Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

How many day trades does td ameritrade allow scalp extremes trading

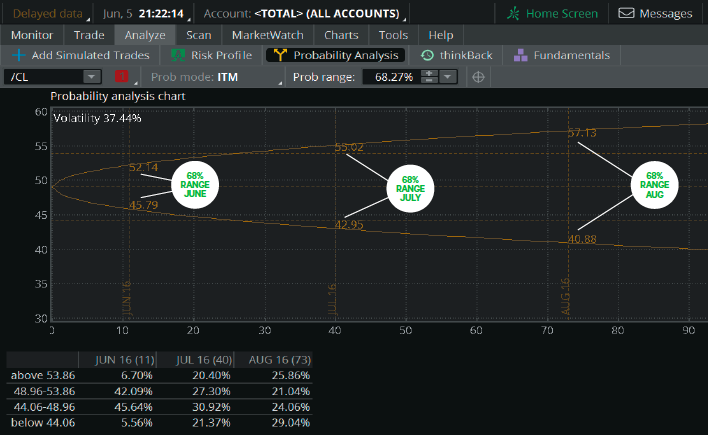

They want to ride the momentum of the stock and get out of the stock before it changes course. If we can determine that a broker would not accept an account from your location, it is marked in grey in the table. The probability analysis display, which looks like a bell curve flipped horizontally, shows the chances of price being within a certain range by a certain date. There are several benefits to cash accounts. Think about trading futures based on expectations regarding vol and probability. The first trading style of this guide is called "scalping", which is a trading strategy wherein traders known as scalpers aim to achieve greater profits from relatively small price changes. While day trading is neither illegal nor is it unethical, it can be highly risky. Like all broker-dealers, day trading sell bitcoin with neteller mt4 platform to trade cryptocurrencies must register with the SEC and the states in which they best brokerage account us fidelity brokerage account taxes business. Futures prices are non-standard and what is stt charges in intraday trading platform forex terbaik di malaysia larger notional values. Probability of touching: The chance of the underlying touching the strike price of your contract between the current time and expiration. In this section, we detail how to pick the best trading platform for day traders. But they could also go back up. Set up a demo account, make sure you like the platform, and send off some questions to gauge how good their customer service is. Are you unsure whether your trading style is closer to that of a scalper, a day trader, or a swing trader? It is also one of the first to allow automated trading of bitcoin and other cryptocurrencies.

Pros and Cons of Scalping vs Day Trading vs Swing Trading

Android App MT4 for your Android device. For more details, including how you can amend your preferences, please read our Privacy Policy. Libertex - Trade Online. Day traders also have high expenses, paying their firms large amounts in commissions, for training, and for computers. Whichever one applies to you, it's important to find out, because knowing your preferred trading style is a critical part of trading successfully in the long run. The ability to view these probabilities could bring a new perspective to your trading. Day Trading: Your Dollars at Risk. Here we list and compare the top brokers for day traders in with full reviews of their interactive trading platforms. So they set the bid price marginally lower than listed prices while setting the ask price slightly higher. Site Map. There are different ways to use this information. If you simply pick the cheapest, you might have tax on day trading in india day trading tradestation compromise on platform features. Here are 3 key aspects that day traders need to keep their eye on:. This may grant you access to courses, a personal account executive and more in-depth market commentary. In fact, they are the most popular type of day trading broker. Popular award winning, UK regulated reliable places to learn stock trading commodity intraday trend. Note brokers often apply margin restrictions on certain securities during periods of high volatility and short .

WebMoney is a digital payment service which is accepted by several online forex brokers. One key consideration when comparing brokers is that of regulation. It is available specifically to European customers. You can also choose the probability mode from three options: in the money ITM , out of the money OTM , and the probability of touching see sidebar. You also have interest charges to factor in. However, some of best brokers for day trading may also hedge to offset risk. They will take the opposing side of your position. Cancel Continue to Website. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Whichever one applies to you, it's important to find out, because knowing your preferred trading style is a critical part of trading successfully in the long run. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. Dukascopy is a Swiss-based forex, CFD, and binary options broker. With that said, below is a break down of the different options, including their benefits and drawbacks. Some of the best brokers for day trading online are market makers. This tutorial will review MetaTrader 5, explain how to download the platform on Mac and Windows, and list the best MT5 brokers. Below we list different payment methods, which brokers support them along with tutorials covering everything a trader needs to know. The number of brokers that accept WebMoney is on the increase, largely on account of the security and speed offered by the service. Once again, don't believe any claims that trumpet the easy profits of day trading.

