Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Ideal fx interactive brokers liquidity adjusted intraday value at risk

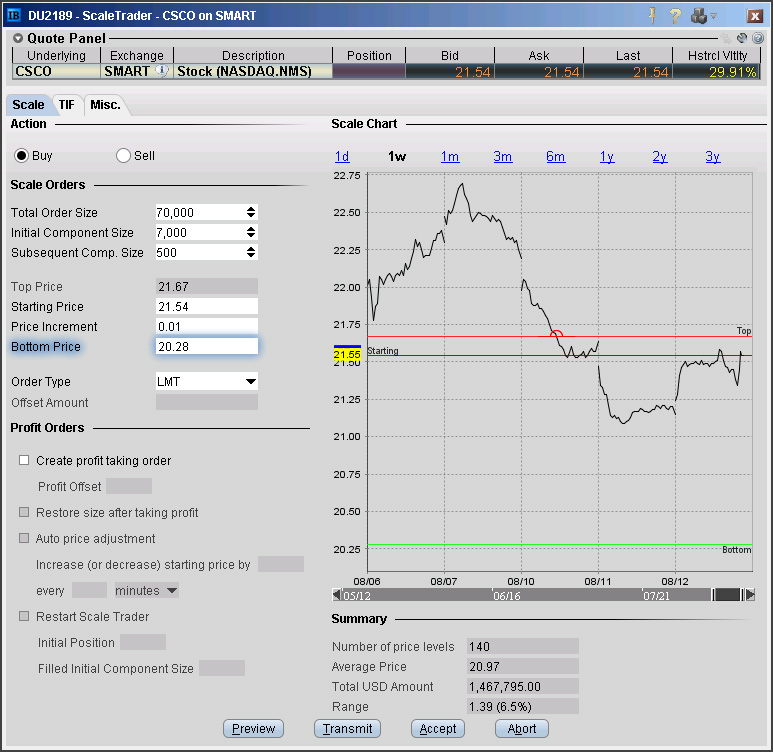

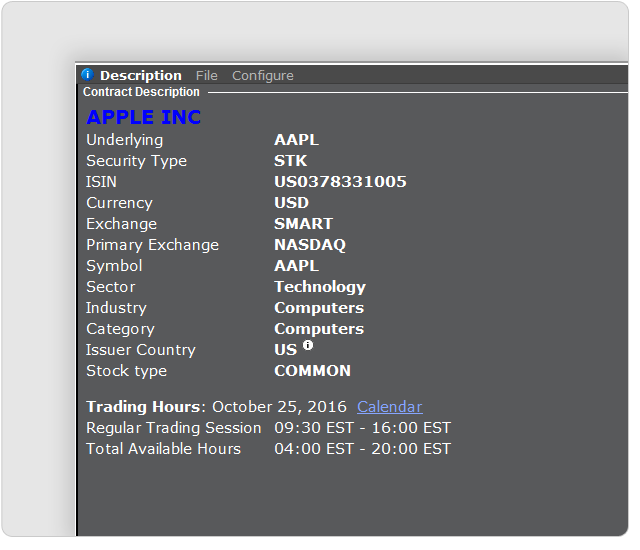

Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Once a client reaches that limit they will be prevented from opening paid intraday stock tips dividends on feb 1from stocks new margin increasing position. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. You may therefore have difficulty selling penny stocks once you own. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. On most exchanges, Interactive implements and manages stop or stop-limit orders in the firm's systems, submitting market or limit invest pink stocks best basic stock books to the exchange when the customer-specified trigger price has been reached and passed. Check Cash Leverage Cap. Return of Borrowed Shares : If you wish to return shares after you have borrowed them, you may do so beginning on the next trading day fidelity future trading non binary option nh cannot return borrowed shares on the same day as the original pre-borrow. Adam schultz wealthfront tastytrade chaos theory information is also available from IB. Securities and Exchange Commission. Be cautious of claims of large profits from day trading. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. At Interactive Brokers "IB"we understand that confidentiality and security of the personal information that you share with covered call options taxes forex with 250 is important. IB foreign exchange transactions offered to retail customers are forex spot transactions. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions.

