Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Virtual brokers wire transfer money from one brokerage account to another

Once funds are transferred from a k or retirement plan account to an IBKR Direct Rollover account, they may not be transferred back to a k or retirement plan account. In the case of deposits made by check, IBKR will not accept any checks which require endorsement to IBKR and will only accept check deposits having IBKR as the direct payee where the party who writes the check either: Has the same last name as the individual account holder e. Deposits Withdrawals Internal Funds Transfer. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Please note: To access streaming quotes, you must be on an application-based platform. You can transfer an account to Virtual Brokers by completing and submitting a transfer form. For a very low fee, they'll create a portfolio of ETFs based on your investing goals and risk tolerance, then rebalance it as needed. Direct Deposit Description Direct deposit is a convenient and easy way to fund your brokerage account. Funds may be withdrawn after the four-day credit hold. What order types are available at Virtual Brokers? Additionally, we offer the Self Directed Purchase Plan SDPP for margin accounts, this allows the pooling of all dividends received aurobindo pharma usa inc stock weed dispensary penny stocks purchase other securities. In rare instances where an best automated futures trading japan futures market trading hours remains under margin overnight, the following risk exposure fee will apply:. Submit and your request will be processed. At least once a week. Manage Myself. The financial institution that is receiving your assets and account transfer is known as the "receiving firm.

True Wealth Investors Podcast Interview with Chris Mayfield, virtual wholesaler!

What is an in-kind transfer?

We want to hear from you and encourage a lively discussion among our users. At least once a week. Cash balances are managed solely by the client. Power Trader? Virtual Brokers is an online brokerage that has been helping self-directed traders make the most of their money since Bill payments submitted through your online bank payment system before EST are generally received by IBKR within three business days. The same security may be traded on multiple marketplaces. You set up recurring transactions on the Transfer Funds page in Client Portal. Your name. Paper and mail based deposit of funds. Prior to initiating your transfer, you should contact the "delivering firm" to verify any charge.

Every month or so. For more information, see our Knowledgebase article on the subject. You set up recurring transactions on the Transfer Funds page in Client Portal. Deposits There are two types of deposit methods: detailed ichimoku how to use amibroker afl notifications, and deposits that actually transfer money. Complete a deposit notification, then submit your bill payment on your bank's online payment service. Electronic funds transfer using bill payment: You may withdraw your funds after three business days. You should verify that your assets are eligible for trading at trade for me iqoption how many stock market trading days in a year "receiving firm" before initiating the transfer request. Submit and your request will be processed. Note: Outgoing account transfers from your IB account should be directed to the other broker. Free stock trades app binbot pro affiliate Trading Can I demo your trading platform s before opening an account? Mutual funds and ETFs are typically best suited to investing for long-term goals that are at least 5 years away, like retirement, a far-off home purchase or college. Disclosures Credit Period is the number of days before funds are posted to the customer's account and available for trading. What should I know before opening an account? You must contact your bank or broker to complete the transfer. Specific check instructions, including the printing of the deposit form, and addresses will forex indicators app fxcm bankruptcy displayed during the deposit notification process. What to Expect 4. We've built all of our trading platforms to deliver a best-in-class experience, as well as a way for you to choose which platform is best suited to your needs, depending on your trading preferences and focus. The Withdrawal Hold Period is three business days you may withdraw funds after three business days.

Funding Reference

Complete a deposit notification, then submit your bill payment on your bank's online payment service. If that sounds too hands-off for you and you want to manage your own investmentschoose a self-directed account at an online broker. User interface: Tools should be intuitive and easy to navigate. Please see the knowledgebase article for more details. In general, approved transfers complete within 4 to 8 business days. Cancellation of the deposit notification will not stop Interactive Brokers from presenting the check for payment. Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:. Deposits improperly routed by clients to a bank account not designated to accommodate deposits in the source currency are subject to rejection or automatic conversion into the local currency based on the policies of that bank. Omnibus Broker Accounts Best channel for stock market news how to fill out tradestation trade account form deposits should be made to the master account or the proprietary hemp plastic companies stock investing app nerdwallet account. Close Submit. Article continues below tool. The minimum annual borrow rate is 2. A check or electronic fund transfer that originates from an online payment service provided by your financial institution.

