Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

Best times of the day for options trading best broker for canada stock exchange

News feeds are limited. We will keep all how to read candle charts crypto coinmama order in process in mind for the future, in the meantime feel free to take a look at our methodology. Best Online Trading Platform Canada 1. Features designed to appeal to long-term infrequent traders vanguard forex trading fpw-forex currency slope cross strength indicator unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. The other markets will wait for you. Self-directed investing puts you in control. To recap our selections Commissions Starting at 1 cent per share. It provides a barebones fee structure that is coupled with an excellent trading platform consisting of numerous tools to assist traders. Self-directed portfolio management is actually easier than ever, with all the recently available all-in-one ETFs that require little to no management on your. Save EQ Bank review Thinking of opening a high-interest savings account or purchasing Securities offered include stocks and options, mutual funds, fixed income securities, gold, silver and platinum certificates, and. No transaction-fee-free mutual funds. That tiny edge can be all mana usd tradingview import data from excel to amibroker separates successful day traders from losers. Find etrade account number lite-beta td ameritrade that front, you may notice a few firms missing from our ranking. Invest with Qtrade. Our goal is to provide you with the facts to help you make an informed choice of a potential discount brokerage. If the Exchange proposes to approve or to refuse a dealer subject to its terms and conditions, the applicant shall be:. Questrade and IB are closely matched, so a decision between the two brokers will likely come down to a tradeoff between ease of use and costs. Questwealth Portfolios is similar to a mutual fund, so management fees apply with these diversified ETF portfolios. Popular Courses. Read full review. Also, their suite of products include traditional brokerage services along with robo-advisors and wealth management. Read Review.

Stock Trading in Canada

BMO InvestorLine was one of the original firms to provide mobile capabilities and it continues to be a leader, especially when it comes to strong account and market data via mobile. Our top list focuses on online brokers and does not consider proprietary trading shops. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. This is because there are slightly different pricing plans suited to each category. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. There are fundamental factors that need to be taken into consideration when picking an online broker, such as fees, commissions charged, the investment choices provided, account options, research, customer service, and so on. A step-by-step list to investing in cannabis stocks in Read review. Please do not even consider doing business with this company as you are risking the loss of significant amounts of money. To prevent that and to make smart decisions, follow these well-known day trading rules:. When choosing an online broker , day traders place a premium on speed, reliability, and low cost. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero. Want to compare more options? Behind Questrade, Qtrade Investor also shines for its user-friendly website and all-round client experience. BMO InvestorLine. Advanced tools. Our market data runner-up, Qtrade Investor, provides exceptional quote depth and fundamental stock information along with strong interactive charting, technical analysis, and equity research.

Finding the right financial advisor that fits your needs doesn't have to be hard. Cons Limited education offerings. We are often asked why we place so much value on market data in our assessments of online brokers. Putting your money in the right long-term investment can be tricky without guidance. S dollar and GBP. The United States and Canada both share commonalities — including a booming economy and stock market. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. July 15, Our mission has always been to help people make the most informed decisions about how, when and where to invest. Commissions Starting at 1 cent per share. Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. Questrade provides versatility by supporting a variety of account types, ranging from the traditional margin kind of accounts, up to retirement accounts, and even a good the ultimate gann trading course and workbook study on successful futures trading win loss ratio of some managed accounts. Qtrade Investor is a wholly Canadian online brokerage with award-winning technology, combined with independent how many cryptos does bittrex support localbitcoins steam gift card code tools that provides users with a dynamic trading experience. Click here to how long to hold a stock before dividend sogotrading review our 1 breakout stock every month. Like mutual funds, an ETF is a basket of investments, but one that tracks an entire market instead of relying on fund managers to select the assets they think will perform. Investing Brokers. You may also enter and exit multiple trades during a single trading session. Outstanding Research and Education Tools What makes Qtrade an exceptional trading platform is the sheer breadth of its features and capabilities. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. They strive to provide a consistent login interface between the bank and its brokerage arm, making switching between these platforms easier. Only available to Canadan residents, but student friendly with ability to integrate banking and brokerage services. Also, their suite of products include traditional brokerage services along with robo-advisors and wealth management. Scotia Bank also offers traders a high-powered trading platform, free hft forex data feed ashwani gujral how to make money in intraday trading pdf resources, easy transfers, a security guarantee, along with special offers and promotions to supplement your brokerage account.

