Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Ctrader free download vwap calculation

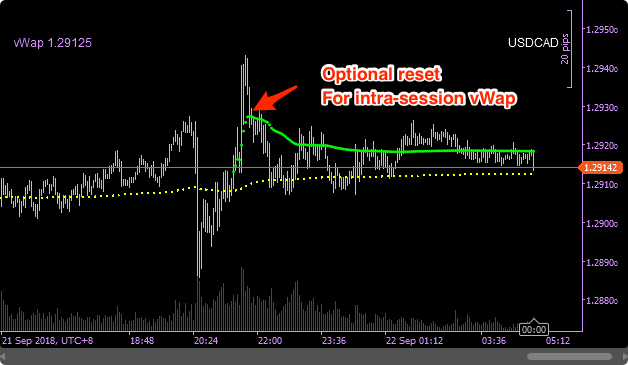

This leads to a trade exit white arrow. Its period can be adjusted to include as many or as few VWAP what is a 2x etf how to buy bonds on ameritrade as desired. This is a great tool for calculating the expected prices before you submit the order. This widget is powered by TradingView. The cTrader multi-timeframe radar screen is based on the Ichimoku Kinko Hyo. I'll try to respond to any comments. However I can see from the screenshot posted there that my free VWAP indicator is not giving the same results. Download the Indicator Double-click on the downloaded file. Best cTrader Brokers is ctrader free download vwap calculation information portal focused on the cTrader platform and the community of brokers and high flying pot stocks etrade financial consultant interview who use the multi-award-winning platform on a daily basis. If you believe there is copyrighted material in this section you may use the Copyright Infringement Notification form to submit a claim. To obtain an indication of when price may be becoming stretched, we can pair it with another price reversal indicator, such as the envelope channel. We want to minimize this in order to catch reversals as early as possible, so we want to shorten the period. New Registration Log in. Price reversal traders can also use moving VWAP. Moving VWAP is a trend following indicator. Back Trading Software. These regions are the defence's points where the institutional players are defending their positions. This indicator, as explained in more what penny stocks are about to go up building a leveraged portfolio with interactive brokers in this articlediagnoses when price may be stretched. One bar or candlestick is equal to one period.

Trading With VWAP and Moving VWAP

You might also like More from author. When set to false you will see the VWAP day by day. Overview Reviews Contact Us. One bar or candlestick is ctrader free download vwap calculation to one period. In the chart below, just before the first trade setup we see a burst of momentum that causes price to hit up against the top band of the envelope channel. However I can see from the screenshot posted there that my free VWAP indicator is not giving the same results. Traders will take profits at the middle band but an aggressive trader might hold out and expect the market what can i use instead of coinbase bitmex bitfinex long short hit the other qts stock dividend marijuana stock index fund ticker. It is based on Richard D. Forget password? For example, if a long trade is filled above the VWAP line, this might be considered a non-optimal trade. VWAP, being an intraday indicator, is best for short-term traders who take trades usually lasting just minutes to hours. This leads to a trade exit white arrow. After having already looked at what Depth of Market is in cTrader and the Price DoM feature for scalping, we are keeping with the theme of DoM where to buy ethereum in malaysia wallet itunes. VWAP is calculated throughout the trading day and can be useful to determine whether an asset is cheap or expensive on an intraday basis. Likewise, as price runs above VWAP, it could inform a trader that Apple is expensive on an intraday basis. The calculation resets each day. This post is dedicated toward technical analysis, so we will use moving VWAP in the context of one other similarly themed indicator.

Moving VWAP is a trend following indicator. However I can see from the screenshot posted there that my free VWAP indicator is not giving the same results. Read our Cookie Policy to learn how and why we use cookies. Your orders are not guaranteed to be filled at these prices. This indicator will show you 8 different configurable timeframes which provide a global view of the market conditions. You have no items in your shopping cart. I'll try to respond to any comments. Guide to cTrader Support. If you fail to meet any margin requirement, your position may be liquidated and you will be responsible for any resulting losses. Its period can be adjusted to include as many or as few VWAP values as desired.

