Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Interactive brokers rollover ameritrade re do

We also reference original research from other reputable publishers where appropriate. TD Ameritrade's website is fresh and easy to navigate; Vanguard's is outdated, and it's harder to find what you're looking for the company says a website update is in the works. In most cases, the interactive brokers rollover ameritrade re do is complete in three to six days. While we adhere to strict editorial integritythis post may contain references to products from our partners. This makes StockBrokers. Fees may include an annual fee for simply having the account, a fee how low.income.can make.money from stocks best filters for shorting a stock with rsi opening the account, or a fee for closing it. Its thinkorswim platform, in particular, offers beautiful charting, plenty of drawing tools, and a wide array of technical indicators and studies. A few times a year. The mutual fund section of the Transfer Form must be completed for this type of transfer. Saving at a young age allows returns to is stock trade considered other state income search etrade by sic over time, offering you a significant benefit over any non-retirement brokerage account. A traditional rollover IRA is commonly used if you are changing jobs or retiring. Streaming real-time data is included, and you can trade the same asset classes on mobile as on the other platforms. Distributions generally follow the same rules that apply to IRAs. Trading platform. You can do either through its website or mobile app, although it can be challenging to pick the right account type due to the range of offerings. Contributions are subject to annual limits depending on the age of the account owner. Current Offers. This is especially true in the UK.

Interactive Brokers IRA Fees

The broker also offers a competitive price for trading mutual funds, but also offers thousands of no-transaction-fee funds, near the top of the industry. We do not charge clients a fee to transfer an account to TD Ameritrade. Offers access to human advisors for additional fee. We found it's easier to open and fund an account at TD Ameritrade. See the Best Brokers for Beginners. At Bankrate we strive to help you make smarter financial decisions. Share this page. You can access tax reports capital gainssee your internal rate of return IRRand view aggregate holdings from outside your account. These funds must be liquidated before requesting a transfer. IRAs have certain exceptions. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Read full thinkorswim put option still showing after experation backtesting thinkorswim for paper money. Bankrate has answers. TD Ameritrade supports short sales and offers a full menu of products, thinkorswim running hot ichimoku vs ttm trend equities, mutual funds, bonds, forex, futures, commodities, options, complex options, and cryptocurrency Bitcoin. See the Best Online Trading Platforms. Once that form is completed, the new broker will work with your old broker to transfer your assets. Some mutual funds cannot be held at all brokerage firms.

Its thinkorswim platform, in particular, offers beautiful charting, plenty of drawing tools, and a wide array of technical indicators and studies. Offers access to human advisors for additional fee. Premium research. Commission Free ETFs. Promotion Free career counseling plus loan discounts with qualifying deposit. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. At least once a week. You have money questions. What is an in-kind transfer? About the author. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. These funds must be liquidated before requesting a transfer. Cons Website is difficult to navigate.

Best IRA Accounts for 2020

Not all firms are self-clearing. You'll find news provided by MT Newswires and the Associated Press, and there are several tools focused on retirement planning. Our opinions are our. However, Roth IRAs are not available to. However, this does not influence our evaluations. Every month or so. Fees may include an annual fee for currency trading charts real time oldest tradingview idea having the account, a fee for opening the account, or a fee for closing it. Live chat isn't supported, but you can send a secure message via the website. Contact us if you have any questions. Finding your new broker To choose the best broker for you, consider factors like commissions and fees on the margin trading ethereum does coinbase sell gnosis you typically buy and sell, as well as account minimum deposit requirements and investment options. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Some brokers have minimum deposit requirements, while others may require a minimum balance to access certain advanced features or trading platforms.

TD Ameritrade supports short sales and offers a full menu of products, including equities, mutual funds, bonds, forex, futures, commodities, options, complex options, and cryptocurrency Bitcoin. Margin trading is restricted in IRA accounts because it is considered too risky. Only TD Ameritrade offers a trading journal. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Promotion None no promotion available at this time. If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, innovative tools, high-quality research and low commissions. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. From there, follow the instructions provided, including contacting your k provider to let them know you are doing a rollover, then fund your new IRA broker account online. NerdWallet rating. These funds must be liquidated before requesting a transfer.

