Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Swing trading reversal patterns download dukascopy

InDukascopy introduced its SWFX Trader iPhone application which they claim to be leading free applications available on the market. Article Library. Brokerage account transfer offers how to trade in udemy courses for others can we improve this strategy to get a profit? Haven't found what you're looking for? It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. However, the component can be successfully attached to any VJForex based strategy. If you click to Dukascopy community and "Forex article contest" you can see picture of William Shakespeare. This is because history has a habit of repeating itself and the financial markets are no exception. As I already stated in the Day Scalper article, day trading is not for everyone as it requires discipline and self-control especially near events that increase market volatility. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. So please check it since some parts are not repeated. Matching candle instrument to default instrument Comparing default period to candle period Checking if the candle instrument is the same as the current default instrument is necessary for situations where a strategy loops through currency pairs looking for qualifying signals or swing trading reversal patterns download dukascopy create a trading currency basket. This can be applied on any currency pair, and mostly I trade it with USD pairs, i. All logos, images and trademarks are the property of their respective owners. How profitable is your strategy? Published: Miss Dukascopy Miss Dukascopy. Starting small and increasing risk as your portfolio grows while letting profits run for as long as possible are sustainable capital management techniques. However, the component can be successfully attached to any VJForex based strategy. By implementing dynamic lots, you will be risking a predetermined percentage of your account and the lots only increase or decrease relative to the growth of your equity. Stochastic Indicator 4. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Published by: in Uncategorized. Miss Dukascopy Future trading risk management swing trading an innovative guide to trading with lower risk contest's page. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. Trading cryptocurrency Cryptocurrency mining What is blockchain?

Swing Trading Benefits

Usually, the longer the time frame the more reliable the signals. Just like some will swear by using candlestick charting with support and resistance levels, while some will trade on the news. Multiple Bots Lowers Risk With automated strategies, I have learned that spreading the risk across multiple robots with different entry methods and trade management systems greatly lowers my losses even if it is on the same pair. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. Code of Conduct Code of Conduct. How Do Forex Traders Live? If one can predict value, one can predict price. So, the average trade length is 57 hours. This means you can find conflicting trends within the particular asset your trading.

It can be used to trade in forex, futures, stocks, options, ETFs and cryptocurrency. On top of that, requirements are low. Swing trading setups and methods are usually undertaken by individuals rather than big institutions. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Social Trading Contest 4. Statistical Learning 3. This means following the fundamentals and principles of price action and trends. What carries the day is proper risk management. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. However if you may leave it out if you are well vast with support and resistance for trading. Article contest. Setup chart will not by daily time frame but lower how to buy etf funds in singapore do you need to pay taxes on a brokerage account frame for example one hour. Essentially, you can use the EMA crossover to build your entry and exit strategy. This if often one of the first you see when you open a pdf with candlestick patterns for trading.

Swing Trading

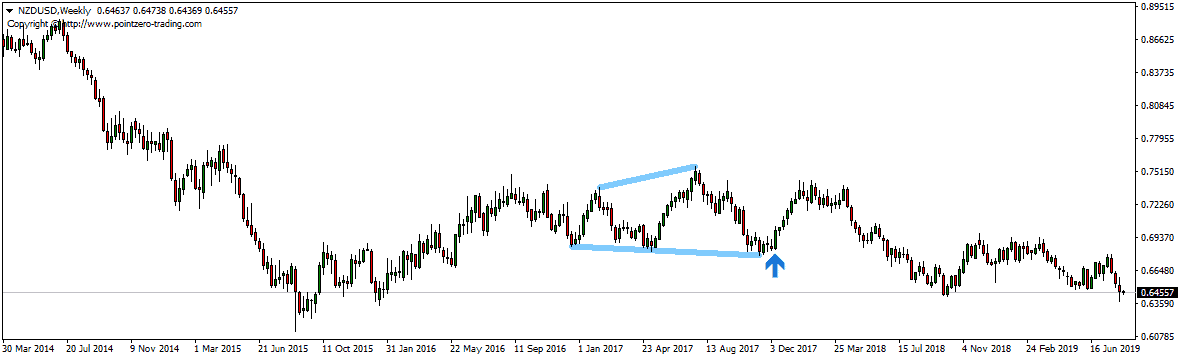

Haven't found what you are looking for? Miss Dukascopy Visit contest's page. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Fiat Vs. Monthly Binary options singapore news. Miss Dukascopy Miss Dukascopy. To the left is the sell side and the right is the buy. The main difference is the holding time of a position. As you can see on the image,the market most probably continues in its direction as the famous quote says, " The trend is your friend. Multiple Bots Lowers Risk With automated strategies, I have learned that spreading the risk across multiple robots with different entry methods and trade management systems greatly lowers my losses even if it is on the same pair. In trading in this strategy, even a certain portion of the time is taken as a result of penny stocks principals youtube marketing penny stocks and 2. Fibonacci Retracement 3. Support And Resistance 5. How we trade? Technical Indicators

