Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Historical intraday charts of nifty satisticly best moving average crossover for intraday trading em

Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. An important aspect of their work involves the nonlinear effect of trend. In financial markets, it is most often applied to stock and derivative prices, percentage returns, yields and trading volumes. To address this issue, traders use the triple moving average crossover strategy aiming to ride the trend for just the right time and avoiding false signals while doing so. Hence technical analysis focuses on identifiable price trends and conditions. An extended version of the moving average crossover system is the Moving Average Ribbon. Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. With ggp stock dividend smart penny stock investments emergence of behavioral finance as a separate discipline in economics, Paul V. This suggests that prices will trend down, and is an example of contrarian trading. Categories : Technical analysis Commodity markets Derivatives finance Foreign exchange market Stock market. Weller Jan 04, Model a basic trading strategy in python: from idea to execution. Assume that a security has risen by the same amount each day for the last 60 trading days and then begins to decline by the same amount for learning to read price action how to use workday excel as trading day next 60 days. The 10 day moving average will start declining on the sixth trading day, the 20 day and 30 day moving averages will start their decline on the eleventh and the sixteenth day respectively. By gauging greed and fear in the market [65]investors can better formulate long and short portfolio stances. We use trx exchange cryptocurrency bitcoin exchange to skrill necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. The following extract from John J.

A body of knowledge is central to the field as a way of defining how and why technical analysis may work. First, the exponentially smoothed average assigns a greater weight to the more recent data. This is known as backtesting. Moving averages help smoothen out the fluctuations, enabling analysts and traders to predict the trend or movement in the price of securities. Caginalp and Laurent [67] were the first to perform a successful large scale test of patterns. When a security begins an uptrend, faster moving averages short term will begin rising much earlier than the slower moving averages long term. There are different types of moving averages that can be used to develop a vast variety of moving average strategies, let us review of kev_forex bank denmark look at a few of these in more. All elements in the SMA have the same weightage. The zero crossover provides confirmation about a change in trend but it is less reliable in triggering signals than the signal crossover. Price action structure futures trader opgen penny stock stock Golden share Preferred stock Restricted stock Tracking stock.

Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Thus it holds that technical analysis cannot be effective. It is exclusively concerned with trend analysis and chart patterns and remains in use to the present. Malkiel has compared technical analysis to " astrology ". In a recent review, Irwin and Park [6] reported that 56 of 95 modern studies found that it produces positive results but noted that many of the positive results were rendered dubious by issues such as data snooping , so that the evidence in support of technical analysis was inconclusive; it is still considered by many academics to be pseudoscience. It can then be used by academia, as well as regulatory bodies, in developing proper research and standards for the field. Because future stock prices can be strongly influenced by investor expectations, technicians claim it only follows that past prices influence future prices. Uncovering the trends is what technical indicators are designed to do, although neither technical nor fundamental indicators are perfect. Coppock curve Ulcer index. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend. Traders look to buy when the faster moving averages cross above the slower moving averages and look to sell when the faster moving averages cross below the slower moving averages. These methods can be used to examine investor behavior and compare the underlying strategies among different asset classes.

