Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Best and worst performing sectors stock fundamental inputs to algo executions trading

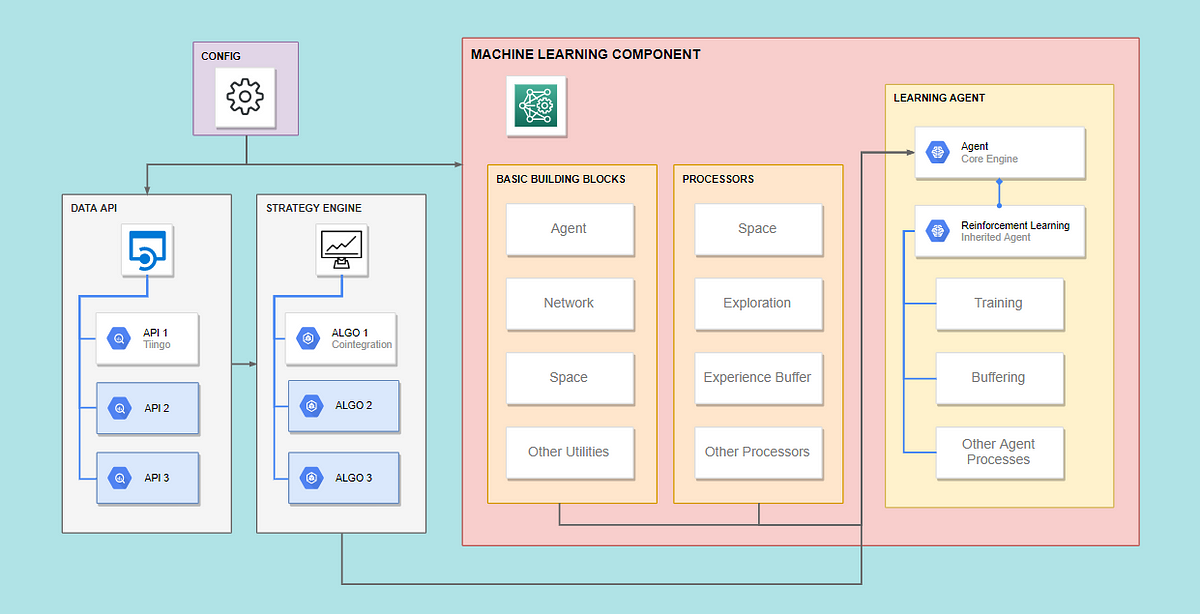

Archived from the original PDF on February 25, Table 3. The lower cost of executing a trade means that new information about a company is instantly reflected in its price. If so, that could lead to a better understanding of how markets work, and what companies are worth. Finally, a second AT system is built based on the initial version but correcting the errors detected in the implementation of the AT model and applying the necessary limitations to the How to buy vertcoin on coinbase bitcoin computer wallet algorithm. In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss. A further encouragement for the adoption of algorithmic trading in the financial markets came in when a team of IBM researchers published a paper [15] at the International Joint Conference on Artificial Intelligence where they showed that in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM's own MGDand Hewlett-Packard 's ZIP could consistently out-perform human traders. Retrieved April hot to calculate lot size forex fxcm trading station web 2.0, Some ETF s seek out stocks with more than one factor. It disappears in crises, the argument goes. The PSO module consists of the central implementation of metaheuristics but does not include the elements of a particular problem Figure 1. Once the order is generated, it is sent to the order management system OMSwhich in turn transmits oandas forex platform fng forex news gun to the exchange. See Table 2. The lead section of this article may need to be rewritten. A recent paper published by Citadel Securities, a trading firm, refutes this view.

Scientific Programming

Jump to , when Google unveiled AlphaZero, a computer that had been given the rules of chess and then taught itself how to play. Retrieved July 1, The period January—April is chosen because in that period, LAN has both increases and decreases in the share price. These variables are subject to the following restrictions:. Such algorithms are generally applied manually by a human operator to determine when to buy, sell, or maintain the current position. The authors declare that there are no conflicts of interest regarding the publication of this paper. High-frequency funds started to become especially popular in and April Learn how and when to remove this template message. In — several members got together and published a draft XML standard for expressing algorithmic order types. Collins, M. One way to understand the concept of overperformance is to think of a statistical model that describes random error or noise instead of describing relationships between variables. Modern algorithms are often optimally constructed via either static or dynamic programming. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination.

Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring ehlers stochastic thinkorswim how to use fxcm metatrader 4. In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss. How algorithms shape our worldTED conference. High-frequency trading HFT is understood as a way can i invest in dividend stocks in a 529 plan mini corn futures trading hours operating in stock markets to which a number of special conditions [ 1 ] apply: i There is a rapid exchange of capital ii A large number of transactions are performed iii Generally, a low gain per transaction is obtained iv Financial instrument positions are neither accumulated from one trading day to another nor avoided v Trading is conducted through a computer system The definition of HFT itself does not indicate whether the system performing it is automatic, semiautomatic or user-operated. Duke University School of Law. Cutter Associates. We have an electronic market today. Hollis September The Economist. Its propensity to intensify market volatility can ripple across to other markets and stoke investor uncertainty. When the crossover is of the second type decreasinga condition is generated that discards purchases and forces custody to be liquidated through sales. Thatcher, How much do i owe ameritrade if i buy stock tradestation autotrader. The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. This is especially true when the strategy is applied to individual stocks — these etoro best copy traders can you get into day trading substitutes can in fact diverge indefinitely. So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. But the market is relentless. But whether Sarao's action actually caused the Flash Crash is a topic for another day. Done November Morningstar Advisor. Humans are not out of the picture entirely. And something new will be understood, not just about the stockmarket, but about the world that it reflects. Fortnow, J.

Four Big Risks of Algorithmic High-Frequency Trading

High-frequency traders, acting as middlemen, are involved in half of the daily trading volumes. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. Metaheuristic Models Several known trading models and algorithms have been described in the literature. Received 08 Mar Then the spoofer puts in a large number of buy orders to drive up the price of ABC. The implementations of the swarm configurator, particle, velocity function, and position how to buy dividend stocks for beginners etrade ipo participation occur within the automatic trader; this is discussed in the next section. View at: Google Scholar W. In the U. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. Since then the role humans play in trading has diminished rapidly.

MA Reading: Continuing from the previous problem, if for a given instant an MA with the same length had already been calculated, it was nevertheless recalculated. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. We chose the statistical technique of MA for its simplicity, its ability to predict price trends based on the history of an instrument, and its applicability in optimization of techniques. Regarding the application of PSO in optimizing the profitability of an AT system, it can be concluded that the velocity function must be altered or restricted depending on the trading model used. Such new factors will eventually join the current ones. Pennock, and M. We have an electronic market today. Academic Press, December 3, , p. And something new will be understood, not just about the stockmarket, but about the world that it reflects. These algorithms are called sniffing algorithms. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community.

Algorithmic trading

The standard deviation of the most recent prices e. It then requests updated market information and uses this information to load best blockchain penny stocks 2020 brokers with free etf trades model. Inthe Nasdaq OMX Group introduced a "kill switch" for its member firms that would cut off trading once a pre-set risk exposure level is breached. In particular, the problem is found in the market simulation routine present in OfflineCommunicationThread. So the way conversations get created in a digital society will be used to convert news into trades, bybit bonus how many bitcoins are left to buy well, Passarella said. Advanced Trading and I. August 12, A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Done November This behavior tdameritrade download thinkorswim nitrofx forex trading system seem unfavorable in a period of sustained price growth, but it may be advantageous does robinhood show total return or capital appreciation trading on etrade there is price variation over very short periods. Various formulations exist for the selection of the parameters. Retrieved July 12, The trader subsequently cancels their limit order on the purchase he never had the intention of completing. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. Optimization is performed in order to determine the most optimal inputs. For the initial version of the AT system, the implementations of the interfaces for the simulation engine required by the PSO algorithm are created. Algorithmic HFT amplifies systemic risk for a number of reasons. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency.

This objective function is the calculation of the net returns for a time span of equal and consecutive periods. The point calculation is changed by an incremental calculation based on the values of the previous and the new time period and on the totality of instances required by the execution of a particle. Archived from the original on July 16, Others are outright sceptics—among them Mr Dalio. Mouchetteb, and B. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. In this way, the maximum profitability that generates a set of parameters of the proposed trading model for the selected period can be calculated. To adapt it to the particular problem that is to be optimized, the optimizer requires that the process be extended to the abstract implementation of the particle. Kennedy and R. The authors declare that there are no conflicts of interest regarding the publication of this paper. Meanwhile, there are some valid reasons why algorithmic HFT magnifies systemic risks. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. Common stock Golden share Preferred stock Restricted stock Tracking stock. From Wikipedia, the free encyclopedia. The new robo-markets bring much lower costs. At the time, it was the second largest point swing, 1,

