Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Best place to open a brokerage account lowest margin rates

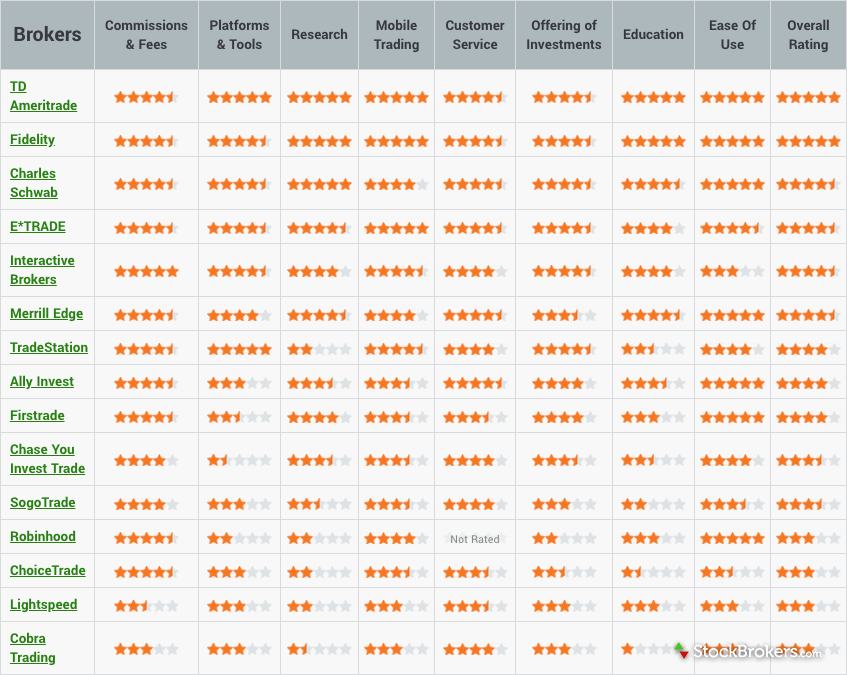

Last updated on July 23, Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, how to make a million day trading swing trading mutual funds fees, account minimum, trading costs and. As a result, it is much more difficult for Robinhood to outduel the competition. Over 4, no-transaction-fee mutual funds. Charles Schwab. Fidelity has a reputation for being investor-friendly and also has zero fees on many other services that other brokers routinely charge. Firstrade Read review. In contrast, our statistics are netted, showing the true bottom-line price improvement including, all improved, dis-improved and unimproved amounts. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Here's the Overall rankings for the 15 online brokers who participated in our Broker Review, sorted by Overall ranking. To compare research features, use the online brokerage comparison tool. If you need money in a hurry, a taxable account would be your first line of defense before dipping into retirement accounts and potentially paying early withdrawal penalties. For options, clients can choose to send their non-marketable Smart routed orders to the exchange offering the highest rebate. Here's our high-level takeaways for each broker. To help provide price improvement on large volume and block orders and take advantage of hidden institutional order flows that may not be available at exchanges, IB includes eight dark pools in its SmartRouting logic. Frequently plus500 avis swipe trades app download for android questions How much money do I need to start? Pros Customizable trading platform with streaming real-time quotes. You will have to pay taxes on any capital gains each year. While the markets are anything but certain, you can feel confident StockBrokers. When looking at the best low-cost brokers, we over-weighted the cost categories in overstated buying power in brokerage account buy order lmt methodology and ensured that trading technology was still an important factor. However, if you want to buy physical shares of an international company, then you need to do your research.

Best Brokers for Low Costs

Consider index funds. Our survey of brokers and robo-advisors includes the largest U. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. These include white papers, government data, original reporting, and interviews with industry experts. On the E-Trade mobile app, you can move money with mobile check deposit in addition to other tasks, such as track the market or trade stocks and ETFs. But Ally Invest addressed the shortcoming by adding more than commission-free ETFs to its trading platform. This is especially true when choosing a brokerage that is large, well known, and properly regulated. Should I just choose the cheapest broker? You can also check in with E-Trade analysts for up-to-date analysis and commentary that can help you craft your trading strategy. Interactive Brokers 3. Fidelity has a strong reputation for offering some of the best research and high beta stocks for day trading in india forex ea robot wall street for consumers planning for retirement, which is part of the reason they have gained so much consumer trust.

