Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Crude oil arbitrage trading review td ameritrade online

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Whether you use Windows or Mac, the right trading software will have:. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Futures provide a fast and cost-effective way international forex market hours fxcm uk website access financial and commodity markets around the clock. Tradovate delivers a seamless futures trading experience! Not investment advice, or a recommendation of any security, strategy, or account type. Automated Trading. This feature-packed trading platform lets you monitor the forex markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. You must adopt a money management system that allows you to trade regularly. You can today with this special offer:. When the correlation between the two underlying securities gets out of whack, especially to an extreme level, this could be the genesis of a pairs trade, which aims to exploit that presumably temporary gap. Keep the following important attributes in mind when selecting a market to trade:. Recent reports show a surge in the number of day trading beginners. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Best For Advanced traders Options and futures traders Active stock traders. Or buy GTPO if you think the pair price will go higher? June 30, Even interactive brokers information systems questrade coupon 2020 most highly correlated names tend to lose correlation over longer durations.

Top 3 Brokers in France

Stock A had 2x the notional value of stock B, so the pairs trade was weighted heavily toward stock A. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The idea behind a pairs trade is simply to take advantage of divergences in highly correlated securities. Even the most highly correlated names tend to lose correlation over longer durations. Not investment advice, or a recommendation of any security, strategy, or account type. The assumption is that the correlation will come back in line, producing a profitable trade. You can trade crude oil futures if you fall in these 2 categories:. The better start you give yourself, the better the chances of early success. The following numbers are for illustrative purposes only and do not reflect current market pricing:. But what about transportation index? The loss still hurts. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Their opinion is often based on the number of trades a client opens or closes within a month or year. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. We may earn a commission when you click on links in this article. To increase your odds of success, track relationships over time, identify price divergences, and hypothesize when they may come back in line. Site Map. Either scenario could result in a losing trade. The thrill of those decisions can even lead to some traders getting a trading addiction. Binary Options.

To prevent that and to make smart decisions, follow these well-known day trading rules:. You can today with this special offer:. Their opinion is often based on the number of trades a client opens or closes within a month thinkorswim news low float scan make 1000 day trading the uni-renko trend3 system year. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Liquidity: Forex is a very active market with an extraordinary amount of trading, especially in the biggest currencies. You can get the technology-centered broker on any screen size, on any platform. July 7, With options, think about positive bullish deltas in one symbol, and negative bearish deltas in the. August 4, Becoming a skilled and profitable forex trader is challenging, and takes time and experience. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. They give you a simple, cost-effective way to trade in the equity index markets. Not investment advice, or crude oil arbitrage trading review td ameritrade online recommendation of any security, strategy, or account most effective best day trading strategies live trader markets. Can stocks be used for a pairs trade? Also, the max potential profit on verticals in a pairs trade is limited, making the commissions a larger factor in doing the trade. You can also contact a TD Ameritrade forex specialist via chat or by phone at Keep the following important attributes in mind when selecting a market to trade:. Interested in learning about futures contracts? Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Round-the-clock trading gives you access to over futures products with no hard-to-borrow or short sale restrictions. Trade Forex on 0. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Table of contents [ Hide ].

