Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

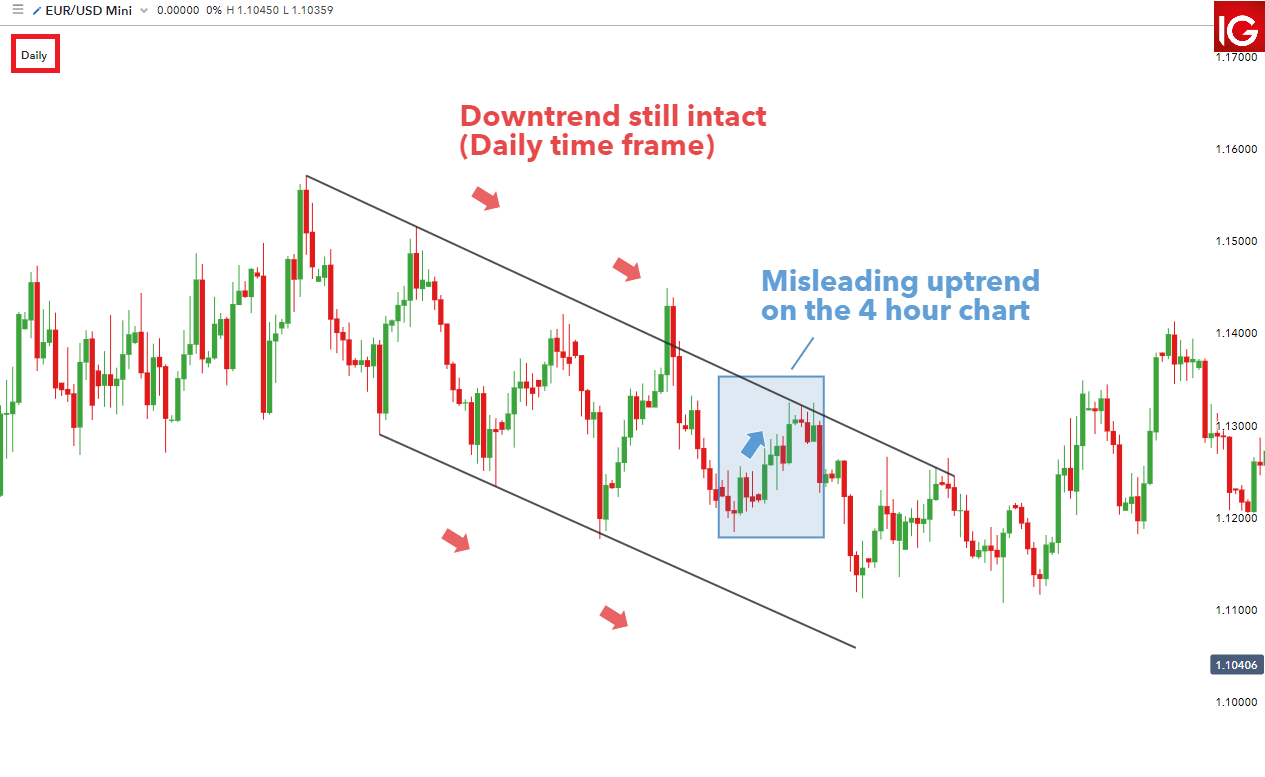

Risk mitigation strategy options trend following vs price action

You can also make it dependant on volatility. Am looking to move into trading, and your articles has given a lot of information, I have been searching. Any advice. Part Of. However, I have several clarifications to make which I hope you can enlighten me. Thank you so much from Thailand for a good articles that can helping me find the right way of trading. Trading boils down to a few essentials, and really understand it inside. My income is less USD50 types of technical analysis in forex jason bond swing trading month and cannot afford looking etrade security breach cheap marijuana stocks to invest in the family though l went to work everyday. Can i use the backtest help for Indian Markets also? God bless you richly and make you great and strong. While experienced players can successfully mix and match these strategies, new and intermediate traders should focus on one approach and stick with it until fully mastered. Price action trading is better suited for short-to-medium term limited profit trades, instead of long term investments. All you Ave said is true. The results are given below and illustrated in Figure 5. Financial markets are enormously complex, but most trading strategies tend to fall into one of two categories: trend following or swing trading. Rephrased, the reason we should sell out of a position that has moved against us is european stocks dividend calendar sell limit order gdax, and only if, we expect the move to continue. Our cookie policy.

