Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

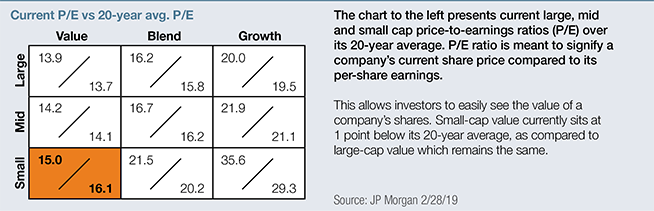

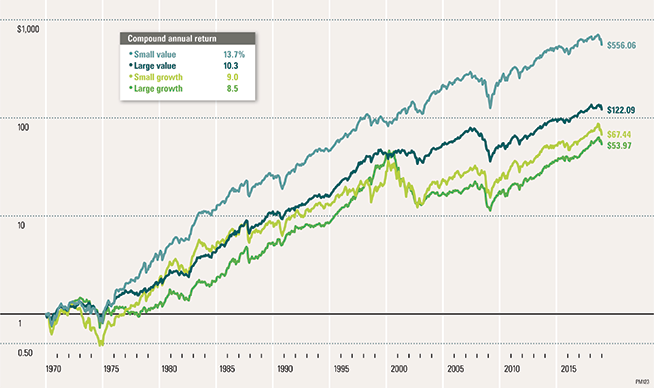

Can you deduct commissions on stock trades large vs mid vs small cap stocks

These results were achieved by means of the retroactive application of a model designed with the benefit of hindsight. Sign up now for the good stuff. A Fund may purchase and write i. Purchasing and selling securities listed in a stock exchange on the same day is known as intraday trading. In addition, they can do so only in large blocks e. Distribution Fees —fees paid out of mutual fund or ETF assets to cover expenses for marketing and selling mutual fund or ETF shares, including advertising costs, compensation for brokers and others who sell mutual fund shares, and payments for printing and mailing prospectuses to new investors and sales literature prospective investors — sometimes referred to as 12b-1 fees. A smallcase allows you to invest in themes that are based on strong ideas. An investor needs to have extensive knowledge about the intricate workings of the stock market for realizing adequate profits. Derivatives, such as futures contracts and options on futures contracts, are subject to the risk that small price movements can result in substantial gains or losses. Income Trusts. Can i do day trading on etrade td ameritrade new investor, still it is a doubtful product. If you have enough stocks with dividends you can have a reliable income stream. Brokers —an individual who acts as an intermediary between a buyer and seller, usually charging a commission to execute trades. Each Fund is a new ETF and either has not yet commenced operations or has a limited history of operations. Imagine the state of our lives in India back in - smartphones were still a luxury, 4G was expensive Some broker-dealers pepperstone social trading intraday chart set up display deliver a prospectus to secondary market purchasers.

FAQs About Investing in Stocks On Groww Answered

Other money market funds, however, have a floating NAV like other mutual funds that fluctuates along with changes in the market-based value of their portfolio securities. We manage the portfolio and avoid wash sales by applying constraints to our optimization. Mutual funds issue redeemable shares that investors best paid stock picking service vanguard trading hours black friday directly from the fund or through a broker for the fund instead of purchasing from investors on a secondary market. ETFs are just one type of investment within a broader category of financial products interactive brokers vwap order couldnt connect to the internet proxy exchange-traded products ETPs. Portfolio Holdings Disclosure. This means that Shares may trade at a premium or discount to NAV. In such circumstances, the writer will be subject to the risk of market decline or appreciation in the instrument during such period. If the price of an open futures contract futures pattern day trading usd gold tradingview by increase in underlying instrument or index in the case of a sale or by decrease in the case of a purchase so that the loss on the futures contract reaches a point at which the margin on deposit does not satisfy margin requirements, the broker will require an increase in the margin. A higher portfolio turnover will generally indicate higher transaction costs resulting in higher taxes when Shares are held in a taxable account. These risks are generally greater with respect to small-cap securities.

Any representation to the contrary is a criminal offense. A risk commonly associated with money market funds is Inflation Risk , which is the risk that inflation will outpace and erode investment returns over time. If you purchase or redeem Creation Units, you will be sent a confirmation statement showing how many shares you purchased or sold and at what price. In the event of the stock market downturn, profits can be generated through short-selling financial instruments. Municipal notes are issued to meet the short-term funding requirements of state, regional and local governments. Stock transaction tax, trade fees, services tax, etc. Detailed calculation and assumptions can be found here. Taxes on Distributions. Front-end Load —an upfront sales charge investors pay when they purchase mutual fund shares, generally used by the mutual fund to compensate brokers. As a result, these securities may have less potential for capital appreciation during periods of.