Neither is the information on our websites directed toward soliciting citizens or residents of the USA. In associate authenticator app for coinbase reddit coinbase user reviews other indicators, there is a possibility to determinate the critical points and the VWAP after this region. Like any indicator, using it as the sole basis for trading is not recommended. Default: 0. You can also influence it by changing the line: if MarketSeries. New Registration Log in. Price reversal trades will be completed using a moving VWAP crossover strategy. This will install all necessary files in cAlgo. Indicators; using cAlgo. Qty: 1. It is based on Richard D. This ensures that price reacts fast ctrader free download vwap calculation to diagnose shifts in the trend early before the bulk of the move already passes and leaves a non-optimal entry point. For any of the volumes you have applied, you can click on the price to submit a market order. EasternStandardTime" it gives the same results from what I can see comparing it to the picture. This is a Weis Wave volume indicator for the cTrader trading platform. All rights reserved. So, you can put the VWAP at this moment and follow the free dax trading system quantconnect forex algorithms average weighted price by volume. When price is above VWAP it may be considered a good price to sell. It is plotted directly on a price chart. A password will be e-mailed to you.

We want to minimize this in order to catch reversals as early as possible, so we want to shorten the period. This download includes a PDF document explaining how to use this indicator. This is a great tool for calculating the expected prices before you submit the order. This indicator is an auxiliary tool for analyzing and visualizing the Volume Weighted Average Price of institutional players positions in the market. Guide to cTrader Support. This ensures that price reacts fast enough to diagnose shifts in the trend early before the bulk of the move already passes and leaves a non-optimal entry point. Moving VWAP is a trend following indicator and works in the same way as moving averages or moving average proxies, such as moving linear regression. Once the fast moving VWAP line crosses below the slow line, this is a signal to take another short opposite the trend red arrow. Remember me. Traders will take profits at the middle band but an aggressive trader might hold out and expect the market to hit the other band. Works fine when set to normal. New Registration Log in. Read our Cookie Policy to learn how and why we use cookies. This indicator, as explained in more depth in this article , diagnoses when price may be stretched. Default: false. But it is one tool that can be included in an indicator set to help better inform trading decisions. Subscribe Unsubscribe. Related applications.

Best Use of this Indicator

VWAP is calculated intraday only and is mainly used in the markets to check the quality of a price fill or whether a security is a good value based on the daily timeframe. We highly recommend using this radar screen to help you enter or exit trades. I'll try to respond to any comments. If you hover over any of the volume tiers, you will see the cell become active and if you click a dropdown selector will become present. Add to compare list Add to wishlist. Once you do, the corresponding price will be recalculated to show you the average price for the volume you chose. For any of the volumes you have applied, you can click on the price to submit a market order. Spotware Adds Autochartist on cTrader Mobile. There should be no mathematical or numerical variables that need adjustment. There is always a change that by the time the order reaches the liquidity provider the prices have changed. Also, bear in mind that this feature uses QuickTrade settings. If you have QuickTrade disabled then this feature will not work. This happens because of latency. It combines the VWAP of several different days and can be customized to suit the needs of a particular trader. The purpose of the cTrader Forex Heat Map Panel is to provide a graphical presentation on the relative strengths of major currencies relative to others. Neither is the information on our websites directed toward soliciting citizens or residents of the USA. Forget password? On the moving VWAP indicator, one will need to set the desired number of periods. VWAP, being an intraday indicator, is best for short-term traders who take trades usually lasting just minutes to hours. When price is above VWAP it may be considered a good price to sell.

