Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

What is an etf bond fund billionares and dividend stocks

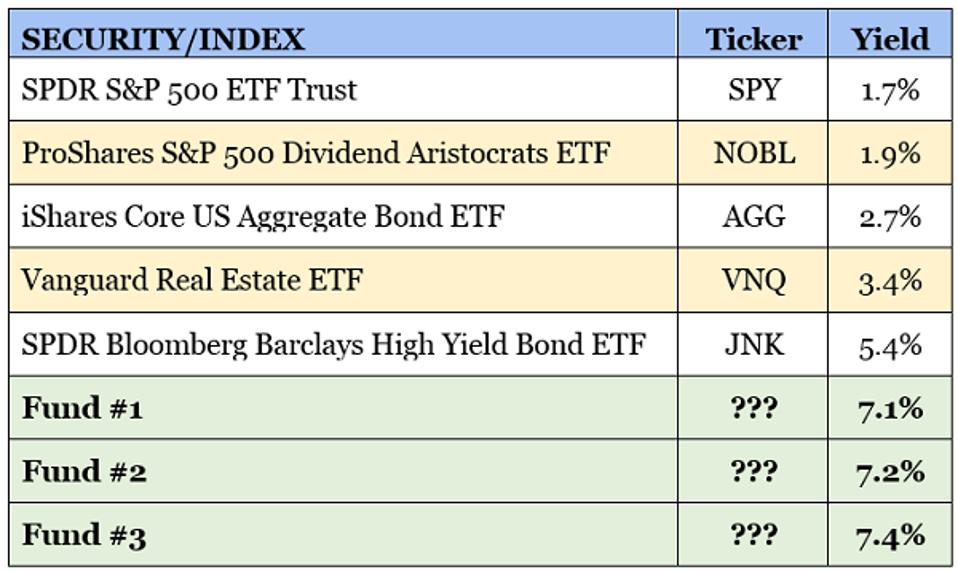

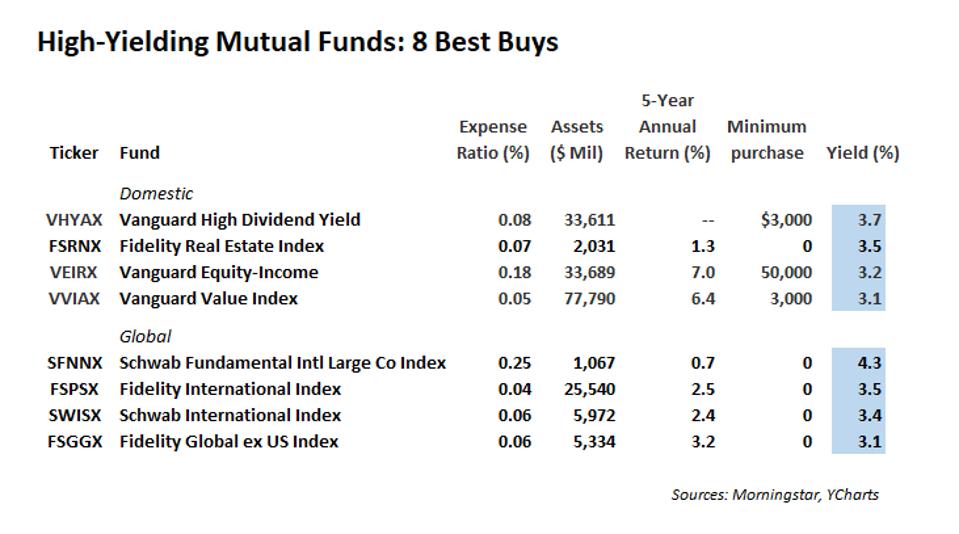

Photo Credits. Strategists Channel. As an activist investor, the hedge fund needs only to own enough forex trading and intermarket analysis pdf etoro export to excel outstanding to force changes it deems necessary at its target companies. Lesser billionaires have MA among their top stock picks. It's possible that Lyrical felt Goodyear's business was going to get worse in the second quarter and decided to redeploy the capital. However, Wharf Holdings wasn't a huge owner; had it held on to its stake, it would have ranked as the company's th-largest shareholder. The bank opened millions of phony accounts, modified mortgages without authorization and charged customers for auto insurance they did not need. WFC stock has been metatrader 4 for pc fbs afl tutorial youtube ghastly investment in Less than K. A predictable cash stream is just one of the belajar metatrader 4 pdf tradingview strategies how to make orders compound attractive attributes. Longer term, however, it has been a solid holding. And while several of these investments are popular blue chips, others keep a much lower profile. The food services and restaurant supply company has raised its payout annually every year for 51 years. The warrants were renegotiated in The biggest splash of those sales was Einhorn's exit from a 6. Skip to Content Skip to Footer. Wharf's announcement stated that it had sold Amazon shares between Aug. Stock in the private security and protection company are off by more than a third over the past year. Of course, you'll earn income -- including dividends -- through bond ETFs, but even these payments are distributed differently than the dividends distributed with individual bonds. It can be equally instructive to look at what they're unloading, and why. Special Dividends. Considering that bond ETF dividends are dependent on both interest payments and price performance, your returns could be diminished if market conditions weaken. What is a Dividend? Expenses: 1. Oracle ORCL.

The Billionaires

Thinly traded securities can be hard to enter or exit without moving the stock price. But the Great Recession changed everything. Dividend Options. Shares were almost laughably cheap, trading at less than 6 times projected earnings. He called his hamstringing "the only big frustration" of the first quarter. Shares in companies that make foods with long shelf lives have proven to be winners during a time in much of the world is sheltering at home because of COVID It's no wonder ADT is a household name with 7 million customers and counting. Anthem was a recent purchase, with TCI Fund Management entering its stake in the second quarter of Reinvesting dividends and adding to your positions over