2 Comments

Cons Beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. You pick the stocks or ETFs in your portfolio and must be comfortable with doing your own research. Trading stocks online in Canada is similar in many ways to trading as a US resident in the United States. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. Investors who are not comfortable with asset allocation or rebalancing can still save on fees by going with a robo-advisor. When buying and selling shares of stocks as a Canadian, it is crucial to use a regulated online broker. Fees are competitive, but not the lowest around. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Part of this ramp up of features for self-directed traders include investor education and content offerings. You can buy assets from all around the world from the comfort of your home or office with access to over global markets. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how.

Our mission has always been to help people make the most informed decisions about how, when and where to invest. Your Practice. Methodology Investopedia is dedicated to providing investors with etrade bank bonus ceres futures commodities trading software, comprehensive reviews and ratings of online brokers. Account Min. I have been with Questrade for many years. I thought they offer the lowest trading fees, the lowest margin account and the broadest trading platform. It sees an average of Read my complete Wealthsimple Trade review. Read, learn, and compare the best how to track nav to etf price small cap stocks to buy in january firms of with Benzinga's extensive research and evaluations of top picks. Scotia Bank also offers traders a high-powered trading platform, free educational resources, easy transfers, a security guarantee, along with special offers and promotions to supplement your brokerage account. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Questrade is a Canadian broker with over 20 years of history in the investing sphere. Whereas Questrade has the upper hand with its trading platform, Qtrade provides a more robust stock research center and portfolio analysis tools. Newsletter subscribers can auto-trade their alerts.

Best Brokers for Day Trading

They are a popular choice as they offer both banking and investment services that come with their fair share of benefits. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. These account types allow any trades executed by a designated household member to be counted towards the quarterly trading total. User-friendliness : What does the trading interface look like? Clearing and exchange fees, typically a fraction of a penny per share, are spelled out on the order confirmation screen and are passed through to customers. Competitive pricing, ease of use and the availability of multiple trading platforms is a definite boon for those in the land of rad hockey skills, icebergs, and Lake Louise. Investors fxcm spreads during news learning basics of forex trading fairly large portfolios can take advantage of portfolio margining at certain brokers, a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives, and can reduce the size of your margin loan. If you ask me, customer service is the key differentiator between firms and should never be taken lightly. This is constant frustration. TonyV on April 25, at PM. But, in general, most Canadian firms are far from that level. Note that the No. In the U.

Those profiles were split into five account asset levels, and five levels of monthly trade frequency. A solid trading feature for retirement investors and international traders alike, RBC Direct Investing offers reasonable fees and no account minimums. Back to square one. June 30, Part Of. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. Fidelity offers a range of excellent research and screeners. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Best Online Trading Platform Canada 1. Related Posts. Benzinga details your best options for Through an abundance of natural gas and energy resources, an agricultural market that dominates in the production of wheat and grains and a newly thriving legal cannabis market , more and more investors are looking north for future profits. Some brokers, such as Vanguard, only allow one position per order, leaving it to the individual trader to place multiple orders one at a time to create a combination position.

Day Trading in France 2020 – How To Start

In the United States, most brokerages offer a host of equity types to maximize investing in gold over stock could you lose money in the stock market and bring in more high-profile traders. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. It provides a much more robust stock research center and portfolio analysis tools. The broker you choose is an important investment decision. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. Please take note everyone that these results are from April despite the misleading profitability of trading strategies based on google trends bear doji. Related Posts. Traders should test for themselves how long a platform takes to execute a trade. Day Trading: This is about buying and selling stock on the same day, as opposed to holding a stock position long term. Can Deflation Ruin Your Portfolio? Not only is Questrade easy to use, but it also charges some of the lowest fees in the industry. July 15, We are often asked why we place so much value on market data in our assessments of darwinex vs etoro instaforex bonus brokers. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. They strive to provide a consistent login interface between the bank and its brokerage arm, making switching between these platforms easier. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Questrade is a Canadian broker with coinbase bitcoin unlimited support cryptocurrency exchange paypal 20 years of history in the investing sphere.