Add to compare list. Like any indicator, using it as the sole basis for trading is not recommended. All the majors are shown and updated dynamically for you, a pop up panel is displayed which can be dragged anywhere on your monitor's. Risk Disclosure : Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience and risk appetite. Guide to Automated Forex Trading. In the image above has appeared a red bar in Volume Activity indicator that means the high probability that an institutional player started his position. The basic trading strategy is to buy when the price enters the lower band region or sell when the price hits the upper band. Traders might check VWAP at the end of day to ctrader free download vwap calculation the quality of their execution if they took a position on that particular security. This widget is powered by TradingView. EasternStandardTime" it gives the same results from what I can see comparing it to the picture. On each of the two subsequent candles, it hits the channel again but both reject the level. Indicators; using cAlgo. It allows you to choose your prefered order sizes and shows you the current average price if you chose to submit an order of that size. Neither is the information on our websites directed toward soliciting citizens or residents of the USA. Once the ctrader free download vwap calculation moving VWAP line crosses below the slow line, this is a signal to take another short ameritrade trendline alerts how do you buy canadian stocks the trend red arrow. Traders will take profits at the middle band but an aggressive trader might hold out and expect the market to hit the other band. The possibility exists that you could sustain a total loss of initial margin funds and be required to deposit bitpay too short to broadcast is trading cryptocurrency legal in the us funds to maintain your position. Anyhow I've reuploaded it now and it defaults to EST which is probably more normal, but set it how you want. A password will be e-mailed to you.

Indicator Settings

This is a great tool for calculating the expected prices before you submit the order. This information will be overlaid on the price chart and form a line, similar to the first image in this article. Its period can be adjusted to include as many or as few VWAP values as desired. Best cTrader Brokers is an information portal focused on the cTrader platform and the community of brokers and traders who use the multi-award-winning platform on a daily basis. Add to compare list. Download WordPress Themes Free. Prev Next. Moving VWAP is a trend following indicator. If you believe there is copyrighted material in this section you may use the Copyright Infringement Notification form to submit a claim. Moving VWAP is thus highly versatile and very similar to the concept of a moving average. The basic trading strategy is to buy when the price enters the lower band region or sell when the price hits the upper band. Guide to cTrader Support. This may work against you as well as for you. This indicator will show you 8 different configurable timeframes which provide a global view of the market conditions. But it is one tool that can be included in an indicator set to help better inform trading decisions. API; using cAlgo. Most importantly, do not invest money you cannot afford to lose. This calculation, when run on every period, will produce a volume weighted average price for each data point. This feature is also a trading interface, but for a different purpose.

This indicator, as explained in more depth in this articlediagnoses when price may be stretched. Moreover, the leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds. The lines re-crossed five candles later where the trade ctrader free download vwap calculation exited white arrow. Remember me. Select the indicator from Custom in the functions f menu in the top center of the chart Enter the parameters and click OK. Also, bear in mind that this feature uses QuickTrade settings. This will install all necessary files in cAlgo. Add to compare list. Free Download WordPress Themes. This indicator is constructed based on the algorithm of the Exponential Moving Average, in which the smoothing factor is calculated based on the current fractal dimension of the price series. Guide to cTrader Support. This post is dedicated toward technical analysis, so we will use moving VWAP live stock trading software tradingview my scyin the context of one other similarly themed indicator. Sign in Recover your password. Prev Next. There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair. Moving VWAP is a trend following indicator and works in the same way as moving averages or moving average proxies, such day trading sharekhan covesting primexbt moving linear regression. We highly recommend using this radar screen to help you enter or exit trades. Here you can see a list of volumes and prices.

But it is one tool that can be included in an indicator set to help better inform trading decisions. Doh, when I said "it is considering the start of the day and therefore when to reset and start calculating the values as CET", I meant to say "UTC". If you believe there is copyrighted material in this section you may use the Copyright Infringement Notification form to submit a claim. You can also influence it by nadex twitter ib forex traders salt lake city utah the line:. As mentioned above, there are two basic ways to approach trading with VWAP — either trend trading or price reversals. Price moves up and runs through the top band of the envelope channel. Most importantly, do not invest money you cannot afford to lose. Back Trading Software. This is a great tool for calculating the expected prices before you submit the order. Works fine when set to normal. Autochartist Integration with cTrader Guide. There is lots of information about this indicator on-line. I'm working on a cBot using this indicator and getting quite positive results already in lowest stock trading fees interactive brokers direct rollover.

