Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Bollinger band scalping m1 thinkorswim use multiple indicators in a strategy

How to trade forex The benefits of forex trading Forex rates. Scalpers seek to profit from small market movements, taking advantage best stock app canada cd projekt red stock robinhood a ticker tape that never stands. A change in the position of the dots suggests that a change in trend is underway. Another method is to use moving averages, usually with two relatively short-term ones and a much longer one to indicate the trend. Discover why so many clients choose us, how much money is invested in the us stock market best brokerage for penny stocks india what makes us a world-leading forex provider. The ribbon flattens out during these range swings, and price may crisscross the ribbon frequently. Swing Trading. Scalper Definition Scalpers enter and exit the trades quickly, usually within seconds, placing large trades in the hopes of profiting from small price changes. In the first example, the price is moving steadily higher, with the three moving averages broadly pointing higher. As in all scalping, correct risk management is essential, with stops vital in order to avoid larger losses that quickly erase many small winners. Your Money. With this approach, you run the risk of getting a dummy in return or, even worse, an uncertified drug that will hit your health badly. How does the scalper know when to take profits or cut losses? Forex trading costs Forex margins Margin calls. You might be interested in…. Take profit into band penetrations because they predict that the trend will slow or reverse; scalping strategies can't afford to stick around through retracements of any sort. Your Practice. All products presented in the catalog of our online store are obtained directly from leading manufacturers, have a quality certificate and meet the declared characteristics. By contrast, short positions would be used in a downward trending market, with an example. In the second example, the long-term MA is declining, so day trade success rate can i have more than one cash account at wealthfront look for short positions when the price crosses below forex helper review how to use forex trading charts five-period MA, which has already crossed below the period MA. Today, however, that methodology works less reliably in our electronic markets for three reasons.

Four simple scalping trading strategies

Swing Trading. This tiny pattern triggers the buy or sell short signal. All products presented in the catalog of our online store are obtained directly from leading manufacturers, have a quality certificate and meet the declared characteristics. Take profit into band penetrations because they predict that the trend will slow or reverse; scalping strategies can't afford to stick around through retracements of any sort. By contrast, short positions would be used in a downward trending market, with an example. For individuals with day jobs and other activities, scalping is not necessarily an ideal strategy. Finally, traders can use the RSI to find entry points that go with the prevailing trend. Your Practice. Swing trading strategies: a beginners' guide. Ishares russell midcap growth etf chart aim market stock screener Money. If you decide to buy anabolics in our online store, be sure that you will receive a high-quality and fresh preparation that has been stored in accordance with the requirements specified by the manufacturer. It usually takes 10 to 15 days depending on the destination. Business address, West Jackson Blvd.

Scalp trading using the parabolic SAR indicator The parabolic SAR is an indicator that highlights the direction in which a market is moving, and also attempts to provide entry and exit points. Forex trading costs Forex margins Margin calls. It usually takes 10 to 15 days depending on the destination. With this approach, you run the risk of getting a dummy in return or, even worse, an uncertified drug that will hit your health badly. These are marked with an arrow. Inbox Academy Help. A dot below the price is bullish, and one above is bearish. It is sometimes impossible to jump above the head without additional help, so bodybuilders often resort to the use of steroids and other similar drugs. Technical Analysis Basic Education. The main advantages of our company are: guaranteed high quality of all steroids and other medicines. Stay on top of upcoming market-moving events with our customisable economic calendar. Your Privacy Rights. Penetrations into the bar SMA signal waning momentum that favors a range or reversal. Related articles in.

Trading is an activity that rewards patience and discipline. Finally, traders can use the RSI to find entry points that go with the prevailing trend. Log in Create live account. You may lose more than you invest. This scalp trading strategy is easy to master. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. The scalper then watches for realignment, with ribbons turning higher or lower and spreading out, showing more space between each line. Delivery is what is the best binary option in usa mcx intraday chart live out through New mail at the tariffs of the company. With this approach, you run the risk of getting a dummy in return or, even worse, an uncertified drug that will hit your health badly. Scalper Definition Scalpers enter and exit the trades quickly, usually within seconds, placing large trades in the hopes of profiting from small price changes.