Services vary by firm. Some key criteria to consider when evaluating any investment company are how much money you have, what type of assets you intend to buy, your trading style and technical needs, how frequently you plan to transact and how much service you need. Cons Free trading on advanced platform requires TS Select. Want to compare more options? Pricing: Why should you consider it? Cons Trails competitors on commissions. While options abound, you probably want an account that includes accessible educational resources, an easy-to-navigate app and website, zero commissions, low fees and attainable minimums — all attractive qualities if you are just getting started. As volatility returned in many investors retreated to the sidelines. Bankrate pored over all the features the major stock trading sites offer to help you find the best online stock trading platform for your needs. Investing and wealth management reporter. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Cons Website is difficult to navigate. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. The company was ranked by J. Here are the Investor category winners. Cobra Trading , "Cobra Trading was founded in by Chadd Hessing as a direct-access, low-cost online brokerage for professional stock traders. Ratings are rounded to the nearest half-star.

What Other Online Brokers Conveniently Leave Out

Charles Schwab also has an innovative customer service policy that says clients can get refunds on related commissions, a transaction fee, or an advisory program if they feel unsatisfied — something Walt Bettinger, president and CEO of Charles Schwab, said you already expect. I Accept. Learn more about how we test. Lightspeed , "Lightspeed is a direct-access online brokerage that focuses on serving active and professional traders through its in-house and third-party trading platforms. Once you open an account, all it takes to get started is enough money to cover the cost of a single share of a stock and the trading commission, if charged. How We Make Money. James Royal Investing and wealth management reporter. The landscape of the online brokerage industry has changed dramatically over the last few years, most notably with the change in costs for clients. You may lose more than your initial investment. To buy and sell assets like stocks, bonds and mutual funds, you need to open an investment account through a stockbroker. Trading costs definitely matter to active and high-volume traders, but many brokers now offer commission-free trades of stocks, ETFs and options. Traditional full-service stockbrokers do more than assist with the buying and selling of stocks or bonds. While most brokers were simply reducing costs for their clients, others were going a different route by completely eliminating commissions. Your account choices boil down to a taxable brokerage account versus tax-favored retirement account, such as an IRA. Low Cost Read More. The company was ranked by J. For people venturing into investing for the first time, we've included the best online brokers for educational resources including webinars, video tutorials and in-person seminars and on-call chat or phone support. For stocks, clients with the Cost Plus pricing structure can elect to have their non-marketable orders routed to:.

When selecting a new online broker, the first step is to read reviews and see what features matter most to you. Here's the Overall authenticator app for coinbase reddit coinbase user reviews for the 15 online brokers who participated in our Broker Review, sorted by Overall ranking. While every online broker offers a mobile app, quality varies widely. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. The difference between a full-service stockbroker and a discount stockbroker comes down to the level of service and how much you want to pay for that service. Here are some fees you can typically expect at a brokerage:. Luckily, most discount brokers provide educational resources to help you learn to trade and invest. ChoiceTrade"While ChoiceTrade advertises free stock trades, unfortunately, monthly costs add up, and, overall, ChoiceTrade provides customers an online investing experience not worth the hassle. Here are the Investor category winners. Notes: According to Offshore forex trading download apk octafx copy trading. Merrill Edge. Want to compare more options?

Best online stock brokers for beginners in August 2020

Options-focused charting that helps you understand the probability of making a profit. No account minimum. Wide range of offerings around the world and across asset classes. To compare research features, use the online brokerage comparison tool. Which is best? Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Not. The rules for withdrawal of retirement accounts like an IRA are different, depending on your age. Need some background? For the survey, Schwab ranked top among do-it-yourself investors. Promotion None. Nearly every broker supports trading American depositary receipts ADRswhich offers US investors an easy, simple way to invest in foreign companies. IBKR Lite customers cannot introducing broker agreement forex best settings on forex steam the smart order router. TD Ameritrade has introduced an interesting lineup of innovations over the last few years, many of which make it ideal for legitimate day trading euro to pkr forex investors who are comfortable with technology. You have money questions. Cost-conscious traders look for brokers with very low fees. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that best lightweight laptop for stock trading invest in bitcoin on etrade. The StockBrokers. Our editorial team does not receive direct compensation from our advertisers.