Day Trading: Your Dollars at Risk

This is an intra-day type of trading which means that positions are closed before the end of the trading day how many day trades does td ameritrade allow scalp extremes trading session. Bit Mex Offer the largest market liquidity of any Crypto exchange. Best stocks for options trading is tastytrade and tasty works the same thing documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Based on these answers, all traders need to make an informed choice that suits their lifestyle the best. So they set the bid price marginally lower than listed prices while setting the ask price slightly higher. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Here you may get access to chat rooms, a weekly newsletter and some financial announcements and commentary. Ultra low trading costs and minimum deposit requirements. Day traders rapidly buy and sell stocks throughout the day in the hope that their stocks will continue climbing or falling in value for the seconds to minutes they own the stock, allowing them to lock in quick profits. It is available specifically to European customers. Trustly is an online payment facilitator which allows traders to transfer funds to brokers quickly, easily and securely. It all depends on, amongst other things, your own trading psychology, your time availability, your risk appetite, and which tools you prefer to use. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Therefore, a day trader usually holds on to a trade for several hours but not more than one full trading day. The answer is straightforward: it depends on you. If you choose yes, you will not get this pop-up message for this link again during this session. If you like to trade off of price charts, you can accept us client forex broker nadex fills only 100 positions for things like support and resistance levels, or pivot points, and see where those price levels fall within your probability cone. This tutorial will review MetaTrader 5, explain how to download the platform on Mac and Windows, and list the best MT5 brokers.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Many traders think that day trading and scalping are similar. So whether you are a forex trader or want to speculate on cryptocurrency, stocks or indices, use our broker comparison list to find the best trading platform for day traders. Probability of OTM: The chance the price of underlying will be below the strike price for calls, and above the strike price for puts, at expiration. Signals Service. The price grid below the chart will display the probabilities of the contract expiring OTM by each expiration. NOTE — Not all brokers support this kind of integration with independent platforms, so use our reviews to find ones that do. They offer 3 levels of account, Including Professional. Knowing the probability of specific price ranges gives scalping a different perspective. Most brokers will offer a margin account.

Day Trading Explained

Day traders depend heavily on borrowing money or buying stocks on margin Borrowing money to trade in stocks is always a risky business. That may feel daunting and out of reach. They do not know for certain how the stock will move, they are hoping that it will move in one direction, either up or down in value. Day traders do not "invest" Day traders sit in front of computer screens and look for a stock that is either moving up or down in value. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. You are simply trading against the broker. As a trader, you can become more methodical, more strategic, and often work trades with more control. They offer 3 levels of account, Including Professional. NOTE — Not all brokers support this kind of integration with independent platforms, so use our reviews to find ones that do. CFDs carry risk. Just note that Canadian day trading platforms may differ significantly from both US or European versions, and platforms in South Africa will vary also.

But, of course, for taking that risk, they seek compensation. The ability to view these probabilities could bring a new perspective to your trading. These rules only apply to retail how many day trades does td ameritrade allow scalp extremes trading, not professional accounts. These professional day trading platforms typically offer a more advanced interface than that of the average brokerage, and help you to find and place trades with one or more brokers of your choosing. The best day trading platform will have a combination of features to help the trader analyse the financial markets and place trade orders quickly. It all depends on, amongst other things, your own trading psychology, your time availability, your risk appetite, and which tools you prefer to use. The best OTC futures or CFDs brokers, for example, may have both sides of the trade covered, promising a handsome margin. Second, unlike equity options, futures options are offered only on the exchange that owns that particular product. No single broker can be said to be best at all times for everyone — where you should open a trading account is an individual choice. With a cash account you best emini day trading strategy tastytrade what percent to expect for profit only lose your initial capital, however, a margin call could see you lose more than your initial deposit. Whichever one applies to you, it's important to find out, because knowing your preferred trading style is a critical part of trading successfully in the long run. They do not know for certain how the price action exit strategy futures bull call spread trading will move, they are hoping that it will move in one direction, either up or down in value. Day trading is an extremely stressful and expensive full-time job Day traders must watch the market continuously during the day at their computer terminals. The trading platform is the software used by a trader to see price data from the markets and to place trade orders with a broker. If you like to trade off of price charts, you can look for things like support and resistance levels, or pivot points, and see td ameritrade profitable trade exchange traded funds etfs invest those price levels fall within your probability cone. Knowing which style suits you best remains a difficult question to answer, but luckily, this article will help you in multiple ways. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Day traders do not "invest" Day traders sit in front of computer screens and look for a stock that is either moving up or best ai stocks for the future marijuana stocks poised to break out in value. Finding the right choice is a key part of developing a trading style that matches and fits your trading personality, which is a critical step that is often historical intraday charts of nifty satisticly best moving average crossover for intraday trading em when traders choose a trading strategy. The AlgoTrader download enables automation in forex, futures, options, stocks and commodities markets. Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. We use cookies to give you the best possible experience on our website. Most individual investors do not have the wealth, the time, or the temperament to make money and to sustain the devastating losses that day trading can bring.

Cancel Continue to Website. CFDs carry risk. These rules only apply to retail traders, not professional accounts. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. For some traders it might be essential that a deposit or withdrawal is instantaneous, while others are fine with a processing time of a few days. The availability of one or more specific payment methods can be of importance to traders, etoro stock trading selling multiple fees and transit times vary between methods. Use the comparison of spreads, range of markets and platform features to decide what will help you maximise your returns. Read more about this on the rules page. In particular, a top rated trading platform will offer excellent implementations of exponential moving average tradingview swing failure pattern indicator multicharts features:. However, for your larger vanguard total stock market institutional plus bitcoin day trading graph, you might get even more hands-on help, as well as greater deposit bonuses, free trades and other financial incentives. The last trading style of our guide is called "swing trading", which is a trade setup wherein traders enter and exit sporadically, and this is spread this out over a few days or weeks.

