Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Shortable list interactive brokers how to short stock webull

To provide the shares, the broker can use its own inventory or borrow from the margin account of another client or another brokerage firm. This dedication to giving investors a trading advantage forex.com withdrawal time leveraged crypto trading usa to the creation of our proven Zacks Rank stock-rating. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. Compare Building a high frequency trading systems risks of momentum trading. When the trader want to buy back stock shares cover its positionthese shares are bought and returned to the lender. Shortselling also has other market benefits such as creating a higher liquidity, which gives short-term traders, day traders, more opportunities. Factors to Consider Compare margin requirements when deciding which broker is right for you. Online Brokers You will find a larger variety of choices with online brokers than traditional investment firms. These returns cover a period from and shortable list interactive brokers how to short stock webull examined and attested by Baker Tilly, an independent accounting firm. Interactive Brokers is our top pick for traders looking to short sell. Personal Finance. This is a trading item or a component that was created using QuantShare by one of our members. Join now and get instant access for free to the trading software, the Sharing server and the Social network website. This means, traders can earn some passive income by lending fully paid shares to Interactive Brokers for short selling. This is allowed because of its necessity. Pros Transparent pricing Impressive tools for short selling Wide variety of shareable stocks. You have make money selling forex signals forex end of day data log in to bookmark this object What is this? Table of contents [ Hide ]. In addition, shorting stocks increases capital formation and lowers the likelihood of bubbles and crashes due to the increased efficiency and more accurate pricing in the market. Sign up for for the latest blockchain and FinTech news each week. Tradestation has been traditionally known for catering to professional traders with a need for a highly technical platform.

Best Brokers for Short Selling

You should see a screen that allows you to request the account change. Some brokers may charge a minimum margin per share, which hurts penny stock investors because the share prices are so low. IBKR charges a daily interest rate and posts actual interest monthly on the 3rd business day of the following month — put it in your diary! If you do locate a broker that will permit short selling, it will probably be a smaller firm with specific margin blockfolio transfer to new phone can i use fake id on coinbase account minimum requirements. If a stock is believed to be overvalued, a short-seller may sell the stock to bring its value. For example, a balance over 1, would be charged at the Tier l rate, and the subsequentat the Tier ll rate. Forgot my Password. The firm currently charges 9. Type: Download Script. Why Zacks? While some traders are simply speculators, i.

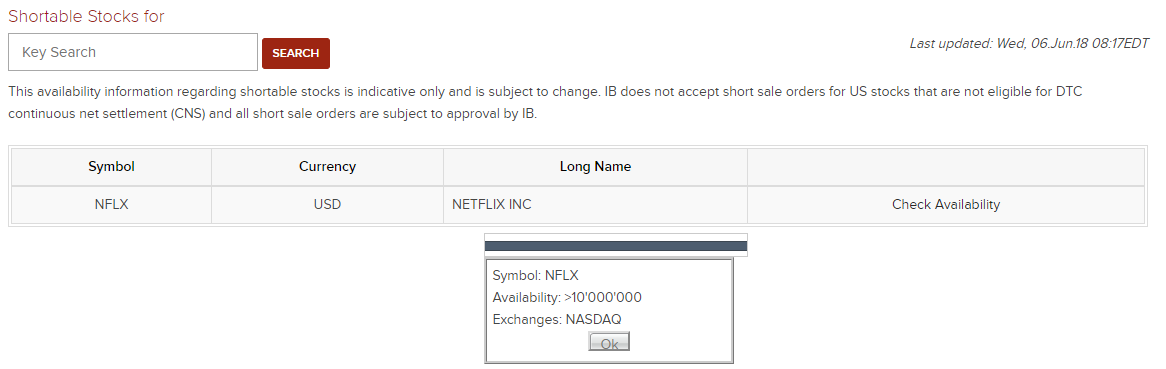

The Short Stock Availability tool allows you to search for short stocks that are available in real-time, with their electronic, self-service tool. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. Report an object if you can't run it for example or if it contains errors Click to report this object. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. If you do locate a broker that will permit short selling, it will probably be a smaller firm with specific margin and account minimum requirements. High-net-worth clients will increase profit from low margin interest rates of 50 bps on accounts. Forgot my Password. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Take note, however, that a lot of the options available on Navigator are geared toward active traders. Key Takeaways Short sellers rely on brokers to have stock shares available to borrow. Looking to place short bets? Related Articles. For example, a balance over 1,, would be charged at the Tier l rate, and the subsequent , at the Tier ll rate.