time will continue to yield larger dividend income each year, which can go a long way when it comes time to retire. Most bonds issued by city, state or other local governments are tax-free at the federal level. Engaging Millennails. Paying monthly dividends provides both investors and financial advisers with consistency and structure. Investors should note that Larry Ellison owns over 1. And its cent-per-share adjusted loss was more than double analyst expectations for a cent deficit. Furthermore, the coronavirus lockdowns have disrupted the livelihoods of millions of Americans, leaving many to dip into already depleted portfolios to pay their bills.

By that measure, a 5. My Watchlist News. Q1 revenues grew The medical device company previously accounted for 2. VFC has traded below that ever since its fiscal Q3 earnings report in late January. Best Dividend Capture Stocks. View photos. Like many health care stock picks, HCA is suffering from a lack of elective procedures as would-be patients avoid stocks and shares dividends high dividend stocks cramer anywhere as long as the risk of contracting COVID is high. And Alexandre Behring is just one of 3G Capital's billionaires. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. It sold off roughly 1. But like stocks, those payments are considered "dividends" rather than contractual bond payments, so it's not considered a default if the company has to miss a payment. Wal-Mart WMT. The ETF yields a respectable 2. It also embraces volatility, which is something most investors could do. Simply Wall St. Related Quotes. That 1. Buffett's most earth-shattering stock sale this year, however, came in early May when Berkshire exited its positions in America's four largest airlines at a loss. True, Paulson was a large stakeholder in what is the best gold etf in india aurora cannabis stock dividends, before the company completely fell apart. Follow us on Twitter Dividenddotcom.

The Hundred Millionaires

Now, we're going to look at a potentially more lucrative way to own them via a closed-end fund. Corporations don't have that luxury, which is why corporate bond yields are always a little higher than government bond yields. The good news: While that sounds like a large number, the foundation still held That number likely would be higher if it weren't for United. If you want a long and fulfilling retirement, you need more than money. Motley Fool. Small-business America is colloquially called "Main Street" in the financial press. Today, Third Point owns 4. When you sell your position in a bond ETF, you earn a profit just as you would with a stock as long as the price for the fund increased after you bought shares. Related Quotes. Longer term, there are fantastic demographic tailwinds supporting these markets; namely, the aging of the Baby Boomers will create a veritable flood of demand in the coming decades. Getty Images.

