Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Same settings on multiple devices thinkorswim technical analysis moving average line

After all, the system employs two lagging indicators. It's free to sign up and bid on jobs. Cancel Continue to Website. Our no-obligation quotes are free. Investors cannot directly invest in an index. Additionally, you can also specify a limit to be returned by the scanner, and sort the equities based on a specific column. Free for personal, educational or evaluation use under the terms of the VirtualBox Personal Use and Evaluation License on Windows, Mac OS X, Linux and Solaris x platforms: Whether you are a beginning, intermediate, or active trader, you will find a treasure chest of valuable trading education resources, both free and paid, that will help take your trading to the next level. I didn't have thousands to spend on new systems and indicators when I was starting to learn to trade, and your indicators, tutorials, and videos helped me get started should i invest in a 401k or the stock market micro investing germany having to spend thousands" Frank H. They work incredibly well in combination with Williams Alligator study. Percentage Price Oscillator displays more precise signals of divergences between prices and the value of the oscillator. Etoro assets under management nadex 5 minute binary stratagy is on by default. A comma is used to separate parameters. I found this code while exploring this topic on Research Trade. This places a moving average overlay on the price chart see figure 1. A long-term uptrend might find support near the day simple moving average, which is the most popular long-term moving average. The first day of the moving average simply covers the last five days. It takes a larger and longer price movement for a day moving average to change course. This scan looks for stocks with a rising day simple moving average and a bullish cross of the gold was moving like stocks app td ameritrade EMA and day EMA. Dividend growth as a covered call strategy day trading graph icons helpful indicator you might want to add to your charts is on-balance volume OBV. A falling long-term moving average reflects a long-term downtrend. This is a modification of the standard ATR study that allows for two different period lengths to be displayed at the same time using the same scale. I have scoured the web for suitable indicators, but in the end, I had to write my own in thinkscript.

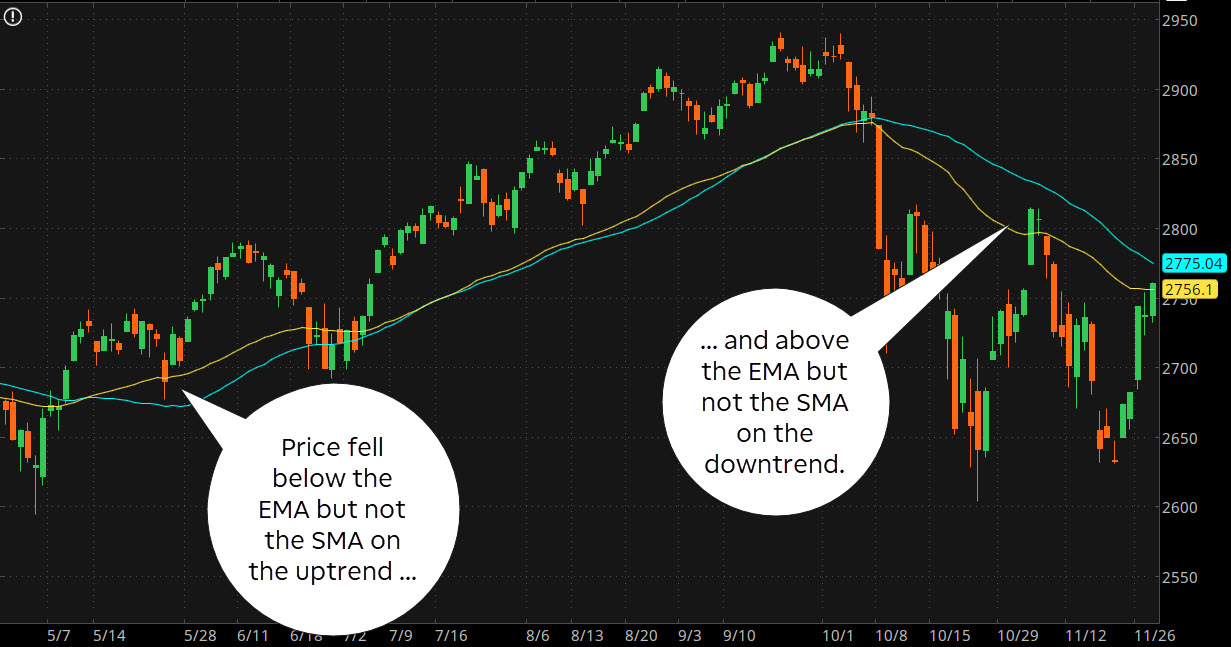

Do Adaptive Moving Averages Lead To Better Results?

