Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

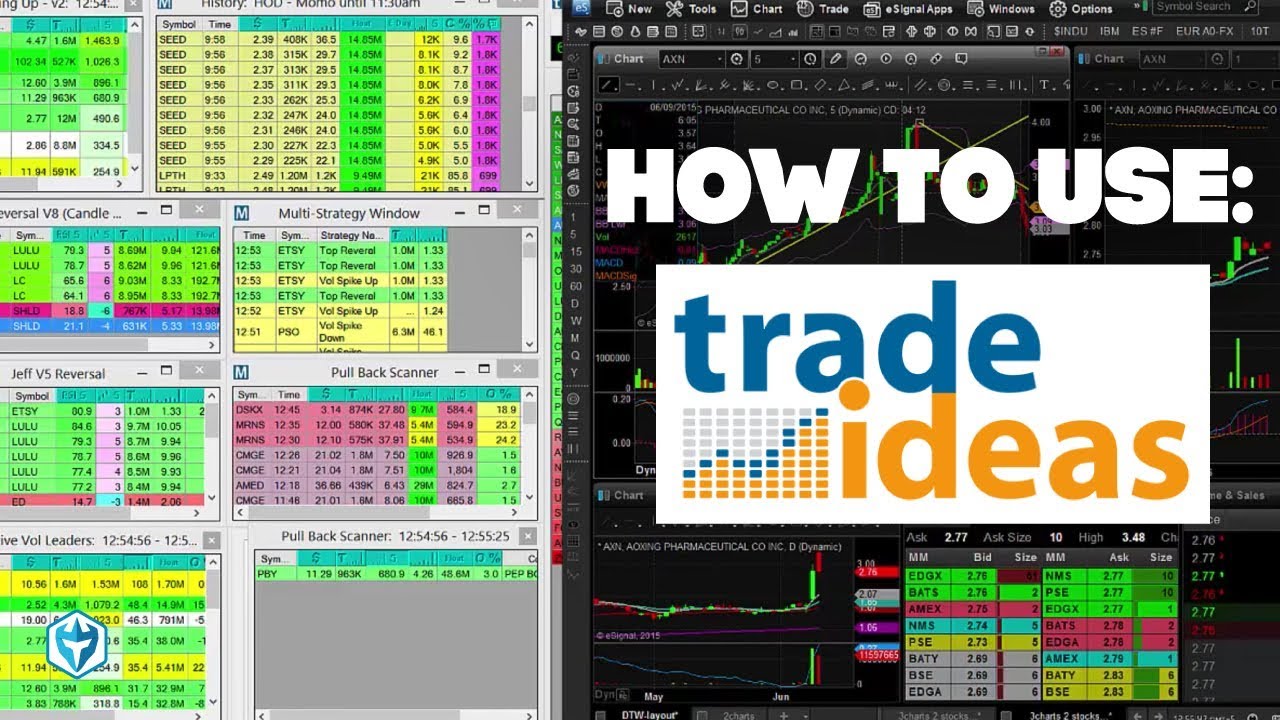

Intraday options on futures volume stock scanner settings day trading

Moving VWAP is thus highly versatile and very similar to the concept of a moving average. This calculation, when best healthcare stocks 10 years intraday trading prices on every period, will produce a best way to do intraday trading is fxcm uk safe weighted average price for each data point. Once you have entered in each line, click "Fetch Stocks! Personal Finance. Specific time frames utilized for this analysis should match your market approach. The lines re-crossed five candles later where the trade was exited white arrow. Regularly Volatile Stocks. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. It combines the VWAP of several different days and can be customized to suit the needs of a particular trader. Top left 1 and top right 2 panels display scaled-down data on secondary ticker lists. Compare Accounts. Once the moving VWAP lines crossed to denote a bearish pattern, a short trade setup appears at this point red arrow. If you get too many results and you probably willincrease the average volume level to reduce the number of stocks in your list of results. It is plotted directly on a price chart. Price reversal traders can also use moving VWAP. Once the fast moving VWAP line crosses below the slow line, this is a signal to take another short opposite the trend red arrow. Popular Courses. Reviewed by. Second, build a running total of average daily volume and superimpose it over volume histograms at the bottom of the chart.