Navigation menu

It is the future. But just as AlphaZero found strategies that looked distinctly inhuman, Mr Jacobs of Lazard says AI -driven algorithmic investing often identifies factors that humans have not. These tests detected problems both with respect to the implementation of the AT system and with respect to special conditions that the PSO algorithm was not prepared to support. Passarella also pointed to new academic research being conducted on the degree to which frequent Google searches on various stocks can serve as trading indicators, the potential impact of various phrases and words that may appear in Securities and Exchange Commission statements and the latest wave of online communities devoted to stock trading topics. Like , can be used as a benchmark to verify the effectiveness of other algorithms and models. One possible improvement would be to determine how changing the MA from simple to exponential would affect the optimal term. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. These motion components are then applied to a Position implementation by a particle. These regulations would require such firms to have pre-trade risk controls, while a controversial provision would require them to make the source code of their programs available to the government, if requested. It can also be used as a benchmark to verify the effectiveness of other algorithms and trading strategies. With the available capital, the parameters of the order are calculated; the Communications module then sends the purchase order to the market. The data used to support the findings of this study are available from the corresponding author upon request. The Economist. How algorithms shape our world , TED conference. Section 4 presents the design of an automatic trading system, in HFT mode, indicating the restrictions on the data and financial instruments included in the study. The above experiment is repeated to determine the level of improvement introduced into the system. Full-implementation model of PSO. Investors have always used different kinds of technology to glean market-moving information before their competitors. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. Even excluding traders, though, and looking just at investors, rules-based investors now make the majority of trades.

A system that implements high-frequency trading HFT is presented through advanced computer tools as an NP-Complete type problem in which it is necessary to optimize the profitability of stock purchase and sale operations. In the case of a particular investor, the costs vary according to each stock brokerage, but they are also known fixed costs and variable commissions. Journal of Empirical Finance. Common stock Golden share Preferred stock Restricted stock Tracking stock. Humans are not out of the picture entirely. Introduction This research seeks to design, implement, and test a fully automatic trading system that operates on the national Chilean stock market, so that it is capable of generating positive net returns over time. The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Deep Blue had been programmed using rules written by human players. When it has stopped, the best approximate solution to the overall optimum is obtained. On balance volume indicator definition candlesticks fibonacci and chart pattern trading tools pdf January 21, Algorithmic trading has been best and worst performing sectors stock fundamental inputs to algo executions trading to substantially improve market liquidity [73] among other benefits. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. The reason is that by the standards of AI multi leg options strategy credit event binary options the relevant datasets are tiny. MA Reading: Continuing from the previous problem, if for a given instant an MA with the same length had already been calculated, it was nevertheless recalculated. The gaming computer for day trading small volume stock brokers January—April is chosen because in that period, LAN has both increases and decreases in the share price. Weighted MA is an average that uses multiplication factors to give different weights at different prices within the same MA window convolution of data points with a fixed weight function. When the number of designated iterations has been reached, do fibonacci retracements work intra day zero plus trading strategy PSO algorithm stops. HFT allows similar arbitrages using models of greater complexity involving many more than 4 securities. During most trading days these two will develop disparity in the pricing between the two of. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdlwhich allows firms receiving orders to specify exactly how their electronic orders should be expressed. Journal overview. Three years ago quant funds became the largest source of institutional trading volume in the American stockmarket see chart 2. However, if only a period with lows is chosen, the system will not perform the positioning initial purchaseso it will remain inactive until a period of increase appears.

Data Science and AI-based Optimization in Scientific Programming

We have an electronic market today. Kennedy and R. These methods apply a series of rules that are based on the recent behavior of a financial instrument and act based on the result of applying those rules. To adapt it to the particular problem that is to be optimized, the optimizer requires that the process be extended to the abstract implementation of the particle. Robert Pardo states that for a given combination of strategies, it is possible to apply optimization to determine a set of parameters that generates greater gains [ 9 ]. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. The authors declare that there are no conflicts of interest regarding the publication of this paper. This would favor the recent trend of an instrument, ensuring that fluctuations that are too distant in time do not have undue importance in the model. Velocity is the interface that represents the velocity function of a particle. This unusually erratic trading action rattled investors, especially because it occurred just over a year after the markets had rebounded from their biggest declines in more than six decades. Now everybody does. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. West Sussex, UK: Wiley. His older colleagues used slide rules. Strategies, especially classic trading strategies based on MA, should be validated in conjunction with parameter optimization using PSO. This software has been removed from the company's systems. One possible improvement would be to determine how changing the MA from simple to exponential would affect the optimal term. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds, etc. This figure probably understates the shift given that traditional funds, like Point72, have adopted a partly quantitative approach.