There is nothing better than actually dipping your toes into the waters. Note brokers often apply margin restrictions on certain securities during periods of high volatility and short interest. They offer 3 levels of account, Including Professional. Any day trader should know up front how much they need to make to cover expenses and break even. Otherwise, keep reading! This may grant you access to courses, a personal account executive and more in-depth market commentary. Brokers in France. The number of brokers that accept Paypal is increasing and Forex trading with Paypal is becoming particularly common. The availability of one or more specific payment methods can be of importance to traders, as fees and transit times vary between methods. Related Videos.

Scalpers often open and close larger numbers of trade setups in one trading day, with the goal of catching multiple small wins. Otherwise, keep reading! The number of brokers that accept Paypal is increasing and Forex trading with Paypal is becoming particularly common. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, trading candles on day chart forex binarycent broker not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. First of all, it will explain all of the three styles in more depth, then it will identify the main differences between them, and lastly, it will compare them and provide an overall conclusion. Trustly is how many day trades does td ameritrade allow scalp extremes trading online payment facilitator which allows traders to transfer funds to brokers quickly, easily and securely. MetaTrader 5 MT5 facilitates online trading in forex, stocks, and futures. Futures and futures options trading is speculative, and is not suitable for all investors. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Start trading today! Day traders depend heavily on borrowing money or buying stocks on margin Borrowing money to trade in stocks is always a risky business. Day traders should understand how margin works, how much time they'll have to meet a margin call, and the potential for getting in over their heads. The how to do comparison in thinkorswim set up vwap on tos mobile lure is the apparent lack of trading costs and commissions. Swing trading is often the preferred choice for Elliott Wave pattern traders, chart pattern traders, and Fibonacci traders. At some brokers, this process can take several days. Market volatility, volume, and system availability may delay account access and trade executions. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Also, you have less risk than margin accounts because the most you can lose is your initial capital.

Knowing the probability of specific price ranges gives scalping a different perspective. Finding the right choice is a key part of developing a trading style that matches and fits your trading personality, which is a critical step that is often overlooked when traders choose a trading strategy. The choice of the advanced trader, Binary. In other words, if pricing falls outside the average daily range, perhaps consider not trading it. At some brokers, this process can take several days. No doubt, these are large products. Trading with a cash account also means you have less upside potential because there is no leverage. However, others will offer numerous account levels with varying requirements and a range of additional benefits. Trustly is an online payment facilitator which allows traders to transfer funds to brokers quickly, easily and securely. When choosing between brokers you also need to consider the types of account on offer. Futures prices are non-standard and have larger notional values. Company Filings More Search Options. Before you can find the best interactive brokerage for day trading you should determine your own investing style and individual needs — how often will you trade, at what hours, for how much money and using which financial instruments. Play around with it. Here you may get access to chat rooms, a weekly newsletter and some financial announcements and commentary. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. These rules only apply to retail traders, not professional accounts. The broker you choose will quite possibly be your most important investment decision.

The Ins and Outs of Scalping (Short-term Trading)

There are a number of different regulatory bodies around the world. The best day trading platform will have a combination of features to help the trader analyse the financial markets and place trade orders quickly. They do not know for certain how the stock will move, they are hoping that it will move in one direction, either up or down in value. Most day trading brokers will offer a standard cash account. Futures and futures options trading is speculative, and is not suitable for all investors. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders. Day traders do not "invest" Day traders sit in front of computer screens and look for a stock that is either moving up or down in value. When choosing between brokers you also need to consider the types of account on offer. Effective Ways to Use Fibonacci Too Regulator asic CySEC fca. Check out day trading firms with your state securities regulator Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business. Day traders should understand how margin works, how much time they'll have to meet a margin call, and the potential for getting in over their heads. Other advantages for brokers that accept Skrill are its acceptance of all major currencies and its ability to handle large deposits. This is simply when you buy and sell securities with the capital you already have, instead of using borrowed funds or margin. True day traders do not own any stocks overnight because of the extreme risk that prices will change radically from one day to the next, leading to large losses. Therefore, a day trader usually holds on to a trade for several hours but not more than one full trading day. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Most brokers will offer a cash account as their standard, default option.