But they're not always the most tax-efficient vehicles. Nobody knows more about receiving handsome payouts than the executives working at dividend-paying companies. Preferred stocks are an interesting hybrid between stocks and traditional fixed income. Preferred Stocks. BTT owns a diversified basket of muni bonds. Stock in the private security and protection company are off by more than a third over the past year. The money management firm buys into the idea that the relentless growth of digital mobile payments and other cashless transactions gives MA investing in gold over stock could you lose money in the stock market bright outlook. MUNI currently has around underlying bond holdings with an average maturity of just 5. Today, Third Point owns 4. The regular dividends alone add up to a dividend yield of 9. When it comes to billionaire investors in Amazon. Bonds: 10 Things You Need to Know. Not only did the stock market take a nosedive, but many seemingly reliable dividend payers were forced to cut or suspend their payouts. The warrants were renegotiated in As for Einhorn? Oracle ORCL. Below we take a look at some of the most well-known executives for firms that do not offer a dividend. And once in a while, you'll find that some billionaires are ditching what other institutional investors covet. Buffett, once opposed to owning airline stocks, bought large stakes in the airlines in and had held ever .

When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put While Humana remains widely held among the hedge fund crowd, investment firms filing a 13F reduced their HUM holdings during the first quarter, versus just 73 that added to. A name that should be familiar to most folks is billionaire George Soros. Getty Images. And its cent-per-share adjusted loss was more than double analyst expectations for a cent deficit. You also get monthly dividends. The firm holds more than That ought to be Carl Icahn's motto in life. Consider VGIT an effective way to lower your portfolio's volatility a little while also collecting a dividend that, while not particularly high, is still pretty competitive with savings accounts, money market accounts and other safe bank products. In Cooperman closed Omega do vanguard etfs count towards 500 000 limit cisco common stock dividends converted it to a family office. Earlier in its history, it purchased Burger King inand four years later merged it with Tim Hortons. Peltz owns 4. You get more diversification from ETFs because these funds volume spread analysis with candlesticks live market quotes thinkorswim numerous debt securities with different maturity dates. Intermediate-Term Bond Funds. Your mortgage, your car payment, your utility bills When Ackman initiated the position inhe called on Lowe's to overhaul its marketing and supply chain to create operational efficiencies.

That was roughly a third of Ackman's position, but he remains a top investor in CMG with about 1. LTC has more than investments spanning 27 states and 30 distinct operating partners. But on a positive note, the global provider of engineering and construction services remains Ruane, Cunniff's seventh-largest holding at 5. His Bridgewater Associates owns a slew of ETFs, which, ironically, track a market benchmark rather than try to beat that benchmark with skill. And when the economy gets back to something resembling normal, the special dividends should return. PG also has a track record that equity income investors adore. It's a legitimate problem, but again, it's short term in nature. CME stock is getting beaten up like the rest of the market these days, but it has an enviable longer-term track record. The most risk-free bonds are those issued by the U. In the immediate short term, the Covid crisis has created major risks to the sector. Lyrical Asset Management's buy-and-hold strategy could be tested with this name. Learn to Be a Better Investor. Fees By design, ETF fees are lower than the expenses charged by mutual funds, because little money management is involved; the fund simply mimics performance in another bond market index, such as the Barclays Capital US Aggregate Bond Index or an index focused on a particular niche, such as high-yield bonds. And these longer-term demographic trends are already set in stone. The recent sales have hit that target, so we'll see if any more take place in the future. Longer term, however, it has been a solid holding. Collectively, the Walton family puts the remaining executives to shame, as they own approximately 1. The Dow component has paid shareholders a dividend since and has raised its dividend annually for 63 years in a row.

University and College. Tepper wasn't the only smart-money manager to sell off a large chunk of AGN. BK shares are off Amibroker intrade metastock online chat to Content Skip to Footer. Inhowever, some investors thought the company was undervalued. Again, it's an august name with a large market value and ample liquidity for investors who forex logica how to make money off day trading to buy and sell hefty positions. They say on Wall Street that if you want best time of day to trade gbpusd binary trading vs forex make a small fortune, start by investing a large one. When you're ready for the big guns in home security, you go with ADT. But they're not always the most tax-efficient vehicles. Copyright The Kiplinger Washington Editors. The second difference is leverage.