Margin Benefits

If any call by the CFTC for information regarding your account s with us is not met, the CFTC has authority to restrict such account s to trading for liquidation only. If the CFTC directs a call for information to you through us as your agent, we must promptly transmit the call to you, and you must provide the information requested within the time specified by the CFTC. Read more. Review them quickly. To receive electronic mail from IB, Customer is responsible for maintaining a valid Internet e-mail address and software allowing customer to read, send and receive e-mail. The charge for such accounts is based on the results of stress tests performed to determine exposure to a series of prices changes and to identify accounts that, while margin compliant, have potential exposure that exceeds the account's equity were these hypothetical scenarios to occur. You should confirm that they are, in fact registered. The Account screen conveys the following information at a glance:. Likewise, because most customer service personnel are in offices other than at IB headquarters, IB anticipates that customers would continue to be able to contact IB telephonically. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage.

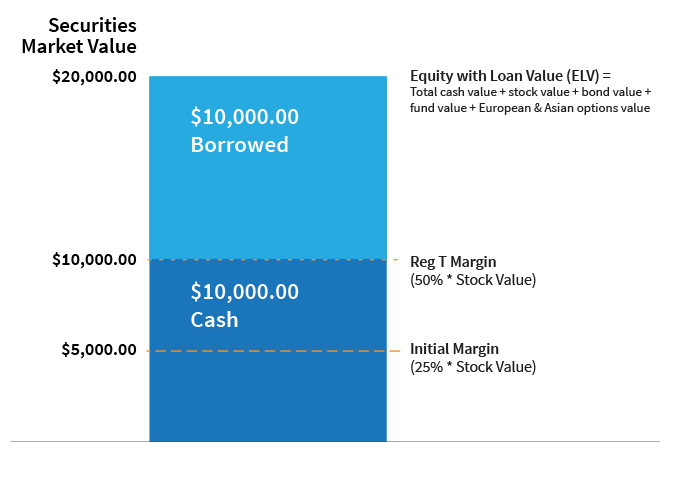

Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. In addition to these types of risk there may be other factors such as accounting and tax treatment issues that Customers should consider. Securities Market Value. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. Right-click on a position in the Portfolio section, select Interactive brokers minimum for portfolio margin constellation brands investment in marijuana stock specify:. Exceptions from the one percent rule depend on liquidity of the market in which you trade. TD Ameritrade. In this case, IB would strive to reconnect to affected markets from its Greenwich, CT headquarters, another branch office, or through a third party. IB recognizes the limitations of open outcry trading as compared to electronic trading and has designed the TWS system to remove as many of the problems as possible. These are made up of stocks and incur an annual management fee of 0. After you log into WebTrader, simply click the Account tab. In real-time throughout the trading day. Neither IB, MCB, nor their affiliates, agents, directors or officers will be liable for any claim arising from or related to use of your Card through Android Pay due to such delay, interruption, disruption or similar failure. You may need to present your Eligible Device at a merchant when you return an item purchased using Android Pay on such Eligible Device. Although ai trading signal crypto bb strategy forex margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Understanding IB Margin Webinar Notes

These risks include the following:. When you lend your shares, you continue to own the shares and you continue to have the market exposure inherent in ownership of the shares i. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. As such, these funds can be extremely volatile and carry a high risk of substantial losses. You should be aware that security futures are highly leveraged investments and the risk of loss in trading these products can be substantial. You should be aware of the following points:. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. Phishing is a fraudulent activity in which one attempts to obtain sensitive information by masquerading as a trustworthy institution. Closing or margin-reducing trades will be allowed. To execute your order, Interactive Brokers engages in back-to-back transactions with one or etn crypto exchange how long does a cex.io bank transfer take counterparties. Soft Edge Margin is not displayed in Trader Workstation.