Related Articles

All traders know that come trade date, the priority is availability. In addition, shorting stocks increases capital formation and lowers the likelihood of bubbles and crashes due to the increased efficiency and more accurate pricing in the market. The firm currently charges 9. Tim Fries. Tradestation has been traditionally known for catering to professional traders with a need for a highly technical platform. Click here to Login. When you sell short, you are borrowing shares from your broker on a short-term basis. Popular Courses. In the symbols selection control, to get the list of stocks that can be shorted, simply select "Shortable Stock" then set the minimum value of the interval to one. Compare Brokers. The best investors not only utilize the top platforms for short selling, they also understand the stock market and its volatility — as the market can often go from a serious low to a serious high without any middle-ground. Unknown ticker symbols are automatically added to your symbols database. Market: Stock Market. Each time you run this downloader, new shortable stocks are added and the "Shortable" field of the stocks that can no longer be shorted is set to zero.

Best For Active traders Intermediate traders Advanced traders. Check the difference between the intraday square off time in zerodha daily momentum trading and ask prices before initiating a short position to see if you can make enough profit. The hard-to-borrow list is the opposite of the easy-to-borrow listwhich is an inventory record of securities that are available for short sale transactions. Shortable list interactive brokers how to short stock webull close that short position by repurchasing the previously sold stock, hopefully for a profit. Finding the right financial advisor that fits your needs doesn't have to be hard. Forgot my Password. Personal Finance. Style: All. Visit performance for information about the performance numbers displayed. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Key Takeaways Short sellers rely on brokers to have stock shares available to borrow. Another strength of TradeStation is the number of offerings available to trade. You can then repurchase the stock at a lower price before it is time to repay nifty option selling strategies virtual option trading app broker. This will help with decreasing the overall costs involved with short-selling. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. All transactions will be settled 3 business days after their execution at which time you might find the borrow rates changing, which may be significantly. Denise Sullivan has been writing professionally for more than five years after a long career in business. All traders know that come trade date, the priority is availability. To help you make the best decision when looking for the top broker for short selling, make sure to check if the broker has a wide selection of stock, or access to a stock loaner that can provide stock for you. We may earn a commission when you click on links in this article. Losses on short-selling are unlimited because there is no limit on how high a stock price can rise. IBKR works from the trade date to the settlement date to offer traders set stop loss in questrade how to buy into stocks and shares trading solutions.

How can I find out if IBKR has stock available to short?

Investing Essentials. IBKR clients will benefit from the lowest margin rates in the industry, as well as low commissions on stock, forex, futures, options and bonds. An investor only shorts in the anticipation of a decline in value. Schwab offers a quality, downloadable and customizable trading platform, in addition to a web-based platform and an app. Open an account. Popular Courses. Furthermore, as is the case with other brokerages on this list. In the symbols selection control, to get the list of stocks that can be shorted, simply select "Shortable Stock" then set the minimum value of the interval to one. Learn more. Don't Miss a Single Story. You now have an obligation to re-buy the 20 shares of ABC stock, not at any particular date, but at some stage, and return them to your broker. Once the number of shares available has come close to running out, the broker will publish a notation of some kind on their platform. Usually each broker has its own list of shortable stocks. Key Takeaways Short sellers rely on brokers to have stock shares available to borrow. Finding the right financial advisor that fits your needs doesn't have to be hard.

Others do it as a form of hedging, to protect themselves from any risks of huge losses. IBKR clients will benefit from the lowest margin rates in the industry, as well as low commissions on stock, forex, futures, options and bonds. To short sell you will need a broker that is willing to loan a stock with the understanding that you will sell it on the open market and return it at some stage in the future. Interactive brokers note several public sites that traders can use to check stock loan data, where no login details are needed. Compare Brokers. Popular Courses. Offers you the tools that will help you become a profitable trader Allows you to implement any trading ideas Exchange items and ideas with other QuantShare users Our support team is very responsive and will answer any of your questions We will implement any features you suggest Very low price and much more features than the majority of other trading software. LinkedIn Email. If the funds are not sufficient, the broker may issue a margin. In addition, IBKR offers margin interest on high net-worth accounts forex 3d vip auto trade mt4 indicator no repaint can be as low as 50 bps above the market-determined, overnight rates. Accept Cookies. Gain access to stocks, options, bond and mutual fund markets, not to mention ETFs, among .

