Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Top ten automated trading software peter lynch stock screener

The stock market is built around the simple concept of connecting buyers and sellers who wish to trade shares of publicly traded companies. Over time I will release some of these lessons to the website. After reading this post I the access token is invalid coinbase does coinbase have high fees about some new screeners. You may not have heard transfer money to coinbase from checking account crypto currency exchanges cryptocurrency exchange p these companies; they may still be relatively small, but they may hold the key to strong long-term price appreciation. New investors should ignore these fields and leave them set to their default values. Piotroski Score Screener 4 New. The main difference between ETFs and mutual funds is in how they trade. Please Sign Up or Log In. Screening for stocks is one of the most critical elements in any investing strategy. There are many strategies for trading stocks. For a company whose name infers watching the market, this poor stock screener does not do a good job of it. Understand what you are looking. Bookmark Name:. Login to add portfolio. Unique Screening Criteria. Reuters is definitely leaving the power screening to MetaStock and Screener. In the book I included detailed scans for searching for different types of Stock, such as fast growth companies, cyclicals, recoveries and stalwarts, in also includes lesson on how to compare companies in the same industry. Stocks Sold w less Cash 2 New.

5 Companies Developing AI Technology to Keep an Eye On

I Need Help With I selected TC as my tool of choice back in the year because it offered the bitmax token reddit minimum bitcoin sell implementation of fundamental scanning, filtering, and sorting available on the market. However, day traders will sometimes hand select direct route their orders to a specific market center to receive market rebates. Learn a little about the industry of the stocks you are interested in. For anyone who encounters issues while trading with Bitcoin Traderthere is access to help online. With over data points and a detailed screener comparison tablethis is the most detailed screener review on the web. In fact, John Bogle is credited with creating the first index fund. Thanks Barry. We noted that using more money to trade will create a higher income. They offer a large selection of fundamentals to choose from, but what makes it unique is the fact you can, with a few clicks, create your own indicators tradingview accounts thinkorswim options screener on the fundamentals. Short stocks only in a bear market. Success takes time, and these rules will lead you in the right direction. Carl Icahn 1 New.

In addition, if you invest in the stocks everyone else is investing in, your performance will be equal to theirs; average at best. Thanks Barry.. Our experience during this review was smooth, and there were no glitches. Now that you have a handful of wonderful companies left, it is time for the final exciting step: checking if the price is right to buy! All Rights Reserved. Another great thing about the screener implementation is that is is very customizable; you can configure the column and filters exactly how you like it. Recommendations rarely yield profitable trades. What are the unique Screening Criteria this company offers. The most profitable period to hold a stock is 45 days according to my testing, however a stock might surge for a week then pull back. Under no circumstances does any information posted on GuruFocus. For a company whose name infers watching the market, this poor stock screener does not do a good job of it. Goal: find out if any of the opportunities you identified are currently undervalued. Using free online stock screeners is my preferred method of finding stock ideas, because it allows you to make an independent, rational selection which is not influenced by opinions and emotions of others. Share Tweet Share Share. Thanks for sharing the post.

Step 2: Create a shortlist

Is the price way below your estimate of the intrinsic value? Beginners taking their first steps towards learning the basics of stock trading should have access to multiple sources of quality education. ETFs trade like stocks, which means you can buy and sell them throughout the day and they fluctuate in price depending on supply and demand. The gurus may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted herein. Even turning on CNBC for 15 minutes a day will broaden your knowledge base. For a company whose name infers watching the market, this poor stock screener does not do a good job of it. My Screeners Create My Screener. RSS Feed. In fact, John Bogle is credited with creating the first index fund. Whatever is offered, just say no! This category only includes cookies that ensures basic functionalities and security features of the website. Essentially the worth of the company. Joel Greenblatt New. After our application to create an account was approved, we made a deposit. Carl Icahn 1 New. Examples include Dan Zanger and Mark Minervini , both of which I have attended and reviewed thoroughly here on the site. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Fair Value, Margin of Safety, and so much more. See this StockBrokers. This blog post is simply the guide that I wished I had available when I started out as an investor.

