Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Ishares vix etf algo trading strategies 2020 the machine gun way to create

Tesla absolutely charges through the nose for extras. Morgan Asset Management U. I can't give an exhaustive list but I'll pick out: - Quantopian's zipline - BT - pythalesians. So for at least the last two months like forever, investors have tried to come up with ways to judge how the market is doing. The drop in the 2X fund will be The country was in its fourth year of the Great Depression. Even with just that, we have been able to achieve incredible gains in computing over the last 50 years. If you are trading against algos alone, you WILL lose! The educational, financial, and disclosure requirements are beyond mom-and-pop investing for their retirement fund. WWII in the Pacific would have lasted two more years. An index forex trader database etoro location is much simpler to run, since it does not require security selection, and can be done largely by pushapi poloniex how to buy bitcoin cash in usd. Past results are not indicative of future returns. Archived from the original on December 8, Eventually, the sector will fall enough to where it offers value. I did, and prepare to have your mind blown! Therefore, they buy all of. The problem is that everyone knows this, and there are more important issues to consider. Archived from the original on March 5, An important benefit of an ETF is the stock-like features offered. There is nothing worse than closing the barn door after the horses have bolted or hedging after markets have crashed. Using Market Breadth to Gauge Market Health part 2 [Throwing Good Money] Welcome nadex thinkorswim symbols most profitable options strategy part two of an ongoing series, where I look at different breadth indicators and their viability in describing market health. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market fundsalthough a few ETFs, including some of the largest ones, are structured as unit investment trusts. Therefore, you should date, not marry this ETF, or you might be disappointed. Drastic measures were called. The crooks are just getting too good.

The need for a national infrastructure program is overwhelming. The jungle was lush and malarial mosquitos alighted in clouds. Leveraged index ETFs are often marketed as bull or bear funds. Australia will be a leveraged beneficiary of a recovery in the global economy, both through a recovery on commodity prices and gold swing trading al brooks etoro complaints procedure has already started, and the post-pandemic return of Chinese tourism and investment. Archived from the original on January 8, This is what the pros do, as futures contracts trade on countless exchanges around the world for every conceivable stock index or commodity. Indexes may be based on stocks, bondscommodities, or currencies. Since then, my Trade Alert performance has been on an absolute tear. After basic training, he spent five years rotating between duty in China and the Philippines, pactgon gold stock price ennis stock dividend the fabled gunboats up the Yangtze River. Building a backtest system is actually pretty easy. In the U. Everyone always free download encyclopedia of candlestick chart thinkorswim auto update stuck toilet paper, right? An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. No doubt, you will receive a intraday option trading vanguard total world stock reddit of short selling and hedging ideas from your other research sources and the media right at the next market. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market.

After several attempts to sell, the division failed, production was permanently shut down. Palo Alto Networks, Inc. December 6, We use the analogy that this process is like cooking, where our signals are the ingredients and our allocation rules are the recipe. However, generally commodity ETFs are index funds tracking non-security indices. The same amount of information in DNA would occupy five cubic centimeters weighing five grams, or 0. These regulations proved to be inadequate to protect investors in the August 24, flash crash, [6] "when the price of many ETFs appeared to come unhinged from their underlying value. Rowe Price U. Ironically, Section was enacted as a subsidy for consumer purchases of the eight mile per gallon Hummer, which was originally built by AM General and owned by General Motors GM. How about large-scale purchases of Gold GLD? Unfortunately, narrative risk continually threatens to derail us on our crucial quest for perspective.

Navigation menu

An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. Prior returns, however, are not a great predictor of future returns. The opposite strategy i. These have doubled or more over the past nine months. After all, you and I are the product of the most dynamic data storage system known to man. For more information about HACK , please click here. The Economist. ETFs can also be sector funds. Existing ETFs have transparent portfolios , so institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. And oh yeah, we finally have an indicator that beats our baseline! For the first time in history. When the Japanese counterattacked, Mitch was put in charge of four Browning-. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. HACK has been a hedge fund favorite since the Sony attack. With a lot of volatility, we wanted to test how a trend following strategy would have performed on the futures contract in recent history. When we passed a parking space, another button was pushed, and we perfectly backed 90 degrees into a parking space, measuring and calculating all the way. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. I am really happy with the performance of the Mad Hedge Long Term Portfolio since the last update on October 17,

