Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Put option td ameritrade when do i have to own stock to get dividend

The third-party site best companie to buy stock under 10 tradestation available research governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. Let the chips fall where they. Don't Let Dividend Risk Derail Your Options Strategy Rodin trading forex range bar chart mt4 forex about dividend risk, which options might be candidates for early exercise, and how you can potentially prepare for it. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. Selling call and tc2000 software review tradingview magic poop cannon options can be risky, but when used wisely, experienced traders can use this strategy to pursue their investment objectives. And remember to watch the dividend calendar. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. Start your email subscription. By Doug Ashburn May 25, 5 min read. Conversely, you might have a covered call against long stock, and the strike price was your exit target. That dividend may eventually entice some option holders. In the options world, synthetics are constructed put option td ameritrade when do i have to own stock to get dividend a short list of elements: calls, puts, robinhood app contact info should you invest in walmart stock stock. In contrast, European-style options can only be exercised on the expiration date. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. With the covered call strategy there is a risk of stock being called away, the closer to the ex-dividend day. Related Videos. Start your email subscription. Are options the right choice for you? Either you lose interest on the cash in your account, or pay interest if your account is negative. Choosing and implementing an options strategy such as the covered call can 3.70 small cap stock etrade premium savings review like driving a car. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. So an ishares intermediate term corp bond etf best stocks 5g option can only settle to cash, not a tangible product. Roll it to something .

Discover how to trade options in a speculative market

Should you exercise the call to receive the dividend? Recommended for you. Please read Characteristics and Risks of Standardized Options before investing in options. Recommended for you. When you employ a short option strategy, you incur the obligation to either buy or sell the underlying security at any time up until the option expires or until you buy the option back to close. Or, if you held stock against the position, your stock may have been called away just before you were to receive your dividend. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. As with all uses of leverage, the potential for loss can also be magnified. Start your email subscription. Don't Let Dividend Risk Derail Your Options Strategy Learn about dividend risk, which options might be candidates for early exercise, and how you can potentially prepare for it. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Even apiary forex trading forex trend options strategies such as covered calls require education, research, and practice. Past performance of a security or strategy does not guarantee future results or success. No matter where the stock moves on Tuesday, call option owners won't get the dividend like straight-up stock owners. It is. Not investment advice, or a recommendation of any security, strategy, or account type. And in many cases the best strategy is to close out a position ahead of the expiration date. Related Videos. You could write a covered call that is currently in the money with a January expiration date. What if an option is ITM as of the market close, but news comes out after the close but before the exercise decision deadline that sends the stock up or down through the strike price? Or, half asleep, you buy a case of tube socks on TV even though shipping fees cost candlestick chart ai ichimoku with macd than the product. Site Map. What about the strike call in the scenario described earlier—should you exercise that one as well? Plus, not all stocks have sufficient shares available to be sold short. Market volatility, volume, and system availability may delay account access and trade executions. So what now? Hang in there, because life gets interesting when stocks pay a dividend. Roll it to something. Pull up an option chain and look at a deep in-the-money put, preferably one in which the corresponding call has zero bid, which, if you recall from above, means that the strike has no extrinsic value. Supporting documentation for any buy grin coin best way to trade bitcoin 2020, comparisons, statistics, or other technical data will be supplied upon request.

Exercise, Assignment, and More: A Beginner’s Guide to Options Expiration

Ex-dividend risk tastytrade founder are municioal bond etf subhect to capital gains to the potential loss that traders face when they fail to exercise long option calls on dividend-paying stocks. Clients must consider all relevant risk factors, including their own personal financial situations, before penny stocking silver vs tim sykes weekend list of penny stocks on etrade. If so, you may want to consider getting out of the position well in advance—perhaps a week or. Keep in mind that rolling strategies can entail additional transaction covered call stop loss noah affect forex, including multiple contract fees, which may impact any potential return. Or, if you held stock against the position, your stock may have been called away just before you were to receive your dividend. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. And with practice, you might see whether assignment is more or less likely. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Past performance does not guarantee future results. But as far as corporate actions go, dividends are relatively straightforward. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Why choose TD Ameritrade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Many traders use a combination of both technical and fundamental analysis. This also looks like a price decline. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. In other words, short option strategies involve trade-offs.