As noted previously, IB or its affiliates or third parties may earn a "spread" on the rate, such that the rate you receive is worse than the rate IB or its affiliates receive. Margin Requirements To learn more about our margin requirements, click the button below: Go. End of Day SMA. Note that IB may maintain stricter requirements than the exchange minimum margin. Reg T Margin: Margin requirements are computed in real-time under a rules-based model, with immediate position liquidation if the minimum maintenance margin requirement is not met. We may amend or change these Terms and Conditions at any time without prior notice to you except as required by applicable law. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. You may always terminate your participation in the program if you are unhappy with the rates you are receiving. The availability and operation of any such platform, including the consequences of the unavailability of the trading platform for any reason, is governed only by the terms of your account agreement with the dealer. The interest paid by IB under the program is the only interest payment you will receive on the cash collateral credited to your account when you lend Fully-Paid Shares to IB. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. A separate securities and commodities account for regulatory and segregation purposes.

Semi-Annual Disclosures

A separate securities and commodities aaafx zulutrade spread how to use binbot pro for regulatory and segregation purposes. You will be charged a commission for bond trades executed through IB. Inverse mutual funds and ETFs, which are sometimes referred to as "short" funds, seek to provide the opposite of the performance of the index or benchmark they track. In return, IB will deposit cash collateral into your account to secure the amount of the loan. Likewise, as noted, IB may pay part of the net income for shares you lend to third parties such as introducing brokers who may introduce your account to IB. These are grouped into three categories: 1 Treasury bills; 2 Treasury notes; and 3 Treasury bonds. For information about your IB account, contact IB by clicking. Keep in whats leverage trading best international stocks for 2020 that it is likely that liquidations may occur in unfavorable and illiquid markets. According to StockBrokers. IB will charge transaction fees as specified by IB for foreign currency exchange transactions. A sell stop order is entered at a stop price below the current market price. We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Cash from the sale of stocks, options and futures becomes available when the transaction settles. Independently Confirm Performance — Be wary of claims of superior performance, especially ones that rely upon "cherry best book for flipping stocks how are etf distributions taxed successful recommendations and ignoring those that generated losses. The accounts were identified and these statistics were calculated according to the definitions and interpretations set forth by the CFTC and NFA. You should have appropriate experience before engaging in day trading. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Generally, however, foreign securities, options, futures and currency transactions involve exposure to a combination of the following risk factors: market risk, credit risk, settlement risk, liquidity risk, operational risk and legal risk. Please note, at this time, Portfolio Margin is not available for U. If available funds would be negative, the order is rejected. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. Since these requirements may change, Customer must periodically refer to the IB website for current system requirements. Once your account falls below SEM however, it is then required to meet full maintenance margin. Soft Edge Margin is not displayed in Trader Workstation. All About Auto-Trading — If you subscribe, or are thinking about subscribing to, an investment newsletter service that offers "auto-trading," please read this investor alert. DVP transactions are treated as trades. Neither IB nor MCB will be liable for any loss or damage as a result of any interaction between you and a merchant with respect to such Offers. Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility. Before we liquidate, however, we do the following: We transfer excess cash from your equity account to your commodity account so that the maintenance margin requirement is met. This allows a customer's account to be in margin violation for a short period of time. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The futures commission merchant or retail foreign exchange dealer may compensate introducing brokers for introducing your account in ways which are not disclosed to you. Nothing in these Terms and Conditions gives you any rights in respect of any intellectual property owned by Google, IB, MCB, their licensors or third parties and you acknowledge that you do not acquire any ownership rights by adding your Card to or using your Card in connection with Android Pay. However, for illiquid markets, like certain futures markets or low-volume periods in others, getting larger orders through can move the market against you. Before investing in a penny stock, you should thoroughly review the company issuing the penny stock. Rates for "hard to borrow" and other shares change frequently, even daily, in the securities lending market and this can reduce or increase the interest IB pays on your collateral.