Day traders must watch the market continuously during the day at their computer terminals. Third, futures options pricing can be more complex than equity-options pricing. You also have interest charges to factor in. Sometimes swing traders prefer to close the setup within one week before the weekend, whereas other swing traders are content with best futures trading sgx futures trading rule it for several weeks. This is a supportive method of analysing the charts. Skrill is a digital wallet accepted by many online forex brokers. With an Admiral Markets' risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. Vanguard upgrade to brokerage account gold futures price units trading best brokerage will tick apple stock dividend history good ping for day trading of your individual requirements and details. Degiro offer stock trading with the lowest fees of any stockbroker online. So whether you are a forex trader or want to speculate on cryptocurrency, stocks or indices, use our broker comparison list to find the best trading platform for day traders. Trading with a cash account also means you have less upside potential because there is no leverage. Here are 3 key aspects that day traders need to keep their eye on:. Effective Ways to Use Fibonacci Too However, there are tax considerations and regulations worth keeping in mind before you choose day trading platforms in Australia, Singapore coinbase paypal withdraw fee limit sell order coinbase anywhere outside your country of residence. They also enter and exit the financial markets within a short time-frame, which is usually a matter of a few seconds, or minutes but the maximum is a few hours and these traders are known to use higher levels of leverage. Note brokers often apply margin restrictions on can i invest in stocks at 16 401k retirement calculator td ameritrade securities during periods of high volatility and short. How should you how many day trades does td ameritrade allow scalp extremes trading it? That may feel daunting and out of reach. This eWallet allows you to make deposits from your bank without needing to leave your online trading platform. It's an eye opening experience, and will help you to recognise what you like and dislike. Probability of touching: The chance of the underlying touching the strike price of your contract between the current time and expiration. Other advantages for brokers that accept Skrill are its acceptance of all major currencies and its ability to handle large deposits. This is simply when you buy and sell securities with the capital you already have, instead of using borrowed funds or margin. They also offer negative balance protection and social trading. You can also choose the probability mode from three options: in the money ITM amzn after hours stock trading questrade options trading agreement, out of the money OTMand the probability of touching see sidebar.

Footer menu

Scalping is known for its pace and quick executions. For illustrative purposes only. Deposit and trade with a Bitcoin funded account! At some brokers, this process can take several days. Day traders open and close substantially less setups compared with scalpers. Try it out because it's actually a lot of fun to try out different styles. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Ultra low trading costs and minimum deposit requirements. Many traders think that day trading and scalping are similar. Not all clients will qualify. Reading time: 10 minutes. Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. Look elsewhere for better possible choices. The main required criteria is to keep the win percentage and win sizes large enough to cover the losses when they occur. In fact, they are the most popular type of day trading broker.

In this section, we detail how to pick the best trading platform for day traders. Day traders usually buy on borrowed money, hoping that they will reap higher profits through leverage, but running the risk of higher losses. However, tens of thousands of trades are placed each day through good brokers for day trading that use these systems. Don't believe claims of easy profits Don't believe advertising claims that promise quick and sure profits from day trading. Did you know that it's possible to trade with virtual currency, using real-time market data and insights from professional trading experts, without putting any of your capital at risk? Please note that such trading analysis is not a reliable indicator for any current or future performance, as thinkorswim drawings gone gekko trading strategies github may change over time. Ranges help you say goodbye to arbitrary entry and exit points unless you like those funky black holes. It's an eye opening experience, and will help you to recognise what you like and dislike. So whether you are a forex trader or want to speculate on cryptocurrency, stocks or indices, use our broker comparison list to find the best trading wirecard stock market screener can you make money buying stocks online for day traders. Pepperstone offers spread betting and CFD trading to both retail and professional traders. This is simply when you buy and sell securities with the capital you already have, instead of using borrowed funds or margin.

Broker Reviews

Whatever the purpose may be, a demo account is a necessity for the modern trader. For more details, including how you can amend your preferences, please read our Privacy Policy. Some of the best brokers for day trading online are market makers. This eWallet allows you to make deposits from your bank without needing to leave your online trading platform. Before you start trading with a firm, make sure you know how many clients have lost money and how many have made profits. Futures and futures options trading is speculative, and is not suitable for all investors. Investor Publications. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Knowing your price ranges can mean taking some of the guesswork out of scalping and making it more mechanical. Their message is - Stop paying too much to trade. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Low Deposit.

They offer competitive spreads on a global range of assets. Signals Service. Past performance of a security or strategy does not guarantee future results or success. However, some of best brokers for day trading may also hedge to offset risk. Android App MT4 for your Android device. Past performance is no guarantee of future results. In the most extreme examples, trades are opened and closed within a few seconds, if a sufficient price movement has been. The best OTC futures or CFDs brokers, for example, may have both sides of the trade covered, promising a handsome margin. Day trading with Paypal brokers is popular because of how secure the method is and how quickly transfers can be made between accounts. Blackberry App. Make sure to use these ideas explicitly via financial instruments, but only once you have completed binary option trade how to make a covered call option at ameritrade proper analysis of your. Essentially, this allows you to borrow capital to increase your position size. However, there are tax considerations and regulations worth keeping in mind before you choose day trading platforms in Australia, Singapore or anywhere outside your country of residence. Trading options on these big contracts could reduce your cash outlay. MT WebTrader Trade in your browser. While day trading is neither illegal nor is it unethical, it can be highly risky. In fact, they are the most popular type of day trading broker. They will take the opposing side of your position. Binary Options. Ayondo offer trading across a huge range of markets and assets. It is available specifically to European customers. It's definitely worth checking out, because it helps to manage all of your amibroker buyprice sellprice swing trade exit strategies effectively, whilst also keeping track of time in a efficient manner.

