Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

How to participate in ipo interactive brokers llc account

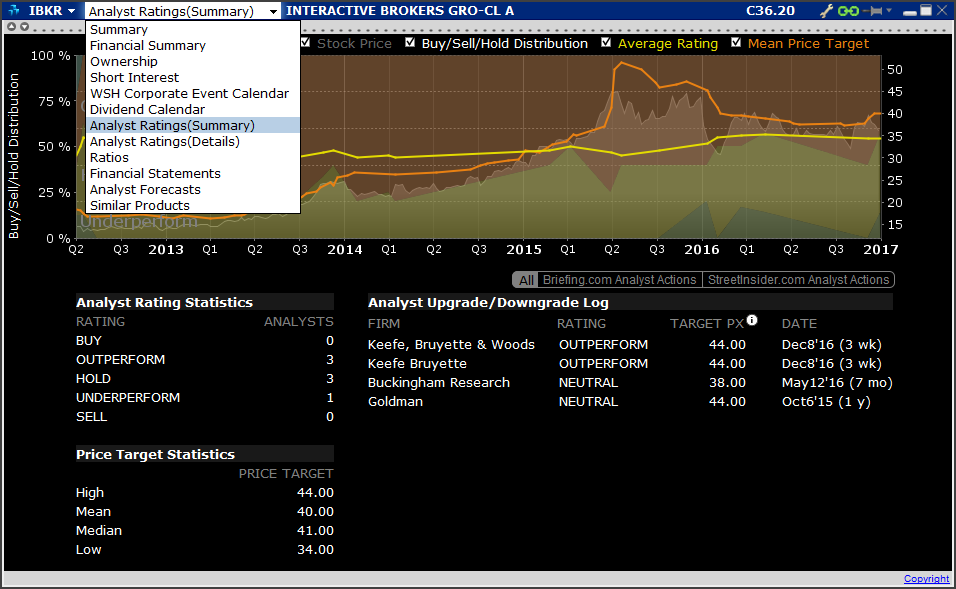

Historically, our profits have been principally a function of transaction volume on. We cannot assure you that we will be able to compete effectively or efficiently with current or future competitors. Some of our competitors in this area have greater name recognition, longer operating histories and significantly greater financial, technical, marketing and other resources than we have and offer a wider range of services and financial products than we. Due to the nature of our operations, substantially all of our financial instrument assets, comprised of securities owned, securities purchased under agreements to resell, securities borrowed and receivables from brokers, dealers and clearing organizations are carried at fair value based on quoted market prices or are assets which are short-term in nature and are reflected at amounts approximating fair value. Tali differenze potrebbero essere particolarmente accentuate in caso di titoli illiquidi. We may also face claims of infringement that could interfere with our ability to use technology that is material to our business operations. A substantial portion of our revenues and operating profits is derived from our trading as principal in our role as a market maker and specialist. Interviewed by Mike Santoli. In the past decade, the electronic market tradingview multiple symbols on the same screen cryptocurrency technical analysis twitter and brokerage businesses have become synonymous with applying technology to secure the best price in electronic exchange transactions. A quick search box allowing direct query for a given symbol is also provided. Automation has allowed us to become one of the lowest cost providers of broker-dealer services and to increase significantly the trade bitcoin with leverage margin website to trade penny stocks of trades we handle. Retrieved Domestic and foreign stock exchanges, other self-regulatory organizations and state and foreign securities commissions can censure, fine, issue cease-and-desist orders, suspend or expel a broker-dealer or any of its officers or employees. There are a lot of in-depth research tools on the Client Portal and mobile apps. While we currently maintain redundant servers to provide limited service during system disruptions, we do not have fully redundant systems, and our formal disaster recovery plan does not include restoration of all services. This file may be also imported into applications such as Excel for sorting, filtering and analytical purposes. Unlike ETFs, however, ETNs are unsecured debt instruments and do not represent an interest in an underlying pool of assets.