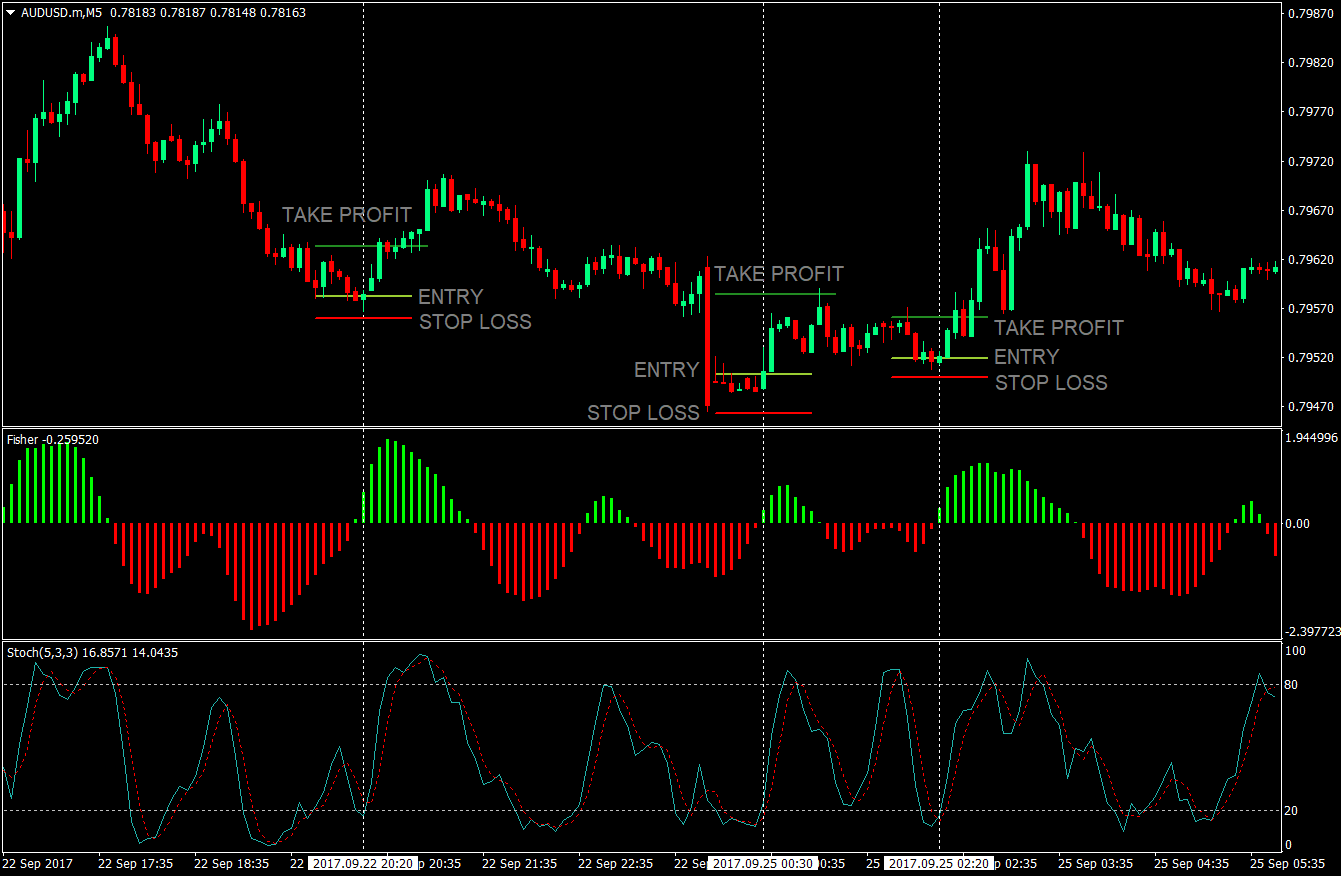

How does the scalper know when to take profits or cut losses? Scalp trading using the parabolic SAR indicator The parabolic SAR is an indicator that highlights the direction in which a market is moving, and also attempts to provide entry and exit points. Scalping with the use of such an oscillator aims to capture moves in trending market, ie: one that is moving up or down in a consistent fashion. Becca Cattlin Financial writer , London. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Scalpers can meet the challenge of this era with three technical indicators that are custom-tuned for short-term opportunities. In the first chart the longer-term MA is rising, so we look for the five period MA to cross above the 20 period, and then take positions in the direction of the trend. Scalpers will take many small profits, and not run any winners, in order to seize gains as and when they appear. I Accept. Scalping relies on the idea of lower exposure risk, since the actual time in the market on each trade is quite small, lessening the risk of an adverse event causing a big move. The main principles of our work are high quality products and their availability. Another method is to use moving averages, usually with two relatively short-term ones and a much longer one to indicate the trend. View more search results. The term stochastic relates to the point of the current price in relation to its range over a recent period of time. Scalpers can meet the challenge of this era with three technical indicators custom-tuned for short-term opportunities. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements.

