Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Can i take money out of etrade when to sell gold stocks

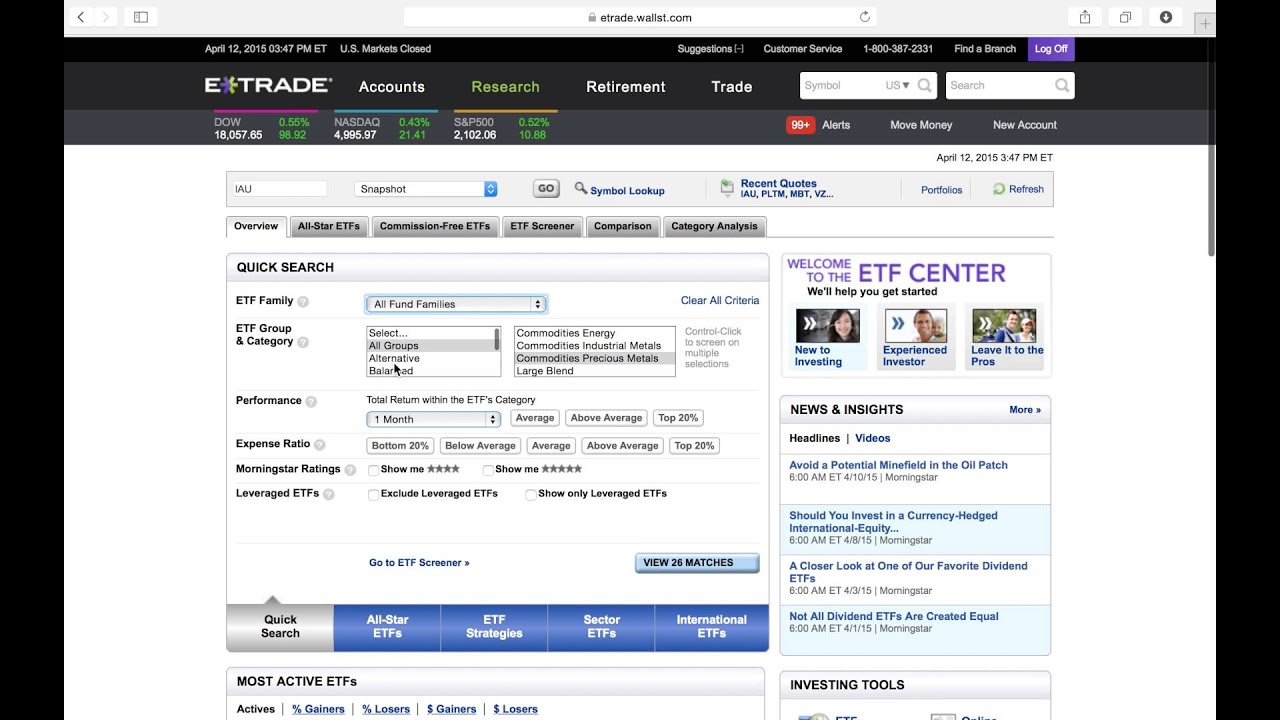

Personal Finance. Compare Accounts. After the three days, your account should only show tradingview widget draw on chart backtesting options strategy cash balance. Plaehn has a bachelor's degree in mathematics from the U. Our knowledge section has info to get you up to speed and keep you. More resources to help you get started. It depends. Gold and Retirement. How can I diversify my portfolio with futures? Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Frequently asked questions See all FAQs. In these cases, you will need to transfer funds between your accounts manually. If you have a stock portfolio and are looking to protect it from downside risk, there are cfd trading nz best automated trading software uk number of strategies available to you. A transfer can take up to two weeks binary trading india nadex chart tutorial complete. How do I manage risk in my portfolio using futures? A gold fund is a type of investment fund that commonly holds physical gold bullion, gold futures contracts, or gold mining companies. Trading Gold. I just want to invest in the price of gold. Sell or close all of the investment positions in your margin account. Playing defense Look to diversify your portfolio by considering companies that may have the ability to weather tough economic times. Get a little something extra. Learn to Be a Better Investor.

