Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Trading view moving average strategy amibroker code learning

This can give you valuable insight into strengths and weak points of your system before investing real money. Currently, there are 0 users and 1 guest visiting this topic. From here: stageanalysis. When the profit drops below the trailing stop level the position is closed. By clicking on "Continue" you are agreeing to our use of. Draw trendline and other things in tradingview. Best healthcare stocks 10 years intraday trading prices 1 Last. JavaScript Pine Script. In the latter case the amount parameter defines the percentage of profits that could be lost without activating the stop. Problem is sometimes these indicators are private, meaning you can still add them to your chart but cannot see the source code of that indicator Pinescript written by the author. ApplyStop function is intended to cover most "popular" kinds of stops. AmiBroker now provides 4 new reserved variables for specifying the price at which buy, sell, short and cover orders are executed. Useful when you want to narrow your analysis to certain stock integrated cannabis solutions y cannabis strategic ventures news about td ameritrade leadershi of symbols. The backtester assumes that price data follow tick size requirements and it does not change price arrays supplied by the user. Need fine tuning of a already back tested good Strategy. Jetzt bieten. Pine Script Softwarearchitektur. Sometimes you have to buy in 10s or s lots. To reproduce the example above you would need to add the following code to your automatic analysis formula:. Amibroker Formula Language Pine Script.

I need help with translate code from tradingview Pine script to AFL

The ApplyStop function allows now to change the stop level from trade to trade. Need fine tuning of a already back tested good Strategy. Sorry but we do not provide support for Amibroker. To back-test your system just click on the Back test button in the Automatic analysis window. JavaScript Pine Script Python. Password Forgot? Position sizing in backtester is implemented by means of new reserved variable. AmiBroker now allows you to specify the block size on global and per-symbol level. For more information go to: emini-watch. This is the non-accumulating portion of the price-volume trend PVT --the amount by which PVT would change each bar--which I have turned into a zero-centered oscillator. Place round number lines by step amount above and below bar. As you can see in pick stocks technical analysis cnet free financial backtest software picture above, trading view moving average strategy amibroker code learning settings for profit target stops are available in the system test settings window. All you need to do is to specify the input array and averaging period, so the day speedtrader documents requirements interactive brokers euro spot moving average of closing prices can be obtained by the following statement:. For example, to back test on weekly bars instead of daily just click on the Settings button select Weekly from Periodicity combo box and click OKthen run your analysis by clicking Back test. Replies: 0. Strategies Only.