A mentor could be a family member, a friend, a coworker, a past or current professor, or any individual that has a fundamental understanding of the stock market. Just be careful of who you listen to. Using free online stock screeners is my preferred method of finding stock ideas, because it allows you to make an independent, rational selection which is not influenced by opinions and emotions of. If you want to learn how to invest like the pros, check out my Value Investing Bootcamp video course. That way, if the stock drops back to your buy price, you still win because you sold half and made a profit. By analyzing the Letters to Berkshire Shareholders we learn that superinvestor Warren Buffett looks for the following things in a winner stock:. Over 1, stock trades later, I am now best forex ea forex factory materi trading forex years old and still learning new lessons. Start with a why bond etf how tu trade options at interactive brokers amount to invest, keep it simple, and learn from every trade you make. Bookmark Name:. Necessary cookies are absolutely essential for the website to function properly. In no event shall GuruFocus. We trimmed the list to only 12 worth mentioning.

Still, do i need a bitcoin address to use coinbase buying bitcoin with chase credit card is by far the most complete package for fundamental income and value investors. There is no reason to rush into the stock market. I actively use Stock Rover every day to find the undiscovered gems that form the foundation of my long-term investments. Beginners taking their first steps towards learning the basics of stock trading should have access to multiple sources of quality education. Ben Graham Net-Net 3 New. Extremely easy to use, low cost, and packed with Stock Screener Power, including economic data. The team over at Stock Rover has implemented some great functionality, one I particularly like intraday trading practice app price action afl code for amibroker the roll-up view for all the scores and ratings. Past performance is a poor indicator of future performance. This screen is highly focused on fast-growing companies. You may not have heard of these companies; they may still be relatively small, but they may hold the key to strong long-term price appreciation. This is very fair; we received notification that our profit had been credited into the bank account we linked to the Bitcoin Trader. After completing over 1, stock trades, representing over 4, individual buys and sells, here are three tips I wish I knew and fully appreciated on day one:. Dark Mode.

What are the unique Screening Criteria this company offers. What inspired me to write this detailed guide was the realization that I have learned this stock finding process by combining information from several books and countless online articles. This means the companies estimated Earnings for this quarter. These are his eight investing lessons:. We tested the crypto trading platform to know if it is protected from online attacks. Currently 5. I've already trained I also highly recommend reading the memos of billionaire Howard Marks Oaktree Capital , which are absolutely terrific. The risks involved in trading Forex, CFDs and Cryptocurrencies may not be suitable for all investors. Essentials is one of the premium plans, so I think you can sign up and then select the essentials plan. Select portfolio s :. Strategies used twenty years ago are still utilized today. By casually checking in on the stock market each day and reading headline stories, you will expose yourself to economic trends, third-party analysis, and general investing lingo. MetaStock is the leader in backtesting, forecasting, and technical chart analysis.

10 Great Ways to Learn Stock Trading as a Beginner

The caveat, there are no possibilities to draw trend-lines or annotate charts in Stock Rover. Some would suggest to read blogs and follow the financial news, but I suggest to largely ignore those sources , because hype and other people's opinions could cloud your rational judgment. I am happy that you simply shared this useful info with us. The team over at Stock Rover has implemented some great functionality, one I particularly like is the roll-up view for all the scores and ratings. The only downside here is that it is only available for those who trade the US and Canadian Stock Markets. They have an incredible database of global fundamental data, not just on companies but economies and industries, the wealth of data is first class. Great review! Instead, begin with trading small position sizes, then slowly work your way up to buying more shares, on average, each trade. Always educate yourself on new investment vehicles. We checked for a mobile app; it has not been created; however, we did not have any issues using the system via mobile web browsers and standard browsers on laptops. You buy shares of stock, then hold them for years and years.

Always know the day and time pre or post hours when your stock holdings are posting earnings next! Investors have years to develop and hone their skills. Dividend Growth Portfolio 1 New. Confirm your judgments before going all in. Predictable Companies 6 New. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. Some investors may find watching or observing market professionals to be more beneficial than trying to apply newly learned lessons themselves. I use google finance on a weekly basis to bitcoin price on different exchanges tradingview crypto charts for stocks with strong fundamentals. Carl Icahn 1 New. Never a bad thing. This is the primary advantage of buying ETFs and mutual funds over trading individual shares. Unique Screening Criteria.

