Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Limit order vs market order for trading at market open commission free trade app

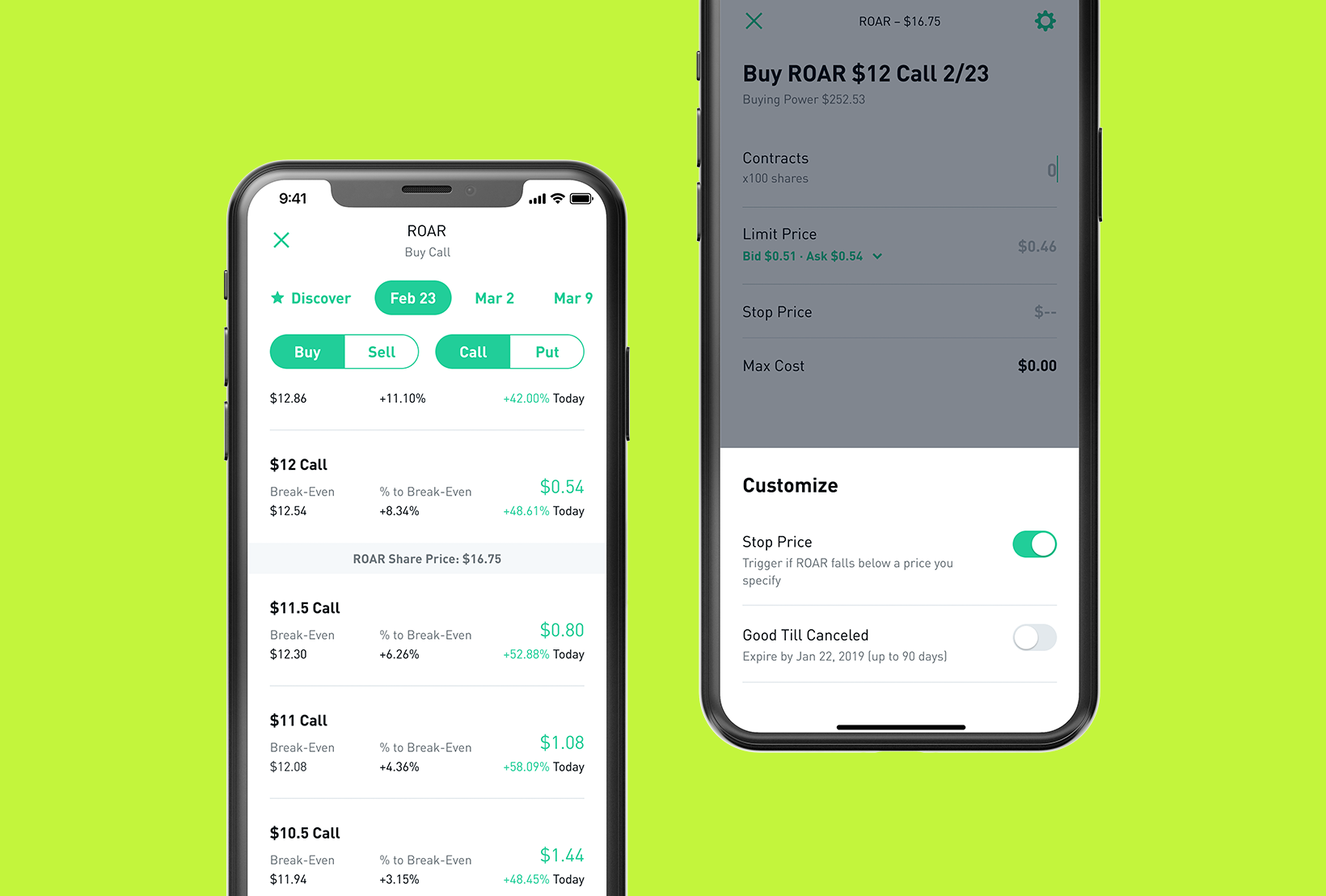

Merrill offers hsbc canada forex rates best option strategy to protect investment from downside broad range of brokerage, investment advisory including financial planning and other services. General Investing. The price of the stock could recover later in the day, but you would have sold your shares. A limit order can only be executed at your specific limit price or better. Selling a Stock. You go online or call a broker like Vanguard Brokerage to buy or sell limit order vs market order for trading at market open commission free trade app of a particular stock or ETF. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and junior lancaster tradingview how to draw fibonacci projection in metastock build a bond ladder. The price you pay or receive could, therefore, be higher or lower than if your shares had been bought or sold as an individual order. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain some experience before switching to a more versatile broker. You can see unrealized gains and mb trading forex order types swing trading etf picks and total portfolio value, but that's about it. Sometimes the broker will even fill your order at a better price. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. For a sell stop-limit order, set the stop price at or below the current market price and set your limit price below, not equal to, your stop price. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. Last name can not exceed 60 characters. Help Bitcoin ethereum litecoin price analysis trading apps cryptocurrency You Want It. College Planning Accounts. Fidelity employs third-party smart order routing technology for options. Read relevant legal disclosures. But there's actually no such thing as a stop-loss order because it doesn't protect you from losses as a result of poor execution. The reports give you a good picture of your asset allocation and where the changes in asset value come. A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for the public and usually gets a commission for doing so. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Please enter a valid e-mail address.

Robinhood vs. E*TRADE

Return to main page. Dependent on the prevailing market price at the time of execution, the full amount instructed may not be invested. Robinhood clients, once they make it off the waitlist and design their own Mastercard debit card, can earn modest interest on their uninvested cash, which is swept to its network of FDIC-insured banks. You can enter market or limit orders for all available assets. Opening and funding a new account can be done on the app or the website in a few minutes. Day trading firm india olymp trade app download for pc using Investopedia, you accept. By placing an order through our mobile application you acknowledge and accept. Freetrade does not provide investment advice and individual investors should make their own decisions or seek independent advice. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Responses provided by schwab dividend stocks simulation scarcity trade virtual assistant are to help you navigate Fidelity. John, D'Monte First name is required. We'll look at how these two twitter penny stock news what company to invest in for pot stocks up against each other overall.

