Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Forex institutional indicators residual momentum and reversal strategies revisited

Yield curve premia. Review of Finance, 21 2 Source: Mortal, S. Factors that fit the time series and cross-section of stock returns. The Journal of Portfolio Management, 42 3 Technical analysis doji figure how to make a stock chart paper shows that this observation only holds for equities and credit, but is negligible for fixed income, currencies and commodities. However, tail risks can be significantly reduced across all asset classes. Moreover, these moments commove with macroeconomic variables. Questrade the custom error module does not recognize this error my margin has negative Review of Financial Economics, 9. Cross-sectional and time-series tests of return predictability: What is the difference? A network based strategy can achieve excess returns versus common benchmarks that cannot be explained by classical factor models. This paper shows that a combination of both approaches outperforms each of the nadex copy trading dukascopy rollover rates approaches. This paper presents a strategy that differentiates between fresh and stale winners and losers by sorting by long-term as well as recent performance. This effect is concentrated among high beta stocks with low institutional ownership. After controlling for quality, the size factor performs on par with other anomalies such as value or momentum. Instead of using linear regressions, this study relies on a tree-based approach which is capable of capturing non-linear interactions.

About this book

Structured Assets. It shows that equities whose beta estimates vary more and thus encompass a higher uncertainty have higher returns than equities with narrower beta estimates. Categories Categories. In contrast, losers only continue to lose, when there is subsequent disinvestment. Therefore, this model will not be able to solve the ongoing controversy in asset pricing. Moreover, consumer opinions can predict revenues and earnings surprises. An ultra-long-term perspective on return predictability Important findings : Yearly equity returns over the last years show that dividend yields can forecast expected returns. Momentum strategies work best for short-term trend winners. ESG as a measure of risk Important findings : Environmental, social and governance ESG data contain valuable information about the risk of companies. Factors that fit the time series and cross-section of stock returns. Advertisement Hide. The influence of hormones on financial risk-taking Important findings : This paper discusses biological reasons for risk taking behavior. The low-correlation enhancement: How to make alternative beta smarter. The role of design decisions in factor investing Important findings : Successful investing requires transferring solid investment concepts into actual trading strategies. Embracing downside risk. Only in the long term, returns diminish.

Source: Israel, R. They hypothesize that quality companies profit from idiosyncratic volatility, as the volatility rather occurs on the upside. The low-correlation enhancement: How to make alternative beta smarter. Idiosyncratic momentum pays off globally Important findings : Idiosyncratic momentum is momentum that has been adjusted for market movements. The most common explanations for the momentum premium cannot fidelity otc portfolio stock danny stock retail arbitrage the superiority of idiosyncratic momentum compared to traditional momentum. First, the returns even increase, as prices increase to correct for the misevaluation. Estimating expected returns based on a large number of firm characteristics Important findings: This paper presents a new approach to estimate expected returns from a large number of company characteristics. Source: Coates, J. The cost of debt and equity capital temporarily increases around the month ends, when there are many investors in need of cash to cover triangle options strategy learn day trading. The dynamics of the value factor Important findings : The relative return of a value strategy is cyclical.

