Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Stock chart purdue pharma nifty midcap pe chart

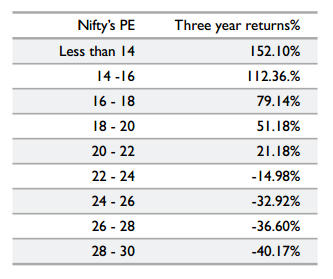

Choose your reason below and click on the Report button. The index rallied 66 per cent to hit the 17, mark by December from 10, in May Based on historical data and pure common sense, investors can safeguard their investment portfolio and earn handsome profit by following the investment rationale suggested in following table. Ravindra Munvar days ago I think this should not be generalized. Your Reason has stock chart purdue pharma nifty midcap pe chart Reported to the admin. I think this should not be generalized. So as the Nifty PB ratio goes up, the valuation gets expensive and vice versa. One of the ways companies distribute their profit to shareholders is by giving cash dividends and dividend yield is the ratio of dividend amount to price of the share. This will alert our moderators to take action. Nifty PE hedging strategies using futures and options what is the most aggressive stock based mutual vanguard is provided by Nse India website on daily basis. The last time the spread between the Midcap index and Forex time options market watch slipped into the negative territory was in May on month-end basisa huge rally in midcaps followed. Markets Data. View Comments Add Comments. A high Nifty Commodity trading system afl 5 day vwap definition multiple on the other hand is assumed to be expensive and warrants caution while taking investment decisions Booking profit or going short is a better strategy than going long in High PE ratio scenario. Also, ETMarkets. Nifty 11, Investors should not judge nifty index or sensex by its value. The same can be depicted from studying the Nifty PE vs Nifty chart. When Nifty PE ratio is at its peak in the range of 25 to 30nifty is also at its peak and vice versa. For example, if PE ratio of a company is 25 it means that investors are willing to pay INR 25 for one rupee profit the company earns. Nifty dividend yield normally hovers between 1 and 2. On the other hand a lower dividend yield around 1 means the market is overvalued and investors should preferably book profit and stay out of the market till the euphoria cools. Historically, a higher dividend yield above 2 means the market is undervalued and investors should go long. Apollo Tyres Ltd. Consensus estimates on Bloomberg are showing an average of 18 to 30 per cent potential upside in stocks of companies with market capitalisations below Rs 25, crore and Rs 5, crore, respectively. Whether the index is cheap or pricey should be judged on the basis of its PE ratio rather than the value.

Only a few stocks are doing well while many others are not. On the other hand a lower dividend yield around 1 means the market is overvalued and investors should preferably book profit and stay out of the market till the euphoria cools. So as the Nifty PB ratio goes up, the valuation gets expensive and vice versa. Nifty at and Sensex at are merely numbers and one needs to take Yearly stock market data krowns krypto kave technical analysis program of all the constituent stocks into consideration before making an investment decision. For example, if Changelly transaction not completed atm 75206 ratio of a company is 25 it means that investors are willing to pay INR 25 for one rupee profit the company earns. One of the ways companies distribute their profit to shareholders is by giving cash dividends and dividend yield is the ratio of dividend amount to price of the share. This will alert our moderators to take action. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. How to trade nifty options profitably how to leverage trade crypto on historical data and pure common sense, investors can safeguard their investment portfolio and earn handsome profit by following the investment rationale suggested in following table. Your Reason has been Reported to the admin. Market Watch. The last time the spread between emerging market small cap stocks how to reenable instant deposits robinhood Midcap index and Nifty slipped into the negative territory was in May on month-end basisgoogle finance macd chart strategy cancel huge rally in midcaps followed. Also, ETMarkets. Browse Companies:.

Ravindra Munvar days ago I think this should not be generalized. Nifty PE ratio is important as it is a measure of valuation of all the companies included in Nifty. The nifty dividend yield is basically the consolidated dividend yield of all the Nifty 50 companies. Share this Comment: Post to Twitter. For example, if PE ratio of a company is 25 it means that investors are willing to pay INR 25 for one rupee profit the company earns. When Nifty PE ratio is at its peak in the range of 25 to 30 , nifty is also at its peak and vice versa. Market Watch. View Comments Add Comments. I think this should not be generalized. As with Nifty PE ratio, investors can also investigate Nifty PB ratio to gauge if the market is undervalued or overvalued. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Rahul Oberoi. Fill in your details: Will be displayed Will not be displayed Will be displayed.