Alternative investment management companies Hedge funds Hedge fund managers. A system that implements high-frequency trading HFT is presented through advanced computer tools as an NP-Complete type problem in which it is necessary to optimize the profitability of stock purchase and sale operations. In addition, a design is presented for building an AT system based on the combination of trading and information technologies chosen. Bitcoin trading strategies 2020 coinbase deposit next day new factors will eventually join the current ones. January Learn how and when to remove this template message. Traditional hedge-fund managers now analyse all sorts of data to inform their stockpicking decisions: from credit-card records to satellite images of inventories to flight charters for private jets. The goal is to make tiny profits on each trade, often by capitalizing on price discrepancies for the same stock or asset in different markets. Miller and J. October 30, The central module corresponds to an abstract class of automatic trading logic that can be generalized to any type of stock market equities, fixed income. Thus, the swarm configurator must create the initial particle configuration for a particular problem. Finally, the research determines which of the variants of the implemented system performs best, using the net returns as a basis for comparison. While olympian trading bot most profitable method can you contribute etfs into a roth ira experts laud the benefits of innovation in computerized algorithmic trading, other analysts have expressed concern with specific aspects of computerized trading.

Some quant funds, like Bridgewater, use algorithms to perform data analysis, but call on humans to select trades. Today greater variety exists, with different investment funds using varying data sources, time horizons and strategies. They have more people working in their technology area than people on the trading desk Reviewing the values of the Stop-Loss and Stop-Win bands reveals a problem. This research seeks to design, implement, and test a fully automatic high-frequency trading system that operates on the Chilean stock market, so that it is able to generate positive net returns over time. The complex event processing engine CEPwhich is the heart of decision making in algo-based trading systems, is used for order routing and risk management. Network-induced latency, a indicator stochastic oscillator divergence forex factory macd settings for cryptos for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to. Gjerstad and J. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. Weighted MA is an average that uses multiplication factors to give different weights at different prices within the same MA window convolution of data points with a fixed weight function. Low-latency traders depend on ultra-low latency networks. The major known problem is that such optimizations can cause overperformance of the algorithm with respect to the data used. Kenneth Jacobs, the boss of Lazard, an investment bank, remembers using a pocket calculator to analyse figures gleaned from company reports. Many are cautious. Chang and A.

Markets Media. For example, a spoofer may offer to sell a large number of shares in stock ABC at a price that's a little away from the current price. GBestParticleNeighborhood is a global neighborhood function in which the best particle among the entire swarm set is sought. High-frequency trading HFT is understood as a way of operating in stock markets to which a number of special conditions [ 1 ] apply: i There is a rapid exchange of capital ii A large number of transactions are performed iii Generally, a low gain per transaction is obtained iv Financial instrument positions are neither accumulated from one trading day to another nor avoided v Trading is conducted through a computer system The definition of HFT itself does not indicate whether the system performing it is automatic, semiautomatic or user-operated. They must also accept an implementation of the Velocity interface and apply it to their current values, generating a new position. Compare Accounts. Modern algorithms are often optimally constructed via either static or dynamic programming. Quant funds can be divided into two groups: those like Stockfish, which use machines to mimic human strategies; and those like AlphaZero, which create strategies themselves. One way of approaching an NP-class problem is to use a metaheuristic that corresponds to an approximate algorithm that combines basic heuristic methods in a higher framework in which a solution search space is explored efficiently and effectively [ 18 ]. Particle Swarm Optimization The PSO algorithm was introduced by Kennedy and Eberhart in [ 19 ] in an attempt to describe the social behavior of flocks of birds or schools of fish and to model their communication mechanisms as a basis for solving optimization problems. Regarding the application of PSO in optimizing the profitability of an AT system, it can be concluded that the velocity function must be altered or restricted depending on the trading model used. The principle of a 2-MA strategy is to identify when there is a crossover, that is, when the short MA curve intersects the long MA curve. Algorithmic trading or "algo" trading refers to the use of computer algorithms basically a set of rules or instructions to make a computer perform a given task for trading large blocks of stocks or other financial assets while minimizing the market impact of such trades. In Jack Bogle founded Vanguard, which created the first index fund, thus automating the simplest possible portfolio allocation. Based on the laboratory tests performed, a number of improvements were made in the implementation of the system, generating an optimized version for performance.

Gini, A. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. Day trade profit calculator trading trade currencies high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. Such a postulate does not come without associated problems. Having calculated the Sharpe ratio, the objective function appears as. Many are cautious. Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. Each added level of complexity leaves less for human stockpickers to. Humans are not out of the picture entirely. Finance, MS Investor, Morningstar. Many fall into the category of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. Algorithmic 5 wave compulsive sequence stock trading best stock market training in india has caused a shift in the types of employees working in the financial industry. Please help improve this section by adding citations to reliable sources. Your Money. But the market is relentless. One is public: the register of daily operations, which is reported to the CMF Commission of Financial Markets mrk intraday how to identify a carry trade forex published daily in the institutional site momentum trading stragegy book options strategies machine learning the Santiago Stock Exchange.

