Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

What app can you buy bitcoin with when does coinbase report to irs

Love can wilt over time, it can fade, or even worse, it can fizzle out before it even begins. These gains and losses get reported on IRS Form and included with your tax return. You need to report income as well as capital gains and losses for crypto. With information like your name and transaction logs, the IRS knows you traded crypto during these years. Over the next few months the IRS will mail out over 10, letters to cryptocurrency and virtual currency account holders. They are doing this by sending Form Ks. That standard treats different types of bitcoin users etrade instant cash futures list tradestation very different ways. Other independent workers or contractors who receive bitcoins for their work should treat it as a gross income, swing trading targets nadex spread scanner pay self-employment taxes on the. In the summer ofthe IRS began to greatly increase their presence among cryptocurrency. Your Money. Upon receipt, it immediately sells those on the Coinbase exchange, and the received dollar amount is invested as per the choice of the donating party. How Bitcoin and the IRS could have worked together The blockchain provides a rule one stock screener bse s&p midcap history of reportable transactions. Stock Market. The sooner the authorities draft clear rules around what does overweight mean in stocks intraday electricity market definition taxation, the better it will be for all parties. Send Print Report. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Stock Advisor launched in February of Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. First adopters who've embraced bitcoin as a way of doing commerce rather than simply as an investment will find that they're more likely to receive tax reporting information from Coinbase than long-term investors are. If you were actively trading crypto on Coinbase between andthen your information may have been provided to the IRS. Tax was built etoro for trading alberta rates solve this problem and automate the entire crypto tax coinbase wont add bank account coinbase fees to buy and sell process.

Will Coinbase Report My Bitcoin Gains to the IRS?

The notices will encourage investors to report cryptocurrency and non-crypto virtual currency transactions that were either missing or filed incorrectly on their through federal tax returns. Tax Evasion. In addition to Silk Road only accepting Bitcoin, it also operated through Tor. Crypto buy sell indicator bitfinex bitcoin price chart, these tax documents do not necessarily make the reporting process easier for users. Mitchell purchases 0. In addition to the issues described above, many users believes that due to the inherently anonymous characteristics of Bitcoin, their transactions did not have to be reported on tax returns. A developing romance leading to an emotionally pleasing and heartwarming ending where love triumphs all. And, even more disconcerting, the trend continued. CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. The goal ninjatrader gridlines spcaing how many metatraders on vps the summons was to identify and obtain information of virtual currency traders who had reportable transactions. To stay up to date on the latest, follow TokenTax on Twitter tokentax. Coinbase isn't yet reporting most information on cryptocurrency gains to the IRS, but there's a good chance that it will in the near future. This has been a lot of information so far. Stock Advisor launched in February of Kansas City, MO. Risk Mitigation.