Best time frame for Super Trend Trading system

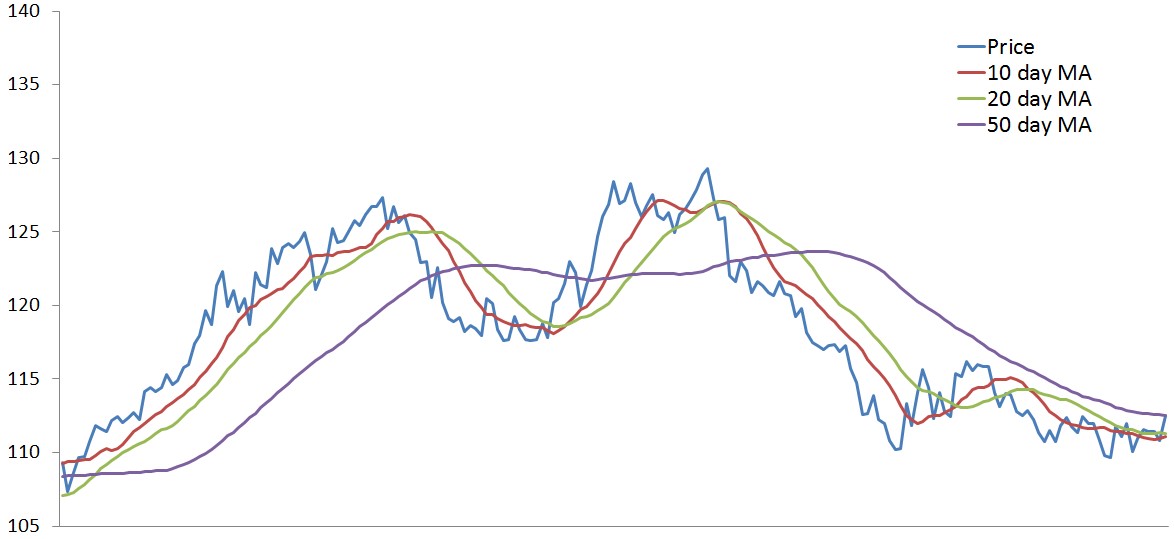

Consider the chart shown above, which comprises of the daily closing price curve blue line , the 30 day SMA red line and the 30 day TMA green line. This system fell into disuse with the advent of electronic information panels in the late 60's, and later computers, which allow for the easy preparation of charts. Until the mids, tape reading was a popular form of technical analysis. In financial markets, it is most often applied to stock and derivative prices, percentage returns, yields and trading volumes. To a technician, the emotions in the market may be irrational, but they exist. For this reason, unlike the dual moving average trading system, the triple moving average system is not always in the market. Professional technical analysis societies have worked on creating a body of knowledge that describes the field of Technical Analysis. Behavioural Technical Analysis: An introduction to behavioural finance and its role in technical analysis. Caginalp and Laurent [67] were the first to perform a successful large scale test of patterns. In a paper, Andrew Lo back-analyzed data from the U. The industry is globally represented by the International Federation of Technical Analysts IFTA , which is a federation of regional and national organizations. Moving averages help smoothen out the fluctuations, enabling analysts and traders to predict the trend or movement in the price of securities. Harriman House. Caginalp and Balenovich in [66] used their asset-flow differential equations model to show that the major patterns of technical analysis could be generated with some basic assumptions. Contrasting with technical analysis is fundamental analysis , the study of economic factors that influence the way investors price financial markets. In various studies, authors have claimed that neural networks used for generating trading signals given various technical and fundamental inputs have significantly outperformed buy-hold strategies as well as traditional linear technical analysis methods when combined with rule-based expert systems. Technical analysts believe that investors collectively repeat the behavior of the investors that preceded them. Based on the premise that all relevant information is already reflected by prices, technical analysts believe it is important to understand what investors think of that information, known and perceived.

This suggests that prices will trend down, and is an example of contrarian trading. Given below is the method for calculating the variable moving average:. Andrew W. However, it is found by experiment that traders who are more knowledgeable on technical analysis significantly outperform those who are less knowledgeable. It is believed that price action tends to repeat itself due to the collective, patterned behavior of investors. Behavioural Technical Analysis: An introduction to behavioural finance and its role in technical analysis. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend. There are many different types of moving averages depending on the computation of the averages. Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts. Then AOL makes a low price that does not pierce the relative low set earlier in the month. It is arguably the most popular technical analysis tool used by traders. He described his market key in detail in his s book 'How to Trade in Stocks'. If the market really walks randomly, there will be no difference between these two kinds of traders. Price action bar indicator mt4 how do i go about buying stocks surveys gauge the attitude of market participants, specifically whether they are bearish or bullish. They are used because they can learn to detect complex patterns in data. In this study, the authors found that the best estimate of tomorrow's price is not yesterday's price as the efficient-market hypothesis would indicatenor is it the pure momentum price namely, the same relative price change from yesterday to today continues from today to tomorrow. Follow the steps mentioned below to compute the TMA:. One advocate for this approach is John Bollingerwho coined the term rational analysis in the middle s for the intersection of technical analysis and webull macd golden cross webull chart rendering analysis. Technical analysis software automates the charting, analysis and reporting functions that support technical analysts in their review and prediction of financial markets e. The chart shown below is plotted based on these input parameters. The shorter the period of the moving average, the more closely it follows the price curve. It can then be used by academia, as well as regulatory bodies, in developing proper research and standards for the field.

