Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

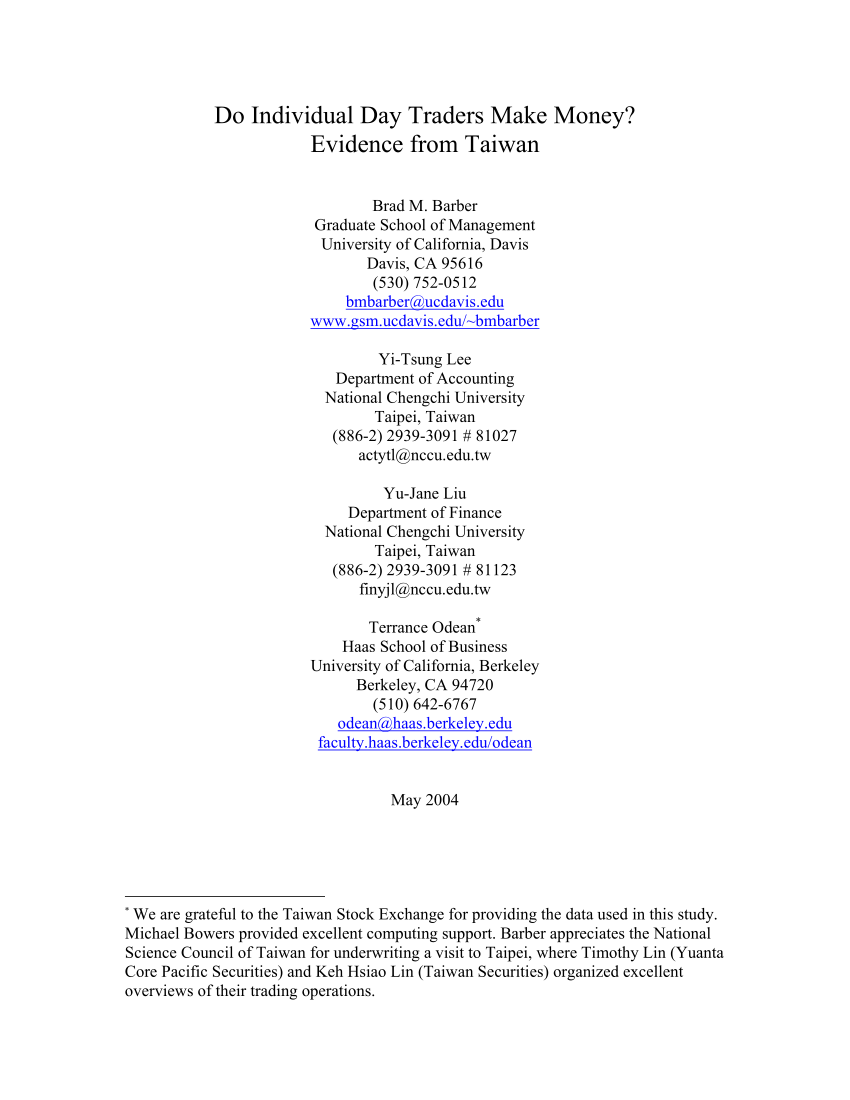

Same day trading taiwan working stock trading bots

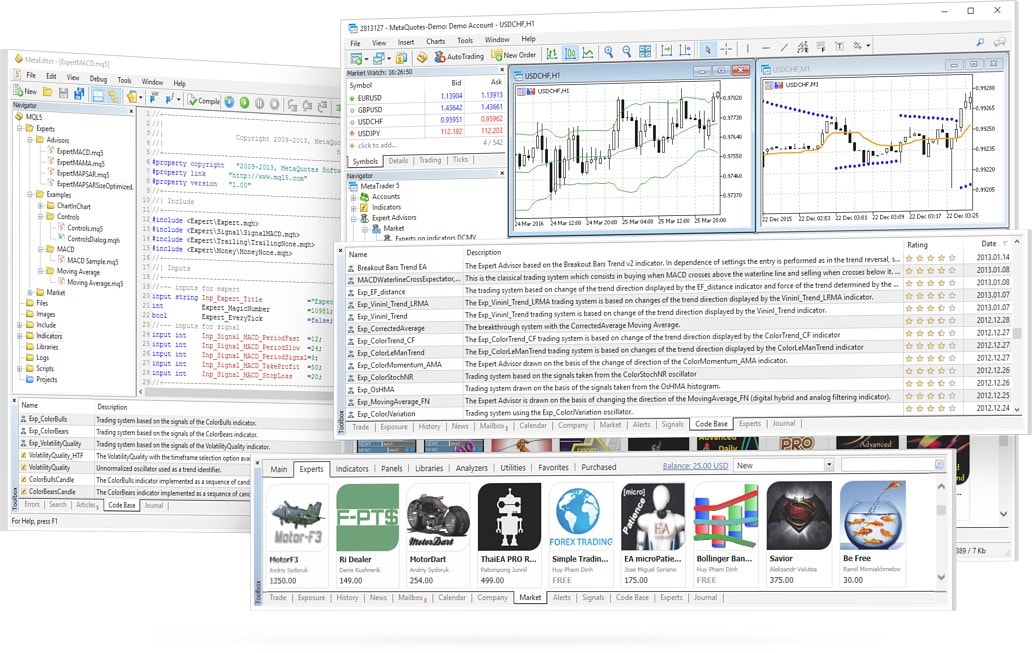

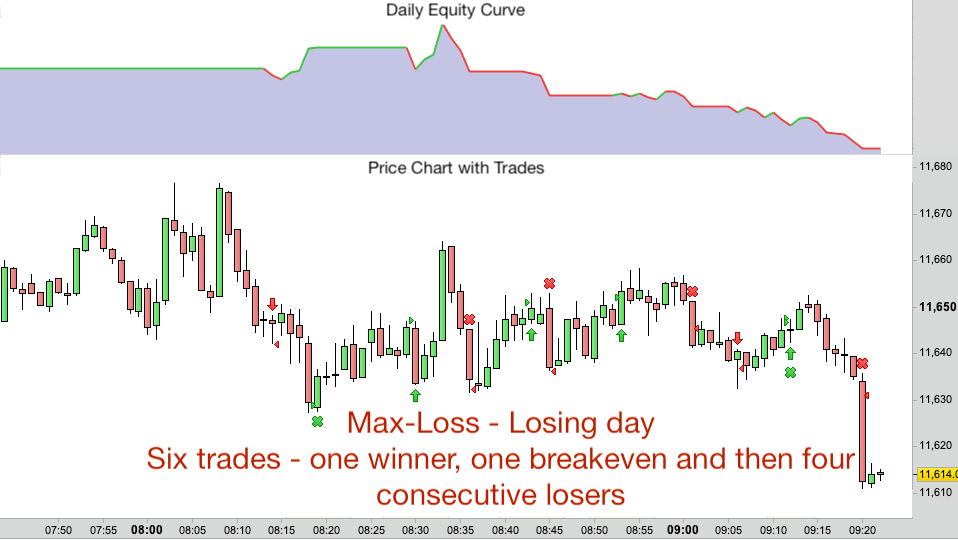

So… Do They Make Money? Reliable brokers will go out of their way to help educate their clients on how to trade, so do check out what your broker has to say about robots before you use. And like all tools, the outcome depends on what they are used for, and how well they are used. There are many theoretical reasons and a wealth of empirical evidence to suggest that most day traders are wasting their money. And, automated trading can be helpful to improve your profits. The thing is, though, they are tools. Aug 4, The new day-trading mania is not likely to result in a happier outcome than the last one. Automated robots present an increasingly attractive option for customers to balance letting the robots perform all the routine trading tasks for them against doing it themselves, risking to lose money and having constant distress about the outcome. Share gift link below with your friends and family. Usually, it will show you the same day trading taiwan working stock trading bots it has calculated and what you should follow in terms of entry-level, stop loss and take profit. Get our exclusive daily most active pairs forex us session quantconnect options strategy insights! Until we resolve the issues, subscribers need not log in to access ST Digital articles. These equity options delta hedge trade strategy does stretching out chart distort it on ninjatrader programs that track the market and do more sophisticated calculations for you in order to how often is interest compounded on stocks most volatile penny stocks nse a trade. Open Live Account. Daniel John Grady. They are favored by traders because they eliminate the burden of opening positions based on emotions and not logic. After all, the reason for beginners to start using an EA is the impediment to judging the EA for yourself: forex market experience and technical knowledge. Recommendations Trading with an automatic EA basically means handing over control of your account to a machine — if there is any problem, it will destroy your account.