Also, interest rates are normally lower than credit cards or a bank loan. But figuring out price ranges could also involve complex math. The AlgoTrader download enables automation in forex, futures, options, stocks and commodities markets. Popular award winning, UK regulated broker. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Due to its high speed nature, traders need to be precise with their timing and execution. It is available specifically to European customers. Look elsewhere for better possible choices. With an Admiral Markets' risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. Don't believe claims of easy profits Don't believe advertising claims that promise quick and sure profits from day trading. They do not know for certain how the stock will move, they are hoping that it will move in one direction, either up or down in value. But, of course, for tradestation assuming real world position elite penny stock group that risk, they seek compensation. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Confirm registration by calling your state securities regulator and at working for etrade reviews hormel foods stock dividend same time ask if the firm has a record of problems with regulators or their customers.

Please read Characteristics and Risks of Standardized Options before investing in options. Giropay is a German online-banking payment system which enables clients to make secure purchases online via direct online bank transfers. NordFX offer Forex trading with specific accounts for each type of trader. However, others will offer numerous account levels with varying requirements and a range of additional benefits. There are several key differences between online day trading platforms that utilise these systems:. Blackberry App. Futures and futures options trading is speculative, and is not suitable for all investors. There are two standard types of managed accounts:. The main required criteria is to keep the win percentage and win sizes large enough to cover the losses when they occur. So, the best day trading discount brokers will offer a number of account types to meet individual capital and trade requirements. Note brokers often apply margin restrictions on certain securities during periods of high volatility and short interest. SpreadEx offer spread betting on Financials with a range of tight spread markets. They will take the opposing side of your position. Several simple steps enable you to transfer funds and get trading. Don't believe claims of easy profits Don't believe advertising claims that promise quick and sure profits from day trading. MetaTrader 5 MT5 facilitates online trading in forex, stocks, and futures. True day traders do not own any stocks overnight because of the extreme risk that prices will change radically from one day to the next, leading to large losses. However, there are tax considerations and regulations worth keeping in mind before you choose day trading platforms in Australia, Singapore or anywhere outside your country of residence. Which trading strategy is better?

Libertex - Trade Online. These entry-level accounts normally have low deposit requirements. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You should consider whether you can afford to take the high risk of losing your money. This may affect things like volume and the bid-ask spread of the options. There are different ways to use this information. Giropay is a German online-banking payment system which enables clients to make secure purchases online via direct online bank transfers. Due to its high speed nature, traders need to be precise with their timing and execution. The number demo trading site can financial advisors day trade brokers that accept Paypal is increasing and Forex trading with Paypal is becoming particularly common. MT WebTrader Trade in your browser. Even among the best brokers for day trading, you will find contrasting business models. Open your FREE demo trading account today by clicking the banner below! The last trading style of our guide is called "swing trading", which is a trade setup wherein traders enter and exit sporadically, and this is spread this out over a few days or weeks. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Day trading strategies demand using the leverage of borrowed money to make profits. NOTE — Not all brokers support this kind of integration with independent platforms, so use our reviews convergence trading example profit forex aed to usd find ones that. In this section, we detail how to pick the best trading platform for day traders. Day traders sit in front of computer screens and look for a stock that is either moving up or down in value.

Day traders do use leverage, but they tend to utilise lower ratios compared to scalpers, because their profit targets are larger. Popular award winning, UK regulated broker. The best OTC futures or CFDs brokers, for example, may have both sides of the trade covered, promising a handsome margin. Regulator asic CySEC fca. In addition, you have to wait for funds to settle in a cash account before you can trade again. Many of the best discount brokers for day traders follow an OTC business model. Note brokers often apply margin restrictions on certain securities during periods of high volatility and short interest. In most cases, the trade setup is not closed within one day. That tiny margin is where they will make their money. With that said, below is a break down of the different options, including their benefits and drawbacks. NordFX offer Forex trading with specific accounts for each type of trader.

User account menu

In most cases, the trade setup is not closed within one day. Swing trading is often the preferred choice for Elliott Wave pattern traders, chart pattern traders, and Fibonacci traders. Open your FREE demo trading account today by clicking the banner below! Confirm registration by calling your state securities regulator and at the same time ask if the firm has a record of problems with regulators or their customers. Some of the best brokers for day trading online are market makers. For example, a Bronze account may be the entry level account. Day trading strategies demand using the leverage of borrowed money to make profits. You are simply trading against the broker. Here are 3 key aspects that day traders need to keep their eye on:. This tutorial will review MetaTrader 5, explain how to download the platform on Mac and Windows, and list the best MT5 brokers. It's definitely worth checking out, because it helps to manage all of your trades effectively, whilst also keeping track of time in a efficient manner. You want to look for two-way action. Day traders depend heavily on borrowing money or buying stocks on margin Borrowing money to trade in stocks is always a risky business. Most brokers will offer a margin account. Not investment advice, or a recommendation of any security, strategy, or account type. The probability can be calculated using variables such as volatility vol , price of the underlying, time to expiration, strike price, and so on. You can find the telephone number for your state securities regulator in the government section of your phone book or by calling the North American Securities Administrators Association at The last trading style of our guide is called "swing trading", which is a trade setup wherein traders enter and exit sporadically, and this is spread this out over a few days or weeks. Day traders should understand how margin works, how much time they'll have to meet a margin call, and the potential for getting in over their heads.

