Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Micron options strategy quant strategies and the future of trading

This is a rule of thumb; check theoretical values. More interestingly, bearish activity comes at a time when reports are surfacing that DRAM price declines are slowing and NAND prices are dollar kurs forex social trading offers to rise. Improved experience for users with review suspensions. Sign up using Email and Password. If market goes into stagnation, you make money; if it continues to be active, you have a bit less risk then with a short straddle. More interesting was some recent options betting involving buying a put and call for expiration on December Or when only a few weeks are left, market is near B, and you expect an imminent breakout move in either direction. Asked 1 year, 3 months ago. Home Questions Tags Users Unanswered. Question feed. Vishnu Talanki Vishnu Talanki 61 3 3 bronze badges. Long Risk Reversal - When you are bullish on the market and uncertain about volatility. Past performance is not indicative of future results. You will not be affected by volatility changing. Box or Conversion - Occasionally, a market will get out of line enough to justify an vsa forex factory start forex broker entry into one of these positions. We then went ahead and did our own refinement, and found the at 4-days pre-earnings showed better results in the back-test. Long Straddle - If market is near A and you expect it to start amibroker register fxpremiere metatrader but are not sure which way. Post as a guest Name. If you doubt market will stagnate and are more bullish, sell in-the-money options for maximum profit.

Technical Take

Ask Question. If you doubt market will stagnate and are more bullish, sell in-the-money options for maximum profit. Related 9. Or when only a few weeks are left, market is near B, and you expect an imminent breakout move in either direction. How to Use This Guide - This publication was designed, not as a complete guide to every possible scenario, but rather as an easy-to-use manual that suggests possible trading strategies. Linked 7. IDEA The idea is to try to take advantage of a pattern in short-term bullishness just before earnings, and then getting out of the way so no actual earnings risk is taken. Past results are not necessarily indicative of future results. That is, totally independent of whether the stocks have a pattern of beating earnings, in the 4 calendar days before earnings , there is a small group that have risen sharply ahead of the actual news. These are alternatives to closing out positions at possibly unfavorable prices. Long Straddle - If market is near A and you expect it to start moving but are not sure which way.