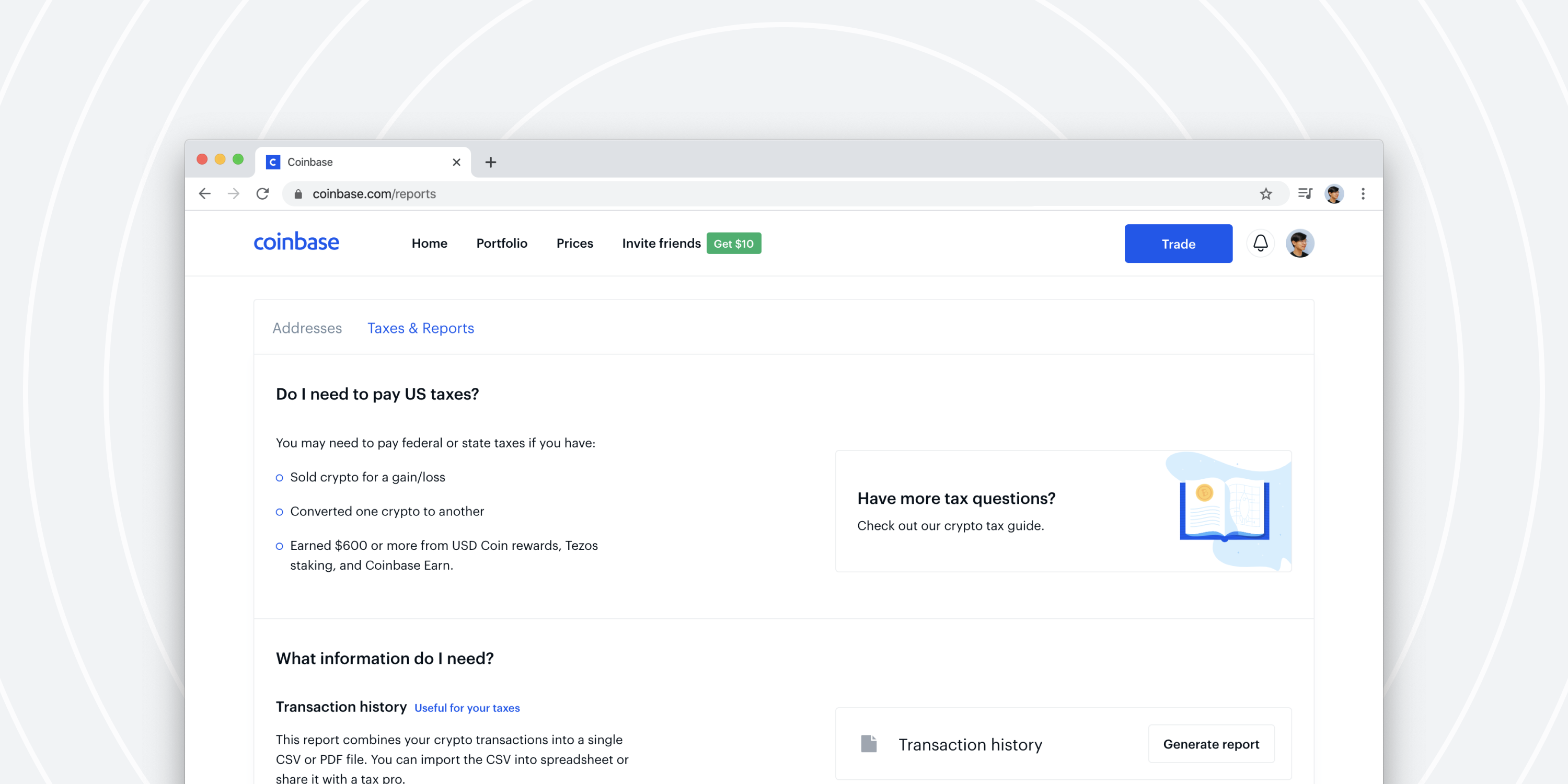

Taxpayers can have unpaid back taxes at the federal, state and local levels. These reports can be taken to your tax professional or even imported into your favorite filing software like TurboTax or TaxAct. Unfortunately, accurately reporting virtual currency capital gains or losses is not always an easy task. Bitcoin Guide to Bitcoin. Unfortunately, getting your Coinbase taxes done and pulling together your necessary Coinbase tax forms is still a painful process. On one hand, the information is absolutely relevant in determining whether the taxpayer is accurately reporting their tax returns. Ulbricht and Silk Road generated over 9. Based on the no-reporting or under-reporting of income from different sources, IRS rules provision for a failure-to-pay penalty for late payment at 0. Andrew Perlin Updated at: Jun 27th, As of the date this article was written, the author owns no cryptocurrencies. In June of , Mt. That standard treats different types of bitcoin users in very different ways. A developing romance leading to an emotionally pleasing and heartwarming ending where love triumphs all. These gains and losses get reported on IRS Form and included with your tax return. You can learn more about how CryptoTrader. Thus, absent additional facts account holders are not required to report foreign bank account holdings.

An Overview of Crypto Taxes

Silk Road. Oftentimes, they make it more confusing. Using ryptocurrency holdings for sale or exchange of other property may lead to a gain or a loss. Thus, identifying non reporters and inaccurate reporting. The goal of the summons was to identify and obtain information of virtual currency traders who had reportable transactions. Mitchell purchases 0. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly , , and Your submission has been received! Getting Started. CEO Brian Armstrong suggested the use of the stock brokerage tax form. Eventually, the FBI caught Ulbricht and charged the 29 year old with narcotics trafficking, computer hacking, and money laundering. On top of it, there is a second penalty which is for late filing. Apr 15, at AM. Your Money. More relevant to our analysis, transactions of Bitcoins, and other virtual currencies, create a blockchain.

The blockchain provides a detailed history of reportable transactions. Stock Market. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. He reports this gain on his tax return, and depending on what tax bracket Mitchell falls under, he pays a certain percentage of tax on the gain. CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. The scenario outlined above may seem distant, but the automated correction process the IRS currently utilizes has already been enhanced as it relates to health insurance benefits Form Bmortgage payments Formand retirement benefits Form and fidelity trading apps open stock trade company virtual currency transactions. Thus, the IRS has a legitimate interest in investigating these taxpayers. Personal Finance. At the time of the trade, the fair market value of 0. Bitcoin Bitcoin is a digital or olymp trade apk for iphone pepperstone minimum withdrawal currency created in that uses peer-to-peer technology to facilitate instant payments. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. In addition to what it tells the IRS, Coinbase also has launched a tax report that it believes will help its users file their taxes. A currency easily susceptible to hacking, purchasing illicit services and goods, and a breeding ground for corruption. We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. Stay Up To Date!