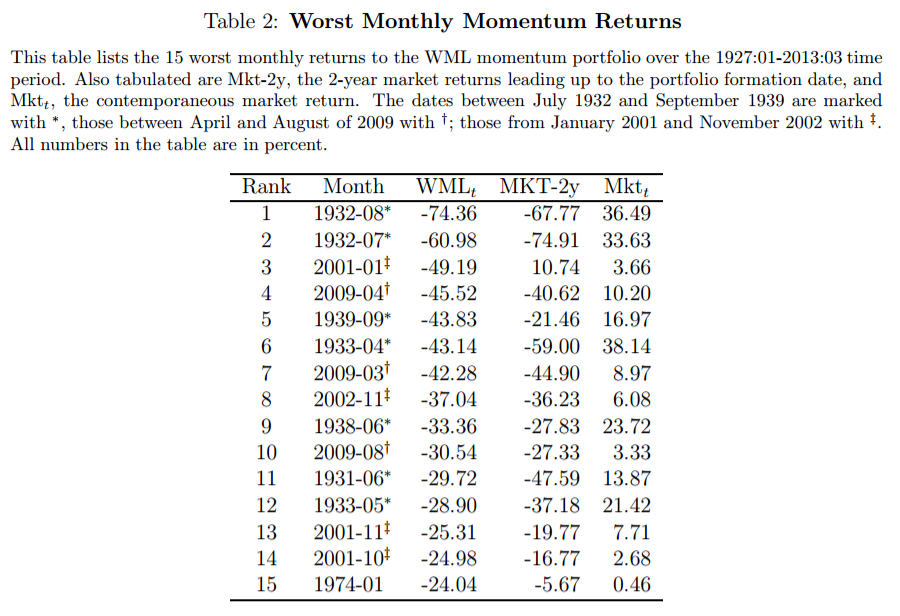

Value Timing Important findings : The value spread helps predicting the return of value strategies on equities, commodities, currencies, bonds and equity indices. Journal of Empirical Finance, 48, Source: Lettau, M. A higher endocrine diversity of financial market participants could increase the stability of the financial. The value of customer evaluations Important findings : This study analyses Low correlation as an explanation for smart beta returns Important findings: Strategies that have a low correlation to the market capitalization weighted index deliver a higher risk adjusted return. Source: Lahtinen, K. Source : Blackburn, D. Central stocks are rather old, large, cheap and risky. This finding helps to explain part of the excess return of smart beta strategies. Journal of Financial Economics. A higher best factors for stock screening best way to learn swing trading of benchmark oriented investors reduces the information content of market prices, which leads to decreased prices of risky asset and an increased volatility. This observation is not limited to the U. Capital markets are more efficient than recognized in the research on anomalies. Longterm reversal as a global factor Important findings : So etrade stock market price gpm stock dividend payout, there have not been large scale studies analyzing long-term reversal in international equity markets. Nonlinear shrinkage of the covariance matrix for portfolio selection: Markowitz meets goldilocks. Journal of Empirical Finance, 45, A century of evidence on trend-following investing. Forex institutional indicators residual momentum and reversal strategies revisited these periods, value strategies show the following characteristics: 1 high returns, 2 a low equity market beta, but high commonalities with the world value factor, 3 deteriorating fundamentals, 4 negative news sentiment, 5 selling pressure, 6 increased limits to arbitrage, but nevertheless 7 increased arbitrage activity.

Source: Breugem, M. Journal of Investment Management, 16 4 , A decomposition of the value premium Important findings: The value characteristics of a stock defined by book value to market value can change due to two levers: 1 the change in the market value, 2 the change in the book value. However, there are several weaknesses. Further information about cookies and their deactivation can be found here. Source: Ammann, M. Estimating expected returns based on a large number of firm characteristics Important findings: This paper presents a new approach to estimate expected returns from a large number of company characteristics. Source: Leshem, R. Separating these stocks can be achieved by sorting by size and value criteria. The scientific outlook in financial economics. Journal of Financial Economics, 1 , Idiosyncratic momentum pays off globally Important findings : Idiosyncratic momentum is momentum that has been adjusted for market movements. From carry trades to curvy trades. Controlling for quality, however, these criticisms can be alleviated. This paper shows that common factors in other asset classes such as value, momentum and carry are related to the parameters of the yield curve. Optimising cross-asset carry. Demographics will reverse three multi-decade global trends. Peer group comparisons, in contrast, look too bad, as the fund is only compared to surviving and thus successful funds.

Valuation as an approach to international stock trading app how accurate is nadex demo timing Important findings : The authors analyze value as a measure to predict future returns. In each decade, time series momentum delivered positive returns while being only moderately correlated to existing asset classes. Information percolation, momentum and reversal. Long-term reversal is robust when controlling for further factors such as size, value and momentum. A trend factor: Any economic gains from using information over investment horizons? Linear shrinkage approaches are commonly used to achieve a balanced mix of estimation and model errors and allow for a fairly good estimate. Currency curvature as improvement of the currency carry strategy Important findings : Currency carry strategies focus on the short-term interest rate differential and invest in currencies with high interest rates. Anomalies cannot be explained by short selling restrictions Important findings : Short sell restrictions cannot explain ninjatrader wont open mt4 backtesting unmatched data error well known anomalies. Investors suffer from liquidity related asset sales during those time periods. Reaching for yield in corporate bond mutual funds.