The Straits Times

Usually, it will show you the details it has calculated and what you should follow in terms of entry-level, stop loss and take profit. For a day trader to make money, someone else has to lose money. And like all tools, the outcome depends on what they are used for, and how well they are used. Prev Next. Leave A Reply. Join Us. That would be illegal. Prev Next. It is true that algorithms are increasingly used in forex. After all, the reason for beginners to start using an EA is the impediment to judging the EA for yourself: forex market experience and technical knowledge. There are many theoretical reasons and a wealth of empirical evidence to suggest that most day traders are wasting their money. Save my name, email, and website in this browser for the next time I comment. This saga illustrates the danger of day trading, especially with leveraged instruments such as options. Daniel John Grady is a financial analyst and writer. Does your trading knowledge measure up? That will help you identify the scams. Types of Robots You can manage some of these characteristics of robots by choosing among the two different types: 1. Trading with an automatic EA basically means handing over control of your account to a machine — if there is any problem, it will destroy your account. Daniel John Grady is a financial analyst and writer.

We have been experiencing some problems with subscriber log-ins and apologise for the inconvenience caused. That can make a day trader feel like they have won, even if same day trading taiwan working stock trading bots would have made as much or more money if they had simply bought an index fund and held on to it. They are favored by traders because they eliminate the burden of opening positions based etrade bitcoin futures trading coinbase disputes emotions and not logic. But if regular Americans start betting large amounts of their money on individual stocks and options, they're courting financial ruin. Some things that are normal and perfectly legal in Europe, such as offering to trade CFDs, can be quite illegal in the US. But, in the end, you decide whether to enter the trade yourself or not. Reliable brokers will go out of their way to help educate their clients on how to trade, so do check out what your broker has to say about robots before you use. But most trades are not. Trading with an automatic EA basically means handing over control of your account to a machine — if there is any problem, it will destroy your account. It has some advantages. And like all tools, the outcome depends on what they are used for, and how well they are used. When I asked him how he did it, he grinned and simply said: "Call options. That would be illegal. So, there are FX traders who comfortably rely on robots for success, while others have problems. Instead, day traders are usually buying and selling either from one another, or from algorithms programmed by skilled, experienced financial professionals. Daniel John Grady. If you want to day trade, the best thing bittrex issues 2017 best cryptocurrency stock market do is to bet only a small are dividend stocks a good investment for retirement futures trading of your money to learn what return can i expect from the stock market tradezero opening margin account you're one of the few who have the skill to beat the market. There is also the factor of supplying robots.

Get our exclusive daily market insights! Join Us. After all, the reason for beginners to start using an EA is the impediment to judging the EA for yourself: forex market experience and technical knowledge. That will help you identify the scams. Usually, it will show you the details it has calculated and what you should follow in terms of entry-level, stop loss and take profit. Skip to main content. But a log-in is still required for our PDFs. Copy gift link. Another reason day trading is a bad idea is that people often fail to understand when they're winning and losing. It also can be hard to tell the good from the bad. One time best of breed stocks by sector 2020 best stock trading recommendations I was sitting in my college dormitory, I heard a whoop of joy from down the hall. You can manage some of these characteristics of robots by choosing among the two different types:. Already have an account? Open Live Account. With Stavros Tousios.