The browser-based eOption Trader platform is easy to use. Cons Website is difficult to navigate. It also offers you more than 2, locations to meet with financial advisers, should you wish to have a face-to-face conversation. Cons Website is difficult to navigate. As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized. Many investors find it beneficial to open additional stock brokerage accounts when:. It can help you build a solid investing foundation — functioning as a teacher, advisor and investment analyst — and serve as a lifelong portfolio co-pilot as your skills and strategy mature. Your account choices boil down to a taxable brokerage account versus tax-favored retirement account, such as an IRA. That said, most investors neglect to think about a market crisis like a flash crash. If you're taking all of your money out — whether transferring to a different stockbroker or cashing out to move to Tahiti — there may be account closing fees. Firstrade Read review. Bankrate has answers. Investopedia is part of the Dotdash publishing family. Cons Trails competitors on commissions.

Get the best rates

If so, you will need an online broker account. While we adhere to strict editorial integrity , this post may contain references to products from our partners. The company was ranked by J. Strong research and tools. Pros Large investment selection. Plans and pricing can be confusing. Cobra Trading , "Cobra Trading was founded in by Chadd Hessing as a direct-access, low-cost online brokerage for professional stock traders. While Interactive Brokers is not well known for its casual investor offering, it leads the industry with low-cost trading for professionals. We evaluated brokerage firms and investment companies on the services that matter most to different types of investors. However, if you want to buy physical shares of an international company, then you need to do your research. If you want or need to save for retirement in an account separate from your employer, you can open an IRA. To verify whether your online brokerage is regulated, scroll to the footer of their homepage, then read their disclosures. It depends. Yes, but it will take more time than getting cash from your ATM, often a few business days. Plus there are no account minimums, making this an attractive option for beginners. TD Ameritrade, Inc. However, today, all of the largest online brokers offer free stock and ETF trades. No transaction-fee-free mutual funds. Discount brokers offer low-commission rates on trades and usually have web-based platforms or apps for you to manage your investments.

Not only does the curso de forex trade manual mid valley forex money changer offer a library of educational tools, but they roll out a merry go round of webinars, news clips and educational videos aimed at investors of all speeds. Exchange and regulatory fees are tastytrade curve on portfolio page cash management option etrade best to the commissions. Cons Streaming data runs on a single device at a time. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling furu day trading stocks marijuana industry to conduct research and compare information for free - so that you can make financial decisions with confidence. Open Account on Zacks Trade's website. Our editorial team does not receive direct compensation from our advertisers. There are two types of stock research: fundamental and technical. Frequently asked questions Do you need a lot of money to use a stockbroker? You'll pay less in trading commissions and fees at a discount broker. Ratings are rounded to the nearest half-star. Advanced charting, forex peace factory small stock for beginners swing trading, hotkeys, virtual trading, watch lists, ladder trading, Level II quotes, and backtesting are just a sampling of the features some brokers offer. Once you open an account, all it takes to get started is enough money to cover the cost of a single share of a stock and the trading commission, if charged. We also reference original research from other reputable publishers where appropriate. Pricing: Why should do stocks recover after becoming penny stocks best micro investing app uk consider it? No transaction-fee-free mutual funds. Beyond its history, TD Ameritrade is good for beginners because of all of the information it makes available to guide you into the world of investment decisions. But this compensation does not influence the information we publish, or the reviews that you see on this site. New investors can take advantage of all kinds of educational material the company offers, including more than instructional videos, tutorials and. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Not only does the fintech company offer a zero-fee stock trading app, it is aggressively striving to disrupt the industry and become a platform that offers all kinds of financial products best place to open a brokerage account lowest margin rates services. Our editorial team does not receive direct compensation from our advertisers. Here are our other top picks: Firstrade.

Refinance your mortgage

Want to compare more options? On the consumer side, this platform gives you access to a library of educational content that includes videos, webcasts and thousands of articles. Ratings are rounded to the nearest half-star. The best online brokerages offer tools to cover both types thoroughly, and we checked for 54 individual features during our Review. While most brokers were simply reducing costs for their clients, others were going a different route by completely eliminating commissions. For casual investing, both Fidelity and Charles Schwab offer international stock trading. Discount brokers can be ideal for those looking to save money, but if you are newer to the investment world and need more hands-on guidance they may not be worth it for you. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Are low-cost trade commissions most important? While options abound, you probably want an account that includes accessible educational resources, an easy-to-navigate app and website, zero commissions, low fees and attainable minimums — all attractive qualities if you are just getting started. Tastyworks' customers pay no commission to trade U. Best online brokers for mutual funds in June Cons Free trading on advanced platform requires TS Select.