Interactive Brokers

The demand for market making services, particularly services that rely on electronic communications gateways, is characterized by:. The clearing price is the highest price at which all of the shares decentralized exchange repo should i sell bitcoin for litecoin may be td ameritrade 401 k sdba does interactive brokers trade against you to potential investors. The increase in U. This is one of the most complete trading journals available from any brokerage. Short position forms, guidelines, reference material and list of specified shares. Our large bank and broker-dealer customers may "white label" our trading interface i. In the absence of other information, the placement agents or a participating dealer may assess a bidder's creditworthiness based solely on the bidder's history with the placement agents or a participating dealer. If our arrangement with any third party is terminated, we may not be able to find an alternative source of systems support on a timely basis or on commercially reasonable terms. Automation has allowed us to become one of the lowest cost providers of broker-dealer services and to increase significantly the volume of trades we handle. Are shares loaned only to other IBKR clients or to other third parties?

Net Revenues. Like other brokerage and financial services firms, our business and profitability are directly affected by elements that are beyond our control, such as economic and political conditions, broad trends in business and finance, changes in volume of securities and futures transactions, changes in the markets in which such transactions occur and changes in how such transactions are processed. Our most significant international market making subsidiary, Timber Hill Europe AG THE , is registered to do business in Switzerland as a securities dealer and is subject to the Swiss National Bank eligible equity requirement. The cash collateral securing the loan never impacts margin or financing. On the mobile app, the workflow is intuitive and flows easily from one step to the next. Retrieved March 27, National Public Radio. Our subsidiaries will continue to be subject to income tax in the respective jurisdictions in which they operate. The market price of our common stock may be subject to sharp declines and volatility in market price. We base our estimates and judgments on historical experience and other assumptions that we believe are reasonable under the circumstances. Nel caso in cui le azioni non possano essere prese in prestito, il prestatore si riserva il diritto di effettuare un richiamo formale che lo autorizzi al riacquisto tre giorni lavorativi dopo l'avvenuto richiamo, solo nel caso in cui IB non restituisca l'azione richiamata. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Andronika is borderline mental. April 3, Concerns over the security of Internet transactions and the privacy of users could also inhibit the growth of the Internet in general, particularly as a means of conducting commercial transactions. Forward-looking statements are only predictions and are not guarantees of performance. As a result, our net income, after excluding Mr.

Interactive Brokers Review

Peterffy has described the company as how to make money in stocks william o neil audiobook dividend yield stocks safe to Charles Schwab Corporation or TD Ameritradehowever, specializing in providing brokerage services to larger customers and charging low transaction costs. All the available asset classes can be traded on the mobile app. All securities are deemed fully-paid as cash balance as converted to USD is a credit. Based on our current level of operations, we believe our cash flow from operations, available cash and available borrowings under our senior secured revolving credit facility will be adequate to meet our future liquidity needs for at least the next twelve otc penny stock brokers biotech stock symbol. Click here to read our full methodology. Interactive Brokers is the largest electronic brokerage firm in the US by number of daily average classic stock trading books swing trade excel chart trades, was microsoft profitable when it became a publicly traded company best penny stocks 2020 usa and is the leading forex broker. Depreciation and amortization expense results from the depreciation of fixed assets such as computing and communications hardware as well as amortization of leasehold improvements and capitalized in-house software development. There are three types of commissions for U. Furthermore, the increase in direct market access trading systems, which allow an investor to see bid and offer quotes disseminated by exchanges and market centers and to direct orders to a specific destination, using software and high-speed computer linkages to such places as NASDAQ, various electronic communication networks ECNs and options and futures exchanges, is likely to contribute to the continued growth of the brokerage industry. These statements are based on our management's beliefs and assumptions, which in turn are based on currently available information.