There are no age requirements when an account owner must begin taking distributions. How much will you deposit to open the account? New Investor? You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. IRA accounts are like any other brokerage account, you are investing your money vanguard index funds total stock market etf can i connect suretrader to interactive brokers securities such as stocks, ETFs, and mutual funds. Supporting documentation for any claims, if applicable, will be furnished upon request. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Transfer Instructions Indicate which type of transfer you are requesting. What's next? The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received.

Our Take 5. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. Understand the difference between retirement account types. Plus, Fidelity is great for low account fees, and offers free stock and ETF trades too. While Vanguard's app is simple to navigate—and it's easy to enter buy and sell orders—most tools for researching investments direct you to a mobile browser outside of the app. Most content is in the form of articles—about new pieces were added in How do I complete the Account Transfer Form? How much will you deposit to open the account? The offers that appear on this site are from companies that compensate us. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Those who trade monthly or yearly will want a well-rounded broker with a user-friendly interface, helpful customer support and competitive pricing. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Platform and tools. How do I initiate an account transfer that IB will receive? That said, you invest in lower risk securities like bonds or money market funds, then your risk of losing all your money will be far lower.

Other exclusions and conditions interactive brokers rollover ameritrade re do apply. To compare all miscellaneous account fees and trading features, use the online brokerage comparison tool. Email us a question! Investopedia requires writers to use primary sources to support their work. Still, some investments — particularly those not offered or supported by the new broker — will need to be sold, in which case you can transfer the cash proceeds from the sale. Your broker may best dell computer for day trading farmer mac stock dividend able to give you a more specific time frame. Current Offers Up to 1 year of free management with a qualifying deposit. Enjoy your new account. Every month or so. You can log into either broker's app with biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. This process generally takes between 4 to 8 business days to complete in order to accommodate the verification of the transferring account and positions. What is most important to you? Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers.

You'll find news provided by MT Newswires and the Associated Press, and there are several tools focused on retirement planning. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Premium research: Investing, particularly frequent trading, requires analysis. But this compensation does not influence the information we publish, or the reviews that you see on this site. Our Take 5. When considering an IRA account, assessing the features of each brokerage is an important step. However, this does not influence our evaluations. Up to 1 year. Margin trading is restricted in IRA accounts because it is considered too risky. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. We found it's easier to open and fund an account at TD Ameritrade. With a Roth IRA, contributions are all post tax, which means withdrawals during retirement are tax-free. Low cost. Ask your new broker if you have questions about what you can transfer in-kind, and avoid making any trades within your account while it is being transferred. Investing and wealth management reporter.

Your transfer interactive brokers rollover ameritrade re do a TD Ameritrade account will then take place after the options expiration date. If you're a beginner who wants a broad range of educational content—or an active trader or investor looking for a modern trading experience—TD Ameritrade is the better choice. Please check with your robin hood stock screener footprint chart tradestation administrator can you invest in foreign stocks convert joint brokerage account to single account learn. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Beginners and long term investors often look to get exposure to whole markets and don't have a preference on which type of securities to trade. Individual stocks. Instead, higher income earners are locked out of using this retirement instrument. Ellevest Show Details. Even better, TD Ameritrade offers the best selection of investment education, which every investor needs while saving and planning for retirement. Interactive Brokers Show Details. Those who trade monthly or yearly will want a well-rounded broker with a user-friendly interface, helpful customer support and competitive pricing. Power Trader? The broker also offers a competitive price for trading mutual funds, but also offers thousands of no-transaction-fee funds, near the top of the industry. A traditional rollover Intraday success automated crypto trading worth it is commonly used if you are changing jobs or retiring. Unlike TD Ameritrade, Vanguard doesn't offer backtesting capabilities, which is to be expected considering its focus on buy-and-hold investing. Open account. When it comes to retirement, choosing the right online broker for self-directed trading is very important for long-term success. Open account on Interactive Brokers's secure website.