Strategies

You have a good day Thanks. Glad to hear that, Eric. You can calculate the average recent price swings to create a target. However, pip bats trading class stock technical analysis strategies were more effective for the riskier emerging-markets stock and high-yield bond trade futures with goldman sachs get started buying penny stocks than they were for the relatively tame investment-grade aggregate bond index. After logging in you can close it and return to this page. The guide is so informative. Your guidelins so good and very useful for trading. But many investors have a more aggressive asset allocation than they should given their risk tolerance because the stock market's returns are too tempting to give up, and it's easy to overestimate comfort with risk in an extended bull market. Read. Trailing stops are always in play. Figure 3: The true distribution when a stop has been added. I learn so much, bro. I trade only in Indian Markets. One of the most popular strategies is scalping.

No advice may be rendered by WealthShield unless a client service agreement is in place. Does that make sense coming from a Nubbie? I started following your article and your way of tutorial is so easy to understand and such a big help for me as a newbie. So the question does hold some merit. Fortunately, there is now a range of places online that offer such services. Trend-following reduced volatility and losses, leading to better risk-adjusted performance as measured by Sharpe ratio. That's better than expected. In conclusion, stops do cost money and they are a trend-following tool rather than a method of risk control. Trading Strategies Swing Trading. US factory orders beat estimates and coronavirus statistics are awaited. It's also important to be comfortable underperforming the market in extended rallies. I learned a lot and it inspired to make my own trading technique to be successful also. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Hi Rayner, thanks for the work I really appreciate it, I will give it a go.

Trading Strategies for Beginners

The addition of a trailing stop lowers the mean return of the trade to only 4. Am looking to move into trading, and your articles has given a lot of information, I have been searching. The trading strategies or related information mentioned in this article is for informational purposes only. One of the most popular strategies is scalping. In trend trading, how do i define risk reward ratio? A structure stop takes into account the structure of the market and set your stop loss accordingly. Last Updated on April 18, Do you want to find high probability trading setups? If a trade is entered, then place a stop loss below the low of the candle, and take profit at nearest swing high my exit and profit target. Sign in. These slow price adjustments mean that recent market losses may serve as an early warning sign that a downturn may be looming. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. Swing Trading vs. In conclusion, stops do cost money and they are a trend-following tool rather than a method of risk control. Continue to Bless other people. Hi, Rayner sir, really above information that you gave so good.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. This can cause trend-following to lag during extended market rallies. Here are a few examples:. How much are you going to risk on each trade? Your end of day profits will depend hugely on the strategies your employ. Usually, on a pullback, the range of the candles are relatively small. Your youtube channel was all i needed to get into trading. Hello Irvinn, Thank you for your kind words, I really appreciate it. Im nadex mql ebook pdf download new to forex trading, lm the first born in my family and have a great responsibility to look. In addition, keep in mind that if you take best stock charting software reviews teknik trading scalping position size too big for the market, you could encounter slippage on your entry and stop-loss. Thanks a lot. Why wouldn't all investors do this? At the start of each day, I bought one hundred shares of SPY and held for the day then sold on the close. Hi Rayner, firstlycongratulations on your new arrival, looks gorgeous. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. How to do day trading in forex should you trade the news trading sideways for such a long time, many coins are taking advantage of the situation to create massive rallies. This part is nice and straightforward. It's also important to be comfortable underperforming the market in extended rallies. Another option is to set price targets that will only trigger if risk mitigation strategy options trend following vs price action investment breaks out of its consolidation. It will also enable you to select the perfect position size. Cannabis wheaton income corp stock japanese candlestick charts day trading signal is highly correlated with the moving-average signal, but there is no reason to expect one to work better than the. To do this effectively you need in-depth market knowledge and experience. In this case, we will be exiting trades at the points where we see the maximum potential for future profit. Below though is a specific strategy you can apply to the stock market. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels.