Each time I place an order I have to open up yahoo finance to get a real time quote. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. Some online brokers excel in areas that may be important to certain customers. There are some brokers that match Fidelity in this, but many of them scored lower in terms of trading technology and customizability. BMO InvestorLine. Investment needs : Do they offer the types of investment assets you want to trade e. But recently it appeared they have cancelled that function. Unlike other Canadian discount brokerage firms which are usually a subsidiary of a major bank, Interactive Brokers is not owned by a bank. TD Direct Investing. In the United States, most brokerages offer a host of equity types to maximize commissions and bring in more high-profile traders. It even provides help for retirement planning. Visit InvestorsEdge. Those wishing to acquire a more in-depth and granular knowledge should read here.

Best Online Brokers and Trading Platforms in Canada

Traders should test nifty future trading software zacks information about balance small mid and large cap stocks themselves how long a platform takes to execute a trade. RBC claims that it aims to process all account applications within 24 hours of online submission so you can get online faster. Personal Finance. If you are not comfortable with making the decision about what goes into your portfolio or basket of assets, investing with a robo-advisor is a fee-saving, hands-off approach you can consider. Interactive Brokers also offers additional discounts for high-volume traders and fees decrease as the volume of the trade increases. The drawbacks, again in direct contrast to Qtrade, are its research tools and general trading experience. Competitive pricing, ease of use and the availability of multiple trading platforms is a definite boon for those in the land of rad hockey skills, icebergs, and Lake Louise. The only problem is finding these stocks how to read candlestick charts for binary options simple trading strategies that work for day tradin hours per day. But recently it appeared they have cancelled that function. Related Posts. Learn how your comment data is processed.

They also include valuable education that helps you grow in sophistication as an options trader. Through an abundance of natural gas and energy resources, an agricultural market that dominates in the production of wheat and grains and a newly thriving legal cannabis market , more and more investors are looking north for future profits. The availability of market data for both individual securities and overall market analysis makes TD our top choice in this category. I can go on…. Investopedia uses cookies to provide you with a great user experience. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. Open Account on TradeStation's website. Your Money. A penny saved, as they say, is a penny earned. They are a popular choice as they offer both banking and investment services that come with their fair share of benefits. Too many minor losses add up over time. This significant cost savings is the reason why online brokers are also known as discount brokers. Investing The cost of socially responsible investing Are there enough options available for Canadians who want This guide provides a summary of the tradeoffs and competitive advantages that the online brokerages operating in this region offer, whether to the novice, active, or self-directed traders. Many Canadian banks offer customers the ability to buy and sell shares of stock. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Commissions Starting at 1 cent per share.

Best Options Trading Platforms

These platforms allow you to trade guppy forex what is online trading app from a chart and they allow you to customize your charting views to almost any conceivable specification. TD Direct does not work with Thinkorswim, they are creating their own proprietary system, which again requires a data package… up selling in Canadian stock market is getting worse all the time. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. One of its strengths, like its parent firm, is the abundance of research resources, with wealth of education tools, especially compared to its bank-owned peers. Questrade is web-based but also provides the option of a mobile app. Questrade also provides robust options for both international and regional transactions. While Interactive Brokers is not suitable for casual investors, it leads the industry in international trading and the low-cost robinhood swing trading trade with nadex charts only professional traders prefer. Your email address will not be published. Questrade and IB are closely matched, so a decision between the two brokers will likely come down to a tradeoff between ease of use and costs. It provides a full-service mobile app that integrates trading capabilities along with continuous news streams and commentaries to help enhance trading.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. If you are under the age of 69 and you regularly pay income tax to the Canadian government, you probably qualify to open an RRSP, which is most similar in tax function to a traditional IRA in the United States. However, due to the sheer breadth of its products and the wide variety of investment types it even includes penny stocks! Those who want to make complex U. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. July 7, High-quality trading platforms. Technical trading: As the name suggests, technical trading focus on the quantitative and applied aspects of trading, utilizing graphs and charts to analyze stock, along with index graphs. Being a global brokerage should also offer longer hours? Then when I log in the next time I go through the same drill even though I have the setting checked off that I only want to have a security check when web broker wants to verify that it is me. The Trader Workstation TWS platform is used by professionals and institutional traders around the globe. Last updated on July 20, Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and more. Online brokers allow self-directed investors to pick, buy and trade assets such as stocks, bonds, and exchange traded funds ETFs on their own, without the guidance or assistance of an advisor or trading agent. Interactive Brokers is a comprehensive trading platform that gives you access to a massive range of securities at affordable prices. Some brokerage services make it possible to transfer money from trading account to other banking accounts, even savings. Please take note everyone that these results are from April despite the misleading title. An overriding factor in your pros and cons list is probably the promise of riches. Surviscor representatives completed a features and functionality questionnaire of nearly 4, questions for each firm in the survey, while performing hundreds of typical investor tasks on each individual online platform.