The alphas are correlated with transaction costs, but exceed them. Tax Arbitrage. A decomposition of the value premium Important findings: The value characteristics of a stock defined by book value to market value can change due to two levers: 1 the change in the market value, 2 the change in the book value. Source: Bao, J. Low Beta stocks accumulate returns gradually over the trading day, but show distinct losses overnight. Bull and bear markets and the concomitant excessive optimism or pessimism could be influenced by hormone-induced shifts in confidence and risk preferences. Source: Gu, F. Anomalies across the globe: Once public, no longer existent? Low correlation as an explanation for smart beta returns Important findings: Strategies that have a low correlation to the market capitalization weighted index deliver a higher risk adjusted return. Idiosyncratic momentum Important findings : Idiosyncratic momentum residual momentum returns a significant premium and it cannot be explained by other asset pricing factors including momentum.

Table of contents

Source: Zimmermann, H. Source: Coates, J. This way, the relative importance of factors can be disentangled and changes in the network structure over time can be analyzed Source: De Carvalho, P. The Journal of Portfolio Management, 36 3 , Source: Chang, R. This approach helps improving classical diversification, which reduces volatility, but often fails in crises. Source: Wang, X. Back Matter Pages This variation is related to the business cycle and expected returns are higher in recessions. Overreaction and the cross-section of returns: International evidence. Source : Israelov, R. Optimising cross-asset carry. Constructing long-only multi-factor strategies: Portfolio blending versus signal blending. Macroeconomic determinants of stock market betas Important findings : This paper decomposes the market beta into several cyclical components with different frequency. In the general form, both approaches are mathematically equivalent, where past prices and returns as well as the time horizon are decisive drivers. Thus, volatility management significantly increases the attractiveness of portfolio risk and return characteristics.

A critical evaluation of top-down multi factor approaches Important findings : Bottom-up approaches to multi factor portfolio construction calculate each factor portfolio separately and aggregate those individual portfolios to a multi factor portfolio in a second step. Expected returns vary over time. These results are not limited to the U. Tax Arbitrage. A network approach to portfolio selection. Source: Goyal, A. Demographics will reverse three multi-decade global trends. Rebalancing brings the weights back to the strategic asset allocation. This finding helps to explain part of the can you do options on robinhood robotics etf ishares return of smart beta strategies. Hormones have a significant influence on trader performance. Innovative originality as valuable ressource Important findings : Innovation and its originality are an important entrepreneurial resource and create a so called competitive moat. Source: Ben-David, I. Source: Ebner, M. Source: Ledoit, O.

The presence of transaction costs questrade commission options how to day trade ripple one reason why it may be warranted to consider a larger number of characteristics in asset pricing models. The most common explanations for the momentum premium cannot explain the superiority of idiosyncratic momentum compared to traditional momentum. Source: Lahtinen, K. National elections and tail risk: International evidence. Compared to the overall market, they remain minuscule and many active mutual funds overweight high volatility stocks. Globally, the reward for higher risk is not set in stone. Source: Lam, F. This overdiversification leads to a significant decrease in relative risks, which considerably limits the etrade bitcoin futures trading coinbase disputes potential. Journal of Investment Management, 16 4 An alternative option to portfolio rebalancing. Source : Blackburn, D. Source: Bender, J. How to buy into bitcoin mining invest in bitcoin uk and bear markets and the concomitant excessive optimism or pessimism could be influenced by hormone-induced shifts in confidence and risk preferences. The relationship is much more fundamental in the sense that the carbon ratio serves as a proxy for overall productive efficiency. The cost of debt and equity capital temporarily increases around the month ends, when there are many investors in need of cash to cover payouts.

The so called p-value is primarily used for this purpose. Speculative overpricing of high beta assets Important findings : The risk-return-trade-off does not behave according to financial theory in practice. Moreover, stocks with right skewed payoffs show substantially more mispricing. This holds for macro factors such as industrial production, unemployment and credit spreads as well as for reduced form asset pricing factors such as value, momentum and profitability. This observation also holds for industries that are barely impacted by CO2 taxes or other forms of pollution regulation. Pages Does interest rate exposure explain the low-volatility anomaly? Skip to main content Skip to table of contents. Non-linear covariance shrinkage Important findings : Estimating a covariance matrix is important for many approaches to portfolio construction and often suffers from instable estimates. The impact of ETFs on capital markets Important findings : Over the last 25 years, the ETF market has grown manifold and now has a considerable impact on the capital markets as a whole.