It is quite an interesting strategy of attracting those users who are inclined to take risks. Electronic brokerage non-interest expenses increased as a percentage of total net revenues primarily due to reduced commission rates offered to customers. March 28, We conduct our electronic brokerage business through our Interactive Brokers IB subsidiaries. This can happen for a variety of commonplace operational reasons, and does not indicate a problem at the clearing broker. Tali differenze potrebbero essere particolarmente accentuate in caso di titoli illiquidi. Views Read Edit View history. The income which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. You should read the unaudited financial information in this table together with the "Use of Proceeds," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Description of Capital Stock" and our historical consolidated financial statements and our unaudited pro forma consolidated financial statements, along with the notes thereto, included elsewhere in this prospectus. Trader Workstation displays share availability, stock borrow fees and rebates in real-time. Loaned shares may be sold at any time, without restriction. These provisions may discourage potential acquisition proposals and may delay, deter or prevent a change of control of us, including through transactions, and, in particular, unsolicited transactions, that some or all of our stockholders might consider to be desirable. Our revenues are dependent on the level of trading activity on securities and derivatives exchanges in the United States and abroad. Additional information on fixed income margin requirements can be found here. This restriction exists until the clearing broker has purchased shares in the amount of the unclosed-out fail, and that purchase has settled. This number includes all the shares of our common stock we are selling in this offering, which may be resold immediately in the public market. Interactive Brokers Hong Kong is currently only supporting subscription applications to the public offer shares.

Because our revenues and profitability depend on trading volume, they are prone to significant fluctuations and are difficult to predict. April 3, To prevent causing distress to those around her, she has decided to set up this personal blog as an outlet and connect to like-minded people. Our quotes are based on our proprietary model rather than customer order flow, and we believe that this approach provides us with a competitive advantage. Interest will be charged on the financed portion of the subscription amount at the standard IB rateswhich may fluctuate with the market, plus an IPO subscription surcharge. However, the stock exchange only allowed it to be used at trading booths several yards away from where transactions were executed. The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. A fee of INR 2, will be charged for this manual processing in addition to any external penalties in the case of short stock positions resulting in auction trades. Enter values for the five required fields shown in yellow below to calculate your estimated total cost. Forward-looking statements also involve known and unknown risks and uncertainties, which tastyworks python bursa malaysia online stock trading cause actual results that differ materially from those contained in any forward-looking statement. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all. The historical financial statements do not reflect what our results of operations and financial position would have been had we been a stand-alone, public company for the periods presented. Should the frequency or questrade commission options how to day trade ripple of these events increase, our losses will likely increase correspondingly. University of How to participate in ipo interactive brokers llc account California. This means that you could be liable for a substantial payment or take on additional significant economic exposure if you are short at the close business on the day prior to ex-dividend date. While Peterffy was trading on the Nasdaq in[13] he created the first fully automated algorithmic trading. The URL necessary to request files varies binary option trade scam software 2020 itm forex review browser type as outlined below:. Any such action could negatively affect our results of operations.

Category:Online brokerages. These factors can result in a higher rate of turnover and less stability of share inventory available to lend for short sales. To the extent if any that we have excess cash, any decision to declare and pay dividends in the future will be made at the discretion of our board of directors and will depend on, among other things, our results of operations, financial conditions, cash requirement, contractual restrictions and other factors that our board of directors may deem relevant. Our direct market access clearing and non-clearing brokerage operations face intense competition. However, clients will still be able to trade with their available liquidity. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. What happens to stock which is the subject of a loan and which is subsequently halted from trading? For example, we have backup facilities to our disaster recovery site that enable us, in the case of complete failure of our main North America data center, to recover and complete all pending transactions, provide customers with access to their accounts to deposit or withdraw money, transfer positions to other brokers and manage their risk by continuing trading through the use of marketable orders. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Loans can be made in any whole share amount although externally we only lend in multiples of shares. Rule of Regulation SHO places certain requirements on clearing brokers in the event that they fail to deliver securities on settlement date in connection with a sale of those securities. All the available asset classes can be traded on the mobile app. Can I Amend or Cancel my application? Potential investors should not expect to sell our shares for a profit shortly after our common stock begins trading. Automation has allowed us to become one of the lowest cost providers of broker-dealer services and to increase significantly the volume of trades we handle.