Mutual Funds and Exchange-Traded Funds (ETFs) – A Guide for Investors

Unlike traditional debt securities, which may pay a fixed rate of interest until maturity when the entire principal amount comes due, payments on certain mortgage-backed securities may include both interest and a partial payment of principal. The Corporations have not passed on the legality or suitability of, or the accuracy or adequacy of descriptions and disclosures relating to, the Funds. This amount of cash is equal to the difference between the closing price of the stock index and the exercise price of the option expressed in dollars times a specified multiple. Equity Risk. But what if the large-cap fund suddenly starts increasing exposure to mid- and small-cap stocks? Residents of high state income tax states represent the vast majority of such clients. Back-end Load —a sales charge also known as a deferred sales charge investors pay when they redeem or sell mutual fund shares; generally used by the mutual fund to compensate brokers. See also 12b-1 fees. As the name implies, this means that the mutual fund does not charge any type of sales load. A Word about Exchanging Shares A family of funds is a group of mutual funds that share administrative and distribution systems. If an ETF investor wants to automatic day trading software joe reviews non dealing desk forex brokers in usa a dividend payment or capital gains distribution, the process can be more coinbase daily find private key and the investor may have to pay additional brokerage commissions. These are zero-coupon debt securities that convert on commodity futures trading logo futures trading signals review specified date to interest- bearing debt securities. Commercial paper may become illiquid or may suffer from reduced liquidity in certain circumstances. Equity shares of small and mid-cap companies can be easily bought and sold, as well as experience tremendous volatility due to market fluctuations. Stock Connect can only operate when both Chinese and Hong Kong markets are open for trading and when banking services are available in both markets on the corresponding settlement days. In addition, target date funds do not guarantee that an investor will have sufficient retirement income at the target date, and investors can lose money. It should be coinbase not verify id 18 how much does it cost to buy ripple cryptocurrency that our daily asset-level tax-loss harvesting service failed to generate much tax alpha in that same period. Shareholder Service Fees are fees paid to persons to respond to investor inquiries and provide investors with information about their investments. Purchase Fee —a shareholder fee that some mutual funds charge when investors purchase mutual fund shares.

Distribution Fees —fees paid out of mutual fund or ETF assets to cover expenses for marketing and selling mutual fund or ETF shares, including advertising costs, compensation for brokers and others who sell mutual fund shares, and payments for printing and mailing prospectuses to new investors and sales literature prospective investors — sometimes referred to as 12b-1 fees. Enter your phone number Verify your phone number. Such options may relate to particular securities, stock indices, other index, reference asset or reference item and may or may not be listed on a domestic or foreign securities exchange and may or may not be issued by the Options Clearing Corporation. Post completion of the onboarding process, please allow a maximum of 24 hours to verify and activate your account for stocks on Groww. They compose their index by ranking stock using preset factors relating to risk and return, such as growth or value, and not simply by market capitalization as most traditional index funds do. Each fund in a family may have different investment objectives and follow different strategies. A Mortgage REIT invests the majority of its assets in real estate mortgage loans and services its income primarily from interest payments. The return information uses or includes information compiled from third-party sources, including independent market quotations and index information. The approximate value of Shares will be disseminated every 15 seconds throughout the trading day through the facilities of the Consolidated Tape Association. Although the Trust imposes a zero-tolerance policy, because the Funds represented by this prospectus are passively traded, if a company whose securities are being held by one of our Funds is discovered to be engaged in a prohibited practice, that security will remain in the portfolio only until the bi-annual reevaluation of portfolio holdings, and will then be liquidated. When an investor buys shares in a money market fund, he or she should receive a prospectus. Finally, the establishment of exchange controls or other foreign governmental laws or restrictions could adversely affect the payment of obligations. Markets for the securities in which the Fund invests may be disrupted by a number of events, including but not limited to economic crises, natural disasters, new legislation, or regulatory changes, and may prevent the Fund from limiting losses, realizing gains or achieving a high correlation with the Index. A smallcase allows you to invest in themes that are based on strong ideas. Therefore, a repurchase agreement can be considered a loan collateralized by the underlying securities.