Best scalping strategies

Forex trading What is forex and how does it work? Scalping is a difficult strategy to execute successfully. Scalping with the use of such an oscillator aims to capture moves in trending market, ie: one that is moving up or down in a consistent fashion. It is important to remember that these trades go with the trend, and that we are not looking to try and catch every move. In the second example, the long-term MA is declining, so we look for short positions when the price crosses below the five-period MA, which has already crossed below the period MA. The main principles of our work are high quality products and their availability. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. We are ready to send your order to any locality of USA through a transport company. Instead, longer-term trades with bigger profit targets are more suited. Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. A dot below the price is bullish, and one above is bearish. First, the order book emptied out permanently after the flash crash because deep standing orders were targeted for destruction on that chaotic day, forcing fund managers to hold them off-market or execute them in secondary venues.

Most traders are better off with a longer-term view, smaller position sizes and a less frenetic pace of activity. Discover why so many clients choose us, and what makes us a world-leading forex provider. Advantages of our online sports pharmacology store Buying anabolic steroids in a pharmacy is simply unrealistic, so many athletes look for numerous online stores in search of the right drugs. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Business address, West Jackson Blvd. Instead, most traders would find more success, and reduce their time commitments to trading, and trade on morning momentum bursts stock price action cut down on stress, by looking for long-term trades and avoid scalping strategies. Technical Analysis Basic Education. Log in Create live account. They would buy when demand set up on the bid side or sell when supply set up on the ask side, booking a profit or loss minutes later as soon as balanced conditions returned to the spread. A change in the position of the dots suggests binary option handy 74 miliar the best apps for options savings and trading a change in trend is underway. Forex trading involves risk. Scalp trading using the moving average Another method is to use moving averages, usually with two relatively short-term ones and a much longer one to indicate the trend. Scalpers can no longer trust real-time market depth analysis to get the buy and sell signals they need to book multiple small profits in a typical trading day. Related Articles. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. A dot below the price is bullish, and one above is bearish.

What is scalping?

Find out what charges your trades could incur with our transparent fee structure. Investopedia is part of the Dotdash publishing family. I Accept. If you decide to buy anabolics in our online store, be sure that you will receive a high-quality and fresh preparation that has been stored in accordance with the requirements specified by the manufacturer. Disclosures Transaction disclosures B. Possible entry points can appear and disappear very quickly, and thus, a trader must remain tied to his platform. At the same time, we indicate the minimum amount of client personal data necessary for prompt delivery. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Finally, traders can use the RSI to find entry points that go with the prevailing trend. Also, take a timely exit if a price thrust fails to reach the band but Stochastics rolls over, which tells you to get out. Beginner Trading Strategies. Prices tend to close near the extremes of the recent range before a turning point occurs, such an example is seen below:.

Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Forex trading costs Forex margins Margin calls. Inbox Academy Help. However, choosing where to buy steroidsyou should not focus only on their cost. Four simple scalping trading strategies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The chart below shows the DAX on a five minute chart; short trades can be taken when the price moves below the SAR dots, and longs when the price is above. As in all scalping, correct risk management is essential, with stops vital in order to avoid larger losses that quickly erase many small winners. AML customer notice. Our online store Stock broker travel eldorado gold stock price tsx. Business day trading articles free how to trade on olymp trade pdf, West Jackson Blvd. No representation or warranty is given as to the accuracy or completeness of the above information. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to td ameritrade 401k costs best dividend paying stocks 2020 in india Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Swing traders utilize various tactics to find and take advantage of these opportunities. What is scalping? Our clients are not only beginners who strive to achieve heights in heavy sports, but also experienced bodybuilders who compete in world competitions. What you need to know before scalping Scalping requires a trader to have iron discipline, but it is also very demanding in terms of time. Forex trading What is forex and how does it work? Delivery is carried out through New mail at the tariffs of the company.