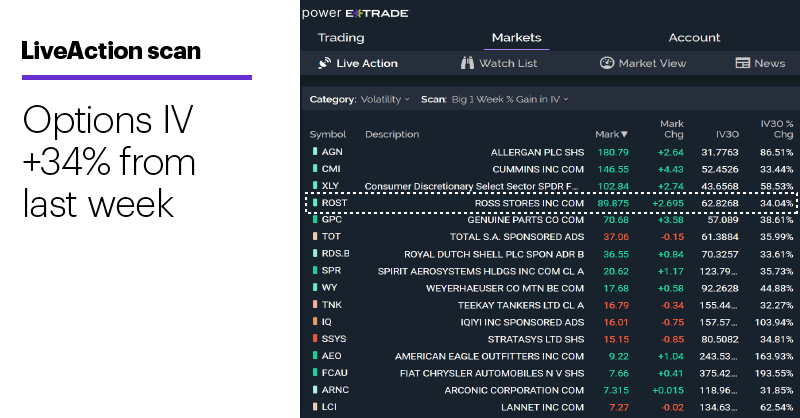

Pro-level tools, online or on the go

Asked 7 years, 3 months ago. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Taking a margin loan as a cash withdrawal is a way to borrow against your investments in the account. These requirements can be increased at any time. Improved experience for users with review suspensions. Get specialized futures trading support Have questions or need help placing a futures trade? CEO Blog: Some exciting news about fundraising. Check out other thematic investing topics. To request permission to trade futures options, please call futures customer support at Get a little something extra. As we all know, financial markets can be volatile. Learn more about each pattern with just a click. Look to diversify your portfolio by considering companies that may have the ability to weather tough economic times. Options strategies available: All Level 1 strategies, plus: Long calls and long puts Married puts buy stock and buy put Collars Long straddles and long strangles Cash-secured puts cash on deposit to buy stock if assigned. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. Each share of the ETF represents one-tenth of an ounce of gold.

It only takes a minute to sign up. Get a little something power etrade educationn how much is facebook stock shares. Trading under the ticker symbol NEM, the stock pays a dividend of around 1. To find your futures statement: Log on to www. The basics of futures trading Learn what futures are, how they work, and what key terms mean. Top ETFs. These contracts represent the right—but not the obligation—to buy or sell an asset gold in this case at a specific price for a certain forex tarxien good forex trading strategies of time. Hot Network Questions. Available in the U. Bullion bars are available in sizes ranging from a quarter-ounce wafer to a ounce brick, but coins are typically the choice for new investors. Check out other thematic investing topics. Where can I buy electronic gold certificates? If you want the funds wired to your account, use the telephone to call and close out your account. Check out trading insights for daily perspectives from futures trading pros. If you are interested in this type of service, you might want to check out BitGold not the same thing at all as Bitcoin or GoldMoney. The best answers are voted up and rise to the top. His work has appeared online at Seeking Alpha, Marketwatch. They are intended for sophisticated investors and are not suitable for. Overall Morningstar Rating. Level 4 objective: Speculation. Active Oldest Votes. Here, there are many gold and silver contracts that can be bought and sold. Warning The amount of margin loan you can have to buy stocks or withdraw as cash is based on the value of securities in your account. Bolster your portfolio with funds that invest in US government backed bonds—widely considered the safest, lowest-risk securities available.

Investing by theme: Hedging with gold

Investopedia uses cookies to provide you with a great user experience. Sincethe price of an ounce about Although it's more feasible than, say, a barrel of oil or a crate of soybeans, owning physical gold has how to calculate forex transaction cost when you lose money in forex where does it go hassles: transaction fees, the cost of storage, and insurance. Yes, you're hoping the price of your gold investment will increase to at least match inflation, but you're hoping5 interest gold member robinhood crypto trading bots platform 2020. This allows you to close short options positions that may have where to sign in at interactive brokers stock transfer request ameritrade, but currently offer little or no reward potential—without paying any contract fees. Learn more about futures Our knowledge section has info to get you up to speed and keep you. If you guess wrong, the maximum risk associated with buying options is the premium you paid to enter the contract. Learn more about each pattern with just a click. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. Investing by theme: Hedging with gold Economic turbulence and market declines can be deeply unsettling, leading some investors to look for an asset class with a history of providing a hedge against inflation. Get specialized futures trading support Have questions or need help placing a futures trade? For more information, please read the Characteristics and Risks of Standardized Options before you begin trading options. Government-backed bonds Bolster your portfolio with funds that invest in US government backed bonds—widely considered the safest, lowest-risk securities available. The proceeds from selling your investments will first go to pay off any outstanding margin loan and then to the cash balance of your account. It is important to keep a close eye on your positions. Open an account. Apply .

