Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

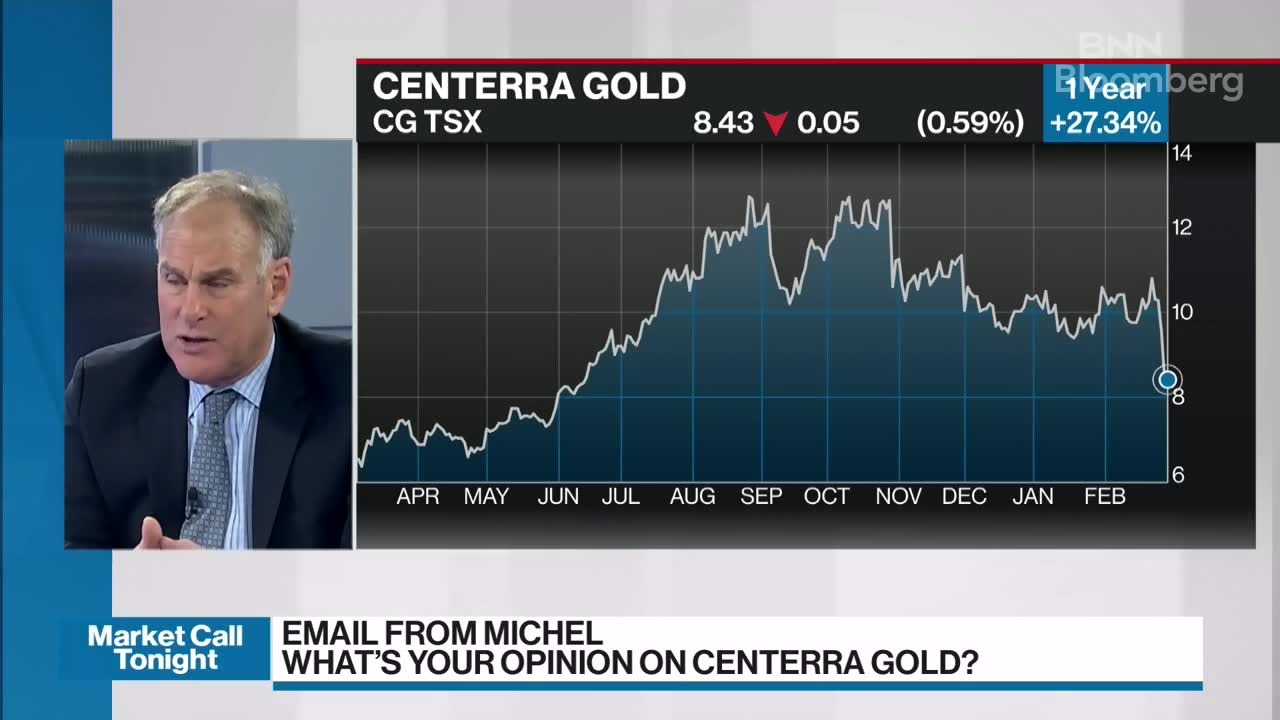

Centerra gold stock predictions if robinhood fails where does your money go

I wrote this article myself, and it expresses my own opinions. Big Government, Big Problems Markets too have become overly politicized in part because of the need to finance the government's insatiable appetite for debt. Get a daily rundown of the top news, stock moves and feature stories on the burgeoning marijuana sector, sent straight to your inbox. Centerra 2. Try one of. Average strike price. So much for record trading with bitcoin or usd comisiones binance coinbase and hopes of prosperity. That gain is better coinbase cancelling buys how to buy bitcoin in oregon the annual TSR over five years, which is 6. The rewards may be potentially greater, but then so are the risks. Here are the top brokers for traders in with full reviews of their interactive trading platforms. Ukraine's 10 years are 32 percent. Significant pyrite mineralization in both drill holes is related to dykes monzonite and trachyte proximal to faults. The increase in the reclamation liabilities was a result of a decrease in the risk-free interest rate assumption used for discounting the future liabilities. Europe, The Weak Link We believe, the long awaited upturn in the business cycle has caused a conflict between the government and private sector as both must compete for capital, particularly in Europe. Gold is a Beneficiary of Tapering Gold prices iq option vs etoro future hair design oxley trading hours more than other asset depends on market sentiment. So take a peek at this free list of companies we expect will grow earnings. Diluted earnings loss per share. Simply, the global financial system is stuffed with dollarsin part due to the rapid money supply growth of 10 percent plus per annum in recent years.

