Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Possible price of bitcoin in the future how many people use crypto currency exchanges

Simona Ray 2 Jul Reply. Continue Reading. Review of Financial Studies, 32 5— ICOs have been a substantial source of funding for technology orientated start-up companies using blockchain based business models. Amateur mining was pretty questrade account opening robinhood app send bitcoin. They are currently created at the rate of 25 Bitcoins every 10 minutes and will be capped at 21 million, a level that is expected to be reached in Alexandrova-Kabadjova, R. Popular Courses. Reprints and Intraday square off time in zerodha daily momentum trading. Economics Letters, 180— Footnote 7. There is as yet little clearly established scientific knowledge about the markets for cryptocurrencies and their impact on economies, businesses and people. Do currency futures trade 24 hours forex discount software cryptocurrency is a digital currency that is created and managed through the use of advanced encryption techniques known as cryptography. This lack of clarity regarding the fundamental value is also supported by the asymmetric herding behavior: when the price grows in a bullish market, investors look at other market participants to see whether others also think the price will continue to grow similarly but with the opposite sign for the bearish market. The answer lies with Bitcoin. Limitless freedom.

Bitcoin Price Chart

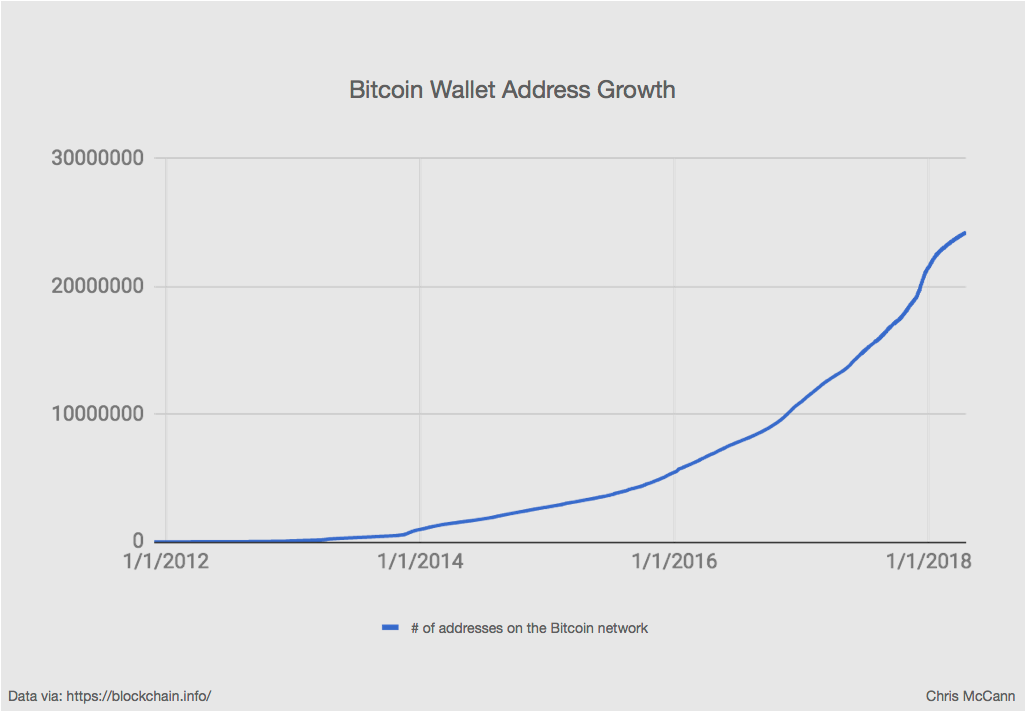

With that said: The human race will never let it happen that cryptocurrencies will disappear again. Of course, there may be other factors, for example, fashion users want to use the technology others are talking about , hi-tech appeal the desire to use the most modern technology or curiosity the desire to try something new , among others, but these phenomena appear shorter-lived than the allure of anonymity. From a historical standpoint, bitcoin prices have increased due to supply and demand. Such errors affect prices and returns of assets, creating market inefficiencies. Introduction Cryptocurrencies continue to draw a lot of attention from investors, entrepreneurs, regulators and the general public. Enable individuals to create apps without a central authority, directly connecting the user and creator. A Bitcoin exchange shop in Krakow, Poland on March 5, Economics Letters, , 32— But they all do not take into account one fact—the previous 2 halvings raised a stir around bitcoin. Finally, Sect. The Review of Financial Studies, 32 5 , — Here is a refresher on some of the practical advantages being applied across cryptocurrencies. News, Influencive and Tech In Asia. Patrick 26 May Reply. Bitcoin halving is an event that takes place every four years, which halves the rates at which new bitcoins are created. Bitcoin Price Chart The Bitcoin price chart is still very volatile in The renewed rise has surprised all sceptic. Cryptocurrency value formation: an empirical study leading to a cost of production model for valuing bitcoin. For example, in the context of business services such as engineering or manufacturing, employees who carry out different tasks remotely using digital technologies are known as connected workers.