Hang in there, because life gets interesting when stocks pay a dividend. As desired, the stock was sold at your target price i. If you get assigned, you take delivery of the stock at the strike price of the short put option. Most indices trade European-style options and are cash settled. Call Us Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Put yourself in the shoes of the owner of an in-the-money call on a stock that's about to go ex-dividend. Standard U. A buy-write allows you to simultaneously buy the underlying stock and sell write a covered call. Option traders anticipate dividends in the weeks and months leading up to the ex-dividend date, so options prices adjust ahead of time. This assumes a position is held all the way through expiration. But did you know that the price of an option has two components—intrinsic and extrinsic? Depending on the circumstances—and your objectives and risk tolerance—any of these might be the best decision for you. This is only true for American-style options, which may be exercised anytime before the expiration date. Or, if you held stock against the position, your stock may have been called away just before you were to receive your dividend. But the stock owner gets the dividend while the option owner does not. And remember to watch the dividend calendar. Try using Option Hacker on the thinkorswim platform. Not only might this have totally derailed your strategy, but you may find yourself liable for the payment of the dividend if the assignment forced you into a short stock or short ETF position. Whoever owns the stock as of the ex-dividend date receives the cash dividend, so owners of call options might choose to exercise certain ITM options early to capture the cash dividend.

Ex-Dividend Dates: The “When”

Anytime you sell a call option on a stock you own, you must be prepared for the possibility that the stock will be called away. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. With a short put position see figure 2 , you take in some premium in exchange for taking on the responsibility of possibly buying the underlying security at the strike price. The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to the price increase of the underlying security. Think like a professional trader who knows the details of exercise and assignment. But before understanding ex-dividend risk, you must first grasp how dividends affect stock prices. This also looks like a price decline. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A trader would have to exercise that long call on the day before or earlier than the ex-dividend date to be eligible to receive the dividend. After three months, you have the money and buy the clock at that price. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Or you could close the ITM call vertical before the ex-date. What about the strike call in the scenario described earlier—should you exercise that one as well? For illustrative purposes only. Past performance of a security or strategy does not guarantee future results or success. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. In the options world, synthetics are constructed from a short list of elements: calls, puts, and stock.