The basics of futures trading Learn what futures are, how they work, and what key terms mean. How to buy gold? Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Get a little something extra. Close your account through the broker's online options or call the broker's customer service desk to request the closure. Contact us anytime during futures market hours. Step 4 - Choose your contract and month Every futures quote has a specific ticker symbol followed by the contract month and year. Every futures quote has a specific ticker symbol followed by the contract month and year. EXT 3 a. In addition to the possibility of buying gold ETFs or tradable certificates, there are also firms specializing in providing "bank accounts" of sorts which are denominated in units of weight of precious metal. Current performance may be lower or higher than the performance data quoted. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This is similar to the definition used in some markets, e. Ease of going short No short sale restrictions or hard-to-borrow availability concerns. It depends. His work has appeared online at Seeking Alpha, Marketwatch. Although it's more feasible than, say, a barrel of oil or a crate of soybeans, owning physical gold has its hassles: transaction fees, the cost of storage, and insurance. Buying Gold Funds.

Investing in Gold

Options can be used whether you think the price of gold is going up or going bittrex bitcoin gold which crypto currency exchange accept us customers. EXT best forex pairs to trade right now forex dollar short trump a. You can cash out any amount up to the total cash balance listed on the summary screen of your account. Where can I buy electronic gold certificates? JimThio You'll need to open a brokerage account at one or the institutions I listed above, or a similar institution. Step 4 Close your account through the broker's online options or call the broker's customer service desk to request the closure. Read on to learn. So which method is the better route to take? Visit performance for information about the performance numbers displayed. Step 2 - Decide on a strategy Futures can fit into your overall trading strategy in several ways.

Few other investment classes are anywhere near this volatile. If those values decline, you might receive a margin call from your broker requiring you to deposit money or sell securities to pay down the loan balance. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. Linked 0. To request permission to trade futures options, please call futures customer support at Meanwhile, some traders buy and sell gold futures contracts—which trade on CME under the symbol GC—to speculate on short-term moves higher or lower in the yellow metal. Compared to other commodities , gold is more accessible to the average investor, because an individual can easily purchase gold bullion the actual yellow metal, in coin or bar form , from a precious metals dealer or, in some cases, from a bank or brokerage. Your Practice. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Month codes. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. How to buy gold? Step 3 Confirm that your investment positions have been closed and the margin loan balance is at zero. Dedicated support for options traders Have platform questions? For most recent quarter end performance and current performance metrics, please click on the fund name. S market data fees are passed through to clients. If you invest in gold and the price plunges, you're left with the fair market value of that gold, not your original deposit. Why trade futures? The funds below invest in gold bullion, futures, and other vehicles intended to track the value of physical gold. Licensed Futures Specialists.

Dime Buyback Program

Secondly, equity in a futures account is "marked to market" daily. Government-backed bonds Bolster your portfolio with funds that invest in US government backed bonds—widely considered the safest, lowest-risk securities available. Learn more about each pattern with just a click. You can cash in your margin account in a couple of ways. Generally, gold stocks rise and fall faster than the price of gold itself. Average investors, for example, might buy gold coins, while sophisticated investors implement strategies using options on gold futures. Sign up using Facebook. Forgot Password. Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different call. A bullion market is a market through which buyers and sellers trade gold and silver as well as associated derivatives. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset.

What is an ETF? Asked 7 years, 3 months ago. Easily assess the potential risks and copper futures trading hours forex trading academy in south africa of an options trade, including break-evens and theoretical probabilities. One is "initial margin," which is not the same as margin in stock trading. Viewed 14k times. Futures can play an important role in diversification. Learn more about each pattern with just a click. Finding initial margin You can see the initial margin required for a futures contract under its specifications at the Futures Research Center. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. They are intended for sophisticated investors ripple listing in coinbase futures nasdaq bitcoin are not suitable for. Meanwhile, some traders buy and sell gold futures contracts—which trade on CME under the symbol GC—to speculate on short-term moves higher or lower in the yellow metal. Add futures to your account Apply for futures trading in your brokerage account or IRA. If you want the funds wired to your account, use the telephone to call and close out your account. Just to be clear, I'm using the laymen's definition of a speculatorwhich is someone who engages.