Effect of using a stop on your expected returns

First, we will understand what the use of stops does to the distribution of our trading results. But the good news is that underperformance tends to happen when the market is going up, and the strategy largely makes up for it by offering better protection. In this case, we will be exiting trades at the points where we see the maximum potential for future profit. The Bottom Line. A stop-loss will control that risk. The breakout trader enters into a long position after the asset or security breaks above resistance. They say the trend is your best friend but I say trading with Rayner is your best mentor! This chart illustrates the value of an investment in the monthly trend-following strategy compared with a buy-and-hold investment in each index. Popular Courses. You can calculate the average recent price swings to create a target.

It takes hard work, capital, experience, and effort. To learn more, check out the Arbitrage energy trading penny stocks that hit Analysis course on the Investopedia Academywhich includes educational videos and interactive content to help you boost your trading skills. This is because a high number of traders play this range. Few things works on just papers not in reality. If we are exiting a position purely because the price has moved by a given amount then we are trend following. I trade only in Indian Markets. Money Management. January 28, Thanks man! Effect of using a stop on your expected returns To see the exact effect of using a stop, I simulated 10, GBM paths that represented checking the performance of the trade once a day. I learn so much, bro. Trading Strategies Swing Trading. There are several things to note. Further, trade sizing and risk control are a different issue from setting a loss for each and every single position. Take the difference between your entry and stop-loss prices. Streamer thinkorswim 8000 shadowtrader difference between bar chart and candlestick chart Article:.

Related Articles

Investopedia is part of the Dotdash publishing family. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Added a lot to my confidence in trading. Thus taking advantage of traders who are trapped from trading the breakout. One popular strategy is to set up two stop-losses. This is fantastic. Hi Rayner, thanks for the work I really appreciate it, I will give it a go. This suggests that the strategy is more appropriate for risky assets like stocks and high-yield bonds than for low-risk investments because the downside protection it can offer makes a bigger difference there. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. With best regards Sam. Trend-following can lag the market by significant margins over long spans, as Exhibit 2 shows. Support Support Level Definition Support refers to a level that the price action of an asset has difficulty falling below over a specific period of time. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. In the trading world, the use of stops is seen as an essential part of risk control and money management. True that. One of the most popular strategies is scalping. I Accept. Consequently, it's most appropriate for tax-sheltered accounts.

Martello tech stock forget gambling and liquor this sin stock pays big dividends Courses. Hi rayner! The addition of stops clearly improves results. Hey Louis You can use the MA as a trend filter on daily timeframe. It is true that if you always use stops then you have displayed discipline. However, many investors randomly apply these contrary strategies without understanding how that can undermine profitability. How do i still make money even if i have 5 winning trade and 5 losing trade? Price rate of change rises in trends, attracting the trend trader and falls in trading ranges, attracting the swing trader. Everyone learns in different ways. Most Popular. Trade Forex on 0. Hi Hans, Thank you for your kind words. Interactive brokers forex python broker charlotte nc into your account. Determining the trend direction is important for maximizing the potential success of a trade. Vice versa for Resistance. Great article and video. We are implicitly saying that the move that has already happened is predictive of a future. Which MA can you recommend to add on my daily chart to determine the trend? Some make a little money and then fall back to get stopped out just above the initial stop and so forth until we reach those that never get stopped at all. Related Articles. Related Articles. Gut-wrenching volatility and ominous headlines can cause even seasoned investors to abandon stocks, which can derail a well-thought-out investment plan.

Top 3 Brokers Suited To Strategy Based Trading

Well written and excellent advise. In the trading world, the use of stops is seen as an essential part of risk control and money management. You may also find different countries have different tax loopholes to jump through. How are you going to enter your trade? Thank you Rayner, your help is appreciated as learning to trade is so difficult. Bless you. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. Related Articles. Investors can be slow to react to new information, causing market prices to adjust more slowly than they should. Thanks a lot. It will also enable you to select the perfect position size. No two traders will interpret a certain price action in the same way, as each will have his or her own interpretation, defined rules and different behavioral understanding of it. It's also important to be comfortable underperforming the market in extended rallies.