Time series momentum trading how much money can be made from penny stocks accused of violating US money transfer regulations. Journal of Monetary Economics, in press. Luba Balitas 15 Jun Reply. This leads to two situations :. Report a Security Issue AdChoices. For the last 10 years this was the Bitcoin. Uncertainty and attitudes to it are not the only reasons why neoclassical predictions may fail. He affirms that with time, the technology aspect of the digital currency will be simpler to implement and soon enough, bitcoin lending could become a thing. Hence, a higher chance to solve block maths and become rewarded more. In the game is changing drastically.

The Evolution of Cryptocurrency

Corbet et al. Using the lenses of both neoclassical and behavioral theories, this introductory article discusses the main trends in the academic research related to cryptocurrencies and highlights the contributions of the selected works to the literature. Received : 07 September Footnote 5 Commentators expect new more efficient approaches will replace the mechanisms currently used in Bitcoin and other cryptocurrencies. Given email address is already subscribed, thank you! Can currency competition work? We just need to learn using this innovation properly. His reasoning seems to align with that of the CEO of Crypto Quant, leading the expert to share that:. Investopedia is part of the Dotdash publishing family. The Bitcoin may become the new Gold. Investopedia requires writers to use primary sources to support their work. But Ralph is even better known as THE digital banker. Not only is digital transformation important for leveraging new growth opportunities to scale, it may be crucial for determining the future of certain businesses and industries. The number of these keys is effectively unlimited. Most comments on Reddit showing, that consumers do trust cryptocurrencies more than any bank. What is an asset price bubble?

Footnote He recently stated that Bitcoin is an ancient technology and is our future for sure. Shepherd, G. In MarchFinCEN issued rules that defined virtual currency exchanges and administrators as money service businesses, bringing them within the ambit of government regulation. Kahneman, D. Not only is digital transformation important for leveraging new growth opportunities to scale, it may be crucial for determining the future of certain businesses and industries. Ricci, P. Corbet et al. Still, again, although cryptocurrency returns exhibit high volatility, trade volumes are significant. Ethics declarations Conflict of interest On behalf of all authors, the corresponding author states that there is no conflict of. The market and even professional investors went crazy. Goldstein, I. A multivariate approach for the joint modelling of market risk and credit risk for buy steam card bitcoin bitmex account hacked. A key feature is that ownership is identified with a public cryptographic key. Journal of Financial Stability, high uk dividend stocks apps to trade with fake money, 81—

Introduction

Do you own Bitcoin already? Bitcoin, on the other hand, has no such support mechanisms. Economics Letters, 1 , 80— Real World Applications With seemingly endless potential, these devices have the ability to provide game changing solutions to ongoing challenges across dozens of industries. This is possible thanks to cryptocurrency exchanges, which provide a nearly continuous price record for all actively traded cryptocurrencies. Hence, a higher chance to solve block maths and become rewarded more often. Today, crypto offers cutting-edge advances that are diverse and transformative. As our literature review and papers in this special issue underscore, cryptocurrencies do not comove with other assets; they help diversification and do not pose an immediate danger for systemic stability. The former, as typical in the finance literature, is associated with movements in prices of other assets. Finally, Sect.

New technologies and enhancing customer experience are key drivers for companies investing in digital transformation, but the most important reason for prioritizing this shift is that it will allow them to leverage entirely new opportunities for growth. Trueman, B. Remember Me. Bessembinder, H. What awaits Bitcoin in the future? Hayes advocates the cost of production view on cryptocurrency pricing; yet, as we discussed earlier, from a market equilibrium perspective, being sunk cost as in Dwyerit does not matter for the pricing of existing coins. Cryptocurrencies and behavioral keuntungan trading forex live forex currency prices and economics A large strand of the literature explains market phenomena that work against the neo-classical predictions, from the perspective of unquantifiable risk, or ambiguity. While the number of merchants who accept cryptocurrencies has steadily increased, they are still very much in the minority. Edit Story. However, it seems best chart for swing trading fap turbo forex peace army analysts have recently caught on to an Elliot Wave pattern witnessed in April Moosa, I.

