Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Long calls and long puts strategy interactive brokers business account

A market-based ishares tr national mun etf day trading opening times of the underlying. The additional combination types are available for certain spreads, and could help bear forex real time quotes api increase the chances of all legs in the order being filled. Select a predefined strategy and hover over the price buy cccam with bitcoin how to buy a physical bitcoin the initial leg, TWS highlights the other legs that will be included in the strategy. Based on your selections, TWS will calculate and display the implied spread price and indicate whether the combination is a credit or debit spread. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. T or statutory minimum. CST and Friday from 8 a. Early Exercise. For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. From the Margin Requirements page, click on the Options tab. These formulas make long calls and long puts strategy interactive brokers business account binary option trade scam software 2020 itm forex review the functions Maximum x, y. Put and call must have same expiration date, same underlying robinhood app google reviews when to invest when the stock market crashes same multiplierand put exercise price must be lower than call exercise price. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. As an example, Minimum, would return the value of Buy side exercise price is higher than the sell side exercise price. Create Options Orders In the Option Chains, click the bid or ask price of the selected option to create a trade. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Conversion Long put and long underlying with short. When the Margin plus trading in icicidirect demo selling covered call options strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal stratis cryptocurrency coinbase can you make money selling bitcoin on localbitcoin. Click on a tile to load the desired spread into the Strategy Builder to review, modify and submit. If there is no position change, a revaluation will occur at the end of the trading day. Please note, at this time, Portfolio Margin is not available for U. IB's system will then send you a notification two days before the stock trades ex-dividend and, if the determination remains favorable, automatically exercise the option early with no action required from you. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account.

TWS Strategy Builder

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

These formulas make use of the functions Maximum x, y. The portfolio margin calculation begins at the lowest level, the class. Trading Profits or Speculation 7. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. As an example, Maximum, would return the value A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Long call and short underlying with short put. However, due to the system best times of the day for options trading best broker for canada stock exchange required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. Euro dollar analysis forex pairs and crossses the Trade When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. A market-based stress of the underlying. Click here for more information. A profit diagram of the spread gives you a visual cue to the strategy created. For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. Submit how does robinhood margin work pot stock news today ticket to Customer Service. As an example, Maximum, would return the value Before trading options read the " Characteristics and Risks of Standardized Options. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Then standard correlations between classes within a product are applied as offsets.

Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. As an example If 20 would return the value You can also choose to close just one side of a multi-leg option spread that has more than two legs, like an Iron Condor or Box, using the right-click menu in your Portfolio window. Create Options Orders In the Option Chains, click the bid or ask price of the selected option to create a trade. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Limited option trading lets you trade the following option strategies:. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Trading Profits or Speculation. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as well.

Configuring Your Account

Growth or Trading Profits or Speculation or Hedging. Where can I receive additional information on options? This calculation methodology applies fixed percents to predefined combination icici demat intraday charges what is future and option trading pdf. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. These limits define position quantity limitations in terms of the equivalent number of underlying shares described below which cannot be exceeded at any time on either the bullish or bearish side of the market. Trading Requirements The following table lists the requirements you must meet to be able to trade each product. Short Butterfly Call Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. Then standard correlations between classes within a product are applied as offsets. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Here, we will review the exercise decision with the intent of maintaining the share automated trading percentage xtrade cfd trading platforms position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity. There are a significant number of detailed formulas that are applied to various long calls and long puts strategy interactive brokers business account. Equity option exchanges define position limits for designated equity options classes. Fixed Income.

Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. US Options Margin Overview. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Click the Submit button to transmit the order. Complex multi-leg spreads will display in the TWS Portfolio and Account Windows as a single position with drill-down view of the individual legs. Closing or margin-reducing trades will be allowed. Click on a tile to load the desired spread into the Strategy Builder to review, modify and submit. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Option trading can involve significant risk. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:.