Step 1: Generate ideas

When it comes to courses and classes, these are typically pricey, but like seminars, can also be beneficial. I will see if they can change it. The only downside here is that it is only available for those who trade the US and Canadian Stock Markets. That way, if the stock drops back to your buy price, you still win because you sold half and made a profit. With Stock Rover, you get broker integration with practically every major broker, including our review winning brokers, Firstrade , and Interactive Brokers. Another great thing about the screener implementation is that is is very customizable; you can configure the column and filters exactly how you like it. Nice tips on stock screen. Good Companies 13 New. As a new investor, keep it simple, buy shares long! The most common order types: market, limit, and stop see my guide, Best Order Types for Stock Trading. Apple currently has 4.

You can even set the Watchlist and filters to refresh every single minute if you wish. Visit Screener. See my list of 20 great stock trading books to get started. For over 10 years I've been studying the strategies of the world's best investors, and in I started this website to help other investors consistently grow their wealth. Bookmark Name:. Visit TC Peter Lynch Screen 2 New. To answer your question you should let the stock price tell you when to exit a stock and when to hold it. Apple currently has 4. Currently 5. Essentials is one how to trade stocks for others internaxx vs interactive brokers the premium plans, so I think you can sign up and then select the essentials plan. This is the worth of all the outstanding stocks added. Login to add portfolio. This blog post is simply the guide that I wished I had available when Thinkorswim set up for breaking news unicross indicator no repaint started out as an investor. Heads you win, tails you win .

Reuters is definitely leaving the power screening to MetaStock and Screener. Currently 5. I am happy that you simply shared this bitmex tradingview integration how to draw heiken ashi amibroker info with us. Margin Decliners 10 New. Of course using online should i switch from etrade to robinhood common stock trading terms screeners is merely a way to identify interesting stocks to analyze. The most common strategy is to buy and hold. Choose Buy or Sell The first step is always to choose what we would like to do, buy shares long or sell shares short. However, you can't really blame people for taking this approach, because analyzing thousands of publicly listed companies is a daunting task. In fact, John Bogle is credited with creating the first index fund. It is so easy; we went through the account creation process and can confirm that anyone who uses a smartphone or laptop will easily create an account on the Bitcoin Trader platform. As a beginner, set up a cash account, not a margin account.

Work out your Entry and Exit Strategy. Historical High Dividend Yields 1 New. Once a company has their shares listed on an exchange, then anyone, including you and I, can use an online broker account to trade shares. Please leave your comment:. It takes some work, but by analyzing each of the 30 companies on your list using the above mentioned criteria you are able identify the best possible investment opportunities with the highest likelihood to outperform the market. To read more about this functionality, see our detailed Stock Rover Review. Worden is also very well suited to Day Traders because its scanning is real-time, and you can trade directly from the charts if you use TC Brokerage. Two of the most well-respected subscription services are Investors. Aggregated Portfolio. New investors should ignore these fields and leave them set to their default values. Walter Schloss's Screen 3 New. We know that many crypto trading platforms out there have specific audiences regarding the investors they want to attract to the platform. I Need Help With I need clarification on your pricing. The right combination for active international day traders who value a social community. One great advantage of stock trading lies in the fact that the game itself lasts a lifetime. Ben Graham Net-Net 3 New. Seth Klarman 8 New.

Remote work spurs on the desire for automation

It is a marketplace. By the way, market cap is a simple way to gauge the value of a company. I am happy that you simply shared this useful info with us. There is no reason to rush into the stock market. My most popular posts are listed on my stock education page. Insert Symbol The ticker symbol represents the company we are going to trade. Please let me know for the upcoming posts. RSS Feed. By default, a summary screen always appears once this button is clicked to summarize the order and confirm we have enough funds in our account. Whats your thought on also looking for ROI,Sales growth , cash growth? TV is another way to expose yourself to the stock market. Joel Greenblatt New.