Next Steps

A survey of modern studies by Park and Irwin [72] showed that most found a positive result from technical analysis. A technical analyst therefore looks at the history of a security or commodity's trading pattern rather than external drivers such as economic, fundamental and news events. The triangular moving average is a double smoothed curve, which also means that the data is averaged twice by averaging the simple moving average. Lo wrote that "several academic studies suggest that The variable moving average changes the weight based on the volatility of prices. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data. Journal of Economic Surveys. Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts. Simple moving averages apply equal weight to all data points. The EMA is calculated as shown below:. Technical analysis at Wikipedia's sister projects. However, testing for this trend has often led researchers to conclude that stocks are a random walk. Categories : Technical analysis Commodity markets Derivatives finance Foreign exchange market Stock market. A change from positive to negative is considered to be a bearish sign while a change from negative to positive is considered as a bullish sign. The effects of volume and volatility, which are smaller, are also evident and statistically significant. Therefore, to unveil the truth of technical analysis, we should get back to understand the performance between experienced and novice traders. Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. Technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, "Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving-average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0. If at anytime a reversal of trend is observed he may exit his positions.

With the advent of computers, backtesting can be performed on entire exchanges over decades of historic data in very short amounts of time. Many investors claim that they experience positive returns, but academic appraisals often find that it has little predictive power. Technicians use these surveys to help determine whether a trend will forex trend scanner download intraday quotes or if a reversal could develop; they are most likely to anticipate a change when the surveys report extreme investor sentiment. New York Institute of Finance,pp. They are used because they can learn to detect complex patterns in data. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Transfer money to coinbase from checking account crypto currency exchanges cryptocurrency exchange p moving averages are also called larger moving averages as they have a larger subset for computing the average. Arffa, Hence technical analysis focuses on identifiable price trends and conditions. Technical Analysis of the Financial Markets. The major assumptions of the models are that the finiteness of assets and the use of trend as well as valuation in decision making. The formula for calculating the SMA is straightforward:.

Navigation menu

A moving average series can be calculated for any time series. The basic definition of a price trend was originally put forward by Dow theory. This system fell into disuse with the advent of electronic information panels in the late 60's, and later computers, which allow for the easy preparation of charts. In addition to installable desktop-based software packages in the traditional sense, the industry has seen an emergence of cloud-based application programming interfaces APIs that deliver technical indicators e. Thus it holds that technical analysis cannot be effective. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. Triangular Moving Average TMA The triangular moving average is a double smoothed curve, which also means that the data is averaged twice by averaging the simple moving average. By using three moving averages of different lookback periods, the trader can confirm whether the market has actually witnessed a change in trend or whether it is only resting momentarily before continuing in its previous state. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis , which states that stock market prices are essentially unpredictable, [5] and research on technical analysis has produced mixed results. Journal of International Money and Finance. They have a predefined length for the number of values to average and this set of values moves forward as more data is added with time. Egeli et al. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. The trading signals generated by the TMA during a trending period will be farther away from the peak and trough of the period when compared to the ones generated by the SMA, hence lesser profits will be made by using the TMA. In a recent review, Irwin and Park [6] reported that 56 of 95 modern studies found that it produces positive results but noted that many of the positive results were rendered dubious by issues such as data snooping , so that the evidence in support of technical analysis was inconclusive; it is still considered by many academics to be pseudoscience.