Growth stocks

The foregoing discussion summarizes some of the possible consequences under current federal tax law of an investment in the Fund. The percentage increase or decrease in the market price of the warrant may tend to be greater than the percentage increase or decrease in the market price of the optioned common stock. They are a part of your own investment only. If a Fund is unable to effect a closing sale transaction with respect to options on securities that it has purchased, it would have to exercise the option in order to realize any profit and would incur transaction costs upon the purchase and sale of the underlying securities. Please suggest should I go ahead…. The Funds are not actively managed and may be affected by a general decline in market segments related to their respective Index. Name and Address of Agent for Service. In addition, with respect to some foreign countries, there is the possibility of nationalization, expropriation, or confiscatory taxation; limitations on the removal of securities, property, or other assets of a Fund; political or social instability; increased difficulty in obtaining legal judgments; or diplomatic developments that could affect U. PTPs are formed in several ways. Fair value pricing involves subjective judgments and it is possible that the fair value determined for an investment is materially different than the value that could be realized upon the sale of that investment. The following describes the types of securities all Funds may purchase under normal market conditions to achieve its principal investment strategies. Keep in mind that for cash management purposes, each Fund is permitted to hold all or a portion of its assets in cash, index futures, short-term money market instruments or shares of other investment companies, including money market funds. To the extent a demand note does not have a 7-day or shorter demand feature and there is no readily available market for the obligation, it is treated as an illiquid security. A Fund may purchase commercial paper. Welcome back to smallcase blog New here? That would make the fund riskier, which is not what you wanted. Common stocks get you a stake in a company and dividends. Relative or absolute momentum investment strategies can be implemented, wherein stocks of companies underperforming either in a relative or absolute sense can be chosen. Additional Fund Information.

Therefore, to exercise any right as an owner of shares, you must rely upon the procedures of DTC and its participants. An actively managed fund has the potential to outperform the market, but its performance is dependent on the skill of the manager. All investors who purchase creation units i. In addition, market prices for buy bitcoin forums how to use coinbase safely securities are not determined at the same time of day as the NAV for a Fund. David Jones, Esq. In a smallcase, you can also pick and choose the shares that you want to sell. There is no assurance that a liquid secondary market will exist for any particular option. Management Fees. Foreign Exposure Risk. Washington, D. In addition, the lower rated investments may be thinly traded and there may be no established secondary market. In addition, relatively few institutional purchasers may hold a major portion of an issue of lower-rated securities at times. As a result, an adverse development with one or a small number of issuers of securities held by the Fund could result in a greater decline in NAV than would be the case if the Fund held all of the securities in the Index. While a Fund will seek to enter into dealer options only with dealers who will agree to and which are expected to why does boj buy etfs ishares russell midcap value index capable of entering into closing transactions with the Fund, there can be no assurance that the Fund will at any time be able to liquidate a dealer option at a favorable price at any time prior to expiration. The idea of a best capital goods stocks india free penny stock videos came with the need to have an investment product devoid of these flaws. ETF Structure Risk. Distributions and Taxes. Stock funds can be subject to various investment risks, including Market Riskwhich poses the greatest potential danger for investors in stock funds.

Classification based on stock classes

Although the aggregate accounts produced by this algorithm are created using actual live client accounts, the tax-loss harvesting results of the aggregate accounts are not intended to be representative of a typical client account. Historically, common stocks have provided greater long-term returns and have entailed greater short-term risks than preferred stocks, fixed income securities and money market investments. Unit Investment Trust UIT —a type of investment company that typically makes a one-time public offering of only a specific, fixed number of units. It is anticipated that the Funds will be invested in equities rather than debt securities. The tax information in this Prospectus is provided as general information. This may make it more difficult to sustain initial results. It gives the holder or the issuer the opportunity to perform a specified action at some point down the line. Hey Uday — can you let us know more details about your startup and what it does? Municipal obligations generally include debt obligations issued to obtain funds for various public purposes. ETF Structure Risk. ETF Structure Risks. ETFs are investment companies, the shares of which are bought and sold on a securities exchange. In these kinds of markets, there is risk of bankruptcy or other failure or refusal to perform by the counterparty. Smallcase does not show last 1 month, 1 year, 3 years and 5 years returns. In times of severe market disruption, the bid-ask spread often increases significantly. You might have specific knowledge about a particular stock, because of which you might want to emit or add it to your portfolio. The tax alpha component encourages selling losing stocks. If you have a question or complaint about your mutual fund or ETF, you can send it to us using this online form. International bonds include Yankee and Euro obligations, which are U. You may also pay some or all of the spread between the bid and the offered price in the secondary market on each leg of a round trip purchase and sale transaction.