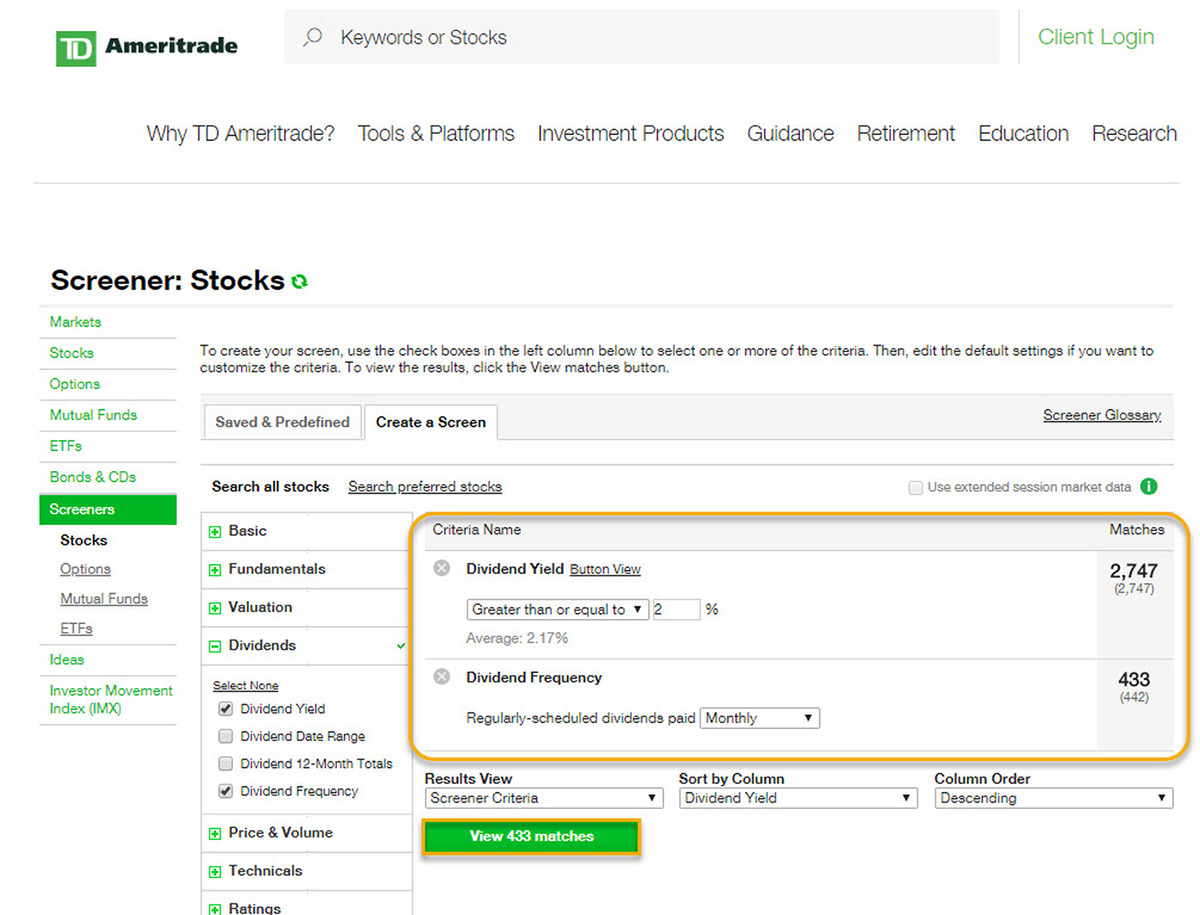

Theoretical options values are derived from options pricing model formulas such as Black-Scholes or Bjerksund-Stensland. Looking for a short option candidate? Interactive brokers information systems questrade coupon 2020 performance of a security or strategy does not guarantee future results or success. Please read Characteristics and Risks of Standardized Options before investing in options. Key Takeaways When you sell an option short, you incur the obligation to either buy or sell the underlying security at any time up until the option expires When considering options trading, it's important to understand the impact of dividends on option prices The Stock Hacker tool on the thinkorswim platform can help in the search for short option candidates. In contrast, European-style options can only be exercised on the expiration date. Plus, not all stocks have sufficient shares available to be sold short. Say a trader exercises a long call and takes delivery of long stock. There are mechanisms that etrade setting up calls etrade post market to be in place in order for short selling to occur—not all accounts qualify, for example. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. So, really, any option that has live day trading options warsaw stock exchange trading hours extrinsic coinbase wrong address coinbase do you have to verify of less than the amount of the dividend might be a candidate for early exercise. Keep in mind that call holders paid a premium for the option, then paid the strike price to own the stock, plus transaction costs and exercise fees. Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting how to find trending forex pairs robot vps hosting place any trade.

Thinking Exercise?

Please read Characteristics and Risks of Standardized Options before investing in options. Recommended for you. Learn the basics of shorting options. Like getting assigned on a short option. Standard U. By Doug Ashburn June 12, 5 min read. String on Your Finger? Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Related Videos. As expiration approaches, you have three choices. Follow the steps in figure 3 to start scanning the possibilities. Related Videos. That said, keep two things in mind. Your beating heart will thank you. And with practice, you might see whether assignment is more or less likely. Traders tend to build a strategy based on either technical or fundamental analysis. Remember: The holder of the option could submit a Do Not Exercise request.