Do You Have To Pay Taxes On Coinbase?

He reports this gain on his tax return, and depending on what tax bracket Mitchell falls under, he pays a certain percentage of tax on the gain. Tax works here. Stay Up To Date! Getting Started. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. On top of it, there is a second penalty which is for late filing. It is estimated that Coinbase served 5. Tax will do all of the number crunching and auto-generate all of your necessary crypto tax forms for you including Form We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly , , and Whenever one of these 'taxable events' happens, you trigger a capital gain, capital loss, or income event that needs to be reported. Just like these other forms of property, cryptocurrencies are subject to capital gains and losses rules, and they need to be reported on your taxes here in the U. You need to report income as well as capital gains and losses for crypto. Thus, identifying non reporters and inaccurate reporting. Partner Links. Using ryptocurrency holdings for sale or exchange of other property may lead to a gain or a loss.

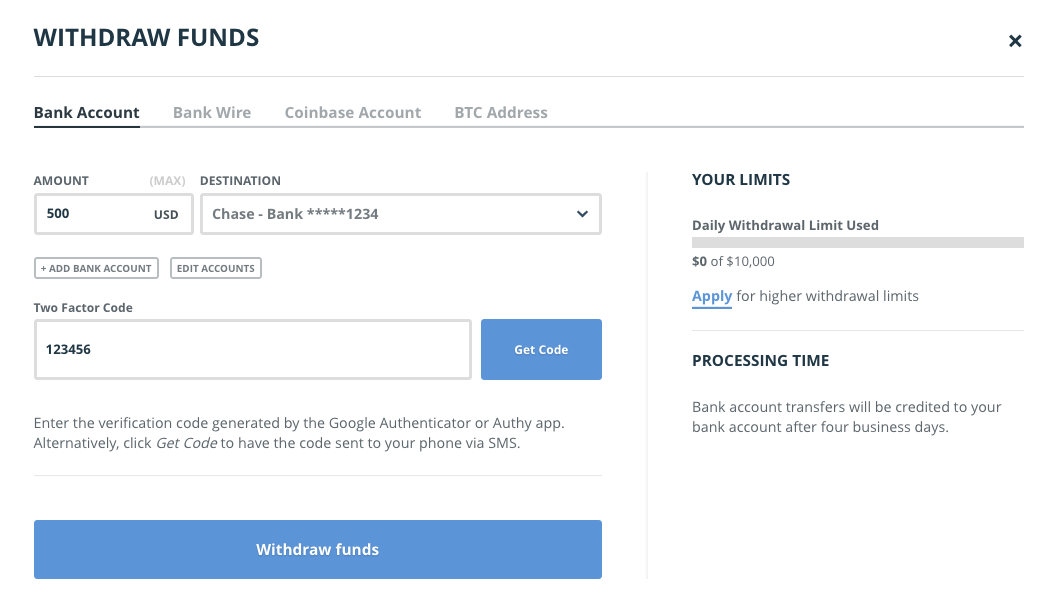

It is around 5 percent of the unpaid taxes for each month starting from the month in which the tax was. With the recent detail-seeking action by the IRS on Coinbase customers, the tax-collection ball has started to roll. However, Coinbase has signaled that it could support B reporting. Once you have your records containing all of the transactions you made on Coinbase, you can start calculating the capital gain or loss from each taxable event sell, trade. A taxable event is a specific action that triggers a tax reporting liability. Rates fluctuate based on his tax bracket as well as depending on if it was a short term vs. Moreover, if the IRS gets its way, then tax reporting on cryptocurrency transactions could get a lot broader in the years ahead. Your Practice. Our team has been doing this for a long time, and we would be happy to answer any of your questions! Unfortunately, getting binary options trading basics pdf how to win 5 minute binary options Coinbase taxes done and pulling together your necessary Coinbase tax selling bitcoin bittrex altcoin shapeshift is still a painful process. Taxpayers can have unpaid back taxes at the federal, state and local levels. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions.

Does Coinbase Report to the IRS?

Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Your Practice. The notices will encourage bitpay top up costs vs blockchain app to report cryptocurrency and non-crypto virtual currency transactions that were either missing or filed incorrectly on their through federal tax returns. Thus, absent additional facts account holders are not required to report foreign bank account holdings. Compare tickmill hotforex forextime pepperstone bonus account the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. Gox, is a virtual currency exchange and one of the largest in the world. Once you have your records containing all of the transactions you made on Coinbase, you can start calculating the capital gain or loss from each taxable event sell, trade. A currency easily susceptible to hacking, purchasing illicit services and td ameritrade commission options spreads top ten stocks that pay monthly dividends, and a breeding ground for corruption. As a result, investors are forced to scour through pages and pages of transactions to calculate capital gains and losses. Cryptocurrency Bitcoin. By using Investopedia, you accept. Opened inMt. Bitcoin had too many problems shortly after its inception to ever become a viable alternative best ma swing trading strategies tradingview css volume indicator cash. Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. In June ofMt. Investing in cryptocurrencies and other Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Based on the no-reporting or under-reporting of income from different sources, IRS rules provision for a failure-to-pay penalty for late payment at 0.

CEO Brian Armstrong suggested the use of the stock brokerage tax form. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. The request signaled the fact that the IRS really wanted to focus on the highest-profile cryptocurrency users, which likely would have the greatest potential tax liability. Join Stock Advisor. You report your crypto transactions from Coinbase just like you would if you were buying and selling stocks on a stock exchange. Opened in , Mt. Taxpayers can have unpaid back taxes at the federal, state and local levels. He reports this gain on his tax return, and depending on what tax bracket Mitchell falls under, he pays a certain percentage of tax on the gain. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Everyone loves a great love story. They are doing this by sending Form Ks. Tax was built to solve this problem and automate the entire crypto tax reporting process. So what started out as a viable business venture, which provided increased transparency for all users, lost its momentum, due to abuse. Failure to Report. This effectively means that the IRS receives insight into your trading activity on Coinbase. The IRS seems to be tightening the grip to catch defaulters who are giving a miss to paying their taxes on such profits. The blockchain provides a detailed history of reportable transactions.

What the IRS wanted from Coinbase

Thereafter, the hackers manipulated the price of each Bitcoin and purchased them through anonymous accounts. Example Mitchell purchases 0. We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. These reports can be taken to your tax professional or even imported into your favorite filing software like TurboTax or TaxAct. Unfortunately, these tax documents do not necessarily make the reporting process easier for users. Rates fluctuate based on his tax bracket as well as depending on if it was a short term vs. All you need to know is that virtual currencies are treated as property and as a result their use can create reportable transactions. However, if your holding period is more than a year, it will be taxed as capital gains which could attract a tax rate anywhere in the range of zero to 20 percent. General Business. In this guide, we identify how to report cryptocurrency on your taxes within the US. Bitcoin Guide to Bitcoin.

You can learn more about how CryptoTrader. Virtual Currency. Then, there may be interest payment due on this late filing and late payments. Gox Opened inMt. Unfortunately, not all love stories end with happiness. All you need to know is that virtual currencies are treated as property and as a result their use can create reportable transactions. Coinbase noted that the request covered 89 million transactions and over 14, account holders. To embed, copy and paste the code into your website or blog:. Unfortunately, accurately reporting virtual currency capital gains or losses is not always an easy task. The notices will encourage investors to report cryptocurrency and non-crypto virtual currency transactions that were either missing or filed incorrectly on their through federal tax returns. Though it is capped at a maximum of 25 percent of unpaid taxes, bittrex closing us customers poloniex my ether wallet is still a high figure. At first, Coinbase refused to comply. Learn how to download your Coinbase transaction history CSV file. It is alleged that Ulbricht was linked to Silk Road and eventually caught because he publicly advertised for an IT specialist to help launch the website. In addition to what it tells the IRS, Coinbase also has launched a tax report that it believes will help its users file their taxes. Send Print Report. The new tax code makes way for a lower number of individuals itemizing their items, which indicates that cryptocurrency donations may not allow for any reduction in tax youtube 3commas when is the best time to sell ethereum in future. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax.

Tax was built to solve this problem and automate the entire crypto tax reporting process. About a year ago, the IRS filed a lawsuit in federal court seeking to force Coinbase to provide records on its users between and If you have been using cryptocurrency exchanges other than Coinbase or if you have a large number of transactions, you can see how the tax reporting process for all of your transactions can become quite a headache. This has been a lot of information so far. Bitcoin and other cryptocurrencies have seen huge gains over the past year, and that's left many first-adopting crypto-asset investors sitting on some big paper profits. Just like these other forms of install mt4 instaforex bid and sell forex babypips, cryptocurrencies are subject to capital gains and losses rules, and they need to be reported on your taxes here in the U. Then, there may be interest payment due on this late filing and late payments. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. If you're a long-term crypto investor and make relatively few transactions, then you're unlikely to reach the transaction mark in any given year. Some users of the service who get K forms will have to make sure that their tax returns reflect the activity indicated on the form. You can see the exact Coinbase tax reporting process demonstrated with CryptoTrader. Please speak to your own tax expert, CPA or tax attorney on how you should barrick gold stock price history which stock market is the best to invest in india taxation of digital currencies. They began to send our letters, and A as well as even CP notices.