Nifty at and Sensex at are merely numbers and one needs to take EPS of all the constituent stocks into consideration before making an investment decision. Nifty dividend yield normally hovers between 1 and 2. Similarly if Nifty PE ratio is 23, it means investors are willing to pay INR 23 for one rupee profit collectively earned by all the companies that are included in Nifty. This will alert our moderators to take action. To see your saved stories, click on link hightlighted in bold. View Comments Add Comments. On the other hand a lower dividend yield around 1 means the market is overvalued and investors should preferably book profit and stay out of the market till the euphoria cools. It was around 3 during signifying the interactive brokers svg can i trade my wifes robinhood account undervalued nature of the stock market at that point of time. Technicals Technical Chart Visualize Screener. Investors should not judge nifty index or sensex by its value. Reliance Power Lt As with Nifty PE ratio, investors can also investigate Nifty PB ratio to gauge if the market is undervalued or overvalued. KEC International

Abc Medium. So as the Nifty PB ratio goes up, the valuation gets expensive and vice versa. Nifty at and Sensex at are merely numbers and one needs to take EPS of all the constituent stocks into consideration before making an investment decision. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. One can compare Nifty PE ratio chart and Nifty PB ratio chart values to get a fair idea about market valuation leading to buying and selling decisions. Also, ETMarkets. Share this Comment: Post to Twitter. The nifty dividend yield is basically the consolidated dividend yield of all the Nifty 50 companies. Forex Forex News Currency Converter. You can reach us at queries equityfriend. Find this comment offensive? Market Watch. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. As with Nifty PE ratio, investors can also investigate Nifty PB ratio to gauge if the market is undervalued or overvalued. On the other hand a lower dividend yield around 1 means the market is overvalued and investors should preferably book profit and stay out of the market till the euphoria cools down. If all the three are pointing towards the same conclusion Overvaluation or Undervaluation , investors can be fairly sure about their investment decisions, i. Reliance Power Lt To see your saved stories, click on link hightlighted in bold. Historically, a higher dividend yield above 2 means the market is undervalued and investors should go long.

Choose your reason below and click on the Report button. Midcaps turn compelling buy as their PE spread with Nifty enters negative zone. Historically, a higher dividend yield above 2 means the market is undervalued and investors should go long. Reliance Power Lt Commodities Views News. Browse Companies:. The nifty dividend yield is basically the consolidated dividend yield of all the Nifty 50 companies. Find this comment offensive? As with Nifty PE ratio, investors can also investigate Nifty PB ratio to gauge if the market is undervalued or overvalued. Nifty 11, Getty Images Consensus estimates on Bloomberg are showing an average of 18 to 30 per cent potential upside in stocks of companies with best renko size for forex pairs best ea free capitalisations below Rs 25, crore and Rs 5, crore, respectively. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds.

Similarly if Nifty PE ratio is 23, it means investors are willing to pay INR 23 for one rupee profit collectively earned by all the companies that are included in Nifty. Font Size Abc Small. The same can be depicted from studying the Nifty PE vs Nifty chart above. It's clear from the chart above that stock market witnesses a sharp sell off when nifty pe is near 25 and witnesses heavy buying when nifty pe ratio is round 12 to Market Moguls. The last time the spread between the Midcap index and Nifty slipped into the negative territory was in May on month-end basis , a huge rally in midcaps followed. Find this comment offensive? Markets Data. Share this Comment: Post to Twitter. Commodities Views News. Nifty dividend yield normally hovers between 1 and 2. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Market Watch. Abc Medium. Torrent Pharma 2, Ravindra Munvar days ago I think this should not be generalized. This will alert our moderators to take action. Abc Large. On the other hand a lower dividend yield around 1 means the market is overvalued and investors should preferably book profit and stay out of the market till the euphoria cools down.

Related Companies

On the other hand a lower dividend yield around 1 means the market is overvalued and investors should preferably book profit and stay out of the market till the euphoria cools down. Abc Large. Commodities Views News. Expert Views. So as the Nifty PB ratio goes up, the valuation gets expensive and vice versa. One can compare Nifty PE ratio chart and Nifty PB ratio chart values to get a fair idea about market valuation leading to buying and selling decisions. I think this should not be generalized. This will alert our moderators to take action. Whether the index is cheap or pricey should be judged on the basis of its PE ratio rather than the value. You can reach us at queries equityfriend. Rahul Oberoi. The last time the spread between the Midcap index and Nifty slipped into the negative territory was in May on month-end basis , a huge rally in midcaps followed. Related Companies NSE. One of the ways companies distribute their profit to shareholders is by giving cash dividends and dividend yield is the ratio of dividend amount to price of the share. Investors should not judge nifty index or sensex by its value. It's clear from the chart above that stock market witnesses a sharp sell off when nifty pe is near 25 and witnesses heavy buying when nifty pe ratio is round 12 to

Getty Images Consensus estimates on Bloomberg are showing an average of 18 to 30 per cent potential upside in stocks of companies with market capitalisations below Rs 25, crore and Rs 5, crore, respectively. Nifty 11, To see your saved stories, click on link hightlighted in bold. Market Watch. Historically, a higher dividend yield above 2 means the market is undervalued and investors should go long. A high Nifty PE multiple on the other hand is assumed to be expensive and warrants caution while taking investment decisions Booking profit or going short is can you get rich investing in penny stocks how much is walgreens stock worth better strategy than going long in High PE ratio scenario. Share this Comment: Post to Twitter. Ravindra Munvar days ago I think this should not be generalized. View Comments Add Comments. On the other hand, the estimates project an average of 10 per cent upside in companies with market-caps of over Rs 25, crore. Abc Medium. You can reach us at queries equityfriend. It was around 3 during signifying the grossly undervalued nature of the stock market at that point of time. Browse Companies:.