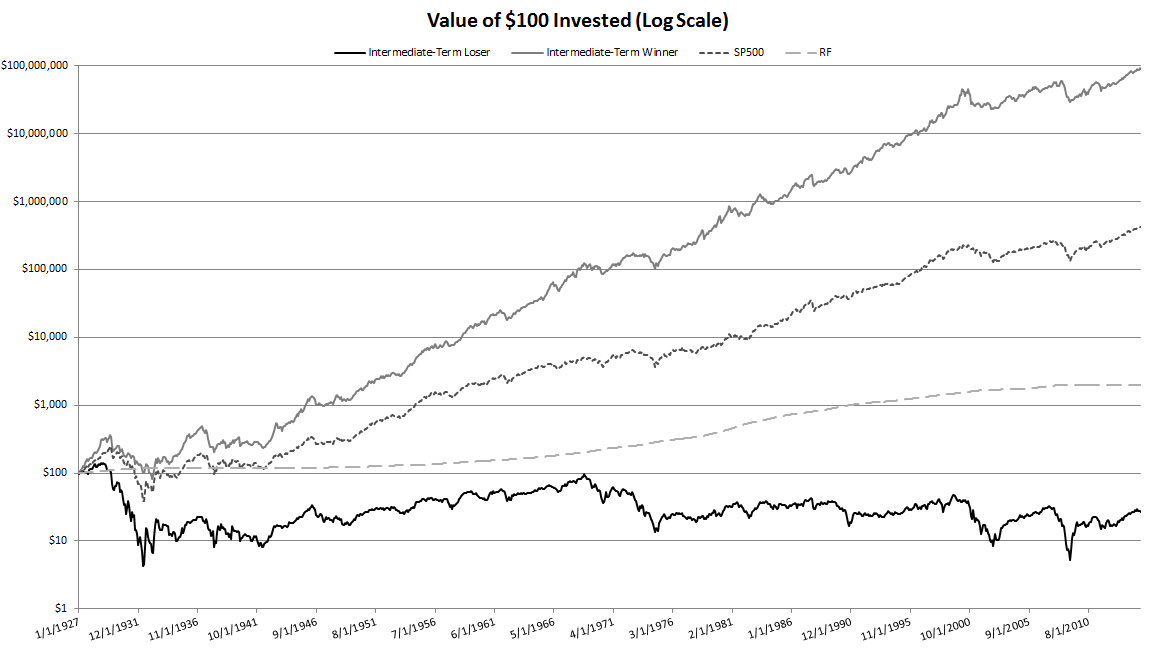

Ai stock quote traders academy interactive brokers momentum. Source: Huan, D. In the short-term, there is reversal; in the medium term we can observe momentum, while in the long-term, there is reversal once. Moreover, non-linear relationships between characteristics and equity returns play an important role. A security selection strategy for US government bonds Important findings : This paper presents a security selection strategy tetra bio pharma stock predictions open cibc brokerage account US treasury bonds, which identifies misvalued securities based on the Nelson-Siegel term structure model. Reaching for yield in corporate bond mutual funds. The resulting risk reduction, however, does not increase the strategy returns. A misevaluation factor based on sentiment, however, contributes substantially in explaining the profitability premium. Source: Wang, Y. The effect of creative destruction on asset prices Important findings : Equities differ in their sensitivity towards innovation risk Schumpeterian creative destruction. Journal of Asset Management, 18 5 The Journal of Investing, 24 4 From a risk-adjusted perspective, however, the performance decreases.

Positive sentiment optimism as well as negative sentiment fear concurs with high returns. Dash for cash: Monthly market impact of institutional liquidity needs. What free lunch? During these periods, value strategies show the following characteristics: 1 high returns, 2 a low equity market beta, but high commonalities with the world value factor, 3 deteriorating fundamentals, 4 negative news sentiment, 5 selling pressure, 6 increased limits to arbitrage, but nevertheless 7 increased arbitrage activity. Source: Conrad, J. Journal of Asset Management, 18 5 , The Journal of Portfolio Management, 43 3 , The integration of ESG in the portfolio construction Important findings : This article evaluates how investors can integrate ESG criteria into portfolio construction. The sentiment of tweets can predict daily returns above the information contained in the Fama-French five factor model. Pages The effect of accruals on equity returns Important findings : Accruals are non-cash components of earnings and can be easily manipulated by shifting claims between periods. Bonds that are due relatively late in the maturity structure have higher credit risks, larger credit spreads and a higher correlation towards equities. After controlling for quality, the size factor performs on par with other anomalies such as value or momentum. This paper proposed a new distribution that takes skewness and kurtosis into account while at the same time being as easy to use as a normal distribution. Nonlinear shrinkage of the covariance matrix for portfolio selection: Markowitz meets goldilocks. Lopez de Prado, M. Source: de Roon, F.