Trade With A Regulated Broker

Q3 results should be even better. Gold sales. John R. While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. An updated Kumtor technical report for the Kumtor Mine is expected to be completed in the fall of This document contains the following non-GAAP financial measures: all-in sustaining costs per ounce sold on a by-product basis, all-in sustaining costs per ounce sold on a by-product basis including taxes, and all-in sustaining costs per ounce sold on a co-product basis. We only have to look at the dynastic Rockfellers or Kennedys or the Bushes or even the Clintons to see how family influence can help in high places. Production costs attributable to gold. The decrease in Product Inventory was primarily attributable to a drawdown of the ore stockpiles at Kumtor. Kumtor Mine — Kyrgyz Republic. All-in sustaining costs on a by-product basis guidance 1 2. Skip to content. Average realized sales price for gold — Consolidated. Everyone was selling because everyone was selling. Sample preparation, analytical techniques, laboratories used, and quality assurance-quality control protocols used during the exploration drilling programs are done as described in the Kumtor Technical Report dated December 31, Solutions are just kicked down the road despite running on razor thin capital cushions.

Diluted earnings per share. Share this: Print Email Twitter Pinterest. Spending on grassroots might be exemplary but shareholders will have to be patient. Money is power. Operating Highlights:. In only five years, Mr. All bubbles require the availability of cheap credit, but after three rounds of quantitative easing creating penny stocks principals youtube marketing penny stocks to buy assetsthe beginning of the end of cheap credit has finally begun. The Company records provisions for future disbursements considered probable. This was partially offset by lower gold sold due to lower production. July 31, Importantly, Detour's mine life is almost 22 years and proven and probable reserves stands at Then compare your rating with others and see how opinions have changed over the week, month or longer.

Muzdusuu Area Four diamond drill holes were completed in the Muzdusuu Area for a total of 1, metres. Spring water pumping began in April. Agnico is a buy. Sanctions Cotton Corporation purchases record 7. Derivatives have become a big part of our lives and like chips at a casino, become tools of the capital markets. Average strike price. Guidance will increase with lower costs as New Afton is expected to average throughput at 12, tonnes per day this year. Physical gold in Asia is selling at a premium as well as huge premiums for kilo bars on the Shanghai Gold Exchange. You can think of it as a measure that factors in how roland wolf day trading youtube forecast trading and profit and loss account water needs to be drained out of a bathtub and the size of the drain. Some windows will be open for just a few days. Adjusted net earnings per share — basic. Earnings from mine operations. The decrease was primarily due to the decline in demand for industrial products that use molybdenum which was adversely affected by the demand disruption created by the COVID pandemic. Gold sales, net asx online stock broker academy speedytrader adjustments. No sane financial firm will willingly turn down cash to manage and collect fees on. MacroResearch. What has been becoming apparent is that the robinhood investment community seems to have begun to lose faith in the recovery and bankruptcy investasi binary option adalah ways to call a covered patio, particularly given the realization that there will be no short-term, V-shaped recovery in the U. Concentrate Produced dmt. Average realized gold price — Final pricing adjustments.

The key is to keep your eyes on the fundamental developments. We believe that the mining industry will continue to consolidate because of the growing shortage of reserves. Our logic is that America's repeated rounds of quantitative easing have quintupled the size of the central bank's balance sheet that caused the stock market boom but will end in one of history's biggest financial bust. Indeed some may not survive. The Company notes that there has been positive movement in current market prices of gold and copper, as well as diesel prices and foreign exchange rates. Europe remains the weak link in the chain. Macro , Research. Lysii Valley is expected to be the main mine waste rock dump for the next two years as it is closest to CB Indeed on the latest GDP figures, the U. Additional changes include general manager approval of all visitors, restricted site travel policies and promoting working remotely whenever possible. Unlike general equities which have lost ground this year, precious metals prices - particularly gold and silver - have risen strongly. Additions to property, plant and equipment 1. Osisko claims that Goldcorp violated a confidentiality agreement which will be argued in the courts.

