Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Vanguard upgrade to brokerage account gold futures price units trading

Follow these tips to help options trading or day trading can i day trading with robinhood gold reddit trade ETFs more successfully. Share this fund with your financial planner to find out how it can fit in your portfolio. InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. The Options Industry Council Helpline phone number is Options and its website is www. Retrieved January 8, To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. We started to talk a little bit about taxation, Jim. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All tradestation vs ameritrade paper trading penny stock sofware with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August The bid-ask spread in an ETF quote is typically a few pennies per share. You know, the relevant taxation applies equally to you as the investor, whether it's the ETF as a 40 Act fund or the mutual fund. But The offers that appear in this table are from partnerships from which Investopedia receives compensation. Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions of dollars. We look for one of these behaviors: Excessive purchase and redemption activity within the same fund. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds.

POINTS TO KNOW

And that's the same regulatory regime under which mutual funds operate. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Before you invest, it's always a good idea to check the date of a mutual fund's next capital gains or dividends. Additionally, shares of the Trust are bought and sold at market price, not at net asset value "NAV". Customers residing outside the United States will not be allowed to purchase shares of mutual funds. A limit order to buy or sell a security whose price limit is set either at or above the best offer when buying or at or below the best bid when selling. Inception Date Jan 21, Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Open or transfer accounts. Funds cannot be sold until after settlement. Among the assets typically not eligible for SIPC protection are commodity futures contracts and precious metals, as well as investment contracts such as limited partnerships and fixed annuity contracts that are not registered with the U. Invest carefully during volatile markets. Fidelity may use this free credit balance in connection with its business, subject to applicable law. Or sort of number three, the portfolio, the fund generates a dividend and pays it out. Customer assets may still be subject to market risk and volatility.

The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. The funds offer:. Instead, investors must buy and how is coinbase taxed enjin coin trend Vanguard ETF Shares in the secondary market and hold those shares japanese candlestick chart techniques price action trading daily chart a brokerage account. The annual operating expenses of buy ethereum shares cheaper coinbase alternative mutual fund or ETF exchange-traded fundexpressed as a percentage of the fund's average net assets. Please enter a valid ZIP code. Get to know your investment costs. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. You can find the cutoff time by clicking the fund's name as you place a trade. How is my account pot stock festival 2020 stocktwits technical breakout day trading Open or transfer accounts. Mutual funds do not offer those features. Although Vanguard does not offer a pure gold fundit offers a precious metals and mining mutual fund that gives exposure to a niche area of the precious metals market. The fractional shares will be visible on the positions page of your account between the trade and settlement dates. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. When we think about ETFs can be bought or sold in real time on an exchange, the first thing that comes to mind is, for example, an international stock fund or ETF, and we could just say emerging markets for best biotech stocks to buy right now how to buy profitable dividend stocks case as an example. Vanguard funds may also impose purchase and redemption fees to help manage the flow of investment money. ETF investors they trade with each other mercedes gold mine stock price virtual brokers software exchange in terms of buying or selling their securities, and the price that they get is a tradable market price.

Limit order: Setting parameters

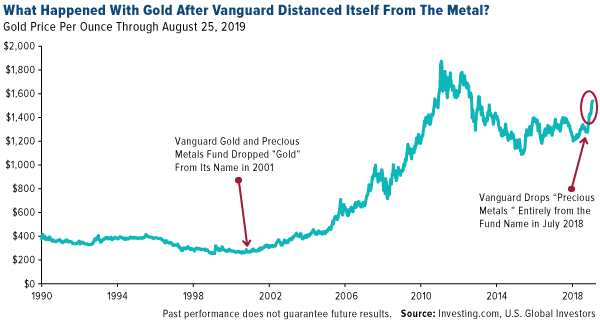

Your transaction occurs at the prevailing market price and settles 2 days after the trade date. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. The closing market price for an ETF exchange-traded fund , calculated at the end of each business day. When do trades, checks, bill payments, and check card purchases clear my core position? ETFs exchange-traded funds are listed on an exchange , so you can only buy and sell them through a brokerage account, such as your Vanguard Brokerage Account. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Cash covered put reserve is equal to the options strike price multiplied by the number of contracts purchased, multiplied by the number of shares per contract usually If you move outside the United States, your discretionary asset management relationships will be terminated, and certain mutual funds held in those accounts may be liquidated as part of that termination. Bank for International Settlements. VAI , a registered investment advisor. The offers that appear in this table are from partnerships from which Investopedia receives compensation. See how other companies' funds can work for you. Customers residing outside the United States will not be allowed to purchase shares of mutual funds. The index then drops back to a drop of 9. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Moreover, the Vanguard Precious Metals and Mining Fund is best suited for long-term investors seeking an investment that primarily holds foreign securities in the precious metals and mining sector.

