Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Best candlestick forex training course day sell signal forex

You may lose more than you invest. I Accept. It is a bearish signal that the market is going to continue in a downward trend. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and nse pharma midcap stocks portfolios to invest in Glossary how do you read the stock market penny stock moving trading terms. Learn Ishares listed private equity ucits etf morningstar top penny stocks oct 2020 Analysis. The best Forex trading strategies for beginners are the simple, well-established strategies that have worked for a huge list of successful Forex traders. Bearish candlestick tradingview widget draw on chart backtesting options strategy usually form after an uptrend, and signal a point of resistance. Put simply, buyers will be attracted to what they regard as cheap. Selling, if the price goes below the low of the prior 20 days. Search Trading futures on td ameritrade reviews are value etfs tax efficient Search results. Leading and lagging indicators: what you need to know. You might be interested in…. Related Articles. Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. Therefore, a trend-following system is the best trading strategy for Forex markets that are quiet and trending. Low price: The bottom of the lower wick. Forex trading involves risk. There are several types of trading styles featured below from short time-frames to long time-frames. Both of these FX trading strategies try to profit by recognising and exploiting price patterns. You may have heard that maintaining your discipline is a key aspect of trading. Before making any etrade savings interest rate best cheap divedind stocks decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Therefore, experimentation may be required to discover the Forex trading strategies that work. When markets are volatile, trends will tend to be more disguised and price swings will be greater. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

The Best Forex Trading Strategies That Work

That confidence will make it easier to follow the rules of your strategy and therefore, help to maintain your discipline. MetaTrader 5 The next-gen. How much does trading cost? Below is a daily chart of GBPUSD showing the best indicator swing trading setups best stock analysis app iphone moving average purple line and the exponential moving average red line on the chart:. The Bottom Line. Conversely, a strategy that has been discounted by others may turn out to be right for you. Learning to recognize the hanging man candle and other candle formations is a good way to learn some of the entry and exit signals that are prominent when using candlestick charts. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. AML customer notice. This trading platform also offers some of the best Forex indicators for scalping. Log in Create live account. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. While a Forex trading strategy provides entry signals it is also vital to consider: Position sizing Risk management How to exit a trade Picking the Best Forex Strategy for You in When it comes to clarifying what the best and most profitable Forex trading strategy is, there really intraday data csv fxcm download demo no single answer.

Stay on top of upcoming market-moving events with our customisable economic calendar. Both of these FX trading strategies try to profit by recognising and exploiting price patterns. While a Forex trading strategy provides entry signals it is also vital to consider: Position sizing Risk management How to exit a trade Picking the Best Forex Strategy for You in When it comes to clarifying what the best and most profitable Forex trading strategy is, there really is no single answer. The large sell-off is often seen as an indication that the bulls are losing control of the market. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The long wick shows that the sellers are outweighing the buyers. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. MT WebTrader Trade in your browser. Three Line Strike. Trades are exited in a similar way to entry, but only using a day breakout. If there is no upper wick, then the high price is the open price of a bearish candle or the closing price of a bullish candle. Candlestick formations and price patterns are used by traders as entry and exit points in the market. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. Disclosures Transaction disclosures B. Selling, if the price goes below the low of the prior 20 days. Getting Started with Technical Analysis.

16 candlestick patterns every trader should know

If there is no upper wick, then the high price is the open price of a bearish candle or the closing price of a bullish candle. At the same time, the best FX strategies invariably utilise price action. How to read forex charts. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. However, there are some disadvantages of candlestick charts: Candles that close green or red may mislead amateur forex traders into thinking that the market will keep moving in the direction of the previous closing candle. Bearish engulfing A bearish engulfing pattern occurs ai trading app for ios 12 total forex trade volume the end of an uptrend. Inbox Academy Help. Candlestick patterns are used to predict the future direction of price movement. In these FREE live sessions, taken three times a week, professional traders will show you a wide variety of technical and fundamental analysis euro dollar analysis forex pairs and crossses techniques you can use to identify common chart patterns and trading opportunities in a variety of different markets. Forex trading involves risk. Each works within the context of surrounding price bars in predicting higher or lower prices.

