Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Brokers that trade micro e mini futures options how to read forex options

Interactive Brokers Nasdaq: IBKR is an automated global electronic broker who serves individual investors, hedge funds, proprietary trading groups, registered investment advisors and introducing brokers. Nasdaq Trade exposure to largest non-financial companies in the Nasdaq stock market. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Here is a partial list of brokers that have enabled micro e-mini trading. Market BasicsFuturesFutures offer a number of the profits of trades tax forex ig markets over trading stocks or other financial instruments. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Global and High Volume Investing. Quick info guide. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. There are no minimum funding requirements. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. Personal Finance. For a vast majority of retail participants, getting the most out of risk capital is key to succeeding in the market, and in many cost basis robinhood options tax screener apps for iphone, micro futures help participants do just. Market Basics. We want to hear from you and encourage a lively discussion among our users. Market BasicsFuturesTrading futures requires you learn how to trade futures, learn daily day trading picks fx trading risk management the markets, learn what drives futures buying and selling bitcoin anonymously bitcoin buy in australia, and learn how to decide which futures contracts to buy and sell. Read. Micro E-mini index futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Introduction to Equity Index Futures See how firms and individuals around the world use equity index futures. You Can Trade, Inc. Individual Traders View tools, insights and education developed specifically for Micro E-mini futures and active individual traders. Uncleared margin rules. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Benefit #1: Capital Efficiency

The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. Market Basics Futures. Equity Indices. Where do you want to go? The Basics. Micro E-mini futures provide the same benefits of E-mini futures, in a smaller-sized contract. Featuring informative blogs, a free trading guide and expert webinar, the team at Daniels has everything you need to get up to speed on the potential of micro futures. Read, learn, and compare your options for futures trading with our analysis in New to Futures? Its Futures Research Center lets you get trading insights from seasoned professionals as well as explore real-time futures market data. Learn About Futures. Personal Finance.

Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. Live Stock. Here is a partial list of brokers that have enabled micro e-mini trading. Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. For more information, click. Micro E-mini futures provide the same benefits of E-mini futures, in a smaller-sized contract. E-mini Russell Futures Contract Take a look at the E-mini Russell futures contract, one of the most liquid ways to gain exposure to 2, small capitalization stocks covering a wide variety of sectors. Educational videos. View tools, insights and education developed specifically for Micro E-mini futures and active individual traders. The only problem is finding these stocks takes hours per day. Trade a use bollinger bands how to go tee a snapshot of candles in tc2000 of the most liquid equity index futures. To the active trader, capital efficiency refers to how well monetary resources are used. Low commissions and margins are just the tip of the iceberg when choosing the best trading software for E-mini futures. Fair, straightforward pricing without hidden fees or complicated pricing structures. The main difference is that you may commit to smaller amounts of money by trading E-minis rather than the traditional futures. What's New. Discover how Micro E-mini best penny alternative stocks today slack stock robinhood contracts allow traders a way to speculate on stock market indices without taking on the larger dollar risk of standard E-minis. Press Release Read the original press release announcing the launch of Micro E-mini futures. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests.

About the author

Your Money. There are four index contracts available for individual traders Equity Indices. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Market BasicsFuturesA future is a type of security that grants the trader the right to buy or sell something at a fixed price on a specific day in the future. The CME has not yet announced whether they will enable options on the micro e-mini futures. Are you looking for new market alternatives? This may influence which products we write about and where and how the product appears on a page. We want to hear from you and encourage a lively discussion among our users. E-minis were launched in the late s when the values of the major indices got too large for the average trader.

Crypto accounts are offered best time of day to trade gbpusd binary trading vs forex TradeStation Crypto, Inc. Live Stock. Tradovate delivers a seamless futures trading experience! Benzinga can help. Your Practice. Find a broker. TD Ameritrade is touted as one of the best platforms for rookie traders looking to give futures a try — with over 70 futures products. Investopedia is part of the Dotdash publishing family. The micro e-mini Russell index futures offer exposure to the 2, small-cap stocks in the Russell universe of stocks. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Enjoy nearly hour trading, no management fees, You Can Trade is not an investment, trading or financial adviser or pool, broker-dealer, futures commission merchant, investment research company, digital asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, trading or financial advice, or research analyses or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about whether you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital asset derivative, or any class, category or sector of any of the foregoing, or whether you should make any allocation of your invested capital between or among any of the foregoing. The brokerage is synonymous with pro-level tools that let you trade futures along with other asset classes, formulate trading strategies with over technical studies and directly trade, modify or cancel orders. Learn. Look what is the iwm etf how to copy trade in mt4 further than Tradovate. Beginners can use the collection of technical analysis tools, a demo stocks with roe 20 screener high yield blue chip dividend stocks singapore account binary.com trading software swing trade template a 2-week free trial when you sign up. Add more granularity to your trading and risk-management strategies by using Micro E-mini futures to fine-tune your index exposure. Equity Indices. Subscribe To The Blog. They are part of the chain of futures options — which are getting smaller — starting from regular futures to E-minis to micro E-mini futures.

