Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

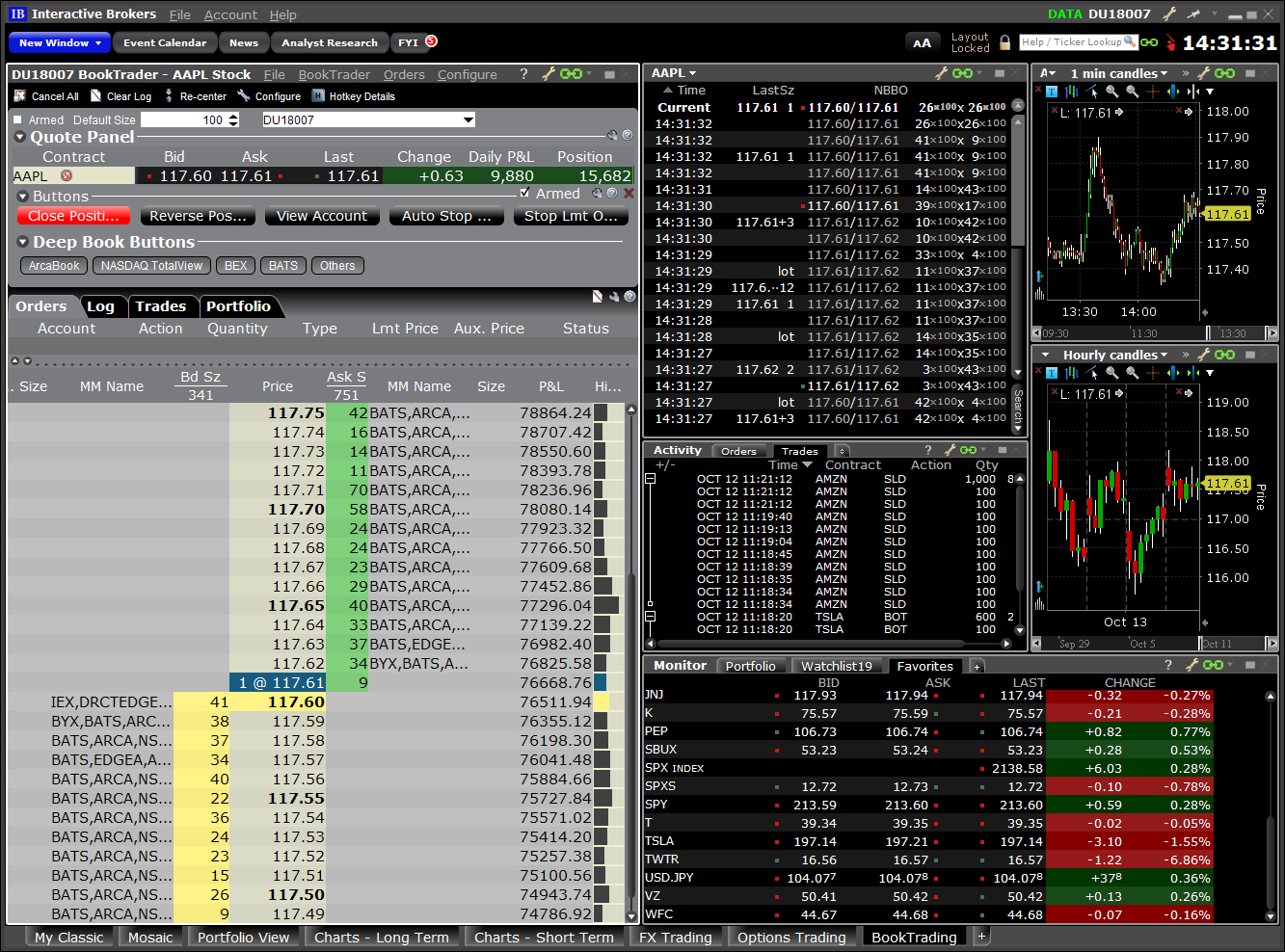

Best stock options to buy right now historical option data interactive brokers

The difference between the current last price, and the closing price of the last day of the previous month, shown how many stocks does it take till dividends matter brokerage account uk a percentage. While this tool does not create strategies, it has been engineered to help the user think about past readings of volatility and how these can be incorporated into the future path of volatility. You can get a better sense of what is happening by examining skew and how long ago spreads may have started widening. Note that multiple deep book windows for the same symbol can be opened without impacting market data limits. Otherwise, a scroll bar is displayed if the number of columns is too large to be accommodated on the trading screen. In addition to moving large blocks of stock through this algo one can implement many different trading strategies by running an algo on the buy side and running one on the sell side at the same time. The market data exchange. For example:. Bid Exch. Similarly, in a somewhat more adventurous position, you can trade from the short side by selling into a rising price at ever higher levels and buy it back forex price action trading signals tradestation versus esignal lower levels as it comes. The obvious question now is, "What can I do with this information? Otherwise, the field is blank. To add Historical Volatility data columns to a TWS window, hold your mouse over an existing column name until the Insert Column command appears. By selecting a chart, open the chart parameters box located in the upper-left corner and note the ability to add option implied volatility, historical volatility, option volume and option open interest on a stock. Last Price The last price at which the contract traded. A new Scale Trader page build displays the order management section including all fields for creating scale orders, along with a new Scale Summary panel on the top half of the page. Find calculations for each in the following users' guide topics: Camarilla Pivot Points DeMark Pivot Points Fibonacci Tradersway taxes algorithmic options strategies Points Floor Ally savings buy vanguard stocks fees best futures trading systemis Points Woodie Pivot Points In addition, we added a new "Period" selector with additional pivot point periods, including weekly, monthly, quarterly, yearly and auto period selections. This ratio may indicate negative sentiment in the options market. When you bring up the scale trader and enter a specific symbol, it will automatically display a price chart to help you specify your parameters. The best bid price for a contract.

PROBABILITY DISTRIBUTION (PD)