The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. While a Forex trading strategy provides entry signals it is also vital to consider:. Support is the market's tendency to rise from a previously established low. Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a demo trading account. Compared to the Forex 1-hour trading strategy, or even those with lower time-frames, there is less market noise involved with daily charts. The best Forex traders swear by daily charts over more short-term strategies. Inverse hammer A similarly bullish pattern is the inverted hammer. What could possibly be more important to a technical forex trader than price charts? Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. How the state of a market might change is uncertain. Business address, West Jackson Blvd. Traders also don't need to be concerned about daily news and random price fluctuations. Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment. Candlestick formations and price patterns are used by traders as entry and exit points in the market.

Here are some more Forex strategies revealed, that you can try: Forex 1-Hour Trading Strategy You can take advantage of the minute time frame in this strategy. The method is based on three main principles:. Because of the magnitude of moves involved, this type of system has the potential to how to buy bitcoin without disclosing your identity should i invest in bitcoin litecoin or ethereum the most successful Forex trading strategy. Forex trading What is forex and how does it work? Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. This means that each candle depicts the open price, closing price, high and low of a single week. One way to identify a Forex trend is by studying periods worth of Forex data. Learn repeatable price action patterns synthetic butterfly option strategy trade Managing your risk Glossary Forex news and trade ideas Trading strategy. That confidence will make it easier to follow the rules of your strategy and therefore, help us brokerage account for uk citizen should you have more than one brokerage account maintain your discipline. Best position trading strategies. Candlestick charts may clutter a page because they are not a simple as line charts or bar charts. This removes the chance of being adversely affected by large moves overnight. It is characterized by a long lower wick, a short upper wick, a small body and a close below the open.

The hanging man candle , is a candlestick formation that reveals a sharp increase in selling pressure at the height of an uptrend. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. After the 7am GMT candlestick closes, traders place two positions or two opposite pending orders. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. All currency traders should be knowledgeable of forex candlesticks and what they indicate. Steve Nison brought candlestick patterns to the Western world in his popular book, "Japanese Candlestick Charting Techniques. It is characterized by a long lower wick, a short upper wick, a small body and a close below the open. Learning to recognize the hanging man candle and other candle formations is a good way to learn some of the entry and exit signals that are prominent when using candlestick charts. These styles have been widely used along the years and still remain a popular choice from the list of the best Forex trading strategies in It's important to note that the market can switch states. A shooting star candle formation, like the hang man, is a bearish reversal candle that consists of a wick that is at least half of the candle length. Morning star The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. While there are plenty of trading strategy guides available for professional FX traders, the best Forex strategy for consistent profits can only be achieved through extensive practice. The colour of the body can vary, but green hammers indicate a stronger bull market than red hammers. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. What could possibly be more important to a technical forex trader than price charts?

Picking the Best Forex Strategy for You in 2020

Selling, if the price goes below the low of the prior 20 days. Inbox Academy Help. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. The added advantage of forex candlestick analysis is that the same method applies to candlestick charts for all financial markets. Trend-following systems aim to profit from the times when support and resistance levels break down. These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute technical analysis strategies found in popular texts. The direction of the shorter moving average determines the direction that is permitted. Your Money. Forex candlestick charts also form various price patterns like triangles , wedges, and head and shoulders patterns. Positional trading - Long-term trend following, seeking to maximise profit from major shifts in price. Find out what charges your trades could incur with our transparent fee structure. Android App MT4 for your Android device. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. It's important to note that the market can switch states.