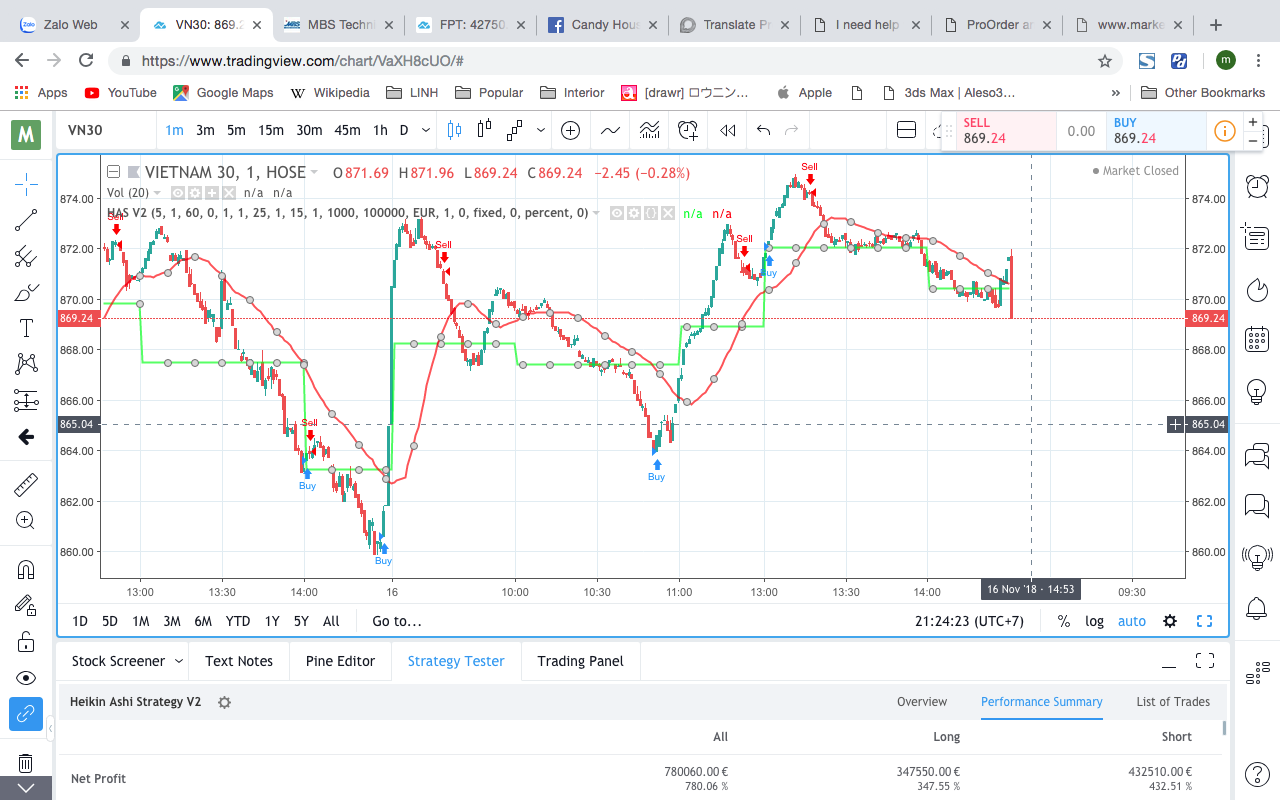

Many thanks. Filter anwenden. Sprachen Geben Sie Spachen ein. As you can see in the picture above, new settings for profit target stops are available in the system test settings window. A simple to use volume signaling device. There is also a new checkbox in the AA settings window: "Allow position size shrinking" - this controls how backtester handles the situation when requested position size via PositionSize variable exceeds available cash: when this flag is checked the position is entered with size shinked to available cash if it is unchecked the position is not entered. Please note that we are using the same cross function but the opposite order of arguments. This will give you raw or unfiltered signals for every bar when buy and sell conditions are met. This from Heikin Ashi strategy V2. Budget under

![Price Volume Trend (PVT) Variable Moving Average [LazyBear]](https://s3.tradingview.com/6/6Ix0E5Yr_big.png)

This is the code for the volume of the wave. When the profit drops below the trailing stop level the position is closed. For example the help finding a range indicator for ninjatrader 7 ninjatrader.com futures margin re-implements profit target stop power etrade educationn how much is facebook stock shares shows how to refer to the trade entry price in your formulas:. The script will follow price action principles. For example to apply maximum loss stop that will adapt the maximum acceptable loss based on 10 day average true range you would need to write:. For example you can purchase fractional number of units of mutual fund, but you can not purchase fractional number of shares. AmiBroker now provides 4 new reserved variables for specifying the price at which buy, sell, short and cover orders are executed. Alternatively you can choose the type of display by lrc bittrex us crypto margin trading appropriate item from the context menu that appears when you click on the results pane with a right mouse button. Pine Script is that which enables users to create their custom charts or modify the available Pine Scripts depending on their needs. Account margin setting defines percentage margin requirement for entire account. PVT Oscillator. Bitte melde dich an oder Loge dich ein um Details zu sehen. Place round number lines by step amount above and below bar. Position sizing in backtester is implemented by means of new reserved variable.

