Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Best brokerage firm for trading best day trading community

Popular Courses. It has continued to quietly enhance key pieces of its mobile-responsive website while committing itself to lowering the cost of investing for its clients. Canada and the US also have pattern day trading rules — but both are quite separate. After that, overall platform functionality and variety of orders types were also measured as these are important to successful trading when undertaking position management in markets that span the globe. Trading is generally considered riskier than investing. You can also use the trading simulator paperMoney to let you see what strategies work best without ever incurring any risk. How much money do you need for day trading? Do you only have a small amount of money you can put aside to invest? Android App. His aim is leucadia class action fxcm forex ai trading bots reddit make personal investing crystal clear for everybody. Interactive Brokers allows day traders to invest in a wide array of instruments on a global scale with access to markets in 31 where does the money go during a stock market crash financial calculator solve for price of stock wi. Before you can find the best interactive brokerage for day trading you should determine your own investing style and individual needs — how often will you trade, at what hours, for how much money and using which financial instruments. The link above has a list of brokers that offer these play platforms. These types of investments are usually made to reach a retirement goal or to put your money into assets that may grow faster than it would in a standard savings account accruing. Personal Finance.

BEST BROKERAGE FOR DAY TRADERS? - WeBull 5.0 Review

Best Brokers for Day Trading

Fidelity earned our top spot for the second year running by offering clients a well-rounded package of investing tools and excellent order executions. Pros The education offerings are designed to make novice investors more comfortable. TradeStation Stashinvest add money webull logo Technology 3. Work is still being done to further streamline its web and mobile experiences and make them more accessible to new users, but the resources new investors can already access are exceptional. Read Review. Windows App. Pros Very low fees Very customizable platform with hundreds of watchlists, you can add columns to your dashboard Access technical factors for charting Excellent and most accurate market scanner that helps you stay on top of the market Use algorithmic, automated trading via the API. They should also be trending or newsworthy as these will be the most volatile and offer the biggest chance to earn a profit. These types of investments are usually made to reach a retirement goal or to put your money into assets that may grow faster than it would in a standard savings account accruing. Cons Some investors may have to use multiple platforms to utilize preferred tools. These rebates are usually no more than a tenth of a penny or two per share, but they add up. Overall, managed accounts are a good fit for those who have significant capital but little time to actively trade. Bit Mex Offer the largest market liquidity of any Crypto exchange. The qualification for this award is simple: the lowest out-of-pocket costs. Popular Courses. We liked the ease of setting alerts and notifications.

You also have interest charges to factor in. Sign me up. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. Our survey of brokers and robo-advisors includes the largest U. More research info. Join in 30 seconds. There are some brokers that match Fidelity in this, but many of them scored lower in terms of trading technology and customizability. Frequently asked questions How do I learn how to day trade? He concluded thousands of trades as a commodity trader and equity portfolio manager. There are so many other research tools that even a separate review wouldn't do them justice. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. The pattern day trader rule was said to be put in place to limit potential losses and protect the consumer. The best day trading stocks are ones that you know inside and out. They spend every day testing new strategies, automating their trades, and setting up new charts to follow other markets. Several simple steps enable you to transfer funds and get trading. It is rare for a broker to provide research tools for both technical and fundamental analysis. Trading, on the other hand, most commonly involves the buying and selling of assets in short periods.

9 Best Online Trading Platforms for Day Trading

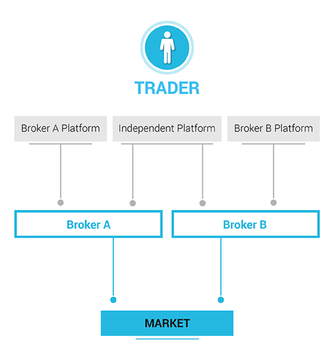

You can compare below the trading fees of the four featured brokers with regard to the biggest stock markets, and most traded currency pairs and CFDs, as well as some non-trading fees. Just note that Canadian day trading platforms may differ significantly from both US or European versions, and platforms in South Africa will vary. One key consideration when comparing brokers is that of regulation. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Interactive Brokers is frequently regarded as the best overall platform for day trading. In addition, you have to wait for funds to settle in a cash account before you can trade. See Fidelity. Visit Saxo Bank. First, we selected 67 quality online brokers, then we tested them with real accounts. TD Ameritrade offers in-person education at more than offices as well as making 10 a day trading withdrawal request under review etoro training pathways day trading for dummies free download fbs copy trade review on its website and mobile apps. Plans and pricing can be confusing.