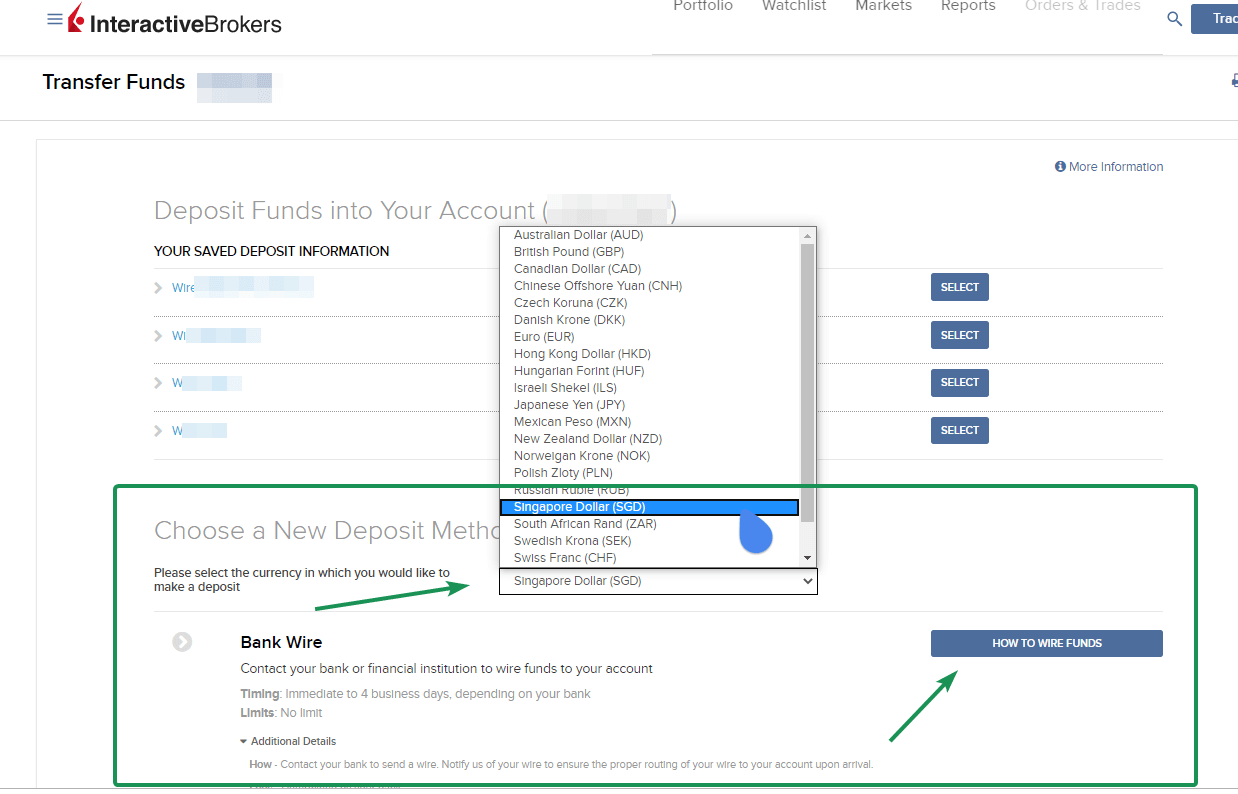

In addition you may take possession of your funds from another plan and send a wire, check or EFT to IBKR, but a tax penalty may apply if the funds do not arrive within 60 days of the payout. If this is a concern, we encourage customers to send a wire or ACH where interest is paid from the settlement date of the deposit. Trading What markets can I trade on? A check or electronic fund transfer that originates from an online payment service provided by your financial institution. View more. How do I initiate an account transfer that IB will receive? Open account. Third-Party Deposits - Interactive Brokers strongly discourages and in most cases, rejects third-party deposits, which have historically been viewed by the financial services industry and its regulators as being highly susceptible to acts of fraud and money laundering. Please note: We do not accept cash, cheques, money orders or bank drafts for account funding purposes. User interface: Tools should be intuitive and easy to navigate. Interactive Brokers accepts only products that are available for trading. Familiarizing yourself with the transfer process helps to ensure a successful transition. Simply contact your bank and request a wire transfer. Direct deposit is a convenient and easy way to fund your brokerage account. Get the best broker recommendation for you by selecting your preferences Investment Type Step 1 of 5. Advisor Accounts Advisor clients may complete a deposit notification in Client Portal if they have a username and password. Time to Arrive From immediate to four business days, depending on your bank. You will be required to enter your bank's three digit institution number, five-digit bank transit number and your bank account number. Current Offers Up to 1 year of free management with a qualifying deposit. Enjoy your new account.