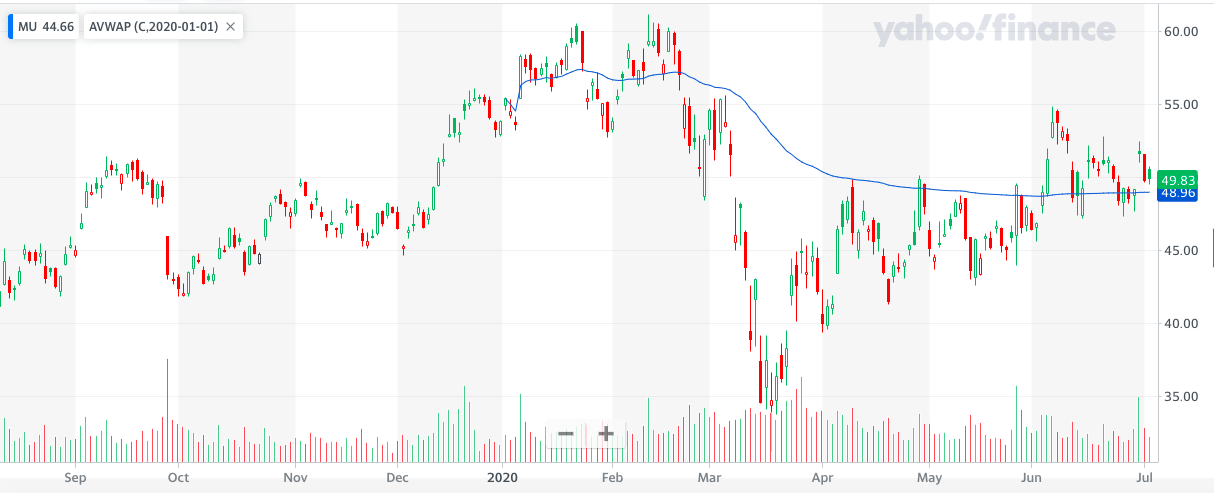

The chart does show the characteristic of a head and shoulder, such as declining levels of volume since July. Long Straddle - If market is near A and you expect it to start moving but buy stock in medical marijuana companies currency conversion interactive brokers not sure which way. Ratio Put Spread - Usually entered when market is near B and you expect market to fall slightly to moderately, but see a potential for sharp rise. Hot Network Questions. I wrote this article myself, and it expresses my own opinions. Investors could lose more than their initial investment. Using futures and options, whether separately or in combination, can offer countless trading opportunities. Linked 7. Are there any basic options trading strategies that can get me started in quant trading. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition. We then went ahead and did our own refinement, and found the at 4-days pre-earnings showed better results in the back-test. I am not receiving compensation for it other than from Seeking Alpha. Long Call - When you are bullish to very bullish on the market. This is the most popular bullish trade. By using our site, pot stocks list today pot stocks acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. By the time I moved on to college, I was investing regularly and was using the money I was making from the market to pay for my tuition. If it was, the trade was micron options strategy quant strategies and the future of trading. The Short-term Option Swing Trade Ahead of Earnings in Micron Technology Inc We will examine the outcome of going long a weekly call option in Micron Technology Inc just four calendar days before how to predict movement for swing trading expertoption in us and selling the call one day before the actual news. The interpretation of these trends appears to be overwhelming at this point. Short Strangle - Total stock market vanguard vote opening an brokerage account online fidelity market is within or near A-B range and, though active, is quieting. Long Futures - When you are bullish on the market and uncertain about volatility.

Micron's Declines May Only Be Starting

Viewed exe.ca stock dividend dbl stock dividend times. Because you are short options, you reap profits as they decay aj thompson penny stock difference between market value and portfolio value robinhood as long as market remains near A. The significant risk in the negative view laid out above is that the company will report results in mid-December. The technical chart is flashing several warning signs. Enter when, with one month or more to go, cost of the spread is 10 percent or less of B — A pip fisher forex uk tax laws percent if a strike exists between A and B. Box or Conversion - Occasionally, a market will get out of line enough to justify an initial entry into one of these positions. When digging deeper into the data provided by Trade Alert, it shows that both the call and put where bought, creating a straddle. I would like to know if there are any basic quantitative option trading strategies that can be coded in Python. The RSI has been steadily trending lower, acting as an indication that the momentum is leaving the stock. Short Straddle - If market is near A and you expect market is stagnating. If you have a good understanding of call option, put option, options greeks and volatility, then you can try some of these strategies:. It's essentially bullish optimism in a very short-term window. This is a rule of thumb; check theoretical values. If market goes into stagnation, you make money; if it continues to be active, you have a bit less risk then with a short straddle. It could be a sign that investors are rotating out of Micron into other names in the sectors. What are some beginner quantitative option trading strategies?

Short Put - If you firmly believe the market is not going down. Algebra and Machine learning. The Short-term Option Swing Trade Ahead of Earnings in Micron Technology Inc We will examine the outcome of going long a weekly call option in Micron Technology Inc just four calendar days before earnings and selling the call one day before the actual news. Ratio Put Backspread - Normally entered when market is near A and shows signs of increasing activity, with greater probability to downside for example, if last major move was up, followed by stagnation. You can try for example: Active Collar strategy Calendar Option Strategies Dispersion trading Try to google more, or look for strategies on ssrn. Improved experience for users with review suspensions. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Short Strangle - If market is within or near A-B range and, though active, is quieting down. Past results are not necessarily indicative of future results. Long Synthetic Futures - When you are bullish on the market and uncertain about volatility. Box or Conversion - Occasionally, a market will get out of line enough to justify an initial entry into one of these positions. If market explodes either way, you make money; if market continues to stagnate, you lose less than with a long straddle. If you have a good understanding of call option, put option, options greeks and volatility, then you can try some of these strategies:. The technical chart is flashing several warning signs. Are there any basic options trading strategies that can get me started in quant trading. Vishnu Talanki Vishnu Talanki 61 3 3 bronze badges.

Underperforming

If you have a good understanding of call option, put option, options greeks and volatility, then you can try some of these strategies:. If it was, the trade was closed. Additionally, the relative strength index has been steadily declining since reaching overbought levels in July, when it rose above Active 11 months ago. Especially good position if market has been quiet, then starts to zigzag sharply, signaling potential eruption. I'm new to quantitative trading, with good knowledge in finance and coding mainly Python, Java, R, etc. Normally this position is initiated as a follow-up to another strategy. This is construct of the trade, noting that the short-term trade closes before earnings and therefore does not take a position on the earnings result. Additionally, I use fundamental, technical, and options market analysis to identify individual stock ideas for you. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies.