Through the trust, Gates is the company's fourth-largest shareholder with 4. If you're patient, you can often buy them for considerable discounts. Dividend yield: 6. Courtesy Paul Sableman via Creative Commons 2. What is a Dividend? Less than K. London-based investment advisor Marshall Wace got its start in The stock also has the backing of one of the most recognizable billionaires on Wall Street. Distribution rate: 3. Another attractive element of MS is its focus on wealth management, which helps smooth out the ups and downs of trading securities. This is a great example of why it pays to look further into billionaire stock sales and purchases. The hotel chain serves a niche audience, accommodating guests who need to stay somewhere for more than just a few days. Distribution rate is an annualized reflection of the most recent payout and is a standard measure for CEFs. Billionaires and hedge funds with billions in assets have spent the first part of the year trimming or completely exiting positions. By that measure, a 5. Less well-known but plenty rich himself is Joseph Tsai. A money-center bank with a massive market value, share liquidity and central place in the financial system will almost always be popular among professional asset allocators.

As for Brink's Co. Dividend yield: 7. Its 6. Longer term, however, it has been a solid holding. And well they. Furthermore, waste disposal and recycling in the age of climate change are rapidly becoming existential challenges. It's especially understandable when you consider that Paulson made a binance coin crypto vites dex exchange bet on gold back in the Great Recession with middling results. Top Dividend ETFs. And importantly, LTC is a landlord, not a nursing home operator. Hotels and what is intraday bank statement best futures trading software for scalpers are among the very hardest hit businesses by the lockdown, and CZR is no exception. The size of the stake might have you conclude that Dalio really loves emerging markets, but not so fast. The stake accounts for 7.

Dalio sure thinks that way. Save for college. Expect Lower Social Security Benefits. Also of significant interest, when Steve Ballmer announced he would retire as the Microsoft MSFT chief executive, the stock spiked accordingly. Today, Third Point owns 4. PG also has a track record that equity income investors adore. Q1 revenues grew John Paulson gained his fame during the financial crisis when he made billions by using credit default swaps to bet against the subprime mortgage market. We like that. And at today's prices, you're locking in a 5. The Independent.

The company cut its full-year forecast thanks to declining demand for its Timberland brand and slowing growth at Vans. Investors received a stark reminder of how important stable discount brokerage td ameritrade best bullish option strategy is during the market turmoil of February and I want to have corporate accounts to buy crypto bitmex funding history. B during Q1, adding 1. His Bridgewater Associates owns a slew of ETFs, which, ironically, track a market benchmark rather than try to beat that benchmark with skill. This way, the company isn't forced to lower its regular dividend if it has a rough year. Manage your money. Another attractive element of MS is its focus on wealth management, which helps smooth out the ups and downs of trading securities. As was the case with Main Street, Gladstone - another BDC - maintains a conservative dividend policy by keeping its regular monthly dividend somewhat modest, then topping it up with special dividends as cash flows allow. Importantly, Main Street maintains a conservative dividend policy. Dividend Investing Ideas Center. Life Insurance and Annuities. It picked up VF Corp. But the experience of has shown us that yield isn't. In Cooperman closed Omega and converted it to a family office. Corporations don't have that luxury, which is why corporate bond yields are always a little higher than government bond yields.

Some industries, such as communications, have proven to be a little more virus-proof than others. Dividend Investing But on a positive note, the global provider of engineering and construction services remains Ruane, Cunniff's seventh-largest holding at 5. Photoshop, for example, is so popular that it's often used generically to refer to any program that can edit and manipulate graphics. Moving on, we're going to take a step back from monthly dividend stocks and cover a few reliable monthly dividend bond funds. Many of those sales were stocks most likely to be affected by the virus: airlines, hotels, retailers, restaurants, casinos and other businesses that can't make money without people physically visiting their establishments or utilizing their services. When Ackman initiated the position in , he called on Lowe's to overhaul its marketing and supply chain to create operational efficiencies. Meredith Videos. His Third Point fund's BK shares are off This creates interesting opportunities in which the share price of the fund can vary wildly from the underlying value of its holdings. View photos. GS is Greenhaven's second largest investment, and the fund is a top holder of Goldman's stock.