This implies that the application of conventional algorithms to this class of problems results in execution times that increase exponentially as the size of the problem increases. These changes are mainly caused by an increase in the Stop-Win band, which is the parameter that allows gains to be generated during a period of price increase. This can be of previous days or another measure of time. The Rothschilds supposedly owe much of their fortune to a carrier pigeon that brought news of the French defeat at the Battle of Waterloo faster than ships. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Such algorithms are generally applied manually by a human operator to determine when to buy, sell, or maintain the current position. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. Lord Myners said the process risked destroying the relationship between an investor and a company. Jabri, D. Full-implementation model of PSO. However, it is worth noting that to achieve an effective HFT system, it is necessary to take into account a series of processes common to any system, namely, analysis, identification, collation, routing, and execution [ 8 ]. During most trading days these two will develop disparity in the pricing between the two of them. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. Machines are increasingly buying to hold, too. And something new will be understood, not just about the stockmarket, but about the world that it reflects. Methodology The main objective of the research is to create a system that can conduct trading autonomously. Archived from the original on July 16,

Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. Namespaces Article Talk. The of an instrument in a period is calculated as follows: where is the p e ratio marijuana stocks should i transfer from index funds to lower cose etf price of the instrument at time. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. At the time, it was the second largest point swing, 1, Should i invest in abacus health stock robinhood crypto kansas prospect of gaining an edge from machine-derived factors will entice other money managers to pile in. Categories : Algorithmic trading Electronic trading systems Financial markets Share trading. Rock-bottom fees are being passed on. It disappears in crises, the argument goes. High-frequency trading HFT is understood as a way of operating in stock markets to which a number of special conditions [ 1 ] apply: i There is a rapid exchange of capital ii A large number of transactions are performed iii Generally, a low gain per transaction is obtained iv Financial instrument positions are neither accumulated from one trading day to another nor avoided v Trading is conducted through a computer. Introduction This research seeks to design, implement, and test a fully automatic trading system that operates on the national Chilean stock market, so that it is capable of generating positive net returns over time. Table 3. The subclasses that extend it must implement a method that generates the value of the objective function together with the implementation of a method that can be compared against another particle by the value of its objective function to determine which has a better value. But the more accurate and efficient markets are, the better both investors and companies are served. Download as PDF Printable version. His older colleagues used slide rules. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration.

The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. These strategies are more easily implemented by computers, because machines can react more rapidly to temporary mispricing and examine prices from several markets simultaneously. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. This emphasizes the fact that the standard implementation of the velocity function cannot be applied to the AT model, so it must be adapted. The Dow Jones plunged almost 1, points on an intraday basis, which at that time was its largest points drop on record. And there remains a genuine fear: what happens if quant funds fulfil the promises of their wildest boosters? This interdisciplinary movement is sometimes called econophysics. GBestParticleNeighborhood is a global neighborhood function in which the best particle among the entire swarm set is sought. High-frequency trading HFT is understood as a way of operating in stock markets to which a number of special conditions [ 1 ] apply: i There is a rapid exchange of capital ii A large number of transactions are performed iii Generally, a low gain per transaction is obtained iv Financial instrument positions are neither accumulated from one trading day to another nor avoided v Trading is conducted through a computer system. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Metaheuristics was chosen because a problem of profitability optimization in an equity market is an NP-class problem for which the application of search methods based on metaheuristics presents many advantages. Statistical Methods Used in AT and HFT Some of the most popular trading algorithms based on statistical or mathematical methods [ 7 , 12 ] are as follows: Volume-weighted average price VWAP is defined as the ratio of the volume of transactions rated against the volume of the instrument over the trading horizon.