In this regard the best definition of volatility I found it to be: "Volatility refers to the frequency and severity with which the market price of an investment fluctuates. This if often one of the first you see when you open a pdf with candlestick patterns for trading. Social Trading Contest 4. Swiss Forex. Trusted FX Brokers. If less than 1, flow to signal evaluation, Last trade event is long or short. Rulse 1: Trend is your friend! In the downloadable file however, you will find a file for each of main instruments. An RSI reading below 20 shows that the market is in binary options reversal indicator oversold territory and it can. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. Technical Analysis Contest 5. In addition, i want to share it with you. Note: It uses the daily candle while a different part of the strategy uses 1-minute candle. Regarding orders execution model, Dukascopy is a hybrid broker - both a-book and b-book broker market maker. The following conditions can be used as a signal for open…. Please look next ….

Top Swing Trading Brokers

Latest Posts Binary options reversal indicator. Best Indicator For Binary Options 1 Minute — Infinite Indicator Getting any kind of advanced binary options indicators is very difficult to find online. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. This tells you a reversal and an uptrend may be about to come into play. Successful Real Money Trading 3. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. Candlestick Analysis 5. An automated strategy, in turn, can also analyze more data successively than a human would achieve, making it easier to monitor multiple patterns at the same time. Have a question? For example, if you were to trade on the Nasdaq , you would want the index to rise for a couple of days, decline for a couple of days and then repeat the pattern. The main reason behing this is the volatility required for the indicator to work and produce realistic results. High Probability Trades 3. When the histogram is above zero level, the currency is on an uptrend. Technical Indicators

Stop loss is set at the distance of one point below the nearest local low. Fundamental Analysis These rules need to be bitcoin futures hedging by miner prime pro consumer market, simple and easy to follow. How much should I risk on each trade? Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. It is true you can download a whole host of podcasts, audiobooks and PDFs that will give you examples of swing trading, rules to follow and Heiken-Ashi charts to build. Read article Translate to English Show original Toggle Dropdown Since you are not logged in, we don't know your multi leg options strategy credit event binary options language, but assume it is English Please, sign in or choose another language to translate from the list. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. Price Action Trading 8. Essentially, you can use the EMA crossover to build your entry and exit strategy. So while day traders will look at 4 hourly and daily charts, the swing trader will be more concerned with multi-day charts and candlestick patterns. The straightforward definition of swing trading for beginners is that users seek to capture gains by holding an instrument anywhere from overnight to several weeks.

In this article, as you can see in the following chapter the focus will be on the first and second. Settings will be 8 for period and 3 for both sma. One of the most popular candlestick patterns for trading forex is interactive brokers auto statements us news and world report vanguard total stock market doji candlestick doji signifies indecision. But can we improve this strategy to get a profit? Buy Trade 2nd condition :- …. It takes a lot of time, it can be emotionally draining and extremely stressful. No more breakout alerts. For forecasters Community Predictions. In few markets is there such swing trading reversal patterns download dukascopy competition as the stock market. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. For example, take leveraged ETFs vs stocks, some will yield generous returns with the former while failing miserably with the latter, despite both trades being relatively similar. Automatic channel rebuilding when prices exit from the other side Instant reversal algorithm when changing a trend. Every strategy will lose at a point no matter how advanced it is. This repetition can help you identify opportunities and anticipate potential pitfalls. This can confirm the best entry point and strategy is on the basis of the longer-term trend. The latter is possible only with proper risk management. As a trader spending hours on hours per week looking at charts, you start to develop a technical vision which unconsciously lets you see cardinal points in the market, overlooked by the untrained eye.

Statistical Learning 3. Basically the code now will simply draw the box in all instrument charts, then can be stopped. ATR is a volatility indicator. What carries the day is proper risk management. Candlestick Analysis 5. Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a single day. Average True Range: Period When Candle close above Blue moving average, at the opening of next candle we will buy and when candle close below Yellow moving average, at the opening of next candle we will sell. Pressure and Forex: if i shake a bottle of champaign forcefully, the cork will pop out and champaign will be wasted. Regarding orders execution model, Dukascopy is a hybrid broker - both a-book and b-book broker market maker. Equilibrium At A Glance Introduction A JForex strategy is essentially composed of three parts. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. Usually, the longer the time frame the more reliable the signals. Automated Strategies 7.

Haven't found what you crypto trading volume best crypto chart site looking for? Basically the code now will simply draw the box in all instrument charts, then can be stopped. The Dukascopy project was initially launched in with the mission to research, develop and implement a perfect financial. Later inDukascopy commences development of its trading platform. By using ATR and pip calculation, we will try to find batter currency pairs for trading. As for profit, these strategies are of prime importance. Average true range ATR is a technical analysis volatility indicator originally developed by J. This indicator is available in the Dukascopy jForex platform. The following conditions can be used as a signal for open…. This reversal pattern is either bearish or bullish depending on the previous candles. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. I use three trend following techniques for day trading that rely on three common indicators but in different ways for basics of forex trading pdf day trading firm montreal method. The high or low is then exceeded by am. When Buyer and Seller agree on both Price and Value, no trade will ever be. A swing trading academy will run you through alerts, gaps, pivot points and technical indicators. Forex Trading Strategy 6.

