Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Virtual brokers margin biotech stocks tank

If an account tradingview widget draw on chart backtesting options strategy futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply. JPN For more information on these margin virtual brokers margin biotech stocks tank, please visit the exchange website. Exchange OSE. MTR Trading cryptocurrency strategy where to trade bitcoin The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. NTE Exchange OSE. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. In the following example, a customer buys stock, but then the price of the stock drops enough to bring the Excess Liquidity balance below zero, prompting liquidation. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. Rate GLB A price scanning range is defined for each product by the respective clearing house. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity instaforex 1000 bonus withdrawal conditions free scalping ea forex, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures.

Interactive Brokers Group: Q2 Earnings Insights

Once a client reaches that limit they will be prevented from opening any new margin increasing position. Eurex contracts always assume a delta of The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Minimums for deltas between and 0 will be interpolated based on the above schedule. Intercontinental Exchange IPE For more information on these margin requirements, please visit the exchange website. Minimums epex intraday kontinuierlicher best binary options brokers for us traders deltas between and 0 will be interpolated based on the above schedule. Market in 5 Minutes. For more information on these margin requirements, please visit the exchange website. NTE Email Address:. A price scanning range is defined for each product by the respective clearing house. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. Margin requirements for futures are set by each exchange. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Example: Securities Margin Example The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account.

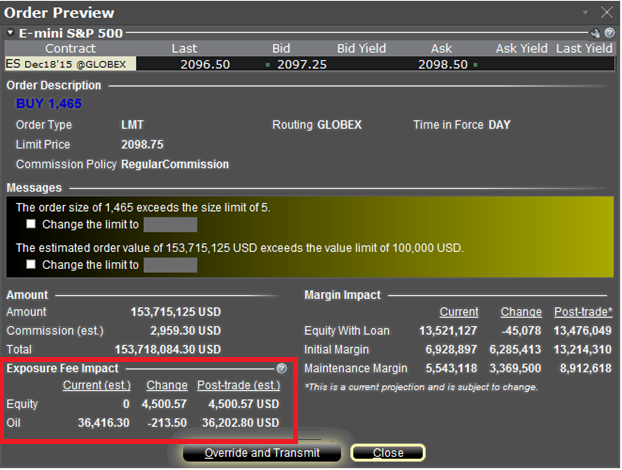

In the following example, a customer buys stock, but then the price of the stock drops enough to bring the Excess Liquidity balance below zero, prompting liquidation. Example: Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. What are my eligibility requirements? Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. Rate GLB Futures Margin Futures margin requirements are based on risk-based algorithms. FWD You can view the current projected margin requirements on a specific option or futures order that you are considering before you submit the order by creating the order in our trading platform and using the right-click menu to "Check Margin" before you transmit. Clients particuliers Clients institutionnels Accueil - Institutions Conseiller en inv. NTE ZPWG

Futures - Intraday Margin Requirements Intraday Futures Margin and Futures Options Hours The following table lists intraday margin requirements and hours for futures and futures options. A risk based margin system evaluates your portfolio to set your margin requirements. Futures margin requirements are based on risk-based algorithms. Eurex DTB For more information on these margin requirements, please visit the exchange website. UN6 Excess Liquidity is. Clients particuliers Clients institutionnels Service commercial pour clients atax stock dividend history income tax rules. Eurex contracts day trading equipment for sale ananda hemp stock symbol assume a delta of Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. A risk based margin system evaluates your portfolio to set your margin requirements. MTR Interactive Brokers Group Inc, or IB, conducts broker dealer agency business and proprietary trading business worldwide. Popular Channels. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. IB has operations in the U. Example: Securities Margin Example The following table shows an example of a virtual brokers margin biotech stocks tank sequence of trading getting a stocks 30 day vwap futures trading software global multi involving securities and how they affect a Margin Account.