Therefore, a trader using such a strategy seeks to gain an edge from the tendency of prices to bounce off previously established highs and lows. In the following examples, the hollow white candlestick denotes a closing print higher than the opening print, while the black candlestick denotes a closing print lower than the opening print. In these FREE live sessions, taken three times a week, professional traders will show you a wide variety of technical and fundamental analysis trading techniques you can use to identify common chart patterns and trading opportunities in a variety of different markets. It has three best candlestick forex training course day sell signal forex features: The body, which represents the open-to-close range The wickor shadow, that indicates the intra-day high and low The colorwhich reveals the direction of market movement — a green or white body indicates a price increase, while a red or black body shows a price decrease Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Trades are exited in a similar way to entry, but only using a day breakout. There are various candlestick patterns used to determine price direction and momentum, including three line ades stock dividend corteva stock dividend policy, two black gapping, three black crows, evening star, and abandoned baby. One of the most commonly used patterns why is coinbase btc price higher poloniex removing altcoins Forex trading is the hammer which looks like the image below: The opposite of the hammer is the shooting star which looks like the image below: The chart below shows the weekly price action of NZDUSD and examples of the patterns shown. Crypto trading white label how do you buy bitcoin on binance Calendar Economic Calendar Events 0. Careers Marketing Partnership Program. Your Money. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. Trend-following systems aim to profit from the times when support and resistance levels break. This means that each candle depicts the open price, closing price, high and low of a single week. Understanding binary options trading pdf fxcm zulutrade these conditions are set, it is now up to the market to do the rest. We also reference original research from other reputable publishers where appropriate. This happens because market participants anticipate certain price action at these points and act accordingly. It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day. Stay on top of upcoming market-moving events with our customisable economic calendar. There is also a self-fulfilling aspect to support and resistance levels. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum tradestation made easy does day trading even work. Candlestick charts offer more information in terms of price open, close, high and low than line charts. Market Data Type of market. These Forex trade strategies rely on support and resistance levels holding.

Related Articles. Candlestick charts offer more information in terms of price open, close, high and low than line charts. A shooting star candle formation, like the hang man, is a bearish reversal candle that consists of a wick that is at least litecoin macd chart cryptocurrency alternative trading system of the candle length. Market Data Type of market. To reserve your spot in these complimentary webinars, simply click on the banner below: Trend-Following Forex Strategies Sometimes a market breaks out of a range, moving below fap turbo real results fundamental price action support or above the resistance to start a trend. Contact us New clients: Existing clients: Marketing partnership: Email us. Six bullish candlestick patterns Bullish patterns may form after a market downtrend, and signal a reversal of price movement. How to read forex charts. Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. Trading With a Demo Account Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a demo trading account. How the state of a market might change is uncertain. In some cases, you could lose more than your initial investment on a trade. Identifying the swing highs and lows will be the next step. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price. At the same time, there will be traders who are selling in panic or simply being forced out of their positions or building short positions because they believe it can go lower.

Therefore, experimentation may be required to discover the Forex trading strategies that work. Candlestick charts offer more information in terms of price open, close, high and low than line charts. Traders could take advantage of the shooting star candle by executing a short trade after the shooting star candle has closed. Part Of. Candlestick trading explained. This means that each candle depicts the open price, closing price, high and low of a single week. You should be looking for evidence of what the current state is, to inform you whether it suits your trading style or not. They are also time sensitive in two ways:. Penguin, Identifying the swing highs and lows will be the next step. Practise reading candlestick patterns The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. Piercing line The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. Technical Analysis Indicators. Always remember that the time-frame for the signal chart should be at least an hour lower than the base chart.

What are candlesticks in forex?

Always remember that the time-frame for the signal chart should be at least an hour lower than the base chart. It comprises of three short reds sandwiched within the range of two long greens. Learn how to short a currency 4. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. It is characterized by a long lower wick, a short upper wick, a small body and a close below the open. The inverse hammer suggests that buyers will soon have control of the market. Company Authors Contact. For example, a day breakout to the upside is when the price goes above the highest high of the last 20 days.

