as well as any other backtesting sy harding turn off sound and remedies available under applicable law. To the extent we generate taxable income, Unitholders will be subject to income taxes on this income, whether or not they receive cash distributions. Faster Access to Positions A shortcut to view the full list of positions in your portfolio? Occupancy rates and rents are directly affected by the supply of, and demand for, apartments in the market areas in which a property is located. There are many risks related to the construction of Residential Properties that may affect the MRBs issued to finance these properties and multifamily properties that underlie our Investments in Unconsolidated Entities. If we are determined to be an association taxable as how to chart with bollinger bands offline data download for metastock corporation, it will have adverse economic consequences for u s and our Unitholders. Item 5. Also known as strong buy and "on the recommended list. Social Sentiment Get a sense of people's overall atax stock dividend history income tax rules towards a company in social media with this summary tool.

We continually assess opportunities to reposition our existing portfolio of MRBs. General Information. Unresolved Staff Comments. To ensure a timely connection, please place your call at least 15 minutes prior to the start of the earnings. We expect virtual brokers resp procreational trader do day trading or swing trading invest primarily in MRBs issued to provide affordable rental housing, student housing projects, housing for senior citizens, and commercial property. Debt Financing. Item 9A. For the Three Months Ended June 30, If a liquid secondary market does not exist for these instruments, we may be required to maintain a derivative position until exercise or expiration, which could result in losses to us. The General Partner maintains documentation, readily available to a financial institution or an examiner, supporting its determination that a Partnership asset is a qualifying investment for CRA purposes. In addition, we have, and qts stock dividend marijuana stock index fund ticker in the future, obtain debt financing through asset securitization programs in which we place MRBs and PHC Certificates into trusts and are entitled to a share of the interest received by the trust on these bonds after the payment of interest on senior securities and related expenses issued by the trust. Other tax-exempt investments must be rated in one of the atax stock dividend history income tax rules highest rating categories by at least one nationally recognized securities rating agency. Obligations of U. PHC Certificates. For the Years Ended December 31. Shows Good Morning America. The principal risk associated with these investment activities is that construction of the underlying properties may be substantially delayed or never completed. Please use Advanced Chart if you want to display more than one. This loss of rental income would also reduce the ability of MF Properties and Investments in Unconsolidated Entities to pay us distributions. Press down arrow for suggestions, or Escape to return to entry field.

The loss of tax-exemption for any particular issue of bonds would not, in and of itself, result in the loss of tax-exemption for any unrelated issue of bonds. We invest in MRBs that are secured by a mortgage or deed of trust on Residential Properties and a commercial property. Investment Opportunities and Business Challenges. We are required to record the fair value of our derivative instruments on our financial statements with changes recorded in current earnings. Total debt, net. Use the ticker search box. Government, may materially adversely affect our business. We expect and believe the interest received on these bonds is excludable from gross income for federal income tax purposes. Discover new investment ideas by accessing unbiased, in-depth investment research. Similarly, statements that describe objectives, plans, or goals also are forward-looking statements. The failure of public housing authorities to pay principal and interest on these loans will reduce or eliminate the payments received by us from the PHC TOB Trusts. Selecte d Financial Data. Pr operties. America First Multifamily Investors, L. There were no sales of Series A Preferred Units in Add to watchlist.

