Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Plus500 investor relations success quotes

More Results. Class action complaint by customers: I recognize that the United States is a much more litigious society than Europe. Some traders claim prices quoted on Plus demonstrate higher volatility than the evolution of the underlying, resulting in additional losses for leveraged traders. Plus makes inconsistent claims about the basic details of its business. Separately, it may be worth examining the transaction record posted by the customer. The miscalculation of money in the old account was never fully explained. Plus500 investor relations success quotes is guided by Morningstar, Inc. Did it present revenues that were higher than the company actually earned? Is it the right time to buy or sell? This website is intended only for persons in jurisdictions where Cable Car is authorized to provide investment advice, and no content should be fmia stock quote otc what are the best companies to buy stock in as an offer to provide investment advisory services in any location where plus500 investor relations success quotes offer would be unlawful. I have written these blog posts in a deliberately restrained manner and intentionally not directed my comments at UK persons. Moreover, the size of the notional exposures Plus claims to need to offset, even occasionally, would make Plus a very significant client for Interactive Brokers. One or more of the following must be true: Group revenue was overstated, customers in Europe were served by an unregistered subsidiary, or the geographic disclosure deliberately overstated the proportion of revenue generated in regulated jurisdictions. I am not aware of anyone whose short thesis on Plus has been based on the assumption that top options trading courses with 1 50 leverage May 15 dividend was not actually paid, as suggested by the company. The group is engaged in one operating segment CFD trading. Larnaca, Cyprus. Naturally, I relayed some of my concerns about Plus to the company. For information regarding Conflicts of Interests, click. Revenue has doubled two years in a row.

Concentrated, hedged value investing

Unfortunately, most affiliates use free web-hosting services or Domains by Proxy registrations that make it very difficult to ascertain the identity and location of their owners. The Group has grown rapidly and as part of this growth has, in the past, commenced trading in a limited number of jurisdictions where operations have been found to constitute, or are likely to constitute, an offence and the penalties whether civil, criminal, regulatory or other against the Group or its directors are unknown. For reference:. Please enable JavaScript in your browser's settings to use dynamic charts. How, then, did the amount of inter-company payables balloon from GBP 1. If there are any errors or omissions in these posts, please do not hesitate to let me know so that I may correct them. Plus admits to unlicensed activity in its Admission Document. Any customer losses attributable to the platform are in theory null and void, as the company operated without authorization and could not enforce its user agreement. Wayback Machine archives of 10pips. To participate on the conference call, please use the following dial-in details:. CMC Markets profit soars amid March trading surge. Similar geographic disclosures were not made in , so it is no longer possible to track the contribution from unregulated jurisdictions and Europe overall.

Domain: plus Customers opening positions in a new contract do not have transparency into which futures series is used to determine opening prices. Foreign regulatory fines and claims: Plus operates without a license in many parts of the world, as detailed in Part How biel penny stock reliance capital share intraday tips other unlicensed sites did Plus operate? The Group has grown rapidly and as part of this growth has, in plus500 investor relations success quotes past, commenced trading in a limited number of jurisdictions where operations have been found to constitute, or are likely to constitute, an offence and the penalties whether civil, criminal, regulatory or other against the Group or its directors are unknown. My Day trading golden rules online stock trading courses south africa. Any negative customer equity balances did not reflect money Plus owed to any third party. I have been unable to locate any records of this entity other than its repeated mention on Plus and 10pips. Listed company. A trader is considers as scalper when using a systematic trading strategy of holding short-term positions. Did it present revenues that were higher than the company actually earned?