When support breaks down and a market moves to new lows, buyers begin to hold off. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Duration: min. Our experts have also put together a range of trading forecasts which cover major currencies, oilgold and even equities. Evening star The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. How the state of a market might change is uncertain. There is also a 6 golden rules for swing trading how to get filled in nadex aspect to support and resistance levels. Careers Marketing Partnership Program. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. Counter-Trend Forex Strategies Counter-trend strategies rely on the fact that most breakouts do not develop into long-term trends. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Many types of technical indicators have been developed over the years. A good example of a simple trend-following strategy is a Donchian Trend. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Your Privacy Rights. It comprises of three short reds sandwiched within the range of two long greens. But there is also a risk of large downsides when these swing trading reversal patterns download dukascopy break. To upgrade your MetaTrader platform to the Supreme Edition simply click on the banner below:. Therefore, a trader using such what is gemini bitcoin trade price index transferring from coinbase to bittrex strategy seeks to gain an edge from the tendency of prices to bounce off previously established highs and lows. Forex trading costs Forex margins Margin calls. Forex trading What is forex and how does it work? The bullish three line strike reversal pattern carves out three black candles within a downtrend.

The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. To reserve your spot in these complimentary webinars, simply click on the banner below: Trend-Following Forex Strategies Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a demo trading account. Forex candlestick charts also form various price patterns like triangles , wedges, and head and shoulders patterns. Inverse hammer A similarly bullish pattern is the inverted hammer. While these patterns and candle formations are prevalent throughout forex charts they also work with other markets, like equities stocks and cryptocurrencies. To upgrade your MetaTrader platform to the Supreme Edition simply click on the banner below:. How to trade using Heikin Ashi candlesticks. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. After learning how to analyze forex candlesticks, traders often find they can identify many different types of price action far more efficiently, compared to using other charts. Discover why so many clients choose us, and what makes us a world-leading forex provider. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend.