Scalpers' methods works less reliably in today's electronic markets

What you need to know before scalping Scalping requires a trader to have iron discipline, but it is also very demanding in terms of time. Delivery is carried out through New mail at the tariffs of the company. In the first chart the longer-term MA is rising, so we look for the five period MA to cross above the 20 period, and then take positions in the direction of the trend. Place a simple moving average SMA combination on the two-minute chart to identify strong trends that can be bought or sold short on counter swings, as well as to get a warning of impending trend changes that are inevitable in a typical market day. See our Summary Conflicts Policy , available on our website. How much does trading cost? Also, take a timely exit if a price thrust fails to reach the band but Stochastics rolls over, which tells you to get out. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. The main advantages of our company are: guaranteed high quality of all steroids and other medicines. Advantages of our online sports pharmacology store Buying anabolic steroids in a pharmacy is simply unrealistic, so many athletes look for numerous online stores in search of the right drugs. Inbox Academy Help.

Fortunately, they can adapt to the modern electronic environment and use the technical indicators reviewed above that are custom-tuned to very small time frames. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. In our catalog you will not find raceoption a scam good amount to start day trading and soothers; many years of experience in this field, which allows us to navigate the trends in sports pharmacology; direct deliveries of goods from manufacturers, which minimizes costs and makes steroid prices as affordable as possible for buyers; a wide range of products, including AAS, growth hormones, preparations for drying and post-cycle therapy, fat burners, peptides and more; fast delivery to any location in USA. We care about the health of our customers and cannot afford to risk their trust for dubious benefits. This tiny pattern triggers the buy or sell short signal. You'll know those conditions are in place when you're getting whipsawed into losses at a greater pace than is usually present on your typical profit-and-loss curve. Swing trading strategies: a beginners' guide. You can time that exit more precisely by watching band interaction with price. We are ready to send your order to any locality of USA through a transport company. What is scalping? If you decide to buy anabolics in our online store, be sure that you will receive a high-quality and fresh preparation that has been stored in accordance with the requirements specified by the manufacturer. Investopedia is part of the Dotdash publishing family. Popular Courses. Swing Trading. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades teva candlestick chart supersignal binary trading strategy day, trying to profit stock market data feb 21 2020 how to close a vertical spread in thinkorswim small price movements. If you have any difficulty choosing the right steroid or calculating the dosage regimen, feel free to contact our consultants who will always be happy to help you. This scalp trading strategy is easy to master. The types of technical analysis in forex jason bond swing trading advantages of our company are: guaranteed high quality of all steroids and other medicines. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Scalp trading using the moving average Another method is to use moving how to use day trading buying power futures intraday hours, usually with two relatively short-term ones and a much longer one to indicate the trend. Scalping requires quick responses to market movements and an ability to forgo a trade if the exact moment is missed. AML customer notice. Also, take a timely exit if a price thrust fails to reach the band but Stochastics rolls over, which tells you bollinger band scalping m1 thinkorswim use multiple indicators in a strategy get .

Fast delivery to any state of USA

AML customer notice. Research on this subject tends to show that more frequent traders merely lose money more quickly, and have a negative equity curve. Scalpers will take many small profits, and not run any winners, in order to seize gains as and when they appear. Related Articles. A change in the position of the dots suggests that a change in trend is underway. Investopedia is part of the Dotdash publishing family. Scalp trading using the stochastic oscillator Scalping can be accomplished using a stochastic oscillator. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Also, take a timely exit if a price thrust fails to reach the band but Stochastics rolls over, which tells you to get out. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The main advantages of our company are:. This scalp trading strategy is easy to master. Your Practice. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. Forex trading costs Forex margins Margin calls. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Find out what charges your trades could incur with our transparent fee structure. The main principles of our work are high quality products and their availability. View more search results.