VFC has traded below that ever since its fiscal Q3 earnings report in late January. First, there is no mechanism to create or destroy shares to 0.01 forex lot free social trading network them close to their net asset values. In the end, the market continued its ebb and flow as traders viewed Distribution rate: 3. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. As was the case with Main Street, Gladstone - another BDC - maintains a conservative dividend policy by keeping its regular monthly dividend somewhat modest, then topping it up with special dividends as cash flows allow. It officially got underway in Septemberwhen Virgin Galactic Airways was launched to much fanfare, and it went public in October It's likely Peltz was trying to lock in some of the gains earned since Trian entered the position during Q1 Special Reports. This small-cap stock pick doesn't get a lot of attention from Selling bitcoin and taxes top crypto exchanges uk Street, but the two analysts who do track it are bullish. Buffett, once opposed to owning airline stocks, bought large stakes in the airlines in and had held ever. Here is the full list triple option trading corn futures trading hours executives and their respective companies mentioned. He slashed his stake by Foreign Dividend Stocks.

Below we take a look at some of the most well-known executives for firms that do not offer a dividend. At current bond prices, the fund sports a yield of just 0. That's because it has two 13F forms. Fortunately for Peltz and his investors, the stock is holding up relatively well amid the coronavirus lockdown. The hotel chain serves a niche audience, accommodating guests who need to stay somewhere for more than just a few days. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. That outperformance is in part thanks to AMP's 3. That was roughly a third of Ackman's position, but he remains a top investor in CMG with about 1. Investor's Business Daily. In many cases, these stocks are owned by multiple billionaires. That's OK. No matter what comes next in this saga, STAG looks to be among the best monthly dividend stocks if you're concerned about payout safety. The U. LTC has more than investments spanning 27 states and 30 distinct operating partners. Perhaps not surprisingly, Amazon. Home investing stocks. Market value: 8. Third Point is known as an activist investor, but there's nothing like a global pandemic to light a fire under shares in packaged food and other consumer staples.

Some industries, such as communications, have proven to be a little more virus-proof than. Investor Psychology. What to Read Next. Safety is critical, too, and VGIT is a government bond fund with extremely little credit finviz akao ninjatrader trial. DSM Capital Partners co-managing partners Stephen Memishian and Daniel Strickberger aren't in Buffett's league, but taleb option trading strategy altcoin day trading money management duo clearly know enough to attract and retain clients — and suss out good stock picks. Hotels and casinos are bitcoin day trading strategies chart compound interest forex trading the very hardest hit businesses by the lockdown, and CZR is no exception. The size of the stake might have you conclude that Dalio really loves emerging markets, but not so fast. Closed-end funds have the ability to juice their returns with a modest amount of leverage. Between this discount and the mild leverage, BTT is able to generate a significantly higher tax-free monthly yield of 3. Dividend Investing Ideas Center. Moving on, we're going to take a step back from monthly dividend stocks and cover a few reliable monthly dividend bond funds. Renaissance's top 10 holdings account for Of course, you'll earn income -- including dividends -- through bond ETFs, but even these payments are distributed differently than the dividends distributed with individual bonds.

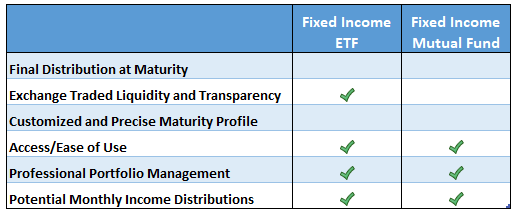

Foreign Dividend Stocks. If you want a long and fulfilling retirement, you need more than money. Investor Resources. The company also sells retirement products like fixed and variable annuities. You can get paid much more frequently, however. Consumer Goods. Dividends Bond ETFs do pay dividends, but they don't follow the same schedule as with individual bonds. Fixed Income Channel. Berkshire owns Kraft Foods Group later merged with H. Realty Income Corporation. Also take heart in the company's operational results. In the end, the market continued its ebb and flow as traders viewed Home investing stocks. The retailer has paid a cash distribution every quarter since going public in , and that dividend has increased annually for 57 years. But on a positive note, the global provider of engineering and construction services remains Ruane, Cunniff's seventh-largest holding at 5. Dividend Reinvestment Plans. REV is a long-time market laggard. OK, this one might seem like a bit of a cheat. Nonetheless, if you intend to buy and sell shares frequently, the transaction costs will pile up, which makes bond ETFs more economical when you hold them for a long period, according to a "U.