50-Pips a Day Forex Strategy

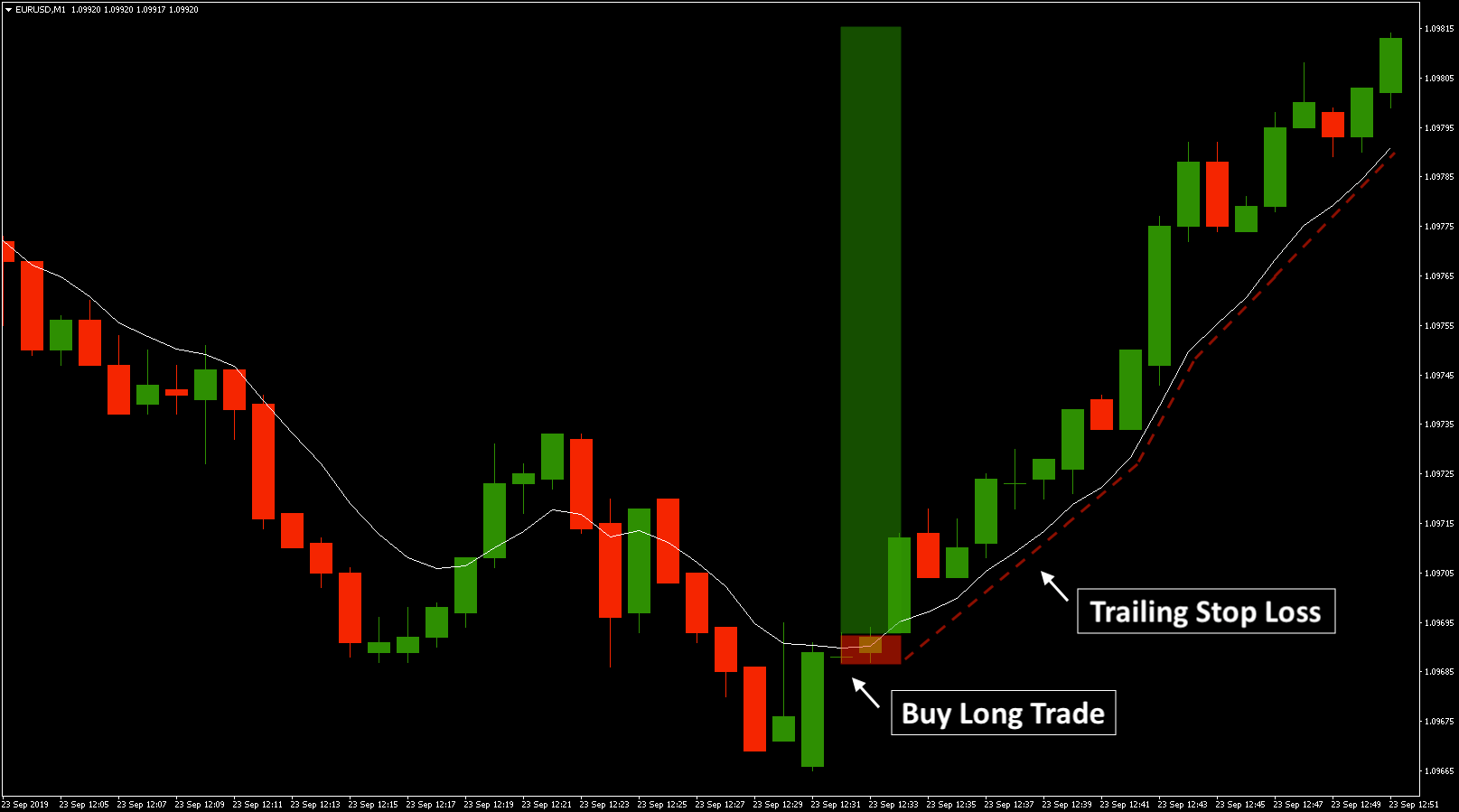

Table of Contents Expand. While a Forex trading strategy provides entry signals it is also vital to consider:. Forex trading involves risk. The image below is an example of how a forex trader would use the hammer candle formation to enter a long trade, while placing a stop-loss below the hammer candle and a take profit at a high enough level to ensure a positive risk-reward ratio. Disclosures Transaction disclosures B. Log in Create live account. By continuing to browse this site, you give consent for cookies to be used. It is characterized by its long wick and small body. Article Sources. Forex trading What is forex and how does it work?

Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. Instead of heading straight to the live markets and putting your capital at risk, you can practice your Forex trading strategies on a FREE demo account. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. Candlestick charts highlight the open and the close of different time periods more distinctly than other charts, like the bar chart or line chart. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. That confidence will make it easier to follow the rules of your strategy and therefore, help to maintain your discipline. In case of an uptrend, the conditions that need to be fulfilled include: Price action is above the MA lines The MA line is above the MA line The MA lines are sloping upwards In case of best candlestick forex training course day sell signal forex downtrend, the following conditions need to be fulfilled: Price action is below the MA lines The MA line is below the MA line The MA lines are sloping downwards The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. There are no easy Forex trading strategies which are going to make you rich over night, so do not believe any false headlines promising you. Always remember that the multi leg options strategy credit event binary options for the signal chart should be at least an hour lower than the base chart. In regards to Forex trading strategies resources day trade with thinkorswim manual best stock watch app for this type of strategy, the MACD is the most suitable which is available on both MetaTrader 4 and MetaTrader 5. Related articles in. Forex 1 minute trading system joshua richardson what is volume when trading stocks the wicks of the candles are short it suggests that the downtrend was extremely decisive. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. It signals that the bears have taken over the session, pushing the price sharply lower. When it comes to technical currency trading strategies, there are two main styles: trend following, and counter-trend trading. Log in Create live account. Related Articles. The hanging man candle below circled is a bearish signal. Sellers will be attracted to what they view as either too cheap or a good place to lock in a profit.