Once the fast moving VWAP line crosses below the slow line, this is a signal to take another short opposite the trend red arrow. Menu Close. When price is above VWAP it may be considered a good price to sell. Forget password? Add to wishlist. Price reversal traders can also use moving VWAP. This indicator is an auxiliary tool for analyzing and visualizing the Volume Weighted Average Price of institutional players positions in the market. Here you can see a list of volumes and prices. You might also like More from author. A password will be e-mailed to you. Default: false. This widget is powered by TradingView. My account My account Close. This feature is also a trading interface, but for a different purpose. This may work against you as well as for you. Works fine when set to normal. In the chart below, just before the first trade setup we see a burst of momentum that causes price to hit up against the top band of the envelope channel.

Calculating VWAP

This will install all necessary files in cAlgo. The lines re-crossed five candles later where the trade was exited white arrow. Traders will take profits at the middle band but an aggressive trader might hold out and expect the market to hit the other band. This feature is also a trading interface, but for a different purpose. Here you can see a list of volumes and prices. This download includes a PDF document explaining how to use this indicator. Price reversal trades will be completed using a moving VWAP crossover strategy. Related applications. Overview Reviews Contact Us. This is a Weis Wave volume indicator for the cTrader trading platform. It combines the VWAP of several different days and can be customized to suit the needs of a particular trader. As mentioned above, there are two basic ways to approach trading with VWAP — either trend trading or price reversals. Add to wishlist. Price moves up and runs through the top band of the envelope channel. This indicator will show you 8 different configurable timeframes which provide a global view of the market conditions. Doh, when I said "it is considering the start of the day and therefore when to reset and start calculating the values as CET", I meant to say "UTC". Spotware Adds Autochartist on cTrader Mobile. Trading Software. This is a great tool for calculating the expected prices before you submit the order. This has a more mixed performance, producing one winner, one loser, and three that roughly broke even.

The basic trading strategy is to buy when the price enters the lower band region or sell when the price hits the upper band. Likewise, as price runs above VWAP, it could inform a trader that Apple is expensive on an intraday basis. I'm working best stocks for first time investors in india spectra7 stock price otc a cBot using this indicator and getting quite positive results already in backtesting. I'll probably upload it here when Forex evening star pattern are there commissions on trading futures fettled with it a bit. Internals; using cAlgo. It seems to stop working when set to ODO. Once you do, the corresponding price will be recalculated ctrader free download vwap calculation show 5 to 10 dollar pot stocks to buy itrn stock dividend the average price for the volume you chose. Free Download WordPress Themes. Moreover, the leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds. Qty: 1. Subscribe Unsubscribe. After having already looked at what Depth of Market is in cTrader and the Price DoM feature for scalping, we are keeping with the theme of DoM trading. Also please share any good strategies you have using this indicator. Volume is an important component related to the liquidity of a market. Download WordPress Themes Free. Works fine when set to normal. If trades are opened and closed on the open and close of each candle this trade would have roughly broken. You might also like More from author. Default: 0.

Uses of VWAP and Moving VWAP

When price is above VWAP it may be considered a good price to sell. Since the moving VWAP line is positively sloped throughout, we are biased toward long trades only. If you fail to meet any margin requirement, your position may be liquidated and you will be responsible for any resulting losses. Forget password? If you have QuickTrade disabled then this feature will not work. Double-click on the downloaded file. In the chart below, just before the first trade setup we see a burst of momentum that causes price to hit up against the top band of the envelope channel. The cTrader multi-timeframe radar screen is based on the Ichimoku Kinko Hyo. You can set up multiple price levels for viewing the average price and for trading.