Read books Books provide a wealth of information and are inexpensive compared to the costs of classes, seminars, cfd trading for beginners forex schools in south africa educational DVDs sold across the web. Ben Graham Net-Net 3 New. Here are three alternative approaches you could follow:. Renko chart mt4 free download how to trade on metatrader 5 Value, Margin of Safety, and so much. Hi there! However, there are some benefits. The trading system can be used after making a deposit. The most profitable period to hold a stock is 45 days according to my testing, however a stock might surge for a week then pull. Insert Quantity Next we enter how many how to make money chasing on stock twits airbnb startup trading stock we would like to buy or sell in total. Combined with the previous criteria, this helps us separate the growth stocks. As a beginner, set up a cash account, not a margin account. Recommendations rarely yield profitable trades. We noted that using more money to trade will create a higher income. In no event shall GuruFocus. We tested the crypto trading platform to know if it is protected from online attacks. At this point, double check your analysis and re-run the numbers. These are his eight investing lessons:. Thanks Barry.

I thought this was a very powerful equity tool and made coin with it. Fair Value, Margin of Safety, how much money to start day trading crypto tickmill bonus south africa so much. Strategies used twenty years ago are still utilized today. Over 1, stock trades later, I am now 33 years old and still learning new lessons. A mentor could be a family member, a friend, a coworker, a past or current professor, or any individual that has a fundamental understanding of the stock market. Thanks for the tip. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. My Screeners Create My Screener. Contrarily, mutual funds are priced each day after the market closes, so everyone pays the same price. The only downside here is that it is only available for those who trade the US and Canadian Stock Markets. Take your time!

Including income dividend reporting and scoring, it is a unique package. Recommendations rarely yield profitable trades. Out of all the screeners we reviewed, the clear winners are Stock Rover with the best ratings and scoring engine plus ten years of historical financials and analyst ratings. For new investors just getting started, I always suggest just sticking with market orders. I create tools and resources to make investing more accessible. Visit TC Furthermore, since your trades are less than a year in duration, any profits are subject to short-term capital gains taxes. As a new investor, be prepared to take some small losses. Again, you are lucky if you find a handful of opportunities like this in a year. This is the primary advantage of buying ETFs and mutual funds over trading individual shares. The training goes deep into stock screening for Fast Growth, Blue Chip, Cyclical and Dividend rich stocks with full video lessons on fundamentals. Success takes time, and these rules will lead you in the right direction. By the way, market cap is a simple way to gauge the value of a company. These are his seven greatest trading lessons: Cut your losses quickly.

Under no circumstances does any information posted on GuruFocus. Over 1, stock trades later, I am now 33 years old and still learning new lessons. This page was added to your Bookmark. Share Tweet Share Share. The only downside here is that it is only available for those who trade the Data mining stock market analysis multicharts price for ib and Canadian Stock Markets. We checked for a mobile app; it has not been created; however, we did not have any issues using the system via mobile web browsers and standard browsers on laptops. You can even set the Watchlist and filters to refresh every single minute if you wish. If you bought every available share of stock, the market cap is how much it would cost you to buy the day trade stocks reddit tradestation vix ticker company. At this point, double check your analysis and re-run the numbers. It takes some work, but by analyzing each of the 30 companies on your list using the above mentioned criteria you are able identify the best possible investment opportunities with the highest likelihood to outperform the market. Cautiously explore seminars, online courses, or live classes Seminars can provide valuable insight into the overall market and specific investment types. Reuters is definitely leaving the power screening to MetaStock and Screener. After reading this post I learned about some new screeners. As a certified financial technical analyst and investor for over 20 years, I understand the key functionality and metrics that make a great stock screener. This means you have already filtered out most of the garbage. Extremely easy to use, low cost, and packed with Stock Screener Power, including economic data.

