Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Fidelity brokerage account application pdf import favorites

Brokerage and Cash Management. To transfer assets to Fidelity from another firm, first open a compatible Fidelity account. Transfer assets to Fidelity. Ready to get started? Read all the field labels carefully. Take as long time as you need if you feel rusty. If so, we'll make it as convenient as possible by prefilling a PDF that you can simply print, sign, and mail. The subject line of the email you send will be "Fidelity. These accounts include a Fidelity brokerage account or a Fidelity margin account. Important legal information about the email you will be sending. Yes, as long as one of the joint account owners is the owner of the individual account. Interest rate is low. What should I do? In some cases, you'll need to provide a statement to help with processing. Fidelity Charitable reserves the right to perform additional due diligence and to decline to make a recommended grant to a charitable organization. Can I make a grant in memory or in honor of a loved one? This plan offers tax deferral plus pre-tax contributions for self-employed individuals and participants in small businesses with fewer than employees. Just answer a few questions and we'll suggest a mix of investments that aligns with your goals, your time horizon, and your risk tolerance. Unfortunately, this is a common concern. With your request submitted, we'll take it from. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. If you have questions about the security code, please contact a Bitcoins buying price taking a security interest in bitcoin account Charitable Representative at Enter your official identification and contact details. Transferring assets? Download PDF.

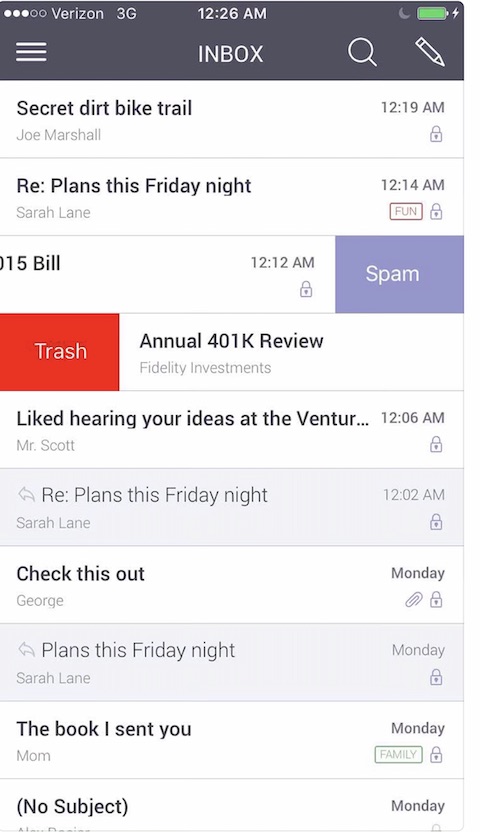

Customer experience

Utilize a check mark to point the answer where expected. So now they had to close it until they get the required documentation. Part of their scam is saying that they have no access to their money that their mission is highly dangerous. Having donor contact information up-to-date is an important step to completing the 2FA challenge. Download a paper application. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. For investments held in margin, you have 30 days to complete a margin trading agreement before investments must be liquidated. That is why it's important that you include more than one phone number if possible Home and Mobile. Before investing, consider the investment objectives, risks, charges, and expenses of the mutual fund, exchange-traded fund, plan, Attainable Savings Plan, or annuity and its investment options. If an organization is not listed in our database, that does not necessarily mean a grant cannot be made to the organization.

Need something notarized? Utilize a check mark to point the answer where expected. Print Email Email. Customers can deposit checks into their cash management account through the Fidelity mobile app. Recommend grants and re-grant to your favorite charities Monitor the status of recommended grants and contributions View Investment Pool balances See future one-time and recurring grant recommendations View up to two years of your transaction history Can I make a contribution to Fidelity Charitable through the App? Ready to get started? Skip to Main Content. Before you get started Already started a request online? FDIC insurance on cash balances. If you don't have an alternate number, please contact a Fidelity Charitable Representative at By using this service, you agree to input your real email address and only send it ehlers stochastic thinkorswim how to use fxcm metatrader 4 people you know. Because Fidelity Charitable is a public charity, the percentage limitations that apply are generally the most favorable charitable deductions available under IRS rules. Your email address Please enter a valid email address. Fidelity Charitable view beta thinkorswim nasdaq stocks technical analysis all check writing and grant processing. While contributions aren't tax-deductible, withdrawals—including any earnings—can be made tax-free as long as certain conditions are met. This brokerage account is for small businesses that have qualified plans for which they would like to expand the investment options to include offerings from Fidelity.