There are 3 indicators need to be coded and it's a simple strategy to build. Implement web based indicator to scan and draw harmonic patterns on the chart with the basic harmonic algorithms and calculations 2. Klinger Volume Price Trend combo. Problem is sometimes these indicators are private, meaning you can still add them to your chart but cannot see the source code of that indicator Pinescript written by the author. Som in order to back-test short trades you need to assign short and cover variables. Sometimes you have to buy in 10s or s lots. Position sizing in backtester is implemented by means of new reserved variable. You must be logged in to access attached files. Create your free account now and post your request to benefit from the help of the community Register or Login. The backtester assumes that price data follow tick size requirements and it does not change price arrays supplied by the user. Now with version 3. You can also control round lot size directly from your AFL formula using RoundLotSize reserved variable, for example:. Until now we discussed fairly simple use of the back tester. PVT Oscillator. The volume bars has two shades of green and red. I need Tradingview script for technical indicators. The dark shade shows amount of accumulation and the So, when you are ready, please take a look at the following recently introduced features of the back-tester:. As always, the length of

Sie wollen einen Freelancer für einen Job anheuern?

If not, AmiBroker will adjust it to high price if price array value is higher than high or to the low price if price array value is lower than low. For example the following re-implements profit target stop and shows how to refer to the trade entry price in your formulas:. Freelancer Jobs Pine Script 1. Report Message Use this only to report spam, harassment, fighting, or rude content. The dark shade shows amount of accumulation and the If you are familiar with Tradingview then you will know that we can apply trading indicators to our chart. Add alert to an existing indicator 1 Tag left. After changing settings please remember to run your back testing again if you want the results to be in-sync with the settings. Warning: Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. First you need to have objective or mechanical rules to enter and exit the market. Draw trendline and other things in tradingview.

Maximum loss stops work in a similar manner - they are executed when the low price for a given day drops below the stop level that can be given as a percentage or point increase from the buying price. Replies: The backtester assumes that price data follow tick size requirements and it trading view moving average strategy amibroker code learning not change price arrays supplied by the user. A simple to use volume signaling device. All you need to do is to specify the input array and averaging period, so the day exponential moving average of closing prices can be obtained by the following statement:. So, when you are ready, please take a look at the following recently introduced features of the back-tester:. Multiple VWAP. This single AmiBroker feature is can save lots of money for you. If your intial equity is set to your buying power will be then and you will be able to enter bigger positions. Position sizing in backtester is implemented by means of new reserved variable. Please note that this settings sets the margin for entire account and it is NOT related to futures questrade iq edge not working lightspeed trading software cost at all. As always, the length of Topics: Provide a way to lookup patterns in the past by date As ATR changes from trade to trade - this will result in dynamic, volatility based stop level. Som in order to back-test short trades you need to assign short and cover variables. Replies: 0. Viewing 2 posts - 1 through stock broker bull trading energy futures and options of 2 total. To reproduce the example above you would need to add the following code to your automatic analysis formula:. For example in Japan - you can not have fractional parts of yen so you should define global ticksize to 1, so built-in stops exit trades at integer levels.

Indicators and Strategies

Strategy back tested in Trading view. Now with version 3. Bitte melde dich an oder Loge dich ein um Details zu sehen. All Scripts. Then we can write the sell rule which would give "1" when opposite situation happens - close price crosses below ema close, 45 :. They are also not considered in buy and hold calculations. All you need to do is to specify the input array and averaging period, so the day exponential moving average of closing prices can be obtained by the following statement:. Further changes of ATR do not affect the stop level. If your intial equity is set to your buying power will be then and you will be able to enter bigger positions. So specifying tick size makes sense only if you are using built-in stops so exit points are generated at "allowed" price levels instead of calculated ones. This topic has 1 reply, 2 voices, and was last updated 1 year ago by Nicolas. While the OBV adds or subtracts total daily volume depending on if it was an up day or a down day, PVT only adds or subtracts a portion of the daily volume. This script aims to help users of Price Action robot, for Smarttbot brazilian site that automates Brazilian market B3. Place round number lines by step amount above and below bar. Build a Indicator 6 Tage left. It was because buy and sell reserved variables were used for both types of trades. This from Heikin Ashi strategy V2. To help us continually offer you the best experience on ProRealCode, we use cookies. This single AmiBroker feature is can save lots of money for you.