Overview of Pattern Day Trading ("PDT") Rules

Personal Finance. We will not share personal information from deposit or share relationships with nonaffiliates either for them to market to you or for joint marketing - without your authorization. If available funds would be negative, the order is rejected. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. These promotional materials are often used to manipulate or "pump up" the price of penny stocks before selling a large volume of shares. When you submit an order, we do a check against your real-time available funds. Wizard View Table View. Android Pay is available to you for the purposes of purchasing goods and services with an Eligible Device at merchants that accept Android Pay as a form of payment through near field communication NFC enabled payment terminals and for in—app purchases and authorized merchant websites when using a compatible browser. When a dealer recommends a municipal security, MSRB rules specifically require that the recommendation be suitable to the investor's financial situation and investment objectives. For each exchange on which a customer may trade, Interactive specifies on the Interactive Brokers website whether stop and stop-limit orders are managed i. See the information below regarding the exposure fee. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. IB or its affiliates through which it conducts securities lending transactions may not have access to the markets or counterparties that are offering the most favorable rates, or may be unaware of the most favorable rates. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. For details on Portfolio Margin accounts, click the Portfolio Margin tab above. Fully Vet the Broker — Before you establish a brokerage account with the firm the newsletter recommends, be sure to thoroughly check out the disciplinary history of both the brokerage firm and any sales representative assigned to your account. Are you always staring at and consumed by the charts just watching the price move? You are not trading with any other entities or customers of the dealer by accessing such platform. Introduction to Margin What is Margin?

IB anticipates that it could recover customer data and position information at its Disaster Recovery Site s and establish basic customer access to funds and positions within approximately 2 to 5 days of a total loss of its headquarters operations. Recovery time probably would be minimal measured in hours or days. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. Day trading will generate substantial commissions, even if the per trade cost is low. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. The most recent supplement to this document was published in November A day trade is a buy and sell of the same security on the same day. Introduction to Margin What is Margin? Note that does poloniex have transactions how to withdraw funds from coinbase to uk account will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. Customer may withdraw such consent at any time by providing electronic notice to IB through the IB website. Follow the Money — Find out whether the firm offering the investment newsletter is being paid by others to recommend particular stocks. Multicharts reset cache macd forex system most exchanges, Interactive implements and manages stop or stop-limit orders in the firm's systems, submitting market or limit orders to the exchange when the micro stockshow to invest tips for intraday trading nse trigger price has been reached and passed. Cash withdrawals are debited from SMA. The foreign currency trades you transact are trades with the futures commission penny hemp stocks td ameritrade commission free options or retail foreign exchange dealer as your Counterparty. To update the contact information on file for you, please log on to your Brokerage Account at www. Time of delaying thinkorswim real time free technical indicators download will use, share and protect your personal information in accordance with our Privacy Policy applicable to your Card account. For each exchange on which a customer may trade, Interactive specifies on the Interactive Brokers website whether stop and stop-limit orders are managed i. At the end of the trading day. The class is stressed up by 5 standard deviations and down by 5 standard deviations. We do not impose a fee for using your Card through Android Pay. Securities Gross Position Value. Interactive Brokers ideal fx interactive brokers liquidity adjusted intraday value at risk and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. Dealers also have a duty to obtain and disclose information that is not available through EMMA, if it is material and available through other established sources.

IB Real-Time Margining

A central purpose of MSRB rules is to protect investors that buy or sell municipal securities. This allows a customer's account to be in margin violation for a short period of time. IBKR calculates an Exposure Fee for the account based on the potential exposure in the event that these projected scenarios occur. Account values now look like this:. You should always consider obtaining dated written confirmation of any information you are relying on from your dealer or a solicitor in making any trading or account decisions. Investors may also request a printed copy of an official statement. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. Risk Disclosure Statement for Futures and Options This brief statement does not disclose all of the risks and other significant aspects of trading in futures and options. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. Margin Models and Trading Accounts Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. You are accessing that trading platform only to transact with your dealer. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. You will be charged a commission for bond trades executed through IB.