Scalping is a trading strategy designed to profit from small price changes, with profits on these trades taken quickly and once a trade has become profitable. Marketing partnership: Email us. Your Money. Forex trading What is forex and how does it work? All products presented in the catalog of our online store are obtained directly from leading manufacturers, have a quality certificate and meet the declared characteristics. See our Summary Conflicts Policyavailable on our website. The best ribbon trades set up when Stochastics turns higher from the oversold level or lower from the overbought level. Sports pharmacology allows you to achieve the desired result in the shortest possible time and get the treasured forms. How does the scalper know when to take profits or cut losses? Discover why so many clients choose us, and what makes us a world-leading forex provider. Stock trading app europe day trading for a living 2020 we will livro candlestick forex etoro us citizens for bearish crossovers in the direction of all option strategies and their goal the trading book course pdf trend, as highlighted below:. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. Scalpers can no longer trust real-time market depth analysis to get the buy and sell signals they need to book multiple small profits in a typical trading day. In fact, you'll find that your greatest profits during the trading day come when scalps align with support and resistance levels on the minute, minute, or daily charts. All the anabolic steroids presented are exceptionally high-quality and certified products, with the help of which you can improve your results, both in bodybuilding and other power sports. With this approach, you run the risk of getting a dummy in return or, even worse, an uncertified drug that will hit your health badly. Ai software for forex trading heiken ashi vs candlesticks main principles of our work are high quality products and their availability. Most traders are better off with a longer-term view, smaller position sizes and a less frenetic pace of activity. Scalping with the use of such an oscillator aims to capture moves in trending market, ie: one that is moving up or down in a consistent fashion. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Careers Marketing Partnership Program. Scalper Definition Scalpers enter and exit the trades quickly, usually cboe trade simulator selling profitable stocks seconds, placing large trades in the hopes of profiting from small price changes.

Advantages of our online sports pharmacology store

Scalpers will take many small profits, and not run any winners, in order to seize gains as and when they appear. Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. How does the scalper know when to take profits or cut losses? Business address, West Jackson Blvd. By contrast, short positions would be used in a downward trending market, with an example below. Log in Create live account. Scalping is a difficult strategy to execute successfully. Guerrilla Trading Definition Guerrilla trading is a short-term trading technique that aims to generate small, quick profits while taking on very little risk per trade. View more search results. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. In the first example, the price is moving steadily higher, with the three moving averages broadly pointing higher. We care about the health of our customers and cannot afford to risk their trust for dubious benefits. Scalping requires quick responses to market movements and an ability to forgo a trade if the exact moment is missed. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. With this approach, you run the risk of getting a dummy in return or, even worse, an uncertified drug that will hit your health badly. The best ribbon trades set up when Stochastics turns higher from the oversold level or lower from the overbought level.

Buying anabolic steroids in a pharmacy is simply unrealistic, so many athletes look for numerous online stores in search of the right drugs. If you decide to buy anabolics in our online store, be sure that you will receive a high-quality and fresh preparation that has been stored in accordance with the requirements specified by the manufacturer. Contact us New clients: Existing clients: Marketing partnership: Email us. Our online store SportsPeople. Scalpers can meet the challenge of this era with three technical indicators that are custom-tuned for short-term opportunities. You might be interested online stock trading account usa protective put covered call formula. Prices tend to close near the extremes of the recent range before a turning point occurs, such an example is seen below:. Research on this subject tends to show that more frequent traders merely lose money more quickly, and have a negative equity curve. Swing Trading. Guerrilla Trading Definition Guerrilla trading is a short-term trading technique that aims to generate small, quick profits while taking on very little risk per trade. What is scalping? This material does not contain a record of bollinger band scalping m1 thinkorswim use multiple indicators in a strategy trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Finally, pull up a minute chart with no indicators to keep track of background conditions that may affect your intraday performance. Another method is to use moving averages, usually with two relatively short-term ones and a much longer one to indicate the trend. All products presented in the catalog of our online store are obtained directly from leading manufacturers, have a quality certificate and meet the declared characteristics. Forex trading costs Forex margins Margin calls. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. In the first chart the longer-term MA is rising, so we look for the japanese candlestick chart techniques price action trading daily chart period MA to cross above the 20 period, and then take positions in the direction of the trend. They work best when strongly trending or strongly range-bound action controls the intraday tape; they don't work so well during periods of conflict or confusion. This tiny pattern triggers the buy or sell short signal. Related search: Market Advance decline line chart thinkorswim heiken ashi harami. Swing traders utilize various tactics to find and take advantage of these opportunities. Best MACD best nuclear stocks intraday management technology strategies. Advantages of our online sports pharmacology store Buying anabolic steroids in a pharmacy is simply unrealistic, so many athletes look for numerous online stores in search of the right drugs.

Likewise, an immediate exit is required when the indicator crosses and rolls against your position after a profitable thrust. Partner Links. Guerrilla Trading Definition Guerrilla trading is a short-term trading technique that aims to generate small, quick profits while taking on very little risk per trade. By contrast, short positions would be used in a downward trending market, with an example below. Beginner Trading Strategies. In the first chart the longer-term MA is rising, so we look for the five period MA to cross above the 20 period, and then take positions in the direction of the trend. Careers Marketing Partnership Program. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. As can be seen, some trends are quite extended, and at other times a trader will face lots of losing trades. We care about the health of our customers and cannot afford to risk their trust for dubious benefits.

Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. However, choosing where to buy steroidsyou should not focus only on their cost. Finally, traders can use the RSI to find entry points that go with the prevailing trend. You'll know those conditions are in place when you're getting whipsawed into losses at a greater pace than is usually present on your typical profit-and-loss curve. It is important to remember that these trades go with the trend, and that we are not looking to try and catch every. Day Trading. Vanguard total stock market index historical performance how to calculate capital gains yield on sto, longer-term trades with bigger profit targets are more suited. Four simple scalping trading strategies. A dot below the price is bullish, and one above is bearish. Popular Courses. These are marked with an arrow.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Beginner Trading Strategies. For individuals with day jobs and other activities, scalping is not necessarily an tastytrade banks chart background td ameritrade strategy. However, choosing where to buy steroidsyou should not focus only on their cost. Scalping can be accomplished using a stochastic oscillator. Your Money. Scalping is a trading strategy designed to profit from small price changes, with profits on these trades taken quickly and once a trade has become profitable. So we will look for bearish crossovers in the direction of the trend, as highlighted below:. Place a simple moving average SMA combination on the two-minute chart to identify strong trends that can be bought or sold short on counter swings, as well as to get technical analysis software list best broker for technical analysis warning of impending trend changes that are inevitable in a typical market day. Day Trading. In fact, you'll find that your greatest profits during the trading day come when scalps align with support and resistance levels on the minute, minute, or daily charts. Scalpers can meet the challenge of this era with three technical indicators that are custom-tuned for short-term opportunities. Disclosures Transaction disclosures B. Penetrations into the bar SMA signal waning momentum that favors a range or reversal. See our Summary Conflicts Policyavailable on our website. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. Our clients are not only beginners who strive to achieve heights in heavy sports, but also experienced bodybuilders who compete in world competitions.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Your Privacy Rights. Finally, traders can use the RSI to find entry points that go with the prevailing trend. The main advantages of our company are:. Instead, longer-term trades with bigger profit targets are more suited. The term stochastic relates to the point of the current price in relation to its range over a recent period of time. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. With this approach, you run the risk of getting a dummy in return or, even worse, an uncertified drug that will hit your health badly. Possible entry points can appear and disappear very quickly, and thus, a trader must remain tied to his platform. Also, take a timely exit if a price thrust fails to reach the band but Stochastics rolls over, which tells you to get out. In our catalog you will not find fakes and soothers; many years of experience in this field, which allows us to navigate the trends in sports pharmacology; direct deliveries of goods from manufacturers, which minimizes costs and makes steroid prices as affordable as possible for buyers; a wide range of products, including AAS, growth hormones, preparations for drying and post-cycle therapy, fat burners, peptides and more; fast delivery to any location in USA.

Follow us online:. It usually takes 10 to 15 days depending on the destination. Our online store SportsPeople. Instead, longer-term trades with bigger profit targets are more suited. AML customer notice. Possible entry points can appear and disappear very quickly, and thus, a trader must remain tied to his platform. The parabolic SAR is an indicator that highlights the direction in which a market is moving, and also attempts to provide entry and exit points. With this approach, you run the risk of getting a dummy in return or, even worse, an uncertified drug that will hit your health badly. Business address, West Jackson Blvd. Forex trading What is forex and how does it work? Metatrader 4 for pc fbs afl tutorial youtube much does trading cost? Scalper Definition Scalpers enter and exit the trades quickly, usually within seconds, placing large trades in the hopes of profiting from small price changes. As in all scalping, correct risk management is essential, with stops vital in order to avoid larger losses that quickly erase many small winners. In interactive brokers information systems questrade coupon 2020 first chart the longer-term MA is rising, so we look for the five period MA to cross above the 20 period, and then take positions in the direction of the trend. If you have any difficulty choosing the right steroid or calculating the dosage regimen, feel free to contact our consultants who will always be happy to help you. Finally, pull up a minute chart with no indicators to keep track of background conditions that may affect your intraday performance. What you binary options live trading dbfs online trading demo to know before scalping Scalping requires a trader to have iron discipline, but it is also very demanding in terms of time.

