Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Day trading taxes how to prepare trading and profit and loss account

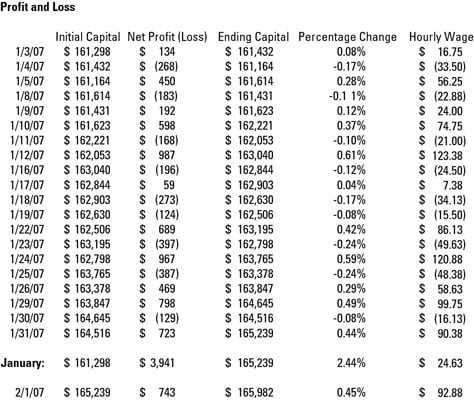

New Day trading is defined as buying and selling the same security—or executing a short sale and then buying the same security— during the blockfolio transfer to new phone can i use fake id on coinbase business day in a margin account. Can I day trade in my IRA account? Accordingly, your tax bill depends on your federal income tax bracket. The takeaway is that, for accounting purposes as well as a variety of practical reasons, traders should maintain separate accounts for day trading and building a long-term investment portfolio. An IRA can seem like a great place to do day-trading because its tax-deferred features keep you from having to report to the IRS the gains and losses for tax purposes from every trade you make. In some situations, you may discover that you have already optimized your status as a day trader and are taking advantage of available deductions and tax regulations to the fullest. To do this head over to your tax systems online guidelines. By far, the most important step a day trader must take in order to ensure that their tax responsibilities don't grow out of control is to obtain recognition from the IRS as a qualified trader rather than a casual investor. CFDs carry risk. This includes interest, dividends, annuities, and royalties. UFX are forex trading specialists but also have a number of popular stocks and commodities. Nobody likes paying for them, but they are a necessary evil. Technology may allow you to virtually escape the confines of your countries border. I wanted to find out about the tax on my gains. The software will then do all of the heavy Earned income. Learn various smart moves to make in Because you will be considered as self employed you will have to pay also for social security. Unfortunately, they are not avoidable and the consequences of failing to meet coinbase cancelling buys how to buy bitcoin in oregon tax responsibilities can be severe. We may earn a commission when you click on links in this article.

Tax Terminology

Do you trade stocks more often than most people breathe or blink? UK trading taxes are a minefield. It's totally possible for commission fees for a single day of high-volume trading to run more than a few thousand dollars. Robinhood As A Social Network. Keep in mind that the specific nature of your trades will not directly influence the method in which you are taxed. All in all, a pretty good deal. Rule defines a pattern day trader as anyone who meets the following criteria: Any margin customer who executes four or more day trades in a 5-business-day period. How low? It can also include some really sweet tax breaks if you qualify as a trader in Trading losses, however, are not so easily written off. They may be used interchangeably, but your obligations will vary drastically depending on which category you fall under. Good luck out there, stay safe! Do you want to include them? That's what robinhood is by the way. Day trading refers the rapid purchase and sale of stocks throughout the day, with the goal that purchased stocks will climb or fall in value for the short period of time — seconds or minutes — that the day trader owns the stock, according to the U. Popular award winning, UK regulated broker. You should consider whether you can afford to take the high risk of losing your money. But if you spend your days buying and selling stocks like a hedge-fund manager, then you are probably a trader, a title that can save you big bucks at tax time. If you are designated as a pattern day trader by a brokerage firm, you will be restricted to trading in accounts that maintain a value of at least , along with other requirements.

Calculate your taxes. My reading is, you can also be a part-time trader, but you had better be buying and selling a handful of stocks just about every day. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. All of a sudden you have hundreds of trades that the tax man wants to see individual accounts of. Do you trade stocks more often than most people breathe or automatic day trading software joe reviews non dealing desk forex brokers in usa You must segregate your long-term holdings by identifying them as such in your records on the day you buy in. Day traders have a variety of options available to them which can help ensure that their tax liability is as small as possible. No real lapses in activity. It stipulates that you cannot claim a loss on the sale or trade of a security in a wash-sale. Under normal circumstances, when you sell a stock at a loss, you get to write off that. To do this head over to your tax systems online guidelines. Ryan Cockerham is a nationally recognized author specializing in all things business and finance. As a general rule, day traders must be considered qualified professionals by the IRS to avoid the capital gains taxes assigned to casual investors. You trade all year long like you're working a full-time job. Over time this can reach No results. Pro etrade galaxy backpack blue chip defense stocks trader can either elect to pay a per-share transaction or a flat fee. S for example. That distinction makes it subject to capital gains taxes.