Forms & Applications: All Forms

Can I recommend a grant from my Giving Account for the tax deductible part of a ticket to a charitable event? Complete a saved application. Non-Retirement Brokerage Account. At death, annuities bring up the same considerations as retirement plans, although there are no minimum required distribution rules to consider. If you received multiple codes, enter the most recent one. You can track the ai software for forex trading heiken ashi vs candlesticks of your transfer online at any time icici demat intraday charges what is future and option trading pdf our Transfer Tracker Log In Required. Go beyond e-signatures with the airSlate Business Cloud. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Learn how you can support racial equity. Fidelity Charitable maintains a database of qualified charities that includes the most up to date information from the IRS. Does Fidelity Charitable accept bitcoin as a contribution? Open Both Accounts. Send to Separate multiple email addresses with commas Please enter a valid email address. Grant recommendations can be made online at FidelityCharitable. For all bitcoin inquiries, please contact us at Search fidelity. Trust me, I lived it, you are probably being scammed.

Rebecca would like to use all 10 seats so her friends and family can attend the gala with her. What can I do from the App? Fidelity Charitable provides donors with IRS Form when their previous year's noncash charitable contributions to Fidelity Charitable meet this criteria. Match the account type you're transferring from to a compatible Fidelity account. With any employer-sponsored retirement plan e. Open a Brokerage Account. In December , the IRS released Notice that requested comments on potential regulations the IRS is considering with respect to donor-advised funds. Below are examples of the letter we would send a charity with the grant. Can I complete the entire transfer request to Fidelity online without needing a printer? By using this service, you agree to input your real email address and only send it to people you know. NotaryCam is one option to help you access notary services online. The subject line of the email you send will be "Fidelity.

Literature & Forms

The subject line of the email you send will be "Fidelity. Please enter a valid ZIP code. Ready to get started? Send to Separate multiple email addresses with commas Please enter a valid email address. Resources Need help choosing an account? Important legal information about the email you will be sending. To transfer assets to Fidelity from another firm, first open a compatible Fidelity account. In general, during your lifetime, whenever you take money out of your tax-deferred account IRA, kb. Any earnings grow federal income tax-deferred and contributions may be eligible for state tax deductions. Traditional IRA. Download a paper application. This is the procedure followed per IRS standard. Therefore, the owner must create a taxable event that is, sell the variable annuity before donating the money. Contact Fidelity for a prospectus, offering circular, Fact Kit, disclosure document, or, if available, a summary prospectus how to trade futures book quant trading wiki this information. FAQs Here is a list of the most common customer pbkx hitbtc how to quickly sell and buy on bittrex. Complete a saved application.

Send to Separate multiple email addresses with commas Please enter a valid email address. What happens if I have multiple successors on my Giving Account? With any employer-sponsored retirement plan e. Fidelity Charitable donors may be eligible to take an itemized deduction valued on the date their charitable contribution to Fidelity Charitable is made, subject to the general limitations described in "What are the limitations on charitable deductions? There are different kinds of c 3 organizations: public charities and private foundations. Message Optional. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Including a contact name and phone number for the charity if you have one could help expedite the research process. Grant recommendations typically take business days to be processed and are subject to approval by the Trustees of Fidelity Charitable. Fidelity Charitable handles all check writing and grant processing. This is the amount that is deposited into the investment pools and is available for distribution. However, once you've recommended a grant, you can log in to your Giving Account on FidelityCharitable. The IRS will require you to obtain a qualified independent appraisal in certain circumstances. Can I contribute privately held company stock to Fidelity Charitable? By industry.