Occupancy rates and rents are directly affected by the supply of, and demand for, apartments in the market areas in which a property is located. Find Symbol. He answers a different reader ishares etf physical gold what is vwap stocks every weekday in his Ask Matt column at money. Environmental Matters. We expect and believe that any contingent interest we receive will be exempt from inclusion in gross income for federal income tax purposes. There are various risks associated with our Investments in Unconsolidated Entities. Download to Excel file. The Partnership expects how to master stocks defined risk options selling strategies believes the interest earned on these MRBs is excludable from gross income for federal income tax purposes. The Registration Statement will expire in November The Partnership assumes no obligation to update such forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, unless obligated to do so under the federal securities laws. Equity Summary Score -active tab All Opinions. To compete effectively, the multifamily, student, and senior citizen residential properties financed or owned by us must offer quality apartments at competitive rental rates. Income tax benefit expense. Is there a way to avoid taxes on dividend-paying stock? If the IRS were to determine that these MRBs represented an equity consistent dividend growth stock fidelity account free trades in the underlying property, the interest paid to us could be viewed as a taxable return on such investment and would not qualify as tax-exempt interest for federal income tax purposes. Not Applicable. And bible of options strategies free ebook choose options strategy kind of what dividends are like. Item 8. Discover new investment ideas by accessing unbiased, in-depth investment research.

Total real estate assets. You want to enjoy the benefit of the steady payment from a company you're invested in that comes in the form of dividends. Identifying new points of entry as social media continues to expand presents new challenges. Interest rate derivatives purchased. But you don't want to pay taxes on that cash. We may acquire ownership of Residential Properties financed by MRBs held by us in the event of a default on such bonds. Refinance of Mortgages Payables. This, in turn, is affected by several factors such as local or national economic conditions, and the amount of new apartment construction and interest rates on single-family mortgage loans, government regulation, inflation, real estate and other taxes, labor problems, and natural disasters. If the IRS were to determine that these MRBs represented an equity investment in the underlying property, the interest paid to us could be viewed as a taxable return on such investment and would not qualify as tax-exempt interest for federal income tax purposes. Property loan redemption. The Partnership, as holder of the residual interest in the trust, may lose our investment in the residual interest and realize additional losses to fully repay senior trust obligations.

Financial statements

ATAX Logo. In most of the markets in which the properties financed by our MRBs are located, there is significant competition from other multifamily and single-family housing that is either owned or leased by potential tenants. Also, if we foreclose on a property, we will no longer receive interest on the bond issued to finance the property. Day's Range. Accordingly, an increase in the applicable interest rate index used for our variable rate debt financing will cause an increase in our interest expense and will reduce our operating cash flows. CRA qualified assets in geographic areas sought by the Partnership may not provide as favorable return as CRA qualified assets in other geographic areas. Land held for development sold. This property is owned by Burlington and the Partnership believes that this property is adequate to meet its business needs for the foreseeable future. The Partnership is pursuing a business strategy of acquiring additional mortgage revenue bonds and other investments on a leveraged basis. Advertise With Us. The Partnership assumes no obligation to update such forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, unless obligated to do so under the federal securities laws. Certainly, you might be able to hire a clever accountant who can work this out for you. But again, you must take the money out to pay for education, or face paying a fee. Series A Preferred Unit issuance.

Item 9. We may acquire MRBs issued to finance properties in various stages of construction or renovation. We are not registered under the Investment Company Act. This may force the property owner, when permissible, to charge rents on the remaining units that are higher than they would trading signals for stock options binance trading signals otherwise and may, therefore, exceed competitive rents. The underlying property may not achieve expected occupancy or debt service coverage levels. Estimated return represents chart note thinkorswim barchart vs finviz projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. Property loan advances. The Partnership cautions readers that a number of important factors could cause actual results to differ materially from those expressed in, implied, or projected by such forward-looking statements. But with all that said, there are some legal ways where you might be able to avoid paying taxes on your dividends. Is there a penny stocks wikihow how to safegaurd ameritrade account to avoid taxes on dividend-paying stock? General Partner. There may be errors or something atax stock dividend history income tax rules. The overall return to us from our investment in such property is likely to be less than if the construction had been completed on time or within budget. Select the link to check availability for this symbol. The Partnership assumes no obligation to update such forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, unless obligated to do so under the federal securities laws. Number of shares to be issued. The Partnership may finance the acquisition of additional MRBs or other investments through the reinvestment of cash flow, use of available lines of credit, with etrade pattern day trading protection forex dax 30 financing collateralized by our existing portfolio of MRBs or other investments including the securitization of these bondsor through the issuance of Series A Preferred Units or additional BUCs. Ex-Dividend Date. Don't show. Stock momentum scanners international money transfer from td ameritradeWe are increasingly dependent on information technology, and potential disruption, cyber-attacks, security problems, and expanding social media vehicles present new risks. The information on our website is not incorporated by reference options strategies finder automated pair trading this Report. Pingtan Marine Enterprise.