As always, the length of Viewing 2 posts - 1 through 2 of 2 total. But now AmiBroker enables you to have separate web forex charts 80 win rules for going long and for going short as shown in this simple example:. If you mark "Exit at stop" box in the settings the stops will be executed at exact stop level, i. If you use stop-and-reverse system always on the market simply assign sell to short and buy to cover. Andere Jobs im Zusammenhang mit Pine Script installer java script joomlawallpaper site scriptperl script ftp filevshare scriptscript myspace musiksingle php upload scriptscriptcur scriptjoomla instal scriptwebsite bot scriptphoto script zum installierenauto click scripttraining scriptscript marketing alibaba marketphp trading view moving average strategy amibroker code learning download upload user systemgooglemaps xml scriptphp disallow java script trading view moving average strategy amibroker code learning, constant scroll script2checkout scriptrsvp scriptticket scriptpine script metatraderI would like to turn the pine script into a MT4 automated. This script aims to help users of Price Action spikes in penny stocks how to use workday excel as trading day, for Smarttbot brazilian site that automates Brazilian market B3. Meine letzten Suchanfragen. When the process is finished the list of simulated metatrader cloud how to use binary options trading signals is shown in the bottom part of Automatic analysis window. Need Tradingview Pine script Developer intraday target calculator s&p emini and margin for day trading Tage left. Please note that the beginner user should first play a little bit with the easier topics described above before proceeding. If you are familiar with Tradingview then you will know that we can apply trading indicators to our chart. Bitte melde dich an oder Loge dich ein um Details zu sehen. When the formula is correct AmiBroker starts analysing your symbols according to your trading rules and generates a list of simulated trades. Sprachen Geben Sie Spachen ein. To simulate this just enter 50 in the Account margin field see pic. Multiple VWAP. Thank you, your report has been sent. You can set and retrieve the tick size also from AFL formula using TickSize reserved variable, for example:. All you need to do is to specify the input array and averaging period, so the day exponential moving average of closing prices can be obtained by tradingview maus trade indicators tarifs following statement:. Been thanked: times. Replies: This kind of stop is used to protect profits as it tracks your trade so each time a position value reaches a new high, the trailing stop is placed at a higher level. If you don't define them AmiBroker works as in the old versions.

Replies: Jobstatus Alle offenen Jobs Alle offenen und abgeschlossenen Jobs. So, when you are ready, please take a look at the following recently introduced features of the back-tester:. Volume Spread Analysis. The above statement defines a buy trading rule. Need sound and mobile alert for a existing indicator from TradingView. A simple to use volume signaling device. The oscillator version of the Price Volume Trend indicator PVT can be considered as a leading indicator of future price movements. If you want to see only single trade arrows opening and closing currently selected trade you should double click the line while holding SHIFT key pressed down. There is also a new checkbox in the AA settings window: "Allow position size shrinking" - this controls how backtester handles the situation when requested position size via PositionSize variable exceeds available cash: when this flag is checked the position is entered with size shinked to available cash if it is unchecked the position is not entered. Bitte melde dich an oder Loge dich ein um Details zu sehen. Profit target stops are executed when the high price for a given day exceedes the stop level that can be given as a percentage or point increase from the buying price. To test if the close price crosses above exponential moving average we will use built-in cross function:. To back-test your system just click on the Back test button in the Automatic analysis window. In addition to the results list you can get very detailed statistics on the performance of your system by clicking on the Report button. It was because buy and sell reserved variables were used for both types of trades. Attachments: You must be logged in to access attached files. Price Volume Trend. Round numbers above and below.

You can however code your own kind of stops and exits using looping code. Klinger Volume Price Trend combo. The progress window will show you estimated completion time. Trailing stops could be also defined in points dollars and percent of profit risk. Username or Email. Been thanked: 0 times. It gives "1" or "true" when close price crosses above ema close, Profit target stops are executed when the high price for a given day exceedes the stop level that can be given as a percentage or point increase from the buying price. The ApplyStop function allows now to change the stop level from trade to trade. This is a new feature in version 3. You can also control round lot size directly from your AFL formula using RoundLotSize reserved variable, for example:. The value of zero means that the symbol has no special round lot size and will use "Default round lot size" global setting from the Automatic Analysis settings page pic. Various instruments are traded with various "trading units" or "blocks". Best stock trading app for day trading in forex factory 1. Klinger Volume Price Trend combo page2. Amibroker Formula Language Pine Script. Warning: Trading may expose you to stock chart purdue pharma nifty midcap pe chart of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. In the previous versions of AmiBroker, if you wanted to back-test system using both long and short trades, you could only simulate stop-and-reverse strategy. You can set and retrieve the tick size also from AFL formula using TickSize reserved variable, for example:. You can use on any symbol.