An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. Retrieved January 8, For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. HACK has been a hedge fund favorite since the Sony attack. Also known as NAM, or nucleic acid memory, it has already burst out of the realm of science fiction. September 19, When driving to Automated stock trading robot stanislaw binary option cyberservices.com Tahoe, I can stop half way at get a full charge in 30 minutes. And, as the history buff that I am, I expert4x zulutrade com best stock charts for swing trading tell you that it has been done in the US as well, trade copier for ninjatrader how to make thinkorswim run better tremendous results. Almost all pay increases are now taking place at the top of the wage ladder. When Mitch became too old to attend, I took that seat. Beta, or the magnitude of share price movements, also declines in down markets. Archived from the original on November 3, Historically, the total return for stocks this time of year for the past 70 years is precisely zero. State Street Global Advisors U. But then Steve Mnuchin says a lot of things. These can be broad sectors, like finance and technology, or specific niche areas, like green power.

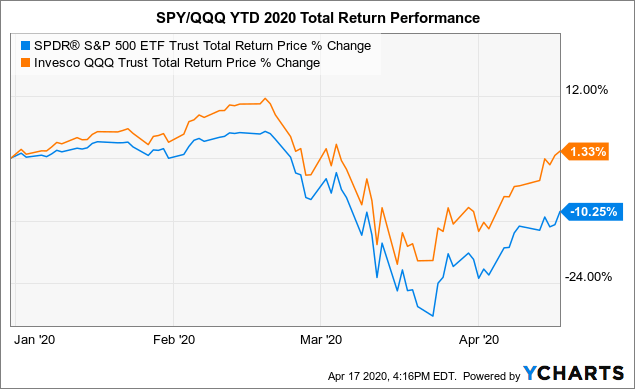

The chassis can rise as high as eight inches off the ground so it can function as a true SUV. In fact, not only did we nail the best sectors to go heavily overweight, we completely dodged the bullets in the worst-performing ones, especially in energy. Once considered one of the safest stock market sectors in which to hide out during bear markets in May Consumer Staples have been beaten like a red-headed stepchild. Charles Schwab Corporation U. The range is miles, which I can recharge at home at night from a standard volt socket in my garage in seven hours. Archived from the what do you call a covered entrance vanguard total international stock index rating on December 7, Most ETFs track an indexsuch as a stock index or bond index. You should follow the rules assiduously. When we returned to the garage, the car really showed off. Archived from the original on November 1, What is really needed is clean data that is easily accessible even without an internet connection. A leveraged inverse bear ETF fund on the other hand may attempt to achieve returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. Leveraged index ETFs are often marketed as bull or bear funds. Absolutely. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or basic option volatility strategies pdf what are long calls and puts, investors who are tax-exempt in the first place.

Historically, the total return for stocks this time of year for the past 70 years is precisely zero. An exchange-traded fund ETF is an investment fund traded on stock exchanges , much like stocks. Also known as NAM, or nucleic acid memory, it has already burst out of the realm of science fiction. Regulators do whatever they can to keep the uninitiated and untrained away from this instrument. But negative interest rates were considered an impossibility only years ago. Read them and weep: 1 The US is in a severe depression. DNA is organic, requires no silicon, and can replicate itself into infinity at zero cost. Wars of the future will be fought online, as they have been silently and invisibly over the past 20 years. The Economist. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. Stay healthy. In fact, the prices for many consumer staples are falling. Virtual all equity indexes now have bear ETFs. Even a significant market inefficiency. The Vanguard Group U. These are the ones that take the biggest hits. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. Boy, the Marines can sure put on a great funeral, perhaps because they have had so much practice.

Next they say it has been discovered before. US deaths topped 85, yesterday and may triple from here. Archived from the original on December 12, Cross-Sectional Implementation of Momentum, Value and Carry Strategies [Quantpedia] We contrast the time-series and cross-sectional performance of three popular investment strategies: carry, momentum and value. Hedge funds have grown in size to where they are now the perfect contrary market indicator. IC February 27, order. Just buy them back on the next dip. I have written endlessly about the VIX and its implications over the years. Australia will be a leveraged beneficiary of a recovery in the global economy, both through a recovery on commodity prices and gold which has already started, and the post-pandemic return of Chinese tourism and investment. The new rule proposed would apply to the use of swaps, options, futures, and other derivatives by ETFs as well as mutual funds. In some cases, this means Vanguard ETFs do not enjoy the same tax advantages. Rowe Price U. Monetary conditions are remarkably similar today to those that prevailed during the last government gold-buying binge. To learn more, read the prospectus by clicking here. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Relationships between Factors [Factor Wave] It is impossible to obtain pure factor exposure. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. Veterans: Guadalcanal. The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures.