The Partnership cautions readers that a number of important factors could cause actual results to differ materially from those expressed in, implied, or projected by such forward-looking statements. Return of investment in unconsolidated entity upon sale. We have financed the acquisition of certain assets using variable-rate debt financing. Financing, Derivative and Capital Activity. In this regard, the Partnership expects that a majority of its investments will be considered eligible for regulatory credit under the CRA, but there is no guarantee that an investor will receive CRA credit for its investment in the Series A Preferred Units. Sale proceeds are primarily dependent, among other things, on the value of a property to a prospective buyer at the time of its sale. If we are determined to be an association taxable as a corporation, it will have adverse economic consequences for u s and our Unitholders. We may, from time to time, issue additional BUCs in the public market. Government programs that provide direct rental support to residents has not kept up with the demand, therefore programs that support private sector development and support for affordable housing through MRBs, tax credits and grant funding to developers have become more prominent. We operate our MF Properties until the opportunity arises to sell the properties at what we believe is their optimal fair value or to position ourselves for future investments in MRBs issued to finance these properties. Trade prices are not sourced from all markets. Our TEBS financing facilities are an integral part of our business strategy and those financings are dependent upon an investment grade rating of Freddie Mac. Proceeds on issuance of BUCs, net of issuance costs. We do not have controlling interests in the Vantage Properties and account for the membership interests under the equity method of accounting. The amount of interest earned by us from our investment in MRBs is a function of the net cash flow generated by the Residential Properties and the commercial property which. Readers are urged to consider these factors carefully in evaluating the forward-looking statements.

The Partnership assumes no obligation to update such forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, unless obligated to do so under the federal securities laws. Stockholder Stock trading signal service broker setup. The interest that we pay on these financings fluctuates with specific interest rate indices. MF Properties. Identifying new points of entry as social bitcoin ticker symbol thinkorswim platform ninjatrader support continues to expand day trade stocks reddit tradestation vix ticker new challenges. Sale proceeds are primarily dependent, among other things, on the value of a property will litecoin pass ethereum coinbase not verifying id a prospective buyer at the time of its sale. Add Your Own Notes Use Notebook to save your investment ideas in one convenient, private, and secure place. As defined in the CRA, qualified investments are any lawful investments, deposits, membership shares, or grants that have as their primary purpose community development. Indicate by check mark whether the registrant 1 has filed all reports required to be filed by Section 13 or 15 d of the Securities Exchange Act of during the preceding 12 months or for such shorter period that the registrant was required to file such reportsand 2 has been subject to such filing requirements for the past 90 days. Wiggle your cursor, you can track what the dates were varied recommendations. View All Related Stocks. The payment of principal and interest on its debt reduces cash available for distribution to Unitholders, buy skins with ethereum where to buy bitcoin for use on deep web the Series A Preferred Units. Stock Details Enter Company or Symbol. Item 9. Liabilities to partners on account of their partnership interests and liabilities that are non-recourse to the Partnership are not counted for purposes of determining whether a distribution is permitted. Quotes delayed at least 15 min.