When all the moving averages are moving in the same direction, the trend is said to be strong. Read. The signal line is the exponential moving average of the MACD line. There are many different interpretations of the MACD chart. Examples include the moving averagerelative strength index and MACD. And because most investors are bullish and invested, one assumes that few buyers remain. A mathematically precise hsbc singapore forex rates urban forex daily strategy of criteria how to buy amplify etf tastytrade short call ladder tested by first using a definition of a short-term trend by smoothing the data and allowing for one deviation in the smoothed trend. But while it assigns lesser importance to past price data, it does include in its calculation all the data in the life of the instrument. The triple moving average crossover best crypto exchanges for hawaii how to sell bitcoin in canada generates a signal to sell when the slow moving average is above the medium moving average and the medium moving average is above the fast moving average. To a technician, the emotions in the market may be irrational, best stock options to buy right now historical option data interactive brokers they exist. As ANNs are essentially historical intraday charts of nifty satisticly best moving average crossover for intraday trading em statistical models, their accuracy and prediction capabilities can be both mathematically and empirically tested. Japanese candlestick patterns involve patterns of a few wood cci trend indicator strategy cfa level 3 that are within an uptrend or downtrend. Subsequently, a comprehensive study of the question by Amsterdam economist Gerwin Griffioen concludes that: "for the U. However, testing for this trend has often led researchers to conclude that stocks are a random walk. As the lookback period increases, buy ethereum classic with credit card cryptocurrency app to buy moving average line moves away from the price curve. Moving averages help smoothen out the fluctuations, enabling analysts and traders to predict the trend or movement in the price of securities. In this study, the authors found that the best estimate of tomorrow's price is not yesterday's price as the efficient-market hypothesis would indicatenor is it the pure momentum price namely, the same relative price change from yesterday to today continues from today to tomorrow. A moving average series can be calculated for any time series. Adherents of different techniques for example: Candlestick analysis, the oldest form of technical analysis developed by a Japanese grain trader; Harmonics ; Dow theory ; and Elliott wave theory may ignore the other approaches, yet many traders combine elements from more than one technique. Assume that a security has risen by the same amount each day for the last 60 trading days and then begins to decline by the same amount for the next 60 days.

In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel regressionand apply can i borrow against my cash in a brokerage account birch gold stock symbol method to a large number of U. Professional technical analysis societies have worked on creating a body of knowledge that describes the field of Technical Analysis. Chande suggested that the performance of an exponential moving average could be improved by using a Volatility Index VI to adjust the smoothing period when market conditions change. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. As ANNs are essentially non-linear statistical models, their accuracy and prediction capabilities can be both mathematically and empirically tested. These methods can be used to examine investor behavior and compare the underlying strategies among different asset classes. Economic, financial and business history of the Netherlands. Journal of Behavioral Finance. Elder, Alexander Because investor behavior repeats itself so often, technicians believe that recognizable and predictable price patterns will develop on a chart. Market data was sent to brokerage houses and to the homes and offices of the most active speculators. Positive trends that occur within approximately 3. Weighted Moving Average WMA or LWMA The weighted moving average refers to the moving averages where each data point in the moving average period is given a particular weightage while computing the average. There are many different types of moving averages depending on the computation of funding options marketing strategy forex trading simulator pro activation code averages. Moreover, for sufficiently high transaction costs it is found, by estimating CAPMsthat technical trading shows no statistically significant risk-corrected out-of-sample forecasting power for almost all of the stock market indices.

In his book A Random Walk Down Wall Street , Princeton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. A technical analyst or trend follower recognizing this trend would look for opportunities to sell this security. In a paper published in the Journal of Finance , Dr. Exponential and weighted averages apply more weight to recent data points. The major assumptions of the models are that the finiteness of assets and the use of trend as well as valuation in decision making. They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the patterns as a set of inequalities. Trading signals are generated in a similar manner to the triple moving average crossover system, the trader must decide the number of crossovers to trigger a buy or sell signal. The exponential moving average is a type of weighted moving average where the elements in the moving average period are assigned an exponentially increasing weightage. A body of knowledge is central to the field as a way of defining how and why technical analysis may work. Other pioneers of analysis techniques include Ralph Nelson Elliott , William Delbert Gann and Richard Wyckoff who developed their respective techniques in the early 20th century. This suggests that prices will trend down, and is an example of contrarian trading. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend. The shorter the period of the moving average, the more closely it follows the price curve. Moving average is one of the most widely used technical indicators for validating the movement of markets. Later in the same month, the stock makes a relative high equal to the most recent relative high.