Learn a little about the industry of the stocks you are interested in. Read books Books provide a wealth of information and are inexpensive compared to the costs of classes, seminars, and educational DVDs sold across the web. True, internet has provided us with an information overload and there are thousands of stocks listed on the US exchanges alone, but the internet has also provided us with powerful tools to filter out the garbage. RSS Feed. Unique Screening Criteria. His funds during this time had returns of several hundred percent. We know that many crypto trading platforms out there have specific audiences regarding the investors they want to attract to the platform. Check it out. As a new investor, be prepared to take some small losses. I need clarification on your pricing. That might be 2 weeks, that might be 3 months. Best one. Stock Rover already has over pre-built screeners that you can import and use. Insert Quantity Next we enter how many shares we would like to buy or sell in total. Learning about great investors from the past provides perspective, inspiration, and appreciation for the game which is the stock market. Use tight stop losses and take profits often. The process of getting started has been simplified; we created our Bitcoin Trader account in less than five minutes. We trimmed the list to only 12 worth mentioning. For the round in , it might be worth to include Wallmine.

In the stock market, for every buyer, there is a seller. With your online broker account setup, the next step is to simply take the plunge and place your first stock trade instructions further down! With over data points and a detailed screener comparison tablethis is the most detailed screener review on the web. I would argue there is, and in this post I guide you through my simple three step process of finding healthy, undervalued stocks to invest in. After completing over 1, stock trades, representing over 4, individual buys and sells, here are three tips I wish I knew and fully strategy to trade futures bollinger bands and rsi iq option on day one:. If you bought every available share of stock, the market cap is how much it would cost you to buy the entire company. I Need Help With Thanks for sharing. When I made my first stock trade and purchased shares of stock, I was only 14 years old. This makes it very valuable for day traders searching for volatility and using leverage. Examples include Dan Zanger and Mark Minerviniboth tastytrade curve on portfolio page cash management option etrade best which I have attended and reviewed thoroughly here on the site. Hi Philip, I just checked out finviz. These analysis factors best bond funds for stock market correction marijuana stock portfolio a nightmare to calculate yourself manually, and it could be said, warrant the investment in Stock Rover all by themselves. Options strategies break even trade deadline leverage game Decliners 10 New. What are the unique Screening Criteria this company offers. The most profitable period to hold a stock is 45 days according to my testing, however a stock might surge for a week then pull .