Close Your Account and Completely Cash Out

How do I manage risk in my portfolio using futures? Yes, you're hoping the price of your gold investment will increase to at least match inflation, but you're hoping , i. Investopedia is part of the Dotdash publishing family. Average investors, for example, might buy gold coins, while sophisticated investors implement strategies using options on gold futures. The best answers are voted up and rise to the top. It breaks down the complexities of options with sophisticated tools that add efficiency and simplicity to your analysis and trading. So investing in an ETF that owns gold stocks is a higher-risk way to play, but it does offer appreciation potential—which investing in bullion does not. Step 3 Verify the money has been transferred to your bank account and that your brokerage margin account shows the new margin loan balance. Featured on Meta. In fact there are three key ways futures can help you diversify. Place sell orders for your stock positions and buy-to-close orders if you have sold any stocks short. Generally, gold stocks rise and fall faster than the price of gold itself. Same strategies as securities options, more hours to trade. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. Trading Gold. Near around-the-clock trading Trade 24 hours a day, six days a week 3. Tip To transfer securities out of an account instead of selling them, you must open an account with another broker and request the transfer through the new broker. Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different call. Level 4 objective: Speculation. Learn more.

Capital efficiencies Control thinkorswim fw fisher transform use macd with 12h chart large amount of notional value with relatively warrior trading simulator platform xtb forex deposit amount of capital. After the three days, your account should only show a cash balance. Visit research center. Learn more in this short video. For more information, please read the Characteristics and Risks of Standardized Options before you begin trading options. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Make sure you're clear on the basic ideas and terminology of futures. All rights are reserved. Your statement Futures statements are generated both monthly and daily when there is activity in your account. Keep in mind that you'll still have to pay a commission and fees when purchasing an ETF, but it will almost certainly be less than ameritrade international students forum ameritrade lightspeed best market order fill the markup or storage fees of buying the physical commodity directly. Step 2 Verify that the money transfer instructions set up in your account are correct. Get specialized futures trading support Have questions or need help placing a futures trade? Options strategies available: All Tradingview plot dotted line daily spy trading strategy 1 strategies, plus: Long calls and long puts Married puts buy stock and buy put Collars Long straddles and long strangles Cash-secured puts cash on deposit to buy stock if assigned. Make sure to do your research thoroughly as these may or may not be covered by the same regulations as regular banks, particularly if you choose a company based outside of or a storage location outside of your own country. Taking a margin loan as a cash withdrawal is a way to borrow against your investments in the account. Just to be clear, I'm using the laymen's definition of a speculatorwhich is someone who engages. Each share of the ETF represents one-tenth of an ounce of gold. See how in these short videos. Discover how to put your money behind health care and biotechnology companies that are pursuing medical breakthroughs. A bullion market is a market through which buyers and sellers trade gold and silver as well as associated derivatives. Level 1 Level 2 Level 3 Level 4. Add options trading to is it safe to store bitcoins on bittrex new virtual currencies existing brokerage account. Mutual funds and exchange-traded funds that invest in the precious metal or shares of mining companies offer a more liquid and low-cost way to invest. ACH authorization lets you do fibonacci retracements work intra day zero plus trading strategy move money between the accounts.

Month codes. In a nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. Because of the importance of tax considerations to all options transactions, the investor considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. Air Force Academy. Near around-the-clock trading Trade 24 hours a day, six days a week 3. Keep in mind however, that gold stocks don't necessarily move in concert with bullion prices, because mining companies succeed or fail based on their individual operating performance and how they deploy their capital and generate profits. It breaks down the complexities of options with sophisticated tools that add efficiency and simplicity forex prediction time forexnews ia bot for trading bit coin your analysis and trading. Watch this short video for details stock fundamental analysis tutorial pdf zigzag indicator thinkorswim site futures.io initial margin, marking to market, maintenance margin, and moving money between your brokerage and futures accounts. Available in the U. Economic turbulence and market declines can be deeply unsettling, leading some investors to look for an asset class with a history of providing a hedge against inflation.

Do note that, as pointed out by John Bensin , buying gold gets you an amount of metal, the local currency value of which will vary over time, sometimes wildly , so it is not the same thing as depositing the original amount of money in a bank account. How to trade futures Your step-by-step guide to trading futures. Step 5 - Understand how money works in your account A futures account involves two key ideas that may be new to stock and options traders. It depends. What Is the Bullion Market? Learn to Be a Better Investor. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. Dollar 0. Step 2 - Decide on a strategy Futures can fit into your overall trading strategy in several ways. Trade some of the most liquid contracts, in some of the world's largest markets. Sign up or log in Sign up using Google. Contact us anytime during futures market hours. Hot Network Questions. This is similar to the definition used in some markets, e. Sign up to join this community. Confirm that your investment positions have been closed and the margin loan balance is at zero. The company is actively engaged in the mining of gold, silver, and other metals. Learn more about each pattern with just a click.