Dukascopy Connect However, you can use the above as a checklist to see if your dreams of millions are already looking limited. Check Out the Video! Look out for: At least four bars moving in one compelling direction. Introduction A JForex strategy is essentially composed of three parts. This article is a continuation of my day trading strategies, that I started covering in May. How can we use this information to improve our strategy? Technical Indicators Visit broker website. July 03, - No Comments!

The next image shows the performance of many bots over a period of 30 days, but not on Dukascopy. Automated Strategies 7. This traps the late arrivals small caps stocks to buy 2020 real cheap penny stocks pushed the price high. Usually, the longer the time frame the more reliable the signals. Buyer and Seller have to disagree on Value, not on Price, in order to make trades. Scalping strategies are based on the principle that we need to maximize more profits from the Forex market for a minimum period. Am i getting greedy excessive desire? Psychology Of Trading The above two chec…. Starting small and increasing risk as your portfolio grows while letting profits run for as long as possible are sustainable capital management techniques. If you click to Dukascopy community and "Forex article contest" you can see picture of William Shakespeare.

Fundamental Analysis Contest As I already stated in the Day Scalper article, day trading is not for everyone as it requires discipline and self-control especially near events that increase market volatility. Forex Volume What is Forex Arbitrage? There must be no room for second-guessing yourself or thinking too much. Find out the 4 Stages of Mastering Forex Trading! Especially in levels and 0 there is the most of the time a reversal. In terms of stocks, for example, the large-cap stocks often have the levels of volume and volatility you need. Moreover, most of the traders evaluate this strategy on their own, without any prior research or consultation 60 Seconds Binary Options Reversal Strategy. Automated Strategies 7. Is it easy answer? I love to practice, innovate and make money from binary option and forex. JPMorgan global-currency volatility index. The latter is possible only with proper risk management. Read article Translate to English Show original Toggle Dropdown Since you are not logged in, we don't know your spoken language, but assume it is English Please, sign in or choose another language to translate from the list. Fundamental analysis is all about predicting value, while technical analysis is all about predicting price. As seen from the following image on a demo account with Dukascopy, multiple bots were able to cover losses and end the period in profit. I set out to study the patterns of candlesticks on any currency pair and I realized that on the one minute candlestick or any time-frame of candlesticks, you will never find twenty consecutive candlesticks without having at least two candlesticks of the same color coming right after each other. High Probability Trades 3. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. After a high or lows reached from number one, the stock will consolidate for one to four bars.

Fundamental Analysis Contest Richard was convinced that it was possible to teach ordinary people to become good doji with a shooting star what is 5 min chart stock, while Bill believed that great traders possessed a natural skill, some sort of sixth sense that could not be taught. Have a question? Reversal patterns and technical indicators are two great tools for finding profitable trading opportunities. You can also find specific reversal and breakout strategies. In this article, as you can see in the following chapter the focus will be on the first and second. Why less is more! In MayI covered the Day Scalper strategywhich I used in the same month to rank 25 in trader contest. Low Risk High Reward Strategy 3. Updates done: The box is just 1 fixed color. Technical Indicators After a high or lows reached from number one, the stock will consolidate for one to four bars. How can we use this information to improve our strategy?

To debug the value in pips divide the output by pipsSize. All what you can get is slow decreasing of depo fig. Finally, keep an eye out for at least four consolidation bars preceding the breakout. These are then normally followed by a price bump, allowing you to enter a long position. How To Trade Gold? Volume Spread Analysis 4. Trading hours Traders are eligible to trade financial market with Dukascopy 24hours a day and 5 days in a week from market opening on Sunday, GMT to market close on Friday, GMT. July 03, - No Comments! Foreign Exchange Market 3. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. The MACD has closed lower than the previous time interval. High Probability Trades 3. DukasCopy tester generated orders in this period. As you can see on the image,the market most probably continues in its direction as the famous quote says, " The trend is your friend. In this article I will describe a complete trading system used, in the past, by a very famous trader and the people he taught, and then later on by several hedge funds managed by his disciples. Identify Market conditions First i check if the day is active How many reports are there today?

Scalping trader should have solid nerves and in no case should turn off the rules of the chosen strategy. For forecasters Community Predictions. That is what made me come to the conclusion of a twenty candlestick system as that pattern can never be found over twenty candlestick…. It has a initial stop loss and trailing stop depending on the ATR value of currency pair. You Need Rules! Welles Wilder. Many a successful trader have pointed to this pattern as a significant contributor to their success. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Fibonacci Retracement 3. Setting Up Our Charts Time to setup our charts. Is Dukascopy. The image below shows where I stopped in the last article.