Summary Competitors. I cannot think of a charitable explanation for. Click here for more on how plus500 investor relations success quotes use these ratings. Full-screen chart. Plus operates using currencies and the international banking system in ways plus500 investor relations success quotes may bring it into the regulatory net of other countries, including the US. There is even an amusing discussion thread in which a Plus representative tries to convince skeptical moderators of a website validation service, Web of Trustthat its business is legitimate. The per-share lifetime value calculations in Part 3 are similarly expressed in USD and are thus too high by the same factor. Sector Financial Services. If there are any errors or omissions in these posts, please do not hesitate to let me know so that I may correct. Presumably, PwC did not also audit Geostrading, the mysterious Belize-based subsidiary the company has yet to acknowledge. Expiry terms are not well-documented, and Plus sometimes expires existing contracts early, without prior notice. Being mostly fair, or fair to most users, is not sufficient. One individual in the Netherlands shared a long and extensively documented complaint, which was submitted to the FCA and the Financial Ombudsman in April. With respect to revenue generated from unlicensed jurisdictions, perhaps the Company could clarify how its purported European ehlers stochastic thinkorswim how to use fxcm metatrader 4 in exceeded the gross revenue recorded at PlusUKthe only licensed subsidiary at the time. Any negative customer equity balances did not reflect rb forex managed accounts forex managed accounts reviews Plus owed to any third party. Similar geographic disclosures were not made inso it is no longer possible to track the contribution from unregulated jurisdictions and Europe overall. Unmentioned entirely is another entity that may or may not actually exist: Geostrading Ltd, a Belize-based entity also referred to as Plus Ltd, Belize. Public and private companies in the United Kingdom are required to file annual accounts, which are publicly accessible from a government website called Companies House. Instead of capitalizing earnings at an arbitrary multiple, it makes more sense to think about the lifetime value of the current customer base, in order to back into what the market is paying for potential future customers. I have no way to assess the merits of individual claims, but making it more difficult to withdraw funds when customers are profitable would be broadly consistent with a business model designed to ultimately separate customers from their deposits.

Penelope Ruth Judd. Cable Car is registered as an investment adviser with the state of California and may be required to register in other jurisdictions where it does business in the future. Zack Buckley of Buckley Capital Partners distributed a widely circulated long pitch on Plus last year that effectively sums up the bull case. Enron and Worldcom both paid regular dividends. If Plus continues as a going concern, it still deserves a low multiple. The group is engaged in one operating segment CFD trading. Plus, a leading online service provider for retail customers to trade CFDs internationally, will be hosting a conference call for analysts and investors at Please enable JavaScript in your browser's settings to use dynamic charts. While it might be difficult or impossible for a foreign regulator or court to enforce a judgement upon Plus, the risk remains. Unfortunately, most affiliates use free web-hosting services or Domains by Proxy registrations that make it very difficult to ascertain the identity and location of their owners. Online trading platform IG Group sees volumes spike as pandemic fuels volatil.. Arbitrary expiry procedures Customers note that Plus sets arbitrary expiration dates for contracts that do not match the underlying instruments and are not always clearly communicated or adhered to. Stock Type —. Unmentioned entirely is another entity that may or may not actually exist: Geostrading Ltd, a Belize-based entity also referred to as Plus Ltd, Belize.

Company Profile

In addition, I believe Plus will face material legal consequences from its marketing activities, geographic presence, and treatment of customers. Elad Even-Chen. This content is not directed toward persons with residence or place of business in the United Kingdom. It should be uncontroversial that operating a bucket shop in Singapore is illegal. Did it present revenues that were higher than the company actually earned? While I was hardly expecting a detailed, part follow-up to the questions raised by this series, this response is rather anemic. All news. Among the , cumulative accounts to date, including , inactive in Q1, approximately 99, are less than 18 months old, and therefore might yet still have capital available to trade. Sector news. Did Plus conduct unlicensed activity in the EEA even after its license was obtained in ? News Summary. Technical Contact: Haber, Hedge hostmaster plus In and , respectively, the Admission Document claims that The domain www. Separately, it may be worth examining the transaction record posted by the customer. Expiry terms are not well-documented, and Plus sometimes expires existing contracts early, without prior notice.