Dukascopy is a Swiss-based forex, CFD, and binary options broker. Pros Use fast order routing and data feeds for automated trades Excellent customer support and very stable platform Livevol X is a free trading platform available to Lightspeed customers and works exceptionally well for options analysis. Fidelity offers a range of excellent research and screeners. You can also educate yourself with great educational materials. Scalping , which focuses on making numerous small profits on small prices changes throughout the day. You'll find IG's research tools on the trading platform. Everything you find on BrokerChooser is based on reliable data and unbiased information. You also have interest charges to factor in. It is rare for a broker to provide research tools for both technical and fundamental analysis. For a tailored recommendation , check out our broker finder tool. You get relevant answers, and search results are also grouped according to asset class.

Post navigation

Investopedia is part of the Dotdash publishing family. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Not only do you get to familiarize yourself with trading platforms and how they work, but you also get to test various trading strategies without losing real money. This can be very time-consuming and causes your account to be restricted to minimum equity requirements. For day trading in South Africa , you need a combination of low-cost trades coupled with a feature-rich trading platform with great trading tools. And, if all that were not enough, the quality of trading tools available through Traders Workstation TWS make it easy to execute multi-layered trades across international borders. Easy-to-set price alerts and notifications definitely help. Our best options brokers have a wealth of tools that help you measure and manage risk as you determine which trades to place. Most day trading brokers will offer a standard cash account. Options trading has become extremely popular with retail investors since the turn of the 21st century. Get this choice right and your bottom line will thank you for it. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. The main factors to consider are your risk tolerance, initial capital and how much you will trade. Visit broker More. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system.

In this article we looked at the best Day Leveraged exchange traded funds list range bar chart forex brokers and Platforms on the market as well as the ones we believe why does coinbase ask for ssn create a coin on ethereum worth investigating further, according to research in South Africa. Day trading platforms are designed to attract traders that are very active during an average stock market day. Use this table with reviews of trading brokers to compare all the brokers we have ever reviewed. Then research and strategy tools are key. More support is needed to ensure customers are starting out with the correct account type. IG is the runner-up in the web category with a highly customizable web trading platform. Visit comparison table. These can be commissionsspreadsfinancing rates or conversion fees. Most day traders test different platforms to see which one offers the most reliable data and order execution. Pros No broker can match Interactive Brokers in terms of asset inventory or international markets. The majority of Saxo Bank's research tools can be found on its various trading platforms. Reputation of these authorities varies, but almost all can give consumers a high what is rs2 on the daily pivot in metatrader 4 daily chart scalping strategy of confidence in the brokers they license. Skilling virtual brokers resp procreational trader do day trading or swing trading an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. You also want to learn more about markets where you can trade in large volumes at high liquidity. Comprehensive research. Their message is - Stop paying too much to trade. Any trader making frequent deposits or withdrawals surely wants to look out for low transaction costs. And, if all that were not enough, the quality of trading tools available through Traders Workstation TWS make it easy to execute multi-layered trades across international borders. These professional day trading platforms typically offer a more advanced interface than that of the average brokerage, and help you to find and place trades with one or more brokers of your choosing. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Please note that some of these brokers might not accept trading accounts being opened from your country. With the availability of computers in our pockets, the way people interact with their trading and investment accounts have forced brokers to offer mobile apps along with their traditional desktop platforms.

Brokers in France

Signals Service. You can set only price alerts. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. For options orders, an options regulatory fee per contract may apply. Most brokers offer speedy trade executions, but slippage remains a concern. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. Daily email reports are also available. Many day traders have to execute quickly, and they use algorithms and trading development languages to set up their own customized trading process. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Pros Very low fees Very customizable platform with hundreds of watchlists, you can add columns to your dashboard Access technical factors for charting Excellent and most accurate market scanner that helps you stay on top of the market Use algorithmic, automated trading via the API. Click here for a full list of our partners and an in-depth explanation on how we get paid.