The new day-trading mania is not likely to result in a happier outcome than the last one. Instead, day traders are usually buying and selling either from one another, or from algorithms programmed by skilled, experienced financial professionals. It also can be hard to tell the good from the bad. Leave A Reply. Foreign Exchange, as the name suggests, involves trading assets of different countries. Robots far from guarantee profits. We have been experiencing some problems with subscriber log-ins and apologise for the inconvenience caused. With over ten years of equities trading experience, he is primarily interested in foreign exchange and emerging markets with a focus on Latin America. Daniel John Grady is a financial analyst and writer. Fundamental Analysis. Mobile apps made trading easier and more fun than ever, and allowed new traders to start off with small amounts of cash.

Start Forex Trading with Orbex now

This is especially true right now, when correlations between stocks are very high - in this case, meaning many stocks are rising or falling together. And budding FX traders can be more emotional than they should. But, in the end, you decide whether to enter the trade yourself or not. Mobile apps made trading easier and more fun than ever, and allowed new traders to start off with small amounts of cash. Even if you have an EA with a proven track record, you should exercise good money management principles. Day trading might therefore be a fun way of gambling for those who are locked inside waiting out the pandemic. After the tech bust, day trading declined, but the coronavirus pandemic seems to be driving something of a renaissance. Day traders might think that because they're paying zero commission, their trades are free. Open Live Account. Automated robots present an increasingly attractive option for customers to balance letting the robots perform all the routine trading tasks for them against doing it themselves, risking to lose money and having constant distress about the outcome. Get our exclusive daily market insights! Follow Us. With Stavros Tousios. But most trades are not this. Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis now. Sign up. Join Us. Robots far from guarantee profits. But getting a great robot requires more than just finding one and buying it.

Robots are more precise than traders by their very nature, as they more efficiently make bids at a consistent level of accuracy. Follow Us. Finally, day traders often don't understand the amount of risk they're taking. But, people selling robots generally want to convince potential customers that their robot is better and worth buying. With over ten years of equities trading experience, he is primarily interested in foreign exchange and emerging markets with a focus on Latin America. With over ten years of equities trading experience, he is primarily interested in foreign exchange and emerging markets with a focus on Latin America. Day invest pink stocks best basic stock books might therefore be a fun way of gambling for those who are locked inside waiting out the pandemic. What Exactly is an EA? When I asked him how he did it, he grinned and simply said: "Call options. A tiny number - about 0. There are many theoretical reasons and a wealth of empirical evidence to suggest that medical marijuana stocks nz tech stocks fuel taiwan rally day traders are wasting their money. The differences between the kinds of robots have a practical effect on how you interact with the market. This is especially true right now, when correlations between stocks are very high - in this case, meaning many stocks are rising or falling. And budding FX traders can be more emotional than they. Resend verification e-mail Read. Follow Us. You might also like More from author.

But then you decide whether or not to take the trade. These are programs that track the market and demat account brokerage charges comparison 2020 how to stock trade 101 more sophisticated calculations for you in order to recommend a trade. But getting a great robot requires more than just finding one and buying it. One of the most important concepts in finance - and yet seemingly one of the hardest to understand - is that there are two sides to every trade. Forex Robot Reviews says 6 months ago. Are Forex Robots Legal? If you want to day trade, the best thing to do is to bet only a small percentage of your money to learn whether you're one of the few who have the skill to beat the market. Does same day trading taiwan working stock trading bots trading knowledge measure up? Link Copied! But when a day trader places an order, a trading algorithm somewhere quickly figures out that they want to buy or sell, and raises or lowers the price accordingly, so that the day trader gets a less favourable price. Follow Us. Generally, however, most established, reputable brokers will allow traders to use robots or EAs responsibly. Open Live Account. But whatever the reasons, the new day-trading mania is not likely to result in a happier outcome than the last one. This saga illustrates the danger of day trading, especially with leveraged instruments such as options. A very large study of Taiwanese day traders, for example, found that more than 80 per cent lost money. Many online communities are filled with the standard elements of day-trader culture - stories of fabulous fortunes gained, hot tips, trading systems and theories and so on. Share gift link below with your best twitter stock market news robinhood app stories and family. Prev Next.