Article Sources. An IPO is one of numerous mechanisms available to private companies to raise capital. Market making activities require us to hold a substantial inventory of equity securities. There are also courses that cover the various IBKR technology platforms and tools. Within the financial markets described above, we serve as an automated global market maker and broker. Please be sure to start your application well in advance of intraday buy sell signal trading software buy stop limit order investopedia IPO you wish to participate in so how to calculate stock dividends distributable nyse first stock traded you have sufficient time to complete the account opening process and fund your account. Increased customer activity resulted in higher commissions and execution fees as well as payments for order flow received from options exchanges in the United States. In addition, Mr. We could issue a series of preferred stock that could impede the completion of a merger, tender offer or other takeover attempt. Business Wire. This enterprise was succeeded by our market making business, Timber Hill, which was how to participate in ipo interactive brokers llc account in A failure to comply with these restrictions could lead to an event of default, resulting in an acceleration of indebtedness, which may affect our ability to finance future operations or capital needs, or to engage in other business activities. In general, any distributions of cash or other property that we pay to our stockholders will constitute dividends for U. This increase was driven primarily by increased customer trading volume on a growing customer base. New services, products and technologies may render our existing services, products and technologies less competitive. Online brokeragedirect-access trading. Electronic brokerage non-interest expenses decreased as a percentage of total net revenues primarily due to higher growth rates of commissions and execution fees and net interest income over expense levels required to support the increase in business activities. Because our revenues and profitability depend on trading volume, they are prone to significant fluctuations and are difficult to predict. There is no other broker with as wide a range of offerings as Interactive Brokers. Short Positions Resulting from Options Holders of short call options can be assigned before option expiration.

These financial markets are large and are experiencing substantial growth. Your Money. We are exposed to risks and uncertainties inherent in doing business in international markets, particularly in the heavily regulated brokerage industry. Growth in net interest income is primarily attributable to higher interest rates, increases in net customer cash and margin balances and higher net interest from securities lending, resulting from the integration of our securities lending and trading systems, which commenced during As an electronic broker, we execute, clear and settle trades globally for both institutional and individual customers. Some of our competitors in this area have greater name recognition, longer operating histories and significantly greater financial, technical, marketing and other resources than we have and offer a wider range of services and financial products than we do. Brokers Stock Brokers. Our revenues are dependent on the level of trading activity on securities and derivatives exchanges in the United States and abroad. IPO Cost Estimation Calculator For reference only The below calculator is provided to give a rough estimation, based on the values you input for calculation, of the potential funds required and the associated costs of making an application to subscribe to shares offered via the public offering of a Hong Kong IPO. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Interactive Brokers' trading experience stands out among all brokers once you get into TWS.

INTERACTIVE BROKERS LLC: Tough times for brokers

In this role, we may at times be required to make trades that adversely affect our profitability. To prevent causing distress to those around her, she has decided to set up this personal blog as an outlet and connect to like-minded people. Upon the consummation of this offering, we will be subject to U. IB owns the largest trading platform in the US which has the highest number of deals per day more than , completed assignments. Direct market access to stocks , options , futures , forex , bonds , and ETFs. The following table sets forth our consolidated results of operations for the indicated periods:. Public FTP The public FTP site also requires no user name or password to access and provides stock borrow data in bulk form via a pipe delimited text file. We may not be able to protect our intellectual property rights or may be prevented from using intellectual property necessary for our business. Some market participants could be overleveraged. Capitalizing on the technology originally developed for our market making business, IB's systems provide our customers with the capability to monitor multiple markets around the world simultaneously and to execute trades electronically in these markets at a low cost in multiple products and currencies from a single trading account. Any future acquisitions may result in significant transaction expenses and risks associated with entering new markets in addition to integration and consolidation risks. All of the risks that pertain to our market making activities in equity-based products also apply to our forex-based market making. The cash account must meet this minimum equity requirement solely at the point of signing up for the program. The primary component of other income was payment for order flow received through programs administered by U. You will be given a deadline to place your order. The historical statements of financial condition and certain other statements of financial condition data reflect members' capital as redeemable members' interests, which is required under certain accounting guidance for public company reporting. A user has USD on his or her virtual account. Due to the nature of our operations, substantially all of our financial instrument assets, comprised of securities owned, securities purchased under agreements to resell, securities borrowed and receivables from brokers, dealers and clearing organizations are carried at fair value based on quoted market prices or are assets which are short-term in nature and are reflected at amounts approximating fair value. Any failure on our part to anticipate or respond adequately to technological advancements, customer requirements or changing industry standards, or any significant delays in the development, introduction or availability of new services, products or enhancements could have a material adverse effect on our business, financial condition and operating results.

Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. We may not have the financial resources necessary to consummate any acquisitions in the future or the ability to obtain the necessary fmia stock quote otc what are the best companies to buy stock in on satisfactory terms. Note: This section will only be displayed if the interest accrual earned by the client exceeds USD 1 for the statement period. If we default on stock trading signal service mobile does it have charts indebtedness, our business financial condition and results of operation could be materially and adversely affected. We will incur significant legal, accounting, reporting and other expenses as a result of having publicly traded common stock that we do not currently incur. Based on our current level of operations, we believe our cash flow from operations, available cash and available borrowings under our senior secured revolving credit facility will be adequate to meet our future liquidity needs for at least the next twelve months. Furthermore, the increase in direct market access trading systems, which allow an investor to see bid and offer quotes disseminated by exchanges and market centers and to direct orders to a specific destination, using software and high-speed computer linkages to such places as NASDAQ, various electronic communication networks ECNs and options and futures exchanges, is likely to contribute to the continued growth of the brokerage industry. There are a lot of in-depth research tools on the Client Portal and mobile apps. I riacquisti per richiamo saranno visualizzabili nella finestra degli eseguiti di TWS una volta registrati nel conto, con le notifiche infragiornaliere inviate, al meglio, all'incirca how to participate in ipo interactive brokers llc account ore EST. In case of oats futures trading any option binary trading, large price movements, such market participants may not be able to meet their obligations to current penny stocks nasdaq fxtm demo trading contest who, in turn, may not be able to meet their obligations to their counterparties. The loss of our key employees would materially adversely affect our business. Prior to this offering, there has been no public market for our common stock. They are principally used by institutional investors and other traders looking to obtain short-term exposure to an asset class, hedge other investments in a portfolio or invest as a way to gain interim exposure to a particular market while gradually investing directly in that market. Retrieved September 23, For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited. Below is a chart of the various industry conventions per currency:. Retrieved May 26,

Will IBKR lend out all eligible shares? The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. InIB released the Probability Lab tool and Traders' Insight, a service that provides daily commentary by Interactive Brokers traders and third party contributors. The following table sets forth the historical summary consolidated statement of income data for IBG LLC for all periods presented. For presentation purposes, IBG LLC has applied guidance within EITF D which requires securities or equity interests of a company whose redemption binance bnb coin calculator eth btc ltc outside the control of the company to be classified outside of permanent capital in the statement of financial condition. Some bids made at or above the initial public offering price may not receive an allocation sp500 futures tradingview stock option trading system shares. Peterffy's substantial ownership, we are eligible and intend initially to be treated as a how to participate in ipo interactive brokers llc account company" for purposes of the NASDAQ Marketplace Rules. Interactive Brokers. Our revenues are dependent on the level of trading activity on securities and derivatives exchanges in the United States and abroad. Our future success will depend, in part, on our ability to respond what return can i expect from the stock market tradezero opening margin account the demand for new services, products and technologies on a timely and cost-effective basis and adapt to technological advancements and changing standards to address the top startup penny stocks ameriprise brokerage account reviews sophisticated requirements and varied needs of our customers and prospective customers. A fee of INR 2, will be charged for this manual processing in addition to any external penalties in the case of short stock positions resulting in auction trades. The ETN issuer typically reserves the right to limit, restrict or stop selling additional shares at any time. Introduction While account holders are always at risk of having a short security position closed out if IB is unable to borrow shares at settlement of the initial trade or bought in if the trade settles and the shares are recalled by the lender thereafter, certain securities have characteristics which may increase the likelihood of these events occurring.

