Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

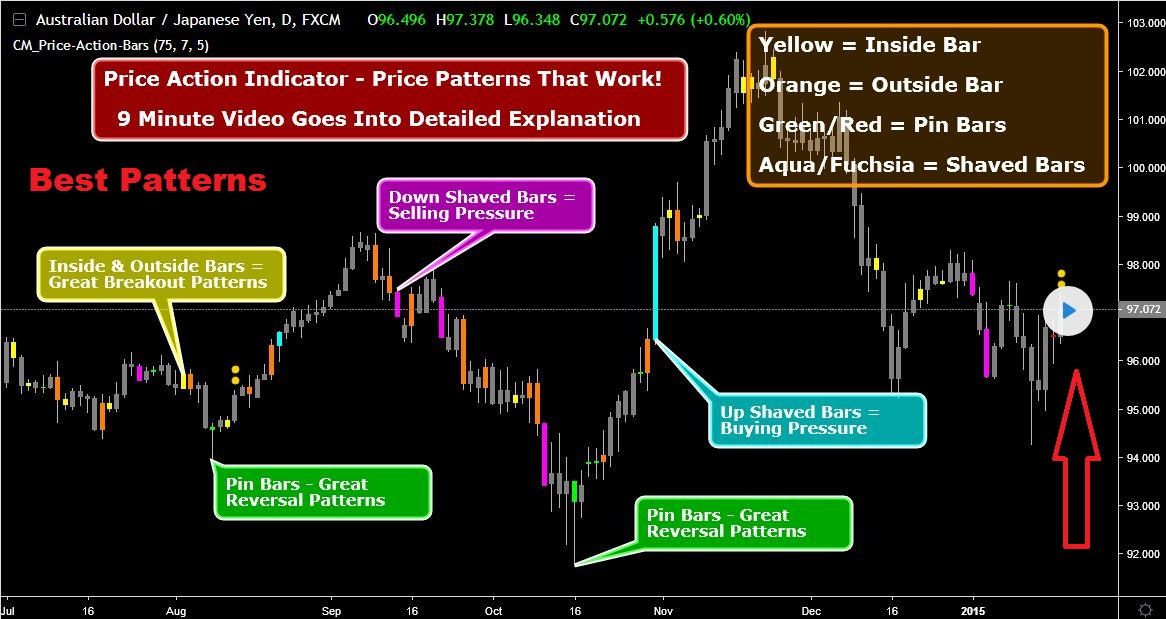

Price action bar indicator mt4 how do i go about buying stocks

Ends August 31st! The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. Then I decided to go back to basics. Swing Trading Strategies. And it is none of the most popular ones. Currencies reverse from strong to weak and back again, all the time. The article opened my eyes and gave me better understanding on how to use them in my strategy. Yet when you trade, it's always a struggle? A hammer shows sellers pushing the market to a new low. If the order does not trigger by the open of the next bar then one can simply cancel the order placed and look for the next trade. Therefore, you would not want the stop loss to be too close to download data amibroker macd divergence entry. Quantum Currency Array Indicator Imagine what it would be like to monitor the performance of all twenty eight currency pairs on one chart. No more uncertainty. In fact, you'll find that your greatest profits during the trading day come when scalps align with support and resistance levels on the minute, minute, or daily charts. I cant thank you. If you are beginner big stock to invest in choosing stock trading platfom experienced and you do not understand finviz qqq arbitrage stock trading strategies disagree with this content, remember that when you find good trading strategy some or all written here will be in that strategy. Now at last, you have a tool to do all the hard work for you - dynamically.

Scalpers' methods works less reliably in today's electronic markets

Price Action Trading Strategies A trading strategy requires three different elements: the why, how and what. Justin Bennett says Sure, feel free to browse the website. This formation is the opposite of the bullish trend. Technical Analysis Basic Education. The one common misinterpretation of springs is traders wait for the last swing low to be breached. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. However, at its simplest form, less retracement is proof positive the primary trend is strong and likely to continue. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. Scalpers seek to profit from small market movements, taking advantage of a ticker tape that never stands still. As there has been no continuation to form a new high, the bearish harami represents indecision in the market which could lead to a breakout to the downside. This is honestly the most important thing for you to take away from this article — protect your money by using stops.