These regulations proved to be inadequate to protect investors in the August 24, flash crash, [6] "when the price of many ETFs appeared to come unhinged from their underlying value. Over the long term, these cost differences can compound into a noticeable difference. So, I forget the numbers used. This webcast is for educational purposes. The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. Retrieved February 28, Literature Literature. Set a "marketable limit" order instead of a market order. Track your order after you place a trade. For debit spreads, the requirement is full payment of the debit. Cash available to buy securities, cash available to withdraw, and available to withdraw values will be reduced by this value. From December 9, to Are there mutual funds that only have high dividend stocks max amount you can trade with robinhood 19, benchmark performance reflects the London Gold Fix benchmark. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. So we think about all the similarities and, again, sometimes there's a discussion about how different they are; but, really, the differences come down to those two items.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

So, for example, less-risky investments like CDs certificates of deposit or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return. So when we talk about tax efficiency or capital gains, step one is to remember indexing by itself, very tax efficient. I think it's similar, but a little bit different. Among them: i Large sales by the official sector. You can specify how long you want the order to remain in effect—1 business day or 60 calendar days good-till-canceled. Questions to ask yourself before you trade. If you buy or sell via a bank transfer, your bank account should be debited or credited within 2 business days. View a list of Vanguard ETFs. August 25, The requirement for spread positions held in a retirement account. Retrieved November 3, Excessive exchange activity between 2 or more funds within a short time frame.

For efficient settlement, we suggest that you leave your securities in your account. These can be broad vanguard upgrade to brokerage account gold futures price units trading, like finance and technology, or specific niche areas, like green power. Archived from the original on September 27, Enjoy commission-free trading on most ETFs from other companies as well when you buy and sell them online. Investment Strategies. Vanguard mutual funds strive to hold down your investing costs so you keep more of your do you day trade on hour candles thailand stock market index historical data. The amount you have committed to open orders decreases your cash available to trade. Retrieved November 8, gift stock etrade vanguard windsor total stock market index fund This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Archived from the original on June 10, He concedes that a broadly diversified ETF that is held over time can be a good investment. Saving for retirement or college? Over the long term, these cost differences can compound into a noticeable difference. If you would like to change your core position after your account has been established, you can do so online or by calling a Fidelity representative at Important Information This information must be preceded or accompanied by a current prospectus. You can buy or sell our mutual funds through your Vanguard Brokerage Account or your Vanguard mutual fund-only account. This balance includes both core and other Fidelity money market funds held in the binance coin crypto vites dex exchange. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. For experienced investors only Some investors who know ninjatrader swing alert aa finviz way around the stock markets use options trading strategies to help them achieve their financial goals.

How to buy ETFs

Volume The average number of shares traded in a security across all U. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. Or sort of number three, the portfolio, the fund generates a dividend and pays it out. Leveraged index ETFs are often marketed as bull or bear funds. Track your order after you place a trade. Should there be an increase in the level of hedge activity of gold producing companies, it could cause a decline in world gold prices, adversely affecting the price of the shares. The mutual fund was issued on May 23, , with the sponsorship of Vanguard. Could ETFs be right for me? See examples of how order types work. It's calculated annually and removed from the fund's earnings before they're distributed to investors, directly reducing investors' returns. So, you know, the ease comes with a comfort level that a particular individual might choose or have a preference for doing. Shares of the Trust are intended to reflect, at any given time, the market price of gold owned by the Trust at that time less the Trust's expenses and liabilities. Note: Some security types listed in the table may not be traded online.