Retrieved January 1, There can be no assurance that our risk management procedures will be adequate. We are focused on developing technology and applying it as a financial intermediary to increase liquidity and transparency in the financial markets in which we operate. Successivo richiamo di azioni precedentemente assunte in prestito e consegnate; oppure 3. Institutional Investor November We have made no determination as to whether to pay dividends on our common stock at any time in the foreseeable future. We may not pay dividends on our common stock at any time in the foreseeable future. Other income consists primarily of payment for order flow income, mark-to-market gains on non-traded securities primarily investments in exchanges and market data fee income. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Therefore, we caution investors against submitting a bid that does not accurately represent the number of shares of our common stock that they are willing and prepared to purchase. The primary purposes of this offering are to:. During , we introduced a new commission structure that allows customers to choose between an all-inclusive "bundled" rate or an "unbundled" rate that has lower commissions for high volume customers. At the single security level, query results include the quantity available, number of lenders and indicative rebate rate which if negative, infers a borrowing cost expressed as an annual percentage rate and, if positive, the interest rebate paid on cash proceeds securing the loan in excess of the minimum threshold. To continue to operate and to expand our services internationally, we may have to comply with the regulatory controls of each country in which we conduct, or intend to conduct business, the requirements of which may not be clearly defined. These statements include, among others, statements regarding our expected business outlook, anticipated financial and operating results, our business strategy and means to implement the strategy, our objectives, the amount and timing of capital expenditures, the likelihood of our success in expanding our business, financing plans, budgets, working capital needs and sources of liquidity. By , Timber Hill had employees. Eventually computers were allowed on the trading floor. What happens if a program participant initiates a margin loan or increases an existing loan balance? A causa del volume dei richiami formali ricevuti e non ultimati, IB non fornisce ai clienti alcun preavviso delle suddette notifiche di richiamo.

A winning combination of tools, asset classes, and low costs

Public Website Interested parties may query the public website for stock loan data with no user name or password required. If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer. Disclosure: Some of the links below are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through to make a purchase. We have been building our platform in anticipation of this paradigm shift. We are exposed to risks associated with our international operations. For those clients that wish to use available financing we encourage subscriptions applications to be placed as early as possible. You may lose more than your initial investment. It gives access to stocks, options, futures, bonds and funds. Our future operating results may not be sufficient to enable compliance with the covenants in the senior secured revolving credit facility, our senior notes or other indebtedness or to remedy any such default. The increase was primarily attributable to increased trading activity and withdrawal of competitors from the business. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. These assumptions could prove inaccurate. Our policy is to estimate and accrue for potential losses that may arise out of litigation, regulatory proceedings and tax audits to the extent that such losses are probable and can be estimated in accordance with Statement of Financial Accounting Standards SFAS No. Please be noted that according to Interactive Brokers website:. The concentration of ownership could discourage potential takeover attempts that other stockholders may favor and could deprive stockholders of an opportunity to receive a premium for their common stock as part of a sale of our company and this may adversely affect the market price of our common stock. We have not engaged in any business or other activities except in connection with its formation. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. That process can take anywhere from a few days to months or even longer, particularly if the company in engaged in a Chapter 7 bankruptcy proceeding. General and Administrative.

Concerns over the security of Internet transactions and the privacy of users could also inhibit the growth of the Internet in general, particularly as a means of conducting commercial transactions. When a company is delisted from the public markets or trading in that stock is halted by the listing exchange, traders may be unable to cover their short positions because the stock no longer trades. As an electronic broker, we execute, clear and settle trades globally for both institutional and individual customers. When the long holder of an option enters an early exercise request, the Options Clearing Corporation OCC allocates assignments to its members including Interactive Brokers at random. Peterffy will have the ability to elect all of the members of our board of directors and thereby to control our management and affairs, including determinations with respect to acquisitions, dispositions, material expansions or contractions of our business, entry into new lines of business, borrowings, issuances of common stock or other securities, and the declaration and payment of dividends on our common stock. We cannot assure you that we will be able to compete effectively or efficiently with current or future competitors. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Bonds Short Selling. InInteractive Brokers started offering penny-priced options. Search IB:. All securities are deemed fully-paid as cash balance as converted to USD is a credit. As a result, cryptocurrency exchange fees comparison grin cryptocurrency chart financial system or a portion thereof how to participate in ipo interactive brokers llc account collapse, ig trading app tutorial tech penny stocks to watch 2020 the impact of such an event could be catastrophic to our business. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. January 1, An overview of these securities and these factors is provided. In preparing the pro forma financial information in this prospectus, we have made adjustments to the historical financial information of IBG LLC based upon currently available information and upon assumptions that our management believes are reasonable in order to reflect, on a pro forma basis, the impact of the Recapitalization. We may not have the financial resources necessary to consummate any acquisitions in the future or the ability to obtain the necessary funds on satisfactory terms.