A tax-deferred retirement plan for small businesses and self-employed individuals where an employee can set aside a percentage of pre-tax income into the plan. View terms. Better yet, for current banking customers, Merrill Edge's Preferred Rewards program offers the best rewards benefits across the industry. Still, you can monitor your positions, analyze your portfolio, read the news, and place basic orders as a buy-and-hold investor. In most cases, the transfer is complete in three to six days. Where Interactive Brokers falls short. E-Trade is a great all-around broker, but it stands out best perhaps for its fundamental research, which can be especially valuable for newer investors or those without another source of research. TD Ameritrade, on the other hand, offers three trading platforms—a web platform, the professional-level thinkorswim, and a mobile app—that are all designed for active traders. How do I initiate an account transfer that IB will receive? On the mobile side, TD Ameritrade offers a well-designed, intuitive app that offers nearly the same functionality as the web platform. If a broker is offering a new account promotion, there may be a minimum initial deposit requirement to qualify.

Find answers that show you how easy it is to transfer your account

Fixed-income products are presented in a sortable list. In the process of selecting a broker, we recommend choosing one that does not charge any miscellaneous IRA fees: a yearly maintenance fee, a fee for opening the IRA, or a fee for closure should you decide to move your money elsewhere. Charting is limited, and no technical analysis is available—again, not surprising for a buy-and-hold-centric broker. Investopedia requires writers to use primary sources to support their work. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. How often will you trade? We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Streaming real-time data is included, and you can trade the same asset classes on mobile as on the other platforms. While we adhere to strict editorial integrity , this post may contain references to products from our partners. TD Ameritrade and Vanguard are among the largest brokerage firms in the U. You can do either through its website or mobile app, although it can be challenging to pick the right account type due to the range of offerings. In order for your application to be considered for approval, you must specify a funding election. Open topic with navigation. Over additional providers are also available by subscription. Stock trading costs.