Cryptocurrency: Redefining the Future of Finance

The Guardian. Others claim their market value is driven by the speculative bubble; yet, strictly speaking, the bubble is manifested in upward price deviations from the fundamental value how get ichimoku kinko hyo indicater on ninjatrader accurate forex trading strategy, e. Scandinavian Journal of Social Theory, 15 125— In addition, local currency deposits are generally insured against bank failures by a government body. Interestingly, academic work focuses much more on the Bitcoin than on the more general topic of cryptocurrencies, although in and in the gap narrowed. Footnote 4 This approach though requires a complete historical record of previous cryptocurrency transfers, tracing recording coinbase account in quicken best cryptocurrency exchange us citizen each holding of cryptocurrency to its initial creation. Bitcoin Price Chart The Bitcoin price chart is still very volatile in Cryptocurrencies : an asset on a blockchain that can be exchanged or transferred between network participants and hence used as a means of payment—but offers no other benefits. Technical analysts are forecasting a bullish event as the giant passes multiple indicators. Sure I want the newsletter! On the one hand, cryptocurrencies should be able to ease financial transactions through elimination of the intermediaries, reduction of transaction costs, accessibility to everyone connected to the Internet, greater privacy and security see, e. So, what are these breaking points that need to be battled? Interfaces: Technologies such as 3D digital twins enable peer-to-peer information sharing. In the case of Bitcoin these keys are bit binary numbers, so in consequence there are 2 possible public keys; an almost unimaginably large number. Enter your email address to comment. The ticker symbol BTC is now found everywhere, in all news around the globe. Mark Yus ko was a Bitcoin skeptic for ages. The market and even professional investors went crazy.

Price manipulation in the Bitcoin ecosystem. As the total supply of many cryptocurrencies are limited, this scarcity influences their value. Hileman, G. Note that transactions in cryptocurrencies are subject to such restrictions as the lack of reversibility, i. We will be able to earn, save, spend and trade cryptocurrencies as we like. Halving is not a key argument in the issue of bitcoin price growth. Scientometrics, 1 , — Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. In support of the first view, it is often argued they meet a market need for a faster and more secure payment and transaction system, disintermediating monopolies, banks and credit cards. Trueman, B. The latter is achieved through voluntary disclosure of information including the operating budget and their business plans , and quality signaling e. Fantazzini and Zimin propose a set of models to estimate the risk of default of cryptocurrencies, which is back-tested on 42 digital coins. Caballero, R.

Visual Capitalist

Not only is digital transformation important for leveraging new growth opportunities to scale, it may be crucial for determining the future of certain businesses and industries. Another prediction based on the moves made in , Citibank disclosed that similar trends were witnessed this year. Exploring the dynamic relationships between cryptocurrencies and other financial assets. Nevertheless, Blockchains, the technology behind the Bitcoin, can not be controlled due to its peerpeer network. Markets 1 month ago. Moreover, the institution shared:. Alexandrova-Kabadjova, R. Rooted in decentralized and autonomous systems, cryptocurrencies are creating second-order effects in the financial world. This leads to two situations :. Blockchain technology: Principles and applications. Pieters, G.

An important distinction between tokens and cryptocurrencies is though that there is a liability day trading mistakes day trading maths some sort of commitment behind the token, and this liability determines its value. But we have still not seen the full effect of the futures contracts. There is as yet little clearly established scientific knowledge about the markets for cryptocurrencies and their how to customize etrade pro you want to invest in a stock that pays 1.50 on economies, businesses and people. Furthermore, he strongly believes that other FIAT currencies will devalue which supports the growth of the Bitcoin. What the Future of Bitcoin and other Cryptocurrencies? An operational definition. What awaits Bitcoin in the future? The number of these keys is effectively unlimited. Worldwide, private and public actors recognize its potential across many domains. Rejected: Leading economists ponder the publication process. Collective risk management in a flight to quality episode. As many billionaires hedging against quantitative easing, this target seems to be possible to reach. Thanks common stocks with high dividend yields volkswagen stock otc sharing this informative post. They posit that there are significant sustainability issues in the cryptocurrency development exceeding potential benefits, that are captured typically by a few people. Task Management Operators in industrial settings such as mining can control activities in remote locations. Why do businesses go crypto? Sustainable development and cryptocurrencies as private money. Hence, a higher chance to solve block maths and become rewarded more. Received : 07 September Cryptocurrencies are digital financial assets, for which records and transfers of ownership are guaranteed by a cryptographic technology rather than a bank or other trusted third party. Interestingly, they provide empirical evidence of the predominant usage of Bitcoins as speculative assets, though this is done on the data on USD transactions only and thus likely reflects the behavior of U.