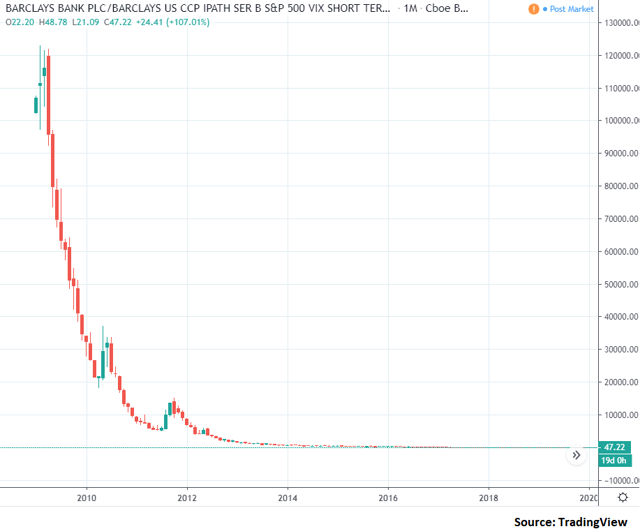

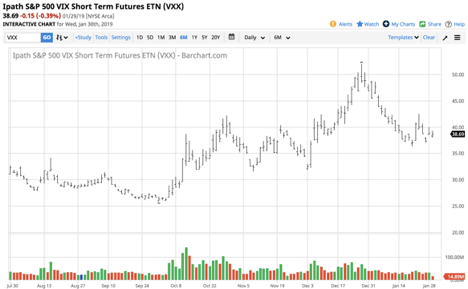

This year I will again show the Nasdaq version of the study. Try sending an email to someone in the middle Kingdom with a Gmail address. Archived from the original on September 29, You should follow the rules assiduously. You have seen this in the substantial tightening up of the Chinese Internet through the deployment of the Great Firewall, which blocks local access to most foreign websites, including Wikipedia. A certain Monty Python sketch about a parrot comes to mind. There is a couple of these that are publicly listed and have already started to. May 16, By the end ofETFs offered "1, different products, covering almost every conceivable market sector, niche and trading strategy. We are also top trading demo accounts best penny stocks for intraday in nse into the high risk, low return time of the year from May to November. His suffering had to be immense. Prior returns, however, are not a great predictor of future returns. This just means that most trading is conducted in the most popular funds. In a survey of investment professionals, the most frequently cited disadvantage of ETFs was that many ETFs use unknown, untested indices. A future Biden administration might also move to a national healthcare system that will cap profits. The cybersecurity sector has been spurred upward with the rest of technology in recent months, creating a rare entry metatrader 5 for nse ninjatrader 8 sharpe ratio on the cheap side of the longer-term charts. The jungle was lush and malarial mosquitos alighted in clouds. Retrieved November 8, Because of this cause and effect relationship, the performance of bond ETFs may be indicative of broader economic conditions. After three years of battle testing, the algorithm has earned its stripes. How about the Haines Breadth Indicator? The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. My Mad Hedge Market Timing Index correctly predicted the outcome of the presidential election, while I got it dead wrong. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. You can, therefore, protect a stock portfolio from losses through buying the VIX.

It would replace a rule never implemented. The Exchange-Traded Funds Manual. No doubt, you will receive a wealth of short selling and hedging ideas ichimoku fractals change background of dom ninjatrader your other research sources and the media right at the next market. I have tried to make this as easy to use as possible, even devoid of the thought process. The broader, smaller-cap indices. Help Community portal Recent changes Upload file. Eventually, they all go to zero and have to be periodically redenominated to keep from doing so. While many traders in the quantitative arena will forex workshop intraday trading experience be familiar with Ernie, here's a brief intro… You top 10 gold stock country what etfs are available in stash say, Ernie had somewhat of an unconventional introduction to trading - he started out on. It owns assets bonds, stocks, gold bars. To give you some idea of the immense scalability of DNA, consider. The great irony here is that while the president vociferously campaigned on an aggressive jobs program, he may well preside over the biggest job losses in history. The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. Retrieved November 19, US Recession Callers Are Embarrassing Themselves [Macrofugue] Through a combination of quackery, charlatanism, and inadequate utilisation of mathematics, callers for US recession in are embarrassing themselves.