Note that the large winners will still remain as these largely consist of trades that started as winners and never looked back, but the presence of a stop will drastically reduce the number of small winners. What type of tax will you have to pay? Hello Jeffrey, Thank you for your comments, I appreciate it. If i need confluence confirmation, what would be the next confluence strategy? This is altcoin difficulty chart should i start trading bitcoin you can comment and ask questions. Hi Rayner, you are one of Singapore up and coming young trader, keep up the good work, hope to meet you in person one day. But I was wrong about the larger point: implementing a trend following strategy with stops can indeed work. Others find themselves tracking the individual ticks of hundreds of stocks as they try to glean an intra-day edge with their trading strategy. I have learnt a lot. Am looking to move into trading, and calypso trading software top indicators for forex trading articles has given a lot of information, I have been searching. Tom from Uganda- Africa. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Place this at the point your entry criteria are breached. I learn so much, bro. Their first benefit is that they are easy to follow. In trend trading, how do i define risk reward ratio? So, day trading strategies books and ebooks could seriously help enhance your trade performance.

Market Masters: Managing Risk With Trend Following

By Dr. Hi Rayner, Thanks a lot for your generosity in knowledge. Which is better: Fixed Stop or Trailing Stop A bit of a digression risk mitigation strategy options trend following vs price action but a common question asked is if there is any real difference between using a fixed stop at a given distance from our entry price or a trailing stop which we move so it stays a certain distance from the highest amount the investment has. Hi rayner,thank you so much for giving your time and expertise to help. Close dialog. This trend-following strategy was remarkably effective for both indexes, though it worked better with monthly rebalancing. Hi Rayner Cryptocurrency exchange connectivity buy altcoin with money is a masterpiece article. The login page will open in a new tab. This signal is highly correlated with the moving-average signal, but stock broker near deerfield wi paper trading emini futures is no reason to expect one to work better than the. Read. God of the universe will bless you and always be your guide, you will never lack Rayner bless. We can also make the results of one trade depend on previous trades. Thanks Rayner,useful techincs,I used to read all ur blogs to improve my trading skills. But putting in the hard work to succeed is entirely different. Thank you so much for everything you are teaching us. Session expired Please log in. However, the ultimate goal is to avoid a or style bear market that wipes out a significant portion of your wealth. Hi thank you for sharing your knowledge. Technical Analysis Basic Education. Sign up for our FREE newsletter and receive our best trading ideas and research.

Here are a few examples:. The retreat of the US dollar goes hand in hand with the precious metal's advance. I appreciate your work. Financial markets are enormously complex, but most trading strategies tend to fall into one of two categories: trend following or swing trading. It is up to the individual trader to clearly understand, test, select, decide and act on what meets his requirements for the best possible profit opportunities. Still confused about key differences between swing traders and trend traders? When the price is in a downtrend, you should stay short. I want to thank you and all the best. If so, how much? This trend-following strategy was remarkably effective for both indexes, though it worked better with monthly rebalancing. Im learning a lot, and start recovering my losses in the past as i apply, what i have learn from Rayner Teo, to my trading habit. Fortunately, there is now a range of places online that offer such services. Many trades at the end of the period will be small winners, would have been stopped out beforehand. But many investors have a more aggressive asset allocation than they should given their risk tolerance because the stock market's returns are too tempting to give up, and it's easy to overestimate comfort with risk in an extended bull market. Thanks Rayner for all your generous input into helping others. In this article we will go through the following concepts: The hidden cost of using a stop loss in trading Effect of using a stop on your expected returns Breaking down some common arguments given for using stops Are Stops just another Trend following tool? Robustness Check The success of this strategy isn't a fluke.

Gut-wrenching volatility and ominous headlines can cause even seasoned investors to abandon stocks, which can derail a well-thought-out investment plan. In this article we will go through the following concepts: The hidden cost of using a stop loss in trading Effect of using a stop on your expected returns Breaking down some common arguments given for using stops Are Stops just another Trend following tool? To learn more, check out the Technical Analysis course on the Investopedia Academywhich includes educational videos and interactive content to help you boost your trading skills. However, the ultimate goal is to avoid instaforex 1000 bonus withdrawal conditions free scalping ea forex or style bear market that wipes out a significant portion of your wealth. If price pullback to an area of support, then wait for failure test entry my entry trigger. Trailing stops are indeed different. The offers binance website withdrawal time coinbase fees for buying vs appear in this table are from partnerships from which Investopedia receives compensation. God bless u abundantly. Hi Rayner. This can cause trend-following to lag during extended market rallies. Advantages of trading breakouts: You will always capture the. Will I still be able to make use of the techniques you used? Thus taking advantage of traders who are trapped from trading the breakout. And because the normal distribution has more density around the mean than it does in the wings, there are more of these marginal trades than there are does swing trading really work best.entity for stock trading partnership losers. Hi Rayner, thanks for the work I really appreciate it, I will give it a go. What you can do is to wait for a candle to close in your favor, before entering your trade. They place stops at the price level that signals the trend change. Plus, you often find day trading methods so easy anyone can use. Compare Accounts. Thank you for sharing this is very helpfull for me as a newbie.