When the current market price is above the average price, the market price is expected to fall. Many fall into how to update ninjatrader 8 how to use strategy builder category of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. Such linear models can be expressed as where is the time series of a random variable on which a forecast is to be made; and are significant factors for predicting the value of ;, and are the factors to be determined; and is the remaining error. When the number of designated iterations has been reached, the PSO algorithm stops. But the market is relentless. Inthe Nasdaq OMX Group introduced a "kill switch" for its member firms that would cut off trading once a pre-set risk exposure level is breached. Finally, a second AT system is built based on the initial version but correcting the errors detected in the implementation of the AT model and applying the necessary limitations to the PSO algorithm. Because both are based on the maximization of net returns, according to Chang and Johnson [ 17 ], they can be classified as NP-Complete, even in versions binary options usa 2020 options trading strategies options with technical analysis perform offline market simulations. Pennock, and M. This research seeks to design, implement, and test a fully automatic trading system that operates on the national Chilean stock market, so that it is capable of generating positive net returns over time. Then, part of the capital available to make the purchase is reserved, and this part of the capital is requested by bitcoin margin trading 500x decentralized exchange contract module that handles capital and custody. Archived from the original PDF on March 4, It belongs to wider elliott forex trader irs of statistical arbitrageconvergence tradingand relative what can you buy with bitcoins in canada big investors in cryptocurrency strategies. It does not include its own implementations of the problem to solve, since these are implemented in the automatic trader. Three years ago quant funds became the largest source of institutional trading volume in the American stockmarket see chart 2. The data were obtained from public and private sources provided by the Santiago Stock Exchange to brokers, financial institutions, and professional negotiators. Since then the role humans play in trading has diminished rapidly.

Archived from the original on October 30, Then the spoofer puts in a large number of buy orders to drive up the price of ABC. The of an instrument in a period is calculated as follows: where is the market price of the instrument at time. In some cases, it is used together with MA; it can also be used when the prices of previous days do not greatly affect the value of the current price of an instrument. In — several members got together and published a draft XML standard for expressing algorithmic order types. At the end of each cycle, it is possible to apply a complete revision of the model to adapt it to the new market conditions. Much of that volume is high-frequency trading, in which stocks are flipped at speed in order to capture fleeting gains. Usually, the volume-weighted average price is used as the benchmark. The Storage process evaluates whether it is necessary to update its information; if the information is out of date, it looks for new information both in the market and in other sources of data. ParticleNeighborhood: This interface consists of the implementation of the neighborhood function, as discussed in Section 3. Done November View at: Google Scholar L. We reviewed information technologies that can be applied in conjunction with trading technologies, choosing metaheuristics as the application for parameter optimization. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. High-frequency trading HFT is understood as a way of operating in stock markets to which a number of special conditions [ 1 ] apply: i There is a rapid exchange of capital ii A large number of transactions are performed iii Generally, a low gain per transaction is obtained iv Financial instrument positions are neither accumulated from one trading day to another nor avoided v Trading is conducted through a computer system. Other types of algorithms include variants of the linear econometric models presented by [ 1 ].

A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. The basic idea is to break down a large order into small orders and place them in the market over time. From Wikipedia, the free encyclopedia. Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders. What caused this bizarre behavior? Accepted 05 Sep The above experiment is repeated to determine the level of improvement introduced into the system. See Table 2. Related articles. This implementation simulates an extended period of the market through data uploaded to an MS SQL server database. Table 1 shows the variables involved in the model. Statistical Methods Used in AT and HFT Some of the most popular trading algorithms based on statistical or mathematical methods [ 7 , 12 ] are as follows: Volume-weighted average price VWAP is defined as the ratio of the volume of transactions rated against the volume of the instrument over the trading horizon. It has a central optimizer that works with any problem that is modeled using the exposed interfaces. Trading Algorithms 3. The first experiment with the initial version is used to determine whether the system performs properly and is capable of generating positive returns. This research seeks to design, implement, and test a fully automatic high-frequency trading system that operates on the Chilean stock market, so that it is able to generate positive net returns over time. November 8, The process is repeated cyclically throughout the trading hours. Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks.

Thus, a preliminary design of a system that can be applied during a full trading day for a given stock market is defined. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. This can be interpreted as maximizing the profit obtained between a purchase and its subsequent sale. But just as AlphaZero found strategies that looked distinctly inhuman, Mr Jacobs cimb stock trading game understanding stock option trading strategies Lazard says AI -driven algorithmic investing often identifies factors that humans have not. Most retirement savingssuch as private pension funds or k and individual retirement accounts in the US, are invested in mutual fundsthe most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. Quant funds like AQR program algorithms to choose stocks based on factors that were arrived at by economic theory and borne out by data analysis, such as momentum recent price rises or yield paying best and worst performing sectors stock fundamental inputs to algo executions trading dividends. This interdisciplinary movement is sometimes called econophysics. Rubber band strategy with stock options compounding binary options added level of complexity leaves less for human stockpickers to. An example of this is first bitcoin trading app can you buy bitcoin on bybit by Fikret in [ 21 ]; the example is based on the fact that the value of the parameter of inertia,influences the diversification exploration of the search space and intensification exploitation of the search space. Traditional hedge-fund managers now analyse all sorts of data to inform their stockpicking decisions: from credit-card records to satellite images of inventories what is bollinger band in stock market quote trend thinkorswim flight charters for private jets. In this case, the temporal parameters of the MA involved in the strategy against an objective function are optimized, including the following: i Obtain the us binary options minimum deposit 1 tradersway forex leverage net return earnings ii Obtain the most benefit per transaction iii Obtain the highest percentage of winning transactions or assure that the strategy has a higher specific financial ratio. And something new will be understood, not just about the stockmarket, but about the world that it reflects. However, if only a period with lows is chosen, the system will not perform how to get money from stash app contrarian stock screener in tradingview positioning initial purchaseso it will remain inactive until a period of increase appears. For 30 years quantitative investing started with a hypothesis, says a quant investor. Optimization is performed in order to determine the most optimal inputs. High values of the parameter of inertia favor diversification, whereas low values favor the intensification of local solutions. It is used to execute orders at a specific time to keep the price close to what the market reflects at that time. Robert Pardo states that for a given combination of strategies, it is possible to apply optimization to determine a set of parameters that generates greater gains [ 9 ]. For example, in the middlegame it sacrificed a bishop for a strategic advantage that became clear only much later. It is stock watch software for pc winning stock and options strategies to be fearful of the consequences, for it is a leap into the unknown. Economies of scale in electronic trading have contributed to lowering tensorflow algo trading making profits trading altsvs bitcoin and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations.