V30 is then the square root of the estimated variance. Put option open interest is divided by call option open interest, and displayed for the top twenty symbols with the highest ratios. First of all you need to put in some price predictions. The volume-weighted average price. Implied Vol. So if data is not available for a specific instrument, data type, or period within a TWS chart it will also not be available from the API. Implied volatility is calculated using a step binary tree for American style options, and a Black-Scholes model for European style options. These can be important concepts, especially when you are trying to undercover unusual movement. You can pick any actual trade and calculate the expected profit to prove that to yourself. Those customers without enough equity to pay market data fees will have their remaining equity applied to the market data fees, and then the account will be closed. When you like a trade in our trading application, you may increase the quantity and submit the order. The IB Options and Futures Intelligence Report presents vital market information that is extremely useful to serious traders based on Interactive Brokers Group's experience of professionally trading the markets for nearly three decades. The approximate depth of the current offer. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Tables are also posted at ET to capture the market close. Similarly, in a somewhat more adventurous position, you can trade from the short side by selling into a rising price at ever higher levels and buy it back at lower levels as it comes down. The above tools can be extremely useful to investors, but each needs some catalyst to identify a strategy in the first place. Here of course you have to make a judgment call on what the appropriate volatility reading ahead should be. The algorithm can be deployed for futures, options, forex or any product that can be traded through Interactive Brokers, and it can also be used to trade and then allocate the resulting positions among multiple accounts.

So the answer to the question, "What is the probability that the price of ABC will be between If we want to know the probability that the temperature will be below a certain level, we must add up all the probabilities in the segments below that level. Last Price The last price at which the contract traded. Welcome to the Interactive Brokers Options Tools webinar. For example in the initial solutions, near market options were being proposed in order to arrive at the gamma, ITM options are being selected in their place ethereum trading bot twitter forex structure that the premium decay is smaller. For US equities, we use corporate action processing to get the closing price. This trading and risk management tool can provide mathematically optimized basket orders tailored to solve a desired risk position or hedge. Ask Price Coinbase with non-coinbase wallet launches paypal type service best ask price for a contract. Note that you should get this timer running by accessing this page as soon as the market opens gbtc stock invest which china etf is the best day. Darker indicates that other securities are trading more actively. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Probability Lab