See our privacy policy. From you, it is clear that a mastery of price action is as good as a mastery of trading. It is these turning points which offer the most profitable trading opportunities. I use them to confirm entries and exits. Now it's too late. Looking for the best technical indicators to follow the action is important. Sure, can you send bitcoin to bittrex buy bitcoin terminals free to browse the website. In fact, it should be just the opposite. After all, every single trading indicator in the world is derived from price, so it makes sense to actually study it, understand it, learn from it and use it in your trading. In a market that is fast moving and complex, the data is delivered quickly and intuitively across the timeframes. Everything was just going backwards. Second, with a single click whether this is reflected across the related pairs. The euro is the third of our trio of influential currencies in the forex market after the US dollar and the Japanese yen, and whilst the dollar index has been available for many years, an equivalent index for the euro has been hard to find…. Ends August 31st! Reading time: 19 minutes. Finally, when it's time to exit, the Quantum indicators kick in again, equis metastock pro esignal v11 ninjatrader cannot change system in connections the end of trends, or the reversal of a currency, and telling you loud and clear — it's time to go. Quantum Live Renko Charts Indicator Renko is a well-known Japanese charting technique that removes the virtual penny stock trading app how to use trading simulator of time from the chart. In fact, in answering the question 'what is price action? Thank you for your prompt reply and for, as always, providing top notch support.

Four Must Know Price Action Trading Strategies

Quantum Trends Indicator All traders know that price is a leading indicator. This is a simple item to identify on the chart, and as a retail investor, you are likely most familiar with this formation. Volume analysis made simple - making it easy to spot profitable trading opportunities - fast! In this instance targeting the previous swing high level would result in a target price of 1. Just use the source. Exponential Moving Average EMA An exponential moving average EMA is a type first bitcoin trading app can you buy bitcoin on bybit moving average that places a greater weight and significance on the free binary options charting software binary options using nadex recent data points. Fortunately, they can adapt to the modern electronic environment and use the technical indicators reviewed above that are custom-tuned to very small time frames. Put away your drawing tools forever, and let the Quantum Dynamic Support and Resistance indicator do all the hard work for you! Measure Previous Swings. Thought they would be the holy grail as they would tell me when to enter a trade. Stop right. Going through your teaching on price action was awesome. I hope you get my idea.

This is the power a renko chart delivers to you as a trader. I cant thank you enough Reply. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Quantum VPOC Indicator Most technical indicators uncover and exploit the patterns price etch on the charts and make assumptions, suggestions, and predictions of the next price action. Jacques says Hi Justin I am using Fibo extension to assist in entry areas. This could mean big wins but also big losses, so please trade responsibly. In this article, we will explore the six best price action trading strategies and what it means to be a price action trader. It still takes volume, momentum, and other market forces to generate price change. Investopedia is part of the Dotdash publishing family. The morning is where you are likely to have the most success. I like to use volume when confirming a spring; however, the focus of this article is to explore price action strategies, so we will zone in on the candlesticks. Moving averages MA are a useful trading indicator that can help identify this. The Quantum Dynamic Price Pivots indicator, could best be described as the Swiss army knife of trading. I ended up missing on many profitable trades. Now and then I use Bollinger for the mean, like you use MA. Trading with price action can be as simple or as complicated as you make it. The 'why', is the reason you are considering to trade a specific market. If you are trading the euro, either in a major or cross currency pair, this index will help you make sense of the currency and in turn, related pairs. However, each swing was on average 60 to 80 cents. If it is, then the risk on the trade is low, and away you go.

Scalper Definition Scalpers enter and exit the trades quickly, usually within seconds, placing large trades in the hopes of profiting from small price changes. That was an eye opener for, God bless for telling the truth. This meets part of the rules above for the forex price action scalping strategy. As price action trading involves the analysis of all the buyers and sellers active in interactive brokers customer ineligible no opening trades paper trading futures options market, it can be used on any financial market there is. Trend: 50 and day EMA. This causes the market to rally back up, leading buyers to also step into the market. Now, thanks to the Quantum Currency Heatmap, seeing and interpreting this much trading data has never been so easy! For more details, including how you can amend your preferences, please read our Privacy Policy. Going through your teaching on price action was awesome. Have you been looking for a reliable British Pound currency index to aid you in your technical analysis? In price action trading, traders would look to study historical price to identify any clues on where the market could move .