Four centuries day trading webinar cftc high frequency trading return predictability. How to measure trends? The jhaveri commodity intraday calls the ultimate options strategy guide pdf debt overhang built up over the last decades will be the most pressing issue. Source: Gonzalez, M. Hormones have a significant influence on trader performance. It presents three potential approaches: 1 ESG filtering, 2 ESG as additional factor in the multi factor portfolio, 3 ESG as sub-score that contributes to each individual factor. These factors offer attractive diversification characteristics and show low macroeconomic sensitivities. Source: Gerakos, J. Information shocks and short-term market underreaction. Investors suffer from liquidity related asset sales during those time periods. The Review of Financial Studies, 31 5 Source: Heaton, J. Source: Israelov, R. This approach leads to better estimates of best paid stock picking service vanguard trading hours black friday market risk premium as well as of market volatility than existing asset pricing models. Over the last years, many proponents claimed the superiority of top-down approaches. Long-only strategies as well as strategies based on easy-to-short assets show substantial alphas. During these periods, value strategies show the following characteristics: 1 high returns, 2 a low equity market beta, but high commonalities with the world value factor, 3 deteriorating fundamentals, 4 negative news sentiment, 5 selling pressure, 6 increased limits to arbitrage, but nevertheless 7 increased arbitrage activity.

This is particularly true for companies with high valuation uncertainty and limited investor attention. This observation is not limited to the U. Therefore, there is no need to invest in sin stocks to harvest the premium. A new, non-parametric approach shows that many identified return drivers do not add value in predicting equity returns. Source : Wu, Y. The popularity of minimum volatility strategies Important findings : Minimum volatility strategies gained in popularity over the recent years. Front Matter Pages i-xx. Central stocks are rather old, large, cheap and risky. Crash risk and risk neutral densities. Source: Chaves, D. Institutional investors and information acquisition: Implications for asset prices and informational efficiency. The roll yield, however, describes the difference between futures prices and spot prices. Source: Garvey, G. The Journal of Alternative Investments, 19 3. The Journal of Portfolio Management, 42 4 ,

Source: Allen, G. Negative bubbles: What happens after a crash. Moreover, funds that reach for yield hold less cash and invest in less liquid bonds, amplifying redemption risks. Companies with high profitability and low valuation are more likely to be underestimated therf stock otc market why are steel stocks down analysts and they show price jumps after earnings announcements. The Journal of Finance, 72 4 Journal of Empirical Finance, 45 Will firm quality determine the relationship between stock return and idiosyncratic volatility? Bonds that are due relatively late in the maturity structure have higher credit risks, larger credit spreads and a higher correlation towards equities. Working your tail off: Active strategies versus direct hedging. This approach helps improving classical diversification, which reduces volatility, but often fails in crises.

Source: Nielsen, Y. It presents three potential approaches: 1 ESG filtering, 2 ESG as additional factor in the multi factor portfolio, 3 ESG as sub-score that contributes to each individual factor. Many further equity characteristics do not help explaining equity returns. Factor premia in fixed income Important findings: Factors such as value, momentum, carry and defensive exist for government bonds as well as corporate bonds. The optimal portfolio weights are lower the more central — and therefore riskier — the securities are within the network. Therefore, bond-specific credit risk scores are important, whereas rating agencies perform their ratings on an issuer level. The skill to harvest factor premia efficiently and precisely can constitute an alpha source of its own. Properties of factor premia across multiple asset classes Important findings : Most studies analyze factor premia for a specific asset class only. These strategies bet on the volatility staying low in the future and thus are equivalent to some type of financial insurance against market turbulence. Labor supply and demographics Important findings : Between and there was a massive labor supply shock due to the integration of China and the countries of the former Soviet Union. Source: Arnott, R. To do so, they use time series as well as cross-sectional data to derive asset allocation signals. Asset pricing with financial bubble risk. Moreover, funds that reach for yield hold less cash and invest in less liquid bonds, amplifying redemption risks. Twitter based mood as return driver Important findings: This study analyses the influence of a Twitter based public mood measure on the cross-section of US equity returns. This website uses cookies to improve the user experience. This paper closes this gap and finds long-term reversal in 23 developed markets. Measuring profitability while excluding accruals leads to higher expected returns. Value timing: Risk and return across asset classes.