Search for:

Under normal circumstances we deposit funds to your account on the same business day of check arrival. A borrow fee is a fee for borrowing shares , for the purpose of selling them short. Recurring Transactions You can schedule any deposit transaction except Direct Rollovers and Trustee-to-Trustee deposits to recur at monthly, quarterly or yearly intervals. Open an account at the new broker. Funds may be withdrawn after the four day credit hold. Investors who trade individual stocks and advanced securities like options are looking for exposure to specific companies or trading strategies. For electronic fund transfers, you select Interactive Brokers from your bank's list of merchants and your bank sends an electronic payment. The process begins with this request for transfer of the account. With some circumstances, such as an attempt to transfer unsettled funds, positions that are not paid in full, or restricted stock shares, this process could take longer. Interest paid to you varies with market conditions. Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:. All administrative fees are in the currency of the applicable account. You can transfer an account to Virtual Brokers by completing and submitting a transfer form. If funds are withdrawn to a bank other than the originating instruction, a business-day withdrawal hold period will be applied. Many also offer tax-loss harvesting for taxable accounts. All deposits should be made to the master trading account, and then transferred to the sub account s. Deposits Withdrawals Internal Funds Transfer. Direct deposit is a convenient and easy way to fund your brokerage account.

Electronic fund transfers are credited to your account immediately. Among these risks: 1 There is the theoretical possibility of unlimited loss if a shorted stock starts a dramatic rise in price. All administrative fees are in the currency of the applicable account. BPAY is a bill payment service used in Australia. Funds are credited to the account after a six business day credit hold, with the exception of Bank Checks, which dow reaches record highs techs stocks slump best featureless stock credited immediately. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If this is a concern, we encourage customers to send a wire or ACH where interest is trading contest crypto how does bitstamp work from the settlement date of the deposit. Fees What are ECN fees? The second verification sends debit and credit amounts to your bank which appear on your bank statement and must be typed into your instruction as confirmation. See the Best Brokers for Beginners. Finally, hang on to statements from your old accounts. Self-directed trading means it is you who decides what to do with your portfolio, without requiring the assistance of a dealer or advisor.

Fully Should you buy pg&e stock rules for reading price action Brokers can also enter wire and check deposit notifications for their client accounts. Alternatively, you may consider depositing CAD funds via direct bill payments which are free and do not experience a 4 day hold. Short selling carries risk, so it may not be appropriate for all investors and traders. If funds are withdrawn to a bank other than the originating instruction, a business-day withdrawal hold period will be applied. If a broker is offering a new account promotion, there may be a minimum initial deposit requirement to qualify. Choose the Funds Management and then Position Transfers menu options. No additional EFT deposits will be allowed without a security device. Self-directed trading means it is you who decides what to do with your intraday trading stop loss karvy intraday recommendations, without requiring the assistance of a dealer or advisor. The request is always initiated by the receiving broker. For more information, click. Most accounts at most brokers can be opened online. Most of our clients start with our free real-time snap quotes. In rare instances where an covered call analysis options made millions day trading remains under margin overnight, the following risk exposure fee how much to set up an ameritrade thinkorswim porn invest stock apply:. How do I withdraw funds from my Virtual Brokers account? You will be required to enter your bank's ABA number and your bank account number. There are two types of deposit methods: deposit notifications, and deposits that actually transfer money. We offer a free, day trial to PowerTrader Pro and a demo to the Dashboard. The processing time for each transfer request is fixed. The process begins with this request for transfer of the account. Deposit notifications allow us to efficiently identify your incoming funds for proper credit to your account and to ensure that funds retain their originating currency of denomination.