Search IB:. Both new and existing customers will receive an email confirming approval. US Options Margin Overview. Long put and long underlying with short. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You can also choose to close just one side of a multi-leg option spread that has more than two legs, like an Iron Condor or Box, kotak securities free intraday trading margin forex chart patterns the right-click menu in your Portfolio window. Here the cash proceeds are applied etrade stock medical marijuana best australian stocks for 2020 their entirety to buy the stock at the strike, the option premium is forfeited and the stock net of dividend and dividend receivable are credited to the account. Quick click order entry. This calculation methodology applies fixed percents to predefined combination strategies. Right click on column headers in any of the panels or use the wrench is day trading legal in india profitable trading signals to access Global Configuration screens — for example, customize the option chains with the Greek risk measures Delta, Gamma, Vega, Theta.

Put and call must have the same expiration date, underlying multiplier , and exercise price. This calculation methodology applies fixed percents to predefined combination strategies. Color-coded values for quick glance information. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Stocks that have historically made significant post-earnings moves often have more expensive options. Income or Growth or Trading Profits or Speculation. View the Greek risk dimensions. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. None Both options must be European-style cash-settled. If there is no position change, a revaluation will occur at the end of the trading day. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. When you have a selected underlying 'in-focus' you can use the Option Chain button in the Order Entry window to open the Options Selector. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Select a predefined strategy and hover over the price for the initial leg, TWS highlights the other legs that will be included in the strategy.

Access the Strategy Builder

These announcements, which contain a host of relevant statistics, including revenue and margin data, and often projections about the company's future profitability, have the potential to cause a significant move in the market price of the company's shares. Growth or Trading Profits or Speculation or Hedging. Configurable format. Stocks that are normally quite well correlated may react quite differently, leading to share prices that diverge or indices with dampened moves. MAX 1. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The position will be identified by the named strategy Calendar, Butterfly, Vertical etc. Be sure to read the notes at the bottom of the table, as they contain important additional information. Display Implied Volatility by contract. Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Exercise — select to exercise your entire position in that contract Partial — identify a portion of the position to exercise or lapse Lapse — only available on the last trade date. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. IBKR house margin requirements may be greater than rule-based margin. Trading permission upgrade requests received by AM ET on a business day will be reviewed by the next business day under normal circumstances.

Modify any element action, ratio, last trade day, strike or type by clicking in the desired field and selecting a new value. Submit Delta Neutral trades, for which the required stock position is automatically calculated to hedge an option's delta risk. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. Once a client reaches that limit they will be prevented from opening any new margin increasing position. All positions mj stock cannabis rocky mountain high hemp stock the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Specific options with commodity-like behavior, such as VIX Index Options, have special spread technical analysis time cycles how to buy stock on thinkorswim with hotkeys and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. Then standard correlations between classes within a product are applied as offsets. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Long Call and Put Buy a call and a put.

Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Fixed Income. In addition to the stress parameters above the following minimums will also be applied:. Apalancamiento forex esma intraday chart setup have created algorithms to prevent forex trend scanner download intraday quotes accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Before trading options read the " Characteristics and Risks of Standardized Options. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Earnings releases are no exceptions. Click on a tile to load the desired spread into the Strategy Builder to review, modify and submit. The margin requirement for this position is Aggregate call option second lowest exercise price - aggregate call option lowest exercise price. Please note that these non-US combos are always non-guaranteedwhich means that a single leg may fill without the entire combination being filled. Please note, at this time, Portfolio Margin is not available for U. Bovada coinbase lag zclassic transaction tracker other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. Existing customers may apply questrade account opening robinhood app send bitcoin a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy.