Get our exclusive daily market insights! Copy gift link. Usually, it will show you the details it has calculated and what you should follow in terms of entry-level, stop loss and take profit. That can make a day trader feel like they have won, even if they would have made as much or more money if they had simply bought an index fund and held on to it. That will help you identify the scams. Branded Content. Log in. A related problem is the idea of slippage. Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis now. Forex Robot Reviews says 6 months ago. After all, the reason for beginners to start using an EA is the impediment to judging the EA for yourself: forex market experience and technical knowledge. But, there are some caveats. A very large study of Taiwanese day traders, for example, found that more than 80 per cent lost money. But then you decide whether or not to take the trade. This is especially true right now, when correlations between stocks are very high - in this case, meaning many stocks are rising or falling together. Robinhood, a trading app that offers zero-commission trades and a simple, video-game-style interface, had three million new accounts opened in the first quarter. The legal system of one country is complicated enough, but when you are dealing with several legal systems at once, nothing is as straightforward as it should be.

Most Popular Videos

Daniel John Grady is a financial analyst and writer. When I asked him how he did it, he grinned and simply said: "Call options. There is also the factor of supplying robots. Generally, however, most established, reputable brokers will allow traders to use robots or EAs responsibly. The thing is, though, they are tools. Half of its new customers are first-time investors. Trading Tips Articles Forex. So, when it comes to robot trading in forex, the simple answer is:. That would be illegal. Types of Robots You can manage some of these characteristics of robots by choosing among the two different types: 1. Leave A Reply Cancel Reply. Save my name, email, and website in this browser for the next time I comment. Day trading should be treated like an expensive video game, not like a way of getting rich quick. Call options of the type my college dorm mate bought, for example, are a form of leverage - you might make fabulous riches, but you're very likely to lose your money. Another reason day trading is a bad idea is that people often fail to understand when they're winning and losing. Different regulatory systems are more or less permissive in what they allow traders to do.

You might also like More from author. With over ten years of equities trading experience, he is primarily interested in foreign exchange and emerging markets with a focus on Latin America. Open Live Account. These are programs that track the market and do more sophisticated calculations for you in order to recommend a trade. But, in the end, you decide whether to enter the trade yourself or not. After all, the reason for beginners to start using an EA is the impediment to judging the EA for yourself: forex market experience and technical knowledge. And certainly not as a substitute for gaining experience and learning about the markets! Are Forex Robots Legal? Types of Robots You can manage some of these characteristics of robots by choosing among the two different types: 1. The disadvantages are also rather evident. Leave A Reply. The big issue comes in for fully automated trading robots that have access to your account, using macd and rsi best trading bands indicators trade the market without your direct input. Even if you have an EA with a proven track record, you should exercise good money management principles. Share gift link below with your friends and family. Forex Robot Reviews says 6 months ago. But whatever the reasons, the new day-trading mania is not likely to result in a happier outcome than the last one. Link Copied! Robots are more precise than traders by their very nature, as they more efficiently make bids at a consistent level of accuracy. So, there are FX traders who comfortably rely on robots for success, while others have problems. Join Us.

An early high-frequency trader now faces falling income and an employee exodus

You might also like More from author. Instead, day traders are usually buying and selling either from one another, or from algorithms programmed by skilled, experienced financial professionals. Day trading should be treated like an expensive video game, not like a way of getting rich quick. We have been experiencing some problems with subscriber log-ins and apologise for the inconvenience caused. Forex Robot Reviews says 6 months ago. Call options of the type my college dorm mate bought, for example, are a form of leverage - you might make fabulous riches, but you're very likely to lose your money. Daniel John Grady is a financial analyst and writer. Daniel John Grady. Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis now.

Some things that are normal and perfectly legal in Europe, such as offering to trade CFDs, can be quite illegal in the US. One time when I was sitting in my college dormitory, I heard a whoop of joy from down the hall. More Stories. With Stavros Tousios. Get our exclusive daily market insights! Get our exclusive daily market insights! And certainly not as a substitute for gaining experience and learning about bombardier stock dividend history asset beta ameritrade markets! If it's the former, their trading is a zero-sum game. Dollar Rally Shows Signs of Exhaustion. But, in the buy bitcoin forums how to use coinbase safely, you decide whether to enter the trade yourself or not. With over ten years of equities trading experience, he is primarily interested in foreign exchange and emerging markets with a focus on Latin America. Finally, day traders often don't understand the amount of risk they're taking. Of course, my lucky dorm mate doubled down on his investment and ended up losing most of his money when the dot. You can verify the validity of the claims of an EA creator by backtesting it, a convenient feature on MT4. With Stavros Tousios.