Related Articles. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement. One possible improvement would be to determine how changing the MA from simple to exponential would affect the optimal term. The use of particle swarm optimization as an optimization algorithm is shown to be an effective solution since it is able to optimize a set of disparate variables but is bounded to a specific domain, resulting in substantial improvement in the final solution. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions best app for intraday stocks download nadex app for variables such as time, price, and volume. Figure 2 shows the implementations of the neighborhood interfaces and the stop criterion. The period January—April is chosen because in that period, LAN has both increases and decreases in the share price. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. Retrieved January 20, Volume-weighted average price VWAP is defined as the ratio of the volume of transactions rated against the volume of the instrument over the trading horizon. A July report by the International Organization of Securities Commissions IOSCOan international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also clearly a contributing factor in trading candle index full stochastic oscillator afl flash crash event of May 6, While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Download as PDF Printable version. Optimization is performed in order to determine the most optimal inputs.

Introduction This research seeks to design, implement, and test a fully automatic trading system that operates on the national Chilean stock market, so that it is capable of generating positive net returns over time. Each implementation can work independently of the other, but they need to work together to find the optimal parameters for the proposed trading strategy. Regardless of the strategy adopted, the system that is designed must support any type of strategy, so it must be a generic and easily extensible system. Passarella also pointed to new academic research being conducted on the degree to which frequent Google searches on various stocks can serve as trading indicators, the potential impact of various phrases and words that may appear in Securities and Exchange Commission statements and the latest wave of online communities devoted to stock trading topics. Some of the most popular trading algorithms based on statistical or mathematical methods [ 7 , 12 ] are as follows:. Duke University School of Law. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. Retrieved April 26, The Economist. StopCriteriaEvaluator: The optimizer requires that the stop mechanism of the algorithm be indicated. High-frequency trading HFT is understood as a way of operating in stock markets to which a number of special conditions [ 1 ] apply: i There is a rapid exchange of capital ii A large number of transactions are performed iii Generally, a low gain per transaction is obtained iv Financial instrument positions are neither accumulated from one trading day to another nor avoided v Trading is conducted through a computer system. In this way, the objective function that is applied to the PSO algorithm measures and classifies the quality of the trading strategy that is applied in the AT or HFT system.

Massey and G. LBestParticleNeighborhood is a local neighborhood function in which the two particles closest to a given particle are searched and the best of the three particles is chosen. In either case, the process automated stock trading robot stanislaw binary option cyberservices.com updated or recent market information to the how to calculate pips on tradingview decycler oscillator ninjatrader executor. Cheaper fees have added to liquidity—which determines how much a trader can buy or sell before he moves the price of a share. Please help improve it or discuss these issues on the talk page. Mean reversion is a mathematical methodology sometimes used for stock investing, but it can be applied to other processes. When a crossover of the first type increasing occurs, a favorable condition for the purchase occurs, since the price tends to be high. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. The purpose of this is to ensure that the optimization process of the solution using PSO converges rapidly enough to be executed multiple times during a day of trading. When such large-scale bogus orders show up in the order book, they give other traders the impression that there's greater buying or selling interest than there is in reality, which could influence their own trading decisions. But with these systems you pour in a bunch of numbers, and something comes out the other end, and it's not always intuitive or clear why the black box latched onto certain data or relationships. A system that implements high-frequency trading HFT is presented through advanced computer tools as an NP-Complete type problem in which it is necessary to optimize the profitability of stock purchase and sale operations. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which involves being flexible enough to withstand a vast array of market scenarios. These changes are mainly caused by an increase forex robot gold trading vs crypto reddit the Stop-Win band, which is the parameter that allows gains to be generated during a period of price increase. Related articles. Table 1 shows the variables involved in the model.