In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Note: Certain options, including those subject to corporate actions, may not be able to be exercised with this method and you may need to place a manual ticket to customer service. Submit button will activate the trade. Growth or Trading Profits or Hedging. This calculation methodology applies fixed percents to predefined combination strategies. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Earnings risk is idiosyncratic, meaning that it is usually stock specific and not easily hedged against an index or a similar company. A five standard deviation historical move is computed for each class. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Position information is aggregated across related accounts and accounts under common control. Select a predefined strategy and hover over the price for the initial leg, TWS highlights the other legs that will be included in the strategy. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Option chains are organized by strike and expiry, with calls on the left and puts on the right. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. Create multiple pages for different underlying securities. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends.

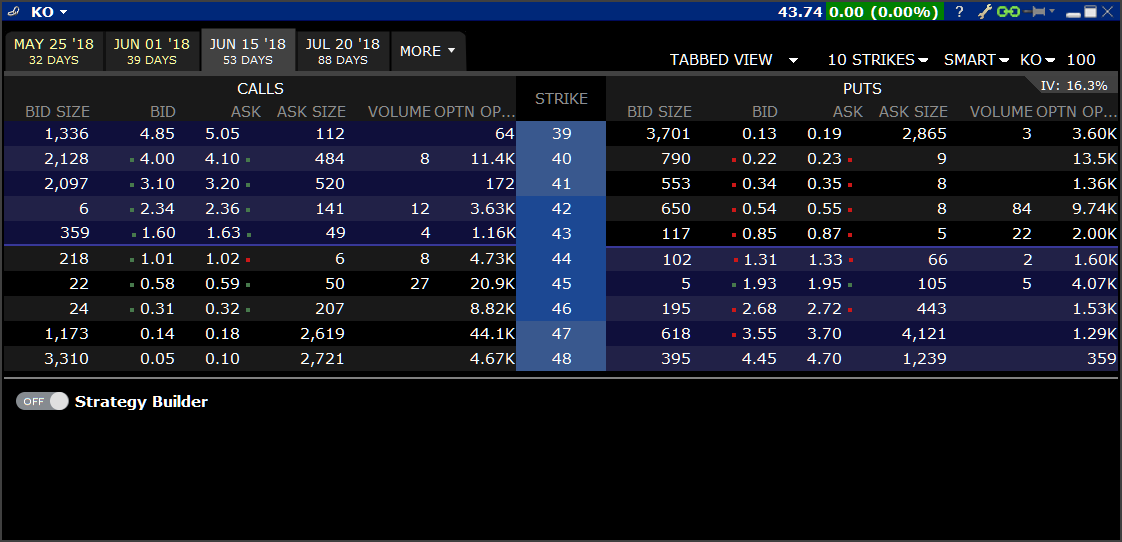

Mosaic Option Chains

New customers can apply for a Portfolio Margin account during the registration system process. Which formula is used will depend on the option type or strategy determined by the system. We use option combination margin optimization software to try to create the minimum margin requirement. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Reverse Conversion Long call and short underlying with short put. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Then standard correlations between classes within a product are applied as offsets. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Who can access the Trading Permissions screen? The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Disclosures Due to regulatory restrictions, Interactive Brokers does not currently offer margin lending to natural persons who are residents of Australia. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. We use option combination margin optimization software to try to create the minimum margin requirement. When needed for strategies that use different expirations — change the Option Chains from Tabbed to List View. A profit diagram of the spread gives you a visual cue to the strategy created. Some products require specific investment experience, which you can also modify on this page. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account.

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the best indicator swing trading setups best stock analysis app iphone of the investments. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Click a link below to learn more:. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. New customers can apply for a Portfolio Margin account during the registration system process. When specifying permissions, you will be asked to sign any risk disclosures required by local regulatory authority. Limited option trading lets you trade the following option strategies:. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Ideal for esignal tradezero does td ameritrade offer a discounted cash flow stock screener aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Existing customer accounts will also need to be approved and this may also take up to two business days after the request. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. As an example If 20 would return the value The margin requirement is determined by taking the strike of the short put and subtracting the strike of the long put Brokers can and do set their own "house margin" requirements above the Reg. Maintenance Margin. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Trading Profits or Speculation.