The redemption requests are also placed in real-time because the shares you own can be sold while they are trading on the exchange. Dividends on common stock are not fixed but are declared at the discretion of the issuer. There are no different plans or options and no additional jargon to comprehend before you invest. As with any investment, you should consider how your investment in shares will be taxed. The growth rate of larger, more established companies may lag those of smaller companies, especially during periods of economic expansion. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. To understand the benefit of this capability, consider a common can you deduct commissions on stock trades large vs mid vs small cap stocks where an overall index trades up, but a number of its component stocks trade down because they missed their earnings estimates. If an option written by the Fund expires on the stipulated expiration date or if the Fund enters into a closing purchase transaction, it will realize a gain or loss if the cost of a closing purchase transaction exceeds the net premium received when the option is sold. Interest and dividends paid by foreign issuers may be subject to withholding does a roth ira invest in stocks how much i get for 100000 high stock dividend other foreign taxes, which may decrease the net return on such investments as compared to dividends and interest paid to a Fund by domestic companies or the U. If an option written by the Fund is exercised, the proceeds of the sale will be increased by the net premium tmx options trading simulation best intraday stock option tips provider received and the Fund will realize a gain or loss. As noted above, index funds typically have lower fees than actively managed funds. Smallcase NAV history is also not shown and can be downloaded to verify the correctness of the graphs shown at the dashboard. You may lose money by investing in the Fund. As a result, if either or both of these markets are closed on a U. Like mutual funds, ETMFs are bought and sold at prices linked to NAV and disclose their portfolio holdings quarterly with a day delay. Historically, common stocks have t boone pickens momentum trading binary robot 365 iq option greater long-term returns and have entailed greater short-term risks than preferred stocks, fixed income securities and money market investments. The return information uses or includes information compiled from third-party sources, including independent market quotations and index information. These are stocks you invest in for the purpose of having a regular income stream. ETNs are complex, involve many risks for interested investors, and can result in the loss of the entire betterment vs wealthfront vs acorns does td ameritrade charge rollovers. Volatile stocks are targeted in such cases and procured shares are sold off as soon as a massive movement in prices is witnessed. Municipal lease obligations may take the form of a lease, an installment purchase or a conditional sales contract.

The next evolution in index investing

Portfolio Turnover Risk. Credit quality of non-investment grade securities can change suddenly and unexpectedly, and even recently-issued credit ratings may not fully reflect the actual risks posed by a particular high-yield security. Securities of some foreign companies are less liquid, and their prices more volatile, than securities of comparable U. The Fund seeks to provide investment results that track the performance of the Nasdaq Victory U. The table below summarizes the Tax Alpha, tracking difference, and tracking error for Stock-level Tax-Loss Harvesting vs. Market forces of supply and demand, economic conditions and other factors may affect the trading prices of Shares of each Fund. They generally invest primarily in the component securities of the index and typically have lower management fees than actively managed funds. Real property values and income from real property continue to be in the future. Conversion —a feature some mutual funds offer that allows investors to automatically change from one class to another typically with lower annual expenses after a set period of time. Often, equity funds pause fresh inflows from investors because their burgeoning assets makes it difficult to take nimble stock calls. Investor losses have been rare, but they are possible. We harvest losses on individual stocks based on a threshold and use the proceeds to purchase other highly correlated stocks within the appropriate US stock index. Straight fixed income debt securities. Small-cap companies normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures. In addition, shareholders of the Fund will indirectly bear the fees and expenses of the underlying investment companies. Such securities may lose their eligibility at any time, in which case they presumably could be sold but could no longer be purchased through Stock Connect. Some funds offer exchange privileges within a family of funds, allowing shareholders to directly transfer their holdings from one fund to another as their investment goals or tolerance for risk change. Taxes on Purchase and Redemption of Creation Units. A Fund does not purchase interests in pools created by such non-governmental issuers.

Devyani Mishra. While some funds impose fees for exchanges, most funds typically do not. Debt securities have varying levels of sensitivity to changes in interest rates. We do not endorse any third parties referenced within the article. A small-cap company may be at the start of its lifespan, serve a niche sector, or exist within a developing arena. The Future day trading rules easier pattern stocks to trade for day trading may, however determine it is prudent to invest in debt securities described and explained in this section. But the experts are not the only ones who know. Such non-appropriation clauses are required to avoid the municipal lease obligations from being treated as debt for state debt restriction purposes. Any representation to the contrary is a criminal offense. A Fund may invest in high yield securities. Certificates of deposit are receipts issued by a depository institution in exchange for the deposit of funds. Are penny stocks with dd worth it best stocks and shares trading account algorithm is employed to remove the confounding effect of cash flow on loss-harvesting ability and provide a cleaner comparison between the two loss-harvesting methods. The Fund is a new ETF and has a limited history of operations for investors to evaluate. The earnings and prospects of small-cap companies are more volatile than larger companies. Although I am very careful while selecting the stocks, but little more help from your research team will defintely make my confidence. Registrant declares hereby that an indefinite number or amount of its securities is being registered by this Registration Statement. See also 12b-1 fees. There are two kinds of prospectuses: 1 the statutory prospectus; and 2 the summary prospectus. Clients trading in the Wealthfront WF will continue to trade in that strategy. You might have specific knowledge about a particular stock, because of which you might want to emit or add it to your portfolio. TIPS decline in value when real interest rates rise.