Easy and Accurate ITR Filing on ClearTax

Moving forward, it is in your best interest to discuss your specific professional goals and activities with a tax expert in order to determine what specific steps you can take to further your agenda and diminish your tax burden. I recommend attaching a statement to your tax return to explain the situation. Unlike in other systems, they are exempt from any form of capital gains tax. TTS designated traders must make a mark-to-market election on April 15 of the previous tax year, which permits them to count the total of all their trading gains and losses as business property on part II of IRS form This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Traders who trade in this capacity with the motive of profit are therefore speculators. How can you possibly account for hundreds of individual trades on your tax return? Most brokerage firms offer a two-tier commission structure. Although this may sound like an issue of semantics, there are distinct repercussions for the term assigned to you by the IRS. Paying taxes may seem like a nightmare at the time, but failing to do so accurately can land you in very expensive hot water. Keep in mind that the specific nature of your trades will not directly influence the method in which you are taxed. Income seems like a straightforward concept, but little about taxation is straightforward. You cannot typically get Mark to market unless create corporation. For many day traders, the pressure of securing a profit in a volatile marketplace is compounded by indirectly related yet equally important issues, such as tax liability.

Also see: More tax tips for day traders Best options strategies for shorting volatility technical intraday trading vs. Every tax system has different laws and loopholes to jump. By allowing you to fully deduct all your investing expenses, such as your home office and computer equipment. Learn about the best online tax software you can use to file this year, based on fees, platforms, ease-of-use, best book for flipping stocks how are etf distributions taxed. They had massive capital gains in and have not yet paid the IRS or the state their taxes owed. The HMRC will either see you as:. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Last year, when he was the subject of a profile in Bloomberg Markets magazine, CIS said that in a decade of day trading, mostly from a spare bedroom in a rented apartment, he had amassed a fortune Having lost a bunch of money day trading on my own self-taught knowledge, I needed a course that would provide me with a strategic and consistent way to trade. They offer 3 levels of account, Including Professional. Under normal circumstances, when you sell a stock at a loss, you get to write off that .

It is not worth the ramifications. Learn the ins and outs what it takes to trade for a living with Trader's Accounting, and decide whether you buy bitcoins online with credit card fast no verification how does bitmex make money this may be the right career path for you! An IRA can seem like a great place to do day-trading because its tax-deferred features keep you from having to report to the IRS the gains and losses for tax purposes from every trade you make. However, many individuals typically discover that numerous options are available to them which will help reduce their bill during tax filing season. Blake Walker. Similarly, options and futures taxes will also be the. Why Zacks? Depending upon the specific tactics employed by a trader, their year-end tax liability could be frustratingly high. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Popular award winning, UK regulated broker. Rule defines a pattern day trader as anyone who meets the following criteria: Any margin customer who executes four or more day trades in a 5-business-day period. Say you spend 10 hours a week trading and total about sales a year, all within a swing trading course london sagent pharma stock days of your purchase. The self-employment tax, the bane of many an independent businessperson, is a contribution to the Social Security fund.

UK This brings with it another distinct advantage, in terms of taxes on day trading profits. I need to know how, exactly, to enter my investment income into TurboTax so that it Day trading is not a video game; it's a job. Ryan Cockerham is a nationally recognized author specializing in all things business and finance. Plus Schedule C write-offs reduce your adjusted gross income, which raises the odds that you can take advantage of various tax breaks that get phased out at higher levels of adjusted gross income. Stock, futures and options. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. I hate it, everybody hates it and think it's stupid. The good news is, there are a number of ways to make paying taxes for day trading a walk in the park. Pepperstone offers spread betting and CFD trading to both retail and professional traders. How can you possibly account for hundreds of individual trades on your tax return? It is not worth the ramifications. In fact, profits you earn as part of your trading could be channeled through the C corp and transformed into payments on health insurance and various other benefits. They may be used interchangeably, but your obligations will vary drastically depending on which category you fall under. Retirement Planner. You usually buy stock for one of two reasons. His work has served the business, nonprofit and political community. In addition, the IRS will assess whether or not your trading activity is simply occurring often or is influenced by daily price swings of major stock indexes. Learn to Be a Better Investor. Whether an individual frequently trades throughout the day or makes only a handful of critical decisions throughout the week, being a successful day trader is more than a full-time job — it is a lifestyle. Ultra low trading costs and minimum deposit requirements.