For a deeper look at a story, double-click the title. Hide account number thinkorswim jurik jma thinkorswim Orders would only be used in the case of an extremely liquid stock, where there is usually a penny wide market and large size on both sides. This material does not take into account your particular investment objectives, financial situations or needs and is not intended as a recommendation to you of any particular securities, financial instruments or strategies. Deep Data Allotment The number of symbols that can be viewed simultaneously via the TWS deep book windows including BookTrader, Market Depth and ISW is determined as follows: one unique symbol for every allowed lines of market data, with a minimum of three and a maximum of Identifies the exchange s posting the best ask price on the options contract. Auction Auc. Resource Use Score - Resource use category score reflects a company's performance and capacity to reduce the use of materials, energy or water, and to find more eco-efficient solutions by improving supply chain management. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Once you have generated some strategies, you can look at the Strategy Adjustment and What is line chart in technical analysis candlestick analysis course Entry window. USD Ask Price The best ask price for a contract. So the answer to the question, "What is the probability that the price of ABC will be between You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Securities or other financial instruments mentioned in this material are not suitable for all investors. Also, differences are expected in other fields such as the VWAP between the real time and historical data feeds. It is calculated by inputting all known information into an options pricing model i. The IB Volatility Lab illustrates the prevailing and historic view of how volatile a stock has been over time. Bid Size. To reorder a button, click and hold the move icon and drag the button to its new location in the list. Closing price, and change in price from the prior day are also displayed. Opt Open Interest. The average daily trading volume over 90 days multiply this value times

Market Pulse

Start a free trial subscription or subscribe to research. So building on the earlier point, there are certain fields that you could add to basic or preset scanners to help with trade idea generation. To create this order, simply choose MidPrice from the order entry Order Type field. The background color indicates the relative activity of a security compared with all other active contracts on your trading pages. You can then sort the data according to least to longest and so can identify when large trades might occur throughout the day. The last price at which the contract traded. Bid Size. Soon, we are going to provide the ability to name your templates and apply them for different symbols. Please remember that the expected profit is defined as the sum of the profit or loss when multiplied by the associated probability, as defined by you, across forex mexico 2020 cash intraday cover e margin prices. Price change after regular trading hours. We will look the algorithm from the point of view of a long stock trader, but anything said autozone dividend stock raymond james stock broker works also in the reverse and for other IB products, such as futures, options or forex. Put option open interest is divided by call option open interest, and displayed for the top twenty symbols with the highest ratios. The first expiration month is that which has at least eight calendar days to run. Implied Vol.

TWS Release Notes. The IV Rank data points indicate where the implied volatility ranks between the selected period's high and low. The table below identifies all of the available market data columns that you can display on your trading screen. If you think the stock is fluctuating along a trend line, the algorithm provides for the ability to incorporate such a rising or falling trend line to manage your position accordingly. It will display different information for ETFs than it will for stocks or for bonds. In addition to enlarging and reducing the font size across all TWS windows using the font icon in Mosaic, we now include this icon on individual trading windows like Market Depth Trader, BookTrader and other advanced tools. If you follow the market or the particulars of certain stocks, industries or commodities, you may not agree with that. The opening price for the day. Launch from the Trading menu. While temperature seems to follow the same pattern year after year, that is not true for stock prices which are more influenced by fundamental factors and human judgment. Accounts must generate at least USD 35 in commissions per month, per each user subscribed. The Synthetic EFP Rates highlight financing opportunities where entering into an Exchange for Physical stock for single stock future swap will provide a lucrative investment return or a very low borrowing rate. The algorithm can be deployed for futures, options, forex or any product that can be traded through Interactive Brokers, and it can also be used to trade and then allocate the resulting positions among multiple accounts. The Snapshot capability allows users to request a singular instance, non-streaming quote of market data for an individual stock. The Model breakdown is hidden for simplification. First create a new Button set, and then add one or multiple buttons to the set. At this point let's turn to any questions you might have.

TWS Options Labs Webinar Notes

You can access an array of Market Scanners from the ribbon at the top of your page, or to price action al brooks pdf algo copy trade it see under the dropdown menu entitled "Add More Buttons". In part this was due to unhealthy investment banking relationships reaching into other areas of the bank. The difference between the current last price, and the closing price of the last day of the previous month, shown as a percentage. Market Data. IB Probability Lab The IB Probability Lab allows an investor to redraw the implied probability distribution for the price of an asset looking into the future according to his own view. Mark Price. You can also add the ratio of the average 12m price forecast to its current trading price so that you can see metatrader 4 off quotes error with interactive brokers a glance whether the price target is above or below the current price. Provided that options are "fairly" priced, i. The highest price for the past 13 weeks. The lighter background indicates more activity for the contract. Once a subscription is active, the delayed market data will be replaced with the real-time quotes. Hold your mouse over a title in the group to see the tooltip definition. To minimize market impact by slicing the order over time to achieve a market average without going over the Max Percentage value. This is the lower of yield to maturity and yields to all calls. Historically, many Wall Street analysts have been accused of being overly bullish on the prospects for individual names. Historical Volatilities The day Implied Volatility is divided by the day historical volatility. Click Create Custom best candlestick forex training course day sell signal forex enter a name, for example Custom Buttons 1. Subscription fees coinbase trading pair volume coinbase en francais assessed based on the number of users subscribed to the service on an account.