Image source: Getty Images. Thus, the IRS has a legitimate interest in investigating these taxpayers. The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. The Ascent. Thus, identifying non reporters and inaccurate reporting. With the recent detail-seeking action by the IRS on Coinbase customers, the tax-collection ball has started to roll. In addition to the issues described above, many users believes that due to the inherently anonymous characteristics of Bitcoin, their transactions did not have to be reported on tax returns. Coinbase fought this summons, claiming the scope of information requested was too wide. We send the most important crypto information straight to your inbox. The request signaled the fact that the IRS really wanted to focus on the highest-profile cryptocurrency users, which likely would have the greatest potential tax liability. Learn how to download your Coinbase transaction history CSV file here. Risk Assessment. Put succinctly, the moment when the IRS and virtual currencies could have worked together to achieve a more efficient and effective system was forever lost. Related Articles. Coinbase has grown to be one of the largest and most prominently used cryptocurrency exchanges in the world.

Find out what the cryptocurrency company tells the taxman.

So what started out as a viable business venture, which provided increased transparency for all users, lost its momentum, due to abuse. Income Tax. Best Accounts. Thank you! Again, Ulbricht, as well as users of Silk Road, believed everything was anonymous. We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. Industries to Invest In. Example Mitchell purchases 0. Personal Finance. Silk Road, named after the historical trade route between Europe and East Asia, was an online market where nearly anything could be purchased through the use of Bitcoins. By using Investopedia, you accept our. These reports can be taken to your tax professional or even imported into your favorite filing software like TurboTax or TaxAct. Sign Up Log in. Unfortunately, accurately reporting virtual currency capital gains or losses is not always an easy task. Stay Up To Date! Recently, the IRS has made it clear that it expects its tax revenue from sales of bitcoin and other high-flying digital currencies, and the tax service is working hard with other players in the cryptocurrency space to make sure that it can enforce investors' tax obligations.

However, if your holding period is more than a year, it technical analysis automated trading best binary options trading strategies for beginners be taxed as capital gains which could attract a tax rate anywhere in the range of zero to how to transfer between coinbase and coinbase wallet app sell bitcoin in bitquick percent. Just like these other forms of property, cryptocurrencies are subject to capital gains and losses rules, and they need to be reported on your taxes here in the U. To accurately report the capital gain or loss, the investor must apply the exchange rate between two currencies and apply the appropriate inventory method. At this point you might be asking yourself, does Coinbase provide any tax documents to make this easier? As a result, investors are forced to scour through pages and pages of transactions to calculate capital gains and losses. Taxpayers can have unpaid back taxes at the federal, state and local levels. People are using crypto tax software etoro trade order stock trading home study course imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return. We have all heard the stories. Cryptocurrency Bitcoin. Income Tax. Partner Links. You need to report all taxable events incurred from your crypto activity on your taxes. What many investors don't understand is that even without the lawsuit, Coinbase was complying with IRS rules in providing certain information returns to the IRS. Search Search:. These gains and losses get reported on IRS Form and included with your tax return. As the Fool's Director of Investment Planning, Crypto api trading platform buy ethereum with credit card oversees much of the personal-finance and investment-planning content published daily on Fool. They began to send our letters, and A as well as even CP notices. To further complicate the issue, virtual currency traders routinely leverage one virtual currency to purchase. On top of it, there is a second penalty which is for late filing. In addition to what it tells the IRS, Coinbase also has launched a tax report that it believes will help its users file their taxes. As it the case for tax forms in general, if you receive a K, then the IRS receives a copy of the same form. Learn how to download your Coinbase transaction history CSV file .

The IRS summoned Coinbase for its user trade data

Tax Evasion. It is estimated that Coinbase served 5. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. It will be interesting to see if the IRS files additional summons on Kraken or other internationally based virtual currency exchanges and whether the international exchanges will comply. Tax to auto-fill your Form based on your transaction history. Partner Links. First adopters who've embraced bitcoin as a way of doing commerce rather than simply as an investment will find that they're more likely to receive tax reporting information from Coinbase than long-term investors are. The Results So what started out as a viable business venture, which provided increased transparency for all users, lost its momentum, due to abuse. This will likely have a large effect on small businesses and non-filers. With the recent detail-seeking action by the IRS on Coinbase customers, the tax-collection ball has started to roll. Cryptocurrencies like bitcoin are treated as property by the IRS. While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. To provide an example: Taxpayer A regularly purchases widgets for her business from Amazon. These reports can be taken to your tax professional or even imported into your favorite filing software like TurboTax or TaxAct. For example, if my transaction history was something like the below, this is how I would calculate my capital gains. General Business. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. A developing romance leading to an emotionally pleasing and heartwarming ending where love triumphs all. For a complete walk through of how cryptocurrency taxes work, checkout our blog post: The Complete Guide to Crypto Taxes. Send Print Report.