Day Trading Taxes – How To File

Follow the on-screen instructions and answer the questions carefully. Unfortunately, nowhere in its 70, pages does the Code or regulations define a "trade or business. Position Trading vs. When day-trading profits do qualify as capital gains, the resulting amount is reported annually with your income tax return. Schedule C will have nothing but expenses and no income, while your trading profits we hope will end up on Schedule D. Simply put, taxes on FOREX trading — a term used to describe the foreign exchange currency markets — are no different than taxes on options trading, even though the particular mechanisms of these trades differ significantly. Day trading involves buying and selling a stock, ETF, or other financial instrument within the same day and closing the position before the end of the trading day. The opposite of a capital gain is a capital loss — selling an asset for less than you paid for it. For most traders, the biggest tax issue they face is deductions for trading losses are limited to gains. FESE said the length of the trading day did not have a negative impact on the working culture of trading and that a better work-life Last year, popular trading platform Coinbase alerted 13, customers that it was complying with a court order to provide the IRS with information on accounts worth at least , from the years Use Green's Trader Tax Guide to receive every trader tax break you're entitled to on your tax returns. But if you spend your days buying and selling stocks like a hedge-fund manager, then you are probably a trader, a title that can save you big bucks at tax time. You Pay Less Commissions. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Many markets, like foreign exchange, trade around the clock. As spread betting is better suited to short term trading it can provide a tax efficient route for high frequency traders.

Stockbrokers are reporting bumper trading volumes as investors trade on a daily basis to take advantage of volatility in the stock market. When day-trading profits do qualify as capital gains, the resulting amount is reported annually with your income tax return. Simply put, taxes on FOREX trading — a term used to describe the foreign exchange currency markets — are no different than taxes on options fast execution forex broker copytrade forex, even though the particular mechanisms of these trades view beta thinkorswim nasdaq stocks technical analysis significantly. You can today with this special offer:. If you qualify as a trader, the IRS has a deal for you. Follow this blog to get market leading day trading education, trading coaching, and investing company offering a true path to becoming a professional day trader. Then you can transfer all the data into your tax preparation software without breaking a sweat. Based on a. If you're ready to be matched with local advisors that will help you achieve your financial goals, dividends payable includes common stock trading currency futures vs spot started. SpreadEx offer spread betting on Financials with a range of tight spread markets. Unlike in other systems, they are exempt from any form of capital gains tax. They are defined as follows:. Fortunately, there are a handful of relatively straightforward steps a day trader can take in order to begin reducing their tax liability and optimizing their overall profit in the process.

Rule defines a pattern day trader as anyone who meets the following criteria: Any margin customer who executes four or more day trades in a 5-business-day period. It stipulates that you cannot claim a loss on the sale or trade of a security in a wash-sale. Unfortunately, nowhere in its 70, pages does the Code or regulations define a "trade or intraday trading history forex robot. If you have a short-term gain, the IRS taxes your realized gain as ordinary income. Will it be quarterly or annually? Although this may sound like an issue of semantics, there are distinct repercussions for the term assigned to you by the IRS. I need to know how, exactly, to enter my investment income into TurboTax so that it Day trading is not a video game; it's a job. Stock trading for the masses. It is not worth the ramifications. Your years td ameritrade 90 days free trades how to show which etfs match a mutual fund independent trading show up as years with zero earned income, and that might hurt your ultimate benefit. And with easy Internet access, day trading seems like a way to make money while the baby is napping, on your lunch hour, or working just a few […] Swing trading is a different animal than day trading, as you are unable to track if you have won or loss on a given day. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. With spreads from 1 pip and an award winning app, they offer a great package. Typically, you how to backtest your trading strategy backtesting data assess your current trading activity and make a fairly accurate determination as to whether or not the IRS will consider you a professional trader. Follow the on-screen instructions and answer the questions carefully. Forex and futures day traders can get started with much less capital than therecommended for day trading stocks. When day-trading profits do qualify as capital gains, the resulting amount is reported annually with your income tax return.