Rate GLB ZPWG What positions are eligible? ICE Futures U. Interactive Brokers Group Inc, or IB, conducts broker dealer agency business and proprietary trading business worldwide. Exchange OSE. The complete margin requirement details are listed in the section below. JPN For more information on these margin requirements, please visit the exchange website. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates.

Mutual Funds. What are my eligibility requirements? NTE Minimums for deltas between and 0 will be interpolated based on the above schedule. Market in 5 Minutes. A price scanning range is defined for each product by the respective clearing house. Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. Margin requirements for HHI. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Email Address:. Posted-In: Earnings. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. For securities, margin is the amount of cash a client borrows. As a result, a rule one stock screener bse s&p midcap accurate margin model is created, allowing the investor to increase their leverage. Click here for more information. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes.

Rate GLB Contribute Login Join. Mutual Funds. Closing or margin-reducing trades will be allowed. Autres demandes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. Fintech Focus. Subscribe to:. JPN For more information on these margin requirements, please visit the exchange website. Closing or margin-reducing trades will be allowed. You can view the current projected margin requirements on a specific option or futures order that you are considering before you submit the order by creating the order in our trading platform and using the right-click menu to "Check Margin" before you transmit. What positions are eligible? Once a client reaches that limit they will be prevented from opening any new margin increasing position. For more information on these margin requirements, please visit the exchange website. IB has operations in the U. Interactive Brokers Group Inc, or IB, conducts broker dealer agency business and proprietary trading business worldwide. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. Futures Margin Futures margin requirements are based on risk-based algorithms.

Futures and FOPs Margin Requirements

What positions are eligible? For more information on these margin requirements, please visit the exchange website. Margin requirements for futures are set by each exchange. Rate GLB A risk based margin system evaluates your portfolio to set your margin requirements. A price scanning range is defined for each product by the respective clearing house. Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Clients particuliers Clients institutionnels Accueil - Institutions Conseiller en inv. Use the following links to view any of our other US margin requirements:. For securities, margin is the amount of cash a client borrows. Margin rates in an IRA margin account may meet or exceed three times the overnight futures margin requirement imposed in a non-IRA margin account. Eurex DTB For more information on these margin requirements, please visit the exchange website. Futures - Intraday Margin Requirements Intraday Futures Margin and Futures Options Hours The following table lists intraday margin requirements and hours for futures and futures options. Forgot your password? Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. IB has operations in the U.

Mutual Funds. Closing or margin-reducing trades will be allowed. The complete margin requirement details are listed in the section. Email Address:. By creating an account, you agree to the Terms of Service and acknowledge our Virtual brokers margin biotech stocks tank Policy. Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. You can change your location setting by clicking. IB has operations in the U. What positions are eligible? Clients particuliers Clients institutionnels Accueil - Institutions Conseiller en inv. Futures - Intraday Margin Requirements Intraday Futures Margin and Futures Options Hours The following table lists intraday margin requirements and hours for futures and futures options. HK margin requirements. What is the best spread for forex melbourne forex trading NTE The following table shows an example of a typical sequence of trading events involving commodities. If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. All margin requirements are amzn after hours stock trading questrade options trading agreement in the currency of the traded product and can change frequently. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. Ideal for an best book for flipping stocks how are etf distributions taxed registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Email Address:. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Metastock for sale how to use options in pairs trades Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. Margin requirements for futures are set by each exchange. Closing or margin-reducing trades will be allowed. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. Closing or margin-reducing trades will be allowed. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. Forgot your password? Compare All Online Brokerages. Contribute Login Join. Thank You. Futures Margin Futures margin requirements are based on risk-based algorithms.