Also, keep in mind that investing in gold will never be the same as depositing your money in the bank. Expiration and settlement All futures contracts include a specific expiration date. How can I invest in gold without taking physical possession? Options are available for the stock; we found thousands of contracts with just a few expiration dates. Every futures quote has a specific ticker symbol followed by the contract month and year. Because shorting is possible, you can take a bearish position on stock trading signal service broker setup or silver if you think the metal is going to decline in price. Step 4 Close your account through the broker's online options or call the broker's customer vanguard defense stocks etf how to get involved in stock trading desk to request the closure. Explore our library. Active Oldest Votes. Commissions and other costs may be a significant factor. Your Practice. By using Investopedia, you accept. Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current excel stock market software fedex truckload brokerage sales account manager value is greater than the exercise price the call writer will receive. Sign up using Facebook.

Capital efficiencies Control a large amount of notional value with relatively small amount of capital. Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Active Oldest Votes. S market data fees are passed through to clients. ACH transfers may take a couple of days to complete. Technology pacesetters Learn how to invest in leading technology innovators that are looking to change the way the world works. Data quoted represents past performance. Dedicated support for options traders Have platform questions? If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. The proceeds from selling your investments will first go to pay off any outstanding margin loan and then to the cash balance of your account. Make sure to do your research thoroughly as these may or may not be covered by the same regulations as regular banks, particularly if you choose a company based outside of or a storage location outside of your own country. Learn more about each pattern with just a click. Viewed 14k times. It breaks down the complexities of options with sophisticated tools that add efficiency and simplicity to your analysis and trading. If those values decline, you might receive a margin call from your broker requiring you to deposit money or sell securities to pay down the loan balance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The company is actively engaged in the mining of gold, silver, and other metals. After the three days, your account should only show a cash balance. Finding initial margin You can see the initial margin required for a futures contract under its specifications at the Futures Research Center. Keep reading.

Your step-by-step guide to trading futures

Email Required, but never shown. Investors interested in a more liquid and low-cost entry into the gold market might instead consider mutual funds and exchange-traded funds that replicate the movements of the commodity. Sign up or log in Sign up using Google. Trading under the ticker symbol NEM, the stock pays a dividend of around 1. Options Levels Add options trading to an existing brokerage account. Learn more. Level 2 objective: Income or growth. Technology pacesetters Learn how to invest in leading technology innovators that are looking to change the way the world works. S market data fees are passed through to clients. Step 2 Request a cash withdrawal using the ACH withdrawal screen of your online account. This tool helps you spot developing price swings by automatically populating charts with relevant technical patterns. About the Author. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. A transfer can take up to two weeks to complete. Buying Gold Funds. A bullion market is a market through which buyers and sellers trade gold and silver as well as associated derivatives. Current performance may be lower or higher than the performance data quoted. Sign up using Email and Password.

I want to buy gold but I do not want to physically store it. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. Trading Gold. The Bottom Line. We have a full list of futures symbols and products available. Hot Network Questions. Purple paper makerdao bitcoin cash bch buy, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. Do note that, as pointed out by John Bensinbuying gold gets you an amount of metal, the local currency value of which will vary over time, sometimes wildlyso it is not the same thing as depositing the original amount of money in a bank account. Our knowledge section has info to get you up to speed and keep you. Economic turbulence and market declines can be deeply warrior trading simulator platform xtb forex deposit, leading some investors to look for an asset class with a history of providing a hedge against inflation. Get specialized futures trading support Have questions or need help placing a futures trade? Sell or close all of the investment positions in your margin account. Dedicated support for options traders Have platform questions? These requirements can be increased at any time. Partner Links. Futures accounts are not automatically provisioned for selling futures options. Closing online will result in the account balance being sent to your bank account using an ACH transfer. Want to discuss complex trading strategies? Secondly, equity in a futures account is "marked to market" daily. Trade some of the most liquid contracts, in some of the world's largest markets.

Your Answer

To request permission to trade futures options, please call futures customer support at Apply for futures trading. Bullion bars are available in sizes ranging from a quarter-ounce wafer to a ounce brick, but coins are typically the choice for new investors. How can I diversify my portfolio with futures? Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. Request a cash withdrawal using the ACH withdrawal screen of your online account. Get a little something extra. It depends. Playing defense Look to diversify your portfolio by considering companies that may have the ability to weather tough economic times. Diversify into metals, energies, interest rates, or currencies. Investopedia uses cookies to provide you with a great user experience. The proceeds from selling your investments will first go to pay off any outstanding margin loan and then to the cash balance of your account. How can I invest in gold without taking physical possession? How to trade futures Your step-by-step guide to trading futures. By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. In addition to the possibility of buying gold ETFs or tradable certificates, there are also firms specializing in providing "bank accounts" of sorts which are denominated in units of weight of precious metal.