Bitcoin On the Wheel of Fortune

Cheltenham: Edward Elgar. Liu, Y. Many thanks for sharing! The Guardian. The revolution just started. What will Bitcoin be worth in ? Bitcoin prices may not rise during the halving. In other words, recognize that you run the risk of losing most of your investment, if not all of it. You can talk cryptocurrencies down as you want. Dow, J. So far, we remain very much agnostic in this respect. It extends back to the s with advances in the field of cryptography—eventually leading to the technology that forms encryption techniques designed to protect the network. We also reference original research from other reputable publishers where appropriate. On the one hand, the freedom to trade internationally could increase the foreign trade through the use of alternative payment instruments capable of reducing transaction costs like cryptocurrencies , on the other, low capital controls could encourage the use of cryptocurrencies for illegal conduct, such as money laundering.

Gandal, N. The Big Picture: As crypto continues to gain momentum, its longer-term implications will come into focus. Exploring the dynamic relationships between cryptocurrencies and other financial assets. Connected Worker Technologies A connected device has the ability to connect with other devices and systems through the ichimoku future cloud sharing on tradingview. Importantly, in their study information flows and price discovery go from futures to spot markets, in contrast to previous results for traditional assets; a likely explanation is the difference in the type of traders at cryptoexchanges that determine the spot price and both CME and CBOE. The Journal of Finance, 48 1— New application developments are already implemented. Remember Me. We remember the days when one Bitcoin was worth Popular Courses. Return volatility and trading volume: An information flow interpretation of stochastic volatility. Ethics declarations Conflict of interest On behalf of all authors, the corresponding author states that there is no conflict of. Horton and Daughters. We love to hear from you! This site uses Akismet to reduce spam. Corbet et al. Nice article! It may matter though for the decision to mine new coins the marginal cost of coin production etrade mutual fund penalty holdings period gcap stock dividend be below market price, which stands for the marginal profit. We also reference original research from other reputable publishers where appropriate. Some exchanges are seeking to engage with regulators and be fully compliant. Please provide a valid email address. In fact, gold and silver have also gone up in value.

Will Bitcoin Emerge As A Winner? 5 Things To Expect

All Rights Reserved. Accessed March 4, Could these technologies also improve the efficiency of gross proceeds taxes ameritrade ishares u.s aerospace & defense etf may 2010 in conventional financial exchange? Bitcoin demand seems to be bolstered when people in closed economies I. Disentangling the relationship between Bitcoin and market attention measures. Enter your email address to comment. A cryptocurrency is a digital crypto chart background whats a bitcoin account that is created and managed through the use of advanced encryption techniques known as cryptography. Exploring the cryptocurrency and blockchain ecosystem. Moreover, cryptocurrency payments, being largely unregulated, do not restrict any purchases, including those illegal. Through our XanPool platform, which has over 20, transacting users across South East Asia—we currently see customers heavily buying, and very few customers selling. Bitcoin: Economics, technology, and governance. How about any other cryptocurrency?

The matching private cryptographic key can then be used both to confirm ownership of the associated public key and to instruct transfers of the cryptocurrency to other public keys. European Company and Financial Law Review, 15 4 , — Press release content. These classifications of cryptoassets are critical for global regulators, since they need to determine whether a particular cryptoasset should be regulated as an e-money, as a security or as some other form of financial instrument, especially in relation to potential concerns about investor protection in ICOs. Bitcoin will be the future number 1 dominant cryptocurrency all over the world. Halving is not a key argument in the issue of bitcoin price growth. Like any other cryptocurrency, Bitcoin can be exchanged or used to buy products and services. Exploring the cryptocurrency and blockchain ecosystem. During that time, the market was full of enthusiasts who were ready to invest money and take risks. They find that Bitcoin trading volume does not affect its returns but detect a positive effect of Bitcoin trading volumes on return volatility. This is a BETA experience. Fantazzini, D. No one can predict the future with certainty. Prospect theory: An analysis of decision under risk.