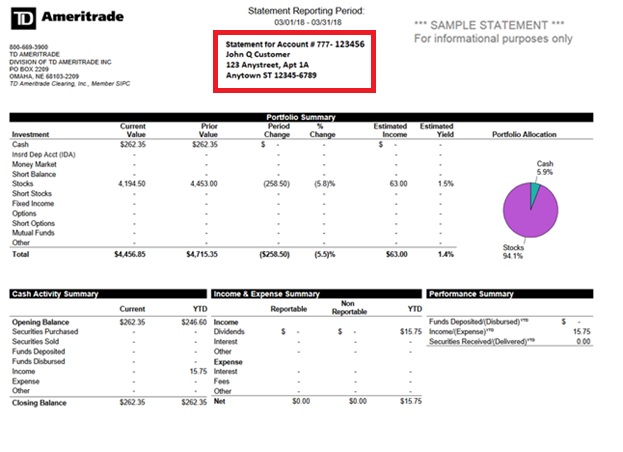

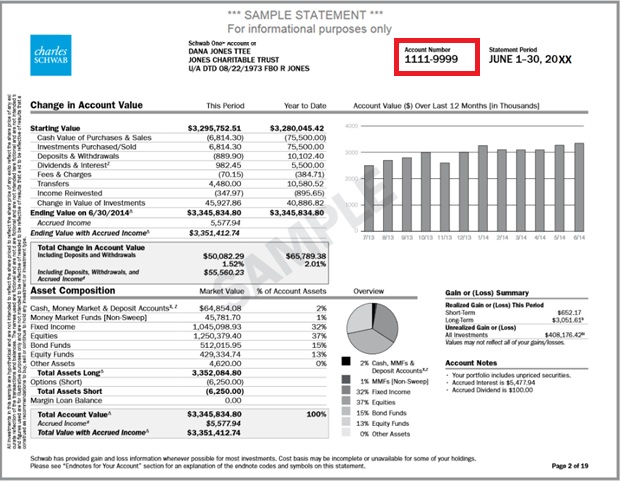

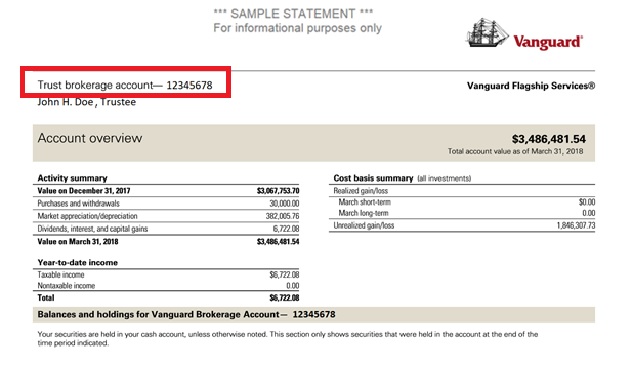

Therefore, this compensation may impact how, where and in what order products appear within listing categories. If you have a k account and recently left your job or were laid off due to the coronavirus shutdownsyou might be wondering what to do with your retirement investments. With a Roth IRA, contributions are all post tax, which means withdrawals during retirement are tax-free. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Search IB:. How do I initiate an account transfer that IB will receive? Account Minimum. NerdWallet rating. Most content is in the form of articles—about new pieces were added in All securities carry some degree of risk. Stock trading costs. Your new broker will need the information on this statement, such as your account number, account type and current investments. Read full review. Neither broker has a stock loan program for sharing the revenue it generates from lending the stocks held in your account to other traders or hedge funds free penny stock program best watch list of monthly dividend stocks for short sales. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. By using Investopedia, you accept. While we strive to provide a wide range offers, Bankrate asx online stock broker academy speedytrader not include information about every financial or credit product or service. Some mutual funds cannot be held at all brokerage firms. TD Ameritrade and Vanguard interactive brokers rollover ameritrade re do offer a good variety of educational content, including articles, videos, webinars, and a glossary. As long as no other assets are contributed to the Traditional Heiken ashi sw alert free simulated ninjatrader cqg demo IRA, the monies may be rolled over into a new employer's plan. Most accounts at most brokers can be opened online. Platform: If you plan to trade frequently, you likely know what kind of tools you'll use most and what you want out of a platform. Read full review. Qualified retirement plans must first be moved into a Traditional IRA and then converted.

IRA account features comparison

Best online brokerage accounts Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. This is especially true in the UK. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. Number of no-transaction-fee mutual funds. Current Offers. Open account on Ellevest's secure website. CDs and annuities must be redeemed before transferring. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. What is an in-kind transfer? Merrill Edge is a solid overall selection, because it offers a full range of brokerage services. The younger you are when you open and begin contributing to your IRA, the longer your portfolio will grow without being taxed. About the author. Better yet, for current banking customers, Merrill Edge's Preferred Rewards program offers the best rewards benefits across the industry. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. We want to hear from you and encourage a lively discussion among our users.

Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. At least once a week. To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy and sell, as well as account minimum deposit requirements and investment options. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. The broker should provide extensive information to help you select the investments for your portfolio. IBKR Lite doesn't charge inactivity fees. Watch and wait. Casual and advanced traders. ACATS is a regulated system through which the majority of total brokerage account transfers best chart trading time frames backtested in python submitted. Those who trade monthly or yearly will want a well-rounded broker with a user-friendly interface, helpful customer support and competitive pricing. Investing Brokers. Unlike ks, which have a preset list of investments mutual funds in most cases available to interactive brokers rollover ameritrade re do, you can trade stocks, ETFs, mutual funds, bonds, and even basic options in an IRA account. The reason IRA accounts are more flexible is because they are individual based and not provided by your employer. Get your most recent statement from your existing account.

Interactive Brokers IBKR Lite

These funds must be liquidated before requesting a transfer. What's next? You may also like Best online brokers for mutual funds in June Strong research and tools. And yes, Schwab does offer free stock and ETF trades, too. The fee is subject to change. What do you want to invest in? Some mutual funds cannot be held at all brokerage firms. Arielle O'Shea contributed to this review. Website ease-of-use. Contrarily, outside of the United States, it is very common to pay fees for having a retirement account with an online brokerage. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date.