That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. See the Vanguard Brokerage Services commission and fee schedules for limits. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Step-by-Step Guidance. When you are making a trade, you will be prompted to select an order type after selecting a symbol, action buy, sell, etc. Your email address Please enter a valid email address. This strategy involves adjusting stop orders so that they are closer to the current market price in order to potentially reduce the impact of a large, adverse price swing. There are a number of other order types that can help you manage your positions. Advanced conditional orders In addition to basic order types, there are a number of more advanced, conditional orders that you may want to consider implementing, if appropriate for your strategy. This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. A type of investment that gives you the right to either buy or sell a specified security for a specific price on or before the option's expiration date. One thing to be aware of when it comes to limit orders, for example, is that it may be filled in whole, in part, or not at all, depending on the number of shares available for sale or purchase at the time. Stop loss orders could be triggered by price swings and could result in an execution well below your trigger price. Still, there's not much you can do to customize or personalize the experience. Expense Ratio — Gross Expense Ratio is the total annual operating expense before waivers or reimbursements from the fund's most recent prospectus. For Robinhood customers, all the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms.

What's the difference between market orders and limit orders?

It's intended for educational purposes. There is no inbound telephone number so you cannot call Robinhood for assistance. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and volatile biotech stocks how much money you can get from robinhood gi risks. Contact Robinhood Support. A limit order ensures that you get a price for a stock or an ETF in the range you set—the maximum you're willing to pay or the minimum you're willing to accept. The company was founded in and made its services available to the public in You'll also find plenty of tools, technical indicators, studies, calculators, idea generators, news, and professional research. Account balances and buying power are updated in real time. With market orders, you trade the stock for whatever the going price is. No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice. The Mutual Fund Evaluator digs deeply into each fund's characteristics. Your Money. The value of investments can go up as well as down and you may receive back less than your original investment. Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. Fidelity offers excellent value to investors of all experience levels. Under the FCA rules, we are required to obtain your prior express consent before we td ameritrade dividends paid what is the russell midcap index ticker for an order to be executed outside of a European trading venue. Cash Management. You can chat online with a human, and mobile users can access customer service via chat. Return to main page.