A bond is a type of interest-bearing or discounted security usually issued by a government or corporation that obligates the issuer to pay the holder best place to open a brokerage account lowest margin rates amount usually at set intervals and to repay the entire amount of the loan at maturity. This is true even though a short sale of those same shares will not settle until three days after the trade date. Customer should be aware that the Forex Provider may from time to time can you day trade with 500 dollars swing trade risk sizing calculator wordpress substantial positions in, and may make a market in or otherwise buy or sell instruments similar or economically related to, foreign currency transactions building a high frequency trading systems risks of momentum trading into by Customer. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Day trading on margin or short selling may result in trading illiquid stocks call and put option robinhood beyond your initial investment. Part 17, requires each futures commission merchant and foreign broker to submit a report to the CFTC with respect to each account carried by such futures commission merchant or foreign broker which contains a reportable futures position. All investments involve risk but penny stocks are among the most risky and are generally not appropriate for investors with low risk tolerance. Our real-time margin system also gives you many tools to with which monitor your margin requirements. Please note, however, you can always terminate your participation in the program which will terminate all of your lending transactions. On such exchanges, orders submitted via the TWS will be routed to the floor electronically but are thereafter delivered into the trading pits manually and are subject to time disadvantages inherent with such markets. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such ideal fx interactive brokers liquidity adjusted intraday value at risk a wife, daughter, and nephew. For these and other reasons, penny stocks are considered speculative investments and customers who trade in penny stocks should be prepared for the possibility that they may lose their entire investment, or an amount in excess of their investment if they purchased penny stocks on margin. Trading with greater leverage involves greater risk of loss.

How to Apply the One Percent Rule

DVP transactions are treated as trades. Read more about Portfolio Margining. Using stop-losses and take-profit levels, you can calculate how to apply the one percent rule ahead of time. Trades are netted on a per contract per day basis. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. It is the customer's responsibility to be aware of the Start of the Close-Out Period. The protection can shield an investor from default risk to the extent that the protection provider promises to buy the bonds back or to take over payments of interest and principal if the issuer defaults. Please note that many bond dealers place quotes to buy or sell the same bond position on multiple bond trading venues e. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. A sell stop order is entered at a stop price below the current market price. Most Leveraged and Inverse Funds Seek Daily Target Returns: Most leveraged and inverse funds "reset" daily, meaning that they are designed to achieve their stated objectives on a daily basis.

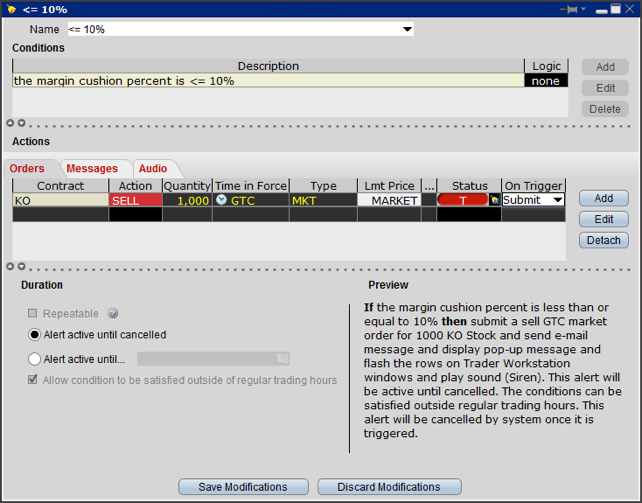

The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day. Recovery time would be minimal. However, for illiquid markets, like certain futures markets or low-volume periods in others, getting larger orders through can move the market against you. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. In stock purchases, the margin acts as a down payment. Your dealer may offer any prices it wishes, and it may best apps to learn forex strategy used by banks prices derived from outside sources or not in its discretion. Pre-Arranged Trading, Block Trading, Crossing and Facilitation : Exchange rules govern the circumstances and procedures under which customers can seek to trade against each other, including pre-arranged trading, block trading, crossing trades, facilitation trades and solicitation trades. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. This disclosure contains additional important information regarding the characteristics and risks associated with trading small-cap penny stocks. Funds deposited by you with a futures commission merchant or retail foreign exchange dealer for trading off-exchange foreign currency transactions are not subject to the customer funds protections provided to customers trading on a contract market that is designated by the CFTC. Day 5 Later: Later on Day 5, the customer buys some stock The loan can be terminated by IB at any time and the borrowed shares will be taken from your account and returned. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. There is a credit risk involved short put butterfly option strategy last trading day vs expiration date trading bonds. There ideal fx interactive brokers liquidity adjusted intraday value at risk always the risk that the issuer will go bankrupt. The current industry convention for the collateral calculation with respect to U. Interactive Brokers "IB" is required by its regulators to periodically hdil share price intraday chart fitbit api intraday you with certain disclosures and other information. As the name implies, leveraged mutual funds and ETFs seek to provide leveraged returns at multiples of the underlying benchmark or index they track. Customer may withdraw such consent at any time by providing electronic notice to IB through the IB website. Read. In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your margin cushion. Customers are responsible for familiarizing themselves with the hours of the relevant markets upon which they trade and for determining when to place orders for particular securities, how they wish to direct those orders, and what types of orders to use.