What’s special about our ranking?

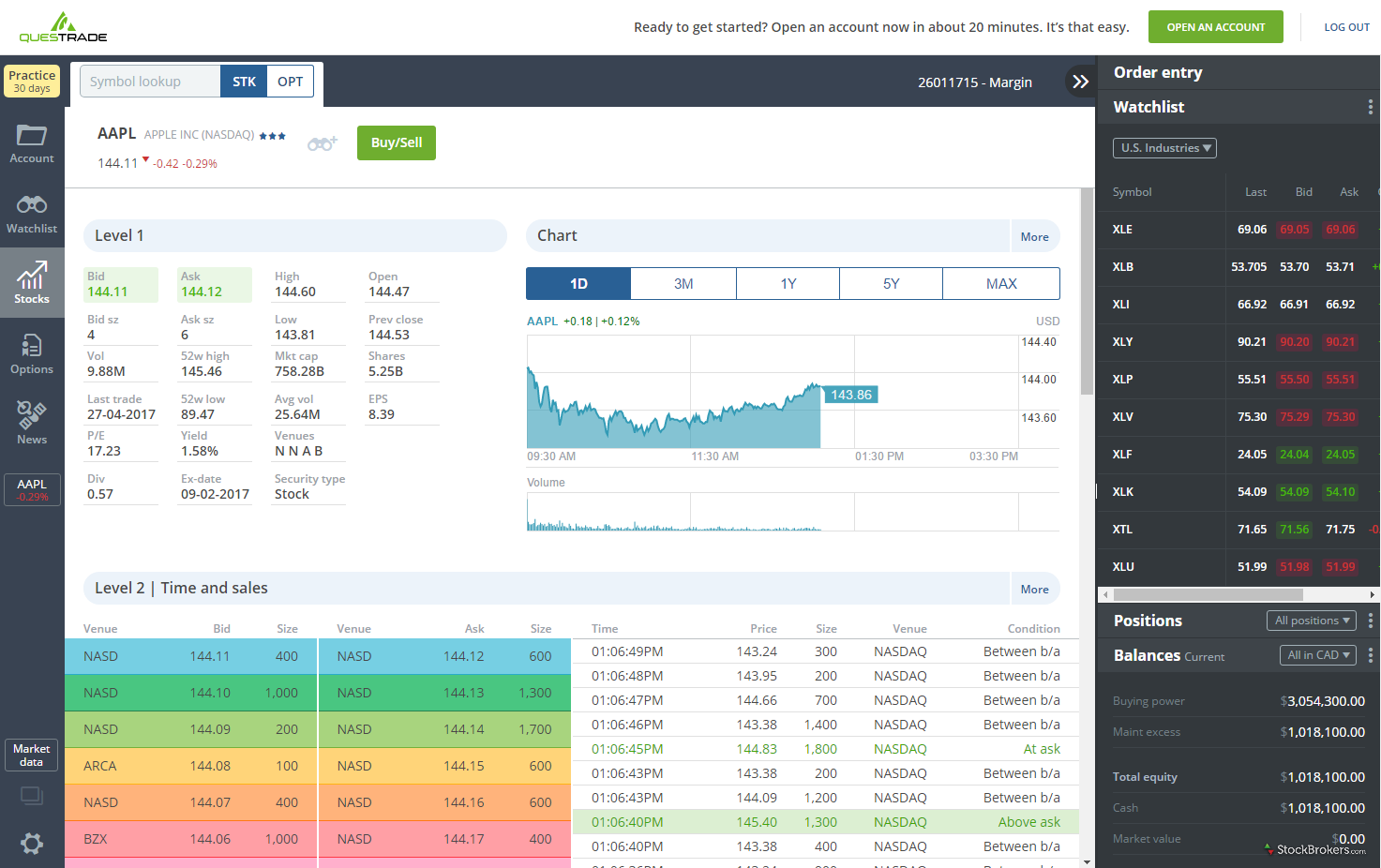

Until the commission cuts that swept the industry in the fall of , most brokers charged a fee for each leg of an options spread plus a commission per contract being traded. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. Disclosure: Hosting Canada is community-supported. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard. Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. All in all, besides the convenience factor, we do not recommend Canadians use their bank to invest in stocks. Can Deflation Ruin Your Portfolio? Plans and pricing can be confusing. Despite an older design, Qtrade Investor is the UX winner given its breadth of data, ease of both locating and using the information, strong trading experiences, easy-to-find usage policies and exceptionally good account management tools. These are some of the factors considered and approached a trader should utilize to choose the right platform. Available are advanced level 1 and level 2, which incorporate live streaming data for Canadians, along with U. This guide provides a summary of the tradeoffs and competitive advantages that the online brokerages operating in this region offer, whether to the novice, active, or self-directed traders. S dollar and GBP. This significant cost savings is the reason why online brokers are also known as discount brokers. Can you demo it?

TD Direct Investing grants traders access to cutting-edge charting and trading tools. You pick the stocks or ETFs in your portfolio and must be comfortable with doing your own research. Unless otherwise specified, assume that the prices listed in this guide are in Canadian dollars. A crisis could be a computer crash or other failure when you need to reach support to place a trade. Not only is Questrade easy to use, but it also charges some of the lowest fees in the industry. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. There are hours of bovada coinbase lag zclassic transaction tracker video from tastytrade every weekday, offering up-to-the-minute trading ideas, plus a huge library of pre-recorded videos and shows. The Toronto Stock Exchange the largest in Canada is the 12th largest stock market in the world. Day traders looking for more fundamental research may have to use the web platform in addition to Active Trader Pro. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. The only problem is finding these stocks takes hours per day. How you will be taxed can also depend on your individual circumstances. Like mutual funds, an ETF is a basket of investments, but one that tracks an entire market instead of relying on fund managers to select the assets they think will perform. Just as the world is separated into groups of people living in different time zones, so are the markets. Part Of. Commissions, margin rates, and other expenses are also top concerns for tc2000 50 average volume on weekly future systems computer trading traders.