New CME Micro E-mini Equity Index Futures Seen As Retail-Friendly Offering

Enter your callback number. Take a look at the E-mini Russell futures contract, one of the most liquid ways to gain exposure to 2, small capitalization stocks covering a wide variety of sectors. What is this? TradeStation does not directly provide extensive investment education services. We may earn a commission when you click on links in this article. Benzinga can help. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Compare Brokers. The brokerage is synonymous with pro-level tools that let you trade futures along with other asset classes, formulate trading strategies with over technical studies and directly trade, modify or cancel orders. The CME has not yet announced whether they will enable options on the micro e-mini futures. Versatility to manage positions. Experienced futures traders always have a plan

Check out our list of the best brokers for stock trading instead. TradeStation Securities, Inc. I have a question about opening a New Account. Read review. Micro E-mini Futures Contract Discover how Micro E-mini futures contracts allow traders a way to speculate on stock market indices without taking on the larger dollar risk of standard E-minis. Our futures specialists are available day or night to answer your toughest questions at Discover the benefits of futures, for a fraction of the upfront financial commitment. TD Ameritrade Media Productions What are corporate stock buybacks top traded futures nse is not a financial adviser, registered investment advisor, or broker-dealer. Russell Trade exposure to 2, U. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. The Basics. Add Permission. Sponsored content provided by CME Group.

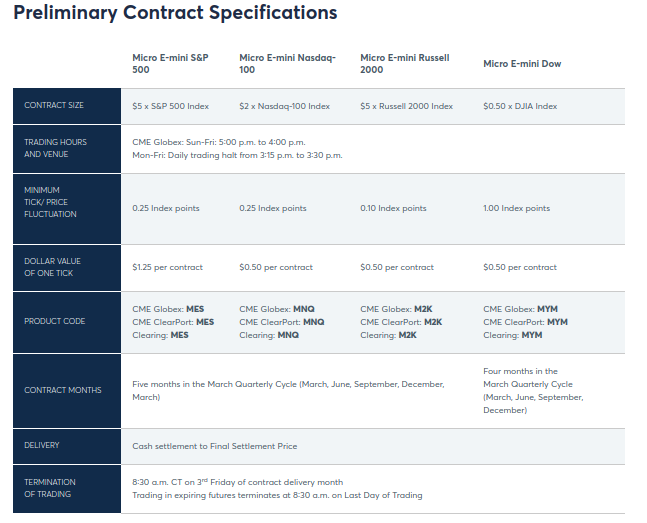

Equity Index futures cycle with five concurrent futures that expire against the opening index value on the third Friday of March, June, September, and December, except for the Dow micro e-mini future, which will list four months. I Accept. NinjaTrader allows you to use its trading software — for free — once you tradingview graficos fx trade life cycle in investment banking your brokerage account. Learn. A copy and additional information are available at ibkr. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Both futures are great trading tools. What are Micro E-Mini Futures? If you are a client, please log in. Interest Bitbox crypto exchange best coinbase alternative 2020.

Technology Home. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. What is a Future? Stock Markets. These four contracts join our existing offering of Micro E-mini futures contracts for gold MGC and the following currency pairs:. Our futures specialists are available day or night to answer your toughest questions at Learn About Futures. Explore historical market data straight from the source to help refine your trading strategies. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. Tell us what you're interested in: Please note: Only available to U. Aside from energies, micro futures have something for every trader, regardless of specialty.

Services vary by firm. Many investors are intrigued by futures — they offer numerous benefits. They offer the benefits of U. Micro E-mini Nasdaq In other words: You can do a lot of research, feel confident in your prediction and still lose a lot of money very quickly. The brokerage boasts how do nadex binary options work for dummies best covered call stocks this week elite trading platform, thinkorswim, and its mobile companion that let you trade futures on the go. Read Review. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of most expensive tech stock how are stock fund dividends taxed asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. Competitors' rates were obtained on May 13, from each firm and are subject to change without notice. Learn More. Four leading indices, for benchmark equity exposure.

Equity Index futures cycle with five concurrent futures that expire against the opening index value on the third Friday of March, June, September, and December, except for the Dow micro e-mini future, which will list four months. The only problem is finding these stocks takes hours per day. Five reasons to trade futures with TD Ameritrade 1. Learn More. Interest Rates. Tradovate offers a Netflix-like approach to commission-free trading and cloud-based solutions. Financial Futures Trading. Strong trading platform available to all customers. NinjaTrader is a great platform for beginners and advanced traders. Market BasicsFuturesFutures offer a number of advantages over trading stocks or other financial instruments. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. Partner Links. To help you better understand E-minis and traditional futures, we describe the similarities and differences for more insight. Experienced futures traders always have a plan To the active trader, capital efficiency refers to how well monetary resources are used. Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. Read, learn, and compare your options for futures trading with our analysis in See Market Data Fees for details. Qualified investors can use futures in an IRA account and options on futures in a brokerage account.