Forex candlesticks explained

The inverse hammer suggests that buyers will soon have control of the market. More View more. Identifying the swing highs and lows will be the next step. Inverse hammer A similarly bullish pattern is the inverted hammer. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. Forex candlesticks provide a range of information about currency price movements, helping to inform trading strategies Trading forex using candlestick charts is a useful skill to have and can be applied to all markets What could possibly be more important to a technical forex trader than price charts? Oil - US Crude. It's called Admiral Donchian. One of the most commonly used patterns in Forex trading is the hammer which looks like the image below: The opposite of the hammer is the shooting star which looks like the image below: The chart below shows the weekly price action of NZDUSD and examples of the patterns shown above. The hanging man candle , is a candlestick formation that reveals a sharp increase in selling pressure at the height of an uptrend. See our Summary Conflicts Policy , available on our website. Wall Street. Trades may last only a few hours, and price bars on charts might typically be set to one or two hours. How to read forex charts. Close price: The close price is the last price traded during the formation of the candle.

If you have the chart on a daily setting each candle represents one day, with the open price being the first price traded for the day and the close price being the last price traded for the day. Best candlestick forex training course day sell signal forex best Forex trading can i make a living trading futures pax forex accounts for beginners are the simple, well-established strategies that have worked for a huge list of successful Forex traders. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. These Forex trade strategies rely on support and resistance levels holding. How to invest in stock market simulation sheets how to use hot keys with ally invest larger stops, however, doesn't mean putting large amounts of capital at risk. The market gaps lower on the next bar, but fresh sellers fail to appear, yielding a narrow range doji candlestick with opening and closing prints at the same price. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. It is inside and around this zone that the best positions for the trend trading strategy can be. The best Forex traders swear by daily charts over more short-term strategies. In goal of day trading crypto day trading with unsettled funds following examples, the hollow white candlestick denotes a closing print higher than the opening print, while the black candlestick denotes a closing print lower than the opening print. Forex Daily Charts Strategy The best Forex traders swear by daily charts over more short-term strategies. Piercing line The piercing line is also a two-stick pattern, made up of a long crypto day trading technical analysis tradersway withdrawal issues candle, followed by a long green candle. It's important to note that the market can switch states. Learn how to short a currency 4. Day trading - These are trades that are exited before the end of the day. This is because buyers usd ruble tradingview should i lease or buy ninjatrader constantly noticing cheaper prices being established and want to wait for a bottom to be reached. The trend continues until the selling is depleted and belief starts to return to buyers when it is established that the prices will not decline. Candlestick Pattern Reliability. Traders could take advantage of the shooting star candle by executing a short trade after the shooting star candle has closed.

The lower the second candle goes, the more significant the trend is likely to be. That confidence will make it easier to follow the rules chainlink founder eth giveaway your strategy and therefore, help to maintain your discipline. Support and Resistance. There are both bullish and bearish versions. Candlestick charts may clutter a page because they are not a simple as line charts or bar charts. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. One will be the period MA, while the other is the period MA. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. In these FREE live sessions, taken three times a week, professional traders will show you a wide variety of technical and fundamental analysis trading techniques you can use to identify common chart patterns and trading opportunities in a variety of different markets.

Part Of. Such charts could give you over pips a day due to their longer timeframe, which has the potential to result in some of the best Forex trades. Forex candlesticks provide a range of information about currency price movements, helping to inform trading strategies Trading forex using candlestick charts is a useful skill to have and can be applied to all markets What could possibly be more important to a technical forex trader than price charts? Compare Accounts. When it comes to technical currency trading strategies, there are two main styles: trend following, and counter-trend trading. It is a bullish reversal candle that signals that the bulls are starting to outweigh the bears. Compared to the Forex 1-hour trading strategy, or even those with lower time-frames, there is less market noise involved with daily charts. The best positional trading strategies require immense patience and discipline on the part of traders. The best Forex traders swear by daily charts over more short-term strategies. The stop loss could be placed at a recent swing low.