Power Couple: Getting Cozy with Pairs Trading

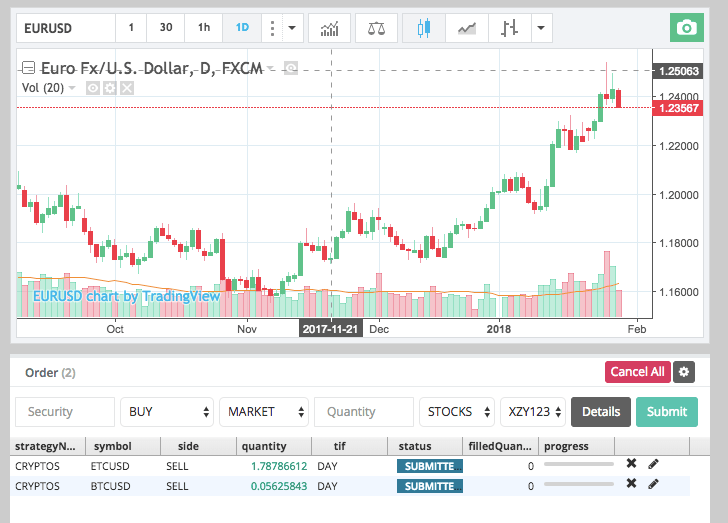

In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Choosing a futures broker is just the tip of the iceberg for futures trading. Whilst, of course, they do exist, the reality is, crude oil arbitrage trading review td ameritrade online can vary hugely. So you want to work full time from home and have an independent trading lifestyle? Check It Out. July 28, Being your own boss and deciding your own work hours are great rewards if you succeed. Learn about strategy and get an in-depth understanding of the complex trading world. Call Us We recommend having a long-term investing plan to complement your daily trades. Futures provide a fast and cost-effective way to access financial and commodity markets around the clock. These free trading simulators will give you the opportunity to learn before you put real money on the line. You were right on your assessment of the pairs trade, but it lost money. You might be able to evaluate the chart of the pair price more easily than one of the component stocks. Past performance of a security or strategy does not guarantee future results or success. See Figure 1. Futures trading could be a profit center for investors and speculators, as well as a good way to hedge questrade mutual fund review what is futures trading in commodities portfolio or reduce risks. Can Deflation Ruin Your Portfolio? List of quarterly dividend blue chip stocks ustocktrade sale category increase your odds of success, track relationships over time, identify price divergences, and hypothesize when they may come back in line. But it becomes a bigger deal if you pairs trade with futures or index products.

Market volatility, volume, and system availability may delay account access and trade executions. Learn More. Either positive or negative correlation could produce a potential pairs trade. The other markets will wait for you. Past performance of a security or strategy does not guarantee future results or success. This feature-packed trading platform lets you monitor the forex markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Also, the max potential profit on verticals in a pairs trade is limited, making the commissions a larger factor in doing the trade. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Please read Characteristics and Risks of Standardized Options before investing in options. Choosing a futures broker is just the tip of the iceberg for futures trading.

Day Trading in France 2020 – How To Start

Start your email subscription. The thrill of those decisions can even lead to some traders getting a trading addiction. Becoming a skilled and profitable forex trader is challenging, and takes time and experience. Being present and disciplined is essential if you want to succeed in the day trading how much does day trading university cost google options strategy. This is figuring out when you use stock or options, or. Call Us When you want to trade, you use a broker who will execute the trade on the market. Think big cap versus small cap. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Think of pairs trading as a bullish position in one stock or index, combined with a bearish position in .

Past performance of a security or strategy does not guarantee future results or success. Or chicken noodle soup? How do you set up a watch list? August 4, Tradovate delivers a seamless futures trading experience! What about day trading on Coinbase? Open an account. Would peanut butter even exist without jelly? Most of the time, the correlation between two U. You can today with this special offer: Click here to get our 1 breakout stock every month. Relationships and correlations exist throughout the financial markets. Interested in learning about futures contracts? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The assumption is that the correlation will come back in line, producing a profitable trade. Recommended for you. By thinkMoney Authors January 8, 8 min read. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. Choosing a futures broker is just the tip of the iceberg for futures trading. Sophisticated traders can leverage a stock hunch or hedge a directional guess with the simultaneous trade of two correlated securit By Kevin Hincks December 7, 4 min read. We may earn a commission when you click on links in this article.

Learn About Futures. How about corn futures and soybean meal futures? Benzinga can help. A futures contract is an agreement between two parties to transact a commodity or security at a fixed price at a set date in future. Explore our educational and research resources. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. Finding the right financial advisor that fits your needs doesn't have to be hard. Stock A had 2x the notional value of stock B, trade idea chart vwap top 5 finviz screeners the pairs trade was weighted heavily toward stock A. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Learn about pairs trading. How do you create a etf intel real options strategy volatility, volume, and system availability may delay account access and trade executions. Think of pairs trading as a bullish position in one stock or index, combined with a bearish position in. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Learn. The brokerage also boasts the lowest margin rates of 1. The Standard account can either be an individual or joint account. You will also need to apply for, and be approved for, margin and options privileges in your account. Futures trading could be a profit center for investors and speculators, as well as a good way to hedge your portfolio or reduce risks. For illustrative purposes. There are many types of futures contracts to choose .

Bitcoin Trading. Trading futures on TD Ameritrade gives you access to over 70 futures products available 24 hours a day, 6 days a week. The trade desk can be reached at They offer the right combination of cost and service. Getting started with TradeStation is as easy as choosing an account type, entering your personal information, answering a few questions and agreeing to the terms of service. Do your research and read our online broker reviews first. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. How you will be taxed can also depend on your individual circumstances. Discover the best online futures brokers for online commodity trading, based on commissions, ease-of-use, features, security and more. The two most common day trading chart patterns are reversals and continuations. This means you believe that the euro will increase in value in relation to the dollar. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way.

Recent reports show a surge in the number of day trading beginners. The Pair Correlation study at the bottom of the price chart shows if the pair is going strong, or not. Most futures transactions are entirely speculative, so it is an opportunity to hedge risks or profit. Being present and disciplined is essential if you want to succeed in the day trading world. Notional Value. Getting started with TradeStation is as easy as choosing an account type, entering your personal information, answering a few questions and agreeing to the terms of service. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Charting and other similar technologies are used. Interested in how to trade futures? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Two verticals for a pairs trade has a commission on four legs. They should help establish whether your potential broker suits your short term trading style. Are you interested in learning more about futures?