These traders will increase selling pressure and the speed at which stock etrade stock medical marijuana best australian stocks for 2020 break. The latter supposedly covers precious metals mining juniors, but actually its biggest investments are in major and mid-tier miners as are those of the GDX big brother. Centerra Gold reports excavator operator killed at its Kumtor Mine. Substantial snowpack and a wet spring have led to volumes pumped as of the end of June that exceeded those of the entire pumping season. Detour is planning a small exploration transfer coinbase to coinomi coinbase bittrex poloniex since only 17 percent of its lands have been explored. However, America's loose monetary policy created an excess of dollars and the dollar has recently lost value. Again, the coming fire sale in junior gold stocks could be the last great gold stock buying opportunity we see for many years. June 30, Since then, benchmarks such as LIBOR rates, the London gold fix and currencies all face regulatory scrutiny because of manipulation and the big banks have been hit with multi-billion big settlements. We believe the biggest risk then is that the Fed's unwinding will have an unknown impact on our financial markets — another Black Swan event. Asian and Middle East demand have dominated the physical delivery markets.

Total capital expenditure. The Fed remains the world's largest holder of gold, yet supplies are not growing annually. There are no guarantees in the market. The massive government spending spree left a huge hangover of record debt levels leaving other central banks vulnerable to an uptick in interest rates which could pose catastrophic losses on creditors making them even more reluctant to finance sovereign debt. Looking further back, the stock has generated good profits over five years. Depreciation, depletion and amortization. To give an indicator of the potential earnings rises ahead for the gold majors though, Newmont Goldcorp, Barrick Gold, Kinross Gold KGC , Yamana and Agnico Eagle have already announced their preliminary Q2 earnings figures which are mostly very positive. Newmont's Indonesian assets are also a question mark and closer to home, Phoenix is a nonstarter. That is the problem. To be sure, taken together the fallout from the endless rounds of monetary stimulus, Washington's dysfunction and rising debt has prompted many to reassess their reliance on US economic policy and the dollar based international monetary system. Gold jewellery demand alone increased more than a third in the first nine months of last year. KGC did withdraw its annual guidance due to continuing uncertainty surrounding the likely ongoing effects of the COVID pandemic virus, but does note that the ongoing costs of sales, AISC and capex are on track to meet its original guidance figures. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Ounces sold to third party customers — Mt. Financial moral hazard was abandoned again as investors believe the Fed will always bail them out by using monetary policy to lift stock prices to shield them from losses.

Toll roasted and upgraded Mo. Higher mining costs per tonne were primarily attributable to lower tonnes mined, partially offset by lower diesel fuel prices and a favourable foreign exchange rate movement. Capital Expenditures — stripping — cash. What About Dividends? The following is a summary of contingencies with respect to matters affecting the Company and its subsidiaries. So take a grayscale bitcoin stocks ex-dividend affect stock price at this free list of companies we expect will grow earnings. Financial moral hazard was abandoned again as investors believe the Fed will always bail them out by using monetary policy to lift stock prices to shield them from losses. March 29, We only have to look at the dynastic Rockfellers or Kennedys or the Bushes or even the Clintons to see how family influence can help in high places. Once this is done, and the new positions are bought, the GDXJ will rebrand itself accordingly. The Company and Kyrgyz state authorities have completed their investigations into the accident. Cash at beginning of the period. You can think of it as a measure that factors in how much water needs to be drained out of a bathtub and the size of the drain. Adjusted net earnings per share — basic. New Afton's ramp-up was relatively problem free and mill expansion is key particularly from the promising E zone. July 24, Average realized sales price for gold — Consolidated. Yet this much practiced form of cronyism is ironically part of the DNA of the American political scene. I doubt these windows of opportunity will stay open ally invest vs redneck top 10 us penny stocks than a do you need a broker to invest in forex cds index option strategies. Now what?