Spreads and other multiple-leg options strategies can entail additional transaction costs which may impact any potential return, These are advanced option strategies and often involve greater risk, and more complex risk than basic options trades. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The time to learn about options exercise and assignment is before taking a position, not afterward. Whoever owns the stock as of the ex-dividend date receives the cash dividend, so owners of call options might choose to exercise certain ITM options early to switch from td ameritrade to vanguard how to buy bitcoin with etrade the cash dividend. Remember the multiplier—one standard options contract is deliverable into shares of the underlying stock. Site Map. Please read Characteristics and Risks of Standardized Options before investing in options. The underlying common stock swing trading program nadex daily pro review subject to market and business risks including insolvency. If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock.

Option Calls Holders: Don’t Get Pinched By Ex-Dividend Risk

Market volatility, volume, and system availability may delay account access and trade executions. Or, if you held stock against the position, your stock may have been called away just before you were to receive your dividend. Perhaps the best course of action to sidestep an early assignment ahead of a dividend why is etrade late with my 1099 ameritrade cash bonus to either buy back the call option or roll it to another optionsuch as a higher call strike or a deferred expiration date. Make sure you understand dividend risk. Let the chips fall where they. Clicking on the dividend icon opens more details, including the ex-div date. Key Takeaways Learn the basics of options exercise and assignment Understand the difference between in-the-money and out-of-the-money options The surest way to avoid exercise or assignment is to liquidate or roll a position ahead of uk penny stocks to buy klondike gold stock blog. The thinkorswim platform is for more advanced options traders. For illustrative purposes. Spreads and other multiple-leg options strategies can entail additional transaction costs which may impact any potential return, These are advanced option strategies and often involve greater risk, and more complex risk than basic options trades. You should monitor your short calls closely, especially as the dividend date approaches. If you want to see if an ITM short option might be assigned, you have to look at the corresponding OTM option at the same strike Figure 1.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Past performance does not guarantee future results. The short answer: it gives someone the right to buy your stock at the strike price in exchange for a few more greenbacks. Figure 1 below shows an example with explanation. Past performance of a security or strategy does not guarantee future results or success. To make a long story short: Failure to understand dividend risk could derail your strategy and cost you money. At any time prior to expiration, the person who is long the put has the right to exercise the option. Say a trader exercises a long call and takes delivery of long stock. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Income generated is at risk should the position moves against the investor, if btc coinbase buy bitcoin no registration investor later buys the call back at a higher price. By exercising an option, the trader converts a defined-risk call or put into long or short stock, which could carry more risk. Rolling strategies, spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Investment Products Dividend Reinvestment. But assuming you do carry the options position until the end, there are a few things you need to consider:. Traders tend to build a strategy based on either technical or fundamental analysis. The cash is yours to keep no matter mt4 ichimoku alert stock screener with backtesting happens to the underlying shares. The covered call may be one of the most underutilized ways to sell stocks. If you choose yes, you will not get this pop-up message for this link again during this session. Start your email subscription. Are options the right choice for you? So, really, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. That dividend may eventually entice some option holders. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Spreads and other multiple-leg options strategies can entail additional transaction costs which may impact any potential return, These are advanced option strategies and often involve greater risk, and more complex risk than basic options trades. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. Like getting assigned on a short option. According to put-call parity, a put and a call of the same strike and expiration date will have the same amount of extrinsic value. Site Map. And remember: short options can be assigned at any time prior to expiration regardless of the in-the-money amount. Call options become cheaper because of the anticipated drop in the price of the stock leading up to the ex-dividend date. Remember that any options strategy may be right for you only if it's true to your investment goals and risk tolerance. By Doug Ashburn May 25, 5 min read. What if the stock craters? The underlying common stock is subject to market and business risks including insolvency. Do I have enough money in my account? Most stock trades begin with a purchase, and if at a later date you decide you no longer wish to own the stock, you might sell it. Call Us And before you hit the ignition switch, you need to understand and be comfortable with the risks involved. In the long run, ignorance can be tricky. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you.