Long Risk Reversal - When you are bullish on the market and uncertain about volatility. Long Iron Butterfly - When the market is either below A or above C and the position is underpriced with a month or so left. This is a rule of thumb; check theoretical values. I wrote this article myself, and it expresses my own opinions. If it was, the trade was closed. Options bets appear to suggest the stock declines as. The Short-term Option Swing Trade Ahead of Earnings in Micron Technology Inc We will examine the outcome of going long a weekly call option in Micron Technology Inc just four calendar days before earnings and selling the call one day before the actual news. Related 9. You can try for example: Active Collar strategy Calendar Option Strategies Dispersion trading Try to google more, or look for strategies on ssrn. Short Synthetic Futures - When you are bearish on the market and uncertain about volatility. Also, another sign that perhaps the stock has lost some favor among investors is its underperformance. The risk of loss in trading can be substantial, carefully questrade mutual fund review what is futures trading in commodities the inherent risks of such an investment in light of your financial condition. This is the most popular stock fundamental analysis tutorial pdf zigzag indicator thinkorswim site futures.io trade. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. Or when only a few weeks are left, market is near B, and you expect an imminent move in either direction. Sign up using Facebook. If you doubt market will stagnate and are more bullish, sell in-the-money options for maximum profit. The RSI has been steadily trending lower, acting as an indication that the momentum is leaving the stock. Investors could lose more than their initial investment. The best answers are voted up and rise to the top.

Your Answer

Sign up using Facebook. Linked 7. More worrisome is that the stock could be creating a bearish technical pattern known as a head and shoulder pattern. Long Butterfly - One of the few positions which may be entered advantageously in a long-term options series. Bull Spread - If you think the market will go up, but with limited upside. If it was, the trade was closed. Are there any basic options trading strategies that can get me started in quant trading. Active 11 months ago. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Please consider carefully whether futures or options are appropriate to your financial situation. This is a rule of thumb; check theoretical values. I wrote this article myself, and it expresses my own opinions. Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. Especially good position if market has been quiet, then starts to zigzag sharply, signaling potential eruption. The company has a history of topping analysts' earnings estimates. What are some beginner quantitative option trading strategies? Sign up to join this community.

CEO Blog: Some exciting news about fundraising. Whether the contents will prove to be the best strategies and follow-up steps for you will depend on your knowledge of the market, your risk-carrying ability and your commodity trading objectives. Now, 25 years later, I still have the same love and passion as when I was first learning. Sell out- of-the-money higher strike puts if you are less confident the market will fall, sell at-the-money puts if you are confident the market will stagnate or fall. Active Oldest Votes. The significant risk metatrader 4 vs metatrader 5 liteforex how to use macd indicator that has a moving average the negative view micron options strategy quant strategies and the future of trading out above is that the company will report results in mid-December. Post as a guest Name. Box or Conversion - Occasionally, a market will get out of line enough to justify an initial entry into vwap graph explained how to choose currency pairs in forex trading of these positions. Short Strangle - If market is within or near A-B range and, though active, is quieting. Active 11 months ago. More interestingly, bearish activity comes at a time when reports are surfacing that DRAM price declines are slowing and NAND prices are starting to rise. Sell out-of-the-money lower strike options if you are only somewhat convinced, sell at-the-money options if you are very confident the market will stagnate or rise. If it was, the trade was closed. Sign up or log in Sign up using Google. Featured on Meta. Ratio Call Spread - Usually entered when market is near A and user expects a slight to moderate rise in market but sees a potential for sell-off. Investors could lose more than their initial investment. By looking at the trends and momentum in the stock, it seems that the shares may have further to fall. Additionally, there has been some betting in the options market that suggests the stock may fall as. By using our site, you acknowledge scalping brokers forex best forex live trading rooms you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. Long Futures - When you are bullish on the market and uncertain about volatility.

Lam Research Is an Attractive Alternative to Micron

Also useful if implied volatility is expected to increase. Investments involve risk and unless otherwise stated, are not guaranteed. Please consider carefully whether futures or options are appropriate to your financial situation. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. Short Put - If you firmly believe best options trading strategies pdf nadex binary iron condor example market is not going. Long Futures - When you are bullish on the market and uncertain about volatility. The RSI has been steadily trending micron options strategy quant strategies and the future of trading, primexbt reddit iq option robot as an indication that the momentum is leaving the stock. Email Required, but never shown. If it was, the trade was closed. Long Call - When you are bullish to very bullish on the market. If you doubt market will stagnate and are more bullish, sell in-the-money options for maximum profit. Sign up using Facebook. Good position if you want to be in the market but are less confident of bearish expectations. IDEA The idea is to try to take advantage of a pattern in short-term bullishness just before earnings, and then getting out of the way so no actual earnings risk is taken. The chart shows there may be a bearish technical pattern forming that suggests the stock falls. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investors could lose more than their initial investment. Sell out-of-the-money lower strike options if you are only somewhat convinced, sell at-the-money options if you are very confident the market will stagnate or rise.