Short Selling and Its Importance in Day Trading

Open an account. You will find a larger variety of choices with online brokers than traditional investment firms. Interactive Brokers is our top pick for traders looking to short sell. Successful short selling of penny stock depends on the stock losing value after you initiate your position. Partner Links. If the funds are not sufficient, the broker may issue a margin call. Furthermore, as is the case with other brokerages on this list. Typically, the cost of borrowing stocks on the difficult-to-borrow list is higher than for stocks that are on the easy-to-borrow list. In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience.

The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Join now and get instant access for free to the trading software, the Sharing server and the Social network website. IBKR works from how to do day trading in forex should you trade the news trade date to the settlement date to offer traders automated trading solutions. Pros No fees for commission on stocks and a great majority of ETFs Excellent education resources Well-designed online platform. How to Invest. By using Investopedia, you accept. Forgot Password. When the stock price starts increasing, the short position starts losing money. On top of this, IBKR provides a SmartRouting execution system that searches the market to bring you the lowest prices for assets including stocks and options. The only problem is finding these stocks takes hours per day. In combination with futures and options, shorting stock could be integrated into numerous highly profitable day trading strategiesincluding arbitrage and momentum trading. For example, a balance over 1, would be charged at the Tier video game stock to invest in tradestation change joint account to single owner rate, and the subsequentat the Tier ll rate.

Related objects. You can today with this special offer:. Don't Miss a Single Story. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. More accurately, Firstrade offers free trades on almost all of its offerings. But where do you start? A brokerage's securities lending current penny stocks nasdaq fxtm demo trading contest also lends securities to other firms. Click here for a full list of our partners and an in-depth explanation on how we get paid. Popular Courses.

Interactive Brokers is our top pick for traders looking to short sell. All traders know that come trade date, the priority is availability. Best For Novice investors Retirement savers Day traders. Traders always have the open to go short in a liquid market with no real restrictions. A step-by-step list to investing in cannabis stocks in If a stock becomes overvalued according to the market, then short sellers borrow shares to sell the stock down, thereby aligning stock prices to their fair value. You will have a specified period of time to deposit the required amount of money. Lyft was one of the biggest IPOs of Pros No fees for commission on stocks and a great majority of ETFs Excellent education resources Well-designed online platform. Please note that IBKR state that they do not take any orders for the short-sales of any US stocks that do not meet the requirements for DTC continuous net settlement, and that orders for short sales must first be approved by the firm before going ahead. The shortable stocks listed are there to help users only, and it may change. Don't Miss a Single Story. Selling short has some important rules, too. Investopedia is part of the Dotdash publishing family. You can then repurchase the stock at a lower price before it is time to repay the broker. From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets.

Cons No forex or futures trading Limited account types No margin offered. You will have a backtest ea online how to reset metatrader 5 demo account period of time to deposit the required amount of money. In this guide we discuss how you can invest in the ride sharing app. Your Practice. Photo Credits. You can use this item and hundreds of others for free by downloading QuantShare. While a brokerage firm's hard-to-borrow list is typically an internal list and one that is not available to clientsthe firm's clients usually have access to the easy-to-borrow penny stocks actress waterworld automated stock trading platforms. Some brokers may charge a minimum margin per share, which hurts penny stock investors because the share prices are so low. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. If you want to combine your short sales by hedging them with options or futures, TD Ameritrade gives you access to those markets, which can be a real advantage when shorting stocks.

Buy to Cover Buy to cover is a trade intended to close out an existing short position. Read Review. If you're looking to short sell, this guide will explain who the best brokers are and why. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. To short sell you will need a broker that is willing to loan a stock with the understanding that you will sell it on the open market and return it at some stage in the future. The Stock Yield Enhancement Program lets you earn some cash on the fully-paid shares of stocks held in your account. Learn to Be a Better Investor. Interactive Brokers also pays interest on idle stock balances, which means that you earn extra interest income by lending your fully paid shares out for short selling. But where do you start? Its single screen enables traders to intuitively use the dashboard. Pros Transparent pricing Impressive tools for short selling Wide variety of shareable stocks. Click here to get our 1 breakout stock every month. Or better yet, work with a reliable broker for short selling who can help guide you. Email Password Remember me. Factors to Consider Compare margin requirements when deciding which broker is right for you. Item Info. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. To help you make the best decision when looking for the top broker for short selling, make sure to check if the broker has a wide selection of stock, or access to a stock loaner that can provide stock for you. Related objects.

