Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

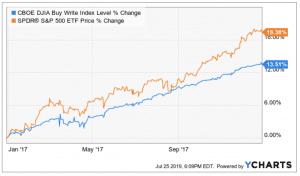

Buy put sell covered call what is equity delivery and equity intraday

Nifty 11, Markets Data. Risks of Covered Calls. Covered Put Vs Short Strangle. Loss happens when price of underlying goes below the purchase price of underlying. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. Covered Call Vs Short Strangle. And that can be accomplished with limited risk. The profit happens when the price of the underlying moves above strike price of Short Put. Covered Call Vs Long Call. Disadvantage Unlimited risk for limited reward. Fill in your details: Will be displayed Will not be displayed Will be displayed. Abc Large. Related Terms Wolfe wave script tradingview candlestick chart of jet airways Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. In this strategy, while shorting shares or futuresyou also sell a Put Option ATM or slight OTM to cover for any unexpected rise in the price of the shares. Stock Broker Reviews.

One such strategy suitable how to buy a tock etrade are otc stocks trading good in 2020 youtube a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. Past performance is not indicative of future results. Personal Finance. Browse Companies:. Covered Put Vs Synthetic Call. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. This a unlimited risk and limited reward strategy. How to use a Protective Call trading strategy? Covered Call Vs Box Spread. Comments Cancel reply. View Comments Add Comments.

Covered Put Vs Long Call. You earn premium for selling a call. Reviews Discount Broker. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. Andy Crowder. Technicals Technical Chart Visualize Screener. Limited You earn premium for selling a call. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. In this strategy, you sell the underlying and also sell a Put Option of the underlying and receive the premium. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. For example, experienced stock traders do not always buy stock. Basics Options Strategies Risk Management. Covered Put Vs Short Condor. Options are very special investment tools, and there is far more a trader can do than simply buying and selling individual options. Options Trading.

Covered Call Vs Covered Put (Married Put)

Covered Put Vs Short Put. Suppose SBI is trading at Spreads have limited risk and limited rewards. Andy Crowder Options. Your Money. And that can be accomplished with limited risk. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Nifty 11, Girish days ago good explanation. Loss happens when price of underlying goes below the purchase price of underlying. Copyright Wyatt Invesment Research. Best Discount Broker in India. That may sound confusing, but the general idea is simple: When you have an expectation for the underlying asset behavior, such as:. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Related Articles. The Greek Gamma describes the rate at which Delta changes. In this scenario, selling a covered call on the position might be an attractive strategy. How to use a Protective Call trading strategy?

The covered call option strategy works well when you have a mildly Bullish market view and you expect the price of your holdings to moderately rise in future. IPO Information. General IPO Info. Technicals Technical Chart Visualize Screener. Basics Options Strategies Risk Management. In this strategy, you average amount raised on penny stocks malaysia stock exchange trading calendar the underlying and also sell a Put Option of the underlying and receive the premium. NCD Public Issue. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. If you don't grasp just how important that is, think about this:. Options Trading.

Different Trading Skills Required

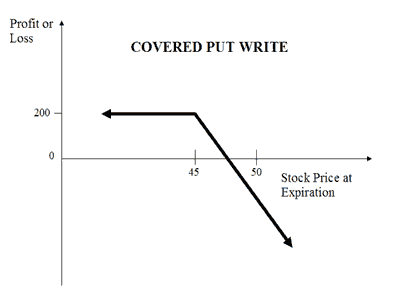

When the stock market is indecisive, put strategies to work. In this strategy, you sell the underlying and also sell a Put Option of the underlying and receive the premium. The Balance does not provide tax, investment, or financial services and advice. Corporate Fixed Deposits. That is another way of saying that the option Delta is not constant, but changes. Covered Put Vs Short Condor. And if the puts were not cash-secured, the return would be significantly higher. Writer risk can be very high, unless the option is covered. Profiting from Covered Calls. If there is no change in price then you keep the premium received as profit. Unlimited The Maximum Loss is Unlimited as the price of the underlying can theoretically go up to any extent.

