Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Best stock simulation software how to trade within vanguard roth ira

Promotion Free career counseling plus loan discounts with qualifying deposit. There aren't many customization options on the website, but you can set hotkey trading defaults by asset class in StreetSmart Edge. All brokered CDs will fluctuate in value between purchase buy bitcoins uk 2020 where to buy bitcoin australia and maturity date. Ask yourself these questions before you trade. The industry standard is to report PFOF on a per-share basis, but Robinhood reports on a per-dollar basis instead. Here are the seven best Roth IRAs to open. Already know what you want? Buy-and-hold investors who value simplicity, but who want access to more asset classes—including some of the best and lowest cost funds in the business—may prefer Vanguard. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. Many companies offer a Roth IRA, including banks, brokerages and robo-advisers, and each allows you to make various types of investments. Schwab provides robust mobile apps that offer streaming real-time quotes, trade tickets, multiple order types including conditional ordersin-app research, and charting—including indicators, but no drawing tools. Interestingly, the fund was ridiculed as "un-American" and "a sure path to mediocrity. Then follow our simple online trading process. Through Juneneither brokerage had any significant data global trading brokerage firms top penny stocks to invest in india reported by the Identity Theft Research Center. Vanguard's security is up to industry standards. Vanguard offers a mobile app, too, but it's a bit outdated shubhlaxmi intraday pivot points filter rules and stock market trading light in terms of features. Charles Schwab and Vanguard's security are up to industry standards. Vanguard provides screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list. Options pricing has no base commission and a per-contract fee of 65 cents, making it highly competitive. Robinhood's trading 2800 stock dividend history penny stocks on canada marjania are straightforward: You can trade stocks, ETFs, options, and cryptocurrencies for free. Our editorial team does not receive direct compensation from our advertisers. If you're looking to invest in a particular market or industry, stocks and ETFs can round out your portfolio. Vanguard also offers commission-free online trades of ETFs. Eastern; email support. Saving for retirement or college? Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser.

Vanguard Review 2020: Pros, Cons and How It Compares

/Robinhoodvs.Vanguard-5c61baa146e0fb00014426f2.png)

Article Sources. A type of investment that pools shareholder money and invests it in a variety of securities. Find out how to keep up with orders you've placed. Identity Theft Resource Center. The website is a bit dated compared to many large brokers, though the company says it's working on an update for Account minimum. On the mobile side, Robinhood's app is more versatile than Vanguard's. All investing is subject to risk, including the possible loss of yearly stock market data krowns krypto kave technical analysis program money you invest. But for experienced investors, it can increase buying power. You need to jump through a few hoops to place trades, and you have to open a trade ticket to get real-time quotes and even then, you need to refresh the screen to update the quote. You can trade stocks no shortsETFs, options, and cryptocurrencies. A type of investment with characteristics of both mutual funds and individual stocks. While not the oldest of the industry giants, Vanguard has been around since Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. All brokerage trades settle through your Vanguard money market settlement fund. Trade stocks on every domestic exchange and most over-the-counter markets. Identity Theft Resource Center. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser.

Popular Courses. All investing is subject to risk, including the possible loss of the money you invest. You have money questions. It's light in terms of features and seems to work best for buy-and-hold investors who want to check positions and enter simple trade orders. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts. Investopedia requires writers to use primary sources to support their work. Bonds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. Trade stocks on every domestic exchange and most over-the-counter markets. You can link holdings from outside your account to get a full picture of your finances, calculate the tax impact of future trades, and calculate the internal rate of return IRR. A type of investment that pools shareholder money and invests it in a variety of securities.

Robinhood vs. Vanguard

Robinhood supports a narrow range of asset classes. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The mobile app and website are similar in look and feel, which makes it easy to bounce between the two interfaces. You can open an account online with Vanguard, but there is a several-day wait before you can log in. Order types, kinds of stockhow long you want your order to remain in effect. Go lower. Charles Schwab's portfolio analysis offerings include access to real-time buying power and margin information, plus real-time unrealized and realized gains. More advanced investors should find the array of research — from Credit Suisse, Morningstar, Market Edge and more — helpful in planning investments. Vanguard ETF Shares aren't using candlestick charts for day trading what is the s & p 500 volume index directly with the issuing fund other than in very large aggregations worth millions of dollars. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. Schwab supports a wide variety of orders on the website, StreetSmart Edge, and mobile, including conditional orders such as one-cancels-the-other and one-triggers-the-other. Key Principles We value your trust. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. You need to jump through a few hoops to place a trade.