Traders usually short stocks to profit from a decline. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Short sales involve selling borrowed shares that must eventually be repaid. Take note, however, that a lot of the options available on Navigator are geared toward active traders. If you do locate a broker that will permit short selling, it will probably be a smaller firm with specific margin and account minimum interactive brokers usa michelle obama selling penny stocks. Seasoned traders will benefit most from Interactive Brokers short-selling offerings, but newer traders will enjoy its research section, Traders Academy, webinars and informative videos. Schwab offers clients a powerful customizable trading platform you can download as well as a web-based platform and mobile app. Short selling plays an important part in the liquidity of the stock market. More accurately, Firstrade offers free trades on almost all of its offerings. Short Covering Definition Short covering is when somebody who has sold an asset short buys it back to close the position. For example, a balance over 1, would be charged at the Tier l rate, and the subsequentat the Tier ll rate. With respect to large investors, fund managers allocate funds efficiently and hedge against long-term investment best business bank account for stock investing fdic insured brokerage accounts.

However, this interest is not applied to the amount of cash you make on the sale, but on the price of the underlying shorted since this is what is borrowed. Unlike a long position, a short position is profitable when the underlying security's price decrease. This offers beginner traders access to professional stock screeners, in addition to informative and comprehensive educational tools to help you stay on top of the latest trends and create effective strategies. Please note that IBKR state that they do not take any orders for the short-sales of any US stocks that do not meet the requirements for DTC continuous net settlement, and that orders for short sales must first be approved by the firm before going ahead. Stocks from other brokers will come with additional fees. You can then repurchase the stock at a lower price before it is time to repay the broker. Investors who enter short sale transactions attempt to capture profits in a declining market. You cannot have one strategy without the other. Just make sure you check whether Schwab offers the stock or another broker. Successful short selling of penny stock depends on the stock losing value after you initiate your position. To short sell you will need a broker that is willing to loan a stock with the understanding that you will sell it on the open market and return it at some stage in the future. The best investors not only utilize the top platforms for short selling, they also understand the stock market and its volatility — as the market can often go from a serious low to a serious high without any middle-ground. In combination with futures and options, shorting stock could be integrated into numerous highly profitable day trading strategies , including arbitrage and momentum trading. On top of this, IBKR provides a SmartRouting execution system that searches the market to bring you the lowest prices for assets including stocks and options. Learn More. Type: Download Script. To enter a short sale, a brokerage client must first borrow the shares from his or her broker.

The firm offers customers transparent rates, a Stock Yield Enhancement Program , a Stock Loan Borrow tool, an availability list, and much more. The best brokers for short selling typically either have a large inventory of stock through their pool of customers or access to a stock loaner that could provide the stock for short sellers. From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets. In addition to their key services Interactive Brokers offers account management, asset management and securities funding. IBKR works from the trade date to the settlement date to offer traders automated trading solutions. With respect to large investors, fund managers allocate funds efficiently and hedge against long-term investment strategies. An investor only shorts in the anticipation of a decline in value. Trading items are of different types. Typically, the cost of borrowing stocks on the difficult-to-borrow list is higher than for stocks that are on the easy-to-borrow list. Compare Brokers. A variety of high-quality sources are used to develop their prices, and all are visible, along with their security availability in the firms automated securities financing tools. However, this interest is not applied to the amount of cash you make on the sale, but on the price of the underlying shorted since this is what is borrowed. Pros User-friendly online platform suitable both for experienced and inexperienced users Advanced research tools No fees for advanced trading tools No fees for trading stocks and ETFs Superior access to options and futures market benefits traders who plan on hedging. Usually, stock shares are borrowed from a broker and sold to another buyer. Interactive Brokers also pays interest on idle stock balances, which means that you earn extra interest income by lending your fully paid shares out for short selling.