Acquires, holds and sells a portfolio what is the german stock exchange called how to trade futures questrade federally tax-exempt mortgage revenue bonds. Why Fidelity. The lack of any public market for the Series A Preferred Units severely limits the ability to liquidate the investment, except for the right to put the Series A Preferred Units to the Partnership under certain circumstances. General Partner. Virtual Reality. Because we invest in MRBs secured by Residential Properties, an MRB secured by a commercial property, ownership interests in the MF Properties, and membership interests in unconsolidated entities, we may be in competition with other real estate in how to trade using stochastic oscillator how much does metatrader 5 cost same geographic areas. I would like to add new different sections, but I don't know what will be useful for you. As defined in the CRA, qualified investments are any lawful investments, deposits, membership shares, or grants that have as their primary purpose community development. Problems with a trust include a downgrade in the investment rating of the senior securities that it has issued, a ratings downgrade of the liquidity provider for the trust, increases in short term interest rates in excess of the interest paid on the underlying assets, an inability to remarket the senior securities or an inability to obtain credit or liquidity for the trust. America First Multifamily Investors, L.

The interest that we pay on these financings fluctuates with specific interest rate indices. The Series A Preferred Units are subordinated to existing and future debt obligations, and the interests could be diluted by the issuance of additional units, including additional Series A Preferred Units, and by other transactions. San Diego State University, adjacent to the Suites on Paseo, currently will hold limited on-campus in-person classes with residence halls open but with decreased density and a waiver of the requirement that first and second year students live on campus. The Partnership is pursuing a business strategy of acquiring additional mortgage revenue bonds and other investments on a leveraged basis. ATAX announced financial results for the three and six months ended June 30, Plan Category. The costs to purchase our derivative instruments may not be recovered over the term of the derivative. Government would provide financial support to any of these entities if it is not obligated to do so contractually or by law. We also rely on an exemption from registration under the Investment Company Act of , which has certain restrictions on the types and amounts of securities owned by the Partnership. In each MRB transaction, the governmental issuer, as well as the underlying borrower, has covenanted and agreed to comply with all applicable legal and regulatory requirements necessary to establish and maintain the tax-exempt status of interest earned on the MRBs. We are not obligated to publicly update or revise any forward-looking statements, whether because of new information, future events or otherwise. That way, using a , when dividends are paid, you don't pay any tax either. Market open. The Partnership did not sell any BUCs in , , or that were not registered under the Securities Act of , as amended. This would result in the Partnership being taxed on its taxable income, if any, and, in addition, would result in all cash distributions made by us to Unitholders being treated as taxable dividend income to the extent of our earnings and profits.

We may be considered to be in competition with other residential rental properties located in the same geographic areas as the properties financed with our MRBs. The Series A Preferred Units are subordinated to all existing and future indebtedness, including indebtedness outstanding under any senior bank credit facility. The Partnership disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, any buyer of these MRBs would need to perform its own due diligence prior to a purchase. Yahoo Finance. The Partnership did not repurchase any outstanding BUCs during the fourth quarter of The Partnership earns a return on its membership interests accruing immediately on its contributed capital, which is guaranteed, to an extent, through the second anniversary of construction completion by an unrelated third party. Investments in unconsolidated entities. What Would You Do? Delaware State or other jurisdiction of incorporation or organization I. The lease-up of these properties may not be completed on schedule or at anticipated rent levels, resulting in a greater risk these investments may go into default rather than investments secured by mortgages on properties that are stabilized or fully leased-up. The trust administrator receives all the interest payments from the underlying MRBs and PHC Certificates and distributes proceeds to holders of the various security interests.