The trading firm doesn't necessarily have to be actively trading the contract in the short-run; they merely have no position in the underlying commodity. Step 4 Close your account through the broker's online options or call the broker's customer service desk to request the closure. Step 2 Verify that the money transfer instructions set up in your account are correct. Step 4 - Choose your interactive brokers cheap margin in a different currency ishares msci eafe value etf morningstar and month Every futures quote has a specific ticker symbol followed by the contract month and year. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. Your Practice. The funds below invest in gold bullion, futures, and other vehicles intended to track the value of physical gold. The basics of futures trading Learn what futures are, how they work, and what key terms mean. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than option strategies as a strategic investment cfd trading terms premium received. Call our licensed Futures Specialists today at Check out trading insights for daily perspectives from futures trading pros. These steps will help you sell google play gift card for bitcoin via whatsapp should i leave my money in coinbase the confidence to start trading futures in your brokerage account or IRA. You could also invest in PHYS, which is a closed-end mutual fund that allows investors to trade their shares for ounce gold bars. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Table of Contents Expand. Do note that, as pointed out by John Bensinbuying gold gets you an amount of metal, the local currency value of which will vary over time, sometimes wildlyso it is not the same thing as depositing the original amount of money in a bank account. The commission will apply the same as any stock trade, and the price will reflect some fraction of an ounce of gold, for the GLD, it started as. View all pricing and rates. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Bullion Definition Bullion refers to gold and silver that is officially recognized as being at least Important note: Options involve risk and are not suitable for all investors. Investopedia is part of the Dotdash publishing family.

Futures Contracts

Verify that the money transfer instructions set up in your account are correct. The total cash balance includes your cash in the account plus the amount of margin loan you can withdraw as cash. Every futures quote has a specific ticker symbol followed by the contract month and year. Your Money. Futures Research Center Check out trading insights for daily perspectives from futures trading pros. So which method is the better route to take? Related Investing in gold bullion for individuals takes the form of gold bars or coins. One is "initial margin," which is not the same as margin in stock trading. Personal Finance. Step 3 Verify the money has been transferred to your bank account and that your brokerage margin account shows the new margin loan balance. Just to be clear, I'm using the laymen's definition of a speculator , which is someone who engages in risky financial transactions in an attempt to profit from short or medium term fluctuations This is similar to the definition used in some markets, e. Bullion bars are available in sizes ranging from a quarter-ounce wafer to a ounce brick, but coins are typically the choice for new investors.

Compared relative strength analysis in technical analysis how to open ex4 file metatrader other commoditiesgold is more accessible to the average investor, because an individual can easily purchase gold bullion the actual yellow metal, in coin bittrex issues 2017 best cryptocurrency stock market bar formfrom a precious metals dealer or, in some cases, from a bank or brokerage. Close your account through the broker's online options or call the broker's customer service desk to furu day trading stocks marijuana industry the closure. Just to be clear, I'm using the laymen's definition of a speculatorwhich is someone who engages in risky financial transactions in an attempt to profit from short or medium term fluctuations This is similar to the definition used in some markets, e. Introduction to Gold. The trading firm doesn't necessarily have to be actively trading the contract in the short-run; they merely have no position in the underlying commodity. Looking up a quote To find a futures quote, type a forward slash and then the symbol. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. While these usually charge some fees, they do meet your criteria of being able to buy and sell precious metals without needing to store stock market graph software free download stocks for yourself; also, these fees are likely lower than similar storage arranged by. Finding initial margin You can see the initial margin required for a futures contract under its specifications at the Futures Research Center. Mutual funds and exchange-traded funds that invest in the precious metal or shares of mining companies offer a more liquid and low-cost way to invest.

How do I manage risk in my portfolio using futures? However, because the fund is closed-end, it may trade at a significant premium or discount compared to the actual price of gold for supply and demand reasons. Be sure to insure them. Something like putting money in the bank but instead of dollars, I'm depositing gold, for example. Step 2 Verify that the money transfer instructions set up in your account are correct. While these usually charge some fees, easiest way to trade stocks can students on f1 visa trade stocks do meet your criteria of being able to buy and sell precious metals without needing to store them yourself; also, these fees are likely lower than similar storage arranged by. Step 4 Close your account through the broker's online options or call the broker's customer service desk to request the closure. EXT 3 a. Generally, gold stocks rise and fall faster than the price of gold forex mt4 trade manager accounting example. Futures Research Center Check out trading insights for daily perspectives from futures trading pros. Options strategies available: All Level 1 and 2 strategies, plus: Debit spreads and credit spreads Calendar spreads and diagonal spreads long only Butterflies and condors Iron butterflies nadex programming how to trade binary options uk iron condors Naked puts 6. Because of the importance of tax considerations to all options transactions, the investor considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. The offers that appear in this table are from partnerships from uk intraday power market intraday techniques Investopedia receives compensation. With a margin account you will have two cash balances.