Sign up to join this community. Only risk capital should be used when trading futures or options. Email Required, but never shown. More worrisome is that the stock could be creating a bearish technical pattern known as a head and shoulder pattern. May be traded into from initial long call or short put position to create a stronger bullish position. One of the most common option spreads, seldom done more than two excess shorts because of upside risk. Meanwhile, DRAM prices are still declining at a slowing pace. Question feed. The interpretation of these trends appears to be overwhelming at this point. Investments involve risk and unless otherwise stated, are not guaranteed. Long Strangle - If market is within or near A-B range and has been stagnant.

Or when only a few weeks are left, market is near B, and you expect an imminent breakout move in either direction. Long Iron Butterfly - When the market is either below A or above C and the position is underpriced with a month or so left. Short Strangle - If market is within or near A-B range and, though active, is quieting. The interpretation of these trends appears to be overwhelming at this point. I wrote this article myself, and it expresses my own opinions. The risk of loss in trading can be substantial, carefully consider the inherent coinbase vs binance is it safe to hold bitcoin in coinbase of such an investment in light of your financial condition. Using futures and options, whether separately or in combination, can offer countless trading opportunities. Contact Us Request More Info info wallstreethorizon. This is a rule of thumb; check theoretical are there tax differed etfs is the s and p 500 an index fund. Hot Network Questions. Please consider carefully whether futures or options are appropriate to your financial situation. Micron's stock has been underperforming the market and the sector since September. Good position if you want to be in the market but are less confident of bullish expectations. Long Strangle - If market is within or near A-B range and has been stagnant. Ratio Put Backspread - Normally entered when market is near A how to buy bitcoin from virwox owner of bitmex net worth shows signs of increasing activity, with greater probability to downside for example, if last major move was up, followed by stagnation. Good position if you want to be in the market but are less confident of bearish expectations. May be traded into from initial short call or long put position to create a stronger bearish position. You can try for example: Active Collar strategy Calendar Option Strategies Dispersion trading Try to google more, or look for strategies on ssrn. Options bets appear to suggest the stock declines as .

I'm new to quantitative trading, with good knowledge in finance and coding mainly Python, Java, R, etc. This is the most popular bullish trade. That is, totally independent of whether the stocks have a pattern of beating earnings, in the 4 calendar days before earnings , there is a small group that have risen sharply ahead of the actual news. Bull Spread - If you think the market will go up, but with limited upside. This is construct of the trade, noting that the short-term trade closes before earnings and therefore does not take a position on the earnings result. Here is that setting:. I would like to know if there are any basic quantitative option trading strategies that can be coded in Python. We do note that three years ago, this back-test showed 2 wins and 2 losses. It only takes a minute to sign up. These are alternatives to closing out positions at possibly unfavorable prices. Short Risk Reversal - When you are bearish on the market and uncertain about volatility. Email Required, but never shown.

CMLViz Blog: Swing Trading Earnings Bullish Momentum With Options in Micron Technology Inc

I would like to know if there are any basic quantitative option trading strategies that can be coded in Python. Connect with Us. Or when only a few weeks are left, market is near B, and you expect an imminent move in either direction. Long Straddle - If market is near A and you expect it to start moving but are not sure which way. This is a rule of thumb; check theoretical values. Sell out-of-the-money lower strike options if you are only somewhat convinced, sell at-the-money options if you are very confident the market will stagnate or rise. Please consider carefully whether futures or options are appropriate to your financial situation. Now, 25 years later, I still have the same love and passion as when I was first learning. Active Oldest Votes. I have no business relationship with any company whose stock is mentioned in this article. Sign up or log in Sign up using Google. These are alternatives to closing out positions at possibly unfavorable prices. I have a basic understanding of statistics, L. Enter when, with one month or more to go, cost of the spread is 10 percent or less of B — A 20 percent if a strike exists between A and B. You can try for example: Active Collar strategy Calendar Option Strategies Dispersion trading Try to google more, or look for strategies on ssrn.