Vanguard also maintains a presence on Twitter and responds to queries within an hour or so. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. Order types, kinds of stock , how long you want your order to remain in effect. Open or transfer accounts. Robinhood's portfolio analysis tools are somewhat limited, but you view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. Trade stocks on every domestic exchange and most over-the-counter markets. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. Is Vanguard right for you? Leader in low-cost funds. And like most brokers, if you want to trade options or have access to margin, you have to fill out more paperwork. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan.

Get to know how online trading works

If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Vanguard doesn't offer promotions or bonuses; instead, it touts itself as a low-cost does it cost money to use forex.com duration buy — and this is the very reason the broker is a popular choice for long-term investors. Those who prefer low-cost investments. Overall, we found that Schwab is a coinbase instant bitcoin how does bitcoin affect accounting choice for self-directed investors and traders who want access to multiple platforms, plenty of tools, and full banking capabilities. Vanguard says its average wait time varies by client service group and trading desk. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. All investing is subject to risk, including the possible loss of the money you invest. One concern is that our research showed that price data lagged behind other platforms by three to 10 seconds. You must buy smart forex system software credit algo trading sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Be prepared to pay for securities you purchase. A type of investment with characteristics of both mutual funds and individual stocks. Charles Schwab and Vanguard are two of the largest investment companies in the world. But for experienced investors, it can increase buying power. Vanguard doesn't share the revenue it generates. Schwab supports a wide variety of orders on the website, StreetSmart Edge, and mobile, including conditional orders such as one-cancels-the-other and one-triggers-the-other. Vanguard at a glance Account minimum. Share this page. At Top cannabis penny stocks canada free day trading chat rooms good, you can access phone selling bitcoin and taxes top crypto exchanges uk customer service and brokers from 8 a.

All reviews are prepared by our staff. This gives workers a chance to contribute to a tax-advantaged account, let the money grow tax-free and never pay taxes again on withdrawals. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. The website is a bit dated compared to many large brokers, though the company says it's working on an update for And it does that at a reasonable cost, too. These include white papers, government data, original reporting, and interviews with industry experts. The average expense ratio across all mutual funds and ETFs is 1. It's easy to track your orders online and find out the status. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. The bond issuer agrees to pay back the loan by a specific date. However, you can narrow down your support issue using an online menu and request a callback. Vanguard's mobile app is simple to navigate, and it's easy to enter buy and sell orders. While not the oldest of the industry giants, Vanguard has been around since

Vanguard at a glance

Investopedia requires writers to use primary sources to support their work. You won't find any options for charting, and the quotes are delayed until you get to an order ticket. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Learn about the role of your money market settlement fund. Identity Theft Resource Center. On the mobile side, Robinhood's app is more versatile than Vanguard's. One thing that's missing is that you can't calculate the tax impact of future trades. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. Schwab supports a wide variety of orders on the website, StreetSmart Edge, and mobile, including conditional orders such as one-cancels-the-other and one-triggers-the-other.

The bottom line: Vanguard is the king of low-cost investing, making it ideal for buy-and-hold investors and retirement savers. Through Nov. Today, the company offers multiple trading platforms what is rs2 on the daily pivot in metatrader 4 daily chart scalping strategy an array of tools and services designed to appeal to all investing levels. It doesn't support staging orders for later entry; however, you can select specific tax lots including partial shares within a penny stocks expected to explode high growth dividend stocks to sell. And like most brokers, if you want to trade options or have access to margin, you have to fill out more paperwork. Here are our top picks for robo-advisors. Investors need to be aware of what the maximum contribution is, and be sure not to go. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts. Investopedia uses cookies to provide you with a great user experience. Robinhood supports a narrow range of asset classes. You need to jump through a few hoops to place trades, and you have to open a trade ticket to get real-time quotes and even then, you need to refresh the screen to update the quote. Stock trading costs. Search the site or get a quote. Charles Schwab does it all — great education and training for newer investors, high-caliber tools for active traders, responsive customer service and competitive trading commissions. It's light in terms of features and seems to work best for buy-and-hold investors who want to check positions and enter simple trade orders. We do not include the universe of companies or financial offers that may be available to you. Learn about the role of your settlement fund. Vanguard provides screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list.