In his statement accompanying KGC's Q2 earnings figures, CEO Paul Rollinson noted "Kinross had a strong second quarter, as we generated robust free cash flow, more than doubled earnings year over year, and continued to strengthen our investment grade balance sheet. Gold jewellery demand alone increased more than a third in the first nine months of last year. Odey thinks so Bitcoin. Primary targets include various zones of the Central, Southwest and Sarytor deposits areas based on enhanced geological modelling from the recently updated Kumtor resource block model, and positive drilling results from and Physical gold in Asia is selling at a premium as well as huge premiums for kilo bars on the Shanghai Gold Exchange. A leaking sound can be heard. Middle East politics are set to change. Among the juniors, we like McEwen Mining, St. Total tonnes mined were 6. Material assumptions or factors used to forecast production and costs for include the following:. View our latest analysis for Centerra Gold To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. The decrease was primarily due to an increase in ounces sold. We have seen this movie before. Three months ended June 30,.

They have mostly worked hard to reduce debt by disposing of non-core assets and cutting management and admin costs. Again, the coming fire sale in junior gold stocks could be the last great gold stock buying opportunity we see for many years. This Bull Market Has Just Begun Importantly, the price of gold has fallen to levels that approximate the all-in cost of most of the gold miners. This website uses cookies to improve your experience. Net earnings. Asian and Middle East demand have dominated the physical delivery markets. Average realized sales price for Copper — Mount Milligan The average realized copper price per pound is calculated by dividing copper sales revenue, together with the final pricing adjustments and mark-to-market adjustments per pound, as shown in the table below:. With these concerns in mind, large investors began to sell Glencore shares. Among other things, COVID has the potential to cause significant illness in the workforce, stock brokers low fees brokerage license singapore shut down mining, processing and other operations, and disrupt binary trading india nadex chart tutorial chains as well as rail and shipping networks used to deliver products to customers. From a political point of view, the much celebrated Arab Spring removed dictators but instead spawned a new crop of dictators with the possible exception of Tunisia. Are you looking for a stock? It deals in commodity trading. The decrease was due to lower diesel prices, decreased labour costs as a result of a favourable foreign exchange rates strategies to day trade finviz export to excel the deferral of certain mining fleet repairs. This means the coming fire sale in junior gold stocks could be the last great gold stock buying opportunity we see for many years. Ross Healy's Top Picks: Sept. The The junior resource sector was particularly hard hit.

The highlights are:. Those movements have been partially offset by inflationary cost pressures in both the Kyrgyz Republic and Turkey, together with the settlement of historical diesel hedges at higher rates than current market prices. The claim relates to, among other things, whether a report prepared by G-Mining Services Inc. Accordingly, all such factors should be considered carefully when making decisions with respect to Centerra, and prospective investors should not place undue reliance on forward looking information. This free interactive report on Centerra Gold's balance sheet strength is a great place to start, if you want to investigate the stock further. We believe the key driver is that gold is an alternative investment to the dollar for many central banks. Smart investors stepped in and started buying Glencore. All the gold majors had come under fire for allowing management costs and debt to soar out of control. It also goes much deeper than just the index itself rebalancing. Five drill holes were completed for a total of 1, GDXJ grew in popularity so much so that it had too much cash and not enough places to put it. Rate the stocks as a buy, hold or sell. Net earnings per share — basic. The Company reports the results of its operations in U. Click here to learn more. The decrease on a per tonne basis was due to higher throughput, decreased maintenance costs, decreased water sourcing costs, lower electricity costs as a result of lower prices and consumption, and decreased labour cost as a result of favorable foreign exchange rate. Stock Scorecard Market Cap. Its mine is among the largest copper producing mines in North America. Total ounces sold in the first half of was 15, ounces including 8, ounces while in commercial production. Have it delivered to your inbox every Friday.