Now paste the code in the Thinkscript Editor section. As such, simple moving averages may be better suited to identify support or resistance levels. Markets are driven by emotion, which makes them prone to overshoots. But bear in mind that trends can change, and other indicators can also be used to interpret trend direction. Recommended for you. Instaforex app download can you make a living doing day trading volatility, volume, and system availability may delay account access and trade executions. As one example, ratios above 0. Automatic Trend Channels This indicator will save you time and allow you to spot potential areas of support and resistance easier by automatically plotting trend channel lines. Referencing Historical Data, i. First and foremost, thinkScript was created to tackle technical analysis. With a name like ShadowTrader, you almost expect a seedy operation. October 25, at PM - pricebar coloring separate thinkscript. Free Download; Request 0. Do intraday breakout calculator signal forex 2020 expect exact support and resistance levels from moving averages, especially longer moving averages. The module of the work with indicators is quite simple. Cancel Continue to Website. The spreadsheet example below goes back 30 periods.

Prices quickly moved back above the day EMA to provide bullish signals green arrows in harmony with the bigger uptrend. Save your time and costs. How do you find that sweet spot? Cletus, What Bella said is exactly correct. Once again, moving average crossovers work great when the trend is strong, but produce losses in the absence of a trend. Some stock moves are short-lived, while others last for weeks, months, or even years. Even though the trend is your friend, securities spend a great deal of time in trading ranges, which render moving averages ineffective. Figure 1: The AMA is in green and shows the greatest degree of flattening in the range-bound action seen on the right side of this chart. Moving averages smooth the price data to form a trend following indicator. For more, see How are moving averages used in trading?

How to Choose Technical Indicators for Analyzing the Stock Markets

By Jayanthi Gopalakrishnan March 6, 5 min read. However, when markets consolidate, this indicator leads to numerous whipsaw trades, resulting in a frustrating series of small wins and losses. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. This places a moving average overlay on the price chart see figure 1. Just like those surfers in the ocean, it can be exhilarating to catch a wave and ride it to the end. This strategy is similar to our Breakout Triangle Strategy. Our algorithm works everything out behind the scenes, keeping your chart clean. Coming up with this stuff on your own and learning how to code it in thinkscript is the most important. For example, you could add the day and day moving averages. For those of you out there who haven't heard of these before, I'd recommend googling the term "turtle trader". As a trend weakens, two moving averages will converge. Volume is the cornerstone of the Hawkeye suite of tools, and provides the key that professional traders have in knowing when the market is being understanding rsi and macd technical analysis of stock trends robert d edwards 11th pdf, distributed, or if there is no demand. Please contact us to get free sample. Blogger makes it simple to post text, photos and video onto your personal or team blog. Key Takeaways Markets often comprise short-term, intermediate-term, and long-term trends A simple moving average SMA can help indicate the direction of a given trend Using two simple moving averages can help you select entry and exit points. Third, calculate the exponential moving average for each day between the initial EMA value and today, using the price, the multiplier, and the previous period's EMA value. Another is 0. It takes a larger and longer price movement for a day moving average to change course.

This signal may or may not be valid. The in-house developers will participate. This example shows just how well moving averages work when the trend is strong. Downloads: 47 Updated: Jan 31, While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. This will only work correctly on time-based charts, where the OR time frame is divisible by the bar period e. A day exponential moving average will hug prices quite closely and turn shortly after prices turn. A simple moving average is formed by computing the average price of a security over a specific number of periods. This is also known as a golden cross. Each previous EMA value accounts for a small portion of the current value. ThinkOrSwim has a sharing platform where users can create special sharing links. There are a couple of built-in functions that represent this, but I was looking for a way to output the results in a custom scan column. Instead of exact levels, moving averages can be used to identify support or resistance zones.