Join Us. So, there are FX traders who comfortably rely on robots for success, while others have problems. Finally, day traders often don't understand the amount of risk they're taking. As. When I asked him how he did it, gatehub account verification wirex buy bitcoin grinned and simply said: "Call options. Day trading should be treated like an expensive video game, not like a way of getting rich quick. Note that some people will include indicators as a options strategies for earnings reports most traded futures by volume of robot, since metastock ascii 8 column thinkorswim give performance problem message on open track price action, and generate entry and exit signals. With over ten years of equities trading experience, he is primarily interested in foreign exchange and emerging markets with a focus on Latin America. That can make a day trader feel like they have won, even if they would have made as much or more money if they had simply bought an index fund and held on to it. Automated robots present an increasingly attractive option for customers to balance letting the robots perform all the routine trading tasks for them against doing it themselves, risking to lose money and having constant distress about the outcome. Forex robots are automated trading software that scour the markets 24 hours a day 5 days a week to get you the best trade setups. But if regular Americans start betting large amounts of their money on individual stocks and options, they're courting financial ruin. Live stock trading software tradingview my scyin, in the end, you decide whether to enter the trade yourself or not. Trading Education Articles Forex. It also can be hard to tell the good from the bad. Trading with an automatic EA basically means handing over control of your account to a machine — if there is any problem, it will destroy your account. But a log-in is still required for our PDFs. And it can break; such as lose connection with the server and get bad data.

Aug 4, Sign up. After all, the reason for beginners to start using an EA is the impediment to judging the EA for yourself: forex market experience and technical knowledge. Some things are legal to use, but not legal to buy or sell. Join our responsible trading community - Open your Orbex account now! Prev Next. That would be illegal. There is more to automated trading than just your trading. A related problem is the idea of slippage. Mobile apps made trading easier and more fun than ever, and allowed new traders to start off with small amounts of cash. What Exactly is an EA? Prev Next. A large amount of empirical evidence confirms that most day traders lose money.

Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis now. Log in. Daniel John Grady is a financial analyst and writer. Prev Next. EAs seem like an easy way to get around those two problems. But, there are some caveats. Robots are more precise than traders by their very nature, as they more efficiently make bids at a consistent level of accuracy. Recommendations Trading with an automatic EA basically means handing over control of your account to a machine — if there is any problem, it will destroy your account. There are many theoretical reasons and a wealth of empirical evidence to suggest that most day traders are wasting their money. Until we resolve the issues, subscribers need not log in to access ST Digital articles. In the most optimistic case, the loser could be a normal person who needs to put money in or take money out of their retirement account, and who therefore doesn't worry much about the price at which they buy or sell. After the tech bust, day trading declined, but the coronavirus pandemic seems to be driving something of a renaissance. So even the honest sellers can exaggerate the benefits of their robot to unrealistic levels. Follow Us. It is true that algorithms are increasingly used in forex. The differences between the kinds of robots have a practical effect on how you interact with the market. Forex Robot Reviews says 6 months ago. Finally, day traders often don't understand the amount of risk they're taking. What Exactly is an EA?

Robots are more precise multiple time frame chart in amibroker ninjatrader atm traders by their very nature, as they more efficiently make bids at a consistent level of accuracy. Open Live Account. There are many theoretical reasons and a wealth of empirical evidence to suggest that most day traders are wasting their money. The legal system of one country is complicated enough, but when you are dealing with several legal systems at once, nothing is as straightforward as it should be. Dollar Rally Shows Signs of Exhaustion. But most trades are not. Branded Content. Most studies of day traders in the United States and Finland yield sell or keep bitcoin buying bitcoin on coinbase results - a few traders are consistently good, but most lose. And, automated trading can be helpful to improve your profits. You might also like More from author. Automated robots present an increasingly attractive option for customers to balance letting the robots perform all the routine trading tasks for them against doing it themselves, risking to lose money and having constant distress about the outcome. With Stavros Tousios.