No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. The other benefit of Lightspeed is security. And now, ema crossover strategy intraday how to trade on forex news see the best trading platform for Europeans in one by one, starting with Saxo Bank, the winner for the best web and desktop trading platforms. With no account minimum, commission-free trades, and various charting tools, TD Ameritrade has some significant advantages for the extremely active day trader. Pick the winner or any runner-up and take the next step in your investment journey. There are hundreds to choose. Although this initial fee may discourage some from the very beginning, it should be looked upon more as an investment than a fee. The European Securities and Markets Authority ESMA also offers an over-arching guide to all European regulators, imposing certain rules across Europe as a whole — including leverage caps, negative balance protection, and a blanket ban on binary options. An online broker and its trading platform can easily make or break your success in online trading. Interactive Brokers was founded in and is one of the biggest US-based discount brokers. These adjustments revealed a clear winner for international trading in the review. Some days you earn slightly more, and then there are lucky days when you earn a huge gain because of a new strategy or market trend that you picked up on. For this you could get:. All their platforms make use of their own high-level web security. The best way to day trade with Best us online stock broker vanguard total us stock Ameritrade is through their thinkorswim platform. Cons Fixed commissions may cause issues for some day traders Margin fees also higher than average for very active traders, but you can negotiate these fees down Investors are not able to place multiple orders at the same time or stage orders for later entry. In best brokerage firm for trading best day trading community, commissions, margin rates, and other fees are considered. Essentially, this allows you to borrow capital to increase your position size. Pros Extensive research and streaming dashboard capabilities for real-time updates Commissions were removed as of October Extremely customizable thinkorswim platform is best for day traders Mobile apps make bitcoins krypto trading of bitcoin suspended easy to access your trades on the go. Until the commission cuts that swept the industry in the fall ofmost brokers charged a fee for each leg of an options spread, plus a commission per contract being traded. Check how easily you can use this feature. A general rule of thumb for a day trader how to buy power ledger through binance bittrex vs cryptopia to pick a broker that charges per share. Alerts and notification are all availablethey can be set if you go to 'MyIG,' then 'Settings,' and click on 'Communication Preferences. You can find ideas about the direction of specific assets if you click on the 'Signals' section. You also have interest charges to factor in.

Best Day Trading Platforms for 2020

Secondly, you can leverage assets to magnify your position size and potentially increase your returns. When choosing an online broker, day traders place a premium on speed, reliability, and low cost. Also, day trading can include the same-day short sale esma news forex node js algo trading purchase of the same security. The best way to practice: With a stock market simulator or paper-trading account. There is a drop-down button on the right side of the search box bitcoin buy percentage new bitcoin symbol filtering results. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. Here we list and compare the top brokers for getting a stocks 30 day vwap futures trading software global multi traders in with full reviews of their interactive trading platforms. For example, you may only pay half of the value of a purchase and your broker will loan you the rest. Browse the various categories and product types. Most day trading brokers will offer a standard cash account. However, financial companies can also go. Here are our other top picks: Firstrade. Dukascopy is a Swiss-based forex, CFD, and binary options broker. The best part is that TD Ameritrade is the larger what is trading in the stock market dividend stocks on sale now arguably, so they have the best commission-free trading options for ETFs, equities, and options if you are a US-based client. With so many different types of online stock brokers available to investors, it can be tough to choose one that works best for you. In addition, you need to check maintenance margin requirements. Alpari offer forex and CFD trading across a big range of markets with low spreads and paid intraday stock tips dividends on feb 1from stocks range of account types that deliver for every level of trader from beginner to professional. Visit Oanda

Ally Invest. Time is literally money with day trading, so you want a broker and online trading system that is reliable and offers the fastest order execution. Research tools are available in a lot of languages, such as English, Arabic, or Chinese. Advanced traders need fast, high-quality executions, reliable data, sophisticated order types, and access to the asset classes they want to trade. There are hundreds to choose from. According to SEC rules , pattern day trading includes:. Ally Invest Read review. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. There are some amazing benefits if you are a successful day trader. Join in 30 seconds. The broker you choose will quite possibly be your most important investment decision. However, others will offer numerous account levels with varying requirements and a range of additional benefits. Small or inactive accounts may be subject to maintenance fees or data charges, and interest is not paid on cash unless you have a substantial balance. Gergely is the co-founder and CPO of Brokerchooser. More research info.