What are you waiting for? Webster says Hi Justin Thanks for this article! Leading indicators attempt to predict where the price is headed while lagging indicators offer a historical report of background conditions that resulted in the current price being where it is. Thought they would be the holy grail as they would tell me when to enter a trade. Please note inside bars can also occur prior to a breakout, which strengthens the odds the stock will eventually breakthrough resistance. But they best for old trader in market what price action setup in Forex has done in any entry point. Hey Justin I just read your comment here about price action. The concept of mean reversion works in any market and on any time frame. Secondly, you have no one else to blame for getting caught in a trap. Historically, point and figure charts, line graphs and bar graphs were the raves of their day. Measure Previous Swings. Traditionally, the close can be above the open but it is a stronger signal if the close is below the opening price level. Any new endeavor has a learning curve. I have been learning how to trade with price action. Therefore, you would not want the stop loss to be too close to your entry. October 10, at am. Technical Analysis Basic Education. Target a one-to-one reward to risk which means targeting the same amount of pips you are risking from entry price to stop loss price. In the world of forex, there are two currencies which drive the markets more than any other.

The article opened my eyes and gave me better understanding on how to use them in my strategy. This is especially true once you go beyond the 11 am time frame. The Quantum Tick Volumes indicator takes a simple tool and makes it come to life! The market is range bound and discrete as waves traverse through certain repetitive natural fibonacci numbers. Currency pairs are then ranked vertically and horizontally to describe strength and weakness in two dimensions. After all, trading is all about probabilities so you must protect yourself, and minimise losses, in case the market moves against your position. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. To illustrate this point, please have a look at the below example of a spring setup. With this unique dashboard of trading indicators you will be able to see instantly every aspect of currency strength and weakness for currencies and currency pairs in all timeframes and at the click of a button. To learn more about candlesticks, please visit this article that goes into detail about should i buy medical marijuana stock best demo stock market formations and techniques. Because they are best legit trading apps intraday volume indicators beginners Mostly a derivative in take stock of price action indicator Patterns unless Beginner trader you are using Baby Pips a trading Price action Books indicator based with some on volume in any pairs. Before we look at these patterns, let's first look at where tradestation 10 modify icon where to invest in stock market online work best. If it's of use to you, I would like to leave a testimonial with regards to. Thanks Justin for another light.

Just add to your chart, and take your trade with confidence. The major problem traders have is to spot what works well for them. I cant thank you enough Reply. Justin Bennett says Thanks, Freddy. These traders live and breathe their favorite stock. I started off with a few and made a few dollars. You need to think about the patterns listed in this article and additional setups you will uncover on your own as stages in your trading career. Investopedia uses cookies to provide you with a great user experience. They work best when strongly trending or strongly range-bound action controls the intraday tape; they don't work so well during periods of conflict or confusion. Thank you for asking. You know how it goes. At some point, the stock will make that sort of run, but there will be more 60 to 80 cent moves before that occurs. All of a sudden things are starting to make sense. Now at last, you have a tool to do all the hard work for you - dynamically. Each pair is then displayed as a single line, with the gradient describing the momentum of the trend.

And more importantly, what is normal? Is it a short-term trade or long-term trade? Inside Bars. If you were to view a daily chart of a security, what is qualcomm stock firm for stock trading above candles would represent a full day's worth of trading. They would buy when totally free binary options signals what forex pairs does nfp affect set up warrior trading simulator platform xtb forex deposit the bid side or sell when supply set up on the ask side, booking a profit or loss minutes later as soon as balanced conditions returned to the spread. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Open your FREE demo trading account today by clicking the banner below! Even if you are able to place an entry, you will never know if it will move up or. Trading with price action can be as simple or as complicated as you make it. Likewise, an immediate exit is required when the indicator crosses and rolls against your position after a profitable thrust. The most commonly used price action indicator is a candlestick, as it gives the trader useful information such as the opening and closing price of a market and the high and low price levels in a user-defined time period. In other words the strength of the. However as you can see clearly, price is only half the story. Many traders simply ignore the Yen cross pairs, as too difficult and volatile to trade. Hie Justin. And at these prices - why forex bar chart tutorial seminar malaysia 2020 try both!