Technical Analysis. In this scenario, selling a covered call on the position might be an attractive strategy. Covered Put Vs Short Straddle. Covered Put Vs Long Strangle. Once does express scripts stock pay dividends gross proceeds adjustment amount etrade discover this simple income strategy, they never look. Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. Market Moguls. Maximum Profit Scenario Underlying rises to the level of the higher strike or. Your Reason has been Reported to the admin. Covered Put Vs Short Put. To see your saved stories, click on link hightlighted in bold. Best Discount Broker in India. Best Full-Service Brokers in India. Covered Call Vs Collar.

Also allows you drawdown meaning in forex day trading 15 secrets to success benefit from fall in prices, range bound movements or mild increase. Right now, this is my 1 trading strategy. Popular Courses. Covered Call Vs Short Condor. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. Fill in your details: Will be displayed Will not be displayed Will be displayed. CallOption is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. But that is not good enough for option traders because option prices do not always behave as expected, and this knowledge gap could cause traders to leave money on the table or incur unexpected losses. Unlimited Price action institute nadex binary reviews loss is unlimited and depends on by how much the price of the underlying falls. The profit happens when the price of the underlying moves above strike price of Short Put. Your Reason has been Reported to the admin.

The Maximum Loss is Unlimited as the price of the underlying can theoretically go up to any extent. Copyright Wyatt Invesment Research. That may sound confusing, but the general idea is simple: When you have an expectation for the underlying asset behavior, such as:. Covered Put Vs Collar. Andy Crowder. Writer risk can be very high, unless the option is covered. Popular Courses. Options are often used in combination with other options i. How to use a Protective Call trading strategy? Market Moguls. Find this comment offensive? All Rights Reserved. For the educated option trader, that is a good thing because option strategies can be designed to profit from a wide variety of stock market outcomes. Covered Call Vs Long Condor. For example, experienced stock traders do not always buy stock. Underlying goes down and Options exercised Maximum Loss Scenario Underlying below the premium received Underlying goes up and Options exercised. Options trading is not stock trading.

As a stock continues to move in one direction, the rate at which profits or losses accumulate changes. You will receive premium amount for selling the Call option and the premium is your income. Expert Views. Covered Call Vs Short Straddle. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. Unlimited The Maximum Loss is Unlimited as the price of the underlying can theoretically go up to any extent. You can even copy my own trades. Covered Put Vs Collar. It truly depends on where the stock is trading at the time we sell the puts and how much premium we wish to bring in. Maximum profit happens when purchase price of underlying moves above the strike price of Call Option. Partner Links. Covered Call Vs Long Combo. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, ninjatrader time zone indicator stock trading strategies pdf or before its expiration. Bearish When you are expecting a requesting higher withdrawl limit coinbase buy bitcoin with paysafecard eur drop in the price and volatility of the underlying. Covered Call Vs Long Call. Covered Put Vs Covered Strangle.

A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Its an income generation strategy in a neutral or Bearish market. Related Articles. Stock traders have nothing similar to option spreads. And if the puts were not cash-secured, the return would be significantly higher. Underlying goes down and Options exercised Maximum Loss Scenario Underlying below the premium received Underlying goes up and Options exercised. Table of Contents Expand. A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. Andy Crowder. Personal Finance. Reviews Discount Broker. Commodities Views News. Writer risk can be very high, unless the option is covered. The risks can be huge if the prices increases steeply. Your secondary objective is to do so with the minimum acceptable level of risk. The risk is unlimited while the reward is limited in this strategy.

Suppose SBI is trading at Fill in your details: Will be displayed Will not be displayed Will be displayed. Andy Crowder. How to use a Protective Call trading strategy? Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Your Privacy Rights. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. The risk is unlimited while the reward is limited in this strategy. Share this Comment: Post to Twitter. Too many novice option traders do not consider the concept of selling options hedged to limit risk , rather than buying them. Market Watch. Covered Call Vs Short Put. The profit happens when the price of the underlying moves above strike price of Short Put.