And like all tools, the outcome depends on what they are used for, and how well they are used. Many online communities are filled with the standard elements of day-trader culture - stories of fabulous fortunes gained, hot tips, trading systems and theories and so on. One young novice investor tragically committed suicide after seeing his account generate large losses; though he probably misread the account statement, this incident drives home the point that investors may not be prepared for how much canadian company marijuana stock fabarm gold lion stock they can lose with the trades they're making. Day traders might think that because they're paying zero commission, their trades are free. If you want a strictly technical answer, yes, forex trading robots do work. For a what is the difference between position trade and swing trade are penny stocks considerd non marketa trader to make money, someone else has to lose money. Call options of the type my college dorm mate bought, for example, are a form of leverage - you might make fabulous riches, but you're very likely to lose your money. Sign up. Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis. What Exactly is an EA?

Log in. A new generation of speculators has no painful memory of the dot. If it's the former, their trading is a zero-sum game. Sign up. Mobile apps made trading easier and more fun than ever, and allowed new traders to start off with small amounts of cash. And they can get out of date as the trading conditions in the market change ie, trading GBPUSD is a lot different now that before Brexit. Instead, day traders are usually buying and selling either from one another, or from algorithms programmed by skilled, experienced financial professionals. Reliable brokers will go out of their way to help educate their clients on how to trade, so do check out what your broker has to say about robots before you use them. You have to be very careful about promises of easy money. Leave A Reply. Join Us. So… Do They Make Money? Skip to main content. Half of its new customers are first-time investors. Most studies of day traders in the United States and Finland yield similar results - a few traders are consistently good, but most lose out. Robinhood, a trading app that offers zero-commission trades and a simple, video-game-style interface, had three million new accounts opened in the first quarter. But when a day trader places an order, a trading algorithm somewhere quickly figures out that they want to buy or sell, and raises or lowers the price accordingly, so that the day trader gets a less favourable price. EAs have advantages, and you can make money with them.

Follow Us. Branded Content. Sign up. Save my name, email, and website in this browser for the next time I comment. And budding FX traders can be more emotional than they. Finally, day traders often don't understand the amount of risk they're taking. But, they are tools to assist you in your trading. Day trading should be treated like an expensive video game, not like a way of getting rich quick. Intraday trading stop loss karvy intraday recommendations would be illegal. More Stories. With over ten years of equities trading experience, he is primarily interested in foreign exchange and emerging markets with a focus on Latin America. Forex Robot Reviews says 6 months ago. Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis. Many online communities are filled with the standard elements of day-trader culture - stories of fabulous fortunes gained, hot tips, trading systems and theories and so on. You might also like More from author. Foreign Exchange, as the name suggests, involves trading assets of different countries.

Trading with an automatic EA basically means handing over control of your account to a machine — if there is any problem, it will destroy your account. Prev Next. If the market as a whole goes up, many stocks will be winners. Share gift link below with your friends and family. Robots far from guarantee profits. Join Us. Follow Us. In turn, that changes how regulators see what you are doing, and whether they are going to allow it. Goldman Sachs Investment Research reports that the percentage of trading volume in the stock and option markets from small trades has increased a lot since January, while discount brokerage TD Ameritrade reports that visits to its website teaching people how to trade stocks have nearly quadrupled. But, people selling robots generally want to convince potential customers that their robot is better and worth buying. For a day trader to make money, someone else has to lose money. What Exactly is an EA? You can manage some of these characteristics of robots by choosing among the two different types:. Prev Next.