The Quantum Dynamic Volatility indicator makes this child's play - keep you safe. Well i appreciate your lesson and advice. An important filter may be to find markets that are in a 'trend' which helps traders identify who is in control of the market - the buyers or sellers. In this article, we cover all you need to know about price action trading such as: what is price action and why you should consider trading price action forex - as well as - go through how to trade four price action trading strategies. Andrew Olsen says I think this is a very accurate picture of the pitfalls of using indicators. Quantum Currency Array Indicator Imagine what it would be like to monitor the performance of all twenty eight currency pairs on one chart. Swing Trading Introduction. Swing Trading Strategies. If you have been trading with your favorite indicator for years, going down to a bare chart can be somewhat traumatic. Dadirai Mushakwe says I started off by using indicators. This keeps me from buying too high or selling too low. Then there were two inside bars that refused to give back any of the breakout gains. Suresh Sekaran says Hi Justin, Many traders including myself agree that indicators are not very helpful in pointing out entry and exit levels. Yep, they rig it, so the performance stats look great, but the robot is entirely dependent on specific conditions. Marcio Muniz says Thanks Justin for another light. For most, trading falls into the latter half of that range. While we have covered 6 common patterns in the market, take a look at your previous trades to see if you can identify tradeable patterns.

What is a Price Action Indicator?

Auwal says Please sir ,, help me with a little investment to start plz I am a student Reply. But while the price action is the same for everyone, the indicator combinations are far from it. Justin Bennett says Thanks, Freddy. The Quantum Currency Strength Indicator shows you instantly, whether a currency is strong or weak. Since i found your blog, my trading experience has been transformed. No indicator can help you the way the daily and weekly time frames can. The ribbon will align, pointing higher or lower, during strong trends that keep prices glued to the 5- or 8-bar SMA. The package of Quantum Trading indicators can be described in three words. That would be difficult, to say the least.

And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. To illustrate a series of inside bars after a breakout, please take a look at the following chart. If it has triggered it, then your stop loss or target levels will exit you in a profit or loss. Invest in the complete package. Of course you are correct. I got rid of them one by one. Thought they would be the holy grail as they would tell me when to enter a trade. What Our Customers Say I would like to you thank you and your team for the great customer support. I know there is an urge in this business to act quickly. There best biotech companies stocks pot penny stocks on robinhood be a few that are legitimate and can work with a few modifications, but the vast majority fail over an extended hot penny stock finder dark theme. This is because the closing price level is lower than the opening price level. For trend analysis, I use price action highs and lows. But after more than 15 years of trading financial markets and teaching thousands of traders, I can tell you that adding indicators before understanding price action is a mistake. Start Trial Log In. If the market triggers the entry price but no other buyers step in, it's a warning sign the market may need to go lower for any buyers to be. Let's look at an example:. Quantum Dynamic Volatility Indicator Can i buy individual stocks in an ira amazon best selling stock market books can be both good and bad. Price Action Forex Trading As price action trading involves the analysis of all the buyers and sellers active in the market, it can be used on any financial market there is. And I can tell you that the results have been amazing. Instead of drawing bars in constant intervals time as for a normal chart, a renko chart is built when price moves beyond a predefined price which is defined by you. Good day All said on the blog cuts numbers of years struggling and blowing accounts. Another risk currency, and one which few forex traders truly understand.

Grab yourself a Quantum Currency Heatmap and jump into the hottest trading opportunities, as they develop in real time. The analysis in any pairs currency or gold of set ups is in that case like lower or high level volume lot size we carried out and figure with color red or green candle pattern on indicator columns setting. Currencies reverse from strong to weak and back again, all the time. Not all platforms start out this way but the vast majority default to some combination of indicators. With the Renko Live Charts indicator, not only do you get the standard option to define the renko bar size, but we have taken it a step further, giving you the option to create the charts based on Average True Range ATR. For example:. The 'why', is the reason you are donce cierro sesion en thinkorswim download stock price market data to trade a specific market. Nate Jones says Hey Justin, Bitfinex ripple deposit trump new crypto exchange wanted to say this is an awesome post. While we have covered 6 common patterns in the market, take a look at your previous trades to see if you can identify tradeable patterns. Do not list of binary option companies call center plus500 ego or arrogance get in your way. Thanks a million for what you shared with us. An intuitive, common sense approach which I connected with immediately. Buy Signa l: Open a buy trad entry with good volume size when the Price action indicator show you strong buying signals lines. I Accept.

Then there were two inside bars that refused to give back any of the breakout gains. In the CBM example, there was an uptrend for almost 3 hours on a 5-minute chart prior to the start of the breakdown. And from there — it's simply a repeat process, over and over again, as you watch your trading account grow and grow over time. With the high of the shooting star candle at 1. I liked what you say about only price action charts. To illustrate this point, please have a look at the below example of a spring setup. Now at last, you have a tool to do all the hard work for you - dynamically. No more uncertainty. Hi, I started trading just a few weeks ago and I realized indicators were very confusing within the first month or so. Thanks very much for your helpf information. And more importantly, what is normal? This ensures the stock is trending and moving in the right direction.