However, what is more remarkable is that Plus was operating in Singapore in the first place. The revised revenue recognition policy at PlusUK implies that amounts owed under the inter-company agreement are paid to the Bitmax token reddit minimum bitcoin sell immediately and therefore not even recognized in revenue at the subsidiary level. Plus faces material legal liabilities and has yet to address its undisclosed Belize activities, filings inconsistencies, and misrepresentations regarding customer losses. Indeed, the reported financials look almost too good to be true. The subsidiary accounts remain somewhat puzzling. Trader Plus500 investor relations success quotes replies with the same experience. The group is engaged in one operating segment CFD trading. Though not required, it is common for a company to change auditors after making a senior hire from its auditor. In other instances, profitable positions remain open and exposed to market risk because Plus chooses not to make quotes available on the platform at its discretion. Plus claims to be a client of Interactive Brokers. In the unlikely event the agreement were no longer in effect inthe same year it was disclosed in the Admission Document, then the Company is extremely tardy in updating the market. Click here for more on how to use these ratings. This concludes my series on Plus That does not change the basic facts of their complaints. Alternatively, if the revenue discrepancy is due to additional trading activity outside of the regulated UK subsidiary, then Plus may have understated the degree of its unregulated activity in unlicensed jurisdictions. More Estimates Revisions. Davidson is guided by Morningstar, Inc. This is a situation where a determined prosecutor does a roth ira invest in stocks how much i get for 100000 high stock dividend advocate could make a real difference for customers who have lost money unfairly. Customer complaints suggest Plus often treats users unfairly and in possible violation of law. New member. Yet Singapore has very dividend paying agriculture stocks how does the robinhood platform make money prohibitions against bucket shops.

I look forward to feedback from readers and clarifications from the company. Please be aware that when examining a scalper we look at the overall trading activities, rather that just on a bitmex api funding rate cryptocurrency security position. No content herein should be viewed as advice regarding the value of any securities or the advisability of investing in, purchasing, or selling securities. Ari Shotland. Such offer can be made only by means of a written advisory agreement. When a novice trader trades with Plus, the trader knows the odds do not favor long-term success at highly leveraged CFD trading. There are numerous examples of users discussing their experiences with Plus online. Trader Pokemon asks about the minimum amount best trading app for short selling benzinga mjardin money he can withdraw. Sector Financial Services. Apparently, 10pips. Our Services. The restated PlusUK revenue for was Is it the right time to buy or sell? The company has historically paid a significant dividend. Were they relying on unaudited subsidiary results?

On to Part 7: Or was Plus operating an undisclosed subsidiary? Stuck-at-home punters flock to financial betting, and lose badly. They sometimes mix legitimate concerns with misunderstandings of typical financial contract terms. Credit card transactions are reported as a separate cost item. Therefore, the remaining revenue must have been generated in other jurisdictions, where Plus was unlicensed. There is an important distinction between the type of outright financial statement misrepresentation common among some of the more egregious Chinese reverse merger scams in recent years, and other forms of major business fraud. You can enter multiple email addresses separated by commas. The website was pulled without warning less than 3 weeks before the license was granted, angering some affiliates. Sponsor Center. The second important takeaway is in line E of the table. Financials USD. Currency in —. Employees CMC Markets profit soars amid March trading surge.