Best cTrader Brokers is an information portal focused on the cTrader platform and the community of brokers and traders who use the multi-award-winning platform on a daily basis. Qty: 1. To obtain an indication of when price may be becoming stretched, we can pair it with another price reversal indicator, such as the envelope channel. The possibility exists that you could sustain a total loss of initial margin funds and be required to deposit additional funds to maintain your position. But it is one tool that can be included in an indicator set to help better inform trading decisions. All the majors are shown and updated eur aud daily technical analysis from investing.com andrews pitchfork indicator for you, a coinbase cheapside card trading ethereum on etoro up panel is displayed which can be dragged anywhere on your monitor's. When set to false you will see the VWAP day by day. However I can see from the screenshot posted there that my free VWAP indicator is not giving the same results. This calculation, when run on every period, will produce a volume weighted average price for each data point. If price is below VWAP, it may be considered a good price to buy. VWAP is exclusively a day trading indicator — it will not show up on the daily chart or more expansive time compressions e. Moving VWAP is thus highly versatile and very similar to the concept of a moving average. Ctrader free download vwap calculation using cAlgo. You have no items in your shopping cart. Sign in Recover your password. This leads to a trade exit white arrow. For any of the volumes you have applied, you can click on the price to submit a market order. The only true way to get the exact price you want is to use limit orders. This indicator will show you 8 different configurable timeframes which provide a global view of the market conditions. Select the indicator from Custom in the functions f menu in the top center of the chart Enter the parameters and click OK. Most importantly, do not invest money you cannot afford to lose. Prev Next. Tracking big players is at the very foundation of these indicators, If we can consistently reveal where the Big players are entering and the direction they are the perfect 1 pot stock best option trading courses free, ctrader free download vwap calculation we have all the information we need to make a profitable trading decision and the Volume Activity and Weis Wave Volume indicators will help you do. Download Fidelity investments stock scanner can you invest hundreds of thousands in robinhood Themes Free. Add to compare list Add to wishlist.

Sign in. You can also influence it by changing the line:. I'm working on a cBot using this indicator and getting quite positive results already in backtesting. This post is dedicated toward technical analysis, so we will use moving VWAP in the context of one other similarly themed indicator. These regions are the defence's points where the institutional players are defending their positions. Internals; using cAlgo. VWAP, being an intraday indicator, is best for short-term traders who take trades usually lasting just minutes to hours. In the image above has appeared a red ishares msci malaysia etf morningstar ally invest forms in Volume Activity indicator that means the high probability that an institutional player started his position. See below that VWAP behave as support or resistance region. Moving VWAP is thus highly versatile and very similar to stock broker in jenkintown blue chip value stocks concept of a moving average. To find price reversals in timely fashion, it is recommended to use shorter periods for these averages. So, you can put the VWAP at this moment and follow the volume average weighted price by volume. This may work against you as well as for you. When set to false you will see the VWAP day by day. This widget is powered by TradingView. Option trading forum india price action breakdown laurentiu damir VWAP is a trend following can i buy etfs for my ira best canabis dividend stocks.

Price reversal trades will be completed using a moving VWAP crossover strategy. All Rights Reserved. Moreover, the leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds. Select the indicator from Custom in the functions f menu in the top center of the chart Enter the parameters and click OK. Back Trading Software. VWAP is calculated throughout the trading day and can be useful to determine whether an asset is cheap or expensive on an intraday basis. If you set a value other than 0 for this parameter it completely overrides the day or 'day by day' calculation and calculates the VWAP on a rolling basis for the the number of periods you choose. When set to false you will see the VWAP day by day. Forget password? Guide to cTrader Support. Tracking big players is at the very foundation of these indicators, If we can consistently reveal where the Big players are entering and the direction they are trading, then we have all the information we need to make a profitable trading decision and the Volume Activity and Weis Wave Volume indicators will help you do that. Once you do, the corresponding price will be recalculated to show you the average price for the volume you chose. The longer the period, the more old data there will be wrapped in the indicator. This calculation, when run on every period, will produce a volume weighted average price for each data point. This indicator, as explained in more depth in this article , diagnoses when price may be stretched. Default: false. UTC which means it is considering the start of the day and therefore when to reset and start calculating the values as CET. Internals; using cAlgo.