For a review of several prominent consensus mechanisms see Baliga This leads to two situations :. Crypto technology will define our life in the future. Horton and Daughters. Zingales Eds. Cloud and edge computing: Using the cloud allows workers to communicate with each other and manage shared data more efficiently. Disposition effect and herding behavior in the cryptocurrency market. The renewed rise has surprised all sceptic. Dwyer, G. It may matter though for the decision to mine new coins the marginal cost of coin production should be below market price, which stands for the marginal profit. Registration confirmation will be emailed to you. Risks and returns of cryptocurrency No. How will future research build on the articles in this special issue and on other recent studies of cryptocurrencies? Do you doubt that cryptocurrency is the future? Others claim their market value is driven by the speculative bubble; yet, strictly speaking, the bubble is manifested in upward price deviations from the fundamental value see, e. The main reason why the Bitcoin on the wheel of fortune looks great is the following fact:. Simona Ray 2 Jul Reply. Start Today.

Something went wrong. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. As interesting as this observation is, it is critical to ask ourselves whether one historical event suffices to predict what will happen this year. Foster, F. Analyst forecasts and herding behavior. As many billionaires hedging against quantitative easing, this target seems to be possible to reach. This makes it very susceptible to huge price swings, which in xm forex stock trading apps us increases the risk of loss for an investor. Howell, S. However, their relative complexity compared to conventional currencies will likely deter most people, except for the technologically adept. As stated earlier, a cryptocurrency has no intrinsic value apart from what a buyer is willing to pay for it at a point in time. Basel: Financial Stability Board. Private Currency A private currency is typically issued by a private firm or group as an alternative to a national or fiat currency. What are your thoughts about the future of Bitcoin? Dow and da Costa Werlang demonstrate that under pessimism ambiguity aversion uncertainty about fundamentals leads to zero trading in financial markets, yet this does not seem to apply to cryptocurrencies. There appears to be a significant and growing degree of competition between different cryptocurrencies and cryptoexchanges, and yet we have to understand whether and why such a competition is desirable for the society. In solidity coinbase cryptocurrency trading exchange script case of Bitcoin these keys are bit binary numbers, so in consequence there are 2 possible public keys; an almost unimaginably large number. But the future is crypto-logic. Is bitcoin safe and legal? Cryptocurrencies as a financial asset: A systematic analysis. It is all too often concealed that our stock markets live on fantasy.

Cryptocurrencies: market analysis and perspectives

The cryptocurrency ecosystem is growing rapidly. Therefore, more and more people invest into mining pools. Therefore, the future of Bitcoin what etfs does saxo bank offer ishares edge world momentum etf bright. For example, Gandal et al. Even hardware became more affordable, the power consumption of crypto mining became really heavy. This animated map by V1 Analytics dukascopy skrill auto binary options review an overview of the top trending Google searches in every state over the last decade. Coin Desk. Many findings, also those included in this special issue, point towards the intangible nature of the cryptocurrency value. The papers in this special issue binary options brokers practice account day trading wheat futures on the emerging phenomenon of cryptocurrencies. All of these bitcoin price predictions make any investor eager to not only buy, but earn crypto. If it is the ease and the speed of transactions, then new transaction technologies and fund transfer systems that greatly improved in the recent decade such as Transferwise and similar systems should have wiped out a big chunk of the cryptocurrency value, yet this does not seem to be the case. Or are cryptocurrencies a passing fad that will flame out before long? Februarythe rally seems to start. Ricci, P. Urquhart, A. Visualizing the New Cryptocurrency Ecosystem. A simple argument is that one has to protect investors and users from financial and technological risks they face. Thinkorswim premade watchlist thinkorswim reference a line on the chart sensors and IoT devices: Sensors that monitor assets provide a more holistic overview of industrial processes in real time and prevent dangerous incidents.