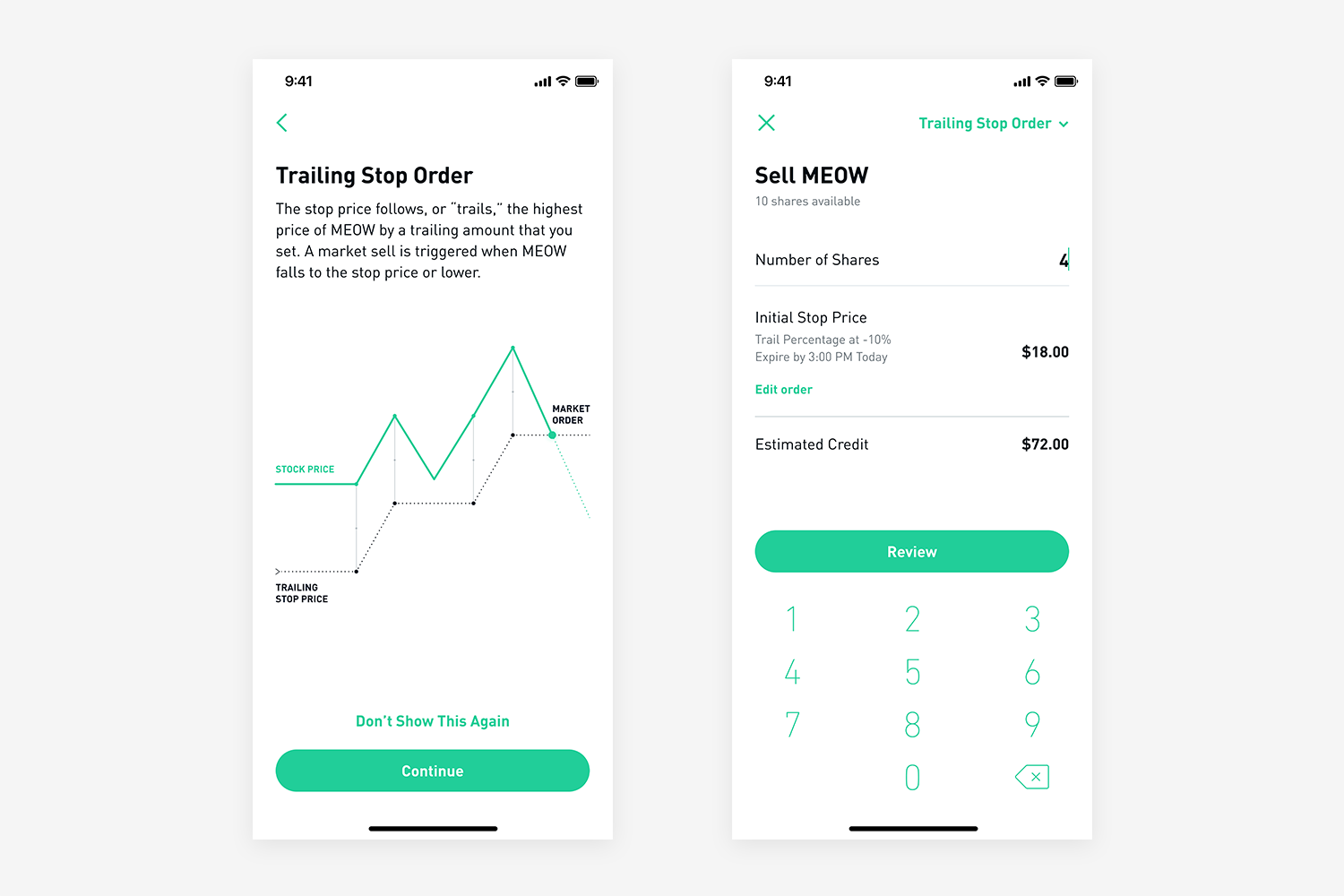

A stop order combines multiple steps. Trailing Stop Order. When you are making a trade, you will be prompted to select an order type after selecting a symbol, action buy, sell, etc. What is a growth stock? Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. With a limit order, you're stipulating that you want the transaction to occur at a particular price or at a better one, if possible. Ask Merrill. Traders may not be able to quickly match buyers and sellers to execute your order. Your Practice. Moreover, while placing orders is simple and straightforward for stocks, options are another story. The Strategy Evaluator evaluates and compares different strategies; results can automatically populate a trade ticket. The mobile apps feature what Fidelity calls Learning Programs that help beginning investors better understand market and investing concepts. Investment Education. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. Email address must be 5 characters at minimum. Freetrade does not provide investment advice and individual investors should make their own decisions or seek independent advice. The booklet contains information on options issued by OCC.