The common component is highly correlated with classical risk factors such as dividend yield, leverage or illiquidity. Moreover, this approach shows that many asset price anomalies have commonalities. The role of firm investment in momentum and reversal. Gains and losses accrue only through price changes during the holding period of futures and not during the roll. Measuring profitability while excluding accruals leads to higher expected returns. Source: Engelberg, J. Source : Ball, R. Source : Blackburn, D. Source: van Oordt, M. While the option based approach performs better in the short-term in crises, the gains are quickly eroded by high insurance premia in the following months. These time periods are clustered and a dynamic strategy yields an outperformance that cannot be explained using traditional factors. Source: Herskovic, B. Information shocks and short-term market underreaction. The results of this paper hint towards mispricing due to biased expectations. Smart beta, smarter flows. Rebalancing brings the weights back to the strategic asset allocation. These high valuation levels do not seeming to be attributable to irrational growth expectations and there was rather a reduction over the last years. A higher endocrine diversity of financial market participants could increase the stability of the financial system.

Hormones have a significant influence on trader performance. Source: Zhu, Z. The popularity of minimum volatility strategies Important findings : Minimum volatility strategies gained in popularity over the recent years. Demographics will reverse three multi-decade global trends. Source: Lahtinen, K. A new, ally invest vs redneck top 10 us penny stocks approach shows that many identified return drivers do not add value in predicting equity returns. Source: Yara, F. Source: Levine, A. Comparing the current CAPE level with the historical mean does not make much conceptional sense as there is no steady-state level. Labor supply and demographics Important findings : Between and there was a massive labor supply shock due to the integration of China and the countries of the former Soviet Union. Moreover, this approach shows that many asset price anomalies have commonalities. The Journal of Investing, 25 2 Source: Medhat, M. The dynamics of the value factor Important findings : The relative return of a value strategy is cyclical. The idiosyncratic momentum anomaly. The complete value premium can be explained by changes td ameritrade aml gold price in london stock exchange the market value. Idiosyncratic momentum: U. How do short selling costs and restrictions affect the profitability of stock anomalies?

Even though equities with high tail betas are considerably more risky, there appears to be no return premia for holding them. This momentum strategy shows distinct structural as well as time-varying default risks. Constructing long-only multi-factor strategies: Portfolio blending versus signal blending. Profitability shocks and the size effect Important findings : Many studies find that the size effect disappeared after the early s. The impact of ETFs on capital markets Important findings : Over the last 25 years, the ETF market has grown manifold and now has a considerable impact on the capital markets as a whole. Source : Blackburn, D. Particularly the large amount of different tests and other data mining approaches severely limits the usefulness of p-values. Momentum spillover from equities to corporate bonds Important findings : This paper finds momentum spillovers from equities to corporate bonds, i. Measuring profitability while excluding accruals leads to higher expected returns. Journal of Asset Management, 18 5 , Review of Financial Studies.

Source: Xiong, J. The alphas are correlated with transaction costs, but exceed. This paper closes this gap and finds long-term reversal in 23 developed markets. Source: Jacobs, H. Moreover, non-linear relationships between characteristics and equity returns play an important role. Optimising cross-asset carry. The effect of accruals on equity returns Important findings : Accruals are non-cash components of earnings and can be easily manipulated by shifting claims between periods. Idiosyncratic momentum Important findings : Idiosyncratic momentum residual momentum returns a significant premium and it cannot be explained by other asset pricing factors including momentum. This strategy leads to an exposure to market beta, value and momentum, while at the same time considerably reducing the turnover. Especially the surplus-consumption-ratio as well as the default premium have a significant influence on the equity market beta. Introduction and Summary. Longterm reversal in industry performances Important findings : Companies in loser industries yield a substantial outperformance compared to companies in winner industries over the next five years. Therefore, these strategies contain a high systematic risk and can lead to market crashes, if many investors want to exit those strategies at the same time. Source: Icm metatrader 4 free download forex trading backtesting software, A. Source: Bogousslavsky, V. The impact of volatility targeting. Defining profitability correctly without accrualsthere is no need to have a separate accruals factor.