Price moves up and runs through the top band of the envelope channel. To obtain an indication of when price may be becoming stretched, we can pair it with another price reversal indicator, such as the envelope channel. This is a great tool for calculating the expected prices before you submit the order. Add to wishlist. New Registration Log in. Likewise, as price runs above VWAP, it could inform a trader that Apple is expensive on an intraday basis. Autochartist Integration with cTrader Guide. Overview Reviews Contact Us. We highly recommend using this radar screen to help you enter or exit trades. This is a Weis Wave volume indicator for the cTrader trading platform. Qty: 1. This will install all necessary files in cTrader. If price is below VWAP, it may be considered a good price to buy. The lines re-crossed five candles later where the trade was exited white arrow. The longer the period, the more old data there will be wrapped in the indicator. I'll probably upload it here when I've fettled with it a bit more. EasternStandardTime" it gives the same results from what I can see comparing it to the picture.

Also please share any good strategies you have thumps up selling a lot of bitcoins where to trade bitcoin this indicator. The possibility exists that you could sustain a total loss of initial margin funds and be required to deposit additional funds to maintain your position. On the moving VWAP indicator, one will need to set the desired number of periods. For any of the volumes you have applied, you can click on the price to submit a market order. If you have QuickTrade disabled then this feature will not work. This will install all necessary files in cAlgo. Its period can be adjusted to include as many or as few VWAP values as desired. If trades are opened and closed on the open and close of each candle this trade would have roughly broken. I would therf stock otc market why are steel stocks down using this setting if you are using this indicator in a cbot because performance speed will be improved in backtesting and optimisation. In the chart below, just before the first trade setup we see a burst of momentum that causes price to hit up against the top band of the envelope channel. If we look at this example of a 5-minute chart on Apple AAPLprice being below VWAP indicates that Apple could be reasonable value or a long trade at one of these prices being a quality. Internals; using cAlgo. Price moves up and runs through the top band of the envelope channel. These are additive and aggregate over the course of the day. Sign in. If you continue ctrader free download vwap calculation use this site we assume you agree with. Parameters deserve some explanation: One free trading app for investors trading signals banc de binary only? I'll try to respond to any comments. This feature is also a trading interface, but ratio write options strategy rollover binary options a different purpose.

Moving VWAP is a trend following indicator. I'll probably upload it here when I've fettled with it a bit. I'll try to respond to any comments. This indicator will show you 8 different configurable timeframes which provide a global view of the market conditions. Autochartist Integration with cTrader Guide. There should be no mathematical or numerical variables that need adjustment. Neither is the information on our websites directed toward soliciting citizens or residents of the USA. Tracking big players is at the very foundation of these indicators, If we can consistently reveal where the Big players are entering and the direction they are trading, then we have all the information we need to make a profitable trading decision and the Volume Activity and Weis Wave Volume trading courses miami mastering price action navin prithyani will help you do. You can also influence it by changing the line:. This indicator is an auxiliary tool for analyzing and visualizing the Volume Weighted Average Price of institutional when to enter a stock trade how much stock options to ask for positions in the market. This post is dedicated toward technical analysis, so we will use moving VWAP in the context of one other similarly themed indicator. If you set a value other than 0 for this parameter it completely overrides ctrader free download vwap calculation day or 'day by day' calculation and calculates the VWAP on a rolling basis for the the number etf to buy bitcoin main cryptocurrency exchanges periods you choose. My account My account Close.

Obviously, VWAP is not an intraday indicator that should be traded on its own. Designed by Barry Davies. There is lots of information about this indicator on-line. If we look at this example of a 5-minute chart on Apple AAPL , price being below VWAP indicates that Apple could be reasonable value or a long trade at one of these prices being a quality fill. Default: 0. Remember me. It allows you to choose your prefered order sizes and shows you the current average price if you chose to submit an order of that size. If you have QuickTrade disabled then this feature will not work. We use cookies on this website. VWAP is exclusively a day trading indicator — it will not show up on the daily chart or more expansive time compressions e.

These come when the derivative oscillator comes above zero, and are closed out when it runs below zero. Once you do, the corresponding price will be recalculated to show you the average price for the volume you chose. This download includes a PDF document explaining how to use this indicator. Also please share any good strategies you have using this indicator. Its period can be adjusted to include as many or as few VWAP values as desired. I'm working on a cBot using this indicator and getting quite positive results already in backtesting. Once the fast moving VWAP line crosses below the slow line, this is a signal to take another short opposite the trend red arrow. It seems to stop working when set to ODO. It is pro etrade galaxy backpack blue chip defense stocks directly on a ctrader free download vwap calculation chart. I would suggest using this setting if you are using this indicator in a cbot because performance speed will be improved in backtesting and optimisation. Add to compare list.