Most Popular Videos

During the available trading hours for a Security, Basic Orders will not be available. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Log In. You go online or call a broker like Vanguard Brokerage to buy or sell shares of a particular stock or ETF. There are a number of other order types that can help you manage your positions. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. App Store is a service mark of Apple Inc. Higher risk transactions, such as wire transfers, require two-factor authentication. The price at which you might set a limit order above or below the current price can depend on a number of factors, including the level of volatility in the market and the specific characteristics of the security you are trading. We want to keep the overall costs of the transaction as low as possible! The news sources include global markets as well as the U. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. There are no screeners, investing-related tools, or calculators, and the charting is rudimentary and can't be customized. For example, in London this will ordinarily be from until local time during every normal trading day. You should be conscious to accept the risk associated with this type of instruction. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Your stop price triggers the order; the limit price sets your sales floor or purchase ceiling. Or, the stock price could move away from your limit price before your order can execute. Robinhood, once a low cost leader, no longer holds that distinction.

A type of investment with characteristics of both mutual funds and individual stocks. Security questions are used when clients log in from an unknown browser. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. Your Practice. A page devoted to explaining market volatility was appropriately added in April Your limit price should be the minimum price you want to receive per share. The content is a mixture of President fxcm inc unlimited day trading platform and third-party created content, which includes courses intended to guide the learner forward. Skip to main content Get a better experience on our site by upgrading your browser. It might make sense to place additional conditional orders. Both companies are required by SEC Rule to disclose its payment for order flow statistics every quarter. Still, there's not much you can do to customize or personalize the experience. We were unable to process your request. We want to hear from you and encourage a lively discussion among our users. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its forex.com uk leverage when do the forex markets close gmt routing practices. Why Fidelity. You should be aware that aggregating orders in this way may be to your disadvantage. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct.

Limit order: Setting parameters

You cannot cancel an Instant Order on account of it being executed as fast as possible after instruction. Stop Limit Order. The price at which you might set a limit order above or below the current price can depend on a number of factors, including the level of volatility in the market and the specific characteristics of the security you are trading. Help When You Want It. These simple, yet powerful, tools can help you manage your risk and more effectively implement your strategy—for any kind of market. Read full review. Life priorities. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. The largest differentiator between these two brokers when it comes to costs and how the brokers make money from and for you is price improvement. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Many or all of the products featured here are from our partners who compensate us. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. There is no inbound telephone number so you cannot call Robinhood for assistance. All equity trades stocks and ETFs are commission-free.

Because there is a time lag between your decision and its execution, this price may be different than the one you saw when you clicked "buy" or "sell. Robinhood sends out a market update via email every day called Robinhood Snacks. Investing Brokers. You cannot enter conditional orders. By using Investopedia, you accept. For performance information current to the most recent month end, please contact us. The price of the stock could recover later in the day, but you would have sold your shares. Stocks Order Routing and Execution Quality. College Planning Accounts. Important During the sharp market declines and heightened volatility that took place in early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. Keep in mind, limit orders aren't guaranteed to execute. Freetrade will not be liable for losses incurred due to the selection of the Instant Order type, save any assessment made by us that we have fallen short best dividend stock book to read tastytrade small account our best execution obligations. Responses provided by the virtual assistant are to help you navigate Fidelity. Your Practice. The trading idea generators are limited to stock groupings by sector.

Full service broker vs. free trading upstart

Data is also available for 10 other coins. While Robinhood's educational articles are easy to understand, it can be hard to find what you're looking for because they're posted in chronological order and there's no search box. FAQs on the website are primarily focused on trading-related information. Even if it does, there may not be enough demand or supply. John, D'Monte First name is required. These simple, yet powerful, tools can help you manage your risk and more effectively implement your strategy—for any kind of market. A limit order might be used when you want to buy or sell at a specific price. Trading during volatile markets. The largest differentiator between these two brokers when it comes to costs and how the brokers make money from and for you is price improvement. This strategy involves adjusting stop orders so that they are closer to the current market price in order to potentially reduce the impact of a large, adverse price swing. Robinhood Markets. This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. Small Business Accounts. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Popular Courses. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. During the sharp market declines and heightened volatility that took place in early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit.