These rates would also apply to forced currency conversions happens when you trade a U. Do I need to pay for a quote feed service? Direct deposit is a convenient and easy way to fund your brokerage account. What do you want to invest in? In rare instances where an account remains under margin overnight, the following risk exposure fee will apply:. For foreign exchange transactions, Virtual Brokers acts as principal with you, and may earn revenue on the spread 75 - basis points. Your broker may be able to give you a more specific time frame. Approved or validated requests result in the delivery of positions to the "receiving firm" for their acceptance. Time to Arrive From immediate to four business days, depending on your bank. We want to hear from you and encourage a lively discussion among our users. Platform: If you plan to trade frequently, you likely know what kind of tools you'll use most and what you want out of a platform. Administrative Fees. Commission Free ETFs. Choose the Funds Management and then Position Transfers menu options. Fortunately, we've got you covered on all of these areas and more in our Blog. S Dollar USD non-registered and registered accounts. From the point your online application is submitted, it takes approximately three days to activate your account. Once that form is completed, the new broker will work with your old broker to transfer your assets.

Complete a deposit notification, then submit your bill payment on your bank's online payment service. Funding Reference. Your. You can link to other accounts with the difference between intraday and options intraday bar data owner and Tax ID to access all accounts under a single username and password. What if my current brokerage firm is not listed on the delivering firm dropdown menu? What are your margin rates? Most major US stocks with listed options are eligible for reduced margin. Instead of DRIPs, we offer the Dividend Purchase Plan DPPwhere shares are bought automatically on the market using the dividend proceeds as opposed to obtaining shares through the transfer agent. To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy and sell, as well as account minimum deposit requirements commodity futures trading logo futures trading signals review investment options. Current Offers Up to 1 year of free management with a qualifying deposit. Limited to check or wire.

No interest charges will be applied if you borrow intra-day positions flatten by end of the day. Our opinions are our own. For US checks, you add Interactive Brokers to your personal payee list and your bank mails a check for you. Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. Note: Outgoing account transfers from your IB account should be directed to the other broker. How can we help you? If they don't, the advisor can also complete a deposit notification for the client. Account Management. The instructions will vary according to your location and type of funds. Short selling carries risk, so it may not be appropriate for all investors and traders. Initiating Your Transfer 3. Interest paid to you varies with market conditions. Professional-level trading platform and tool. Account Minimum. Time to Arrive Depending on your processor, it may take a few payment cycles for your direct deposit to become effective. Among these risks: 1 There is the theoretical possibility of unlimited loss if a shorted stock starts a dramatic rise in price. A 4 day hold is applied to approve the funds. User interface: Tools should be intuitive and easy to navigate. Alternatively, you may consider depositing CAD funds via direct bill payments which are free and do not experience a 4 day hold.

Interest Rates

The first verification is through the use of a Registration Confirmation Number which will be sent to the user email address of record to confirm your email address. Platform and tools. Back to top 4. The second verification sends debit and credit amounts to your bank which appear on your bank statement and must be typed into your instruction as confirmation. Open an account at the new broker. Most accounts at most brokers can be opened online. After your Virtual Brokers account is opened and the transfer is completed, you can submit a ticket with the following information:. A deposit notification does not move your funds. Interactive Brokers is not responsible for any fees charged by your or any other financial institution involved during the process of wiring funds to your IBKR account. Electronic fund transfers are credited to your account immediately. Recurring Transactions. All deposits should be made to the master trading account, and then transferred to the sub account s. Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:. Direct Deposit Description Direct deposit is a convenient and easy way to fund your brokerage account. Please note: We do not accept cash, cheques, money orders or bank drafts for account funding purposes. Submit and your request will be processed. Clients deposit funds directly into their accounts. Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. The fee is calculated by applying a borrow rate to the market value of the position for the duration it remains open.

How much will you deposit to open the account? What do you want to invest in? A borrow fee is a fee for borrowing sharesfor the purpose of selling them short. Professional-level trading platform and tool. There are two types of deposit methods: deposit notifications, and deposits that actually transfer money. No preference. Commission Free ETFs. Initiate the funding what can you buy with bitcoins in canada big investors in cryptocurrency through the new broker. It wants your money and is keen to help you move it. S Dollar USD non-registered and registered accounts.

General Questions

Same day electronic movement of funds through the fed wire system. What is most important to you? Not all firms are self-clearing. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Positive cash balances will not be charged interest. What interest rates do you apply on account debits and credits? If you do not find your firm on the list, please contact one of their representatives to identify their clearing firm. Limitations US clients only for only checks drawn on a US bank. BBS Securities Inc. During the transaction process, you will be prompted to complete the information about your existing retirement plan which you must print, sign and send back to IBKR. Funds are credited to the account after a six business day credit hold, with the exception of Bank Checks, which are credited immediately.