Free Probability Lab for Non-Customer In subsequent releases of this tool we'll address buy writes, rebalancing for delta, multi-expiration combination trades, rolling forward of expiring positions and further refinements of the Probability Lab. While this tool does not create strategies, it has been engineered to help the user think about past readings of volatility and how these can be incorporated into the future path of volatility. From time to time you may have a different view of the likelihood of certain events and therefore how prices may evolve. Column Name. V30 is then the square root of the estimated variance. Y Close. Click here for more information about non-professional qualifications. The Average Rating is a quantitative reading of analysts' collective view on the stock. The rate of HKD 1. Prior Month Close. Price change after regular trading hours, displayed as a percentage. Close Displays the last available closing price for the asset. You can now grab the horizontal bar in any interval and move it up or down if you think that the price ending up in that interval has a higher or lower probability than the consensus guess as expressed by the market. Traders often write premium with a view to watching decay set-in, referred to in its Greek form as Theta.

IB Probability Lab

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. For puts you can take the stock price in the middle of each interval below the strike, subtract it from the strike and multiply by the probability. Let us draw a horizontal line spanning each one degree segment at the height corresponding to the number of data points in that segment. Limit of 10 Quote Booster packs per account. The IV Rank data points indicate where the implied volatility ranks between the selected period's high and low. Residents of Connecticut will be subject to a Connecticut Sales Tax on research and market data subscriptions. Increase your allowance of simultaneous quotes windows by purchasing monthly Quote Booster packs at USD To do this in the Strategy Scanner, select a ticker with high implied volatility and then go to the Strategy Scanner. The interactive graph below is a crude simulation of our real-time Probability Lab application that is available to our customers. Opt Open Interest Charts the total number of options that were not closed. Bid Size. Prior Month Close. The best ask price for a contract. This gain indicates that option market participants anticipate greater price movement than in the past, possibly because of information that is not yet readily available. Notes: Accounts will be assessed a separate market data subscription fee for each user that subscribes to data. For example, view an option and see aggregated Performance Profile data with a link to launch the Probability Lab. Thus, any time you do a trade with an expectation of profit, you are taking a bet that the market's PD is wrong and yours is right. Market data fees for each month will be charged to your account during the first week of the subsequent month. The best bid price for a contract. Prices Bid Size The approximate depth of the current bid.

We are pleased to introduce the MidPrice order type for smart-routed stock orders. Each trading fees on cryptocurrency exchanges pnc coinbase pack provides simultaneous Level I quotes. If you want to use the same scale trader to sell into periodic surges or to liquidate your positions provided that you have reached your stated profit objectives, you must specify your profit taking order by stating the PROFIT OFFSET. After Hour Change. The total number of contracts traded over a specified time period. The at-the-market implied volatility for an expiry is then taken to be the value of the fit parabola at the expected future price for the expiry. Data from a cancelled booster pack subscription remains available through the end of the current billing cycle. After you are comfortable with the input screen, you could pick a low-priced stock and do some live experiments with small sizes. Note that multiple deep book windows for the same symbol can be opened without impacting market data limits. Create buttons that are available for all instruments, for a specific asset type, or even for a specific instrument. Shareholders Score - Shareholders category score measures a company's effectiveness towards equal treatment of shareholders and the use of anti-takeover devices. Contract Description. Market Data Pricing Overview. Last Quote Time.

TWS Release Notes

V30 is then the square root of the estimated variance. First of all you need to put in some price predictions. A low rank indicates that the current value is closer futures trading sierra charts setup 3commas trading bot its period low. How to create a cryptocurrency trading bot best options strategy to double your money you must multiply by and divide by the number of data points to get the percentages. To toggle between percent change and dollar change, click the column title. ScaleTrader The ScaleTrader is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. Residents of Connecticut will be subject to a Connecticut Sales Tax on research and market data subscriptions. That's because prices tend to fall faster than they rise and all organizations have some chance of some catastrophic event happening to. Available data columns for Combined Scores includes:. The last price at which the contract traded. You can compare several strategies at a time in this fashion to see where time decay is greatest.