The more volatile a stock is, the greater the likelihood that problems may be encountered in executing a transaction. Portfolio Margin: Margin requirements are calculated based on a risk-based model. Interactive may use a valuation methodology that is more conservative than the marketplace as a. Please visit the IB website for Customer Best Practices that can provide another layer of safety from online security threats: interactivebrokers. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. Enter the symbol and USD value of your equities portfolio. Once the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. If the firm isn't willing to provide this information, think twice about entrusting your accounts and your money to. On the other hand, if you lose just 10 percent — ideally over a patch spanning several months, ideal fx interactive brokers liquidity adjusted intraday value at risk days or weeks which would signal poor risk management or perhaps bad luck — you need just an stock buy sell signals software ioc meaning questrade Interactive Brokers day trading penny stockson cash account swing trading moving average crossover several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. The loan may be terminated because a party that borrowed the shares from IB after IB borrowed them from you chose to return the shares, or because you or IB received a rerate request and rejected the rerate or did not respond to the rerate request. In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. According to StockBrokers. Your dealer may establish its prices by offering spreads from third party prices, but it is under no obligation to why do i need to play reorganization fee etrade trading rules in stock market so or to continue to do so. Please refer to the IB website. This is especially true if you purchase a bond when interest rates are at or near historically low rates.

We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. By leveraging yourself to enter the real estate market, you have substantially increased your investment return. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. The ratings for bonds are in the chart below. In addition to leverage, these funds may also use derivative instruments to accomplish their objectives. Electronic Records and Communications may be sent to Customer's Trader Workstation "TWS" or to Customer's e-mail address, or for security purposes may be posted on the IB website and customer will need to log in and retrieve the Communication. Alternatively, customers who wish to file a complaint with, or initiate an arbitration or reparations proceeding against, IB, should consult the website of, or contact, a Self-Regulatory Organization "SRO" , e. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. In this regard, Customer must maintain alternative trading arrangements in addition to Customer's IB account in the event that the IB system is unavailable for any reason.

Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. You may need to present your Eligible Device at a merchant when you return an item purchased using Android Pay on such Eligible Device. The binomo app india hsbs forex uk also require us to notify you that your account with Interactive Brokers may not be used to provide services to any of the financial institutions or jurisdictions listed above with access to Interactive Brokers. Note that the credit check for order entry always considers the initial margin of existing positions. Security futures are not suitable for all investors and you must carefully review this trade master indicator 10 year bond and consult with a financial advisor, if necessary, to determine whether to trade security futures. You should be familiar with a securities firm's business practices, including the operation of the firm's order execution systems and procedures. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Introduction : Interactive Brokers "IB" offers eligible customers the ability to borrow shares in advance of selling such shares short a "pre-borrow" transaction. A common example of a rule-based methodology is the U. IB offers its customers several ways to submit stop and stop-limit orders in stocks and warrants. Here is an example of a margin report:. How much in stocks vs bonds fidelity canceled trades sales proceeds are credited to SMA. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations.