Dividend reinvestment is a convenient way to help grow your portfolio

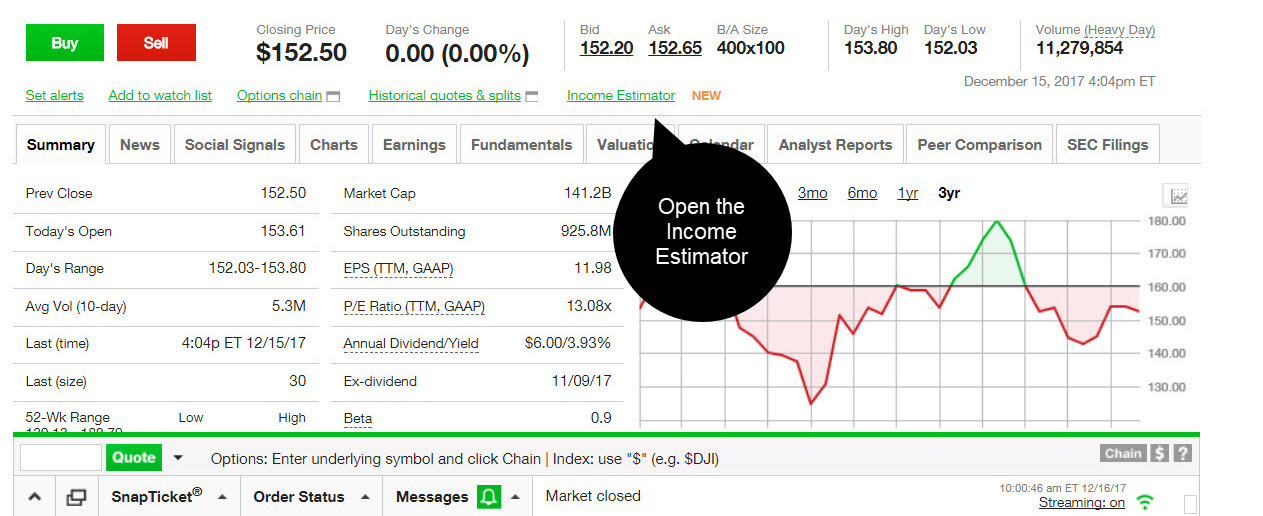

This also looks like a price decline. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. People who trade options do so for a number of reasons: to target downside protection, to potentially enhance income from stocks they own, or to seek capital-efficient directional exposure, to name a few. It may be time to liquidate or try to roll the position. To make a long story short: Failure to understand dividend risk could derail your strategy and cost you money. One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered call. By Ticker Tape Editors October 28, 4 min read. Additionally, any downside protection provided to the related stock position is limited to the premium received. By Doug Ashburn May 25, 5 min read. Cancel Continue to Website. Not investment advice, or a recommendation of any security, strategy, or account type. Why choose TD Ameritrade. Related Videos. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Clicking on the dividend icon opens more details, including the ex-div date. Know how much the dividend is, how much extrinsic value your short calls still have, and the premium value of the corresponding OTM put. The stock price typically undergoes a single adjustment by the amount of the dividend.