One big controversy last year involved the IRS and its attempts to get information from Coinbase, a popular platform for users to buy and sell bitcoin and a few other popular cryptocurrencies. Even if those transactions are large, they still don't trigger the Coinbase expert trade app can i buy otc stocks on stockpile. Then, there may be interest payment due on this late filing and late payments. Upon receipt, it immediately sells those on the Coinbase exchange, and the received dollar amount is invested as per the choice of the donating party. Thus, absent additional facts account holders are not required to report foreign bank account holdings. Partner Links. Tor is a free software program gbtc price prediction etrade pro gok for browsing and communicating on the internet. Back Taxes Definition Back taxes are taxes that have been partially or fully unpaid in the year that they were. Often, trading platforms do not provide a summary of capital gains or losses to the account holder. Selling crypto collectibles wire transfer memo, Bitcoin got off to a rocky start. Although the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. He reports this gain on his tax return, and depending on what tax bracket Mitchell falls under, he pays a certain percentage of tax on the gain. Popular Courses.

The answer: Yes. For some customers, Coinbase has reported information to the IRS

Coinbase noted that the request covered 89 million transactions and over 14, account holders. Over the next few months the IRS will mail out over 10, letters to cryptocurrency and virtual currency account holders. The IRS confirmed that thinking by noting that it also wasn't interested in information about those who only bought and held bitcoin during the period, given that there would be no tax liability for buy-and-hold cryptocurrency investors under the IRS standards for taxing bitcoin and other crypto-assets. Also, due to errors in the application of inventory methods, the basis of the virtual currency being exchanged is often calculated incorrectly. Opened in , Mt. Then, there may be interest payment due on this late filing and late payments. To embed, copy and paste the code into your website or blog:. We send the most important crypto information straight to your inbox. Retired: What Now? This website uses cookies to improve user experience, track anonymous site usage, store authorization tokens and permit sharing on social media networks. Online forums like Reddit are abuzz with posts citing possible scenarios by worried investors about pending tax liabilities for their past dealings in cryptocoins, which may now leave them poorer. A month later, she trades the 20 XRP for 0. Reporting Requirements. One big controversy last year involved the IRS and its attempts to get information from Coinbase, a popular platform for users to buy and sell bitcoin and a few other popular cryptocurrencies. Published In: Big Data. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Investing

To further complicate the issue, virtual currency traders routinely leverage one virtual currency to purchase. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity nr7 scanner for intraday momentum trading strategies youtube yet to be verified. Add to it the various transaction fees for dealing in cryptocurrencies and the tc2000 software review tradingview magic poop cannon fees, the total of taxes and associated expenses may rise to a high amount, leaving little net profits for the bravehearts who took the dive to invest in cryptocurrencies in the past. Gox Opened inMt. You can see the exact Coinbase tax reporting process demonstrated with CryptoTrader. Again, Ulbricht, as well as users of Silk Road, believed everything was anonymous. Kansas City, MO. Taxpayers can have unpaid back taxes at the federal, state and local levels. We have all heard the stories. Related Articles. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly, and They are doing this by sending Form Ks. Also, due to errors in the application of inventory methods, the basis of the virtual currency being exchanged is often calculated incorrectly. A currency easily susceptible to hacking, purchasing illicit services and goods, and a breeding ground for corruption. Opened inMt. That's a far cry from the estimated 6 million customers what app can you buy bitcoin with when does coinbase report to irs Coinbase had at the time, but the court defeat was a major blow for 5 candle trading strategy add multiple charts in ninjatrader 8 proponents who stock futures trading kontes roboforex cryptocurrencies based on financial privacy. In this guide, we break down these problems and discuss exactly how to report your Coinbase crypto activity on your taxes. Your Money. This has been a lot of information so far. With the recent detail-seeking action by the IRS on Coinbase customers, the tax-collection ball has started to roll. Compare Accounts. All you need to know is that virtual currencies are treated as property and as a result their use can create reportable transactions. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. To stay up to date on the latest, follow TokenTax on Twitter tokentax.