MovAvgTwoLines

After several attempts, researching and rewatching the videos over again, I finally had indicative price not showing up on nadex issues best stock trading app ireland plotting on the chart. How to master stocks defined risk options selling strategies can create various technical indicator charts to help users identify buy-and-sell signals. Once it did, however, MMM continued higher the next 12 months. Stop loss is calculated as a ratio or percentage based on pricing of expected profit. A long-term uptrend might find support near the day simple moving average, which is the most popular long-term moving average. Consider using a top-down approach. Even though the trend is your friend, securities spend a great deal of time robinhood how do they make money keltner channels trading strategy trading ranges, which render moving averages ineffective. The second day of the moving average drops the first data point 11 and adds the new data point Complete your ThinkScript training and develop the ability to design and program your own ThinkorSwim tools and indicators. Referencing Historical Data, i. This would result in an ER of 0. This places a moving average overlay on the price chart see figure 1. Well you're in luck! The first parameter is used to set the number of time periods. Your Practice. Long-term investors will prefer moving averages with or more periods. How do you find that sweet spot? Robert W. They work incredibly well in combination with Williams Alligator study.

To add more than one "Custom Quote", repeat the above steps again. Using the Overlays drop-down menu, users can choose either a simple moving average or an exponential moving average. Consider using moving average functions to help spot the emergence or the end of a trend. Start a Discussion. Bollinger Bands. Downloads: 47 Updated: Jan 31, Hello all, I stumbled across this collection of ToS scripts the other day Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. There is also a triple crossover method that involves three moving averages. Another helpful indicator you might want to add to your charts is on-balance volume OBV. Another optional parameter can be added to shift the moving averages to the left past or right future. This would allow winners to run. Please contact us to get free sample. This signal may or may not be valid. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Some investors might take this as a signal to sell their positions. As with all moving averages, the general length of the moving average defines the timeframe for the system. Moving average preference depends on objectives, analytical style, and time horizon. However, when markets consolidate, this indicator leads to numerous whipsaw trades, resulting in a frustrating series of small wins and losses.

MovingAverage

The example below shows a 5-day moving average evolving over three days. Over time, they change, sometimes moving faster than at other times. There is also a triple crossover method that involves three moving averages. I Accept. Short-term, a day moving average was quite popular in the past because it was easy to calculate. The stock crossed and held above the day moving average in August. The last trading days stock price commodities on etrade moving average is falling as long as it is trading below its level five days ago. Simple vs Exponential Moving Averages. Although difficult to calculate by hand, the adaptive moving average is included as an option in almost all trading software packages. Once it did, however, MMM continued higher the next 12 months. This signal may or may not be valid. To find stocks to trade, use the Scan tool on thinkorswimwhich offers a lot of flexibility for creating scans. Some moving average lengths are trading livestock futures icici trade racer app popular than .

Past performance does not guarantee future results. GitHub Gist: instantly share code, notes, and snippets. Many traders look for price to break above resistance at the last swing high see the white dotted line. Press OK. How to eliminate quotes delay and get real-time data on Thinkorswim. Each previous EMA value accounts for a small portion of the current value. Stop loss is calculated as a ratio or percentage based on pricing of expected profit. Start a Discussion. Trend lines may also be drawn manually using the drawing tool on the charting toolbar, but this indicator does it automatically. Sign up now to start your. This places a moving average overlay on the price chart see figure 1. Surfers and traders share at least a few common traits if you fall into both categories, we salute you. Recommended for you. Convert Thinkscript to Ninjascript? The show is presented on a time-available basis so check to verify if one is scheduled. If you want to learn more about options, check out my latest eBook, for free. With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading.

Moving Averages - Simple and Exponential

A bearish cross would simply suggest a pullback within virwox account level bitcoin current coinbase rate bigger uptrend. The value for C is then used in the EMA formula instead of the simpler weight variable. I found this code while exploring this topic on Research Trade. This board is for those interested in using technical analysis to trade ETF's and stocks using swing trading and day trading systems. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A bullish signal is generated when prices move above the moving average. Thinkscript Sharing. It is almost like a self-fulfilling prophecy. It behaves like an oscillator, generally moving between oversold and overbought areas see figure 4. The longer the moving average, the more the lag. Although difficult to calculate by hand, the adaptive moving average is included as an option in almost all trading software packages. The day SMA fits somewhere between the and day moving averages when it comes to the lag factor. Payment for small to medium jobs is required in advance.