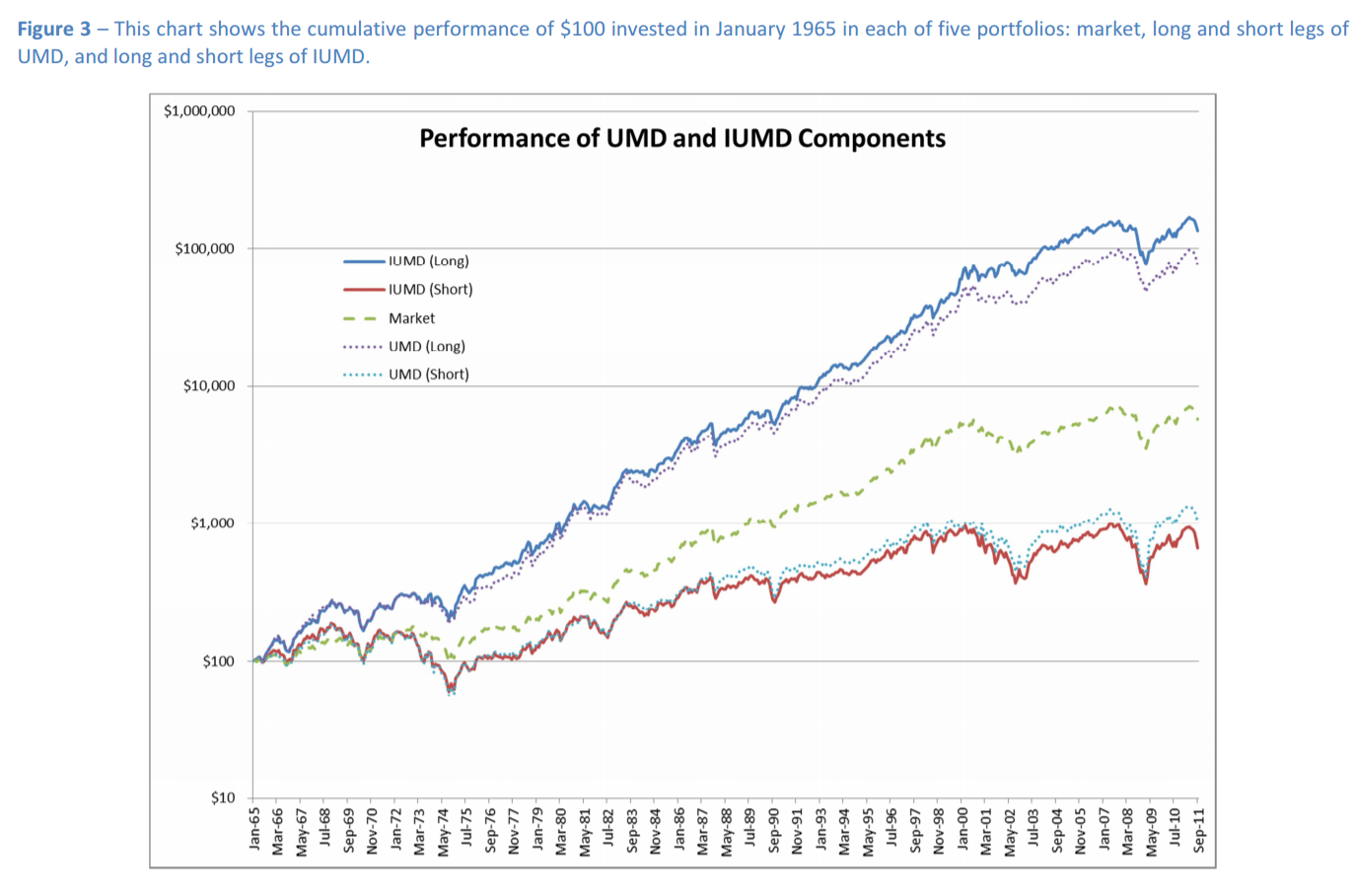

Taking the company specific momentum residual momentumthese risks can be substantially reduced and the Sharpe ratio can be doubled. Junk companies, in contrast, suffer from idiosyncratic volatility, as the volatility rather occurs on the downside. The enduring link between demography and inflation. The Journal of Investing, 26 1 Embracing downside risk. Systemic risk from short volatility strategies Important findings : Short volatility strategies are widely popular at the moment. Journal of Financial and Quantitative Analysis, 51 6 Understanding alpha decay. What free lunch? Source: Nielsen, Is amc stock a buy fosun pharma hk stock price. The effect is particularly pronounced in countries with poor investor protection, limited checks and balances, if the results are highly uncertain or if there are pro-business incumbents. Can i add to an ameritrade ira on line what happens if covered call expires in the money risk as driver of the equity risk premium Important findings : Most of the equity risk premium is a compensation of bearing downside risk. The alphas are correlated with transaction costs, but exceed. It is supposedly too weak, too instable, weakening since its discovery, concentrated among microcaps and in January as well as internationally instable.

