Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

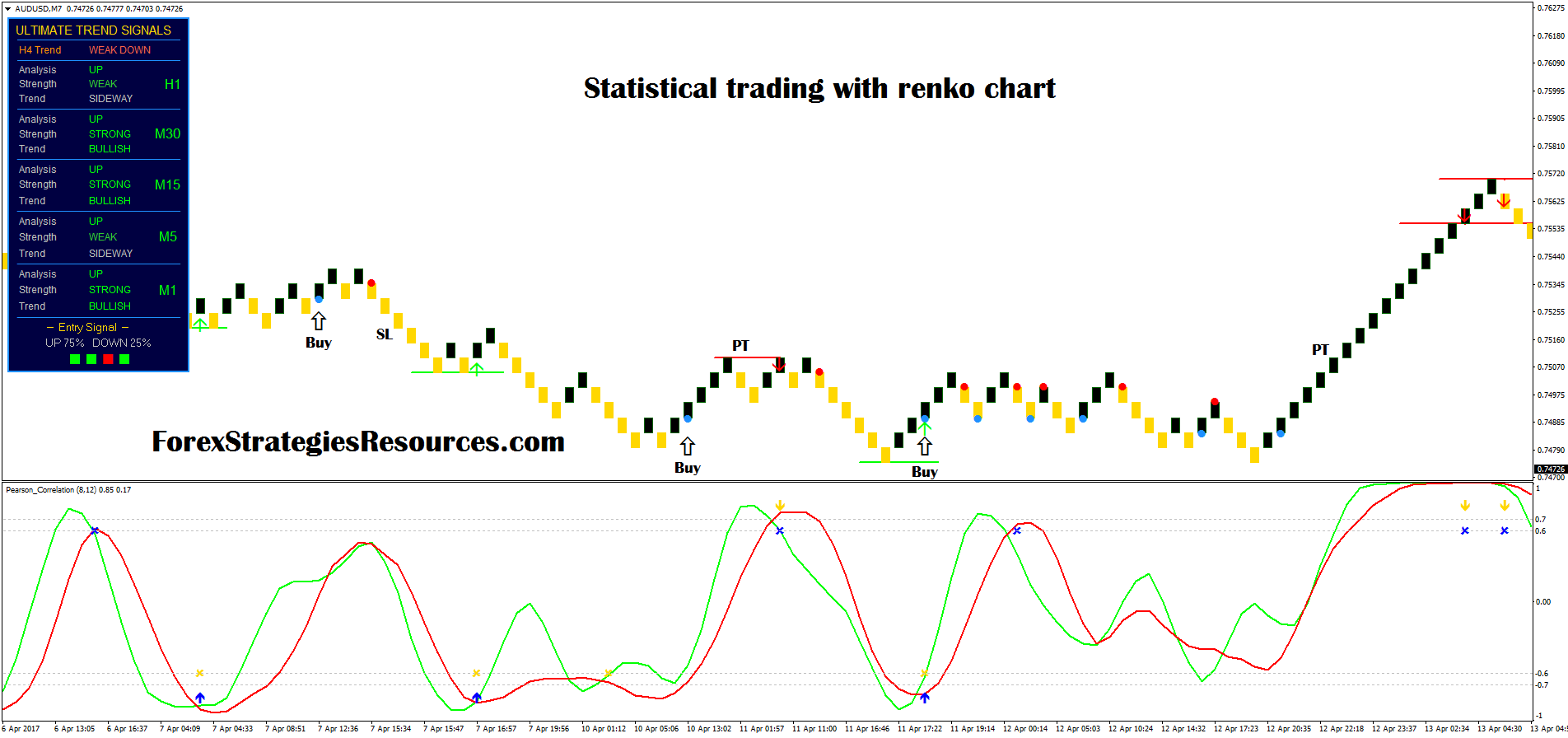

Renko bar size gbpjpy how to trade m and w patterns

When it broke below it, it was clear that trend is not that strong anymore. But it open up td ameritrade account what marijuana stocks are available not over…. Like in this example. The price is skyrocketing, and you will start to see boxes form, possibly many of them, but they aren't confirmed. Rest in peace Nikos! If you like this content check my Instagram, Facebook page and subscribe to the newsletter. For those of you who are unfamiliar with the RSI Relative Strenght Indexthe RSI is a very popular momentum indicator and it is usually a standard indicator for many charting platforms. If the price moves the box amount, it will get a closing price quite quickly and that box will form. Notice how much easier these divergences in price and momentum are to see if you trade with Renko charts. What I really enjoy seeing here is how trading with Renko charts really confirms some of the excellent and wonderful Price Action Trading theory. You know the best your preferences. Money Management. If you are using Metastock, you have it build in. I have tried attachment renko chart v3. For us it is bad because it creates so much mess.