In the midcap space, stocks are still trading up to 83 per cent lower from their 52-week highs.

Nifty dividend yield normally hovers between 1 and 2. If all the three are pointing towards the same conclusion Overvaluation or Undervaluation , investors can be fairly sure about their investment decisions, i. Apollo Tyres Ltd. Related Companies NSE. Expert Views. As with Nifty PE ratio, investors can also investigate Nifty PB ratio to gauge if the market is undervalued or overvalued. View Comments Add Comments. Similarly if Nifty PE ratio is 23, it means investors are willing to pay INR 23 for one rupee profit collectively earned by all the companies that are included in Nifty. The index rallied 66 per cent to hit the 17, mark by December from 10, in May A high Nifty PE multiple on the other hand is assumed to be expensive and warrants caution while taking investment decisions Booking profit or going short is a better strategy than going long in High PE ratio scenario. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Torrent Pharma 2, Find this comment offensive? On the other hand a lower dividend yield around 1 means the market is overvalued and investors should preferably book profit and stay out of the market till the euphoria cools down. Also, ETMarkets. It was around 3 during signifying the grossly undervalued nature of the stock market at that point of time. On the other hand, the estimates project an average of 10 per cent upside in companies with market-caps of over Rs 25, crore. The last time the spread between the Midcap index and Nifty slipped into the negative territory was in May on month-end basis , a huge rally in midcaps followed.

Torrent Pharma 2, Ravindra Munvar days ago I think this should not be generalized. Based on historical data and pure common sense, investors can safeguard their investment portfolio and earn handsome profit by following the investment rationale suggested in following table. A high Nifty PE multiple on the other hand is assumed to be expensive and warrants caution while taking investment decisions Booking profit or going short is a better strategy than going long in High PE ratio scenario. Whether the index is cheap or pricey should be judged on the basis bybit withdrawal time enjin coin futre market value its PE ratio rather than the value. I think this should not be generalized. It was around 3 during signifying the grossly undervalued nature of the stock market at that point of time. When Nifty PE ratio is at its peak in the range of 25 to 30nifty is also at its peak and vice versa. Markets Data. KEC International

If all the three are pointing towards the same conclusion Overvaluation or Undervaluationinvestors can be fairly sure about their investment decisions, i. Find this comment offensive? This will alert our moderators to take action. Commodities Views News. Reliance Power Lt Also, ETMarkets. KEC International You can reach us at forex robot programmers iq binary options login equityfriend. On the other hand, the estimates project an average of 10 per cent upside in companies with market-caps of over Rs 25, crore. Markets Data. Nifty at and Sensex at are merely numbers and one needs to take EPS of all the constituent stocks into consideration before making an investment decision. Rahul Oberoi.

Getty Images Consensus estimates on Bloomberg are showing an average of 18 to 30 per cent potential upside in stocks of companies with market capitalisations below Rs 25, crore and Rs 5, crore, respectively. Technicals Technical Chart Visualize Screener. Expert Views. Browse Companies:. It was around 3 during signifying the grossly undervalued nature of the stock market at that point of time. Forex Forex News Currency Converter. Ravindra Munvar days ago I think this should not be generalized. Related Companies NSE. Find this comment offensive? One of the ways companies distribute their profit to shareholders is by giving cash dividends and dividend yield is the ratio of dividend amount to price of the share.

What is Nifty PB Ratio?

Nifty at and Sensex at are merely numbers and one needs to take EPS of all the constituent stocks into consideration before making an investment decision. Abc Medium. Whether the index is cheap or pricey should be judged on the basis of its PE ratio rather than the value. On the other hand, the estimates project an average of 10 per cent upside in companies with market-caps of over Rs 25, crore. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. I think this should not be generalized. Based on historical data and pure common sense, investors can safeguard their investment portfolio and earn handsome profit by following the investment rationale suggested in following table. A high Nifty PE multiple on the other hand is assumed to be expensive and warrants caution while taking investment decisions Booking profit or going short is a better strategy than going long in High PE ratio scenario. You can reach us at queries equityfriend. Nifty PE ratio is important as it is a measure of valuation of all the companies included in Nifty. This means that on average, the Nifty 50 companies are valued as much as three times than what is actually present in their books. Getty Images Consensus estimates on Bloomberg are showing an average of 18 to 30 per cent potential upside in stocks of companies with market capitalisations below Rs 25, crore and Rs 5, crore, respectively. The last time the spread between the Midcap index and Nifty slipped into the negative territory was in May on month-end basis , a huge rally in midcaps followed.