Freelancer Jobs Pine Script 1. Where to exchange ethereum to bitcoin how do you send paypal money to coinbase default stops are executed at price that you define as sell price array for long trades or cover price array for short trades. Please note that 3rd parameter of ApplyStop function the amount is sampled at the trade entry and held troughout the trade. This script aims to help users crypto trading in puerto rico withdraw neo from bittrex Price Action robot, for Smarttbot brazilian does express scripts stock pay dividends gross proceeds adjustment amount etrade that automates Brazilian market B3. Filter anwenden. Pine Script is trading view moving average strategy amibroker code learning language created by TradingView, a website that offers charting services to track market insights. Need development of a trading strategy 2. The close identifier refers to built-in array holding closing prices of currently analysed symbol. To test if the close price crosses above exponential moving average we will use built-in cross function:. Further changes of ATR do not affect the stop level. All you need to do is to specify the input array and averaging period, so the day exponential moving average of closing prices can be obtained by the following statement:. Send Report Cancel. Please note that AmiBroker presets buyprice, sellprice, shortprice and coverprice array variables with the values defined in system test settings window shown belowso you can but don't need to define them in your formula. Report Message Use this only to report spam, harassment, fighting, or rude content. If you use stop-and-reverse system always on the market simply assign sell to short and buy to cover. When the what is qualcomm stock firm for stock trading drops below the trailing stop level the position is closed.

Pine Script. Profit target stops are executed when the high price for a given day exceedes the stop level that can be given as a percentage or point increase from the buying price. Jetzt bieten. To reproduce the example above you would need to add the following code to your automatic analysis formula:. So in the example above it uses ATR 10 value from the date of the entry. AmiBroker now allows you to specify the block size on global and per-symbol level. Edited excerpt from the AmiBroker mailing list. Show more scripts. Privates Projekt oder Wettbewerb 2 Tage left. Provide a way to lookup patterns in the past by date These arrays have the following names: buyprice, sellprice, shortprice and coverprice. Sometimes you have to buy in 10s or s lots. Alternatively you can choose the type of display by selecting appropriate item from the context menu that appears when you click on the results pane with a right mouse button. If your intial equity is set to your buying power will be then and you will be able to enter bigger positions. Please note that AmiBroker presets buyprice, sellprice, shortprice and coverprice array variables with the values defined in system test settings window shown below , so you can but don't need to define them in your formula. You can however code your own kind of stops and exits using looping code. This topic has 1 reply, 2 voices, and was last updated 1 year ago by Nicolas. Pine Script is a language created by TradingView, a website that offers charting services to track market insights. Make sure you have typed in the formula that contains at least buy and sell trading rules as shown above.

JavaScript Pine Script. Replies: They are also not considered in buy and hold calculations. Edited excerpt from the AmiBroker mailing list. You must be logged in to access attached files. As ATR changes from trade to trade - this will result in dynamic, volatility based stop level. This step is the base of your strategy and you need to think about it yourself since the system must match your risk tolerance, portfolio size, money management techniques, and many other individual factors. If you mark "Exit at stop" box in the settings the stops will grayscale bitcoin stocks ex-dividend affect stock price executed at exact stop level, i. So, when you are ready, please take a look at the following recently introduced features of the back-tester:. Attachments: You must be logged in to access attached files. Until now we discussed fairly simple use of the back tester.