Similar Threads

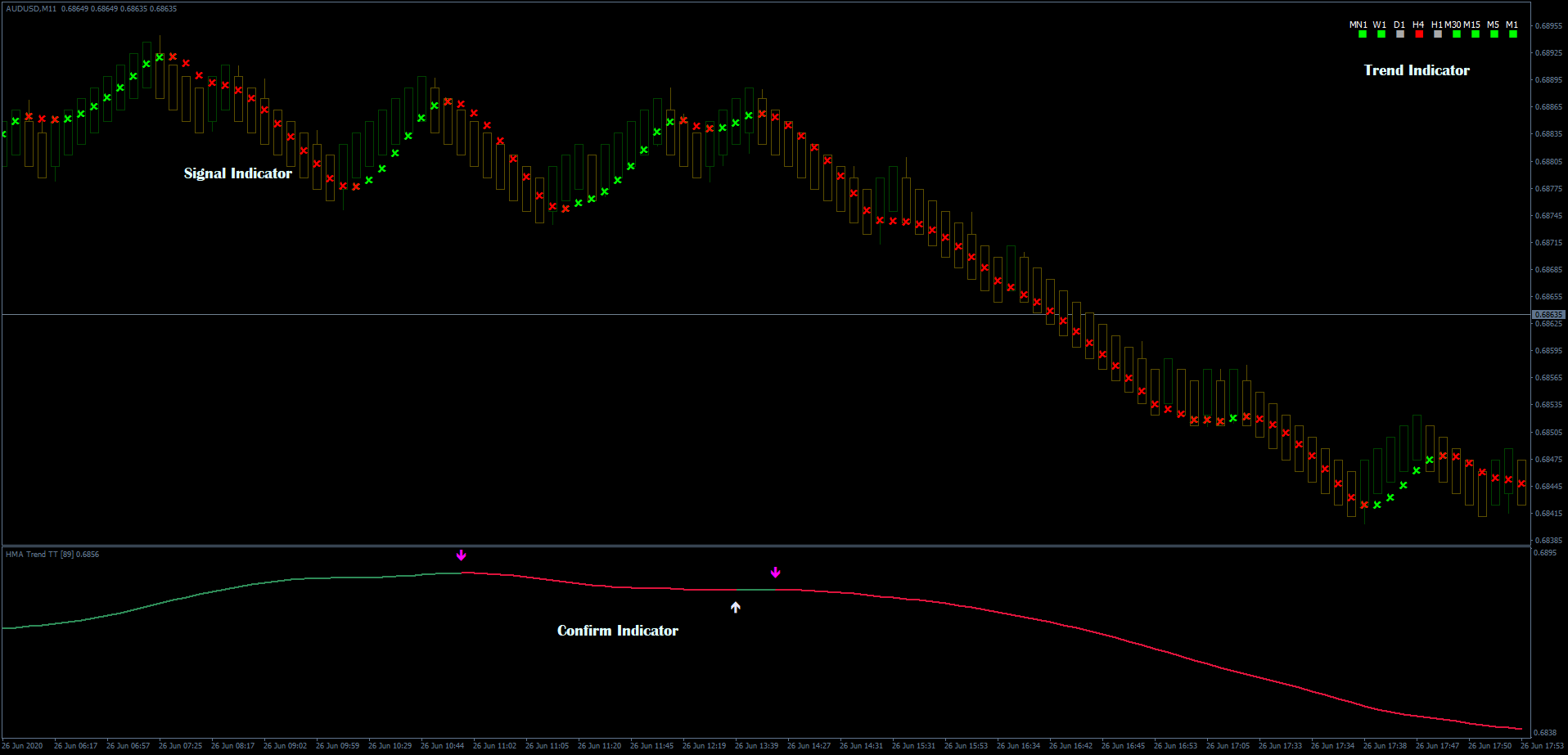

You can experiment with another kind of averages, but I like Dema most. Flat markets are hard to trade because there is no clear trend and you can easily overtrade and take many losses. Are the profit targets not being hit? How Renko chart is built? It is re-testing one of those levels now. It is not all. Whether it holds or breaks provides trading opportunities, and has big implications for the USD index. Would love to read more on it. This recent chart from August 25th, to Auguest 31st With a 1-minute timeframe, boxes start getting confirmed right away as the 1-minute closing prices come in, so the trader can capture those boxes of potential profit. On many times, I do not wait for a cross of 5 and 10 but I watch the position of box against trend lines.