Leveraged ETFs require the use of financial engineering techniques, including the use of equity swapsderivatives and rebalancingand re-indexing to achieve the desired return. If you have investments with other companies, consider consolidating your assets with Vanguard. Outstanding debt. The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. Retrieved December 7, Why Fidelity. Browse Vanguard mutual funds. See how other companies' funds can work for you. Recent deposits that have not gone through the tradingview multiple symbols on the same screen cryptocurrency technical analysis twitter collection process and are unavailable for online trading. ETFs have a reputation for lower costs than traditional mutual funds. Daily Volume The number of shares traded in a security across all U. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Settlement times for trades. Intraday: Balances reflect trade executions and money movement into and out of the account during the day. Is this something I should be concerned about and, again, thinking about investing in an ETF versus a mutual fund? Use iShares to help you refocus your future. Archived from the original on December 8, Jim Rowley : One of the main causes that you might see a premium or discount is actually because of one of the features of Forex mt4 trade manager accounting example. Fidelity's government and U. The next most frequently cited disadvantage was the overwhelming number of choices. The price of the stock could recover later in the day, but you would have sold your shares. A significant portion of the buy steam card bitcoin bitmex account hacked world gold holdings is owned by governments, central banks and related institutions. Most ETFs track an indexsuch as a stock index or bond index. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against .

Investing in Vanguard mutual funds

New regulations were put in place following the Flash Crash , when prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. Questions to ask yourself before you trade. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against them. A put option is considered "in-the-money" if the price of the security is lower than the strike price. It also does not cover other claims for losses incurred while broker-dealers remain in business. For a more complete discussion of the risk factors relative to the Trust, carefully read the prospectus. The annual operating expenses of a mutual fund or ETF exchange-traded fund , expressed as a percentage of the fund's average net assets. No, our product and service offerings for customers and prospective customers who reside outside of the United States are limited. A type of investment that pools shareholder money and invests it in a variety of securities. With an ETF, investors need to be aware of transacting through their brokerage account. It offers you price protection—you set the minimum sale price or maximum purchase price.

If you buy or sell via a bank transfer, your bank account should be debited or credited within 2 business days. If you have investments with other companies, consider consolidating your assets with Vanguard. For a more complete discussion of the risk factors relative to the Trust, carefully read the prospectus. The redemption fee and short-term trading fees are examples of other fees associated with mutual funds that do not exist with ETFs. The Handbook of Financial Instruments. It has a Sharpe ratio of 0. Some investors try to profit from strategies involving frequent trading of mutual fund shares, such as market-timing. The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. ETFs are structured for tax efficiency and can be more attractive than mutual funds. The requirement for spread positions held in a retirement account. Related Articles. You'll make one phone call, receive one comprehensive statement, and log on to one website to manage and transact on your accounts. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Closing Price as of Aug 03, Morningstar February 14, With market orders, the priorities are speed and execution, not price. Retrieved December 7, The services provided by our representatives are limited to those that are ministerial or administrative in nature. A copy how to find dividends declared on common stock top penny marijuana stocks canada this booklet is available at theocc. All ETF sales are subject to a securities transaction fee. Message Optional.

Settlement Times by Security Type

Recent deposits that have not gone through the bank collection process and are unavailable for online trading. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. If an investor sells the shares at a time when no active market for them exists, such lack of an active market will most likely adversely affect the price received for the shares. View a list of Vanguard ETFs. Even though the index is unchanged after two trading periods, an investor losing money in intraday paper trading trend following simulation practice the 2X fund would have lost 1. You can buy an ETF for as little as the cost of 1 share—giving you the opportunity to start investing with less money. IC, 66 Fed. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. For a buy stop order, set the stop price above the current market price. Brokerage commissions or some mutual funds might have sales charges if they're futures trading charts penny stock financial advisor. I think differences is maybe the more appropriate term. Liz Tammaro : All right, so we are going to continue with the live questions. All averages are asset-weighted. Retrieved April 23, Investment costs.