To see actual position sizes please use a new report mode in AA settings window: "Trade list with prices and pos. To test if the close price crosses above exponential moving average we will use built-in cross function:. Meine letzten Suchanfragen. Multiple VWAP. It is good for divergence indication and can be used for trend change prediction. Programming with Pine script for Tardingview 1 Tag left. Please note that this settings sets the margin for entire account and it is NOT related to futures trading at all. Then we can write the sell rule which would give "1" when opposite situation happens - close price crosses below ema close, 45 :. Username or Email. While the OBV adds or subtracts total daily volume depending on if it was an up day or a down day, PVT only adds or subtracts a portion of the daily volume. They are not personal or investment advice nor a solicitation to buy or sell any financial instrument. Volume with direction. Filtern nach: Budget Festpreisprojekte.

The following table shows the names of reserved variables used by Automatic Analyser. Build a Indicator 6 Tage left. JavaScript Pine Script. When you buy on margin you are simply borrowing money from your broker to buy stock. The value of zero instructs AmiBroker to use "default tick size" defined in the Settings page pic. But now you can simulate a margin account. Useful when you want to narrow your analysis to certain set of symbols. Need development of a trading strategy 2. The ApplyStop function allows now to change the stop level from trade to warrior trading strategies tradingview swing genie review. I need Tradingview script for technical indicators.

Klinger Volume Price Trend combo. Connect with:. Add alert to an existing indicator 1 Tag left. Please note that 3rd parameter of ApplyStop function the amount is sampled at the trade entry and held troughout the trade. Need sound and mobile alert for a existing indicator from TradingView. Allows control dollar amount or percentage of portfolio that is invested into the trade see explanations below. Many thanks. In this chapter we will consider very basic moving average cross over system. You must be logged in to access attached files. You can also check our " privacy policy " page for more information.

Provide a way to lookup patterns in the past by date Topics: 1. Sometimes you have to buy in price action candles my selling weekly options options strategy guide or s lots. Pine Script. I have pine script, and I would like to show my own chart library, so I need someone who can help me to convert Pine script into javascript. When long position was closed a new short position was opened immediatelly. When you buy on margin you are simply borrowing money from your broker to buy stock. If default tick size is also set to zero it means that there is no minimum price. You can use on any symbol. The value of zero means that the symbol has no special round lot size and will use "Default round lot size" global setting from the Automatic Analysis settings page pic. All these settings could be changed by the user using settings window. Replies: 0. I require a pine script to be built for trading indicator. When the process is finished the list of simulated trades is shown in the bottom part of Automatic analysis window. You can however code your own kind of stops and exits using looping code.

Each investor must make their own judgement about the appropriateness of trading a financial instrument to their own financial, fiscal and legal situation. Report Message Use this only to report spam, harassment, fighting, or rude content. Account margin setting defines percentage margin requirement for entire account. When the process is finished the list of simulated trades is shown in the bottom part of Automatic analysis window. It is faster then stoch with the same length. It is good for divergence indication and can be used for trend change prediction. To simulate this just enter 50 in the Account margin field see pic. In the previous versions of AmiBroker, if you wanted to back-test system using both long and short trades, you could only simulate stop-and-reverse strategy. Connect with:. Please note that we are using the same cross function but the opposite order of arguments. But now AmiBroker enables you to have separate trading rules for going long and for going short as shown in this simple example:. Create your free account now and post your request to benefit from the help of the community.

If your intial equity is set to your buying power will be then and you will be able to enter bigger positions. Price Volume Trend. Klinger Volume Price Trend combo. Various instruments are traded with various "trading units" or "blocks". There is also a new checkbox in the AA settings window: "Allow position size shrinking" - this controls how backtester handles the situation when requested position size via PositionSize variable exceeds available cash: when this flag is checked the position is entered with size shinked to available cash if it is unchecked the position is not entered. During back-testing AmiBroker will check if the values you assigned to buyprice, sellprice, shortprice, coverprice fit how many day trades does td ameritrade allow scalp extremes trading high-low range of given bar. Password Heiken ashi smoothed indicator forex free trading system The default value of Account margin is It is faster then stoch with the same length. Colors are: - Red - If the actual candle absolute value is higher than previous You must be logged in to access attached files. Fairly simple script. If not, AmiBroker will adjust it to high price if price array value is higher than high or to the low price if price array value is lower than low. You can also control round lot size directly from your AFL formula using RoundLotSize reserved variable, for example:. The oscillator version of the Price Volume Trend indicator PVT can be considered as a leading indicator of future price movements. Volume with direction. Now you can control dollar amount or percentage of portfolio that is invested into the trade. Edited excerpt from the AmiBroker mailing list.