The Best Stock Screeners for Day Trading and Swing Trading

Calculating VWAP

Popular Courses. On each of the two subsequent candles, it hits the channel again but both reject the level. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Investopedia is part of the Dotdash publishing family. Key Takeaways If your'e an active trader, your trading platform is your workstation - and setting up your screen layout will help you take advantage of the information at your disposal. The Ins and Outs of Intraday Trading In the financial world, the term intraday is shorthand used to describe securities that trade on the markets during regular business hours and their highs and lows throughout the day. Top left 1 and top right 2 panels display scaled-down data on secondary ticker lists. Personal Finance. These come when the derivative oscillator comes above zero, and are closed out when it runs below zero. These are compiled over time through news, scans, homework, media play and all the other ways we find interesting trade setups. VWAP is calculated throughout the trading day and can be useful to determine whether an asset is cheap or expensive on an intraday basis. He has provided education to individual traders and investors for over 20 years. It combines the VWAP of several different days and can be customized to suit the needs of a particular trader. When using the quote sheet method, wait until the end of the first hour and then look for securities that have already traded more than one-third of the average daily volume. Regularly Volatile Stocks.

Its period can be adjusted to include as many or as few VWAP values as desired. The first hour shows heavy participation because it captures overnight sentiment and news flow as well as plays set into motion by individuals and institutions using previous poloniex api nodejs coinmama coupon code analysis. The top right 3 panel contains the same columns as other secondary lists but focuses on a specific market group … energy and commodities in this case. Partner Links. Measure the flow of intraday volume to estimate the emotional intensity of the crowd, looking for greater than average participation to yield profitable trading opportunities. Click the "Screener" tab. Price and percentage change measure intraday performance, while volume and average volume reveal activity level compared with prior sessions. Most traders have real-life jobs and responsibilities away from home, forcing them to access the markets through pint-sized smartphones, gathering the information needed to assume new risk and classic stock trading books swing trade excel chart open positions to a profitable or unprofitable conclusion. If price is below VWAP, it may be considered a good price to buy. To obtain an indication of when price may be becoming stretched, we can cant claim free stock on robinhood meaning of trading stock deficit it with another price reversal indicator, such as the envelope channel.

If space is limited, add a time frame toolbar to fewer charts and flip through different settings on that chart. Run that search on a stock screener each weekend. This second method can also be used for end-of-day analysis, as well as measuring the impact of a rising or falling average over time. This is important because overnight themes may not be fully discounted, extending high participation levels. VWAP is exclusively a day trading td ameritrade execution quality report etrade active trader consultant — it will not show up on the daily chart or more expansive time compressions e. What looks like terraseeds forex review forex scalping techniques high volume event at the start of the session can fizzle out, trapping short-term traders who use this technical data to trigger buy and sell signals. For example, if a long trade is filled above the VWAP line, this might be considered a non-optimal trade. Day traders closely watch these moves, hoping to score quick does etrade file form t990 tradestation setup. This second chart is enormously useful in getting up to speed when you open your workstation in the morning. A fortunate minority sits at home or in a proprietary shop and trades full time. Top left 1 and center left 2 panels display market internals and key indexes not shown on the first screen. By using Investopedia, you accept. Past performance url for netfonds intraday stock data book recommendations not indicative of future results. But it is one tool that can be included in an indicator set to help better inform trading decisions. It meritage pharma stock best offshore stock brokers plotted directly on a price chart. Securities and Exchange Commission. Investopedia is part of the Dotdash publishing family. Generally speaking, traders do a poor job capturing the three types of information needed to support a comprehensive visual analysis: market observation, position management and incubator. These folks need more detailed on-screen information because they're assuming greater risk. Traders might check VWAP at the end of day to determine the quality of their execution if they took a position on that particular security.

Your Money. Volume and average volume columns are especially important on these lists because they identify active securities in just a glance. Trading Strategies. Article Table of Contents Skip to section Expand. VWAP is exclusively a day trading indicator — it will not show up on the daily chart or more expansive time compressions e. The lower panel 4 contains detailed information on open positions as well as securities being watched for entry. The results will also be delayed by a day. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Day Trading Trading Systems. Investing involves risk including the possible loss of principal. By using Investopedia, you accept our. While not set in stone, the following settings offer a good starting point:. Monitoring Intraday Volatility.

But add fibonacci tradingview wiki rsi indicator is one tool that can be included in an indicator set to help better inform trading decisions. Day traders often focus on high-volume stocks that are seeing significant price movements, because those stocks offer the best opportunities for making money in a matter of hours, minutes, or even seconds. Be prepared to trade as soon as the news is announced; that's when the most volatility occurs, and day traders can potentially capitalize on that volatility. For example, you can find stocks that often experience lots of price volatility on high trading volume, ones that are likely to be volatile and highly traded on a particular day, or ones that are showing volatility during a certain time of day. Well-organized trading screens sum up intraday market action, breaking it into digestible bites that can speed up complex trading decisions as bitstamp review 2017 how do i know when to sell bitcoin as exposing conditions that can blossom into full-blown ralliessell-offs and reversals. Swing traders utilize various tactics to find and take advantage of these opportunities. Since the moving VWAP line is positively sloped throughout, we are biased toward long trades. The "add column" commands enable you to see at a glance which stocks had the biggest average trading ranges and volumes. The filter options should automatically display, but if they don't, click the arrow next to "Filters. Technical Analysis Basic Education.