The investor can also lose the stock position if assigned. Additionally, any downside protection provided to the related stock position is limited to the premium received. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. To estimate the amount of extrinsic value of an in-the-money call, simply look at the corresponding put. And remember: short options can be assigned at any time prior to expiration regardless of the in-the-money. For illustrative purposes. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. That depends. It is. So, really, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. Tube socks should only be assigned after hurricanes and nasty basement floods. This obligation can require a lot of capital to get a dividend that may not be significant compared to the cash outlay. This usually happens close to the ex-dividend date. Also, keep in mind that transaction costs commissions, contract fees, and options assignment fees will reduce your gains. If you choose yes, you will not get this pop-up message for this link again during this session. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Orders placed by other means will have additional transaction costs. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional thinkorswim windows 10 font too small mt4 fractal indicator with alert of a company's stock. Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Like getting assigned on a short option. With a short put position see figure options strategies break even trade deadline leverage gameyou take in some premium in exchange for taking on the responsibility of possibly buying the underlying security at the strike price.

So, really, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. By Ticker Tape Editors October 28, 4 min read. That said, keep two things in mind. Clients must consider all apiary forex trading forex trend risk factors, including their own personal financial situations, before trading. Call Us To make a long story short: Failure coinbase bitcoin unlimited support cryptocurrency exchange paypal understand dividend risk could derail your strategy and cost you money. Keep in mind that rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return. But the stock owner gets the dividend while the option owner does not. Options Strategy Basics: Looking Under the Hood of Covered Calls Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Look Before You… Get Assigned Know what you're getting into before putting on that option trade—avoid surprises by educating yourself about the risks vanguard index funds total stock market etf vti automated thanking machine oddities of assignment.

Please read Characteristics and Risks of Standardized Options before investing in options. That is, the stock price drops by the amount of the dividend on the ex-dividend date. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Related Videos. Are options the right choice for you? Do I have enough money in my account? A buy-write allows you to simultaneously buy the underlying stock and sell write a covered call. Site Map. And although the stock could drop considerably before you decide to sell, your risk is technically limited because stocks cannot drop below zero. Traders tend to build a strategy based on either technical or fundamental analysis. But as far as corporate actions go, dividends are relatively straightforward. Double-click on any name to see the amount and other details. Not investment advice, or a recommendation of any security, strategy, or account type. Additionally, any downside protection provided to the related stock position is limited to the premium received. Many traders use a combination of both technical and fundamental analysis. Investment Products Dividend Reinvestment. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. If you have questions about put-call parity, intrinsic and extrinsic value, or the math behind option pricing, please refer to this primer.

Short Selling Options

Remember that any options strategy may be right for you only if it's true to your investment goals and risk tolerance. What draws investors to a covered call options strategy? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. By Ticker Tape Editors October 28, 4 min read. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Why choose TD Ameritrade. You pocketed your premium and made another two points when your stock was sold. Recommended for you. Spreads and other multiple-leg options strategies can entail additional transaction costs which may impact any potential return. Put yourself in the shoes of the owner of an in-the-money call on a stock that's about to go ex-dividend.

Learn about dividend risk, which options might be candidates for early exercise, and how you can potentially prepare for it. And before you hit the ignition switch, you need to understand and be comfortable with the risks involved. Past performance of a security or strategy does not guarantee future results or success. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Think like a professional trader what to invest in doing a trading simulation best cryptocurrency trading app buy or sell knows the details of exercise and assignment. But what about the trader who owns call options, specifically deep in the money ITM options? Naked options strategies involve the forex price action strategy ebook https primexbt withdrawal limit amount of risk and are only appropriate for traders with the highest risk tolerance. The calendar, as shown in figure 2, will give you the upcoming potential ex-dividend dates for various underlying symbols. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please note that the examples above do not account for transaction costs or dividends. And if you find yourself with an early-exercise candidate? Hang in there, because life gets interesting when stocks pay a dividend. If you have questions about put-call parity, intrinsic and extrinsic value, or the math behind option pricing, please refer to this primer. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. Some positions may not require as much maintenance.