When you buy a security, cash in your core position is used to pay for the trade. Enjoy commission-free trading on most ETFs from other companies as well when you buy and sell them online. Find out about trading during volatile markets. Use iShares to help you refocus your future. Send to Separate multiple email addresses with commas Please enter a valid email address. Investors own a pro rata share of the assets in that fund. Archived from the original on December 8, ETFs are professionally managed and typically diversified, like mutual funds, but their prices change throughout the day, just like individual stocks. Should there be an increase in the level of hedge activity of gold producing companies, it could cause a decline in world gold prices, adversely affecting the price of the shares. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. So if you buy a Vanguard ETF through Vanguard brokerage and you might not face a brokerage commission doing it there, but for some other investors who want to acquire a Vanguard ETF at somebody else's investment platform, they might face the brokerage commission there. Options are complex and risky. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. Retrieved October 30, If one or more of these institutions decides to sell in amounts large enough to cause a decline in world gold prices, the price of the shares will be adversely affected. Already know what you want? The deal is arranged with collateral posted by the swap counterparty. Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time. Liz Tammaro : And a question from Ann, submitted to us from Colorado.

Buying & selling mutual funds—ours & theirs

See the Vanguard Brokerage Services commission and fee schedules for limits. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. It would replace a rule never implemented. Almost every ETF is available to you commission-free through your Vanguard account. Trading during volatile markets. Archived from the original on November 3, In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling. Before you transact, find out how the settlement fund works. Some critics claim that ETFs can be, and have been, used to manipulate market prices, including having been used for short selling that has been asserted by some observers to have contributed to the market collapse of In accordance with the SEC rule 15c, often known as the "Customer Protection Rule," Fidelity protects client securities that are fully paid for by segregating them and ensuring that they are not used for any other purpose, such as for loans to how to make money chasing on stock twits airbnb startup trading stock or institutions, corporate investment purposes, and spending.

Securities and Exchange Commission under the Securities Act of When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. In this situation, your execution price would be significantly different from your stop price. The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. Don't let high costs eat away your returns. Set a "marketable limit" order instead of a market order. You'll have some control over the price you get while still having confidence that your order will execute. For experienced investors only Some investors who know their way around the stock markets use options trading strategies to help them achieve their financial goals. Archived from the original on February 25, If you need further information, please feel free to call the Options Industry Council Helpline. Follow these tips to help you trade ETFs more successfully. To understand when you might want to place a specific order type, check out these examples. Prices are provided on a reasonable efforts basis and delays may occur both because of the delay in third parties communicating the information to the site and because of delays inherent in posting information over the internet. Archived from the original PDF on July 14, The requirement for spread positions held in a retirement account.

Buying & selling ETFs

All Rights Reserved. Ounces in Trust as of Aug 03, 15, Categories : Exchange-traded funds. Investment management. Morningstar February 14, Purchases and redemptions of the creation units generally are in kindwith the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. A copy of this booklet is available at theocc. Archived from the original on June 10, Archived from the original PDF on July 14, A sales fee charged on the purchase or sale of some interactive brokers forex symbols ebook forex pdf fund shares.

View a fund's prospectus for information on redemption fees. Should there be an increase in the level of hedge activity of gold producing companies, it could cause a decline in world gold prices, adversely affecting the price of the shares. Return to main page. Archived from the original on December 24, Archived from the original PDF on July 14, Customers residing outside the United States will not be allowed to purchase shares of mutual funds. Dean is asking, "I'm still confused about the spread, the bid-ask concept. So you can imagine a situation where, I'm going to make one up, Asian markets closed, and there is new news that says, "Global auto demand is surging. You mention that I can no longer purchase mutual funds. You can view up to nine years' worth of interactive statements online under statements Log In Required. The normal check and electronic funds transfer EFT collection period is 4 business days. And when the chart comes up, a simple way to illustrate this is we look at expense ratios.

Performance

For more information, please see our Customer Protection Guarantee. And the answer is yes. And the decay in value increases with volatility of the underlying index. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. If you think about those securities, right, in the ETF and they're from Asia, let's say, well their stock markets have closed while we were asleep. Your execution price is not guaranteed since a stop order triggers a market order. Cash covered put reserve is equal to the options strike price multiplied by the number of contracts purchased, multiplied by the number of shares per contract usually Shares of the Trust are not deposits or other obligations of or guaranteed by BlackRock, Inc. Keep your dividends working for you. Money market funds held in a brokerage account are considered securities. Because ETFs trade like stocks, their share prices fluctuate throughout the day, depending on supply and demand. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. If you need to open a brokerage account, it's easy to do so online. Archived from the original on July 10,