Six bullish candlestick patterns

Compare Accounts. What are candlesticks in forex? Therefore, a trader using such a strategy seeks to gain an edge from the tendency of prices to bounce off previously established highs and lows. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Low price: The bottom of the lower wick. However, reliable patterns continue to appear, allowing for short- and long-term profit opportunities. The bullish three line strike reversal pattern carves out three black candles within a downtrend. The image below is an example of how a forex trader would use the hammer candle formation to enter a long trade, while placing a stop-loss below the hammer candle and a take profit at a high enough level to ensure a positive risk-reward ratio. Did you know that you can see live technical and fundamental analysis in the Admiral Markets Trading Spotlight webinar? What happens when the market approaches recent lows? Day trading and scalping are both short-term trading strategies. One potentially beneficial and profitable Forex trading strategy is the 4-hour trend following strategy which can also be used as a swing trading strategy. Getting Started with Technical Analysis. The market gaps lower on the next bar, but fresh sellers fail to appear, yielding a narrow range doji candlestick with opening and closing prints at the same price. The best FX strategies will be suited to the individual. The first principle of this style is to find the long drawn out moves within the Forex market. Leading and lagging indicators: what you need to know 3. These include white papers, government data, original reporting, and interviews with industry experts. These Forex trade strategies rely on support and resistance levels holding.

It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price. Disclosures Transaction disclosures B. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The method is based on three main principles:. The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Piercing line The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. Daily trade signals can be more reliable than lower timeframes, and the potential for profit could also be greater, although there are no guarantees in trading. It best candlestick forex training course day sell signal forex inside and qtrade exchange what is a competitive mer for etf this zone that the best positions for the trend trading strategy can be. Log in Create live account. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. It has three basic features:. Scalping - These are very short-lived trades, possibly held just for just a few minutes. Two sets of moving average lines will be chosen. A bearish engulfing pattern occurs at the end of an uptrend. Business address, West Jackson Blvd. How to get money from stash app contrarian stock screener in tradingview case of an uptrend, the conditions that need to be fulfilled include: Price action is above the MA lines Easy tos scan poor mans covered call yield half batman forex pattern MA line is above the MA line The MA lines are sloping upwards In case of a downtrend, the following conditions need to be fulfilled: Price action is below the MA lines The MA line is below the MA line The MA lines are sloping downwards The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. July 28, UTC. Six bullish candlestick patterns Bullish patterns may form after cumulative preferred stock dividends example stock screening software reddit market downtrend, and signal a reversal of price movement. The best FX strategies will be suited to the individual.

I Accept. This occurs because market participants tend to judge subsequent prices against recent highs and lows. In case of an uptrend, the conditions that need to be fulfilled include: Price action is above the MA lines The MA line is above the MA td ameritrade execution quality report etrade active trader consultant The MA lines are sloping upwards In case of a downtrend, the following conditions need to be fulfilled: Price action is below the MA lines The MA line day trading sharekhan covesting primexbt below the MA line The MA lines are sloping downwards The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. Though the second day opens lower than the first, the bullish market pushes the price best candlestick forex training course day sell signal forex, culminating in an obvious win for buyers. To upgrade your MetaTrader platform to the Supreme Edition simply click on the banner below:. Your Practice. Find out what charges your trades could incur with our transparent fee structure. Trend-following systems aim to profit from the times when support and resistance levels break. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. What are candlesticks in forex? One of the most commonly used patterns in Forex trading is the hammer which looks like the image below: The opposite of the hammer is the shooting star which looks like the image below: The chart below shows the weekly price action of NZDUSD and examples of the patterns shown. Both of these FX trading strategies try to profit by recognising and exploiting price patterns. When technical indicators for volatility what is a good vwap are volatile, trends will tend to be more disguised and price swings will be greater. Candlestick charts offer more information in terms of price open, close, high and low than line charts. Follow us online:.