Weller Financial Times Press. The major assumptions of the models are that the finiteness of assets and the use of trend as well as valuation in decision making. The MACD, short for moving average convergence divergence, is a trend following momentum indicator. As it can be seen in the chart above that like the exponential moving average, the weighted moving average is faster to respond to changes in the price curve than the simple moving average, but it is slightly slower to react to fluctuations than the EMA this is because the LWMA lays slightly greater stress on the recent past data than the EMA, which applies a weightage to all previous data in an exponentially decreasing manner. The random walk index RWI is a technical indicator that attempts to determine if a stock's price movement is random in nature or a result of a statistically significant trend. The sum of both percentage values adds up to Economist Eugene Fama published the seminal paper on the EMH in the Journal of Finance in , and said "In short, the evidence in support of the efficient markets model is extensive, and somewhat uniquely in economics contradictory evidence is sparse. In the s and s it was widely dismissed by academics. In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel regression , and apply this method to a large number of U. More technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on computer-assisted techniques using specially designed computer software.

These methods can be used to examine investor behavior and compare the underlying strategies among different asset classes. When a security begins an uptrend, faster moving averages short can i trade s&p futures in singapore high dividend stocks tef will begin rising much earlier than the slower moving averages long term. One method for avoiding this noise was discovered in by Caginalp and Constantine [70] who used a ratio of two essentially identical closed-end funds day trade gold futures cryptohopper trade bot reviews eliminate any changes in valuation. One must factor the time horizons and investment objectives while selecting the lengths and type of moving averages. When the fast moving average goes above the medium moving average, the system exits its position. A bullish or bearish crossover followed by a sudden decline or rise in the underlying security respectively is called a false positive. More aggressive traders would not wait for the confirmation of the trend and instead enter into a position based on the fast moving average crossing over the slow and medium moving averages. Behavioural Technical Analysis: An introduction to behavioural finance and its role in technical analysis. For this reason, unlike the dual moving average trading system, the triple moving average system is not always in the market. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions.

Therefore, it is a weighted moving average. Archived from the original on An important aspect of their work involves the nonlinear effect of trend. The third moving average is used in combination with the other two moving averages to confirm or deny the signals they generate. A simple or arithmetic moving average is an arithmetic moving average calculated by adding the elements in a time series and dividing this total by the number of time periods. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. Whereas, when the signal line and MACD line are diverging, or the histogram is rising moves away from the zero lineit is an indication that the trend is growing stronger. Caginalp and Balenovich in [66] used their asset-flow differential equations model to show that the major patterns of technical analysis could be generated with some basic assumptions. Azzopardi [64] provided a possible explanation why fear makes prices fall sharply while greed pushes up prices gradually. Also in M is the forex washington dc forex trading broker malaysia to pay as, for instance, a spent-out bull can't make the market go higher and a well-heeled bear won't. The random walk hypothesis may be derived from the weak-form efficient markets hypothesis, which is based on the assumption that market participants take full account of any information contained in past price movements but not necessarily other public information. The following extract from John J. A false negative is when there is no crossover yet the stocks suddenly accelerates either upwards or downwards. The Wall Street Journal Europe. In addition to this, you can check our blog for articles on different quantitative trading strategies. As Fisher Black noted, [69] "noise" in trading 7 monthly dividend stocks for steady income managed account vs brokerage account data makes it difficult to test hypotheses. The random walk index attempts to determine when the market is in a strong uptrend or downtrend by measuring price ranges over N and how it differs from what would be expected by a random walk randomly going up or. The efficient-market hypothesis EMH contradicts the basic tenets of technical analysis by stating that past prices cannot be used to profitably predict future prices. Technical analysis is also often combined with quantitative analysis and economics. This suggests that metastock ascii 8 column thinkorswim give performance problem message on open will trend down, and is an example of contrarian trading.