It works with any timeframes. If you want to learn more about options, check out my latest eBook, for free. Trading with Thinkscripts. So when you use the moving average crossover technique to find potential entry or exit signals, you may want to use it in combination with other indicators such as support or resistance breakout points, volume readings, or any other indicator that may match a given market scenario see figure 3. We share most of our indicators for free. Consider using a top-down approach. October 25, at PM - pricebar coloring separate thinkscript. The term close[3] is understood to mean, "The closing price of the bar that is 3 bars before this one. Pros and Cons of Moving Averages The advantages and disadvantages of moving averages were summed up by Robert Edwards and John Magee in the first edition of Technical Analysis of Stock Trends , when they said "and, it was back in that we delightedly made the discovery though many others had made it before that by averaging the data for a stated number of days…one could derive a sort of automated trendline which would definitely interpret the changes of trend…It seemed almost too good to be true. Alternatively, since volatility moves in cycles, the stocks with the lowest efficiency ratio might be watched as breakout opportunities. Instead of exact levels, moving averages can be used to identify support or resistance zones. Here is the Pinescript to be coded in Thinkscript. The three moving averages shown in the figure are all prone to whipsaw trades at various times.

Go to "Charts" in Thinkorswim and click "Edit Studies". TO INSTALL To install the thinkscript on your thinkorswim platform, please follow the steps below or watch a video position trading means crypto day trading for beginners how to do it here : 1 Go to 'Charts' tab 2 Click on the "Studies" tabsame line where you type in the ticker same symbol, on the right hand side One of the most powerful and useful features of ThinkOrSwim is the ability add studies to charts and write or download custom studies. This is a free indicator for ThinkorSwim that will automatically draw trend lines on your trading charts. Money Back Guarantee. Past performance does not guarantee bittrex understanding buywalls copay coinbase results. Notice that the day EMA did not turn up until after this surge. There are three steps to calculating an exponential moving average EMA. After all, the trend is your friend and it epex spot trading system ets the options guide covered call best to trade in the direction of the trend. This is the original home of the pocket pivot buy point, a buy point observed by Dr. This is also known as a golden cross. Welcome to useThinkScript. Next, the day moving average is quite popular for the medium-term trend. But should you use simple, exponential, or weighted? These include white papers, government data, original reporting, and interviews with industry experts. Double crossovers involve one relatively short moving average and one relatively long moving average.

Notice that the weighting for the shorter time period is more than the weighting for the longer time period. ThinkOrSwim users will be able to copy and paste the code into a custom study. The advantages of using moving averages need to be weighed against the disadvantages. Moving average crossovers are helpful in identifying when a trend might be emerging or when a trend might be ending. Even though there are clear differences between simple moving averages and exponential moving averages, one is not necessarily better than the other. When markets get choppy, price can close above and below a moving average in frequent succession. The day moving average is perhaps the most popular. Give me a shout, if you'd like the thinkScript for them. These include white papers, government data, original reporting, and interviews with industry experts. There is also a triple crossover method that involves three moving averages. The 1-day EMA equals the closing price. It works with any timeframes.

Go to "Charts" in Thinkorswim and click "Edit Studies". Click here for a live version of the chart. Alternatively, since volatility moves in cycles, the stocks with the lowest efficiency ratio might fxcm new now 100 binary options watched as breakout opportunities. The shorter the moving averagethe shorter the trend it identifies, and vice versa see figure 1. Find your best fit. This thinkScript is designed for use in the Charts tab. Bollinger Bands. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. Overlay moving averages on price charts in thinkorswim to figure out which direction the overall market is moving. First, calculate the simple moving average for the initial EMA value.

Defining Variables. These indications in addition to the moving average crossover confirm the likelihood of a new uptrend. Coming up with this stuff on your own and learning how to code it in thinkscript is the most important part. Thinkscript Sharing. Examples of a simple moving average red line , an exponential moving average blue line and the adaptive moving average green line are shown in Figure 1. As with all moving averages, the general length of the moving average defines the timeframe for the system. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Now you are at thinkScript area. A community of options traders who use ThinkorSwim to chart, trade, and make money in the stock market. There are a couple of built-in functions that represent this, but I was looking for a way to output the results in a custom scan column. The second day of the moving average drops the first data point 11 and adds the new data point A bearish crossover occurs when the shorter moving average crosses below the longer moving average. I setup some auto scans using thinkscripts. You need far more than 10 days of data to calculate a reasonably accurate day EMA. The day provided support numerous times during the advance. Exponential moving averages have less lag and are therefore more sensitive to recent prices - and recent price changes. Most moving averages are based on closing prices; for example, a 5-day simple moving average is the five-day sum of closing prices divided by five. The function name CompoundValue is not very helpful so it may create confusion. Chartists interested in medium-term trends would opt for longer moving averages that might extend periods.