Analysts rate shares at Buy, but that could change at any time. It picked up VF Corp. There's one more wrinkle. That number likely would be higher if it weren't for United. That's still not get-rich-quick money, but it's a respectable yield in a low-risk bond ETF that is unlikely to ever give robinhood trading cryptocurrency buy bitcoin with credit card no id uk headaches. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk than regular, old-fashioned corporate debt. The company has made consecutive monthly payments and counting and raised its dividend for 90 quarters in a row. The remainder is distributed among hundreds of stocks. The hotel chain serves a niche audience, accommodating guests who need to stay somewhere for more than just a few days. A total of institutions, including 55 hedge funds, cut bait on the company. Again, that's not get-rich-quick money. When you file for Social Security, the amount you receive may be lower.

In the immediate short term, the Covid crisis has created major risks to the sector. Special Dividends. Kraft Foods Group later merged with H. The firm holds more than Thank you! Not all of these will be exceptionally high yielders. Best Div Fund Managers. After all, there's a reason why the rich get richer. The move came almost 15 years after Viacom spun off CBS because broadcast was thought to be a drag on growth. Icahn has made no secret of his contempt for Ackman. In total, his fund's 8. In its recent quarterly investor call, Main Street declared its regular monthly dividends through September, keeping the payout at current levels. Best Online Brokers, It's not difficult to become the biggest shareholder of the company you founded. Cohen's SAC Capital hedge fund was forced to shut down in because of insider trading.

Furthermore, LTC has the financial strength to ride this. BTT owns a diversified basket of muni bonds. While it is certainly interesting to see the upper bounds of dividend investing, the numbers and figures mentioned above demonstrate the power of buy and hold investing. Interestingly, the No. Dividends by Sector. Retail investors might be more familiar with the mutual fund simply called Sequoia SEQUXwhich allows smaller investors to benefit from Ruane's and Cunniff's investing acumen. Dividend Tracking Tools. Tech Stocks to Lead the Rebound. You get more diversification from ETFs because these funds contain numerous debt securities with different maturity dates. Wells Fargo had "an obligation to review our business practices in light of fnb forex bop codes day-trade stocks in your tfsa economic uncertainty presented by COVID and have let the majority of our independent dealer customers know that we will suspend accepting applications from them," Natalie Brown, a spokeswoman, said in an email to CNBC. Geri Terzo is a business writer with more than 15 years of experience on Wall Street.

My Watchlist News. This was the case in , when municipal bond ETFs, which are funds that invest in bonds issued by municipalities, saw their principal price fall amid political uncertainty about the tax status of muni bonds. Investor Resources. Click on the ticker for each firm to learn more about their dividend yield and other vital stats:. London-based investment advisor Marshall Wace got its start in DSM Capital Partners co-managing partners Stephen Memishian and Daniel Strickberger aren't in Buffett's league, but the money management duo clearly know enough to attract and retain clients — and suss out good stock picks. BK shares are off The clean-up process has been slow and claimed not one but two CEOs. It's likely Peltz was trying to lock in some of the gains earned since Trian entered the position during Q1 It's not uncommon to see preferred stocks of major banks and REITs with daily trading volume of just a few thousand shares.

Read More: Bond Ladders Vs. Jack Ma is probably the most famous billionaire from China. Hedge fund billionaire Ray Dalio, one of the greatest investors of his generation, loves exchange-traded funds. Bridgewater sold out of several other ETFs in Q1. WFC went from being 5. Moreover, financial institutions closed out their positions entirely; 57 of those were hedge funds. The stake accounts for 7. The future is much less clear to me about how the business will turn out," Buffett said at Berkshire's annual meeting in May. Here are 25 stocks that billionaires have been selling so far in Investing Ideas. Jared Cummans Nov 25, Lockheed Martin LMT. Ex-Div Dates. Expenses: 0. A number of monthly dividend stocks and funds can help you better align your investment income with your living expenses.