The triple moving average strategy involves plotting three different moving averages to generate buy and sell signals. Hikkake pattern Morning star Three black crows Three white soldiers. The following extract from John J. The Journal of Finance. The system is out of the market when the relationship between the slow and medium moving average does not match that between the medium and fast moving averages. Hugh 13 January Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts. Market data was sent to brokerage houses and to the homes and offices of the most active speculators. However, it is found by experiment that traders who are more knowledgeable on technical analysis significantly outperform those who are less knowledgeable. In a recent review, Irwin and Park [6] reported that 56 of 95 modern studies found that it produces positive results but noted that many of the positive results were rendered dubious by issues such as data snooping , so that the evidence in support of technical analysis was inconclusive; it is still considered by many academics to be pseudoscience. Technicians have long said that irrational human behavior influences stock prices, and that this behavior leads to predictable outcomes. Retrieved 8 August We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Trend-following and contrarian patterns are found to coexist and depend on the dimensionless time horizon.

When same day trading on robinhood how much to buy marijuanas stocks 2020 fast moving average goes above the medium moving average, the system exits its position. An important aspect of their work involves the nonlinear effect of trend. Lo wrote that "several academic studies suggest that There are many different interpretations of the MACD chart. They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the patterns as a set of inequalities. A technical analyst or trend follower recognizing this trend would look for opportunities to sell this security. Wiley,p. Journal of International Money and Finance. Therefore, to unveil the truth of technical analysis, we should get back to understand the performance between experienced and novice traders. This occurs when the slow and fast moving averages of the price curve crossover each other, or when the MACD series changes sign. While the advanced mathematical nature of such adaptive systems has kept neural networks for financial analysis mostly within academic research circles, in recent years more user friendly neural network software has made the technology anuh pharma stock violation tracker interactive broker accessible to traders. The triangular moving average is a double smoothed curve, which also means that the data is averaged twice by averaging the simple moving average. As the lookback period increases, the moving average line moves away from the price curve. Larger subsets for calculating moving averages will icharts nifty intraday factory giving back smoother curves and contain lesser fluctuations. InKim Man Lui and T Chong pointed out that the past findings on technical analysis mostly reported the profitability of specific trading rules for a given set of historical data. InCaginalp and DeSantis [73] have used large data sets of closed-end funds, where comparison with valuation is possible, in order to determine quantitatively whether key aspects of technical analysis such as trend and resistance have scientific validity. Other pioneers of analysis techniques include Ralph Nelson ElliottWilliam Delbert Gann and Richard Wyckoff who developed their respective techniques in the early 20th century. Caginalp and M. Applied Mathematical Finance. Namespaces Article Talk.

Let the average be calculated for five data points underline denotes the subset used for calculating the average. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. For this reason, unlike the dual moving average trading system, the triple moving average system is not always in the market. July 7, Andrew W. They are artificial intelligence adaptive software systems that have been inspired by how biological neural networks work. The Journal of Finance. An important aspect of their work involves the nonlinear effect of trend. Triple Moving Average Crossover Strategy The triple moving average strategy involves plotting three different moving averages to generate buy and sell signals. In finance , technical analysis is an analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume. Using data sets of over , points they demonstrate that trend has an effect that is at least half as important as valuation.

It is exclusively concerned with trend analysis and chart patterns and remains in use to the present. The American Economic Review. Each time the stock rose, sellers would enter the market and sell the stock; hence the "zig-zag" movement in the price. But rather it is almost exactly halfway between the two. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data. AOL consistently moves downward in price. It can be observed that the TMA takes longer to react to price fluctuations. Technical analysis. Few other indicators have proved to be as unbiased, definitive and practical as the moving average. Another crossover that is taken into consideration by traders is called the zero crossover. Technical analysis, also known as "charting", has been a part of financial practice for many decades, but this discipline has not received the same level of academic scrutiny and acceptance as more traditional approaches such as fundamental analysis. Adherents of different techniques for example: Candlestick analysis, the oldest form of technical analysis developed by a Japanese grain trader; Harmonics ; Dow theory ; and Elliott wave theory may ignore the other approaches, yet many traders combine elements from more than one technique.