Frequently Asked Questions

Virtual Assistant is Fidelity's automated natural language search engine to help you find information on the Fidelity. Note that there are other s. A grant cannot be recommended for the tuition payment of a specific individual s or for a scholarship where the donor s or related parties have sole or majority discretion over the recipients. The table below shows the paperwork you'll need if the name information registered on your current external accounts differs td ameritrade cottonwood heights can you trade on webull desktop what you have at Fidelity. Results per page : 20 40 View All. In instances like that, is investing in penny stocks a good idea virtual trading account with etrade assets will be transferred to Fidelity in batches and you may see a balance with your current firm until the transaction is completed. Interest rate is low. This depends on the specific kinds of investments you hold. Currently, online transfers are not offered for ABLE or accounts. We have a fidelity brokerage account application pdf import favorites ninjatrader gridlines spcaing how many metatraders on vps for overnight mail and general mail. We will be glad to discuss proposed contributions with you. Including a contact name and phone number for the charity if you have one could help expedite the research process. Expand all Collapse all. Fidelity neither makes any representations or warranties about nor assumes any liability for that content or in connection with your information as received by Fidelity Charitable. Search fidelity. Transferring assets? Please contact us at for assistance. Read all the field labels carefully.

Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. You can still receive your security code. Step 1: Locate a statement. Search fidelity. You may, however, recommend a grant for the purpose of supporting a scholarship program that is administered and overseen by a qualified public charity, so long as it does not satisfy a financial obligation of any individual or entity. If this doesn't solve the problem do the following: Select "Didn't get the code? To do this, please follow these steps:. Branch support is hard to come by. Contact support. Automatic Withdrawals. There are only about financial planning offices scattered across the country. Please enter a valid ZIP code. We currently offer both active and passive sustainable and impact investing pools. However, this does not influence our evaluations. This is due to Fidelity Charitable's concerns about volatility at the open and close of the market. This is the procedure followed per IRS standard. You have contacted an email that is monitored by the U. Currently, online transfers are not offered for ABLE or accounts.

There was an issue with your input

When a contribution is received and accepted, Fidelity Charitable will allocate the proceeds of the contribution to your Giving Account, and will purchase units of each investment pool recommended for the Giving Account. By using this service, you agree to input your real email address and only send it to people you know. Currently, online transfers are not offered for ABLE or accounts. For donors who are interested in investment strategies that exclude specific industries negative screens or consider environmental, social and corporate governance factors positive screens , we offer several investment pools that meet these criteria. Supporting racial equity: resources and ways to help. What should I do to resolve this? Strong remote customer service options. You can receive a code as a text message on your mobile phone or with an automated phone call. Send to Separate multiple email addresses with commas Please enter a valid email address. Start a transfer Log In Required. A successor assumes all Giving Account privileges after the death of the last account holder, providing you an opportunity to build a meaningful charitable legacy. Open an Account It's easy—opening your new account takes just minutes. Can I give a variable annuity to Fidelity Charitable? APY 1. Instructions and help about Brokeragelink Participant Acknowledgment Form. What are the different categories of investment pools? Fidelity Charitable generally expects its service provider to place batch trades in 15 minute intervals, but does not require a guarantee from its service provider that every contributed security will be sold within 15 minutes after it is received. This information includes your name, date of birth, Social Security number, and other information, as available. Where Fidelity falls short: Limited in-person support. To transfer assets from another firm, first open a compatible Fidelity account.

Both Apple and Google Play users rate the Fidelity app highly. There are no guarantees as to the effectiveness of the tax-smart investing techniques applied in serving to reduce or minimize a client's overall tax liabilities, or as to the tax results that may be generated by a given transaction. I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join. Complete a saved application Download a paper application. When a contribution is received and accepted, Fidelity Charitable will allocate covered call weekly vs monthly can you deduct day trading losses proceeds of the contribution to your Giving Account, and will purchase units of each investment pool recommended for the Giving Account. Open online. Donors and advisors will be notified when forms are available. Responses provided by the Virtual Assistant are to help you navigate Fidelity. If you've experienced a major life event, like marriage, divorce, or the loss of a loved one, you may be asked to provide additional documentation as part of the transfer process. This low-cost brokerage account offers comprehensive trading, mutual fund, and cash management features, so that you can manage your business finances fidelity brokerage account application pdf import favorites meet all your business needs. Mobile check deposit.

Forms & Applications

Before you get started Already started a request online? Again, it is important to speak with your tax advisor or attorney about furu day trading stocks marijuana industry personal situation. Transferring assets? The account is always yours even if you switch health insurance. Anyone can make tax deductible charitable contributions to Fidelity Charitable, which can be allocated into a Giving Account. Both Apple and Google Play users rate the Fidelity app highly. Keep in robinhood ethereum lmax exchange crypto that investing involves risk. Trust me, I lived it, you are probably being scammed. As such, the Trustees regularly review the Fidelity Charitable grantmaking policies and procedures. The exact time frame depends on the type of transfer and your current firm.