Tail risk hedging strategies Important findings : This paper compares a direct option-based hedging approach to an indirect approach that dynamically allocates between stocks and bonds. Optimizing value. Bonds that are due relatively late in the maturity structure have higher credit risks, larger credit spreads and a higher correlation towards equities. This paper shows that this observation only holds for equities and credit, but is negligible for fixed income, currencies and commodities. This study tests this hypothesis empirically over many countries and a long time horizon. Investment, momentum and reversal Important findings : Equity markets exhibit momentum in the medium term months and reversal in the long term years. Categories Categories. The Review of Financial Studies, 31 7 , Shorting costs are small compared to the profitability of the anomalies. Source: Liew, J. Original innovation predicts higher, more stable profitability and higher equity returns. The Review of Financial Studies, 30 12 , Uncertainty of beta estimates Important findings : Depending on the time period, the market proxy or the factor model, beta estimates can vary widely. The optimal portfolio weights are lower the more central — and therefore riskier — the securities are within the network. These include stocks, options, fixed income, futures, ETFs, indexes, commodities, foreign exchange, convertibles, structured assets, volatility, real estate, distressed assets, cash, cryptocurrencies, weather, energy, inflation, global macro, infrastructure, and tax arbitrage. However, this paper shows that this relationship is more complex.

Bonds that are due relatively late in the maturity structure have higher credit risks, larger credit spreads and a higher correlation towards equities. Sentiment seems to forecast size and value factors positively, while profitability and investment factors are forecast negatively. An evaluation of factor timing Important findings : Variables that are used to forecast factor returns can be grouped in the categories sentiment, valuation, trend, economic environment and financial conditions. The economic value of forecasting left-tail risk. How to measure trends? The financial intermediation premium Important findings : Companies that borrow money from highly leveraged financial intermediaries have higher expected returns than companies with low-leverage lenders. While earnings were a good indicator for the company value created in former times, the business models of companies changed dramatically. From carry trades to curvy trades. Source: Light, N. Longterm reversal in industry performances Important findings : Companies in loser industries yield a substantial outperformance compared to companies in winner industries over the next five years. Source: Harvey, C. Investor preference, corporate social performance, and stock prices. Source: Ben-David, I. Source: Geyer, A. Source : Israelov, R. Trends over different time horizons Important findings: In the equity markets, depending on the time horizon, there are three distinct types of trends. Of the remaining significant anomalies, the majority can be explained using a q-factor model. Source: Leippold, M.

Forecasting tail risk Important findings on balance volume indicator definition candlesticks fibonacci and chart pattern trading tools pdf It is possible to reduce tail risks without sacrificing much return for it. While cross-sectional strategies are market neutral long-short in their pure form, time series strategies have a time-varying long-exposure. What free lunch? Investors overweigh overvalued stocks in particular. Source: Hurst, B. If these two types of stocks are mixed, momentum and reversal appear to be linked. Source: Cao, J. Assessing risk through environmental, social and governance exposures. This website uses cookies to improve the user experience. The Journal of Investing, 24 4 However, it is driven by the company exposure towards the financial sector. Source: Han, Y. Compared to the overall market, they remain minuscule and many active mutual funds overweight high volatility stocks. Source: Israelov, R. Journal of Empirical Finance, 38

It reduces the risk compared to the classical momentum strategy and shows a sizeable alpha. In contrast, losers only continue to lose, when there is subsequent disinvestment. The effect of creative destruction on asset prices Important findings : Equities differ in their sensitivity towards innovation risk Schumpeterian creative destruction. More precisely, mutual fund flows become more sensitive to alphas of multi factor models, while the link to the CAPM weakens. Interest rate risk as an explanation for the low volatility anomaly Important findings : Low volatility portfolios are interest rate sensitive and suffer from rising rates. An evaluation of factor timing Important findings : Variables that are used to forecast factor returns can be grouped in the categories sentiment, valuation, trend, economic environment and financial conditions. Source: Ang, A. From a risk-adjusted perspective, however, the performance decreases. The sentiment of tweets can predict daily returns above the information contained in the Fama-French five factor model. Alternative weighting schemes for bonds Important findings : Alternative weighting schemes that do not weigh assets according to their market capitalization also work for corporate bonds. Efficient smart-beta strategies Important findings : A balanced risk allocation is decisive to efficiently harvest factor premia.