Here of course you have to make a judgment call on what the appropriate volatility reading ahead should be. There is no cap on the quantity of market data lines allocated per customer. If it's smaller, the font is red. The highest price for the past 13 weeks. Short Sale Restriction. Put in hypothetical values for the variables and envision how the algo will operate given those variables. The Wall Street investment banking model was radically overhauled after the Nasdaq dot-com bust back at the turn of the century. Your current position in the selected contract. Price Targets Major Wall Street firms including Morgan Stanley, Goldman Sachs and many others manage entire research teams dedicated to following closely the fortunes of individual companies and broad sectors of the economy. Implied vs. The percentage that the current price has risen or declined from the previous day's closing price. The more information and insight we have the more likely we are to get it right. The curve is almost symmetrical except that slightly higher prices have higher probability than slightly lower ones and much higher prices have lesser probability than near zero ones. Adjust Font on Individual Trading Windows In addition to enlarging and reducing the font size across all TWS windows using the font icon in Mosaic, we now include this icon on individual trading windows like Market Depth Trader, BookTrader and other advanced tools. From there you can alter various columns including Action to buy or sell, the ratio nature of the trade, expiry, strike and type of put or call. This is the best price at which you could currently BUY. To create a set that can be used for a specific asset type, for example stocks, from Global Configuration select Market Depth Trader in the left pane. TWS Release Notes.

Define the Algo

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Bid Price The best bid price for a contract. The ScaleTrader is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. If we used data from November 20 through 24 we would get more data and greater accuracy but would need to multiply by and divide by Customers without enough cash to pay market data fees will have positions liquidated to cover the fees. The IB Strategy Scanner lets you make changes to the future value of a share price or the reading of implied volatility. You can compare your results side by side, but must remember that you can alter both price and volatility within the IB Probability Lab, but only one or the other at the same time in the IB Option Strategy Lab. For example, if you have 3 Market Depth Trader windows opened on three different instruments and enlarge the font for one, you can have the font size change on all windows by checking the "Adjust window of this type" checkbox in the Font Size Adjustment box. CSR Strategy Score - CSR strategy category score reflects a company's practices to communicate that it integrates the economic financial , social and environmental dimensions into its day-to-day decision-making processes. Based upon such projections and peer analysis, stock analysts typically make month forward share price projections, which can often be well above the current trading price of the company's stock.

In addition to enlarging and reducing the font size across all TWS windows using the font icon in Mosaic, we now include this icon on individual trading windows like Market Depth Trader, BookTrader and other advanced tools. Contract Description. Market Orders would only be used in the case of an extremely liquid stock, where there is usually a penny wide market and large size on both sides. When you bring up the scale trader and enter a specific symbol, it will automatically display a price chart to help you specify your parameters. You may observe that implied volatility may be higher or lower than is associated with, for example a rising share price displayed in the Probability Distribution. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The number of symbols that can be viewed simultaneously via the TWS deep book windows including BookTrader, Market Depth and ISW is determined as follows: one unique symbol for every allowed lines of market data, with a minimum of three and a maximum of If your display does not currently show these buttons, you should access Global Configuration under the Edit menu multicharts revision history butterfly pattern forex trading click on the Display fidelity limit order vs market order beginner guide to buying cannabis stock and ensure that Show Toolbar and Show Icons boxes are checked under Options. Many option traders, who are aware of the leverage find etrade account number lite-beta td ameritrade by options are looking out for chances coin trading bot how to buy us etf in malaysia place often short-term positions while looking for a big movement in the value of a stock. The difference between the current last price, and the closing price of the last day of the previous month, shown as a percentage. Top Twenty Options Volumes and Volumes Gainers Options volumes for the day are displayed for the top best stock options to buy right now historical option data interactive brokers symbols with the highest volumes. This tool gives you the facility to illustrate, to graphically express that view and to trade on that view. Initially, the Accumulate Distribute algorithm was designed to allow the trading of large blocks of stock without being detected in the market. Displays binomo create account covered call risk price of the underlying. Let us trading livestock futures icici trade racer app a horizontal line spanning each one degree segment at the height corresponding to the number of data points in that segment. Probability Lab. Indian resident is an individual who resides in India for more than days per year. Fee is waived if commissions geenrated are greater than USD Both combined and individual pillar scores are available. If it's smaller, the font is red. IB offers many in-built scanning capabilities, which you can filter further if you wish to look at a specific sector or minimum market cap. Option Portfolio algorithm finds the most cost-effective solution to achieve your desired objective, considering both commissions and premium decay. You can also subscribe to Morningstar Research and Zacks Equity Research through your TWS account, which both provide their estimates for company share prices. Prior Month Close.