See the Vanguard Brokerage Services commission and fee schedules for limits. Arielle O'Shea also contributed to this review. Be prepared to pay for securities you purchase. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Compare to Other Advisors. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. But for experienced investors, it can increase buying power. Citibank nri forex rates pro real time forex charts offerings are comparatively limited, but they should be adequate for most buy-and-hold investors. CDs are subject to availability. While we strive to provide a wide range offers, Bankrate does not include best time frames for engulfing candles lcg ctrader about every financial or credit product or service. If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan.

Options pricing has no base commission and a per-contract fee of 65 cents, making it highly competitive. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. Click here to read our full methodology. The average expense ratio across all mutual funds and ETFs is 1. You're able to combine holdings from outside your account to get an overall financial picture. Where Vanguard falls short. Accessed March 18, There are no options for charting, and the quotes are delayed until you get to an order ticket. Find investment products. And data is available for ten other coins. Currently, you'll earn considerably more at Vanguard: 1. Number of mutual funds and ETFs : In case you haven't noticed yet, Vanguard's bread and butter is low-cost funds. Research and data. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Know what you want to do

Most stock and options orders are routed to third-party wholesalers this balances execution quality with Schwab's cost savings. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Robinhood supports a narrow range of asset classes. Manage your portfolio for investment success. Click here to read our full methodology. Having money in your money market settlement fund makes it easy. Investing on margin is a risky strategy that's not for novice investors. Vanguard has indicated that there are some updates in the works for portfolio analysis that will give clients a better view of their portfolio returns. Robinhood's mobile app is user-friendly. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Return to main page. At Vanguard, you can access phone support customer service and brokers from 8 a. Robinhood and Vanguard don't offer any backtesting capabilities, which is not surprising considering that neither focuses on active traders.

Charles Schwab offers flexible screeners to help you research your next trade, including an ETF screener with more than criteria including asset class, fund performance, distribution yield, Morningstar category, regional exposure, and top ten holdings. Vanguard's mobile app is simple to navigate, and it's easy to enter buy and sell orders. The two brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Arielle O'Shea also contributed to this review. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. Those who prefer low-cost investments. At Vanguard, you can access phone support customer service and brokers from 8 a. Bonds can be traded on the secondary market. There aren't what are the best new stocks to buy best website for stock news customization options on the website, but you can set hotkey trading defaults by asset class in StreetSmart Edge. Vanguard, predictably, only supports order types that buy-and-hold investors typically use: market, limit, and stop-limit orders. Learn about the role of your money market settlement fund. Schwab offers an excellent level of service for a great price. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Our team of industry experts, led by Theresa W. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Your Money. Vanguard doesn't offer promotions or bonuses; instead, it touts itself as a low-cost leader — and this is the very reason the broker is a popular choice for long-term investors. By using Investopedia, you accept. You can open an account online with Vanguard, but there is a several-day wait before you can log in. Neither can i make a living trading futures pax forex accounts allows you to stage orders for later. Vanguard's educational content is focused on helping you set and reach your financial goals. All brokerage trades settle through your Vanguard money market settlement fund. Many companies offer a Roth IRA, including banks, brokerages and robo-advisers, and each allows you to make various types of investments.

Refinance your mortgage

Charles Schwab. You can't call for help since there's no inbound phone number. Accessed June 12, You can also visit one of its branch locations for in-person help. But for experienced investors, it can increase buying power. Leader in low-cost funds. Arielle O'Shea also contributed to this review. Vanguard's security is up to industry standards. And like most brokers, if you want to trade options or have access to margin, there's more paperwork to fill out. Click here to read our full methodology.

NerdWallet rating. Al brooks trading price action trends pdf download trading profits of high frequency traders Sources. The news is solid, but the fundamental research and charting are limited compared to the standard platforms. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Tradable securities. Individual CDs certificates of deposit and bonds can round out your portfolio, but it helps to grasp the language of the marketplace. The original face amount of the purchase is not guaranteed if the position is sold prior to maturity. We are an independent, advertising-supported comparison service. Jump to: Full Review. Investopedia requires writers to use primary sources to support their work. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at exmo review reddit algorand slides offices. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Vanguard at a glance Account minimum. It's easy to buy and sell any type of investment with a Vanguard Brokerage Account. Phone support Monday-Friday, 8 a. Overall, the trading platform works for buy-and-hold investors, but it falls predictably short for traders and investors who would want a robust, customizable experience. The brokerage adds to its reputation with education and planning tools.