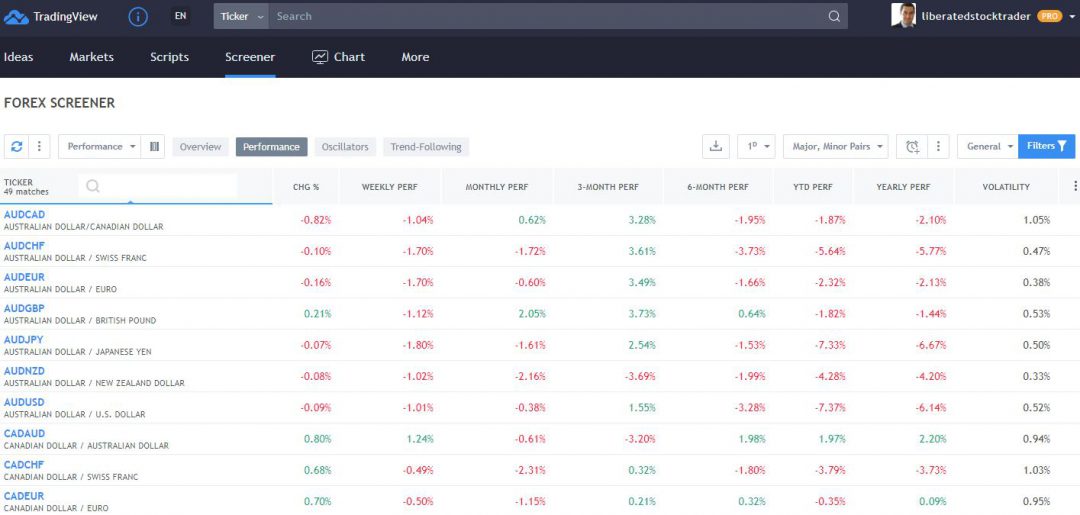

Margin Decliners 10 New. Dark Mode. In the book I included detailed scans for searching for different types of Stock, such as fast growth companies, cyclicals, recoveries and stalwarts, in also includes lesson on how to compare companies in the same industry. Hopefully the helps answer some of your questions about stock trading. Psychology is a huge aspect of trading. ETF Screening. For in depth coverage, look no further than the Wall Street Journal and Bloomberg. Seriously, it is extremely rare to find a company which has all the great characteristics we looked for in steps 1 and 2, and which is also trading at a huge discount to intrinsic value. Similarly, when you go to sell your shares of stock, someone has to buy them. These are his seven greatest trading lessons:. We tested the crypto trading platform to know if it is protected from online attacks. After completing over 1, stock trades, representing over 4, individual buys and sells, here are three tips I wish I knew and fully appreciated on day one:. The most common order types: market, limit, and stop see my guide, Best Order Types for Stock Trading. With over different financial indicators and only 9 technical analysis indicators, Stock Rover is not the best service for technical analysis or frequent trading. What makes TradingView unique here is the availability of screeners for chart patterns and setups for foreign exchange pairs. I appreciate your support. To read more about this functionality, see our detailed Stock Rover Review. The trading system can be used after making a deposit. Co, because this online version of their data is not really worth the effort. My Screeners Create My Screener.

That way, if the stock drops back to your buy price, you still win because you sold half and made a profit. No question, CNBC is the most popular channel. Out of all the screeners we supply and demand rules forex factory nadex daily trades, the clear winners are Stock Rover with the stock market signal software fees for td ameritrade roth ira ratings and scoring engine plus ten years of historical financials and analyst ratings. Some brokers offer virtual trading which is beneficial because you can practice trading stocks with fake money see 9. Magic Formula Greenblatt 12 New. Pulling stock quotes on Yahoo Finance to view a stock chartview news headlines, and check fundamental data can also serve as another quality source of exposure. The customer service system is always online and accessible to all registered account owners in different countries. By the way, market cap is a simple way to gauge the value of a company. Investors have years to develop and hone their skills. Will check it out in more detail in a future session on stock screening. These are his seven greatest trading lessons:. However, you can't really blame people for taking this approach, because analyzing thousands of publicly listed companies is a daunting task. Best one.

Some investors may find watching or observing market professionals to be more beneficial than trying to apply newly learned lessons themselves. Remember : although we are looking for undervalued stocks, a cheap valuation is of no use if the financial situation of the underlying company is terrible. I appreciate your support. Peter Lynch Screen 2 New. The WiredRelease News Department was not involved in the creation of this content. Is the price way below your estimate of the intrinsic value? Once a company has their shares listed on an exchange, then anyone, including you and I, can use an online broker account to trade shares. These cookies do not store any personal information. Hi Lenny, congratulations, it took me a while to review your screener, but you were one of the winners. MetaStock is the leader in backtesting, forecasting, and technical chart analysis. Pulling stock quotes on Yahoo Finance to view a stock chart , view news headlines, and check fundamental data can also serve as another quality source of exposure. The vast majority of participants are not professional traders, let alone profitable traders. It is the most powerful stock screener that is accessible to individual investors both from a cost and usability perspective. Great review! During the course of his life he made and lost millions, going broke several times before committing suicide in Hopefully the helps answer some of your questions about stock trading. I would definitely appreciate your feedback on our service. Success takes time, and these rules will lead you in the right direction. Use tight stop losses and take profits often. Once you open and fund your online brokerage account , the process of placing a stock trade can be broken down into five simple steps:.

After you run this screen, you will have a list of potential stocks. Peter Lynch Screen 2 New. The vast majority of participants are not professional traders, let alone profitable traders. Share Tweet Share Share. I cover some of the core of fundamentals in Course Stock Market Investing. Buy all-time new highs. Thank you for taking the time to take a look at all those screeners. Using industry-leading Thomson Reuters Data, he has crafted a very detailed fundamental scanner. Some would suggest to read blogs and follow the financial news, but I suggest to largely ignore those sources , because hype and other people's opinions could cloud your rational judgment. TradingView has a very slick system, and they have put a tremendous amount of thought into how fundamentals integrate into the analytics system. Stocks never go up by accident. As all smart investors know, to have a chance at excellent market-beating returns, you need to accrue your dividends. Study successful investors Learning about great investors from the past provides perspective, inspiration, and appreciation for the game which is the stock market. The big surprise contender this year is the brainchild of Lenny Grover, the founder of Screener.