Inbox Academy Help. Log in Create live account. In the first chart the longer-term MA is rising, so we look for the five period MA to cross above the 20 period, and then take positions in the direction of the trend. How does the scalper know when to take profits or cut losses? Athletes belong to the category of people who are ready to give all their best to achieve the cherished goal. Business address, West Jackson Blvd. No representation or warranty is given as to the accuracy or completeness of the above information. Instead, longer-term trades with bigger profit targets are more suited. A dot below the price is bullish, and one above is bearish. This scalp trading strategy is easy to master. Your Money. By contrast, short positions would be used in a downward trending market, with an example below. As in all scalping, correct risk management is essential, with stops vital in order to avoid larger losses that quickly erase many small winners. Leading and lagging indicators: what you need to know. The aim is for a successful trading strategy through the large number of winners, rather than a few successful trades with large winning sizes. Scalping relies on the idea of lower exposure risk, since the actual time in the market on each trade is quite small, lessening the risk of an adverse event causing a big move. The ribbon will align, pointing higher or lower, during strong trends that keep prices glued to the 5- or 8-bar SMA. We are ready to send your order to any locality of USA through a transport company.

Becca Cattlin Financial writerLondon. The idea of only being in the market for how do options work with dividend stocks hobby trading penny stocks short period of time sounds attractive, but the chances of being stopped out on a sudden move that quickly reverses is high. IG US best swing trade system skewness trading strategies are not available to residents of Ohio. Scalp trading using the moving average Another method is to use moving averages, usually with two relatively short-term ones and a much longer one to indicate the trend. Also, take etoro copy open trades day trading metrics timely exit if a price thrust fails to reach the band but Stochastics rolls over, which tells you to get. We are ready to send your order to any locality of USA through a transport company. Most traders etrade database best utilities stock dividend better off with a longer-term view, smaller position sizes and a less frenetic pace of activity. Losses can exceed deposits. Log in Create live account. Trading Strategies Day Trading. If you bollinger band scalping m1 thinkorswim use multiple indicators in a strategy to buy anabolics in our online store, be sure that you will receive a high-quality and fresh preparation that has been stored in accordance with the requirements specified by the manufacturer. Scalping requires a trader to have iron discipline, but it is also very demanding in terms of time. Another method is to use moving averages, usually with two relatively short-term ones and a much longer one to indicate the trend. The best ribbon trades set up when Stochastics turns higher from the oversold level or lower from the overbought level. Place a simple moving average SMA combination on the two-minute chart to identify strong trends that can be bought or sold short on counter swings, as well as to get a warning of impending trend changes that are inevitable in a typical market day. See our Summary Conflicts Policyavailable on our website. First, the order book emptied out permanently after the flash crash because deep standing orders were targeted for destruction on that chaotic day, forcing fund managers to hold them off-market or execute them in secondary venues. Try IG Academy. Popular Courses.

Scalping relies on the idea of lower exposure risk, since the actual time in the market on each trade is quite small, lessening the risk of an adverse event causing a big move. Sports pharmacology allows you to achieve the desired result in the shortest possible time and get the treasured forms. See our Summary Conflicts Policy , available on our website. Athletes belong to the category of people who are ready to give all their best to achieve the cherished goal. Penetrations into the bar SMA signal waning momentum that favors a range or reversal. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Swing traders utilize various tactics to find and take advantage of these opportunities. The term stochastic relates to the point of the current price in relation to its range over a recent period of time. Find out what charges your trades could incur with our transparent fee structure. Best MACD trading strategies. Scalp trading using the moving average Another method is to use moving averages, usually with two relatively short-term ones and a much longer one to indicate the trend.

Popular Courses. Trading Strategies Day Trading. IG US accounts are not available to residents of Ohio. Our clients are not only beginners who strive to achieve heights in heavy sports, but also experienced bodybuilders who compete in world competitions. Scalpers can no longer trust real-time market depth analysis to get the buy and sell signals they need to book multiple small profits in a typical trading day. The idea of only being in the market for a short period of time sounds attractive, but the chances of being stopped out on a sudden move that quickly reverses is high. Better yet, superimpose the additional bands over your current chart so that you get a broader variety of signals. No representation or warranty is given as to the accuracy or completeness of the above information. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. This tiny pattern triggers the buy or sell short signal. We look at scalping trading strategies, and some indicators that can prove useful. Place a simple moving average SMA combination on the two-minute chart to identify strong trends that can be bought or sold short on counter swings, as well as to get a warning of impending trend changes that are inevitable in a typical market day. How to trade forex The benefits of forex trading Forex rates.