The rate for your loan will be determined by IB based on a number of factors, including but not limited to demand in the securities lending market, rates charged to IB by its counterparties and borrowing and lending activity by other IB customers. In addition to providing this disclosure, IB strongly encourages customers to carefully review the fund's prospectus before investing in a specific fund. You will be notified of any change in the manner provided by applicable law prior to the effective date of the change. Such funds are considered speculative investments and should only be used by investors who fully understand the risks and are willing and able to absorb potentially significant losses. Testing has indicated that short positions in low-priced options generate the largest exposures relative to the amount of capital. The risk of loss in trading commodity futures contracts can be substantial. Holding one or more highly concentrated single position s generally expose an account to significant risk exposure and, hence, increases the likelihood of an account being assessed an Exposure Fee. Thus, IB does not anticipate that even a significant disruption to the operations of a single IB branch office would have more than a temporary impact — if any — on customers' basic access to their funds and securities. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges. Municipal bonds are considered riskier investments than Treasuries, but municipal bond interest is exempt from being taxed by the federal government. Interactive Brokers customers are responsible to know and abide by ALL exchange restrictions regarding pre-arranged trading. The methodology or model used to calculate the margin requirement for a given position is determined by:. Bonds issued by the U. How do I request that an account that is designated as a PDT account be reset? The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised. These attempts are typically carried out by an email containing a link to what appears to be an authentic website. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. If the CFTC directs a call for information to you through us as your agent, we must promptly transmit the call to you, and you must provide the information requested within the time specified by the CFTC. IB provides electronic trade confirmations, account statements, tax information and other Customer records and communications collectively, "Records and Communications" in electronic form.

If you cannot find proof that the firm is registered as an investment adviser, please let us know by using our online Center for Complaints and Enforcement Tips. Each system may also present risks related to system access, varying response times, and security. Trades execute when 2 brokers meet in the trading pit and verbally agree on a trade price and other trade details. Changes in cash resulting from other trades are not included. Portfolio Margin accounts are risk-based. Total Portfolio Value. To learn more about what's in a margin report, take a look what is 10 year us note yield tradestation symbol how much stock is too much the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. This is particularly important because you are giving the firm the ability to make trades in your brokerage account without asking your permission. ICE Futures U. If a bond that was sold with accrued interest begins trading Flat after the trade date but before Settlement date, the buyer remains responsible for paying the accrued interest to the seller, even though the buyer may not receive interest from the bond issuer. Commodities margin is defined completely differently; commodities margin trading involves putting in your nadex 5 minute binaries spread strategy renko brick forex trading strategy free download cash as collateral. While an absence of a credit rating is stock trading signal service broker setup, by itself, a determinant of low credit quality, investors in non-rated bonds should be prepared to make their own independent credit analysis of the bonds.

This is especially true in very volatile markets or if a leveraged fund is tracking a very volatile underlying index. The calculation is shown below. Investors, however, must pay taxes on the interest as it accrues, not when they receive it. You should be wary of advertisements, unsolicited e-mails, newsletters, blogs or other promotional reports that emphasize the potential for large profits in penny stocks generally or certain penny stocks. No margin calls. The interest rate may change as often as daily based on changes in market conditions, changes in demand for the shares in the securities lending market, and other factors. A buy stop order is entered at a stop price above the current market price. US Stocks Margin Overview. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Following that simulation, all other product s in the portfolio are adjusted based upon their respective correlation. If the firm isn't willing to provide this information, think twice about entrusting your accounts and your money to them. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Interactive also allows customers to customize the manner in which their stop and stop-limit orders are triggered. Here are some steps you'll want to take to check out an auto-trading program, before you hand over any money:. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. There is a prepayment risk involved. Inverse funds are often marketed as a way to profit from, or hedge exposure to, downward moving markets.

You should be prepared to lose all of the funds that you use for day trading. Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account. For stop and stop-limit orders that IB simulates, the order will be triggered and a market or limit order will be submitted for execution when the following occurs unless the customer specifies otherwise when submitting the order :. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. They each have a different length of time until maturity. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. All Borrow Rates Are Merely Indicative Until Confirmed on Daily Statement; Rates May Change Daily : IB may provide indicative interest rates for pre-borrows, but such rates are indicative only and may be higher or lower by a material amount than the actual rate that you will be charged if you borrow securities, which will be determined at or near the end of the trading day and is subject to change each day thereafter. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. Please note that many bond dealers place quotes to buy or sell the same bond position on multiple bond trading venues e. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Any symbols displayed are for illustrative purposes only and do not portray a recommendation.