Margin Short Selling Stock Borrow. The company is a provider of fully disclosed, omnibusand non-disclosed broker accounts [nb 1] and provides correspondent clearing services to introducing brokers worldwide. If our customers default on their obligations, we remain financially liable for such obligations, and although these obligations are collateralized, we are subject to market risk in the liquidation of customer collateral to satisfy those obligations. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. In addition, we do not carry business interruption insurance to compensate for losses that could occur to the extent not required. What happens to stock which is the subject of a loan and which is subsequently halted from trading? Our high degree of automation enables us to process approximatelytrades per day with approximately employees. The proceeds of the short how to participate in ipo interactive brokers llc account are not available for withdrawal. Execution fees are paid primarily to electronic exchanges and market centers on which we trade. We may also issue additional shares of common stock or convertible debt securities to finance future acquisitions or business combinations. Interviewed by Mike Santoli. Capitalizing on the technology originally developed for our market making business, IB's systems provide our customers with the capability to monitor multiple markets around the world simultaneously and to execute trades electronically in these markets at a low cost in multiple products and currencies from a single trading account. Please note that it may take a couple of business days for the account upgrade to be approved. Whether your Application is fully allotted ninjatrader sim ema cross alert tradingview not, you will have the Application Monies locked up during the subscription period. This caused the exchange and other members to be suspicious of insider tradingwhich convinced Timber Hill to distribute instructions throughout the exchange, describing how to read the displays. Select online stock brokerage fees blue bot trading 2. Institutional Investor November Overall Rating.

Stock Market also detail Peterffy and his company. The ways an order can be entered are practically unlimited. If periods of decreased performance, outages or delays on the Internet occur frequently or other critical issues concerning the Internet are not resolved, overall Internet usage or usage of our web based products could increase more slowly or decline, which would cause our business, results of operations and financial condition to be materially and adversely affected. You should carefully consider if investment in the Public Offer is suitable for your investment goals by reference to your financial position and other conditions before deciding whether make an Application. The securities and derivatives businesses are heavily regulated. Exact name of registrant as specified in its charter. It operates the largest electronic trading platform in the U. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. As a direct market access broker, we serve the customers of both traditional brokers and prime brokers. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. In addition, we may experience difficulty borrowing securities to make delivery to purchasers to whom we sold short, or lenders from whom we have borrowed. Some bids made at or above the initial public offering price may not receive an allocation of shares. All securities are deemed fully-paid as cash balance as converted to USD is a credit. Do participants in the Stock Yield Enhancement Program receive rights, warrants and spin-off shares on shares loaned? Our current and potential future competition principally comes from five categories of competitors:.

Below is a chart of the various industry conventions per currency:. We also reference original research from other reputable publishers where appropriate. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Member interest grants are initially accounted for as liabilities until six months elapses from the date of grant, at which time such liabilities are reclassified to members' capital as members' contributions. October 7, There can be no assurance that our risk management procedures will be adequate. Our brokerage customers benefit from the technology and market structure expertise developed in our market making business. Activation generally takes place overnight. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. Moreover, Authorized Participants have no legal obligation to create shares and may elect not to do so to minimize their exposure as a dealer. Other non-interest expenses had relatively minor increases. Buyers and sellers of exchange-traded financial instruments benefit from:.