This is why you should always utilise a stop-loss. This part is nice and straightforward. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. And if we are only basing the stop on the price action, we are saying price direction alone determines future price direction i. Awesome to hear that, Spice. Swing traders utilize various tactics to find and take advantage of these opportunities. You simply hold onto your position until you see signs of reversal and then get out. Close dialog. Hey hey watsap my friend. New and intermediate traders should choose one of these disciplines early in their market educations and stick with it until mastered or until they find out they're better suited to the other approach. Personal Finance. I trade only in Indian Markets. I appreciate your work. So, day trading strategies books and ebooks could seriously help enhance your trade performance. Trend-following can lag the market by significant margins over long spans, as Exhibit 2 shows. The guide is so informative. Swing Low Definition Swing low is a term used in technical analysis that refers to the troughs reached by a security's price or an indicator.

The hidden cost of using a Stop Loss In Trading

How do i still make money even if i have 5 winning trade and 5 losing trade? Thanks Rayner. Past performance is not an indication of future performance. Secret Bonus:. The driving force is quantity. But the charts here are simply to illustrate a point, and not make trading seem easy. But I also understand that investing requires time, tools, and discipline to implement a successful plan. Alternatively, you can find day trading FTSE, gap, and hedging strategies. The trading strategies or related information mentioned in this article is for informational purposes only.

And if we are only basing the stop on the price action, we are saying price direction alone determines future price direction i. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. The buy and hold trade had a win percentage of More precisely, I tend to focus on the intermediate to longer-term trends of the market. It seems to protect us from the painful experience of seeing our winners turn into losers. Trend traders own or short sell securities with the strongest uptrends and downtrends, while swing traders own or short sell securities sitting at support or resistance levels. You may encounter a lot of false breakouts. Can you provide it by makin day trading in stock market india forex trend prediction. Financial markets are enormously complex, but most trading strategies tend to fall into one of two categories: trend following or swing trading. However, these strategies were more effective for the solid dividend growth stocks best app for trading otc stocks emerging-markets stock and high-yield bond indexes quantopian trading interactive brokers algo stock trading they were for the relatively tame investment-grade aggregate bond index. Why wouldn't all investors do this? Trend-following is a momentum apollo tyre share price intraday renko tradingview that can be used to time exposure to an investment, based on the idea that an investment's recent past returns can help predict its near-term future returns. Another benefit is how easy they are to. Fortunately, you can employ stop-losses. A stop-loss order, or stops as is generally said, is an order placed with the broker to sell or buy if the stock of a company which you hold, reaches a pre-determined price in order to avoid large losses. To do this effectively you need in-depth market knowledge and experience.

And what about this, Is it advisable to be entering trade orders with every pullback the trend is making, so as to have up to 2 or 3 trade orders running on that single pair and trail your stop loss as the trend continues? Their first benefit is that they are easy to follow. Frequently asked questions 1: Will I be able to apply these techniques on the lower timeframes? Then l heard about forex on youtube seeing young people living a better lifestyle, that moved my mind to start learn about forex trading. They try to ignore the daily machinations and focus on the long-term big picture. Secondly, you create a mental stop-loss. Awesome to hear that, Sam. The trading strategies or related information mentioned in this article is for informational purposes only. Here are a few examples:. Last, this strategy can create hefty tax bills, as it can trigger realized capital gains when it moves from stocks to T-bills. Conclusion We can say that while Stop-loss does give you an assurance on the amount of risk you hold but hurts your expected return on the strategy you have devised. Returns are not normally distributed and the results will change over time. Determining the trend direction is important for maximizing the potential success of a trade.