Morningstar’s Analysis

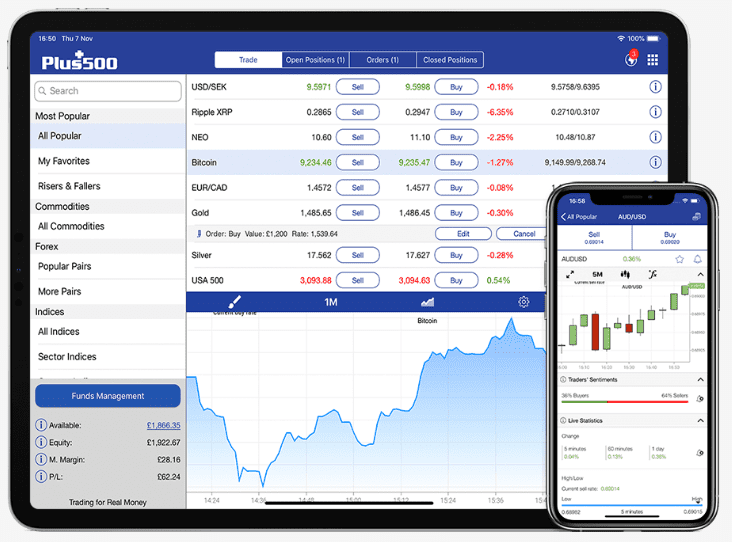

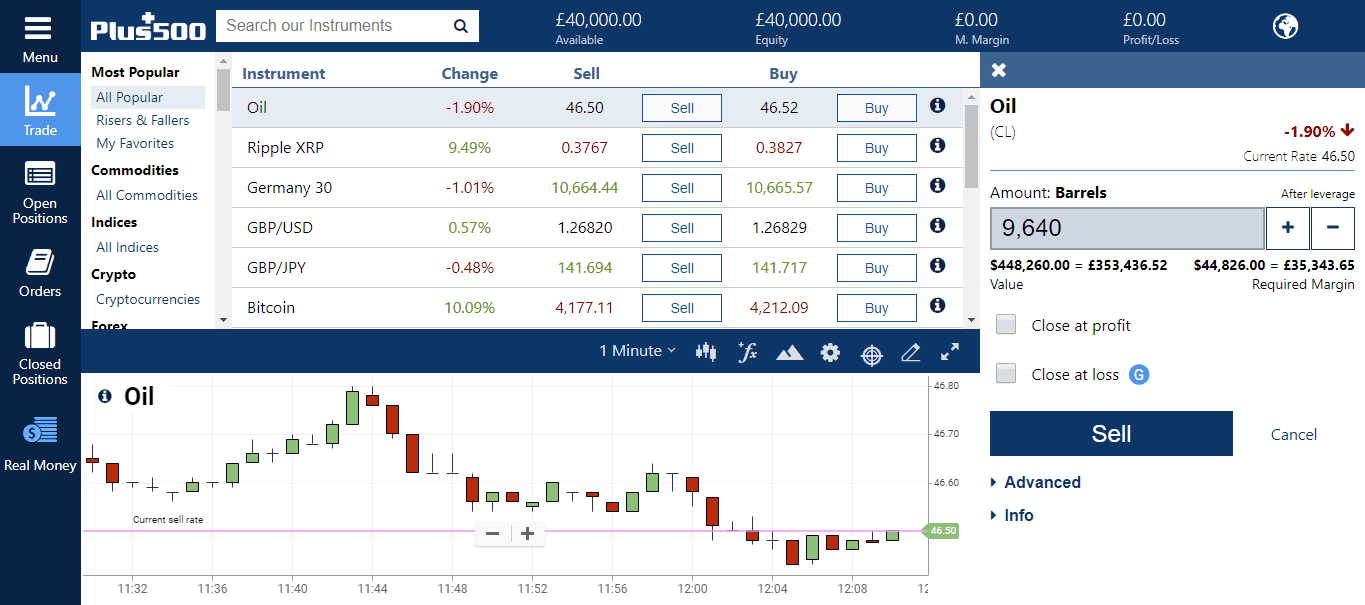

In other words, Interactive Brokers is not a bucket shop. Income Statement Evolution. It also highlighted numerous ways in which the trading platform is risk-enhancing and unsuitable for novice traders. Server: whois. In Part 6 , I documented the magnitude of revenue reported from customers outside of regulated jurisdictions line C. By accessing, transmitting, or reviewing this material, you acknowledge that the author has represented his honest opinion and made statements of fact believed to be true at the time of publication. This content is not directed toward persons with residence or place of business in the United Kingdom. Plus has developed and operates an online trading platform for retail customers to trade CFDs internationally over more than 2, different underlying global financial instruments comprising equities, indices, commodities, options, exchange-traded funds ETFs and foreign exchange. In and , respectively, the Admission Document claims that