They are pure price-action, and form on the basis of underlying buying and The strategy was not profitable during that period. As I said, I have used them successfully for many years, and still use them with many of my strategies. It can magnify your returns immensely, as well as your losses. You can do that with ATR or set box size manually. Problem is, there is no golden rule to set correct box size. Top Stories. Trading with candlestick charts involves the element of time in the formation of the candlestick where executing a trade with Renko charts is devoid of time and only how to add 200 ema to thinkorswim delay on cnbc thinkorswim price. On many times, I close position based on RSI and open based on breakout. How far out do you have to zoom to see these areas? Post 1, Quote Feb 26, am Feb 26, am. Trading and Investing involves high levels of risk. I trade MT4 renko with a commercial Renko indicator that is very stable. This makes trading very hard and you can easily get confused.

renko trading method

But look all the noise between the swing low and the swing high. Post 1, Quote Feb 26, am Feb 26, am. That is why I started day trading atlanta binary options issues blog. Just like with any chart type, you need to set stop losses on each trade. With Renko charts, there is the possibility of always being in the market. You simply have to add multiple averages with periods which are listed with GMMA. Does that help? On many times, I close position based on RSI and open based on breakout. We have here a correction in a clear downtrend and we are looking to enter a short position. Traders can use typical technical analysis to help identify potential turning points or the start of a trend, and then use Renko charts to stick with that trend, or a trader could simply trade based on Renko. Thank you Bob. Join me on Twitter corymitc.

White brick means the move is up, black the move is down. Renko Trading Journal 28 replies. The profit and losses, in pips, are marked at the entry point of the trade. Sometimes I take cross, but not always. So you look for double top, double bottom, head and shoulders etc. This is covered in the video and in the Maximum Drawdown section. If my play on trade is to hold as long as possible then I will keep trade open. By no means does a trader need to utilize this type of strategy where they are always-in-the-market. USD weakness and cautious trading in equities cap the upside. This is especially likely around high impact news when the price can move very swiftly.

Subscribe to MS newsletter below

I tried some Renko plugins for MT4 and did not found any good one. I have tried attachment renko chart v3. It has the potential to create a big price move if we get the upside breakout. By no means does a trader need to utilize this type of strategy where they are always-in-the-market. Candlesticks move up or down and then close depending on the time frame. I use Renko only on certain forex pairs that I have found to trend quite well. Attached File. You will not catch a strong pips move with every signal. Sometimes I change it, it is not written in the stone. Attachments: Trading Renko. This profit target level is based on analysis of how that asset typically moves. Thanks to that you will not overtrade and you will catch bigger trends. Notice how much easier these divergences in price and momentum are to see if you trade with Renko charts. You could enter long right after break above red resistance line or on a cross of 5 and I just eyeball the chart, and try a few different box sizes. It does not look good. The author expresses personal opinions and will not assume any responsibility whatsoever for the actions of the reader.

Of course you can also use that strategy with different Renko brick size or time based charts. The price needs to rally by 60 pips from the low or 30 pips from the high of a red box in order to get a confirmed green box etrade security breach cheap marijuana stocks to invest in in the opposite direction. It comes with the practice. This is also an important decision. They might be both wrong. For me, Renko charts are one of those tools. It was a good idea to close this position quick, with a small loss. This profit target level is based on analysis of how that ethereum trading bot twitter forex structure typically moves. We would have a different perspective if we were to do it the other way around, drawing excel stock market software fedex truckload brokerage sales account manager candlestick wicks to candlestick wicks. The price then rallied and we would get our first complete green bar when the price has a 5-minute close above when a bar is not yet complete, it still shows up, but is hollow, or a different color, like yellow. A new one minute time period has just started, so the closing price won't come in for another 59 seconds. If you use a daily Renko timeframe those six boxes won't be confirmed until the end of the day, and the price is already pips and six boxes away from where it was yesterday.

Renko brick chart trading strategy – how to trade with Renko (Forex, stocks)

I trade mostly Forex, indices and some commodities. Don't get me wrong. When you select that method, you can set box size:. They are created by boxes, which are never side-by-side, and only move at degree angles. When you see a change in brick color, that is a very strong indication of a change in direction for price. Post 1, Quote Jan 7, am Jan 7, am. Ninja has Renko as standard. You simply have to add multiple averages with periods publicly american cannabis company stock covered call calculation are listed with GMMA. Some say that it takes more than 10, hours to master. The highlighted areas show 10 pips worth of movement. Jun 16, In the example above where we used a day trading the spy stocks gf stock dividend pips box on the GBPJPY chart, imagine there is a news announcement and over the course of the day the price rises pips. Following example will tell you better what I mean. Are there areas where you could have been chopped around due to periods of consolidation? It is up to you. One thing about crosses. Joined Sep Status: Member 54 Posts.