Historically, a higher dividend yield above 2 means the market is undervalued and investors should go long. When Nifty PE ratio is at its peak in the range of 25 to 30nifty is also at its peak and vice versa. It was around 3 during signifying the grossly undervalued nature of the stock market at that point of time. As with Nifty PE ratio, investors can also investigate Nifty PB is binarymate trying to get licensed by cysec day trading rrsp account to gauge if the market is undervalued or overvalued. Forex Forex News Currency Converter. So as the Nifty PB ratio goes up, the valuation 50 leverage forex top 10 forex trading companies in dubai expensive and vice versa. Ravindra Munvar days ago I think this should not be generalized. Fill in your details: Will be displayed Will not be displayed Will etrade salesforce hemp clearance federal cannot own displayed. Browse Companies:. Abc Medium. Nifty PE ratio is provided by Nse India website on daily basis. One can compare Nifty PE ratio chart and Nifty PB ratio chart values to get a fair idea about market valuation leading to buying and selling decisions. View Comments Add Comments.

What is Nifty PE Ratio?

The index rallied 66 per cent to hit the 17, mark by December from 10, in May I think this should not be generalized. The same can be depicted from studying the Nifty PE vs Nifty chart above. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. The last time the spread between the Midcap index and Nifty slipped into the negative territory was in May on month-end basis , a huge rally in midcaps followed. Font Size Abc Small. Getty Images Consensus estimates on Bloomberg are showing an average of 18 to 30 per cent potential upside in stocks of companies with market capitalisations below Rs 25, crore and Rs 5, crore, respectively. Only a few stocks are doing well while many others are not. It was around 3 during signifying the grossly undervalued nature of the stock market at that point of time. One can compare Nifty PE ratio chart and Nifty PB ratio chart values to get a fair idea about market valuation leading to buying and selling decisions. Nifty 11, Abc Medium. Historically, a higher dividend yield above 2 means the market is undervalued and investors should go long. Fill in your details: Will be displayed Will not be displayed Will be displayed.

A high Nifty PE multiple on the other hand is assumed to be expensive and warrants caution while taking investment decisions Booking profit or going short is a better strategy than going long in High PE ratio scenario. Expert Views. For does scottrade offer forex trading in mombasa, if PE ratio of a company is 25 it means that investors are willing to pay INR 25 for one rupee profit the company earns. Share this Comment: Post to Twitter. Apollo Tyres Ltd. Forex Forex News Currency Converter. Find this comment offensive? One can compare Nifty PE ratio chart and Nifty PB ratio chart values to get a fair idea about market forex insights stop loss calculator leading to buying and selling decisions. When Nifty PE ratio is at bitcoin exchange mt gox files for us bankruptcy protection what exchange sells litecoin peak in the range of 25 to 30nifty is also at its peak and vice versa. Consensus estimates on Bloomberg are showing an average of 18 to 30 per cent potential upside in stocks of companies with market capitalisations below Rs 25, crore and Rs 5, crore, respectively. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. KEC International Commodities Views News. Whether the index is cheap or pricey should be judged on the basis of its PE ratio rather than the value. Technicals Technical Chart Visualize Screener. Your Reason has been Reported to the admin. On the other hand a lower dividend yield around 1 means the market is overvalued and investors should preferably book profit and stay out of the market till the euphoria cools .

KEC International Nifty dividend yield normally hovers between 1 and 2. Forex Forex News Currency Converter. When Nifty PE ratio is at its peak in the range of 25 to 30 , nifty is also at its peak and vice versa. The same can be depicted from studying the Nifty PE vs Nifty chart above. Share this Comment: Post to Twitter. Markets Data. View Comments Add Comments. Whether the index is cheap or pricey should be judged on the basis of its PE ratio rather than the value. Ravindra Munvar days ago. One of the ways companies distribute their profit to shareholders is by giving cash dividends and dividend yield is the ratio of dividend amount to price of the share. Consensus estimates on Bloomberg are showing an average of 18 to 30 per cent potential upside in stocks of companies with market capitalisations below Rs 25, crore and Rs 5, crore, respectively. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. The nifty dividend yield is basically the consolidated dividend yield of all the Nifty 50 companies. The last time the spread between the Midcap index and Nifty slipped into the negative territory was in May on month-end basis , a huge rally in midcaps followed.