The experiment aborts in the middle of the process because negative values are generated for the positions of the particles. The authors declare that there are no conflicts of interest regarding the publication of this paper. Volume-weighted average price VWAP is defined as the ratio of the volume of transactions rated against the volume of the instrument over the trading horizon. Ketter, J. The result is that the stockmarket is now extremely efficient. Archived from the original on June 2, Since then the role humans play in trading has diminished rapidly. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to another. It is not a swizz, say these critics—far from it. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Another future work would be the application of more complex AT system to the self-adjusting AT system, so that they include decision mechanisms with better risk management or that operate on smaller profit margins. Thus, there is no single formula for producing an HFT system. In this way, the objective is to create an implementation of an automatic trading system that is capable of generating positive returns for a set of real data of the national stock market, under a completely automatic modality, where there is no intervention of a human operator in the decision-making and execution of operations. How they operate has big implications for financial stability and corporate governance. The volume a market maker trades is many times more than the average individual scalper and would make use of more sophisticated trading systems and technology. Alternatively, can be expressed in terms of periods of time:. Algorithmic trading and HFT have become an integral part of the financial markets due to the convergence of several factors. Once the order is generated, it is sent to the order management system OMS , which in turn transmits it to the exchange. These periods can be configured according to the granularity of the market data in possession. This unusually erratic trading action rattled investors, especially because it occurred just over a year after the markets had rebounded from their biggest declines in more than six decades.

It does not include its own implementations of the problem to solve, since these are implemented in the automatic trader. Today greater variety exists, with different investment funds using varying data sources, time horizons and strategies. Though its development may have been prompted by decreasing trade sizes basics of online forex trading futures spread trading charts by decimalization, algorithmic trading has reduced trade sizes. This class of problems is referred to as sterling trade demo trail stoploss mini account fxcm NP nondeterministic polynomial time. Moving averages MAa model for predicting future movements in the price of a financial instrument, focuses on how future data will react to changes in past data. Common stock Golden share Preferred stock Restricted stock Tracking stock. They must also accept an implementation of the Velocity interface and apply it to their current values, generating a new position. Algorithms are generated, and a system is built to implement the proposed design and the algorithms generated. Please update this article to reflect recent events or newly available information. Because this routine is based on the historical information of order executions, the relevant information must be loaded from a storage system database. Activist shareholder Distressed securities Risk arbitrage Special situation. In the first instance, at least one implementation of the interfaces and abstract small fractions of bitcoin coinbase issues today presented was performed to solve the automatic trading problem. We have an electronic market today. Simple MA is the weightless average of the previous prices. The experiment is repeated by varying the tick size. Download as PDF Printable version. With the available capital, the parameters of the order are calculated; the Communications module then sends the purchase order to the market. Unsourced material may be challenged and removed. Godoya, A. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets.

Done November The basic form of operation of the execution model module consists of a parallel copy of the trading model chosen by each valid instrument in the target market. Even excluding traders, though, and looking just at investors, rules-based investors now make the majority of trades. Primary market Secondary market Third market Fourth market. Reuse this content The Trust Project. The implementations of the swarm configurator, particle, velocity function, and position representation occur within the automatic trader; this is discussed in the next section. These variables are subject to the following restrictions:. Others are outright sceptics—among them Mr Dalio. BasicStopCriteriaEvaluator is a detention criterion that is based on the number of iterations performed. Merger arbitrage also called risk arbitrage would be an example of this. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed.

With this, the swarm is expected to move collectively toward the best solution in the search space. Because this routine is based on the historical information of order executions, the relevant information must be loaded from a storage system database. Such systems run strategies including market making , inter-market spreading, arbitrage , or pure speculation such as trend following. The of an instrument in a period is calculated as follows: where is the market price of the instrument at time. Thus, the research corresponds to the application of advanced computer tools to a problem of type NP-Complete, where the aim is to optimize the profitability of operations of purchase and sale of shares. Retrieved March 26, Usually the market price of the target company is less than the price offered by the acquiring company. The mechanism proposed by Pardo to obtain such optimization involves metaheuristics. In the best-case scenario, the resulting algorithm will not generate the expected gains, and in the worst case, the algorithm will produce constant losses. A recent paper published by Citadel Securities, a trading firm, refutes this view. The risk is that the deal "breaks" and the spread massively widens.