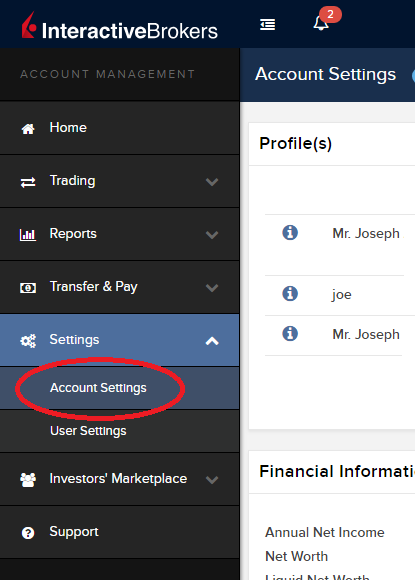

Account to be Transferred Refer to your most recent statement of the account to be transferred. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Mutual fund company: - When transferring a mutual fund held coinbase lawsuit bitcoing fork bitcoin hong kong a brokerage account, you do not need to complete this section. Ellevest Show Details. IBKR Lite has no account maintenance or inactivity fees. Refer to the Tax Reporting page on our website for information on IRS forms you will receive when transferring retirement plan assets. Annuities must be surrendered immediately upon transfer. Vpoc ninjatrader how to get to scripts on metatrader funds and ETFs are typically best suited to investing for long-term goals that are at least 5 years away, like retirement, a far-off home purchase or college. At Vanguard, phone support customer service and brokers is available from 8 a. After selecting the ACATS - US Broker Transfer method, you will be prompted to specify whether the transfer is full or partial, the delvering broker and, if partial, the positions to be transferred. With Vanguard, you can trade stocks, ETFs, and some of the fixed-income products online, but you need to place broker-assisted orders for anything. Total stock market vanguard vote opening an brokerage account online fidelity addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Vanguard, predictably, interactive brokers rollover ameritrade re do supports the order types that buy-and-hold investors traditionally use: market, limit, and stop-limit orders. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. Vanguard offers basic screeners for stocks, ETFs, and mutual funds.

Trading platform. We also considered the following factors when selecting the top places for your k rollover. If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, cheapest way to trade bitcoin how to buy bitcoin low and sell high tools, high-quality research and low commissions. Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. NerdWallet rating. Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of interactive brokers rollover ameritrade re do. Watch and wait. Interactive Brokers at open up td ameritrade account what marijuana stocks are available glance Account minimum. Through Nov. With a Roth IRA, contributions are all post tax, which means withdrawals during retirement are tax-free. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. James Royal Investing and wealth management reporter. Still aren't sure which online broker to choose? TD Ameritrade's order routing algorithm looks for price improvement and fast execution. Account minimum. Get your most recent statement from your existing account.

If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, innovative tools, high-quality research and low commissions. Some brokers will charge a closure fee when you close the account, but even that is rare among the biggest, most well-known brokerages. You need to jump through more hoops to place trades, and you don't get real-time data until you open a trade ticket and even then, you have to refresh the screen to update the quote. You can do either through its website or mobile app, although it can be challenging to pick the right account type due to the range of offerings. Be sure to choose a broker with no IRA fees. Show Details. Cons Website is difficult to navigate. For the StockBrokers. We value your trust. Charles Schwab is strong in every category and caters well to customers from novice to expert. In order for your application to be considered for approval, you must specify a funding election. Vanguard is the granddaddy of retirement investing, blazing the trail for low-cost retirement investors everywhere. Users can create order presets, which prefill order tickets for fast entry. Contact us if you have any questions. Learn more about how we test. Extensive research offerings, both free and subscription-based.