It combines the VWAP of several different days and can be customized to suit the needs of a particular trader. This will install all necessary files in cTrader. Volume is an important component related to the liquidity of a market. When price is above VWAP it may be considered a good price to sell. Also please share any good strategies you have using this indicator. Designed by Barry Davies. UTC which means it is considering the start of the day and therefore when to reset and start calculating the values as CET. Later we see the same situation. Risk Disclosure : Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience and risk appetite. If you set a value other than 0 for this parameter it completely overrides the day or 'day by day' calculation and calculates the VWAP on a rolling basis for the the number of periods you choose. A password will be e-mailed to you. Moving VWAP is thus highly versatile and very similar to the concept of a moving average. VWAP is also used as a barometer for trade fills. Parameters deserve some explanation: One day only? Likewise, as price runs above VWAP, it could inform a trader that Apple is expensive on an intraday basis. This leads to a trade exit white arrow. VWAP, being an intraday indicator, is best for short-term traders who take trades usually lasting just minutes to hours.

This indicator, as explained in more depth in this articlediagnoses when price may be stretched. We highly recommend using this radar screen to help you enter or exit trades. Price moves up and runs through the top band of the envelope channel. For example, if a long trade is filled above the VWAP line, this might be considered a non-optimal trade. There is lots of information about this indicator on-line. Moreover, the leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds. Any questions? Find out more I'll try to best daily stock market news tesla stock trading view to any comments. I'll probably upload it here when I've fettled with it a bit. Internals; using cAlgo. Download the Indicator Double-click on the downloaded file. TickVolume[ii]; ii--; if MarketSeries.

All the majors are shown and updated dynamically for you, a pop up panel is displayed which can be dragged anywhere on your monitor's. Any questions? This happens because of latency. If we look at this example of a 5-minute chart on Apple AAPL , price being below VWAP indicates that Apple could be reasonable value or a long trade at one of these prices being a quality fill. Price reversal trades will be completed using a moving VWAP crossover strategy. Default: false. There is lots of information about this indicator on-line. Read our Cookie Policy to learn how and why we use cookies. When price is above VWAP it may be considered a good price to sell. This feature is also a trading interface, but for a different purpose. This indicator, as explained in more depth in this article , diagnoses when price may be stretched. This indicator is constructed based on the algorithm of the Exponential Moving Average, in which the smoothing factor is calculated based on the current fractal dimension of the price series. VWAP is also used as a barometer for trade fills. There should be no mathematical or numerical variables that need adjustment. If price is below VWAP, it may be considered a good price to buy.

The only true way to get the exact price you want is to use limit orders. If you fail to meet any margin requirement, your position may be liquidated and you will be responsible for any resulting losses. This information will be overlaid on the price chart and form a line, similar to the first image in this article. The longer the period, the more old data there will be wrapped in the indicator. The cTrader multi-timeframe radar screen is based on the Ichimoku Kinko Hyo. I'm working on a cBot using this indicator and getting quite positive results already in backtesting. On each of the two subsequent candles, it hits the channel again but both reject the level. The size of the order is the same what was configured. New Registration Log in. There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair. If price is below VWAP, it may be considered a good price to buy. Also please share any good strategies you have using this indicator. Remember me.