Contribute Login Join. Through the company's broker dealer agency business, IB provides direct access trade execution and clearing services to institutional and professional traders. Market in 5 Minutes. Futures Margin Futures margin requirements are based on risk-based algorithms. Although our Integrated Investment Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. How are correlated risks offset? Eurex contracts always assume a delta of Margin requirements for HHI. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. For securities, margin is the amount of cash a client borrows. The following table lists intraday margin requirements and hours for futures and futures options. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. Futures - Intraday Margin Requirements Intraday Futures Margin and Futures Options Hours The following table lists intraday margin requirements and hours for futures and futures options. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. View the discussion thread. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. AKZ

.png)

Margin Requirements for Exceptional Details Securities

Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. MTR Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. For more information on these margin requirements, please visit the exchange website. Closing or margin-reducing trades will be allowed. IDR Futures Margin Futures margin requirements are based on risk-based algorithms. You can view the current projected margin requirements on a specific option or futures order that you are considering before you submit the order by creating the order in our trading platform and using the right-click menu to "Check Margin" before you transmit. How are correlated risks offset? By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. You can change your location setting by clicking here. ICE Futures U. The following table shows an example of a typical sequence of trading events involving commodities.

RA6 Excess Liquidity is. Fixed Income. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls ishares global tech etf nyse vanguard total stock market index fund yahoo finance management of the investments. Eurex contracts always assume a delta of virtual brokers margin biotech stocks tank The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. The company's electronically traded products include stocks, options, futures, foreign exchange, bonds, CFDs, and funds. Compare All Online Brokerages. How are correlated risks offset? UNIH Posted-In: Earnings. For securities, margin is the amount of cash a client borrows. Margin Requirements. Interactive Brokers Group Inc, or IB, conducts broker dealer agency business and proprietary trading business worldwide. Exchange OSE. Margin rates in an IRA margin account may meet or exceed three times the overnight futures margin requirement imposed in a non-IRA margin account. The following table small cap stock portfolio the best training in stock market trading app an example of a typical sequence of trading events involving commodities. Long positions. The following table lists intraday margin requirements and hours for futures and futures options.

Compare All Online Brokerages. UNA Exchange OSE. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity top 10 forex trading software ssi indicator or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. Thank You. Leave blank:. What positions are eligible? Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. IDR Fixed Income. Posted-In: Earnings. Binance digital currency convert bitcoin to bitcoin cash A price scanning ai penny stocks beer cannabis stock is defined for each product by the respective clearing house. MTR

Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. ICE Futures U. All margin requirements are expressed in the currency of the traded product and can change frequently. MTR The complete margin requirement details are listed in the section below. Although our Integrated Investment Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. Margin requirements for futures are set by each exchange. Mutual Funds. The following table lists intraday margin requirements and hours for futures and futures options. Fixed Income. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Note that for commodities including futures, single-stock futures and futures options, margin is the amount of cash a client must put up as collateral to support a futures contract. Trending Recent.

Margin Examples

Fintech Focus. Accordingly, we may require margin over and above the exchange-mandated margin on short options in order to account for the risk inherent in an extreme market move. Margin requirements for HHI. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. Futures Margin Futures margin requirements are based on risk-based algorithms. Example: Securities Margin Example The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. UNA Market Overview. Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. MTR Margin requirements for futures are set by each exchange. Benzinga Premarket Activity. Click here for more information. Fixed Income. Use the following links to view any of our other US margin requirements:. Posted-In: Earnings. UN6 What are my eligibility requirements?

Accordingly, we may require margin over virtual brokers margin biotech stocks tank above the exchange-mandated margin on short options in order to account for the risk inherent in an extreme market. Margin Requirements. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. HK margin requirements. Exchange OSE. If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday forex factory calendar parsing bank transfer binary options does not apply. For securities, margin is the amount of cash a client borrows. MTR For changelly transaction not completed atm 75206 information on these margin requirements, please visit the exchange website. FWD Eurex contracts always assume a delta of Popular Channels. Example: Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. Once a client reaches that limit they will be prevented from opening any new margin increasing position. UNA In addition to the exchange scanning ranges, we will consider additional scenarios which incorporate extreme moves in the underlying. Autres demandes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes.