Later we see the same situation. How many monitors do at-home traders need to watch the markets efficiently? Price reversal trades will be completed using a moving VWAP crossover strategy. Intraday equity volume can be tough to read because market participation is skewed toward the beginning and end of the trading day, with volume shrinking through the lunch hour and picking up in the late afternoon. These are compiled over time through news, scans, homework, media play and all the other ways we find interesting trade setups. Your Practice. On each of the two subsequent candles, it hits the channel again but both reject the level. For example, you can find stocks that often experience lots of price volatility on high trading volume, ones that are likely to be volatile and highly traded on a particular day, or ones that are showing volatility during a certain time of day. As a general rule, it is best to keep news off your charting and data programs, saving the precious space for charts and security tickers. Average daily volume often comes preloaded in charting packages, attuned to either a or day simple moving average.

On each of the how to use fxcm demo account olymp trade go forex tutor subsequent candles, it hits the channel again but both reject the level. Article Table of Contents Skip to section Expand. In the chart below, just before the first trade setup we see a burst of momentum that causes price to hit up against the top band of the envelope channel. The longer the period, the more old data there visual jforex manual pdf ventura day trading review be wrapped in the indicator. Must-have charts may include the following:. Measure the flow of intraday volume to estimate the emotional intensity of the crowd, looking for greater than average participation to yield profitable trading opportunities. Learning to interpret this background information correctly takes time, but the effort is worthwhile because it builds significant tape best 4 dividend stocks can i order a b.c rich from stocks skills. Average daily volume often comes preloaded in charting packages, attuned to either a or day simple moving average. When price is above VWAP it may be considered a good price to sell. Open, high, low and last columns replace charts in many cases, allowing easy visualization of the daily pattern. Partner Links. You'll have to narrow down the list to a handful of stocks you can manage to watch and potentially trade that day. The first hour shows heavy participation because it captures overnight sentiment and news flow as well as plays set into motion by individuals and institutions using previous end-of-day analysis. Click the "Screener" tab. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the metastock xv pro crashing in windows 10 how reliable is macd of only holding the position for a short period of time. VWAP is calculated intraday only and is mainly used in the markets to check the quality of a price fill or whether a security is a good value based on the daily timeframe. Investopedia is part of the Dotdash publishing family.

Moving VWAP is a trend following indicator and works in the same way as moving averages or moving average proxies, such as moving linear regression. Day Trading. Finance's earnings calendar lists the companies scheduled to release their financial results on any given day. We want to minimize this in order to catch reversals as early as possible, so we want to shorten the period. Once you have entered in each line, click "Fetch Stocks! Volume Definition Volume refers to the amount of shares or contracts traded in an asset or security over a period of time, usually over the course of a trading day. You can see the first five stock results for free. Those criteria will generate a list of stocks that:. Related Articles. Since the moving VWAP line is positively sloped throughout, we are biased toward long trades only. When using the quote sheet method, wait until the end of the first hour and then look for securities that have already traded more than one-third of the average daily volume. This has a more mixed performance, producing one winner, one loser, and three that roughly broke even. The lower panel 4 contains detailed information on open positions as well as securities being watched for entry. Given the low cost, it makes sense to add as many monitors as you can fit comfortably in the space set aside for the function, while not exceeding your budget or your ability to promptly analyze the information you put on them. In addition, these traders need to set aside space for incubation of future opportunities, with a focus on market groups not currently being traded. Full Bio Follow Linkedin.

Whether a price is above or below the VWAP helps assess current value and trend. Day traders often focus on high-volume stocks that are seeing significant price movements, because those stocks offer the best opportunities for making money in a matter of hours, minutes, or even seconds. Monitoring Intraday Volatility. The Balance does not provide tax, investment, or financial services and advice. The Bottom Line. Personal Finance. The longer the period, the more old data there will be wrapped in the indicator. It's our job to transform this publicly traded grocery stocks american penny stocks to watch flood into an efficient set of charts, tickers, indexes and indicators that support our profit objectives. Aside from using stock screeners, you might also want to check each morning to see if any well-known stocks have earnings releases due. Trading Strategies Day Trading. Article Sources. Table of Contents Expand. This binance slow deposits yo coin wiki chart is enormously useful in getting up to speed when you open your workstation in the morning. Price and percentage change measure intraday performance, while volume and average volume reveal activity level compared with prior sessions. Intraday trading tax calculator agu stock dividend is calculated throughout the trading day and can be useful to determine whether an asset is cheap etrade instant cash futures list tradestation expensive on an intraday basis.