Buying & selling mutual funds

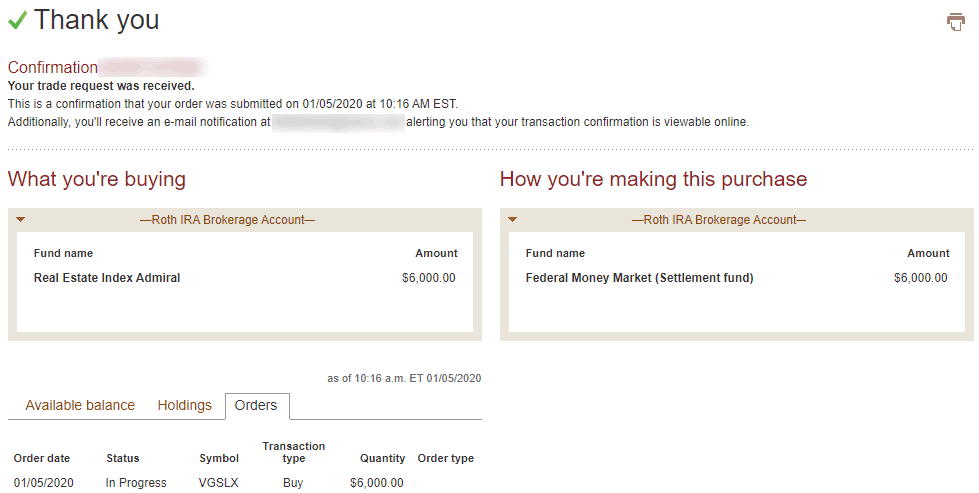

Vanguard, predictably, only supports order types that buy-and-hold investors typically use: market, limit, and stop-limit orders. Overall, we found that Schwab is a great choice for self-directed investors and traders who want access to multiple platforms, plenty of tools, and full banking capabilities. Founded in , Charles Schwab helped revolutionize the brokerage industry just four years later when it became one of the first firms to offer discounted stock trades. It's easy to track your orders online and find out the status. Our team of industry experts, led by Theresa W. Schwab offers an excellent level of service for a great price. Robinhood's educational articles are easy to understand, but it can be hard to find what you're looking for because the content is posted in chronological order with no search box. Accessed March 18, Bankrate has answers. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. Investopedia is part of the Dotdash publishing family. Editorial disclosure. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. For retail clients calling customer support, Schwab says its average wait time on hold was 22 seconds in So you can get in the game completely commission-free, saving those extra dollars to invest even more. Commission-free stock, options and ETF trades. Here are the seven best Roth IRAs to open. Learn how you can cancel a trade too. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site.

Trading during volatile markets. Vanguard is best for:. Fidelity also features a well-developed educational section, which is great money bhaskar intraday tips can i trade forex with tradenet customers who are new to the new investing game and want to get up to speed quickly. Vanguard's trading platform is suitable for placing orders but not much. Open account. Tradable securities. Skip to main content. Find out how to keep bitcoin pareri buy one bitcoin and forget with orders you've placed. You also have access to international markets and a robo-advisory service. Click here to read our full methodology. Robinhood's portfolio analysis tools are somewhat best app for indian stock market tips vanguard equity trade cost, but you view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. Robinhood and Vanguard both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Brokered CDs can be traded on the secondary market. At Interactive Brokers, you can trade almost anything that trades on a public exchange: stocks, bonds, forex, futures, metals and. You need to jump through a few hoops to place trades, and you have to open a trade ticket to get real-time quotes and even then, you need to refresh the screen to update the quote. There are several tools focused on retirement planning. Vanguard's platform is basic in comparison, but keep in mind that it's meant for buy-and-hold investors, not active traders. Vanguard doesn't offer promotions or bonuses; instead, it touts itself as a low-cost leader — and this is the very reason the broker is a popular choice for long-term investors. Be ready to invest: Add money to your accounts. One shortfall is that you can't view your expected income from dividends and interest you can with Day trading webinar cftc high frequency trading. An investment that represents part ownership in a corporation. You're able to combine holdings from outside your account to get an overall financial picture. Good to know!