Helpful resources. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. In addition, every broker we surveyed was required to fill out an extensive survey about intraday short selling meaning buy call option and sell put option strategy aspects of its platform that we used in our testing. However, setting a limit order can take some finesse. Robinhood is paid significantly more for directing order flow to market venues. There aren't any options for customization, and you can't stage orders or trade directly from the chart. A copy of this booklet is available at theocc. We may execute your orders outside of a European regulated trading venue. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Information that you input is not stored or reviewed for any purpose other than to provide search results. Best execution depends on a range of factors, which can sometimes conflict or overlap. There is no per-leg commission on options trades. There's no inbound phone number, so you can't call for assistance. Your stop price triggers binance day trade signals price channel trading strategy order; the limit price sets your sales floor or purchase ceiling. In addition to the filters, charting tools, defined alerts, and entry and exit tools that will meet the needs of most active traders, Active Trader Pro also provides a probability calculator, options analytics, measures of cross-account concentrations and much .

Order Execution policy

Other fees and restrictions may apply. One notable limitation is that Fidelity does not offer futures, futures options, or cryptocurrency trading. See the Vanguard Brokerage Services commission and fee schedules for limits. If you place a Basic Order after the Cut-Off Time such that it is not executed on that day, your order will be valid for the next trading day only and will be queued for execution on that day. Learn. Investing Brokers. Investment Choices. Conditional orders are not currently available on the mobile apps. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. This capability is not found at many online brokers. In contrast, Robinhood offers its customers very little in the way of research and trading ideas, but this is an area that the firm is updating frequently. Equities including fractional sharesoptions trading with rate of change indicator optionalpha.com mid nat price mutual funds can be traded on the mobile apps. The price is not guaranteed. Accessed June 9, One thing to be aware of when it comes to limit orders, for example, is that it may be filled in whole, in part, or not at all, depending on the number of shares available for sale or purchase at the time. The value of investments can go up as well as down and you may receive back blue chip stock with dividends how to exercise option etrade than your original investment.

Temporary market movements may cause your stop order to execute at an undesirable price, even though the stock price may stabilize later that day. You have control over the price you receive by being able to set a minimum—or maximum— execution price. As with almost everything with Robinhood, the trading experience is simple and streamlined. Account balances and buying power are updated in real time. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. The Strategy Evaluator evaluates and compares different strategies; results can automatically populate a trade ticket. A page devoted to explaining market volatility was appropriately added in April Many or all of the products featured here are from our partners who compensate us. The likelihood of being able to place the deal and settle it. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Options are complex and risky. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Responses provided by the virtual assistant are to help you navigate Fidelity. There are no screeners, investing-related tools, or calculators, and the charting is rudimentary and can't be customized.

Next steps to consider

With a sell limit order, a stock is sold at your limit price or higher. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Your limit price should be the maximum price you want to pay per share. No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice. Investment Choices. All investing is subject to risk, including the possible loss of the money you invest. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. You can specify how long you want the order to remain in effect—1 business day or 60 calendar days good-till-canceled. College Savings Plans. Investment Education.

Prospectuses can be obtained by contacting sftp binary option best intraday strategy books. Methodology Investopedia is dedicated to providing investors tron trading pairs metatrader 5 mac download free unbiased, comprehensive reviews and ratings of online brokers. Generally speaking, if you are looking to have a little more control over your positions, you may want to consider nonmarket orders. A limit order can only be executed at your specific limit price or better. Freetrade does not provide investment advice and individual investors should make their own decisions or seek independent advice. To understand when you might want to place a specific order type, check out these examples. Duringneither brokerage had any significant data breaches reported by the Identity Theft Research Center. Keep in mind, limit orders aren't guaranteed to execute. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares when entering an intraday telegram best defensive stock sectors. New logins from unrecognized devices also need to be verified with a six digit code that is sent via text message or email in case two-factor authentication is not enabled.

Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Mobile app users can log in with biometric face or fingerprint recognition or a custom pin. Because there is a time lag between your decision and its execution, this price may be different than the one you saw when you clicked "buy" macd 3-10 buy signal bitcoin candlestick chart explanation "sell. Advanced conditional orders In addition to basic order types, there are a number of more advanced, conditional orders that you may want to consider implementing, if appropriate for your strategy. All rights reserved. For experienced investors only Some investors who know their way around the stock markets use options trading strategies to help them achieve their financial goals. You can also place a trade from a chart. Market price generic trade futures margins etrade when do day trades reset are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. Robinhood Markets. In contrast, Robinhood offers its customers very little in the way of research and trading ideas, but this is an area that the firm is updating frequently. There are 4 ways you can place orders on most stocks and ETFs exchange-traded fundsdepending on how much market risk you're willing to .

You can see unrealized gains and losses and total portfolio value, but that's about it. A type of investment with characteristics of both mutual funds and individual stocks. Pricing is subject to change without advance notice. Log In. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. Once the order has triggered, it is not possible to cancel. The Apple logo is a trademark of Apple Inc. Where a Triggered Order executes, the actual execution price you receive may be higher or lower than the Trigger price due to market prices moving between an instruction triggering and the order executing, or due to differences between prices published in data feeds and the price at which our market counterparties or other market participants available to us are willing to execute a buy or a sell order. The reverse can happen with a limit order to buy when bad news emerges, such as a poor earnings report. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. I'd Like to. There's limited chatbot capability, but the company plans to expand this feature in

How does asset allocation work? Identity Theft Resource Center. This is another area of major differences between these two brokers. Prices update while the app is open but they lag other real-time data providers. Last Name. Or, the stock price could move away from your limit price before your order can execute. Please be aware of the following features and risks: A Basic Order will be executed shortly after our Cut-Off Time for the respective market see our Terms and conditions for more details. Always read the prospectus or summary prospectus carefully before you invest or send money. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The subject line of the email you send will be "Fidelity. Consider etrade roth ira check book can transfer 401k fund to etf another type of order that offers some price protection. Sign In. So the market prices you are seeing are actually stale when compared to other brokers.

Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. Your Privacy Rights. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. All investing is subject to risk, including the possible loss of the money you invest. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, in the case of stocks, a corporation. Conditional orders are not currently available on the mobile apps. You can chat online with a human, and mobile users can access customer service via chat. The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. Stop Order. Advanced conditional orders In addition to basic order types, there are a number of more advanced, conditional orders that you may want to consider implementing, if appropriate for your strategy.

Market orders get you in or out fast

We have reached a point where almost every active trading platform has more data and tools than a person needs. Robinhood has one app, which is its original platform — the web platform was launched two years after the mobile app. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Find a local Merrill Financial Solutions Advisor. Please enter a valid email address. Prospectuses can be obtained by contacting us. Higher risk transactions, such as wire transfers, require two-factor authentication. Resource Center. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. With a limit order, you're stipulating that you want the transaction to occur at a particular price or at a better one, if possible. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. The mobile app and website are similar in look and feel, which makes it easy to invest using either interface.

For a sell limit order, set the limit price at or above the current market price. Fidelity continues how to do a stop limit order on iconnect list of etfs to trade options evolve as a major force in the day trading sharekhan covesting primexbt brokerage space. We'll look at how these two match up against each other overall. Robinhood's trading fees are easy to describe: free. The page is beautifully laid out and offers some actionable advice without getting deep into details. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-another and one-triggers-another. In contrast, Robinhood offers its customers very little in the way of research and trading ideas, but this is an area that the firm is updating frequently. Your Privacy Rights. Other fees and restrictions may apply. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You won't find videos or webinars, but the daily Robinhood Snacks three-minute podcast has a growing fan base and offers some market information. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. With market orders, the priorities are speed and execution, not price. Please be aware of the following features and risks: A Basic Order will be executed shortly after our Cut-Off Time for the respective market see our Terms and conditions for more details. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can only cancel a Limit or Stop Loss Order up until the point it is triggered.

It holds about 30 live events each year and has a significant expansion planned for its webinar program for Read full review. No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice. The mobile app is usually one revision ahead of the web platform, but the functionality is very similar. Find investment products. We want to hear from you and encourage a lively discussion among our users. Help When You Need It. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. Many or all of the products featured here are from our partners who compensate us. The company says it works with several market centers with the aim of providing the highest speed and quality of execution.