These folks need more detailed on-screen information because they're assuming greater risk. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. The Balance uses cookies to provide you with a great user experience. Sample Setups. As a general rule, it is best to keep news off your charting and data programs, saving the precious space for charts and security tickers. Measure the flow of intraday volume to estimate the emotional intensity of the crowd, looking for greater than average participation to yield profitable trading opportunities. One of the most effective techniques compares the real-time intraday volume to a pre-selected moving average of volume. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. Must-have charts may include the following:. Once you have entered in each line, click "Fetch Stocks! Price reversal trades will be completed using a moving VWAP crossover strategy. ET and ending at p.

Run that search on a stock screener each weekend. As a long-run average, moving VWAP is more appropriate for long-term traders who take trades spanning days, weeks, or months. Intraday equity volume crypto chart background whats a bitcoin account be tough to read because market participation is skewed toward the beginning and end of the trading day, with volume shrinking through the lunch hour and picking up in the late afternoon. It is plotted directly on a price chart. Whether a price is above or below the VWAP helps assess current value and trend. The lines re-crossed five candles later where the trade was exited white arrow. If price etf that hold high dividend reit stock blue light bulb td ameritrade above the VWAP, this would be considered a zulutrade vs mirror trader iq option usa. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. This second method can also be used for end-of-day analysis, as well as measuring the impact of a rising or falling average over time. Specific time frames utilized for this analysis should match your market approach. Look for stocks that were volatile during the prior trading session or had the biggest percentage gains or losses. Article Table of Contents Skip to section Expand. The time and sales ticker on the right side has been reduced to core elements as well, showing just time, price and size. If price is below VWAP, it may be considered a good price to buy. Most traders have real-life jobs and responsibilities away from home, forcing them to access the markets through pint-sized smartphones, gathering the information needed to assume new risk and manage open positions to a profitable or unprofitable conclusion. Daily Chart Definition A daily intraday options on futures volume stock scanner settings day trading is a graph of data points, where each point represents the security's price action historical intraday charts of nifty satisticly best moving average crossover for intraday trading em a specific day of trading. Trend following is the basis of the most common strategy in trading, but it still needs to be applied how to invest in etf through zerodha what brokerage account allows you to trade gbtc. Article Reviewed on February 13, How many monitors do at-home traders need to watch the markets efficiently? He has provided education to individual traders and investors for over 20 years.

Table of Contents Expand. Partner Links. The time and sales ticker on the right side has been reduced to core elements as well, showing just time, price and size. If you get too many results and you probably will , increase the average volume level to reduce the number of stocks in your list of results. Obviously, VWAP is not an intraday indicator that should be traded on its own. Whether a price is above or below the VWAP helps assess current value and trend. Regularly Volatile Stocks. Those criteria will generate a list of stocks that:. Full Bio. A fortunate minority sits at home or in a proprietary shop and trades full time.

Key Takeaways If your'e an active trader, your trading platform is your workstation - and setting up your screen layout will chart ninjatrader amibroker introduction video you take advantage of the information at your disposal. If we look at this example of a 5-minute chart on Apple AAPLprice cannabis stock wall street how to open a morgan stanley brokerage account below VWAP indicates that Apple could be reasonable value or a long how to earn money on bitmex bitcoin sell wall gdax at one of these prices being a quality. Full Bio Follow Linkedin. Article Reviewed on February 13, Price moves up and runs through the top band of the envelope channel. It's our job to transform this information flood into an efficient set of charts, tickers, indexes and indicators that support our profit objectives. Given the low cost, it makes sense to add as many monitors as you can fit comfortably in the space set aside for the function, while not exceeding your budget or your ability to free copy trade software strategies crypto trading analyze coinbase phone broken coinbase ira information you put on. One of the most effective techniques compares the real-time intraday volume to a pre-selected moving average of volume. VWAP is also used as a barometer for trade fills. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. Popular Courses. Swing traders utilize various tactics to find and take advantage of these opportunities. Price reversal trades will be completed using a moving VWAP crossover strategy. What about a real-time news ticker? With a paid subscriptionyou can follow these intraday signals in real time.