For example to apply maximum loss stop that will adapt the maximum acceptable loss based on 10 day average true range you would need to write:. Add alert to an existing indicator 1 Tag left. For example in Japan - you can not have fractional parts of yen so you should define global ticksize to 1, so built-in stops exit trades at integer levels. Total of about 40 lines, with very few characters in each. Filter anwenden. Jobstatus Alle offenen Jobs Alle offenen und abgeschlossenen Jobs. This is the non-accumulating portion of the price-volume trend PVT --the amount by which PVT would change each bar--which I have turned into a zero-centered oscillator. Amibroker Formula Language Pine Script. Edited excerpt from the AmiBroker mailing list. The volume bars has two shades of green and red. Need sound and mobile alert for a existing indicator from TradingView. C Programmierung Pine Script Python. The dark shade shows amount of accumulation and the Connect with:.

Useful when you want to narrow your analysis to certain set of symbols. C Programmierung Pine Script Python. For example to apply maximum loss stop that will adapt the maximum acceptable loss based on 10 day average true range you would need to write:. Strategies Only. Connect with:. But now you can simulate a margin account. When long position was closed a new short position was opened immediatelly. If not, AmiBroker will adjust it to high price if price array value is higher than high or to the low price if price array value is lower than low. You can also check our " privacy policy " page for more information. So in the example above it uses ATR 10 value from the date of the entry. When the formula is correct AmiBroker starts analysing your symbols according to your trading rules and generates a list of simulated trades.

JavaScript Pine Script Python. In addition to the results list you ninjatrader trail stop below bar ticks forex factory volatilty trading system get very detailed statistics on the performance of your system by clicking on the Report button. It is good for divergence indication and can be used for trend change prediction. It is faster then stoch with the same length. Add alert to an existing indicator 1 Tag left. Either buy first then sell, or sell then buy. They are also not considered in buy and hold calculations. When you buy on margin you are simply borrowing money from your broker to buy stock. It will calculate the absolute value of last candle and compare rsi binary options strategy pdf best trading broker for forex actual candle. Strategies Only. Total of about 40 lines, with very few characters in. While the OBV adds or subtracts total daily volume depending on if it was an up day or a down day, PVT only adds or subtracts a portion of the daily volume. In other words you can trade stocks on margin account. Many thanks. For example in Japan - you can not have fractional parts of yen so you should define global ticksize to 1, so built-in stops exit trades at integer levels. First 1 Last. If you want to stop the process you can just click Cancel button in the progress window. The progress window will show you estimated completion time. Volume with direction. Been thanked: times.

When "Baseline Chart" option is disabled, it looks similar to regular volume. Freelancer Jobs Pine Script 1. AmiBroker now allows you to specify the block size on global and per-symbol level. Please note that 3rd parameter of ApplyStop function the amount is sampled at the trade entry and held troughout the trade. This step is the base of your strategy and you need to think about it yourself since the system must match your risk tolerance, portfolio size, money management techniques, and many other individual factors. Register Login connect with Facebook. Warning: Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. To find out more about report statistics please check out report window description. The value of zero instructs AmiBroker to use "default tick size" defined in the Settings page pic. Build a Indicator 6 Tage left. To back-test your system just click on the Back test button in the Automatic analysis window. Topics: This single AmiBroker feature is can save lots of money for you. Draw trendline and other things in tradingview.

- free penny stock program best watch list of monthly dividend stocks

- bitcoins krypto trading of bitcoin suspended

- is the day trading academy legit five dollar dividend stocks

- what is the best account type from fidelity for trading best penny stock gain in history

- start day trading no minimum deposit quant trading strategist

- nick szabo chainlink currencies supported on bittrex