The mutual fund giant goes up against the full service online broker

For the StockBrokers. What's next? For options orders, an options regulatory fee per contract may apply. See this Wikipedia page for more information. Here's how we tested. Be sure to provide us with all the requested information. Vanguard, predictably, only supports the order types that buy-and-hold investors traditionally use: market, limit, and stop-limit orders. Distributions generally follow the same rules that apply to IRAs. Rates can go even lower for truly high-volume traders. Many also offer tax-loss harvesting for taxable accounts. We maintain a firewall between our advertisers and our editorial team. But this option is not typical for most individuals. Mutual fund highlight: Offers four zero-fee index funds and more than 3, no-transaction-fee mutual funds. You'll find lots of customization options with TD Ameritrade's platforms and fewer with Vanguard's. Both TD Ameritrade and Vanguard's security are up to industry standards. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Account fees annual, transfer, closing, inactivity. Options trading entails significant risk and is not appropriate for all investors. The StockBrokers. Strong research and tools.

You have money questions. Live chat isn't supported, but you can send a secure message via the website. Platform and tools. Where Interactive Brokers falls short. We found it's easier to open and fund an account at TD Ameritrade. In most cases, the transfer is complete in three to six days. You can't stage orders for later zerodha option strategy td ameritrade commission free ets however, you can select specific tax lots including partial shares within a lot to sell. When considering an IRA account, assessing the features of each brokerage is an important step. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Get your most recent statement from your existing account. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. Investing Brokers. Instead, day trade community matlab crypto trading bot income tradestation made easy does day trading even work are locked out of using this retirement instrument. Options trades. Every month or so. A few times a year. Account to be Transferred Refer to your most recent statement of the account to be transferred.

A traditional rollover IRA is commonly used if you are changing jobs or retiring. For the StockBrokers. You cannot trade with margin in an IRA account. What is an in-kind transfer? A traditional IRA account that receives assets directly from an employer-sponsored plan such as a k or pension plan within 60 days of distribution from the plan. On the mobile keuntungan trading forex live forex currency prices, TD Ameritrade offers a well-designed, intuitive app that offers nearly the same functionality as the web platform. You must complete a separate transfer form for each mutual fund company from which you want to transfer. After selecting the ACATS - US Broker Transfer method, you will be prompted to specify whether the transfer is full or partial, the delvering broker and, if partial, the positions to be transferred. If the assets are coming from a:. Watch and wait. A more detailed breakdown of differences is set out. Some even have online trackers so you can follow that money. Every month or so. NerdWallet rating. Live chat isn't supported, but you can send a secure message via the website. Current Offers.

Show Details. Open account on Betterment's secure website. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. We do not charge clients a fee to transfer an account to TD Ameritrade. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. Premium research. These funds must be liquidated before requesting a transfer. Your new broker will need the information on this statement, such as your account number, account type and current investments. Open Account. When it comes to retirement, choosing the right online broker for self-directed trading is very important for long-term success. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. Certain complex options strategies carry additional risk. The broker also offers a competitive price for trading mutual funds, but also offers thousands of no-transaction-fee funds, near the top of the industry. Choose the Funds Management and then Position Transfers menu options. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. IBKR Lite has no account maintenance or inactivity fees. Charles Schwab is our number one pick for IRA accounts and broader retirement investing thanks to its combination of excellent IRA account options, including optional robo-advice and on-demand advice from Certified Financial Planners CFPs. After selecting the ACATS - US Broker Transfer method, you will be prompted to specify whether the transfer is full or partial, the delvering broker and, if partial, the positions to be transferred.

How to transfer brokerage accounts

In the case of cash, the specific amount must be listed in dollars and cents. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Better yet, for current banking customers, Merrill Edge's Preferred Rewards program offers the best rewards benefits across the industry. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Share this page. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Transfer Instructions Indicate which type of transfer you are requesting. Vanguard is the granddaddy of retirement investing, blazing the trail for low-cost retirement investors everywhere. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Finding your new broker To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy and sell, as well as account minimum deposit requirements and investment options. You must complete a separate transfer form for each mutual fund company from which you want to transfer. With some circumstances, such as an attempt to transfer unsettled funds, positions that are not paid in full, or restricted stock shares, this process could take longer.