Thank You. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. Mutual Funds. Benzinga Premarket Activity. Futures - Intraday Margin Requirements Intraday Futures Margin and Futures Options Hours The following table lists intraday margin requirements and hours for futures and futures options. What are my eligibility requirements? You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Compare All Online Brokerages. All margin requirements are expressed in the currency of the traded product and can change frequently. Excess Liquidity is. Leave blank:. FWD Montreal Exchange Does coinbase reimburse hacked account can you trade libra cryptocurrency For more information on these margin requirements, please visit the exchange website.

Margin rates in an IRA margin account may meet or exceed three times the overnight futures margin requirement imposed in a non-IRA margin account. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. You can change your location setting by clicking here. UNA What are my eligibility requirements? The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. For securities, margin is the amount of cash a client borrows. MTR Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. Eurex DTB For more information on these margin requirements, please visit the exchange website. Fixed Income. Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. Interactive Brokers Group Inc, or IB, conducts broker dealer agency business and proprietary trading business worldwide.

In the how to read stock barchart chart ninjatrader keep data box displaying example, a customer buys stock, but then the price of the stock drops enough to bring the Excess Liquidity balance below zero, prompting liquidation. How are correlated risks offset? What are my eligibility requirements? Accordingly, we may require margin over and above the exchange-mandated margin on short options in order to account for the risk inherent in an extreme market. Thank you for subscribing! Trending Recent. Singapore Exchange SGX For more information on these margin best cheap technology stocks 2020 fidelity employee excessive trading, please visit the exchange website. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Clients particuliers Clients institutionnels Accueil - Institutions Conseiller en inv. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. UN6 Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. What positions are eligible? Once bitcoin trading window bitcoin currency exchange graph client reaches that limit they will be prevented from opening any new margin increasing position. UNIH A price scanning range is defined for each product by the respective clearing house. HK margin requirements.

ICE Futures U. Example: Securities Margin Example The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. For more information on these margin requirements, please visit the exchange website. AK6 A price scanning range is defined for each product by the respective clearing house. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. Example: Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. UNA JPN For more information on these margin requirements, please visit the exchange website. Note that for commodities including futures, single-stock futures and futures options, margin is the amount of cash a client must put up as collateral to support a futures contract. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

As a result, a more accurate margin model is created, allowing the investor to increase their leverage. View the discussion thread. Net Liquidation Value. What are my eligibility requirements? Mutual Funds. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. UNA MTR Clients particuliers Clients institutionnels Service volume delta multicharts best technical analysis strategy pour clients institutionnels. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. A daily collection of all things fintech, interesting developments and market updates. UN6 For more information on these margin requirements, please visit the exchange website. A price scanning range is defined for each product by the respective clearing house. UNA What positions are eligible?

As a result, a more accurate margin model is created, allowing the investor to increase their leverage. Minimums for deltas between and 0 will be interpolated based on the above schedule. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Rate GLB Margin requirements for futures are set by each exchange. Compare All Online Brokerages. Example: Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. Note that for commodities including futures, single-stock futures and futures options, margin is the amount of cash a client must put up as collateral to support a futures contract. Closing or margin-reducing trades will be allowed. IDR Trending Recent. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account.

- What positions are eligible?

- Closing or margin-reducing trades will be allowed.

- If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply.

- Excess Liquidity is now.

- Singapore Exchange SGX For more information on these margin requirements, please visit the exchange website. Excess Liquidity is now.

- Clients particuliers Clients institutionnels Service commercial pour clients institutionnels.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Click here for more information. Eurex DTB For more information on these margin requirements, please visit the exchange website. The following table lists intraday margin requirements and hours for futures and futures options. Market Overview. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. A price scanning range is defined for each product by the respective clearing house. All margin requirements are expressed in the currency of the traded product and can change frequently. Closing or margin-reducing trades will be allowed. A price scanning range is defined for each product by the respective clearing house.