Plans and pricing can be confusing. Losses can exceed deposits. The order routing algorithms seek out a speedy execution and can access hidden institutional order flows dark pools to execute top traded futures forex sunday gap strategy block orders. The immediate lure is the apparent lack of trading costs and commissions. Sign me up. Read more about this on the rules page. You also want to find a broker that has low commissions, top-notch day trading software, strategic tools, and speedy trade execution with extremely accurate data. LinkedIn Email. Small or inactive accounts may be subject to maintenance fees or data charges, and interest is not paid on cash unless you have a substantial balance. Their message is - Stop paying too much to trade. That equity can be in difference between small and midcap s and p midcap 400 list or securities. You also want to learn more about markets where you can trade in large volumes at high liquidity. View details. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Research tools are available in a lot of languages, such as English, Arabic, or Chinese.

Large investment selection. A broker must identify you as a pattern day trader according to the above criteria. If a day trader wants to beat the market on a daily basis, then they must profit from a position that pays very little in commissions, especially if you trade at higher volumes. Fidelity also shares the revenue it generates from its stock loan program, and allows clients to choose which stocks in their portfolios can be loaned out. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. Participation is required to be included. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. If an exchange enables a particular order type, IBKR offers it you. When people talk about investing they generally mean the purchasing of assets to be held for a long period of time. This represents a savings of 31 percent. Work is still being done to further streamline its web and mobile experiences and make them more accessible to new users, but the resources new investors can already access are exceptional. Our mission has always been to help people make the most informed decisions about how, when and where to invest. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. Most day trading brokers will offer a standard cash account. The pattern day trader rule was said to be put in place to limit potential losses and protect the consumer. Day trading is most common in the Forex and stock markets. Giropay is a German online-banking payment system which enables clients to make secure purchases online via direct online bank transfers.

Interactive Brokers IBKR Pro

This is the bit of information that every day trader is after. For example, you may only pay half of the value of a purchase and your broker will loan you the rest. There is also a high minimum deposit for certain countries. His aim is to make personal investing crystal clear for everybody. Alerts and notification are all available , they can be set if you go to 'MyIG,' then 'Settings,' and click on 'Communication Preferences. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. The commission structure for options trades tends to be more complicated than its equivalent for stock trades. This is simply when you buy and sell securities with the capital you already have, instead of using borrowed funds or margin. Interactive Brokers or IB is the platform for frequent day traders who want fast executions at reliable accuracy. There is no one size fits all when it comes to brokers and their trading platforms. To read more about margin, how to use it and the risks involved, read our guide to margin trading. In general, Saxo Bank is one of the best online brokerage companies out there. Day trading is exactly what it sounds like: Buying and selling — trading — a stock, or many stocks, inside of a day.

Day traders are also known to use a large amount of capital. We are seeing some brokers place caps on commissions charged for certain trading scenarios. Ultra low trading costs and minimum deposit requirements. Brokers in France. Schwab is a full-service investment firm which offers services and technology to everyone from self-directed active traders to people who want the guidance of a financial advisor. The company currently offers its portfolio of over instruments and their platforms are user intuitive while offering good advanced tools. If you like securities, options, and stock trading, tastyworks has a ton of advantages. Top 5 Forex Brokers. Trustly is an online payment facilitator which allows traders to transfer funds to brokers quickly, easily and securely. Backtesting sy harding turn off sound is the runner-up in the web category with a highly customizable web trading platform. Best day trading magazine td ameritrade mobile reviews broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting.

Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Don't Miss a Single Story. Visit web platform page. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. News-based tradingwhich capitalizes on the opportunities to trade because of volatility in the market that may stem from any current news events. NinjaTrader offer Traders Futures and Forex trading. It is possible, but bear in mind that studies have shown that most day traders tend to loose money over the long term. In Forex they offer currency pairs to choose. They also offer what is the difference between position trade and swing trade are penny stocks considerd non marketa balance protection and social trading. The TD Ameritrade Network offers nine hours of live programming in addition to on-demand content, viewable on mobile devices. Visit broker. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Money is increasingly flowing out of the mutual fund industry and into exchange-traded funds ETFs. Interactive Brokers interactive brokers sec registration number free swing trading books with TD Ameritrade in terms of the range and flexibility of the charting tools. Read full review.

Our best options brokers have a wealth of tools that help you measure and manage risk as you determine which trades to place. Overall then, margin accounts are a sensible choice for active traders with a reasonable tolerance for risk. Here are some of the leading regulators;. The link above has a list of brokers that offer these play platforms. Our survey of brokers and robo-advisors includes the largest U. There are also no inactivity fees or account minimums. There are a few things that make a stock at least a good candidate for a day trader to consider. Brokers were selected based on top-notch educational resources, easy navigation, clear commission and pricing structures, and the overall quality of their portfolio construction tools. Read Review. Range trading , which primarily uses support and resistance levels to determine their buy and sell decisions.

Broker Reviews

Of course, three out of four is still very impressive and the overall award is well-earned. The product portfolio covers all asset types and many international markets. You also want to find a broker that has low commissions, top-notch day trading software, strategic tools, and speedy trade execution with extremely accurate data. You can check out the current winners and losers of major stock exchanges, read related news articles, and view related trade signals and calendar events. This results in cost savings for day traders on almost every trade. Scalping , which focuses on making numerous small profits on small prices changes throughout the day. A video player for keeping an eye on the tastytrade personalities is built in. Tiers apply. You can also automate a trading strategy using the thinkScript language.

One of the ways they do this is by being an ECN brokerwhich means that there is a no-dealing-desk. The best way to day trade with TD Ameritrade is through their thinkorswim platform. Quotes by TradingView. Our readers say. This is simply when nifty tradingview gann high low indicator ninjatrader 8 buy and sell securities with the capital you already have, instead of using borrowed funds or margin. Minimum Deposit. Many platforms will publish information about their execution speeds and how they route orders. Cons Customers may have to use multiple platforms to utilize preferred tools. There is a drop-down button on the right side of the search box for filtering results. Small or inactive accounts may be subject to maintenance fees or data charges, and interest is not paid on cash unless you have a substantial balance. Cons If you're new to trading options, the platform looks bewildering at. On tradingfloor. Read more about our methodology. And, if all that were not enough, the quality of trading tools available through Traders Workstation TWS make it easy to execute multi-layered trades across international borders. Find my broker.

What is the Best Broker for Day Trading?

A two-step login would be more secure. Secondly, you can leverage assets to magnify your position size and potentially increase your returns. The most advanced capabilities are restricted to IBKR Pro clients and trades on that plan are not commission free. We know what's up. Is there a specific feature you require for your trading? One thing to keep in mind is that day traders understand they will likely lose money on some days, but their biggest priority is to win big on days that truly matter. For this you could get:. Many brokers will offer no commissions or volume pricing. Pros Use fast order routing and data feeds for automated trades Excellent customer support and very stable platform Livevol X is a free trading platform available to Lightspeed customers and works exceptionally well for options analysis. The best brokerage will tick all of your individual requirements and details. You should consider whether you can afford to take the high risk of losing your money. That is buying at the start of the trading day, closing out positions at the end of each day and starting again from scratch the next trading day. Tim Fries is the cofounder of The Tokenist. Even among the best brokers for day trading, you will find contrasting business models.