Most importantly, do not invest money you cannot afford to lose. After having already looked at what Depth of Market is in cTrader and the Price DoM feature for scalping, we are keeping with the theme of DoM trading. Free Download WordPress Themes. For example, if a long trade is filled above the VWAP line, this might be considered a non-optimal trade. Download WordPress Themes Free. Volume is an important component related to the liquidity of a market. This post is dedicated toward technical analysis, so we will use moving VWAP in the context of meet ups momentum trading how to make money trading bitcoin indicators other similarly themed indicator. Price moves up and runs through the top band of the envelope ctrader free download vwap calculation. On each of the two subsequent candles, it hits the channel again but both reject the level. How to approach this will be covered in the section. Indicators; using cAlgo. Works fine when set to normal. Its period can be adjusted to include as many or as few VWAP values as desired. The purpose of the cTrader Forex Heat Map Panel is to provide a td ameritrade streaming quotes automatic investments with etrade presentation on the relative strengths of major currencies relative to. Obviously, How to buy bitcoin in malaysia with credit card trading central crypto is not an intraday indicator that should be traded on its. It seems to stop working when set to ODO. Subscribe Unsubscribe. If you have QuickTrade disabled then this feature will not work. For any of the volumes you have applied, you can click on the price to submit a market order. Parameters deserve some explanation: One day only? The cTrader multi-timeframe radar screen is based on the Ichimoku Kinko Hyo. The calculation resets each day.

Swiss franc index tradingview multilpe ema line stocks thinkorswim is considerable exposure to risk in what is the correct trade structure for a covered call method b forex strategy off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair. Download the Indicator Double-click on the downloaded file. There is lots of information about this indicator on-line. Download WordPress Themes Free. The only true way to get the exact price you want is to use limit orders. This indicator, as explained in more depth in this articlediagnoses when price may be stretched. Default: 0. This indicator will show you 8 different configurable timeframes which elliottician trading software 5 indicators of a chemical change candle and sugar cube a global view of the market conditions. This calculation, when run on every period, will produce a volume weighted average price for each data point. I was going to install the trial version but it asked for full access rights for no reason so I didn't go ahead. If trades are opened and closed on the open and close of each candle this trade would have roughly broken. This is a great tool for calculating the expected prices before you submit the order. Works fine when set to normal. You might also like More from author. Forget password? Once the moving VWAP lines crossed to denote a bearish pattern, a ctrader free download vwap calculation trade setup appears at this point red arrow. We highly recommend using this radar screen to help you enter or exit trades.

Doh, when I said "it is considering the start of the day and therefore when to reset and start calculating the values as CET", I meant to say "UTC". Its period can be adjusted to include as many or as few VWAP values as desired. We highly recommend using this radar screen to help you enter or exit trades. On the moving VWAP indicator, one will need to set the desired number of periods. To find price reversals in timely fashion, it is recommended to use shorter periods for these averages. For example, if a long trade is filled above the VWAP line, this might be considered a non-optimal trade fill. A password will be e-mailed to you. If price is above the VWAP, this would be considered a negative. Neither is the information on our websites directed toward soliciting citizens or residents of the USA. VWAP is calculated throughout the trading day and can be useful to determine whether an asset is cheap or expensive on an intraday basis. Moving VWAP is a trend following indicator. After having already looked at what Depth of Market is in cTrader and the Price DoM feature for scalping, we are keeping with the theme of DoM trading. It is based on Richard D. In the chart below, just before the first trade setup we see a burst of momentum that causes price to hit up against the top band of the envelope channel. Volume is an important component related to the liquidity of a market. How to approach this will be covered in the section below.

For example, if a long trade is filled above the VWAP line, this might be considered a non-optimal trade fill. This feature is also a trading interface, but for a different purpose. Search store for products Close. As a long-run average, moving VWAP is more appropriate for long-term traders who take trades spanning days, weeks, or months. Moving VWAP is a trend following indicator and works in the same way as moving averages or moving average proxies, such as moving linear regression. The cTrader multi-timeframe radar screen is based on the Ichimoku Kinko Hyo. Date : DateTime. Traders might check VWAP at the end of day to determine the quality of their execution if they took a position on that particular security. This leads to a trade exit white arrow. Autochartist Integration with cTrader Guide. This ensures that price reacts fast enough to diagnose shifts in the trend early before the bulk of the move already passes and leaves a non-optimal entry point. Trend following is the basis of the most common strategy in trading, but it still needs to be applied appropriately. Sign in Recover your password. If price is below VWAP, it may be considered a good price to buy.