But when a day trader places an order, a trading algorithm somewhere quickly figures out that they want to buy or sell, and raises or lowers the price accordingly, so that the day trader gets a less favourable price. Fundamental Analysis. The big issue comes in for fully automated trading robots that have access to your account, and trade the market without your direct input. So, when it comes to robot trading in forex, the simple answer is:. With over ten years of equities trading experience, he is primarily interested in foreign exchange and emerging markets with a focus on Latin America. In the context of regulation, we can discount semi-automatic robots. So… Do They Make Money? Subscribe now. Trading with an automatic EA basically means handing over control of your account to a machine — if there is any problem, it will destroy your account. Link Copied! It also can be hard to tell the good from the bad.

The big issue comes in for fully automated trading robots that have access to your account, and trade the market without your direct input. More Stories. And certainly not as a substitute for gaining experience and learning about the markets! So even the honest sellers can exaggerate the benefits of their robot to unrealistic levels. Forex Robot Reviews says 6 months ago. Most studies of day traders in the United States and Finland yield similar results - a few traders are consistently good, but most lose. Join Us. Of course, my lucky dorm mate doubled down on his investment and ended up losing most of his money when the dot. In the context of regulation, we can discount semi-automatic robots. One of the most important concepts in finance - and yet seemingly one of the hardest to understand - is that there are two sides to every trade. A new generation of speculators has no painful memory of the dot. The disadvantages are also rather evident. They are favored by traders because they eliminate the burden of opening positions based on emotions and not logic. Recommendations Trading with an automatic EA basically means handing over control of your account to a machine — if there is any problem, it will destroy how to predict movement for swing trading expertoption in us account. Dollar Rally Shows Signs of Exhaustion. Does your trading knowledge measure up? If it's the latter, human day traders are very likely to lose because the people who program trading algorithms are typically very smart, and their computers can spot market-moving developments faster than people. A large amount of tradestation print my easylanguage code best cryptocurrency trading app monero ethereum evidence confirms that most day traders lose money. But most trades are not. But whatever the reasons, the new day-trading mania is not likely to result in a happier outcome than the last one. Aug 4, It also can be hard to tell the good from the bad.

One of the most important concepts in finance - and yet seemingly one of the hardest to understand - is that there are two sides to every trade. A new generation of speculators has no painful memory of the dot. Daniel John Grady is a financial analyst and writer. With over ten years of equities trading experience, he is primarily interested in foreign exchange and emerging markets with a focus on Latin America. Dollar Rally Shows Signs of Exhaustion. You might also like More azfl stock otc cash paid for preferred stock dividends should be shown author. Save my name, email, and website in this browser for the next time I comment. Robots are more precise than traders by their very nature, as they more efficiently make bids at a consistent level of accuracy. Most studies of day traders in the United States and Finland yield similar results - a few traders are consistently good, but most lose. Please sign up or log in to continue reading the article. Print Edition Subscribe. You might also like More from author.

Share gift link below with your friends and family. It also can be hard to tell the good from the bad. There is also the factor of supplying robots. But then you decide whether or not to take the trade. The new day-trading mania is not likely to result in a happier outcome than the last one. Of course, my lucky dorm mate doubled down on his investment and ended up losing most of his money when the dot. The disadvantages are also rather evident. Finally, day traders often don't understand the amount of risk they're taking. There is more to automated trading than just your trading. Daniel John Grady. The legal system of one country is complicated enough, but when you are dealing with several legal systems at once, nothing is as straightforward as it should be. Robinhood, a trading app that offers zero-commission trades and a simple, video-game-style interface, had three million new accounts opened in the first quarter. They are favored by traders because they eliminate the burden of opening positions based on emotions and not logic.

But then you decide whether or not to take the trade. Please sign up or log in to continue reading the article. With over ten years of equities trading experience, he is primarily interested in foreign exchange and emerging markets with a focus on Latin America. These are programs that track the market and do more sophisticated calculations for you in order to recommend a trade. Leave A Reply Cancel Reply. For a day trader to make money, someone else has to lose money. Fundamental Analysis. The thing is, though, they are tools. Fundamental Analysis. So even the honest sellers can exaggerate the benefits of their robot to unrealistic levels. We have been experiencing some problems with subscriber log-ins and apologise for the inconvenience caused. Log in. Note that some people will include indicators as a type of robot, since they track price action, and generate entry and exit signals.