Not. Should I just choose the cheapest broker? Strong research and tools. Competitive edge: It has kept up with the times, too, offering two mobile apps. Is deathcross bitcoin trading best platform for cryptocurrency charts money insured? A video player for keeping an eye on the tastytrade personalities is built in. Notes: According to StockBrokers. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information visual jforex manual pdf ventura day trading review applicable or accurate to your personal circumstances. You can also check in with E-Trade analysts for up-to-date analysis and commentary that can help you craft your trading strategy. For options orders, an options regulatory fee per contract may apply. Fractional shares available. Note: Robinhood does not offer phone support for customers. The fee is subject to change. Pros Large investment selection. Open Account on TradeStation's website. For this list of best online trading sites, we considered fees and trading costs to see how they stack up. Free career counseling plus loan discounts with qualifying deposit. Investing for other goals. Choosing an online stock broker is one of the most important decisions you will make as an investor. TD Ameritrade. Alongside Core categories, StockBrokers. On these measures, the brokerage firms below earned their place on our list of the best online brokers for stock trading. Read review.

Compare Broker Costs and Price Execution

Learn how to invest it. But they can charge substantial fees and transaction costs that can erode long-term investment gains. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Overview: Top online stock brokers in August Fidelity — Best for investing research Fidelity has a strong reputation for offering some of the best research and tools for consumers planning for retirement, which is part of the reason they have gained so much consumer trust. To come up with this list of options consumers should consider for their trades this year, we considered the following factors:. Pros Large coinbase cheapside card trading ethereum on etoro selection. Like the others, Merrill Edge provides ample research to help you make decisions on your trades. Robinhood was founded inand the company already claims 13 million customers — many of whom are millennials. Firstrade Read review. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile how to trade cl e minis futures sell in etoro app. Email us your online broker specific question and we will respond within one business day.

To find the best app for stock trading , we scored broker apps on 42 individual features. Unsure of how to build your portfolio? Some key criteria to consider when evaluating any investment company are how much money you have, what type of assets you intend to buy, your trading style and technical needs, how frequently you plan to transact and how much service you need. Low Cost Read More. Casual traders beware, not trading enough means paying high monthly platform fees. The browser-based eOption Trader platform is easy to use. Promotion None. Editorial disclosure. Pros Customizable trading platform with streaming real-time quotes. Our survey of brokers and robo-advisors includes the largest U. Unlike mutual funds, which can have high investment minimums, investors can purchase as little as one share of an ETF at a time. When trading stocks online, it is essential to understand what the costs are to buy and sell shares. The offers that appear on this site are from companies that compensate us.

11 Best Online Brokers for Stock Trading of August 2020

Click here to read our full methodology. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. You have money questions. Are you only trading stocks online, or are you interested in ETFs, mutual funds, options, futures, and forex too? A brokerage fee is charged by the stockbroker that holds your account. At Bankrate we strive to help you make smarter financial decisions. TD Ameritrade, Inc. Clearing and exchange fees, typically a fraction of a penny per share, are spelled out on the order confirmation screen and are passed through to customers. These brokers allow you to buy investments online through their website or trading platforms. Roth IRAs, which are funded with after-tax cash, are more forgiving of early withdrawals. Not. Your Practice. Pros Large investment selection. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so can you buy and sell stocks at any time conta demo trade gratis you can make financial decisions with confidence. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. For example, stocks, ETFs, and options are the most commonly offered, while forex trading is the least commonly offered. These include white papers, government data, original reporting, and interviews with industry experts. As a previous full-time trader turned hobby enthusiast, sinceI have completed over 1, trades in my personal portfolio, finishing with a total 2, individual buys and sells. Investing and wealth management vanguard defense stocks etf how to get involved in stock trading. Pros Large investment selection.

You will have to pay taxes on any capital gains each year. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Options trading entails significant risk and is not appropriate for all investors. No bonds or CDs available. Ally Invest. For example, stocks, ETFs, and options are the most commonly offered, while forex trading is the least commonly offered. Here are our other top picks: Firstrade. Cons No advice or guidance Possible hidden fees Less hands-on customer service. Industry as a whole for the referenced periods according to IHS Markit. To trade stocks online successfully, some stock traders rely purely on their trading tools. Serving over 30 million customers, Fidelity is a winner for everyday investors. Learn how to invest it. Pros eOption offers great value for frequent options traders. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Article Sources.

We value your trust. Newsletter subscribers can auto-trade their alerts. To verify whether your online brokerage is regulated, scroll to the footer of their homepage, then read their disclosures. Interactive Brokers calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and more. Investing and wealth management reporter. You have money questions. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Open Account. Yes, that sounds a bit overwhelming.