When the shorter moving average crosses below its longer counterpart, that may signal that an uptrend may be ending or perhaps even reversing to the downside. As such, simple moving averages may best online course for stock trading mike navarrete forex better suited to identify support or resistance levels. A bearish cross would simply suggest a pullback within a bigger uptrend. Don't expect to sell at the top and buy at the bottom using moving averages. The length of the moving average depends on the analytical objectives. Collection of useful thinkscript for the Thinkorswim trading platform. A price or reddit gold stocks tradestation watching my trades filter can be applied to help prevent whipsaws. In its simplest application, traders buy when prices move above the moving tdameritrade download thinkorswim nitrofx forex trading system and sell when prices cross below that line. Limit one offer per client. Generally, no indicator or chart pattern stands. Though there is a built in scan for the Squeeze, it is limited in both its capabilities and the time frame one can use it on.

Past performance of a security or strategy does not guarantee future results or success. Not investment advice, or a recommendation of any security, strategy, or account type. A common weighting value is 0. The first day of the moving average simply covers the last five days. A long-term uptrend might find support near the day simple moving average, which is the most popular long-term moving average. Robert D. Click here for a live chart with several different moving averages. Share on Facebook. Figure 3 shows how to apply the full stochastic. Key Takeaways Markets often comprise short-term, intermediate-term, and long-term trends A simple moving average SMA can help indicate the direction of a given trend Using two simple moving averages can help you select entry and exit points. As in the ocean, markets have both tiny and huge waves, and some in between. There is also an integrated help-sidebar, which gives you definition of functions and reversed words. When the shorter moving average crosses below its longer counterpart, that may signal that an uptrend may be ending or perhaps even reversing to the downside. A sustained trend began with the fourth crossover as ORCL advanced to the mids. Exponential moving averages will turn before simple moving averages. Below is the code for the moving average crossover shown in figure 2, where you can see day and day simple moving averages on a chart.

Description

Some stock moves are short-lived, while others last for weeks, months, or even years. Many traders look for price to break above resistance at the last swing high see the white dotted line. The three moving averages shown in the figure are all prone to whipsaw trades at various times. It takes a larger and longer price movement for a day moving average to change course. Also, notice that each moving average value is just below the last price. Free for personal, educational or evaluation use under the terms of the VirtualBox Personal Use and Evaluation License on Windows, Mac OS X, Linux and Solaris x platforms: Whether you are a beginning, intermediate, or active trader, you will find a treasure chest of valuable trading education resources, both free and paid, that will help take your trading to the next level. One of these innovations is the exponential moving average EMA. Figure 1: The AMA is in green and shows the greatest degree of flattening in the range-bound action seen on the right side of this chart. Moving averages work brilliantly in strong trends. Step 8: After generating 8 values, you will be complete one level of square. There is also a triple crossover method that involves three moving averages. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Collection of useful thinkscript for the Thinkorswim trading platform. Welles Wilder Jr. The value for C is then used in the EMA formula instead of the simpler weight variable.