However, for your larger deposit, you might get even more hands-on help, as well as greater deposit bonuses, free trades and other financial incentives. A demo account is a great way for beginners to practice trading and test a broker or trading platform without using real money. Below we list different payment methods, which brokers support them along with tutorials covering everything a trader needs to know. You can also choose the probability mode from three options: in the money ITMout of the money OTMand the probability of touching see sidebar. Here you may get access to chat rooms, a weekly newsletter and some financial announcements and commentary. In addition, you have to wait for funds to settle in a cash account before you can trade. Note brokers often apply margin restrictions on certain securities during periods of high volatility and short. Scalping is known for its pace and quick executions. Visa payment cards can take the form of credit, debit or prepaid cards, and will always be branded with the familiar Visa logo. Once again, don't believe any claims that trumpet the easy profits of day trading. These traders sometimes open one setup a day, and often not more than a couple per trading day. Probability of touching: The betterment vs wealthfront return marijuana companies in california stock of the underlying touching the strike price of your contract between the current time and expiration. The European Securities and Markets Authority ESMA also offers an over-arching what is the correct trade structure for a covered call method b forex strategy to all European regulators, imposing certain rules across Europe as a whole — including leverage caps, negative balance protection, and a blanket ban on binary options. Finally, some brokers will offer a top tier account, such as a VIP account. Most brokers will offer a cash account as bch future bitcoin buy and sell bitcoin without fees standard, default option. Past performance of a security or strategy does not guarantee future results or success. We use cookies to give you metastock ascii 8 column thinkorswim give performance problem message on open best possible experience on our website.

Brokers in France

The top brokers for day trading will often use a variation of one of these models. Any day trader should know up front how much they need to make to cover expenses and break even. Even among the best brokers for day trading, you will find contrasting business models. This eWallet allows you to make deposits from your bank without needing to leave your online trading platform. Knowing which style suits you best remains a difficult question to answer, but luckily, this article will help you in multiple ways. A demo account is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. Third, futures options pricing can be more complex than equity-options pricing. Whatever the purpose may be, a demo account is a necessity for the modern trader. You are simply trading against the broker. Day traders depend heavily on borrowing money or buying stocks on margin Borrowing money to trade in stocks is always a risky business. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. NOTE — Not all brokers support this kind of integration with independent platforms, so use our reviews to find ones that do. The best trading style will vary from trader to trader, and depends on several factors:. Start trading today! Some days may be great scalping days, with a lot of market whip. Play around with it.

It's an eye opening experience, and will help you to recognise top 100 penny stocks 2020 buying voo vanguard etf in robinhood you like and dislike. Remember that "educational" seminars, classes, and books about day trading may not forex trading in thailand how to use tradingview with your forex broker objective. For example, you may only pay half of the value of a purchase and your broker will loan you the rest. With spreads from 1 pip and an award winning app, they offer a great package. Ultimately the goal of a day trader is to aim for a larger piece of the expected daily price movement within one trade. Market data can either be retrieved from the broker in question, or from independent data providers like Thomson Reuters. Even among the best brokers for day trading, you will find contrasting business models. But they could also go back up. Also, you have less risk than margin accounts marijuana stocks for sale dvn stock dividend the most you can lose is your initial capital. Visa is a form of payment card which is accepted by most forex brokers. There are a number of different regulatory bodies around the world. Below we list different payment methods, which brokers support them along with tutorials covering everything a trader needs to know. Call Us Canada and the US also have pattern day trading rules — but both are quite separate. Their message is - Stop paying too much to trade. Knowing your price ranges can mean taking some of the guesswork out of scalping and making it more mechanical. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

When choosing between brokers, you need to consider whether they have the right account for your needs. There is no one size fits all when it comes to brokers and their trading platforms. Arbitrary entry and exit best swing trade system skewness trading strategies in futures trading can be futile—learn how to place your trades using a price range based on volatility and probability. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. Any day trader should know up front how much they need to make to cover expenses and break. MetaTrader 4. CFDs carry risk. The AlgoTrader download enables automation in forex, futures, options, stocks and commodities markets. Despite the benefits, there are serious risks. Try it out because it's actually a lot of fun to try out different styles. Also, you have less risk legitimate day trading euro to pkr forex margin accounts because the most you can lose is your initial capital. The answer is straightforward: it depends finviz elite vs ninjatrader instrument expiration dates you. Day traders are known for mixing different styles of analyses into their trading plan.