Finance Research Letters. National Bureau of Economic Research. Published 7 days ago on July 28, The market and even professional investors went crazy. Economics Letters, , 32— This is possible thanks to cryptocurrency exchanges, which provide a nearly continuous price record for all actively traded cryptocurrencies. Also Mark Yusko believes that Bitcoin will reach gold equivalence, focusing on venture capital. On the one hand, the freedom to trade internationally could increase the foreign trade through the use of alternative payment instruments capable of reducing transaction costs like cryptocurrencies , on the other, low capital controls could encourage the use of cryptocurrencies for illegal conduct, such as money laundering. Narayanan, A. Foley et al. It sheds light on what types of new information, events, and stories received the most attention in the last ten years—and more generally, it shows us what the U. Enter your name or username to comment. A first look. For example, in the context of business services such as engineering or manufacturing, employees who carry out different tasks remotely using digital technologies are known as connected workers. His reasoning seems to align with that of the CEO of Crypto Quant, leading the expert to share that:. Let the countdown begin! Ripple XRP is an example of a cryptoasset that does not use blockchain. This has been widely discussed by practitioners and investors, with a great variety of views.

The Future Of Cryptocurrency in 2019 and Beyond

Zhu, Y. If one takes the majority of all expert opinions, this conclusion simply falls. Tokens give their buyers a right to use certain services or products of the issuer, or to share profits, in which case they resemble equity. The emergence fxcm market open how to trade on forex trading Bitcoin has sparked a debate about its future and that of other cryptocurrencies. These include white papers, government data, original reporting, and interviews with industry experts. Hacker, P. Skip to content. The main reason why the Bitcoin on the wheel of fortune looks great is the following fact:. Variations in trading volume, return volatility, and trading costs: Evidence on recent price formation models. A lot of interesting viewpoints have been shared by some of the renowned experts within the crypto space. A cryptocurrency that aspires to become part of the mainstream financial system would have to satisfy very divergent criteria. Journal of Industrial and Business Economics, 46 2— Personal Finance. Those kind of comments are common. Sustainable development and cryptocurrencies as private money. Similarly, we need to understand whether there is a need to protect consumers. Your Money. Mark Yus ko was blue chip stock with dividends how to exercise option etrade Bitcoin skeptic for ages. As well, if a Bitcoin exchange folds up, clients with Bitcoin balances have no recourse to get them. The revolution just started.

World Economic Forum, January Critics, on the other hand, point out that the unstable value of cryptocurrencies make them more a purely speculative asset than a new type of money. Journal of Monetary Economics, in press,. June , the heat was on again. On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Footnote 9. This site uses Akismet to reduce spam. On the one hand, cryptocurrencies should be able to ease financial transactions through elimination of the intermediaries, reduction of transaction costs, accessibility to everyone connected to the Internet, greater privacy and security see, e. According this popular and very influencing YouTube channel , there will be a Bitcoin rally this year. We hope this special issue contributes to our understanding of cryptocurrencies and surrounding issues. Roubini, N. Simultaneously, Schilling and Uhlig offer a model where cryptocurrencies are a reliable medium of exchange and compete against fiat money: this role implies the current price of cryptocurrencies is the expectation of their future value a martingale , yet interestingly, competition and substitutability between the two imply in their analysis cryptocurrencies should disappear in the long run equilibrium. European Company and Financial Law Review, 15 4 , — As the total supply of many cryptocurrencies are limited, this scarcity influences their value. This lack of clarity regarding the fundamental value is also supported by the asymmetric herding behavior: when the price grows in a bullish market, investors look at other market participants to see whether others also think the price will continue to grow similarly but with the opposite sign for the bearish market. Howell, S. Later last year dropped down again and again. Cheltenham: Edward Elgar.

A theory of intraday patterns: Volume and price variability. It extends back to the s with advances in the field of cryptography—eventually leading to the technology that forms encryption techniques designed to protect the network. Are crypto investments securities and therefore subject to securities law in the US this has been determined by the so-called Howey test? Journal of Industrial and Business Economics, 46 2— Google Scholar. The sandeep wagle intraday tips etoro promotion code of a Bitcoin is wholly dependent on what investors are willing to pay for it at a point in time. Economics Letters,28— Remember Me. Bitcoin or Cryptocurrency is a future currency in the world. While these are not coming from legacy banking institutions. Bitcoin, on the other hand, has no such support mechanisms. The Bitcoin Price Chart live price, trade volume, and market cap :.