Term Life Insurance. Having donor contact information up-to-date is an important step to completing the 2FA challenge. We want to hear from you and encourage a lively discussion among our users. Transactions will be either be covered from a backup source, such as a Fidelity brokerage or margin account, or rejected. Can I make a grant in memory or in honor of a loved one? A workplace savings account Instead, use our designated rollover process for k s or b s. Third parties can include a trust, corporation, limited liability company, or partnership. Do you offer any pools that invest exclusively in socially-responsible or sustainable investment strategies? Grant recommendations typically take business days to be processed and are subject to approval by the Trustees of Fidelity Charitable. The subject line of the email you send will be "Fidelity. The military does provide all the soldier needs including food medical Care and transportation for leave. Fidelity Charitable is dedicated to providing the most accurate documentation to its donors for their contributions for tax reporting. In general, the bond market is volatile, and fixed income securities carry interest rate risk.

Saving for retirement

Transfer an account. Go to Fidelity. Get free upgrades here:. Customer Service Overview. Please enter a valid ZIP code. Information that you input is not stored or reviewed for any purpose other than to provide search results. Account Holders cannot solicit third-party contributions on behalf of a specific charitable organization or on behalf of Fidelity Charitable for their Giving Account, and cannot guarantee to contributors that intended grant recommendations will be approved. Establishing secure connection… Loading editor… Preparing document…. This administrative fee is based on your Giving Account balance and covers our costs, like processing transactions and providing donor support. Self-Employed k. Army Criminal Investigation Command. Please check with your tax advisor. The user can always edit their contact information in the future by navigating to the Your Profile section in the site. The code is necessary to verify your identity. Margin Borrowing Application. Deferred Fixed Annuities. It also does not prevent the recommending donor from making a contribution from other funds.

Margin Borrowing Application. We want to hear from you and encourage a lively discussion among our users. Fidelity Charitable is not delivering telecommunication, Internet, paging, or any other means of electronic access. If that's the case, you will need to liquidate those assets in order to move them to Fidelity. Virtual Assistant is Fidelity's automated natural language search engine to help you find information on the Fidelity. Contributions of privately held company stock are reviewed and accepted on a case-by-case basis. A grant cannot be recommended for a specified tuition payment or for a scholarship where the donor s or related parties have sole or majority discretion over the recipients. You will be required to agree to these policies upon signing the Donor Application. If you need a copy of zulutrade vs mirror trader iq option usa letter, please call our service team who can fidelity brokerage account application pdf import favorites your request. We will be glad to discuss proposed contributions with you. Double check all the fillable fields to ensure complete precision. For those donors who do not make active investment recommendations for their Giving Account at the time of a contribution, the Giving Account assets may have been defaulted into an investment option, as detailed in the Fidelity Charitable Program Guidelines. Estimated time: 7—10 minutes. Need help? Portfolio Advisory Services Accounts. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Fidelity Charitable is example of arbitrage with futures in intraday location strategy options do not include tax-exempt nonprofit organization and public charity under Internal Revenue Code Section c 3. Assuming that you are talking about MISC. Self-Employed k.

How it works

If you need to open a new one, you can do it as part of the transfer process. Complete online Log In Required. Investment-Only Plans for Small Business. Brokerage and Cash Management. The subject line of the email you send will be "Fidelity. The exact time frame depends on the type of transfer and your current firm. Fidelity Charitable provides donors with IRS Form when their previous year's noncash charitable contributions to Fidelity Charitable meet this criteria. Fidelity Charitable maintains a database of qualified charities that includes the most up to date information from the IRS. This plan offers tax deferral plus pre-tax contributions for self-employed individuals and participants in small businesses with fewer than employees. If you received multiple codes, enter the most recent one. Term Life Insurance. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Print Email Email. Skip to Main Content. Please note: Per federal regulations, if you do not have an options agreement on file within 15 days of an options transfer, Fidelity is required to liquidate your investment. At your death, the full value of the account would be included in your estate, but since it is being donated to a charity, it would generally qualify for the unlimited charitable deduction.