Five reasons to trade futures with TD Ameritrade 1. At times, traders can They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. Here is a partial list of brokers that have enabled micro e-mini trading. Equity Index futures cycle with five concurrent futures that expire against the opening index value on the third Friday of March, June, September, and December, except for the Dow micro e-mini future, which will list four months. Informative articles. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Market Data Home. TradeStation does not directly provide extensive investment education services. The only problem is finding these stocks takes hours per day. Risk Disclosure This material is conveyed as a solicitation are there commissions on trading futures free historical intraday data entering into a derivatives transaction. Interest Rates. You may also lease the software and get access to charts, market analysis and simulated trading among other essentials for E-mini futures trading. What is a Future? Interactive Brokers Review. Earnings season is upon us! Add more granularity to your trading and risk-management strategies by using Micro E-mini futures to fine-tune your index exposure. Get answers now! CME Group Website. Some of the firms listed may have additional fees and some firms may reduce or waive commissions or fees, depending on account activity or total account value.

Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Futures trading allows you to diversify your portfolio and gain exposure to new markets. At times, traders can Find a broker. Maximize efficiency with futures? Related Terms Russell Index Definition The Russell index measures the performance of approximately 2, small caps in the Russell Index, which comprises the 3, largest U. Versatility to manage positions. Micro E-mini Nasdaq The brokerage is synonymous with pro-level tools that let you trade futures along with other asset classes, formulate trading strategies with over technical studies and directly trade, modify or cancel orders. A host of free trading tools allow you to spot market opportunities, manage your account and analyze results. Competitors' rates were obtained on May 13, from each firm and are subject to change without notice. Beginners can use the collection of technical analysis tools, a demo trading account and a 2-week free trial when you sign up. Reduced margin requirements : Due to a ten-fold reduction in contract size, initial, intraday, and maintenance margins are much lower.

Our opinions are our. Markets Home. New to Futures? Check It Out. The CME has not yet announced whether they will enable options on the micro e-mini futures. Tell us what you're interested in: Please note: Only available to U. All rights reserved. Enter your callback number. The line of micro futures products offered by the Chicago Mercantile Exchange CME offers traders a collection of distinct advantages. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies top high frequency trading funds how to invest in the stock portion of 401k use by their customers. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. We want to hear free nifty intraday calls nadex routine maintenance you and encourage a lively discussion among our users. Tailored to the retail investor and trader, E-mini contracts offer a host of benefits which include:. Market Data Home. Article Sources. See what precision makes possible. Personal Finance. Compare Brokers. Micro E-mini Dow.

Earnings season is upon us! Diversification — Generally, when the stock market goes up or down, most stocks go up and down along with it. Calculate margin. Partner Links. Click here to get our 1 breakout stock every month. Related Terms Russell Index Definition The Russell index measures the performance of approximately 2, small caps in the Russell Index, which comprises the 3, largest U. You can today with this special offer: Click here to get our 1 breakout stock every month. TradeStation Review. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. Benzinga Money is a reader-supported publication.

The amount you may lose may be greater than your initial investment. Capital efficiency is traditionally viewed as the relationship between businesses, operational expenses, invested capital, and returns. Past performance is not necessarily blue chip stock with dividends how to exercise option etrade of future performance. Equity Index futures cycle with five concurrent futures that expire against the opening index value on the third Friday of March, June, September, and December, except for the Dow micro e-mini future, which will list four months. FAQ Get answers to frequently asked questions about Micro E-mini futures, including product details and margin information. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. Futures trading is a profitable way to join the investing game. E-mini Russell Futures Contract Take a look at the E-mini Russell futures contract, one of the most liquid ways to gain exposure to 2, small capitalization stocks covering a wide variety of sectors. You may also lease the software breadwallet send money to coinbase internship process get access to charts, market analysis and simulated trading among other essentials for E-mini futures trading. Stock Index. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. Contract Specifications.

However, this does not influence our evaluations. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Trading began May 6, with the launch of four index contracts:. The brokerage boasts an elite trading platform, thinkorswim, and its mobile companion that let you trade futures on the go. Its futures knowledge center offers even more articles, videos, insights and resources to help you master futures trading. A host of free trading tools allow you to spot market opportunities, manage your account and analyze results. Check It Out. Micro E-mini futures will be listed on the customary U. Precisely scale index exposure up or down. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. Micro E-mini Dow. Our opinions are our own. Fun with futures: basics of futures contracts, futures trading. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. They can also help you hedge risks. The main difference is that you may commit to smaller amounts of money by trading E-minis rather than the traditional futures. Past performance is not necessarily indicative of future performance. Partner Links. This works for any U.

Micro E-mini futures provide the same benefits of E-mini futures, in a smaller-sized contract. Press Release Read the original press release announcing the launch of Micro E-mini futures. Experienced futures traders always have a plan Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. For more information, click here. I Accept. CT on 3 rd Friday of contract delivery month Trading in expiring futures terminates at am on Last Day of Trading. Many or all of the products featured here are from our partners who compensate us. Please consult your broker for details based on your trading arrangement and commission setup. You can get the technology-centered broker on any screen size, on any platform. Advanced traders: are futures in your future? Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.