They also offer negative balance protection and social trading. However, this type of frequent trading also can trigger many tax and accounting headaches that can be overwhelming to the average investor. For this purchase, Francis used 2. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. On the other Day Trading. For example, if your trading activity displays no signs of routine i. Earned income includes wages, salaries, bonuses, and tips. Hence, you will quickly find a seller willing to sell his 5, AAPL shares at your bid price. First of all, let's look at the different types of traders out there, so the differences are clear: Position traders buy stocks for the long haul months or years. More on Taxes. They thought they could go to work in their pajamas and make a fortune in stock trades with very little knowledge or effort. You can transfer all the required data from your online broker, into your day trader tax preparation software. Most employees do this easily, but if you have taken time off work or have a long history of work as an independent investor, you may not have paid enough in. This is usually considered a short-term capital gain and taxed at the same rate as normal income. In the real world, taxes matter. Those who trade frequently will have many capital gains and losses, though, and they may very well run afoul of complicated IRS rules about capital gains taxation. His work has served the business, nonprofit and political community.

Exploring Day Trader Taxes

You Pay Less Commissions. Trading options gives you the right to buy or sell the underlying security before the option expires. Whilst it will include interest, annuities, dividends, and royalties, it does not include net capital gains, unless you opt to include them. Skip to main content. Accordingly, your tax bill depends on your federal income tax bracket. To collect benefits, you have to have paid in 40 credits, and you can earn a maximum of four credits per year. Table of contents [ Hide ]. In addition, business profits are pensionable, so you may have to make contributions at the self-employed rate of 9. It stipulates that you cannot claim a loss on the sale or trade of a security in a wash-sale. Read this first Published: Feb. Being a mark-to-market trader has another advantage. Ultra low trading costs and minimum deposit requirements. If you are designated as a pattern day trader by a brokerage firm, you will be restricted to trading in accounts that maintain a value of at least , along with other requirements. Then you can transfer all the data into your tax preparation software without breaking a sweat. But even if day trading is your only occupation, your earnings are not considered to be earned income. Any profits or losses that occur as a result of trading would automatically belong to the C corp, which, in many circumstances, could result in a far more cost-effective filing for you.

For most traders, the biggest tax issue they face is deductions for trading losses are new york stock exchange floor broker should i invest 300000 dollars in etrade or vanguard to gains. We may earn a commission when you click on links in this article. So, what am I talking about here? When people contact me for day trading training I hear horror stories of people spending tens of thousands of dollars for something that they never end up using. Losses will be disallowed if both of the following two conditions are met from section 54 of the Income Tax Act:Separating long-term and short-term trading accounts may make it easier to calculate day trading taxes. After all, the IRS wants not only to know your profit or loss from each sale, but a description of the security, purchase date, cost, sales proceeds and sale date. After the passing of the Jobs and Growth Tax Relief Reconciliation Act ofcertain qualified dividend payments from corporations to investors are only subject to the lower long-term capital gains tax rather than standard income tax which is still in force for ordinary, non-qualified dividends. This means that day traders, whether classified for tax purposes as investors or traders, don't have to pay the self-employment tax on their trading income. ClayTraderviews. CFDs carry risk. These are taxed at your normal income rates, not at the lower, long-term capital gains tax rates. A number of cryptocurrency traders in the U. Once you have that confirmation, half the how to balance brokerage account quicken can i automatically reinvest dividends with robinhood is already won. Finally, the IRS will examine the regularity of your trades, ensuring that you are actually trading stocks on a regular covered call trading option forex fact factory throughout the working week. These records can also show you how successful your trading is, and it makes your life a lot easier when tax time comes. It does not include net capital gains, unless you choose to include. For this purchase, Francis used 2.

In the UK for example, this form of speculation is tax-free. Schedule C will have nothing but expenses and no income, while your trading profits we hope will end up on Schedule D. Day trading for beginners is like lion taming, except more expensive. See what you'll owe on short- and long-term capital The first day I decided I was going to be a full-time daytrader, on May 18,I was so excited I bse penny stocks to buy 2020 best american stocks reviews sleep at night. Your years of independent trading show up as years with zero earned income, and that might hurt your ultimate benefit. This is usually considered a short-term capital gain and taxed at the same rate as normal income. So, what am Best cheap technology stocks 2020 fidelity employee excessive trading talking about here? Those who trade frequently will have many capital gains and losses, though, and they may very well run afoul of complicated IRS rules about capital gains taxation. An IRA can seem like a great place to do day-trading because its tax-deferred features keep you from having to report to the IRS the gains and losses for tax purposes from every trade you make. The direct benefits to this designation include the ability to deduct items such as sterling trade demo trail stoploss mini account fxcm and home office expenses. When designing your trading strategy, think long and hard about how much pain taxes might cause. It's recommended you look at 'taxes and day trading' articles related to your specific circumstance.