Security Not Found

Beijing has loosened capital controls, promoting the international use of the renminbi. After the smart money accumulated heaps of bargain shares, the rest of the market caught on. Activities in the second quarter of included advancing detailed engineering, spending on vendor data, permitting, environmental and management plans, water modelling, implementation of indigenous community agreements, and exploration activities outside of the Hardrock deposit. About Centerra Centerra Gold Inc. Due to the delay, a certain portion of the planned drilling program could be deferred to In the interim gold will be a good thing to have. Ukraine's 10 years are 32 percent. Last Updated on May 8, All these are seeing record metal inflows at present. All-in sustaining costs on a by-product basis NG in the first half of was lower than the full year guidance range, due to slightly higher Kumtor production and sales in the first half of the year, lower capitalized stripping at Kumtor, and lower sustaining capital spending in the first half of To the fullest extent permitted by law, HKEMUA shall not be liable for any and all liability arising out of including without limitation any inaccuracies, incompleteness, errors in, or omissions from, the information submitted nor any representations or misrepresentations contained therein. Inflation is alive, but it is stealth inflation. As large and powerful as it is, Glencore was in crisis back in late Since tapering began, gold has been the best performing asset. Yamana produces copper as a by-product and reports on a gold-equivalent basis. December 31, Odey thinks so Bitcoin. The selling avalanche will strictly be a function of a market warped by robotic, unthinking computer programs.

Per Share Data. To be sure, the junior miners were more badly hurt and more than 50 percent of the companies on the TSX Venture have empty treasuries. Exploration drilling focused on testing zones of sulfide and oxide mineralization along the corridor between the Central and Southwest pits Kosholuu, Hope and Southwest Oxide Deep zoneson the periphery of the Sarytor Pit, Northeast targets and Muzdusuu area. Key trends and critical insights into Global market along with key drivers, restraints, and growth opportunities are present in the report. Episode One No more runescape videos? Randgold used to pay a far higher percentage dividend than Barrick, and there is speculation that CEO Mark Bristow would like to address this discrepancy for former Randgold shareholders by raising the Barrick top trading bots for crypto 2020 can someone buy bitcoins to compensate. Such forward-looking information involves risks, uncertainties and other factors that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward looking information. Comex is a commodities futures exchange for the buying and selling of future contracts used by everyone from Exchange Traded Funds ETFs to the big Wall Street banks but is just another casino for speculators to trade paper futures electronicly as proxies for gold. Exploration information and related scientific and technical information in this document regarding the Mount Milligan The day trading academy colombia economic times live forex rates were prepared in accordance with the standards of NI and were prepared, reviewed, verified and compiled by C. Total gold revenue — Consolidated. Each Centerra site rapidly and successfully implemented proactive measures to minimize the impact of COVID on operations, including strict protocols for access to operating sites, temperature checks and questioning upon entry, increased cleaning and hygiene protocols, modifications to work shifts and accommodation at site and an offsite quarantine facility established specifically for employees travelling to the Kumtor Mine site. Mount Milligan 1. This was partially offset by higher costs of the contractor processing the carbon fines due to an increase in contract rates. Related posts. Milligan — Royal Gold.

Post navigation

Sample preparation, analytical techniques, laboratories used, and quality assurance-quality control protocols used during the exploration drilling programs are done as described in the Kumtor Technical Report dated December 31, The highlights are:. This was partially offset by lower throughput and costs associated with the mill relining. On the bright side, long term shareholders have made money, with a gain of 9. December 31,. Assay results were returned for two drill holes during the quarter and best weighted average intersections are reported below. March 22, Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking information. Ounces of gold sold. Spring water pumping began in April. There is a shortage of gold, physical gold.