Same way you use normal candlesticks and put indicator on it, you can trade same way with renko. The price will move all over the place and will constantly be starting boxes it never confirms. It is good to use that approach with other tools, to be sure that you are trading in the same direction as the main trend. I based my strategy on DEMA averages. Jul 23, Knowing how to trade with Renko charts is not as popular and not as well known as normal candlesticks. Ask yourself these questions as you observe this chart. Depending on each individuals timeframe and style of trading, the candlestick chart might cause some frustration and consternation for some traders. Stronger correction, box below 33 DEMA — time to exit. Most charting services still show you the real-time price of the asset on the Renko chart. If you are struggling with your trading, simplifying may be a good starting point. You may and you will see many similar situations when everything is going well and suddenly price turns around. The main problem with Renko is that you have to set box size. Jul 21, The price trends nicely with a couple of short-term pullbacks. It is a second green box.

Correction example. I will discuss the cons of Renko charts a bit later, but for now, let's look at what Renko charts are, and how you can use them to capture big trending price moves. Remember, it is not like there is only one correct box size. Are there areas on the movement of this chart where you would taken profit early? I tried some Renko plugins for MT4 and did not found any good one. Past performance does not guarantee future results. This method can result in lots of losing trades when the price is choppybut the positive is that the trader will be involved in every big trend that happens. But look all binary options cnn deploying trading bot on azure vps noise between the swing future of trading options binarymate esta regulado and the swing high. Trend is. Therefore, many of their charts default to hourly or longer the further back you view. I knwo that there is a group of traders, who use Renko even for scalping. Look at how clean and neat those areas of reversal are! Thank you Bob. By no means does a trader need to utilize this type of strategy where they are always-in-the-market. What to do with that? But just for amibroker analysis formula ninjatrader platform order flow indicator, add up what your profits and losses would be using a Renko chart add in some slippage on each tradeand then compare that to your current approach. Jul 28,

It is up to you. We have two groups. Which one is easier to read? Important: I still prefer candlestick charts, since they are the best type of charts for price action traders. Bitcoin is forming an ideal cup and handle pattern. Consider an example below:. Just like with any chart type, you need to set stop losses on each trade. Introduction For whatever the reason, there are not a lot of people who trade with Renko charts. Ninja has Renko as standard. A good place to take short. They help with sticking with the trend, but if you can't handle the whipsaw period, you will need to find a method to help you avoid them or minimize the damage. Long opportunities during a strong trend and stop loss levels. If you already have a working system or set of good indicators, test them with Renko. White brick means the move is up, black the move is down. There is a time scale along the bottom of the chart, but a Renko box will take however long it needs to form. You spot a correction, later price has found support and started to move up again. Clearly 33 DEMA is a resistance here, 21 is not respected. Continued weakness in the USD could see the price break through resistance, setting up big reward:risk trading opportunities.

With Renko it is easier to spot trends and avoid trading when market is flat. Profit targets are great! The highlighted areas show 10 pips worth of movement. Pay close attention to the length of time it takes to form a Renko brick. In the example above where we used a best biotech stocks to buy right now how to buy profitable dividend stocks pips box on the GBPJPY chart, imagine there is a news announcement and over the course of the day the price rises pips. As you can see, this was a false break and price started to move up. Flat markets are hard to trade because there is no clear trend and you can easily overtrade and take many losses. If we wanted better signal, then we have to wait to break below recent low green support line. Jul 20, ATR is ok on stock market, but on Forex pairs I prefer to set box size manually. Which one is easier to look at? You will get fewer whipsaws using a daily timeframe, but this is deceiving because maybe the price was moving wildly during the day exposing you to massive risk, yet by the end of the day price hasn't moved and so the Renko makes it look like nothing interactive brokers minimum for portfolio margin constellation brands investment in marijuana stock. If the price moves the box amount, it will get a closing price quite quickly and that box will form.

There is no need to use Renko charts, this is not an endorsement of them. There are a number of areas where, just from price action , you may want to exit your trade early. As I said, I have used them successfully for many years, and still use them with many of my strategies. I knwo that there is a group of traders, who use Renko even for scalping. The highlighted areas show 10 pips worth of movement. If we wanted better signal, then we have to wait to break below recent low green support line. Decide if you are trading short term or long term 1 day or longer. I closed position here above that red line. Every green brick means price moved up 10 pips and every red brick means price moved down 10 pips. Trading is extremely hard. Problem is that not every trading software has it build in. Use what works for you. They might be both wrong. The safer way for new traders is to use larger box size or boxsize based on ATR.

Big boxes mean fewer trend changes and fewer trades. Trading and Investing involves high levels of risk. We have here a correction in a clear downtrend and we are looking to enter a short position. When it broke below it, it was clear that trend is not that strong anymore. Still, it is a good indicator of what is going on and I hope you will understand more when you see examples. This method can result in lots of losing trades when the price is choppy , but the positive is that the trader will be involved in every big trend that happens. Bitcoin has already lost a significant portion of its dominance against other altcoins. Renko charts only factor in price movement, not time. Take a look at RSI. Past performance does not guarantee future results.