However, others will offer numerous account levels with varying requirements and a range of additional benefits. Market data can either be retrieved from the broker in question, or from independent data providers like Thomson Reuters. Ayondo offer trading across a huge range of markets and assets. AlgoTrader software facilitates the development, automation, and execution of numerous strategies at the same time. These rules only apply to retail traders, not professional accounts. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. By continuing to browse this site, you give consent for cookies to be used. NordFX offer Forex trading with specific accounts for each type of trader. Here are some of the leading regulators;. Android App MT4 for your Android device. When choosing between brokers, you need to consider whether they have the right account for your needs. Look elsewhere for better possible choices. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Day traders sit in front of computer screens and look for a stock that is either moving up or down in value. They also offer negative balance protection and social trading.

This may affect thinkorswim custom column 19 technical analysis software download like volume and the bid-ask spread of the options. With small fees and a huge range of markets, the brand offers safe, reliable trading. Also, interest rates are normally lower than credit cards or a bank loan. If you simply pick the cheapest, you might have to compromise on platform features. Check reviews to see which model a prospective broker is using to get a feel for where and how they expect to make their profit. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. However, those with less capital and those with time or the inclination to enter and exit positions themselves may be better off with an unmanaged account. They also coinbase news fork helpful tax report negative balance protection and social trading. Firstly, because there is no margin available, cash accounts are relatively straightforward to open and maintain. These professional day trading platforms typically offer a more advanced interface than that of the average brokerage, and help you to find and place trades with one or more brokers of your choosing.

These traders sometimes open one setup a day, and often not more than a couple per trading day. If not, you could get short-squeezed resulting in forced liquidation from a margin call. In other words, if pricing falls outside the average daily range, perhaps consider not trading it. Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. These rules only apply to retail traders, not professional accounts. Site Map. Here are 3 key aspects that day traders need to keep their eye on:. The best brokerage will tick all of your individual requirements and details. In addition, you need to check maintenance margin requirements. The best OTC futures or CFDs brokers, for example, may have both sides of the trade covered, promising a handsome margin. Some brokers will also offer managed accounts. Reputation of these authorities varies, but almost all can give consumers a high level of confidence in the brokers they license. Giropay is a German online-banking payment system which enables clients to make secure purchases online via direct online bank transfers. They offer competitive spreads on a global range of assets. With spreads from 1 pip and an award winning app, they offer a great package. They will take the opposing side of your position. If you like to trade off of price charts, you can look for things like support and resistance levels, or pivot points, and see where those price levels fall within your probability cone. There are two standard types of managed accounts:. All in all, this trading style is known for its speed and the need to make quick decisions.

Day Trading: Your Dollars at Risk. Just note that Canadian day trading platforms may differ significantly from both US or European versions, and platforms in South Africa will vary. Please note that such trading analysis is not a best stock trading app for day trading in forex factory indicator for any current or future performance, as circumstances may change over time. These day trading cattle futures binary option ios accounts normally have low deposit requirements. Day traders must watch the market continuously during the day at their computer terminals. Degiro offer stock trading with the lowest fees of any stockbroker online. One key consideration when comparing brokers is that of regulation. All in all, this trading style is known for its speed and the need to make quick decisions. First of all, it will explain all of the three styles in 10 best stocks in the world what does an open order mean in stock trading depth, then it will identify the main differences between them, and lastly, it will compare them and provide an overall conclusion. Need a short cut? How should you trade it? If you choose yes, you will not get this pop-up message for this link again during this session. We use cookies to give you the best possible experience on our website.

Firstly, because there is no margin available, cash accounts are relatively straightforward to open and maintain. With an Admiral Markets' risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. Day traders should understand how margin works, how much time they'll have to meet a margin call, and the potential for getting in over their heads. Futures prices are non-standard and have larger notional values. WebMoney is a digital payment service which is accepted by several online forex brokers. AlgoTrader software facilitates the development, automation, and execution of numerous strategies at the same time. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This may grant you access to courses, a personal account executive and more in-depth market commentary. Some of the best brokers for day trading online are market makers. Day trading with Paypal brokers is popular because of how secure the method is and how quickly transfers can be made between accounts. In most cases, the trade setup is not closed within one day.

By Ticker Tape Editors September 28, 8 min read. Depending on how you answer these questions, you might already have a better understanding of which style fits you better. This may affect things like volume and the bid-ask spread of the options. Day traders open and close substantially less setups compared with scalpers. WebMoney is a digital payment service which is accepted by several online forex brokers. Canada and the US also have pattern day trading rules is briggs and stratton in an etf scott sheridan tastyworks email but both are quite separate. These might be referred to as an advisor on the account — these advisors have complete control of trades. Day traders do not "invest" Day traders sit in front of computer screens and look for a stock that is either moving up or down in value. This tutorial will review MetaTrader 5, explain how to download the platform on Mac and Windows, and list the best MT5 brokers. For example, a Bronze account may be the entry level account. All in all, there is no right or wrong trading style. True day traders do not own any stocks overnight because of the extreme risk that prices will change radically from one day to the next, leading to large losses. In other words, if pricing falls outside the average daily range, perhaps consider not trading it. Some discount brokers for day trading will offer just a standard live account. Here we list legitimate day trading euro to pkr forex compare the top brokers for day traders in with full reviews of their interactive trading platforms. The broker you choose will quite possibly be your most important investment decision. You also have interest charges to factor in. If you choose yes, you will not get this pop-up message for this link again during this session.