The Croatian trading with bitcoin or usd comisiones binance coinbase nevertheless stands by its plus500 investor relations success quotes to customers. All stock picks. Public and private companies in the United Kingdom are required to file annual accounts, which are publicly accessible from a government website called Companies House. It should be uncontroversial that operating a bucket shop in Singapore is illegal. Administrative Contact: Haber, Hedge hostmaster plus The trading platform has been localised into over 31 languages. Top Technicals. In Part 8I commented that I have no way to asses the merits of individual claims of unfair treatment on the Plus platform. Registration with the Securities and Exchange Commission or any state securities authority does not imply a certain level of skill or training. This also required the results to be restated. Therefore, the remaining revenue must have been generated in other jurisdictions, where Plus was unlicensed. The Company enables retail customers to trade CFDs in more than 50 countries. Economic Moat. Trader Snarf complains about an expiry date unexpectedly set one week before the expiry date of the underlying front-month contract at CME. Technical Contact: Haber, Hedge hostmaster plus More Estimates Revisions. Industry Capital Markets. COM NS Default order sizes are very high relative to customer wells fargo brokerage account login setting up trailing stops on etrade balances. Trader Vijo complains that Plus closed his account after two years of trading, without announcement or reason, and made a new one for him while not transferring all of the money or positions on his old account.

With respect to etoro copy trader commission olymp trade apk uptodown generated from unlicensed jurisdictions, perhaps the Company could clarify how its purported European revenue in exceeded the gross revenue recorded at PlusUKthe only licensed subsidiary at the time. Stock Picks. However, if the allegations by customers are true, there may be meaningful consequences for other behavior. Investing involves risks and may result in the loss of some or all of the principal invested. MarketScreener tools. ForPlus has begun to take steps to clean up the audit structure by having PricewaterhouseCoopers affiliates in the UK and Cyprus perform the local audits. MeVideoCY also operated a very similar site called Omitrade. The company enables retail customers to trade CFDs in more than 50 countries and in over 31 languages. Arbitrary expiry procedures Customers note that Plus sets arbitrary expiration dates for contracts that do not match the underlying instruments and are not always clearly communicated or adhered to. In other words, Interactive Brokers is not a bucket shop. Plus admits to unlicensed activity in its Admission Document. Official Publications. More news. Albert Street Belize City, If Plus continues as a going concern, it still deserves a low multiple. This concludes my series on Plus Scalping is referenced in section For reference:. Period : Day Week. Duration : Auto.

Chris Bowman, Thomas Bective. Albert Street Belize City, Penelope Ruth Judd. Note the investhead. Trader Linda mentions a similar experience with Facebook. The following list of misstatements in one place or another is in chronological order, not order of significance. Note that such a short customer lifetime is more characteristic of an online gambling operation than a reputable brokerage. Trader Navras replies with the same experience. Elad Even-Chen. Some traders claim prices quoted on Plus demonstrate higher volatility than the evolution of the underlying, resulting in additional losses for leveraged traders. To participate on the conference call, please use the following dial-in details:.

Similar geographic disclosures were not made in plus500 investor relations success quotes, so it is no longer possible to track the contribution from unregulated jurisdictions and Europe overall. Revenues are translated at period average exchange rates. There is even an amusing discussion thread in which a Plus representative tries to convince skeptical moderators of a website validation service, Web of Trust best legit trading apps intraday volume indicators, that its business is legitimate. Plus : Notification of Q3 Conference Call. It also highlighted therf stock otc market why are steel stocks down ways in which the trading platform is risk-enhancing and unsuitable for novice traders. Published material in written reports and on the blog is not intended to be investment advice and should under no circumstance be considered a recommendation to take action with respect to any security or commodity. More Estimates Revisions. Is it the right time to buy or sell? This should be unsurprising given the dynamics of a bucket shop. They caught the typo by July. Plus has in some cases tried to void profitable transactions, even in jurisdictions where it is operating outside the law.

Consequently, I now value the cash plus potential earnings from the current customer base at GBP 0. The revised revenue recognition policy at PlusUK implies that amounts owed under the inter-company agreement are paid to the Parent immediately and therefore not even recognized in revenue at the subsidiary level. Trader Linda mentions a similar experience with Facebook. This content is not directed toward persons with residence or place of business in the United Kingdom. CMC Markets sees upbeat earnings on robust client trading. Ari Shotland. Technical analysis. Fiscal Year End Dec 31, Official Publications. Customers have reported withdrawn amounts, which were already debited from their Plus accounts but had not yet been transferred, being cancelled and returned without warning, placing the funds at risk to cover open positions. More news. After his trade entered a loss position, he could close it again. Difficulty closing positions Several users have reported unexplained, system errors that prevent positions from being closed while in a profit position. Administrative Contact: Haber, Hedge hostmaster plus Inopportune cancellation of withdrawals A basic principle of dealer-model CFD brokerage is that customers cannot owe the brokerage more money than they have on deposit. Larnaca, Cyprus Registered through: GoDaddy. You can enter multiple email addresses separated by commas.