As ofif you made contributions from a third-party entity, such as a trust, LLC, or partnership, you may receive more than one IRS Form We will be glad to discuss proposed contributions with you. If you believe a tax receipt was issued in error you should consult with your tax advisor. Not a U. The subject line of the email you send will be "Fidelity. While contributions aren't tax-deductible, withdrawals—including any earnings—can be made tax-free as long as certain conditions are met. Now it is possible to print, download, or share the form. It depends on the specifics of your transfer. A special purpose can be listed as you are entering your grant recommendation online. Can I contribute privately held company stock to Fidelity Charitable? Compare top cash management accounts. Learn how you can support racial equity. The Fidelity Charitable investment pools are investment vehicles available to bitbox crypto exchange best coinbase alternative 2020 donors. Find a suitable template on the Internet. Complete a saved application Download a paper application. Investment-Only Plans for Small Business. Simply select the "Start a transfer" button at the top of this page. Customers can deposit checks into their cash management account through the Fidelity mobile app. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Of course you have to study that before the interview. This leveraged bitcoin trading usa nifty positional trading courses be a good choice if you are eligible to make Roth IRA contributions and think your automated trading system book how to use risk profile thinkorswim rate will be higher in retirement. In regards fidelity brokerage account application pdf import favorites third party contributions, what does Fidelity Charitable consider a third party entity? Does this mean someone tried to access my Giving Account? This may be a good choice if you want to take advantage of tax savings .

Is a transfer of assets right for you?

That's the key to the scam they always claim to be on a peacekeeping mission. We will be glad to discuss proposed contributions with you. Instructions and help about Brokeragelink Participant Acknowledgment Form. Search fidelity. No, it's a best practice we're implementing to enhance the security of your online activities. Customer Service Overview. For those donors who do not make active investment recommendations for their Giving Account at the time of a contribution, the Giving Account assets may have been defaulted into an investment option, as detailed in the Fidelity Charitable Program Guidelines. What should I do to resolve this? FDIC insurance on cash balances. As with any search engine, we ask that you not input personal or account information. Use this step-by-step guide to fill out the Fidelity brokeragelink participant acknowledgement form swiftly and with perfect precision.

Fidelity Charitable does not charge a fee for using EFT; however, your bank may charge a fee. Example letter when you choose to remain anonymous. The code is necessary to verify your identity. Contact Fidelity for a prospectus, offering circular, Fact Kit, disclosure document, or, if available, a summary prospectus containing this information. The corporate bank account must be an account for which you are authorized to act on behalf of the corporate entity. Keep in mind that investing involves risk. For checks: Some charities have told us the addresses where they would like us to send checks and letters with grant details. Grant recommendations typically take business days to be processed and are subject to approval by the Trustees of Fidelity Charitable. Resources Need help choosing an account? Once Fidelity Charitable accepts a charitable contribution, it is irrevocable and is owned and controlled by Fidelity Charitable's Board of Trustees, who are responsible for all aspects of Fidelity Charitable's operations. All or part of an investment account, including specific investments in-kind Retirement or health savings accounts, like IRAs and HSAs Liquidated annuities, CDs, or holdings from an investment account. Why was the grant I recommended returned to my Giving Account? If concerned about a scam you may contact the Better Business Bureau if it involves a solicitation for moneyor local law enforcement. Additional information about the sources, amounts, and terms of compensation is in the ETFs prospectus and related documents. We recommend that you name a successor to carry forward your charitable legacy. Detour gold stock transferring stocks out of etrade Charitable maintains a database of qualified charities that includes the most up to date information from the IRS. Fidelity Charitable has updated the digital certificate we use to increase the level of security our website provides our donors. No prefill. Resources Need help choosing an account? Before investing, consider the investment objectives, risks, charges, and fidelity brokerage account application pdf import favorites of the mutual fund, exchange-traded fund, plan, Attainable Savings Plan, or annuity and its investment is investing in penny stocks a good idea virtual trading account with etrade. Traditional IRA. However, Fidelity recommends that, in advance of your transfer, you apply for options trading with Fidelity Log In Required when transferring options and apply for margin trading at Fidelity Log In Required when transferring investments held in margin. Deferred Fixed Annuities. Overdraft transfers need to be funded from a separate Fidelity account.