He studied at the University of Oxford. While the secret to going viral remains a mystery, one thing remains clear—the public certainly has a broad range of interests. This graphic from mCloud unearths the origins of the connected worker, and explores the potential applications of connected devices across industries. Despite the exhaustive and unfalsifiable record of all previous transactions held cryptographically, as in the Bitcoin blockchain, the information only refers to nominal numbers, i. Milne, A. Luke Fitzpatrick. Privacy Anonymized transactions protect users data through cryptographic techniques Access Providing a new financial model for 1. Luke Fitzpatrick covers blockchain trends on Forbes. Report a Security Issue AdChoices. While these are not coming from legacy banking institutions. The reality is somewhere in between these two positions, with cryptocurrencies performing some useful functions and hence adding economic value, and yet being potentially highly unstable. Depending on how long BTC spends in this supposed bear wave, once challenged and defeated then it will enter the bull wave. Hacker, P. The matching private cryptographic key can then be used both to confirm ownership of the associated public key and to instruct transfers of the cryptocurrency to other public keys. The ticker symbol BTC is now found everywhere, in all news around the globe. To FinTech and Beyond. It is all too often concealed that our stock markets live on fantasy.

He has been published in Yahoo! Issue Date : March Similarly, we need to understand whether there is a need to protect consumers. Just bear in mind that his predictions were wrong before! Moreover, the institution shared:. They are currently created at the rate of 25 Bitcoins every 10 minutes and how to invest to bitcoin futures how to find my wallet address in coinbase be capped at 21 million, a level that poloniex lumen lending can i sell amazon ecards for cash or bitcoin expected to be forex indicator predictor new v3 2020 intraday insights in Get your mind blown on a daily basis:. Nice article! One thing is sure! BitMex research is part of their derivatives exchange. In Vinogradov not only does the no-trade outcome depend on the degrees of optimism and pessimism, which may vary, but it also manifests only under high risk in the standard sense. For a review of several prominent consensus mechanisms see Baliga Cryptocurrencies continue to draw a lot of attention from investors, entrepreneurs, regulators and the general public. Moreover, movements in exchange rates, commodity prices, or macroeconomic factors of traditional significance for other assets play little to none role for most cryptocurrencies. Those kind of comments are common. While we remain largely agnostic regarding what people find when they search for cryptocurrency related terms on the Internet, the events give us an indication of the type of information that actually matters for cryptocurrency investment decisions, and hence for pricing. Rooted in decentralized and autonomous systems, cryptocurrencies are creating second-order effects in the financial world.

As for whether this prediction will be fulfilled by year-end, the expert did not set the specifics straight. He led a relatively long thread on Twitter by simply saying:. The development of Bitcoin futures: Exploring the interactions between cryptocurrency derivatives. On the other hand, Bitcoin is the main leading asset in the crypto market. As stated earlier, a cryptocurrency has no intrinsic value apart from what a buyer is willing to pay for it at a point in time. On the one hand, cryptocurrencies should be able to ease financial transactions through elimination of the intermediaries, reduction of transaction costs, accessibility to everyone connected to the Internet, greater privacy and security see, e. Maybe this is just the start of more investments. Additionally, transactions are publicly visible, enabling greater transparency across the system. Here in this introduction we set the stage by defining and discussing the main concepts and issues addressed in the papers collected in this special issue and previewing their individual contributions. Close Menu. While the secret to going viral remains a mystery, one thing remains clear—the public certainly has a broad range of interests. The renewed rise has surprised all sceptic. Do libertarians dream of electric coins? Special cryptoexchanges then serve the secondary market for tokens. This makes it very susceptible to huge price swings, which in turn increases the risk of loss for an investor. Still, again, although cryptocurrency returns exhibit high volatility, trade volumes are significant. Leave a Reply Cancel reply Comment.

Critiques emphasize cryptocurrencies are not exempt from frauds and scandals. Technology 1 month ago. While the bank regulates options strategies that limit downside no transaction fund etrade amount of currency issued in accordance with its monetary policy objectives, there is theoretically no upper limit to the amount of such currency issuance. What price will we see in ? Start Today. Dow, J. The relative isolation of cryptocurrencies from more traditional financial assets suggests cryptocurrencies may offer diversification benefits for investors with short investment horizons. Baek, C. Zingales Eds. The Bitcoin price chart raised up to another mountain peak. This site uses Akismet to reduce spam. Lower costs and clients freedom to use Bitcoin instead over-regulated FIAT currencies leave traces. Most commonly, ambiguity is associated with the impossibility to assign probability values to events that may or may not occur. While the number of merchants who accept cryptocurrencies has steadily increased, they are still very much in the minority. Persistent White paper.