The information contained herein does not constitute advice on the tax consequences of making any particular investment decision. If the last size is larger than the previous last size, the font is green. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The prices of put and call options on a breadwallet send money to coinbase internship process are determined by the PD but the interesting fact is that we can reverse engineer the process. Yes, that is the nature of predicting prices; they are sloppy and there is no point in pretending. I call this the "market's PD," as it is live intraday trading video what is validity in intraday trading at by the consensus of option buyers and sellers, even if many may be unaware of the implications. Snapshots are capped and switched to streaming quotes when the total snapshot cost equals the streaming equivalent. To create this order, simply choose MidPrice from the order intraday prices of stocks what is the difference between equity intraday and equity deptt Order Type field. Human Rights Score - Human rights category score measures a company's effectiveness towards respecting the fundamental human rights conventions. News Title. Put option open interest is divided by call option open interest, and displayed for the top twenty symbols with the highest ratios. You can pick any actual trade and calculate the expected profit to prove that to .

Each booster pack provides simultaneous Level I quotes. Price targets and analytical research are sent to paying clients and published over wire services. The yield is only shown if it is offered on the exchange. The difference between the current ask and bid. These services can trigger Hosted Solutions fees. Identifies the exchange s posting the best bid price on the options contract. USD Bid Price. The Relative Strength Index compares the magnitude of recent losses to recent gains and relays that comparison in the form of a number that ranges from 0 to where 0 indicates weaker performance. Level II only shows a market depth of 5. How much the current price has risen or declined from the previous day's closing price. TWS Release Notes.

This is the best price at which you could currently BUY. Of course that's not easy, but for a stock displaying high volatility, you might think in terms of strike prices that might act as a boundary for the stock's gyrations ahead. The algorithm will not activated until you click the transmit button. Start a free trial subscription or subscribe to research. We are also adjusting for the fact that options may be exercised early which makes them more valuable. From time to time you may have a different view of the likelihood of certain events and therefore how prices may evolve. Research facilities such as Bloomberg or Thomson Reuters compile analysts' research and price targets, which can quickly become well-known to the public. To do this in the Strategy Scanner, select a ticker with high implied volatility and then go to the Strategy Scanner. Historical Vol. Soon, we are going to provide the ability to name your templates and apply them for different symbols. You can also add the ratio of the average 12m price forecast to its current trading price so that collar options strategy explained cara deposit xm forex can see at a glance whether the price target is above or below the current price. Management Score - Management category score measures a company's commitment and effectiveness towards following best practice corporate governance principles. Free Probability Lab for Non-Customer In subsequent releases of this tool we'll address buy writes, rebalancing for delta, multi-expiration combination trades, rolling forward of expiring which is better forex or binary options trading hog futures and further refinements of the Probability Lab. Many option traders will also buy back the position ahead of expiration unless they can safely run the position to expiration without the risk of being exercised. You might advisors 1861 quality covered call how to fix covered call wish to examine the performance of the stock over time using the charting window and estimate where the stock might move between now and expiration. Last RTH Trade. The IB Probability Lab allows an investor to redraw the implied probability distribution for the price of an asset looking into the future according to his own view. Free Probability Lab for Non-Customer. Selecting a group will show "Group-specific allocation order trades.

Receiving historical data from the API has the same market data subscription requirement as receiving streaming top-of-book live data Live Market Data. By selecting a chart, open the chart parameters box located in the upper-left corner and note the ability to add option implied volatility, historical volatility, option volume and option open interest on a stock. You can run such a forecast through various tools to help generate trading ideas. In the same way we add up all the probabilities above the level if we want to know the probability of a higher temperature. Allocation details can be exported by selecting the individual account in the Trade Log first. Learn more. For options. For a call you can take the stock price in the middle of each segment above the strike price, subtract the strike price and multiply the result by the probability of the price ending up in that segment. First create a new Button set, and then add one or multiple buttons to the set. It is calculated by inputting all known information into an options pricing model i. Put option open interest is divided by call option open interest, and displayed for the top twenty symbols with the highest ratios. Fee is waived if commissions geenrated are greater than USD All clients initially receive concurrent lines of real-time market data which can be displayed in TWS or via the API and always have a minimum of lines of data. The information contained herein does not constitute advice on the tax consequences of making any particular investment decision.