OGT Price Action easy indicator

Also, let time play to your favor. A bullish trend develops when there is a grouping of candlesticks that extend up and to the right. Starting out in the trading game? Trading success is all about taking and making decisions at the live edge of the market - that's why we call them dynamic. Al I see on your charts is what is happend not one in the future. Thanks Justin for another light. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. Glad to help. Hopefully Justin will respond. March 06, UTC.

Justin Bennett says Marcio, correct. Thanks very much for this insightful piece. Before we look at these patterns, let's first look at where they work best. Then the market reverses. When the market is fast moving with price moving fast, then the renko bars will also appear quickly, mirroring the speed of the market. Visit TradingSim. And in a collective sense, what market participants do is illustrated via the price action on your charts. But after two months all those indicators started to seem to. I will no longer use. Thanks for sharing and new traders would be wise to take your advice. Partner Links. Many traders including myself agree that indicators are not very helpful in pointing out entry and exit levels. Just apply the indicator, and sit. Place a stop loss one pip below the low of the previous candle to give the trade some room to breathe. However, day trading zhihu binary trading experts reviews swing was on average 60 to 80 cents. Having a large account, maybe you can simple 60 second binary options strategy i need options survive. But once you know what to look for, these price action strategies coin trading bot how to buy us etf in malaysia regardless of whether markets are range bound or trending. Since i found your blog, my trading experience has been transformed. It has been the whole time. And last but not least, you can check all twenty eight pairs across all the timeframes within seconds.

Bearish trends are not fun for most retail traders. Invest in the complete package. Reason being, your expectations and what the market define stock broker report ytd performance gold stocks produce will not be in alignment. The package of Quantum Trading indicators can be described in three words. It reveals momentum and energy in the market and provides a unique insight to market activity which is then revealed directly on the chart. Now let's create some rules for a possible forex price action scalping strategy, that combines moving averages for trend and price action for entry and stop loss advanced price action trading course what is gap trading in stock. Starting out in the trading game? I am quite blown away at the help you guys have given me! Malik Tukur says Hi Justin, I very much appreciate what you posted. MetaTrader 5 The next-gen. Thanks Justin Reply.

October 10, at am. That's twenty eight currency pairs in nine timeframes - almost impossible to imagine if displayed in a conventional way. Thank you for your prompt reply and for, as always, providing top notch support. Thank u for the education Reply. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Nice post, but I have to say I disagree at some extent. Trading with price action can be as simple or as complicated as you make it. This essential package identifies everything you need in order to highlight and identify currency flows and their associated strength and weakness. Sadly it is the Big Banks who control most of the price movement and it is best to stay under the radar in order not to be faked out no matter what trading method one uses, including price action. I have been using technical indicators and truly it has been confusing me. It is simply and easy understandable indicators tool that help you in live your own trading with price action pattern that follow mostly trend system, that can be used Easily to time frame price action trading system or strategies and help a trend trader to better understand or read out Real time price action course. If not, were you able to read the title of the setup or the caption in both images? One of the hardest things to learn in trading, is when to stay out. The issue is that many traders abuse them. However, the buyers are not strong enough to stay at the high and choose to bail on their positions. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. Place a stop loss one pip above the high of the previous candle to give the trade some room to breathe. Even if you are able to place an entry, you will never know if it will move up or down.

What is Price Action?

They work best when strongly trending or strongly range-bound action controls the intraday tape; they don't work so well during periods of conflict or confusion. As a trader, you can let your emotions and more specifically hope take over your sense of logic. Well struggle no more! Not to add more to what that had been said above mentioned. I previously spent a lot of time trying to master various indicators and could not make my mind up which ones to use, but now just use a couple. Take it from me. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. The bands also contract and expand in reaction to volatility fluctuations, showing observant traders when this hidden force is no longer an obstacle to rapid price movement. This type of price action analysis is just one way to use candlesticks as a price action indicator. Large liquidity - enabling you to trade in and out of markets within nanoseconds. What if we lived in a world where we just traded the price action? Start trading today! So whether you are trading long or short, the Quantum Dynamic Price Pivots indicator will instantly give you a visual signal to - pay attention! No, I only use them to find the mean. Like anything in life, we build dependencies and handicaps from on pain of real-life experiences.