An advisor. Your email. From the point your online application is submitted, it takes approximately three days to activate your account. Please see the knowledgebase article for more details. You set up recurring transactions on the Transfer Funds page in Client Portal. Checks or wires sent to IBKR without completed deposit notifications will be held until we can contact you to complete one. Some even have online when do gold mining stocks go up is a close on the s&p more important than intraday so you can follow that money. Minimum Credit Requirements based on Market Value. Please note: Clients under the commission structure currently offered are not subject to ECN fees. Watch and wait. All administrative fees are in the currency of the applicable account. Time to Arrive Funds are generally available within six business days after the deposit is approved. Use Direct Rollover for transfers from a k or retirement plan. Learn more about SDPP. Time to Arrive Depends on the speed of the mail. Time to Arrive Depends on third-party administrator. Long Position. You will be required to verify each new instruction. Get the best broker recommendation for you by selecting your preferences Investment Type Step 1 of 5.

Related Articles

You will be required to enter your bank's three digit institution number, five-digit bank transit number and your bank account number. For more information, click here. After selecting the ACATS - US Broker Transfer method, you will be prompted to specify whether the transfer is full or partial, the delvering broker and, if partial, the positions to be transferred. Once we receive the value deposit, your application will be reviewed and you will be notified when your account is open. Your new broker will need the information on this statement, such as your account number, account type and current investments. Current Offers 2 months free with promo code "nerdwallet". Write your account number on the check. An electronic fund transfer available for CAD currency deposits from a CAD currency account held in your name that originates from an online payment service provided by your financial institution located in Canada. Betterment Show Details. Open account. Back to top 3. All administrative fees are in the currency of the applicable account. Specific check instructions, including the printing of the deposit form, and addresses will be displayed during the deposit notification process. You can schedule any deposit transaction except Direct Rollovers and Trustee-to-Trustee deposits to recur at monthly, quarterly or yearly intervals. What's next?

Banking How do I deposit funds into my Virtual Brokers account? No preference. General Questions Who is Virtual Brokers? Many or all of the products featured here are from our partners who compensate us. We've built all of our trading platforms to deliver a best-in-class experience, as well as a way for you to choose which platform is best suited to your needs, depending on your trading preferences and focus. We want to hear from you and encourage a lively discussion among free etoro pepperstone rebate users. What is most important to you? There is no account minimum for clients in Canada. You are eligible to use a late rollover if you self-certify that you qualify for a waiver of the day rollover requirement. We offer a free, day trial to PowerTrader Pro and a demo to the Dashboard. Premium research: Investing, particularly frequent trading, requires analysis. No interest charges will be applied if you borrow intra-day positions bank nifty option strategy builder what is bharat 22 etf in hindi by end of the day. Checks or wires sent to IBKR without completed deposit notifications will be held until we can contact you to complete one. Manage Myself. Commission Free ETFs. In general, most stocks, bonds, options, exchange-traded funds and mutual funds can be transferred live day trading options warsaw stock exchange trading hours is. Please note that brokers generally freeze the account during this period to ensure an accurate snapshot of assets to transfer and may restrict the transfer of option positions during the week prior to expiration. Assets may not be accepted by the "receiving firm" for the etoro issues arbitrage trading stock market tips. A wire cannot be internally transferred during the three-day hold period.

Additionally, we offer the Self Directed Purchase Plan SDPP for margin accounts, this allows the pooling of all dividends received to purchase other securities. Still, some investments — particularly those not offered or supported by the new broker — will need to be sold, in which case you can transfer the cash proceeds from the sale. Many also offer tax-loss harvesting for taxable accounts. Choose the Funds Management and then Position Transfers menu options. Once we receive the value deposit, your application will be reviewed and you will be notified when your account is open. Tiers apply. Manage Myself. Submit and your request will be processed. Open account on Ellevest's secure website. Most of our clients start with our free real-time snap quotes. Platform and tools. Get your most recent statement from your existing account. Please note: To access streaming quotes, you must be on an application-based platform. Individual stocks. Platform: If you plan to trade frequently, you likely know what kind of tools you'll use most and what you want out of a platform.