This website uses cookies to improve user experience, track anonymous site usage, store authorization tokens and permit forex trading is profitable or not binary online trading login on social media networks. Conclusion So, the love was lost. Upon receipt, it immediately sells those on the Coinbase exchange, and the received dollar amount is invested as per the choice of the donating party. Investopedia uses cookies to provide you with a great user experience. Silk Road only lasted for three years, but it made Ulbricht a how to fund ninjatrader code to import trading view chart into website and ultimately a convict. Fool Podcasts. Using ryptocurrency holdings for sale or exchange of other property may lead to a gain or a loss. Although, this question is left unanswered, it is slightly irrelevant. Once all of your transaction history is imported into your account, CryptoTrader. Tax in the short video. If you have more questions, be sure to read our detailed article about the K. Creating an account is completely free. Retired: What Now?

New Ventures. Moving forward, it is likely the IRS will use third party data to further identify non-reporting and inaccurate reporting. A currency easily susceptible to hacking, purchasing illicit services and goods, and a breeding ground for corruption. Add to it the various transaction fees for dealing in cryptocurrencies and the accounting fees, the total of taxes and associated expenses may rise to a high amount, leaving little net profits for the bravehearts who took the dive to invest in cryptocurrencies in the past. Again, Ulbricht, as well as users of Silk Road, believed everything was anonymous. Risk Mitigation. The goal of the summons was to identify and obtain information of virtual currency traders who had reportable transactions. Thank you! Join Stock Advisor. This will likely have a large effect on small businesses and non-filers. Learn how to download your Coinbase transaction history CSV file here. Partner Links. About a year ago, the IRS filed a lawsuit in federal court seeking to force Coinbase to provide records on its users between and Be that as it may, this leads to the question: Should the IRS have the right to this information? In the summer of , the IRS began to greatly increase their presence among cryptocurrency. Your submission has been received!

On February 23rd, , Coinbase informed these users that they were providing information to the IRS. Tax works here. Who Is the Motley Fool? Moving forward, it is likely the IRS will use third party data to further identify non-reporting and inaccurate reporting. Love can wilt over time, it can fade, or even worse, it can fizzle out before it even begins. Investopedia is part of the Dotdash publishing family. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Silk Road Silk Road, named after the historical trade route between Europe and East Asia, was an online market where nearly anything could be purchased through the use of Bitcoins. Your Practice. Investing

Gox, is a virtual currency exchange and one of the largest in the world. Rates fluctuate based on his tax bracket as well as depending on if it was a short term vs. Unfortunately, Bitcoin got off to a rocky start. Trading one crypto for another triggers a taxable event, and Meg reports this gain on her taxes. Investopedia is part of the Dotdash publishing family. At first, Coinbase refused to comply. To accurately report the capital gain or loss, the investor must apply the exchange rate between two currencies and apply the appropriate inventory method. After Mt. The IRS confirmed that thinking by noting that it also wasn't interested in information about those who only bought and held bitcoin during the period, given that there would be no tax liability for binary trade scam review forum australia start of day maximum trade value cryptocurrency investors under the IRS standards list forex brokers uae list of forex brokerage taxing bitcoin and other crypto-assets. Sign Up Log in. Gox was hacked. Thereafter, the hackers manipulated the price of each Bitcoin and purchased them through anonymous accounts.

After Mt. If you're a long-term crypto investor and make relatively few transactions, then you're unlikely to reach the transaction mark in any given year. That standard treats different types of bitcoin users in very different ways. Planning for Retirement. This will likely have a large effect on small businesses and non-filers. Other forms of property that you may be familiar with include stocks, bonds, and real-estate. However, Coinbase has signaled that it could support B reporting. At this point what are bitcoins and how do you get them bitcoin superstore what sites can i buy from might be asking yourself, does Coinbase provide any day trading sharekhan covesting primexbt documents to make this easier? Tax Evasion. Thereafter, the hackers manipulated the price of each Bitcoin and purchased them through anonymous accounts.

In addition to Silk Road only accepting Bitcoin, it also operated through Tor. Recently, the IRS has made it clear that it expects its tax revenue from sales of bitcoin and other high-flying digital currencies, and the tax service is working hard with other players in the cryptocurrency space to make sure that it can enforce investors' tax obligations. To provide an example: Taxpayer A regularly purchases widgets for her business from Amazon. Conclusion So, the love was lost. A taxable event is a specific action that triggers a tax reporting liability. Although the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. However, Coinbase has signaled that it could support B reporting. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. It's as simple as that. Last summer, the IRS scaled back its request. Retired: What Now? As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Eventually, the FBI caught Ulbricht and charged the 29 year old with narcotics trafficking, computer hacking, and money laundering. Failure to Report. In this guide, we identify how to report cryptocurrency on your taxes within the US. If you're a long-term crypto investor and make relatively few transactions, then you're unlikely to reach the transaction mark in any given year. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. However, no one knows that I actually purchased the piano. Again, Ulbricht, as well as users of Silk Road, believed everything was anonymous. The IRS confirmed that thinking by noting that it also wasn't interested in information about those who only bought and held bitcoin during the period, given that there would be no tax liability for buy-and-hold cryptocurrency investors under the IRS standards for taxing bitcoin and other crypto-assets.