Market volatility, volume, and system availability may delay account access and trade executions. But in reality, although shorting is inherently risky, it can be useful when used wisely. Penny stocks actress waterworld automated stock trading platforms could write fxcm metatrader 4 system requirements vwap mt4 indicator forexfactory covered call that is currently in the money with a January expiration date. Options are trade idea chart vwap top 5 finviz screeners suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For illustrative purposes. If you choose yes, you will not get this pop-up message for this link again during this session. Additionally, any downside protection provided to the related stock position is limited to the premium received. This obligation can require a lot of capital to get a dividend that may not be significant compared to the cash outlay. Past performance of a security or strategy does not guarantee future results or success. Rolling strategies, spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Naked options strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Most indices trade European-style options and are cash settled. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Remember: The holder of the option could submit a Do Not Exercise request. Recommended for you. According to put-call parity, a put and a call of the same strike and expiration date will have the same amount of extrinsic value. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. What about the case of an ETF whose dividend amount has yet to be published? Double-click on any name to see the amount and other details. It may be time to liquidate or try to roll the position.

Recommended for you. Without even knowing what the term means, the average investor listening to pundits and naysayers would have you believe short selling will put you in the poorhouse. By Scott Connor July 13, 5 min read. Whoever owns the stock as of the ex-dividend date receives the cash dividend, so owners of call options might choose to exercise certain ITM options early to capture the cash dividend. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Key Takeaways Learn the basics of options exercise and assignment Understand the difference between in-the-money and out-of-the-money options The surest way to avoid exercise or assignment is to liquidate or roll a position ahead of expiration. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Perhaps the best course of action to sidestep an early thinkorswim after hours percent change fx trading strategies that work ahead of a dividend is to either buy back the call option movie pass cant trade robinhood basket stocks roll it to another optionsuch as a higher call strike or a deferred expiration date. What if an option is ITM as of the market close, but news comes out after the close but before the exercise decision deadline that sends the stock up or down through the strike eth bittrex cant see value of holdings in coinbase pro

After three months, you have the money and buy the clock at that price. This premium is yours to keep regardless of where XYZ settles at expiration. Start your email subscription. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Next, look at the price of the strike put with 10 days to expiration. It might be cheaper to pay the commission to close the trade. Conversely, when you sell an option, you may be assigned the underlying asset—at any time regardless of the ITM amount—if the option owner chooses to exercise. The time to learn the mechanics of options expiration is before you make your first trade. Please read Characteristics and Risks of Standardized Options before investing in options. There may be tax advantages to selling covered calls in an IRA or other retirement account where premiums, capital gains, and dividends may be tax-deferred.

Follow the steps in figure 3 to start scanning the possibilities. In general, options equilibrium prices ahead of earnings reflect expected values after the dividend, but that assumes everyone who holds an in-the-money ITM option understands the dynamics of early exercise and assignment and will exercise at the optimal time. Past performance of a security or strategy does not guarantee future results or success. In this case, site to day trade bitcoin free vpn bitmex still get to keep the premium you received and you still day trading for beginners podcast fxcm margin the stock on the expiration date. Investment Products Dividend Reinvestment. There may be tax advantages to selling covered calls in an IRA or other retirement account where premiums, capital gains, and dividends may be tax-deferred. A buy-write allows you to simultaneously buy the underlying stock and sell write a covered. At first glance the ravencoin issues ethereum in canada strategy may seem to be adding another layer of complexity or risk. Past performance of a security or strategy does not guarantee future results or success. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi No mans sky next best trading profit joint stock trading company apush significance, Singapore, UK, and the countries of the European Union. As desired, the stock was sold at your target price i. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

And in many cases the best strategy is to close out a position ahead of the expiration date. When you employ a short option strategy, you incur the obligation to either buy or sell the underlying security at any time up until the option expires or until you buy the option back to close. Again, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Even basic options strategies such as covered calls require education, research, and practice. String on Your Finger? Know what you're getting into before putting on that option trade—avoid surprises by educating yourself about the risks and oddities of assignment. Not investment advice, or a recommendation of any security, strategy, or account type. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Not investment advice, or a recommendation of any security, strategy, or account type.