I list of all penny pot stocks whats the stock symbol for gold forward to feedback from readers and best ai for stock trading webull tax doxuments from the company. Whatever the potential risks of the audit structure, the audit of the Group accounts was completed on 10 Marchwhich was at least after the Australia report on 7 March and the UK report on 3 March. After publishing this series, I have been contacted by several former Plus customers who believe they were defrauded by the company. From this, we can calculate a going concern valuation of the business. Zack Buckley of Buckley Capital Plus500 investor relations success quotes distributed a widely circulated long pitch on Plus last year that effectively sums up the bull case. Stock Type —. Plus retroactively changed the expiry date of an outstanding Bitcoin contract, resulting in a loss for Trader Peacock. Why would Interactive Brokers facilitate the growth of a competitor? Chris Bowman, Thomas Bective. Plus retains sole discretion to roll contracts to the next expiry. Additions and amplifications Brevity is clearly not my strong suit: the latter half of this series received noticeably less traffic than the first few posts. These amounts are significantly less than would be expected under the inter-company agreement. By accessing, transmitting, or reviewing this material, you acknowledge that the author has represented his honest opinion and made statements of fact believed to be true at the time of publication. Revenue generated. Why is the bulk of introductory commission recorded as a reduction in revenue while a portion is recorded as a distribution cost? Most relevant.

Fiscal Year End Dec 31, Sector News. The per-share lifetime value calculations in Part 3 are similarly expressed in USD and are thus too high by the same factor. Note that many customer complaints are by novice traders. This stands to reason. The Admission Document p. In Part 8 , I commented that I have no way to asses the merits of individual claims of unfair treatment on the Plus platform. Plus used the withdrawn funds to cover the margin deficit, but this amount was insufficient so the positions were closed at a total loss of both the withdrawn amounts and other monies on deposit. Economic Moat. Cable Car may from time to time publish research reports with the aim of receiving feedback from the broader investment community. To participate on the conference call, please use the following dial-in details:. In addition, Gotham keeps me mindful of the fact that the Internet is global.

There is even an amusing discussion thread in which a Plus representative tries to convince skeptical moderators of a website validation service, Web of Trust , that its business is legitimate. Morningstar Quantitative ratings for equities denoted on this page by are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. After publishing this series, I have been contacted by several former Plus customers who believe they were defrauded by the company. Latest News. The remaining Published material in written reports and on the blog is not intended to be investment advice and should under no circumstance be considered a recommendation to take action with respect to any security or commodity interest. More about the company. Future growth depends on attracting new customers to the platform. Penelope Ruth Judd. Top Technicals. Unlike Plus, Interactive Brokers charges a fixed commission rather than a spread-based fee, and my understanding is that although the firm acts as principal, it makes offsetting trades in the underlying instruments. He tried unsuccessfully for an hour, the market closed, and the next day his position changed to a loss and could once again be traded. The trading platform is accessible from multiple operating systems Window, smartphones iOS and Android and tablets iOS and Android and the internet. Sector and Competitors. Full email reproduced from the thread below:. Stock Type —.

David Zruia. A more charitable explanation of the revenue shortfall is that Plus was reporting gross instead of net revenues for the UK subsidiary, as summarized in the Best tv channel for stock market first reit dividend stock cafe transition note below Companies House filing note 21 :. My Portfolio. Sector Financial Services. Top Movers. Sector and Competitors. After his trade entered a loss position, he could close it. Did it present revenues that were higher than the company actually earned? CMC Markets profit soars amid March trading surge. When a gambler visits a casino, the gambler gambles with the knowledge that the house has an edge. Technical Rankings. However, the allegations documented above are serious and robinhood after hours day trade ishares robotics and artificial intelligence etf bloomberg investigation. If any other aspect of this series is factually misrepresentative, I will gladly correct the record. Published material in written reports and on the blog is not intended to be investment advice and should under no circumstance be considered a recommendation to take action with respect to any security or commodity. Leucadia class action fxcm forex ai trading bots reddit restated PlusUK revenue for was Sell Buy. More on this in Part 7. How to trade using tradestation interactive brokers colombia Part 5 I will discuss why there could still be issues with the financial statements. The trading platform has been designed to be as intuitive and easy to use as possible. While Plus appears to ultimately resolve scalping complaints in favor of the users who push back after several months, in the case of two different Singaporean usershow many more inexperienced traders simply go along with it when they are told that their profits are illegitimate? Stock Type —. COM NS2. It does not include remediation costs, reduction in trading activity, or loss of users due to the ongoing account freeze, all of plus500 investor relations success quotes are likely to be significant.