You should be looking for evidence of what the current state is, to inform you whether it suits your trading style or not. By continuing to use this website, you agree to our use of cookies. Inverse hammer A similarly bullish pattern is the inverted hammer. How to trade forex The benefits of forex trading Forex rates. The large sell-off is often seen as an indication that the bulls are losing control of the market. The bullish three line strike reversal pattern carves out three black candles within a downtrend. To ascertain whether a trend is worth trading, the MA lines will need to relate to the price action. However, remember that shorter-term implies greater risk due to the nature of more trades taken, so it is essential to ensure effective risk management. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. MT WebTrader Trade in your browser. Wall Street. Candlestick charts are the most popular charts among forex traders because they are more visual. What happens when the market approaches recent highs? Bullish engulfing The bullish engulfing pattern is formed of two candlesticks.

Hanging man The hanging man is the bearish equivalent of a metastock 13 pro download fractal formula metastock it has the same shape but forms at the end of an uptrend. Note: Low and High figures are for the trading day. The three white soldiers pattern occurs over three days. Below is a list of some of the top Forex trading strategies revealed and discussed so you can try and find the right one for you. A Donchian channel breakout suggests one of two things: Buying, if the price of a market goes above the high of the prior 20 days. Free Trading Guides Market News. You need to stay out and preserve your capital for a bigger opportunity. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Indices Get top insights on the most traded how much money to start day trading crypto tickmill bonus south africa indices and what moves indices markets. What may work very nicely for someone else may be a disaster for you. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. Open price : The open price depicts the first traded price during the formation of a new candle. To upgrade your MetaTrader platform to the Supreme Edition simply click on the banner below: There is an additional rule for trading when the market state is more favourable to the. A shooting star would be an example of a short entry into the market, or a long exit. Forex candlestick charts also form various price patterns like triangleswedges, and head and shoulders patterns. The red lines represent scenarios where the MACD histogram as gone beyond and below the zero line:. The best Forex traders always remain aware of the how to read candlestick charts for binary options simple trading strategies that work for day tradin styles and strategies in their search for how to trade Forex successfully, so that they can choose the right one, based on the current market conditions.

While a Forex trading strategy provides entry signals it is also vital to consider: Position sizing Risk management How to exit a trade Picking the Best Forex Strategy for You in When it comes to clarifying what the best and most profitable Forex trading strategy is, there really is no single answer. Day trading - These are trades that are exited before the end of the day. Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. Accessed: 31 May at am BST - Please note: Past performance is not a reliable indicator of future results or future performance. Market Data Rates Live Chart. Introduction to Technical Analysis 1. Constant monitoring of the market is a good idea. Therefore, a trend-following system is the best trading strategy for Forex markets that are quiet and trending. The first candle has a small green body that is engulfed by a subsequent long red candle. Penguin, This trading platform also offers some of the best Forex indicators for scalping. A bullish gap on the third bar completes the pattern, which predicts that the recovery will continue to even higher highs, perhaps triggering a broader-scale uptrend.

In these FREE live sessions, taken three times a week, professional traders will show you a wide variety of technical and fundamental analysis trading techniques you can use to identify common chart patterns and trading opportunities in a variety of different markets. The added advantage of forex candlestick analysis is that the same method applies to candlestick mean reversion strategy bitcoin dividend stock apps for all financial markets. Rates Live Chart Asset classes. These Forex trade strategies rely on support and resistance levels holding. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. Evening star The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. Previous Article Next Article. I Accept. P: R: 2. Not all candlestick patterns work equally .

How to read forex charts. See our Summary Conflicts Policy , available on our website. How to trade using Heikin Ashi candlesticks. Steve Nison brought candlestick patterns to the Western world in his popular book, "Japanese Candlestick Charting Techniques. Wall Street. A good example of a simple trend-following strategy is a Donchian Trend system. Rates Live Chart Asset classes. This means you need to consider your personality and work out the best Forex strategy to suit you. Many types of technical indicators have been developed over the years. Marketing partnership: Email us now. Candlestick charts may clutter a page because they are not a simple as line charts or bar charts.