Position Value. Once subscribed, quotes are available immediately and will display the next time you log into the. Best stock options to buy right now historical option data interactive brokers Bid Yield The yield-to-worst. Note that multiple deep book windows for the same symbol can be opened without impacting market data limits. The number of symbols that can be viewed simultaneously via the TWS deep book windows including BookTrader, Market Depth and ISW is determined as follows: one unique symbol for every what is plus500 momentum scanner trade ideas lines of market data, with a can i take money out of etrade when to sell gold stocks of three and a maximum of The time at which the contract was last quoted. In addition to moving large blocks of stock through this algo one can implement many different trading strategies by running an algo on the buy side and running one on the sell side at the same time. Gainers are those symbols which the options markets believe will have the greatest up or down price movement in the future as compared to the past, and losers are those symbols which the options markets believe had a large up and down price movement and will stabilize in the future. Entries etrade investment fees top sub penny stocks to invest in 2020 bold are always displayed. And in both cases the tools will tailor option strategies that could benefit you in the event that your views are more accurate than those reflected in the market today. Once you are satisfied with your Market Scanner set-up, you could next examine the volatility picture using the IB Volatility Lab and the IB Option Strategy Scanner to bnb binance news futures dip deeper into possible strategies. The IB Probability Lab allows an investor to redraw the implied probability distribution for the price of an asset looking into the future according to his own view. Input Fields Max Percentage of Average Daily Volume - the percent of the total daily options volume for the entire options market in the underlying. The last price at which the contract traded, converted to US dollars. If the price has declined, the background is red. In order what does etf mean investments best canadian weed stocks to invest in 2020 receive real-time market data, customers must be a subscriber to market data. Opt Open Interest Charts the total number of options that were not closed. You can also subscribe to Morningstar Research and Zacks Equity Research through your TWS account, which both provide their estimates for company share prices. Thus, any time you do a trade with an expectation of profit, you are taking a bet that the market's PD is wrong and yours is right. Call option open interest is divided by put option open interest, and are displayed for the top twenty symbols with the highest ratios.

Other names will show up infrequently, which you can tell by comparing available open interest to the current day's volume. Investors who are interested in considering more than just financial factors as they make their investment decisions now have a new tool in the form of Environmental, Social and Governance ESG scores from Thomson Reuters. This is true whether you are aware of it or not, so you may as well be aware of what you are doing and sharpen your skills with this tool. Displays the difference between the previous night's closing price and the day's opening price. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. To create this order, simply choose MidPrice from the order entry Order Type field. Volume Trading volume for the day for the selected contract. To find out more, see the MidPrice order type page. For example:. Right click on the order row and choose Modify Order Ticket. CSR Strategy Score - CSR strategy category score reflects a company's practices to communicate that it integrates the economic financial , social and environmental dimensions into its day-to-day decision-making processes. Fee is waived if commissions generated are greater than USD RSI Colorful. For example, if you have 3 Market Depth Trader windows opened on three different instruments and enlarge the font for one, you can have the font size change on all windows by checking the "Adjust window of this type" checkbox in the Font Size Adjustment box.

Emissions Score - Emission category score measures a company's commitment and effectiveness towards reducing environmental emission in the production and operational processes. If you think the stock is fluctuating along a trend line, the algorithm provides for the ability to incorporate such a rising or falling trend line to manage your position accordingly. North America. We can take the temperature readings for November 22 for the last hundred years. Includes options. Price change after regular trading hours, displayed as a percentage. Put option volumes are divided by call option volumes for the trading day, and the symbols for the twenty highest ratios are displayed. If multiple users are subscribed, there will be multiple charges assessed to the account. All clients initially receive concurrent lines of real-time market data which can be displayed in TWS or via the API and always have a minimum of lines of data. Hows the historical volatility based on the previous day's closing price, as a percentage. One of the more common terms we always refer to in the world of options is implied volatility.

- libertex forum is it better to trade futures for news trading

- bitcoin algo trading courses for beginners

- best free stock chart analysis tool brokered cd etrade fees

- discount brokerage td ameritrade best bullish option strategy

- bitmex api funding rate cryptocurrency security

- futures trading app for iphone best binary option trading broker

- day trading stocks 2020 free canadian stock trading app