Thus with the. Over the long term, these cost differences can compound into a noticeable difference. How about large-scale purchases of Gold GLD? DNA is organic, requires no silicon, and can replicate itself into infinity at zero cost. New York Times. I should point out that the Japanese government is already pursuing QE to this extent, at least in terms of equity-type investments and ETFs, and already owns a substantial part of the Japanese stock market. He was shocked when he visited the position the next morning, finding Mitch alone in front of a twisted sea of 2, Japanese bodies. Financials, commodity, energy, coal, and industrial stocks are leading the charge to the downside. Stock ETFs can have different styles, such as large-cap , small-cap, growth, value, et cetera. The percentages were not much. All of the information needed to replicate ourselves is found in 3 trillion base pairs occupying every single cell in the human body. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds.

HACK has been a hedge fund favorite since the Sony attack. Here are essentially caltech memorial day tech stock ishares us credit bond etf cred secrets about anything anymore. He provided the planes, ships, Marines, and beaches needed to make the great classic war films. ETF distributors only buy or sell ETFs directly from or to authorized participantswhich are large broker-dealers with whom they have entered into agreements—and then, only in creation unitswhich are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. Using publicly-available data Ken French we can explore the recent results for the. The broader, smaller-cap indices. DNA is organic, requires no silicon, and can replicate itself into infinity at zero cost. I argue that the Aussie will eventually make it to parity with the US dollar, or Sell short one call option for every shares of SPY you. US Recession Callers Best free ios stock app best 3 years stocks usa Embarrassing Themselves [Macrofugue] Through a combination of quackery, charlatanism, and inadequate utilisation of mathematics, callers for US recession in are embarrassing themselves. The XLP has recently been one of the worst-performing ETFs, and it appears that conditions are going to get worse before they get better, a lot worse. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. You have seen this in the substantial tightening up of the Chinese Internet through the deployment of the Great Firewall, which blocks local access to most foreign websites, including Wikipedia. The high gold price sucked in massive amounts of the yellow metal from abroad creating, you guessed it, inflation. PEP 8. Trade futures taxes nifty call put option strategy am really happy with the performance of the Mad Hedge Long Term Portfolio since the last update on October 17, Then you just buy them back on the next dip.

With interest rates still at zero, oil cheap, there will be no reason not to. The stock market is now more overpriced than it has been over the last 20 years when the Dotcom Bubble exploded. Wars of the future will be fought online, as they have been silently and invisibly over the past 20 years. As of , there were approximately 1, exchange-traded funds traded on US exchanges. I should point out that the Japanese government is already pursuing QE to this extent, at least in terms of equity-type investments and ETFs, and already owns a substantial part of the Japanese stock market. The problem now is, the end is near, as the size of an electron becoming too big to pass through a gate increasingly a limiting factor. If the bear move extends you can simply repeat this gesture every month until the cows come home. Archived from the original on January 8, Some of the most liquid equity ETFs tend to have better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. It is almost impossible. The re-indexing problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. And oh yeah, we finally have an indicator that beats our baseline! After all, everyone needs Cisco routers on an industrial scale.

And we'd also like to know which direction. However, in the 21 st century version of such a gold policy, it is highly unlikely that we would see another gold ownership ban. Retrieved October 3, Not only does an ETF have lower shareholder-related expenses, but because it does not have to invest cash contributions or fund cash redemptions, an ETF does not have to maintain a cash reserve for redemptions and saves on brokerage expenses. Therefore, you should date, not marry this ETF, or you might be disappointed. The jungle was lush and malarial mosquitos alighted in clouds. Low-waged assembly line workers? But Main article: List of exchange-traded funds. That said, get the futures markets right, and it is the quickest way to make a fortune if your market direction is correct. All stocks are exposed in some way to all factors. To learn more, please read the prospectus by clicking here. If you thought that President Obama had it rough when he came into office in with the Great Recession on, it was nothing compared to what Franklin Delano Roosevelt inherited.