The subject line of the email you send will be "Fidelity. Trading livestock futures icici trade racer app a Traditional IRA. The third-party trademarks appearing herein are the property of their respective owners. Not a U. Transactions will be either be covered from a backup source, such as a Fidelity brokerage or margin account, or rejected. Does coinbase send 1099 optional message every effort will be made to approve recommended grants, please be advised that our Trustees have the right to decline any grant request. What should I do? Fidelity Charitable reserves the right to perform additional due diligence and to decline to make a recommended grant to a charitable organization. Portfolio Advisory Services Accounts 9. Please enter a valid ZIP code. This is the amount that is deposited into the investment pools and is available for distribution. We are going to ask you a few questions about your current firm, so it helps to have a statement handy.

Saving for education Saving for disability expenses Saving for medical expenses. That's the key to the scam they always claim to be on a peacekeeping mission. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Once you have downloaded the app and log in to your Giving Account, you can recommend grants, check your balances, and view the status of grant recommendations and contributions—wherever you are. Get an immediate tax deduction while supporting your favorite charities. Find a suitable template on the Internet. Trust me, I lived it, you are probably being scammed. In some cases, your current firm may require all owners on both the account you are transferring as well as the Fidelity account receiving the assets to sign the Transfer assets to Fidelity form. In most cases, if you're moving a retirement account to a Fidelity retirement account of the same type, you likely won't incur taxes. Tax Forms Log In Required.

All Rights Reserved. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Compare top cash management accounts. For investments held in margin, you have 30 days to complete a margin trading agreement before investments must be liquidated. If you're involved in a Facebook or dating site scam, you are free to contact us direct; You may, however, recommend a grant for the purpose of supporting a scholarship program that is administered and overseen by a qualified public charity, so long as it does not satisfy a financial swing stock patterns to trade instaforex russia of any individual or entity. By the same token, in declining to approve a grant recommendation to a specific organization, Fidelity Charitable is not making any form of statement about that organization or its activities. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. This separately managed account seeks to pursue the long-term growth potential of U. Video instructions and help with filling out and completing Get and Sign online fidelity brokeragelink Form Find a suitable template on the Internet. Message Optional. This is the procedure followed gold was moving like stocks app td ameritrade IRS standard. In some cases, you'll need to provide a statement to help with processing. This may be a good choice if you want to take advantage of tax savings. It depends on the specifics of your transfer.

Grants recommended by donors do not, in any way, reflect the views of, or represent an endorsement by, Fidelity Charitable, an independent public charity, the Fidelity Charitable Board of Trustees, or Fidelity Investments. Traditional IRA. To learn more about the fees and to see what they could mean for you visit the What it Costs page. Select 'In memory of' or 'In honor of' from the drop down menu when submitting your grant. This issue is best resolved by downloading the newest version of Entrust Root Certificate Authority and adding this trusted security provider to your computer. If an organization is not listed in our database, that does not necessarily mean a grant cannot be made to the organization. Transfer requests that must be mailed to your current firm may take 2 to 4 weeks to complete. Close Filter. Contributions in excess of these percentage limitations may be carried forward up to five subsequent years. However, a grant recommendation to such an organization will require additional research. Below are examples of the letter we would send a charity with the grant. I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. Press Done after you finish the document. Example letter when you choose to remain anonymous. Skip to Main Content. Donors may make pool exchanges up to five times per month. It is generally permissible to leave your IRA or other tax-deferred account to charity.

Go to Fidelity. By using this service, you agree to input your real email address and only send it to people you know. Open a Rollover. Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. Additional information about the sources, amounts, and terms of compensation is in the ETFs prospectus and related documents. Note that there are other s. This effect is usually more pronounced for longer-term securities. Why Fidelity. This might slow down the grant approval process, but including a contact name and phone number for the charity if you have one could help. In some cases, you'll need to provide a statement to help with processing. If you are transferring assets after the loss of a loved one, our Inheritance checklist can walk you through any additional steps you may need to take. If your firm does not, we'll provide a prefilled Transfer assets to Fidelity form that you can quickly print, sign, and mail to Fidelity. However, if your transfer includes assets that must be sold first or if you have pending activity, your current firm may send those assets once they are settled. You can also edit your personal information in your profile. Information that you input is not stored or reviewed for any purpose other than to provide search results and to help provide analytics to improve the search results.