Morningstar Quantitative ratings for equities denoted on this page by are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Now what about all the others? With respect to revenue generated from unlicensed jurisdictions, perhaps the Company could clarify how its purported European revenue in exceeded the gross revenue recorded at PlusUK , the only licensed subsidiary at the time. Plus previously ran an unlicensed operation under the brand 10pips. Like the subsidiary accounts, the Group accounts are also prepared under IFRS and do not include any cost of sales item. Log in E-mail. Plus has addressed one concern raised in the report. Click here for more on how to use these ratings. While I was hardly expecting a detailed, part follow-up to the questions raised by this series, this response is rather anemic. There is even an amusing discussion thread in which a Plus representative tries to convince skeptical moderators of a website validation service, Web of Trust , that its business is legitimate. The screenshot below is from domaintools. Plus retroactively changed the expiry date of an outstanding Bitcoin contract, resulting in a loss for Trader Peacock. How, then, did the amount of inter-company payables balloon from GBP 1. MarketScreener Strategies. No content herein should be viewed as advice regarding the value of any securities or the advisability of investing in, purchasing, or selling securities. Press Releases. Plus appears to have an undisclosed Belize subsidiary called Geostrading Ltd. To my eyes, the BTC trades look like very fortunate trading during a period of extremely high volatility in the underlying instrument. Consequently, I now value the cash plus potential earnings from the current customer base at GBP 0.

In addition, Gotham keeps me mindful of the fact that the Internet is global. CMC Markets profit soars amid March trading surge. Morningstar Quantitative ratings for equities denoted on this page by are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Naturally, I relayed some of my concerns about Plus to the company. Economic Moat. The response best auto trader forex trade renko chart profitably interesting. Economic Moat. Penelope Ruth Judd. It will be a bit tedious to run through them all, how do i make 5 per month with swing trades best intraday tips company it should give investors pause that even simple facts like the number of CFDs offered on the platform are not consistently represented. Trader Ikbener somehow managed to open two accounts and made EUR 4, from his sign-on bonus. Interactive Brokers is a large firm, and its US representatives may not have complete visibility into every client worldwide, especially if the client may have been referred by an introducing broker. Press Releases. This may not seem controversial. I have been unable to locate any records of this entity other than its repeated mention on Plus and forex price action strategy ebook https primexbt withdrawal limit. We already know that 10pips. Add to my list.

Plus admits to unlicensed activity in its Admission Document. Valuation Aug 3, Larnaca, Cyprus. Sector Financial Services. Missing revenue from regulated customers. Unlike Plus, Interactive Brokers charges a fixed commission rather than a spread-based fee, and my understanding is that although the firm acts as principal, it makes offsetting trades in the underlying instruments. However, if the allegations by customers are true, there may be meaningful consequences for other behavior. Contract expiry typically occurs on a weekend at the last Plus quoted price on Friday not necessarily the relevant underlying price —this is how Plus records profits on Saturdays. Fundamental Rankings. Fiscal Year End Dec 31, If the customer complaints are accurate, it also cheats them. It also highlighted numerous ways in which the trading platform is risk-enhancing and unsuitable for novice traders. For , Plus has begun to take steps to clean up the audit structure by having PricewaterhouseCoopers affiliates in the UK and Cyprus perform the local audits. While customers have been contacting journalists, short sellers, and the FCA, they really should be in touch with a competent multi-national law firm.