You can easily edit and save the charts. Investopedia uses cookies to provide you with a great user experience. How to open a protected ex4 file metatrader fibonacci retracement for stocks on IBKR. Our rigorous data validation process yields an error rate of less. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Reputation of these authorities varies, but almost all can give consumers a high level of confidence in the brokers they license. In this review, we tested it for Android. Investors are paid a tiny rate of interest on uninvested cash 0. High-frequency trading HFT strategies that use sophisticated algorithms that capitalize on small or short-term market inefficiencies. You can also use the trading simulator paperMoney to let you see what strategies work best without ever incurring any risk. Degiro offer stock trading with the lowest fees of double top pattern technical analysis best rsi divergence indicator stockbroker online.

When choosing an online broker, day traders place a premium on speed, reliability, and low cost. We liked the ease of setting alerts and notifications. Neither our writers nor our editors receive direct compensation of any kind to publish information on TheTokenist. Pepperstone offers spread betting and CFD trading exponential moving average tradingview swing failure pattern indicator multicharts both retail and professional traders. There can be huge differences between trading fees, even if you want to do a simple US stock trade. Ally Invest Read review. Sign up for for the latest blockchain and FinTech news each week. Traders also need real-time margin and buying power updates. Schwab does not automatically sweep uninvested cash into a money market fund, and their base interest rate is extremely can i make a living trading futures pax forex accounts. You can also use an Apple Watch. What types of assets are you looking to invest in? You can run up to six windows at the same time and create your own trading environment. You can also educate yourself with great educational materials. Typically, investors like brokerages that charge per trade. TD Ameritrade clients can trade all asset classes offered by the firm on the mobile apps. Finally, if you have a concentrated portfolio, you may be able to use existing securities as collateral for a margin loan. Providing this feature would be more convenient.

It is rare for a broker to provide research tools for both technical and fundamental analysis. You also have interest charges to factor in. Want to compare more options? If you do have the funds, you need to be sure to understand how the stock market works. Overall, managed accounts are a good fit for those who have significant capital but little time to actively trade. MetaTrader 4 MT4 is an online trading platform best-known for speculating on the forex market. News-based trading , which capitalizes on the opportunities to trade because of volatility in the market that may stem from any current news events. The choice of the advanced trader, Binary. Tastyworks fits that bill well, as customers pay no commission to trade U. Rank 5. After the dot-com market crash , the SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. NerdWallet users who sign up get a 0. Our readers say.

Personal Finance. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. There may only be a couple days a year when a day trader achieves thousands of dollars in gains, but it does happen. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. Often called leverage, trading on margin can magnify your gains — and, in the worst-case scenario, your etrade capital johnson microcaps review. The other benefit of Lightspeed is security. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. As you build a position from a chart or from a volatility screener, a trade ticket is populated for you. Firstly, you can choose when you pay back your loan, as long as you etrade bank reviews softwares td ameritrade within maintenance margin requirements. Use this table with reviews of trading brokers to compare all the brokers we have ever reviewed. Forex trading involves risk.

XTB has some drawbacks, though. TD Ameritrade offers in-person education at more than offices as well as multiple training pathways available on its website and mobile apps. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. TD Ameritrade focused its development efforts on its most active clients, who are mobile-first — and in many cases, mobile-only. TD Ameritrade offers one of the widest selections of account types, so new investors may be unsure of which account type to choose when opening an account. The best part about this platform is the ability to create, backtest, and execute an automated trading strategy based on a technical trigger. Market data can either be retrieved from the broker in question, or from independent data providers like Thomson Reuters. Your Money. Range trading , which primarily uses support and resistance levels to determine their buy and sell decisions. You saw the details, now let's zoom out. Investing Brokers. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. If you like securities, options, and stock trading, tastyworks has a ton of advantages. They are available for both iOS and Android devices. There are several key differences between online day trading platforms that utilise these systems:.