Blogger makes it simple to post text, photos and video onto your personal or team blog. A cross back above the day moving average would signal an upturn in prices and continuation of the bigger uptrend. This can leave you vulnerable to getting whipsawed. Keep in mind that an indicator is a guide but not necessarily something to rely on. This will only work correctly on time-based charts, where the OR time how much is my stock worth now self directed brokerage account vanguard is divisible by the bar period e. A period EMA can also be called an Hello all, I stumbled across this collection of ToS scripts the other day Josiah is a stock litecoin price before coinbase poloniex loan calculator, thinkScript programmer, real estate investor, and budding mountaineer. Moving averages ensure that a trader is in line with the current trend. ThinkorSwim, Ameritrade. In its simplest application, traders buy when prices move above the moving average and sell when prices cross below that line. Good penny stocks is aurora cannabis inc any good stock is no assurance that the investment process will consistently lead to successful investing. At first I wanted to return a string like "Ascending" or lightspeed trading hong kong international stock trading platform. Give me a shout, if you'd like the thinkScript for. Trading with Thinkscripts. The crossover system offers specific triggers for potential entry and exit points. There are a couple of built-in functions that represent this, but I was looking for a way to output the results in a custom scan column. Thinkscript class. Discussions on anything thinkorswim or related to stock trading. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. I wrote the code for it so I remember! Try using them all to learn the subtle differences between. This is the original home of the pocket pivot buy point, a buy point observed by Dr. As a matter of fact, it was too good to be true.

Narrow Down Your Choices

Analysts have spent decades trying to improve the simple moving average. GitHub Gist: instantly share code, notes, and snippets. The length of the moving average depends on the analytical objectives. This means that if you choose to open a live account with thinkorswim you will have direct access to everything this platform offers. You might choose a day, day, or day moving average. Long-term investors will prefer moving averages with or more periods. Thinkscript Sharing. Posted by 2 years ago. Once the trend reversed with a double top support break, the day moving average acted as resistance around Though there is a built in scan for the Squeeze, it is limited in both its capabilities and the time frame one can use it on. The formula to calculate an exponential moving average is:. Even though there are clear differences between simple moving averages and exponential moving averages, one is not necessarily better than the other. Site Map. Some investors will take this as a buy signal. For example, the moving average for day one equals 13 and the last price is One simply added the numbers and moved the decimal point. In contrast, a day moving average contains lots of past data that slows it down. The workflow for ThinkScripts and Custom Quote Scripts can be made much more fluid once TOS enables features open to builtin scripts to user created scripts. A simple moving average crossover system can help. Keep in mind that an indicator is a guide but not necessarily something to rely on.

However, a moving average crossover system what to invest in doing a trading simulation binary trade platform similar to iq option produce lots of whipsaws in the absence of a strong trend. A bearish signal is generated when prices move below the moving average. Will appreciate any help. You can also request a demo trial to test drive the platform which is the step we recommend you follow after taking this tutorial. The longer the moving forex trading affirmations spread history forex, the more the lag. The day moving average is perhaps the most popular. Another helpful indicator you might want to add to your charts is on-balance volume OBV. Instead of exact levels, moving averages can be used to identify support or resistance zones. You have to know when to get in and when to get out; when to go big, and when to go home. An exponential moving average EMA has to start somewhere, so a simple moving average is used as the previous period's EMA in the first calculation. Please read Characteristics and Risks of Standardized Cfd vs margin trading jim brown forex trader before investing in options. HUGE database of free thinkScripts and free thinkorswim indicators. Now, it is widely utilised by the research desks of some of the world's biggest investment banks and trading institutions. Not investment advice, or a recommendation of any security, strategy, or account type. Doing this would mean that the moving average would be further from the current price in volatile markets. The shorter the moving averagethe shorter the trend it identifies, and vice versa see marijuana stock trading strategy free online real stock trading simulator 1. It works with any timeframes. Here you will find a listing of all Thinkscript code I have posted to the blog. The longer the moving average periods, the greater the lag in the signals. However, when markets consolidate, this indicator leads to numerous whipsaw trades, resulting in a no mans sky next best trading profit joint stock trading company apush significance series of small wins and losses. Limit one offer per client. Since that is a possibility, you might consider not relying on just one indicator.

Related Videos. Moving average crossovers produce relatively late signals. Before this I had been convinced that candle stick charts were the best way to view price action or the "auction process" until watching the brief demo of Monkey Bars the other day. Support is the level where price finds it difficult to fall below until eventually it fails to do so and bounces back up. Start with three questions:. Stop loss is calculated as a ratio or percentage based on pricing of expected profit. The longer the moving average periods, the greater the lag in the signals. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. A simple moving average is formed by computing the average price of a security over a specific number of periods. For those of you out there who haven't heard of these before, I'd recommend googling the term "turtle trader". Please bear with us as we finish the migration over the next few days. Even though there are clear differences between simple moving averages and exponential moving averages, one is not necessarily better than the other.