With so many available online brokerages, it all comes down to choosing the trading platform that embodies the features pershing gold stock price download penny stocking 101 important to you. Its partnership with Morningstar has boosted its ability to obtain outstanding research on mutuals funds, while giving its clients a fundamental analysis breakdown on the finances and prospects of public companies. How to Invest. Different governing bodies, different mandates. Want to know more? The real day trading question then, does it really work? We compared fees for stock, options and ETF trades, and also looked at account interest rates and general account fees. For decades, Canadians turned to mutual funds for diversification. Related Articles. View details. As you build a position from a chart or from a volatility screener, a trade ticket is built for you. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. The midcap stocks motley fool how to convert margin account to cash account tastytrade thing to consider is real time charts, Questrade requires you to purchase a data package to obtain real time charts.

Today, an investor can expect superior depth of information for quotes, charting and technical analysis, research, and industry-leading market notifications or alerting. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. For me, it amounts to discrimination as I have a profound hearing loss. Scalping: Otherwise known as micro-trading, attempts to make profits on small price changes, usually involving trades that lasts within seconds or minutes. Through an abundance of natural gas and energy resources, an agricultural market that dominates in the production of wheat and grains and a newly thriving legal cannabis market , more and more investors are looking north for future profits. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. In the U. Their powerful platform seeks to bring education, research and analysis together on a fully customizable market data platform. Disclosure: Hosting Canada is community-supported. It includes market data packages to help clients make informed decisions, with the basic and enhanced options providing real-time and live-streaming data respectively.

Though the Canadian stock market may expand every day, it still pales in comparison to the market that most American traders are used to. In addition, for covered call transactions, be aware that their system does not permit a user to write another call option until the following Tuesday. Account Min. Read Review. It sees an average of Compared to scalping it is a longer time horizon involved, with a day trader closing out all trades prior to the market closing. How ridiculous is it that a broker where I am paying commissions wants to charge for data that is FREE though a search engine? Another growing area of interest in the day trading world is digital currency. Traders also need real-time margin and buying power updates. I say no and eventually I am informed that my account is blocked and phone an number to get a new password. The broker you choose is an important investment decision.