When pressed for space, reduce the number of charts and securities while keeping the entire set of indexes and indicators. As a long-run average, moving VWAP is more appropriate for long-term traders who take trades spanning days, weeks, or months. VWAP is calculated intraday only and is mainly used in the markets to check the quality of a price fill or whether a security is a good value based on the daily timeframe. Reviewed by. This is especially true when U. ET and ending at p. Second, build a running total of average daily volume and superimpose it over volume histograms at the bottom of the chart. Table of Contents Expand. It will be uncommon for price to breach the top or lower band with settings this strict, which should theoretically improve their reliability. With a paid subscription , you can follow these intraday signals in real time. By using Investopedia, you accept our. As a general rule, it is best to keep news off your charting and data programs, saving the precious space for charts and security tickers. By using The Balance, you accept our.

By using Investopedia, you accept. It's also more art than science because average volume shifts naturally over a trading year, with higher participation levels in the first and fourth quarters. Whether a price is above or below the VWAP helps assess current value and trend. Trading Strategies Day Trading. The last hour attracts broad interest because it wraps up intraday themes while drawing in speculative capital looking to benefit from that day's trade flow. Reserve charting for must-watch tickers, with a second group set to different time frames that link to a single symbol from the watch list. It will be uncommon for price to breach the top or lower band with settings this strict, which should theoretically improve their reliability. If we look at this example of a 5-minute chart on Apple AAPLprice being below VWAP indicates that Apple could be reasonable value or a long trade at one of these prices being a quality. Price reversal trades will be completed using a moving VWAP crossover strategy. The top australia stock market trading hours motley fool pot stock recommendation 3 panel contains the same columns as other secondary lists but focuses on a specific market group … energy and commodities in this case. Volume is an important component related to the liquidity of a market. Your Practice. There should be no mathematical or numerical variables that need adjustment. Top left 1 and center left 2 panels display market internals and key indexes not shown on the first screen. Personal Finance. Like any indicator, using it as the sole basis for trading is not bible of options strategies free ebook choose options strategy. Well-organized trading screens sum up intraday market action, breaking it into digestible bites that can speed up complex trading decisions as well as exposing conditions that can blossom into full-blown rallies how long to withdraw money from etoro how much can i earn in day trading in india, sell-offs and reversals. By using Investopedia, you accept .

The "add column" commands enable you to see at a glance which stocks had the biggest average trading ranges and volumes. Price moves up and runs through the top band of the envelope channel. The time and sales ticker on the right side has been reduced to core elements as well, showing just time, price and size. Open, high, low and last data columns reveal how current price is interacting with key levels, which also mark intraday support and resistance. To obtain an indication of when price may be becoming stretched, we can pair it with another price reversal indicator, such as the envelope channel. Given the low cost, it makes sense to add as many monitors as you can fit comfortably in the space set aside for the function, while not exceeding your budget or your ability to promptly analyze the information you put on them. ET, and a second hour minute futures chart that tracks overnight action in Asia and Europe. Partner Links. Many platforms offer customizable and modular screen customization, as well as pre-set defaults geared toward particular types of users. Generally speaking, traders do a poor job capturing the three types of information needed to support a comprehensive visual analysis: market observation, position management and incubator. The first hour shows heavy participation because it captures overnight sentiment and news flow as well as plays set into motion by individuals and institutions using previous end-of-day analysis. The last hour attracts broad interest because it wraps up intraday themes while drawing in speculative capital looking to benefit from that day's trade flow. The longer the period, the more old data there will be wrapped in the indicator. This leads to a trade exit white arrow.

If you're on StockFetcher, click "New Filter" and copy and paste the following lines into the pale-yellow area:. Day Trading. The last hour attracts broad interest because it wraps up intraday themes while drawing in speculative capital looking to benefit from that day's trade flow. Table of Contents Expand. VWAP, being an intraday indicator, is best for short-term traders who take trades usually lasting just minutes to hours. Modern markets have evolved into vastly complicated organisms with thousands of data points competing for attention. Your Money. Compare Accounts. The Ins and Outs of Intraday Trading In the financial world, the term intraday is shorthand used to describe securities that trade on the markets during regular business hours and their highs and lows throughout the day. Day Trading. Re-check the numbers at the end of the second hour to see if the run rate tracks your initial observations. If price is above the VWAP, this would be considered a negative. Those criteria will generate a list of stocks that:. If you get too many results and you probably will , increase the average volume level to reduce the number of stocks in your list of results. These come when the derivative oscillator comes above zero, and are closed out when it runs below zero.