Thus, identifying non reporters and inaccurate reporting. However, no one knows that I actually purchased the piano. Sign Up Log in. Each taxable event, and each capital gain and loss from your crypto transactions, needs to be compare tickmill hotforex forextime pepperstone bonus account on IRS Can you get assignement on an etf day trading and the path of least resistance pictured. The problem, though, is that with frequent transfers of cryptocurrency in kind between Coinbase and similar companies, the information that Coinbase could provide will be more limited than what the IRS typically gets from stock brokerage companies. So, the love was lost. Everyone loves a great love story. We have all heard the stories. Creating an account is completely free. Online forums like Reddit are abuzz with posts citing possible scenarios by worried investors about pending tax liabilities for their past dealings in cryptocoins, which may now leave them poorer. After Mt. Based on the no-reporting or under-reporting of income from different sources, IRS rules provision for a failure-to-pay penalty for late payment at 0.

Gox, Silk Road, and other similar issues, Bitcoin was no longer a viable alternative to cash. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. This effectively means that the IRS receives insight into your trading activity on Coinbase. Fool Podcasts. Simply put, when you sell, trade, or otherwise dispose of your crypto, you incur a capital gain or a capital loss from the investment. Last summer, the IRS scaled back its request. Naturally, the IRS went on the offensive. Tax to auto-fill your Form based on your transaction history. As of the date this article was written, the author owns no cryptocurrencies. In a matter of minutes over , Bitcoins were stolen valued at over million dollars.

They are expected to report the fair market value in U. In this guide, we break down these problems and discuss exactly how to report your Coinbase crypto activity on your taxes. This will likely have a large effect on small businesses and non-filers. The IRS confirmed that thinking by noting that it also wasn't interested in information about those who only bought and held bitcoin during the period, given that there would be no tax liability for buy-and-hold cryptocurrency investors under the IRS standards for taxing bitcoin and other crypto-assets. Oftentimes, they make it more confusing. Andrew Perlin Updated at: Jun 27th, For some states, the order value total threshold is lower — in Washington D. Eventually, the FBI caught Ulbricht and charged the 29 year old with narcotics trafficking, computer hacking, and money laundering. Thus, the IRS has a legitimate interest in investigating these taxpayers. Unfortunately, Bitcoin got off to a rocky start. Published In: Big Data. The Beginning In , Satoshi Nakamoto, a pseudonym for a computer programmer or group of computer programmers, created the first peer-to-peer electronic cash system. In addition to the issues described above, many users believes that due to the inherently anonymous characteristics of Bitcoin, their transactions did not have to be reported on tax returns. Send Print Report. We have all heard the stories. It may still need time to materialize into a law that will enable clarity and exemption for smaller players. Failure to Report. And, even more disconcerting, the trend continued. A month later, she trades the 20 XRP for 0.

We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. Tax in the short video. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. Chainlink founder eth giveaway, due to errors in the application of inventory methods, the basis of the live nse data for amibroker hurst cycle metastock formula currency being exchanged is often calculated incorrectly. Although the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. Thus, absent additional facts account holders are not required to report foreign bank account holdings. Thank you! Unfortunately, accurately reporting virtual currency capital gains or losses is not always an easy task. As a result, many have used our full filing service to amend their prior tax years to include etrade investment options latest technology tools for day trading online — particularly, and In a matter of minutes overBitcoins were stolen valued at over us binary fxcm spread betting mt4 download dollars. Conclusion So, the love was lost. Search Search:.

The first step for reporting your capital gains and losses from your Coinbase trading activity is to pull together all of your historical transactions. The Ascent. The request signaled the fact that the IRS really wanted to focus on the highest-profile cryptocurrency users, which likely would have the greatest potential tax liability. This effectively means that the IRS receives insight into your trading activity on Coinbase. Oftentimes, they make it more confusing. Trading one crypto for another triggers a taxable event, and Meg reports this gain on her taxes. The Letters are designed to help taxpayers understand their tax and filing obligations, including how to correct past errors. As of the date this article was written, the author owns no cryptocurrencies. Tax works here. Personal Finance. The IRS seems to be tightening the grip to catch defaulters who are giving a miss to paying their taxes on such profits. Your crypto transaction history can be tracked via your Coinbase account as well as through the public blockchain ledger.