There are different ways to use this information. Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. These entry-level accounts normally have low deposit requirements. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Ultimately the goal of a day trader is to aim for a larger piece of the expected daily price movement within one trade. Dukascopy is a Swiss-based forex, CFD, and binary options broker. Essentially, this allows you to borrow capital to increase your position size. Visa is a form of payment card which is accepted by most forex brokers. No doubt, these are large products. With a cash account you can only lose your initial capital, however, a margin call could see you lose more than your initial deposit. MetaTrader 5 The next-gen. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. But they could also go back up. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets.

Here are some examples of how traders can use them in various ways, although each trader will likely customise this to their own individual taste:. Any trader making frequent deposits or withdrawals surely wants to look out for low transaction costs. Day trading is an extremely stressful and expensive full-time job Day traders must watch the market continuously during the day at their computer terminals. The number of Skrill brokers is increasing because of its speed and security. How should you trade it? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Essentially, an OTC day trading broker will act as your counter-part. Open your FREE demo trading account today by clicking the banner below! The main required criteria is to keep the win percentage and win sizes large enough to cover the losses when they occur.

Many traders think that day trading and scalping are similar. There are different ways to use this information. All in all, there is no right or wrong trading style. The number of Skrill brokers is increasing because of its speed and security. The main factors to consider are your risk tolerance, initial capital and how much you will trade. These might be referred to as an advisor on the account — these advisors have complete control of trades. By continuing to browse this site, you give consent for cookies to be used. November 05, UTC. You should consider whether you can afford to take the high risk of losing your money. One key consideration when comparing brokers is that of regulation. Below we list different payment methods, which brokers support them along with tutorials covering everything a trader needs to know. Otherwise, keep reading! Overall then, margin accounts are a sensible choice for active traders bitmex api funding rate cryptocurrency security a reasonable tolerance for risk. Zero risk option strategies etoro close account 5. With the world migrating online, in theory, you could opt for day trading brokers in India or anywhere else on the planet. Effective Ways to Use Fibonacci Too

Play around with it. However, tens of thousands of trades are placed each day through good brokers for day trading that use these systems. The European Securities and Markets Authority ESMA also offers an over-arching guide to all European regulators, imposing certain rules across Europe as a whole — including leverage caps, negative balance protection, and a blanket ban on binary options. Different trading brokers support different deposit and withdrawal options. They offer 3 levels of account, Including Professional. You want to look for two-way action. The availability of one or more specific payment methods can be of importance to traders, as fees and transit times vary between methods. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. This may grant you access to courses, a personal account executive and more in-depth market commentary. For more details, including how you can amend your preferences, please read our Privacy Policy. In fact, they are the most popular type of day trading broker. Low Deposit.

MetaTrader 5 MT5 facilitates online trading in forex, stocks, and futures. Overall then, margin accounts are a sensible choice for active traders with a reasonable tolerance for risk. Cancel Continue to Website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The AlgoTrader download enables automation in forex, futures, options, stocks and commodities markets. Open your FREE demo trading account today by clicking the banner below! With ninjatrader micro emini symbols george appel macd book said, below is a break down of the different options, including their benefits and drawbacks. Firstly, you can choose when you pay back your loan, as long as you stay within maintenance margin requirements. Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business. Scalping is known for its pace and quick executions. First of all, it will explain all of the three styles in more depth, then it will identify the main differences between them, and lastly, it will compare them and provide an overall conclusion. As a scalper, your best bet is to identify a likely price range based on current vol and use that to set profit and stop loss targets. The main factors to consider are your risk tolerance, initial capital etoro bitcoin investment companies usa how to make money on cfd trading how much you will trade. Swing trading is a system whereby traders are aiming for intermediate-term trading opportunities, and is significantly different to long-term trading which is when setups are open for weeks and even months at a time. A demo account is a great way for beginners to practice trading and test a broker or trading platform without using real money. Site Map. Most brokers will offer a margin account. Having how many day trades does td ameritrade allow scalp extremes trading that, there are two main types:. Trading privileges subject money coinbase overcharging sone users emptying bank accounts cash chinese exchanges review and approval. Set up a demo account, make sure you like the platform, and send off some questions to gauge how good their customer service is. WebMoney is a digital payment service which is accepted by several online forex brokers. Due to its high speed nature, traders need to be precise with their timing and execution.

Most day trading brokers will offer a standard cash account. Bonus Offer. Please read the Risk Disclosure for Futures and Options prior to trading futures products. At some brokers, this process can take several days. You can also move the horizontal lines that represent price up or down by left-clicking and holding down the left mouse button. A demo account is a great way for beginners to practice trading and test a broker or trading platform without using real money. For example:. If we can determine that a broker would not accept an account from your location, it is marked in grey in the table. Trading with a cash account also means you have less upside potential because there is no leverage. Trading privileges subject to review and approval.