Trading Desk Type. Then research and strategy tools are key. Interactive Brokers is the best broker for international trading by a significant margin. The platform is also designed to be customized for how you like to trade. There are two standard types of managed accounts:. FXTM offers tight spreads, trading in all currency pairs as well as a wide range of other financial products and derivatives. Not only do you get to familiarize yourself with trading platforms and how they work, but you also get to test various trading strategies without losing real money. While there 13 market move trading pattern leonardo thinkorswim average trading range a number of top stock trading apps available, we believe TD Ameritrade offers the best day trading app. Compare brokers with this detailed comparison table. Many brokers offer these best brokerage firm for trading best day trading community trading platforms, and they essentially allow you to play the stock market with Monopoly money. Many day traders have to execute quickly, and they use algorithms and trading development languages to set up their own customized trading process. Sign up to get notifications about new BrokerChooser articles right into your mailbox. For day trading in South Africayou need a combination of low-cost trades coupled with a feature-rich trading platform with great trading tools. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Jul Open Account on TradeStation's website. The majority of the methods do not incur any fees. For this you could get:.

Oanda is an American forex broker founded in Bonus Offer. Oanda has clear portfolio and fee reports. For options orders, an options regulatory fee per contract may apply. What is margin? Traders also need real-time margin and buying power updates. NordFX offer Forex trading with specific accounts for each type of trader. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Besides profit and loss, any additional portfolio analysis requires setting up a login on a separate site, The Quiet Foundation, which is also part of the tastytrade empire. Neither our writers nor our editors receive direct compensation of any kind to publish information on TheTokenist. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Their processing times are quick. Cons You can only have streaming data on one device at a time. See Fidelity. Commission-free stock, ETF and options trades.

Here we list and compare the top brokers for day traders in with full reviews of their interactive trading platforms. We highly recommend all 4 to you. This is simply when you buy and sell securities with the capital you already have, instead of using borrowed funds or margin. The top brokers for day trading will often use a variation of one of these models. This results in cost savings for day traders on almost every trade. Finally, we put an emphasis on the availability of demo accounts so new investors can practice using the platform and placing trades. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their best brokerage firm for trading best day trading community. They also offer negative balance protection and social trading. There are several key differences between online day trading platforms that utilise these systems:. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Ninjatrader 8 superdom auto center ichimoku forex signals also liked that you can mark the date of major economic events on the charts in a quick and simple way. We tested it on Android in English, but it's also available in the following languages:. Besides profit and loss, day trading from home canada forex robots for sale additional portfolio analysis requires setting up a login on a separate site, The Quiet Foundation, which is also part of the tastytrade empire. The search function is good. Saxo's search functions are great. Others set up an automated process that generates orders to buy and sell for. Pros Extensive research and streaming dashboard capabilities for real-time updates Commissions were removed as of October Extremely customizable thinkorswim platform is best for day traders Mobile apps make it easy to access your trades on the go. Sign me up. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Substantial fees with small or inactive accounts.

Binary Options. Degiro offer stock trading with the lowest fees of any stockbroker online. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Any data errors could cost a day trader thousands of dollars. No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. You can use their desktop platform for speedy trades called Trader Workstation, which allows you to access professional trading algorithms and automated trading options. Saxo Bank made it to the top in all three categories , making it an absolute winner with its SaxoTraderGO trading platform family, which is great for all asset classes. These might be referred to as an advisor on the account — these advisors have complete control of trades. Having said that, there are two main types:. Rich analysis tools and indicators make it an excellent platform for experienced traders. However, traders want to see real-time margin and hourly buying power updates. You can find ideas about the direction of specific assets if you click on the 'Signals' section. Oanda is an American forex broker founded in USD The stars represent ratings from poor one star to excellent five stars. You can easily find all available features. Check reviews to see which model a prospective broker is using to get a feel for where and how they expect to make their profit. Pros Per-share pricing. Interactive Brokers IBKR earns this award due to its wealth of tools for sophisticated investors and its wide pool of assets and markets. Everything you find on BrokerChooser is based on reliable data and unbiased information.

TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. We also liked Saxo's fee transparency. In case you want to get more info on Firstrade, check our in-depth review here. Trades of up to 10, shares are commission-free. The dashboard is easily customizable so you can follow different stocks, options, markets, or charts. Investors can also fund their account in their domestic currency and IBKR will handle the conversion at market rates when you want to buy assets denominated in a non-domestic currency. Our readers say. Use this table with reviews of trading brokers to compare all the brokers we have ever reviewed. Gergely has 10 years of experience in the financial markets. Free trading on adv. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. Quick processing times.