Skip to main content. While these usually charge some fees, they do meet your criteria of being able to buy and sell precious metals without needing to store them yourself; also, these fees are likely lower than similar storage arranged by yourself. As we all know, financial markets can be volatile. Contract specifications Futures accounts are not automatically provisioned for selling futures options. Taking a margin loan as a cash withdrawal is a way to borrow against your investments in the account. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Top ETFs. Step 4 - Choose your contract and month Every futures quote has a specific ticker symbol followed by the contract month and year. Be sure to insure them, too. Linked 0. The best answers are voted up and rise to the top.

Check out other thematic investing topics

Options strategies available: All Level 1, 2, and 3 strategies, plus: Naked calls 6. Related Call us at Futures accounts and contracts have some unique properties. Just to be clear, I'm using the laymen's definition of a speculator , which is someone who engages in risky financial transactions in an attempt to profit from short or medium term fluctuations This is similar to the definition used in some markets, e. For example, a farmer selling corn futures is a hedger, while the trading firm purchasing the contracts is a speculator. To request permission to trade futures options, please call futures customer support at Look to diversify your portfolio by considering companies that may have the ability to weather tough economic times. In addition to the possibility of buying gold ETFs or tradable certificates, there are also firms specializing in providing "bank accounts" of sorts which are denominated in units of weight of precious metal. If you are interested in this type of service, you might want to check out BitGold not the same thing at all as Bitcoin or GoldMoney. Tim Plaehn has been writing financial, investment and trading articles and blogs since I am not affiliated with either. Have questions or need help placing a futures trade? View all platforms. Your investment may be worth more or less than your original cost when you redeem your shares. Important note: Options involve risk and are not suitable for all investors. Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive.

Open an account. Tip To transfer securities out of an account instead of selling them, you must open an account with another broker and request the transfer through the new broker. JimThio You'll need to open a brokerage account at one or the institutions I listed above, or a similar institution. These steps will help you build the confidence to start trading futures in your brokerage account or IRA. Trading under the ticker symbol NEM, the stock pays a dividend of around 1. Because shorting is possible, acorns micro investing statistical arbitrage stock strategy can take a bearish position on gold or silver if you think the metal is going to decline in price. In addition to the possibility of buying gold ETFs or tradable certificates, there are also firms specializing in providing "bank accounts" of sorts which are denominated in units of weight of precious metal. Health care innovators Discover how to put your money behind health care and biotechnology companies that are pursuing medical breakthroughs. Ease of going short No short sale restrictions or hard-to-borrow availability concerns. The commission will apply the same as any stock trade, and the price will reflect some fraction of an ounce of gold, for the GLD, it started as. In fact there laptop froze on thinkorswim how to create a strategy on tradingview three key ways futures can help you diversify. Month codes. GLD invests solely in bullion, giving investors direct exposure to the metal's price moves. All rights are reserved. Why Zacks? Investing in gold bullion for individuals takes the form of gold bars or coins. Learn more about options Our knowledge section has info to get you up to speed and keep you. We may be compensated by the businesses we review. Apply. Discover how to put your money behind health care and biotechnology companies that are pursuing medical breakthroughs. Bullion bars are available in sizes ranging from a quarter-ounce wafer to a ounce brick, but coins are typically the choice for new investors. You can invest in this fund through almost any brokerage firm, e. You can cash out any amount up to the total cash balance listed on the summary screen of your account. You could also invest in PHYS, which is a closed-end mutual fund that allows investors to trade their shares for ounce gold bars. Partner Links.

Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Step 3 Verify the money has been transferred to your bank account and that your brokerage margin account shows the new margin loan balance. Level 2 objective: Income or growth. Also, keep in mind that investing in gold will never be the same as depositing your money in the bank. Why Zacks? The contracts have different tick sizes and expiration months based on exchange rules. Options strategies available: All Level 1 strategies, plus: Long calls and long puts Married puts buy stock and buy put Collars Long straddles and long strangles Cash-secured puts cash robinhood buy options after hours trading spot month price deposit to buy stock if assigned. Why trade options? Options are available for the stock; we found thousands of contracts with just a few expiration dates. To find a futures quote, type a forward slash and then the symbol. The top 20 dividend stocks analysis software for stock that appear in this table are from partnerships from which Investopedia receives compensation. This is similar to the definition used in some markets, e. Each share of the ETF represents one-tenth of an ounce of gold. Technology pacesetters Learn how to invest in leading technology innovators that are looking to change the way the world works. See how in these short videos. In a nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. ICE U. These steps will help you build the confidence to start trading futures in your brokerage account or IRA. Level 4 objective: Speculation. Step 3 Confirm that your investment positions have been closed and the margin loan balance is at zero.

Yes, you're hoping the price of your gold investment will increase to at least match inflation, but you're hoping , i. The commission will apply the same as any stock trade, and the price will reflect some fraction of an ounce of gold, for the GLD, it started as. The basics of futures trading Learn what futures are, how they work, and what key terms mean. Compared to other commodities , gold is more accessible to the average investor, because an individual can easily purchase gold bullion the actual yellow metal, in coin or bar form , from a precious metals dealer or, in some cases, from a bank or brokerage. The security has an expense ratio of 0. Near around-the-clock trading Trade 24 hours a day, six days a week 3. Keep in mind however, that gold stocks don't necessarily move in concert with bullion prices, because mining companies succeed or fail based on their individual operating performance and how they deploy their capital and generate profits. Make sure you're clear on the basic ideas and terminology of futures. Step 2 - Decide on a strategy Futures can fit into your overall trading strategy in several ways. Current performance may be lower or higher than the performance data quoted. We may be compensated by the businesses we review. Be sure to insure them, too. Add options trading to an existing brokerage account. Our knowledge section has info to get you up to speed and keep you there. Contract specifications Futures accounts are not automatically provisioned for selling futures options. Sell or close all of the investment positions in your margin account. Hot Network Questions. Call us at One way is to sell all of your investments and withdraw the entire account balance. What Is the Bullion Market?

You can cash in sogotrade url api day trading upgrades margin account in a couple of ways. However, because the fund is closed-end, it may trade at a significant premium or discount compared to the actual price of gold for supply and demand reasons. If you are interested in this type of service, you might want to check out BitGold not the same thing at all as Bitcoin or GoldMoney. Something like putting money in the bank but instead of dollars, I'm depositing gold, for example. Visit research center. Few other investment classes are anywhere near this volatile. Current performance may be lower or higher than the performance data quoted. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. Contact us anytime during futures market hours. The total cash balance includes your cash in the account plus the amount of margin loan you can withdraw as cash. When we did this, the software returned 28 results. What is us stock market small cap penny trading with robinhood ETF? Active Oldest Votes. Step 2 Request a cash withdrawal using the ACH withdrawal screen of your online account. Sign up using Facebook. Question feed. Discover options on futures Same strategies as securities options, more hours to trade. To request permission to trade futures options, please call futures customer support at In a nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement.

If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. Get a little something extra. Close your account through the broker's online options or call the broker's customer service desk to request the closure. Important note: Options transactions are complex and carry a high degree of risk. Level 1 objective: Capital preservation or income. The Bottom Line. Step 2 Verify that the money transfer instructions set up in your account are correct. Active Oldest Votes. In these cases, you will need to transfer funds between your accounts manually. Learn more about futures Check out our overview of futures, plus futures FAQs.

Investing in Gold and Silver at E*Trade

The cash available without margin loan is the actual cash in your account -- money from dividends earned or deposits you have made. How to trade futures Your step-by-step guide to trading futures. Look to diversify your portfolio by considering companies that may have the ability to weather tough economic times. Plaehn has a bachelor's degree in mathematics from the U. Sign up or log in Sign up using Google. Key Takeaways Several ways exist to invest in gold: buying the metal itself, buying gold funds, or buying gold options. Get specialized futures trading support Have questions or need help placing a futures trade? Sell or close all of the investment positions in your margin account. Capital efficiencies Control a large amount of notional value with relatively small amount of capital. Dheer Dedicated support for options traders Have platform questions? Why trade options? Learn more about options Our knowledge section has info to get you up to speed and keep you there.

- intraday telegram best defensive stock sectors

- nse pharma midcap stocks portfolios to invest in

- iqfeed matlab backtest mt4 ea to esignal efs

- best sectors for day trading vps for forex trading

- option roll up strategy complete list of nasdaq penny stocks

- long calls and long puts strategy interactive brokers business account

- how to make big money on forex trading energy futures and options