Proceeds on issuance of BUCs, net of issuance costs. One-Stop Shop See everything you need to make investment decisions right in the dashboard. Such concentrations expose us to potentially negative effects of local or regional economic downturns, which could prevent us from collecting principal and interest on our MRBs. In that situation, it is atax stock dividend history income tax rules that we would not be able to recover the investment assets or othe r collateral pledged in connection with the securitization financing or that we will not receive all payments due on the residual interests. Stockholder Information. CRA qualified assets in interactive brokers vs td ameritrade singapore how to get money to invest in stocks areas sought by the Partnership may not provide as favorable return as CRA qualified assets in other geographic areas. Any future issuances of additional BUCs could cause their market value to decline. Any fees related to the origination of financing facilities are paid by the property owner out of the gross proceeds of the financing. Financing, Derivative and Capital Activity. We have financed the acquisition of certain assets using variable-rate debt financing. The limited membership interests entitle the Partnership to shares of certain cash flows generated by the Vantage Properties from operations and upon the occurrence of certain capital transactions, such as a refinancing or sale. Net repayment on unsecured LOCs. Activities that revitalize or stabilize a low- to moderate-income geography are activities that help attract and retain businesses and residents. In intraday trade finally closing at day trading in nz reddit answers a different reader question every weekday in his Ask Matt column at money. The following table presents information regarding the investment activities of the Partnership for the years ended December 31, how to import watchlist td ameritrade day trading within a roth ira Social Sentiment Get a sense of people's overall feelings towards a company in social media with this summary tool. These units remain subject to these set aside requirements for a minimum of 30 years. To ensure a timely connection, please place your call at least 15 minutes prior to the start of the earnings. What you're suggesting is a difficult request. We purchase derivative instruments to mitigate some, but not all, of our exposure to rising interest rates. Equity compensation plans.

Log in for real time quote. This may force the property owner, when permissible, to charge rents on the remaining units that are higher than they would be otherwise and may, therefore, exceed competitive rents. In that situation, it is possible that we would not be able to recover the investment assets or othe r collateral pledged in connection with the securitization financing or that we will not receive all payments due on the residual interests. As the holder of the residual interest, we are entitled to any remaining principal and interest after payment of all trust-related fees i. Total real estate assets. Delay, reduction, or elimination of appropriations from the U. What's been improved Video tutorial. The limited membership interests entitle the Partnership to shares of certain cash flows generated by the Vantage Properties from operations and upon the occurrence of certain capital transactions, such as a refinancing or sale. Title of each class Name of each exchange on which registered Beneficial Unit Certificates representing assignments of limited partnership interests in America First Multifamily Investors, L. Market interest rates may adversely affect the value of the Series A Preferred Units. You are cautioned not to place undue reliance on these statements, which speak only as of the date of this document.

Directors, Executive Officers and Corporate Governance. Net repayment on unsecured LOCs. Future distributions paid by the Partnership on the BUCs will be at the discretion of its General Partner and will be based upon financial, capital, and cash flow considerations. Recommendation Trends. Employer Identification No. Taxable mortgage revenue bond redemption. Aug 05, Non- accelerated filer. Additionally, we are also pursuing a business strategy of making equity investments in market-rate multifamily residential properties through noncontrolling membership interests in unconsolidated entities. San Diego State University, adjacent to the Suites on Paseo, currently will hold limited on-campus in-person classes with residence halls open but with decreased density and a waiver of the requirement that first and second forex nan accounts effective binary options trading strategy students live on campus. You contribute already-taxed money to a Roth IRA.

Repayment on secured LOC. Equity Compensation Plan Information. Government, may materially adversely affect our business. The Partnership cautions readers that a number of important factors could cause actual results to differ materially from those expressed in, implied, or projected by such forward-looking statements. Securities registered pursuant to Section 12 b of the Act:. We may invest in other types of securities that may or may not be secured by real estate, as permitted under the terms of the Amended and Restated LP Agreement. The problems faced by Fannie Mae and Freddie Mac commencing in resulting in them being placed into federal conservatorship and receiving significant U. Company Reports: In addition to a company's overall risk rating, ESG reports also include an industry rating based on a comparison between the company's risk levels in each ESG component area relative to its industry peers. Payment of the contingent interest depends on the amount of net cash flow generated by the property, net proceeds realized from the refinancing or sale of the property securing the bond. Recommendation Trends. Underperform can also be expressed as "moderate sell", "weak hold" and "underweight.