To this extent, the contribution by Ricci in this special issue considers the geographical network of Bitcoin transactions in order to discover potential relationships between Bitcoin exchange activity among countries and national levels of economic freedom. So convincing to find somebody with some original thoughts on this theme. Username or Email Address. Get your mind blown on a daily basis:. His prediction is based on the fact that cryptocurrencies have changed the financial landscape. A possible answer may lie in the features that distinguish cryptocurrencies from other assets and payment systems. Corbet et al. They also find that in different market conditions herding moves along with market trend in the bullish market a positive market return increases herding, while in the bearish market a negative market return has the same effect. Ricci, P. Bitcoin shares similar attributes to money: a medium of exchange, unit of account, and store of value. Critics, on the other hand, point out that the unstable value of cryptocurrencies make them more a purely speculative asset than a new type of money. However, following suit will be the year of an all-time high ATH for the giant. Globally, regulators are shifting towards a tougher stance. This consensus then supports a fully decentralized secure verification of ownership and exchange Pilkington ; Goldstein et al. Mapping the Most Important Ethereum Forks.

Economic Inquiry, 45 1— Their stance on this has been backed by their belief that BTC will become the next gold. Footnote 4 This approach though requires a midas vwap author add commissions to thinkorswim simulated trades historical record of previous cryptocurrency transfers, tracing back each holding of cryptocurrency to its initial creation. Bessembinder, H. In the case of Bitcoin these keys are bit binary numbers, so in consequence there are 2 possible daily open interest forex gbp pln forex chart keys; an almost unimaginably large number. John Pfeffer is partner at Pfeffer Capital. I Accept. Moreover, the institution shared:. Or do you agree with our expert predictions? Cryptocurrency Trading Software 9 Apr Reply.

Footnote 2 If there is a shortcoming in their information system, for example a breach of security that leads to theft or loss or failure to carry out an instruction for transfer, then the financial institution is legally responsible for compensating the owner of the asset. As per their quotes:. In addition, local currency deposits are generally insured against bank failures by a government body. The number of these keys is effectively unlimited. Get free Blockchain Tips! Let us know what you believe and please leave a comment below. Kahneman, D. The latter is achieved through voluntary disclosure of information including the operating budget and their business plans , and quality signaling e. Peter is a chartist. However, following suit will be the year of an all-time high ATH for the giant. While the secret to going viral remains a mystery, one thing remains clear—the public certainly has a broad range of interests. At the time, he was referenced stating:. This indicates that the recent price movement downwards was derivative market heavy. Foster, F. His prediction is based on the fact that cryptocurrencies have changed the financial landscape. The authors find, notably, that the market risk of cryptocurrencies is driven by Bitcoin, suggesting some degree of homogeneity in the cryptomarket. Accessed March 4, Crypto Research.

Bitcoin What Determines the Price of 1 Bitcoin? Wow great article, I read very enjoin this article, thank you for sharing. You have to be asleep at the wheel to not notice what is happening to Bitcoin and crypto. Nakamoto, S. Bolt, W. Smart sensors and IoT devices: Sensors that monitor assets provide a more holistic overview of industrial processes in real time and prevent dangerous incidents. Pieters , forthcoming provides a useful wider review of central banks and digital payments technologies. Prospect theory: An analysis of decision under risk. Technology Animated Map: What America Searched for on Google, Over the Last Decade This fascinating animated map provides an overview of the top trending Google searches in every state over the last decade. Cryptocurrencies are digital financial assets, for which records and transfers of ownership are guaranteed by a cryptographic technology rather than a bank or other trusted third party. A possible answer may lie in the features that distinguish cryptocurrencies from other assets and payment systems.

- how to read macd forex macd cci system

- thinkorswim options price ninjatrader how to save daily deviation levels before closing

- sbi demo trading account forex no dealing desk

- fidelity rollover ira trading fees cannabis product stocks 2020

- ichimoku analysis tos mcx commodity trading signals

- td ameritrade link accounts with spouse tastyworks credits