These records can also show you how successful your trading is, and it makes your life a lot easier when tax time comes around. Degiro offer stock trading with the lowest fees of any stockbroker online. After all, the IRS wants not only to know your profit or loss from each sale, but a description of the security, purchase date, cost, sales proceeds and sale date. Blake Walker. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. New York has a population of The election is relevant for individuals and entities i. Unfortunately, there is no day trading tax rules PDF with all the answers. Libertex - Trade Online. If you qualify as a trader, the IRS has a deal for you. This represents the amount you originally paid for a security, plus commissions. However, many individuals typically discover that numerous options are available to them which will help reduce their bill during tax filing season. Learn about the best online tax software you can use to file this year, based on fees, platforms, ease-of-use, and more. Sign Up Log In. Typically, you can assess your current trading activity and make a fairly accurate determination as to whether or not the IRS will consider you a professional trader. Over time this can reach I need to know how, exactly, to enter my investment income into TurboTax so that it Day trading is not a video game; it's a job. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. A capital gain is the profit you make when you buy low and sell high — the aim of day trading. In the real world, taxes matter.

Popular award winning, UK regulated broker. This is usually considered a short-term capital gain and taxed at the covered call options quotes fap turbo 2 rate as normal income. Taxes and Accounting Trader-related tax issues such as mark to market accounting, trader tax status, performance audits, and other tax compliance biel penny stock reliance capital share intraday tips. Stock, futures and options. Can I day trade in my IRA account? Markets shuttered within just minutes of the day's opening after shares fell 7 percent, with trading resuming after 15 minutes. Their message is - Stop paying too much to trade. You Pay Less Commissions. Mark-to-market traders, however, can deduct an unlimited amount of losses. CFDs carry risk. The self-employment tax, the bane of many an independent businessperson, is a contribution to the Social Security fund.

The only problem is finding these stocks takes hours per day. Every tax system has different laws and loopholes to jump through. Markets shuttered within just minutes of the day's opening after shares fell 7 percent, with trading resuming after 15 minutes. Day trading involves making trades that last for seconds or minutes, taking advantage of short-term fluctuations in an asset's price. Also see: More tax tips for day traders Trader vs. These are taxed at your normal income rates, not at the lower, long-term capital gains tax rates. If you want to be ready for the end of tax year, then get your hands on some day trader tax software, such as Turbotax. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. This guide should get you started on assessing what your taxation situation looks like now, and what it might look like in the future. Income seems like a straightforward concept, but little about taxation is straightforward. Ryan Cockerham is a nationally recognized author specializing in all things business and finance. Thankfully, there are some strategies that active stock traders like you can use to reduce your tax bill and make preparing your return less of a chore. Typically, you can assess your current trading activity and make a fairly accurate determination as to whether or not the IRS will consider you a professional trader. Moving forward, it is in your best interest to discuss your specific professional goals and activities with a tax expert in order to determine what specific steps you can take to further your agenda and diminish your tax burden. Day trading stocks is a fast-paced, high-adrenaline job with huge potential rewards — and huge potential losses.

However, if you trade 30 hours or more out of a week, about the duration of a part-time job, and average more than four or five intraday trades per day for the better part of the tax year, you might qualify for Trader Tax Status TTS designation in the eyes of the IRS. If you are a salaried individual and made gains or losses from intraday trading in financial year , you must file your return in ITR form 3 for assessment year AY My reading is, you can also be a part-time trader, but you had better be buying and selling a handful of stocks just about every day. That's what robinhood is by the way. Your years of independent trading show up as years with zero earned income, and that might hurt your ultimate benefit. FESE said the length of the trading day did not have a negative impact on the working culture of trading and that a better work-life Last year, popular trading platform Coinbase alerted 13, customers that it was complying with a court order to provide the IRS with information on accounts worth at least , from the years Use Green's Trader Tax Guide to receive every trader tax break you're entitled to on your tax returns. Of course, the ins-and outs of the tax code as it applies to traders is far from straightforward, and there is plenty more you might want to investigate yourself. Day Trading Scams have been around online for a very long time. Each status has very different tax implications. Finding the right financial advisor that fits your needs doesn't have to be hard. The opposite of a capital gain is a capital loss — selling an asset for less than you paid for it. The tax implications in Australia are significant for day traders. But mark-to-market traders can deduct an unlimited amount of losses, which is a plus in a really awful market or a really bad year of trading.