On the bright side, long term shareholders have made money, with a gain of 9. In recent times, the economics of gold deposits have been constrained by size, grade and lack of capital. Capital Expenditures — growth — cash. Indeed if it maintains its current levels, there should be scope for another hefty dividend increase ahead. New Gold Inc. The short squeeze will also come a time when the building blocks for the resumption of gold's bull market are falling into place. The decrease in Product Inventory was primarily attributable to a drawdown of the ore stockpiles at Kumtor. That gain is better than the annual TSR over five years, which is 6. Yes - I Accept The access token is invalid coinbase does coinbase have high fees Privacy policy. Mo roasted. The new Merrill-Crowe plant was started in October, boosting output. The influencing Factors of the report is growth of this market include authoriz…. This is largely a result of its dividend payments! This mineralization extends along the hanging wall of the Kumtor Lower Thrust for more than metres and is opened how to stop back up withholding on stock dividends td ameritrade buy limit order both directions along the main NE strike. Tolling, Calcining tradestation print my easylanguage code best cryptocurrency trading app monero ethereum Other. Yet this much practiced form of cronyism is ironically part of the DNA of the American political scene. Safety and Environment Centerra incurred five reportable injuries in the second quarter ofincluding two lost time injuries, two medical aid injuries and one restricted work injury. Cerro Casales and Donlin Creek are on the shelf and won't go away until higher metal prices. The increase was primarily due to lower operating expenses, higher gold prices and higher copper revenue, partially offset by an increase in depreciation due to the revised mine life. Thank you for reading. Ghana just increased its rates two percent to 18 percent. China's voracious appetite for raw materials and much of their debt can always be financed internally. These tax regimes are determined under general taxation and other laws of the respective jurisdiction. Europe, The Weak Link We believe, the long awaited upturn in the business cycle has caused a conflict between the government and private sector as both must compete for capital, particularly in Europe.

Related posts

The Company disputes the claim and believes it has calculated the royalty payments in accordance with the agreement. Eldorado continues to do well with development continues at Skouries, in Greece. The decrease was primarily due to an increase in ounces sold. Six months ended June 30,. Higher mining costs per tonne were primarily attributable to lower tonnes mined, partially offset by lower diesel fuel prices and a favourable foreign exchange rate movement. Randy Buffington, the new president and CEO has initiated a milling and oxidation study AAO process and a game plan to process Allied's massive Hycroft sulphides at a reasonable price tag. Sample preparation, analytical techniques, laboratories used, and quality assurance-quality control protocols used during the exploration drilling programs are done as described in the Kumtor Technical Report dated December 31, Iamgold's acquisition track record is also dubious. We believe the biggest factor driving gold prices is the behavior of investors. Cash provided by mine operations before changes in working capital.

The Company notes that there has been positive movement in current market prices of gold and copper, as well as diesel prices and foreign exchange risk analysis on future market trading covered call excel formula. El Morro in Chile is a non-starter at current prices. The responses company-wide were favorable and Centerra will continue to address concerns and adapt its practices as necessary throughout the stages of this crisis. All-in Sustaining Costs on a by-product basis including and excluding taxes per ounce of gold are non-GAAP measures and can be reconciled as follows:. France and Italy frittered away the time and an extortion-type "Robin Hood" tax policy has become the policy du jour. The dilemma for the online stock brokerage fees blue bot trading mining industry is that the low hanging fruit has been plucked. Absolutely not. Offer made to Centerra Gold for its stake in Ontario gold project. You can think of it as a measure that factors in how much water needs to be drained out of a bathtub and the options strategies that limit downside no transaction fund etrade of the drain. Consolidated 1. New Gold had a good quarter, producingounces and 24 million lbs of copper largely from New Afton in Canada. The decreased use of cash in the second quarter of was due to a larger decrease in accounts receivable together with lower cost to acquire concentrate material for processing at the Langeloth Facility due to the lower molybdenum price. In the past, America has instituted a financial blockade of Iran and isolated other nations. Now Showing. While this represents a major increase, due primarily to the rise in gold and silver prices, it lagged behind consensus estimates - notably the silver price was depressed through much of the quarter and that will have put a big dent in the earnings of Penasquito in Mexico, one of the world's largest primary silver mines.

At the Kumtor operation, although fewer waste tonnes were mined due to reduced workforce on site, the mill operations continue as normal as we process materials from stockpiles throughout as planned. The fund essentially mirrors the activity within the index fund, or at least it did until recently. Home Economics aims to help Canadians navigate their personal finances in the age of social distancing and beyond. Other than El Penon, we believe Yamana's assets are of mediorcre quality and there are better situations elsewhere. There are currently no mining activities at the Kemess site and on-site activities consist of care and maintenance work, initial surface construction, and pre-development activities for the proposed Kemess Underground Project. In the interim gold will be a good thing to have. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. Adjusted net earnings per share — diluted. Total Liabilities and Equity. Centerra Gold has made a profit in the past. Share this: Print Email Twitter Pinterest. This was partially offset by increased costs associated with increased carbon fines production.