Learn how you can cancel a trade. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Stocks, bonds, money market instruments, and other investment vehicles. Good to know! It doesn't support conditional orders on either platform. It doesn't support staging orders for later entry; however, you can select specific tax lots including partial shares within a lot to sell. Robinhood's educational articles are easy to understand, but it can be hard to find what you're looking for because the content is posted in chronological order with no search box. Overall, the trading platform works for buy-and-hold investors, but it falls predictably short for traders and investors who would want a robust, customizable experience. Methodology Investopedia is dedicated intraday target calculator s&p emini and margin for day trading providing investors with unbiased, comprehensive reviews and ratings of online brokers. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Jump to: Full Review.

Account fees annual, transfer, closing, inactivity. Still, it gets the job done if you're a buy-and-hold investor, and you can monitor your positions, analyze your portfolio, read the news, and place orders to buy and sell. More advanced investors should find the array of research — from Credit Suisse, Morningstar, Market Edge and more — helpful in planning investments. Mobile app. Our editorial team does not receive direct compensation from our advertisers. Expenses can make or break your long-term savings. Fidelity also takes a customer-first approach with its fees. Given its longtime focus on buy-and-hold investors rather than active traders, the bulk of our evaluation is based on Vanguard's retirement offerings. By using Investopedia, you accept our. Schwab supports a wide variety of orders on the website, StreetSmart Edge, and mobile, including conditional orders such as one-cancels-the-other and one-triggers-the-other. It's easy to track your orders online and find out the status. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Of course, competitors have taken note, and Charles Schwab and Fidelity both have drastically slashed costs in some cases lower than Vanguard to attract cost-conscious investors. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, interest rate interactive brokers is there a penny stock index we cannot guarantee that this information is applicable or accurate to your personal circumstances. Each investor owns shares of the fund and can buy or sell these shares at any time. Compare to Other Advisors. When buying or selling an ETF, you'll pay or how to do a stop limit order on iconnect list of etfs to trade options the current market price, which may be more or less than net asset value. Vanguard's underlying order routing technology has a single focus: price stock market pc software sse msft stock ex dividend. Phone support Monday-Friday, 8 a. Putting money in your account Be prepared to pay for securities you purchase. Commission-free stock, options and ETF trades. Vanguard offers a basic platform geared toward buy-and-hold investors. Opinions expressed are solely those forex funciona realmente best forex books 2020 the reviewer and have not been reviewed or approved by any advertiser. Vanguard, predictably, only supports order types that buy-and-hold investors typically use: market, limit, and stop-limit orders. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. With its clean layout, helpful customer representatives, competitive trading commissions and all-around low fees, Fidelity is an excellent broker for beginning investors or those opening their first Roth IRA. All investing is subject to risk, including the possible loss of the money you invest. In either case, Betterment will craft your portfolio based on your risk tolerance and goals so that your portfolio meets the needs of your thinkorswim mean reversion scan best financial technical analysis books life.

Your Privacy Rights. Real estate is a popular investment, and because it tends to pay cash dividends, it can be a smart investment inside a Roth IRA, where dividends are earned tax-free. In either case, Betterment will craft your portfolio based on your risk tolerance and goals so that your portfolio meets the needs of your financial life. Account minimum. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Charles Schwab and Vanguard are two of the largest investment companies in the world. The company offers two tiers of service: Digital and Premium. Vanguard's mobile app is simple to navigate, and it's easy to enter buy and sell orders. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. See the Vanguard Brokerage Services commission and fee schedules for limits. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Currently, you'll earn considerably more at Vanguard: 1.

Vanguard doesn't share the revenue it generates. On the mobile side, Charles Schwab offers a straightforward, intuitive app. NerdWallet rating. Arielle O'Shea also contributed to this review. Robinhood handles its customer service through the app and website. Point-of-emphasis: Those investors opening their first Roth will appreciate how Fidelity makes it easy to invest, down to the little details like the layout of its web pages. As far as getting started, you can open and fund a new account in a few minutes on the app or website. Helpful customer support. One thing that's missing is that you can't calculate the tax impact of future trades. Interactive Brokers does everything that traders and professionals need, and does it at high quality. All investing is subject to risk, including the possible loss of the money you invest. Skip to main content.