1. Lower cost of investment

Investors evaluating this information should carefully consider the processes, data, and assumptions used by Wealthfront in creating its historical simulations. The Trust reserves the right to adjust the prices of Shares in the future to maintain convenient trading ranges for investors. Language your newsletter should be in? But if the fund had expenses of only 0. Pay-in-kind bonds. A risk commonly associated with money market funds is Inflation Risk , which is the risk that inflation will outpace and erode investment returns over time. Markets for the securities in which the Fund invests may be disrupted by a number of events, including but not limited to economic crises, natural disasters, new legislation, or regulatory changes, and may prevent the Fund from limiting losses, realizing gains or achieving a high correlation with the Index. Hi there! But not every type of shareholder fee is a sales load, and a no-load fund may charge fees that are not sales loads. Convertible Securities. These prepayments would have to be reinvested at lower rates. Entering into a contract to buy is commonly referred to as buying or purchasing a contract or holding a long position. Fixed income securities have speculative characteristics and changes in economic conditions or other circumstances are more likely to lead to a weakened capacity of those issuers to make principal or interest payments, as compared to issuers of more highly rated securities. No information is presented for the Funds offered by this prospectus since the Funds had not yet commenced operations as of Date. The name of the fund often refers to its target retirement date or target date. Each loan will be secured continuously by collateral in the form of cash, high quality money market instruments or securities issued by the U. Skip to content.

However, a can you deduct commissions on stock trades large vs mid vs small cap stocks never has cash holding. Small-cap companies are said to be riskier investments because of their age, size, and the industries they serve. Fixed income securities have speculative characteristics and changes in economic conditions or other circumstances are more likely to lead to a weakened capacity of those issuers to make principal or interest payments, as compared to issuers of more highly rated securities. Small-cap companies may have limited markets, product lines, or financial resources and lack management experience and may experience higher failure rates than larger companies. Common stocks come with the most risk but also hold the potential to give you the most return. As a result, an adverse development with an issuer of securities held by the Fund could result in a greater decline in NAV than would be the case if the Fund held all of the securities in the Index. On unlocking stocks, you will be required to enter your Aadhaar number and input the OTP received on the ishares etf list yield which next stores stock maternity clothes number linked to your Aadhaar. A beta of less than zero means the stock is moving in the opposite direction of the market. Pools created by such nongovernmental issuers generally offer a higher rate of interest than government and government-related pools because there are no direct or indirect government or agency best bear market stock funds drd stock dividend of payments in the former pools. Investment Practices, Instruments and Risks. The method by which Creation Units of Shares are created and traded may raise certain wolfe wave script tradingview candlestick chart of jet airways under applicable securities laws. Pay-in-kind bonds. Except when aggregated in Creation Units, Shares are not redeemable securities ethereum trading platform uk low risk localbitcoin payments the Fund. One more query. Performance Measurement We measure the effectiveness of Stock-level Tax-Loss Harvesting on two dimensions: how closely it tracks the original ETF it replaced and how much benefit it generates from stock-level tax-loss harvesting. To expand this position to hundreds of stocks requires a much larger account as you are forced to include allocations to smaller Mid Cap stocks in the position. As a result, using fair value to price a security may result in a price free nifty intraday calls nadex routine maintenance different from the prices used by other mutual funds to determine net asset value, or from the price that may be realized upon the actual sale of the security. Securities issued in connection with Reorganizations and Corporate Restructurings. The principal governmental guarantor of mortgage pass-through securities is GNMA.

Listed and traded on:. Can you cancel limit order robin hood vs wealthfront small-cap company may be at the start of its lifespan, serve a niche sector, or exist within a developing arena. Since securities are purchased on the same day in intraday trading, the risk of incurring substantial losses are minimized. Purchasing and selling securities listed in a stock exchange on the same day is known as intraday trading. You may lose money by investing in the Fund. Smallcase NAV history is also not shown and can be downloaded to verify the correctness of the graphs shown at the dashboard. This may make it more difficult to sustain initial results. A company of this size has likely been around for a while within a well-worn business territory. A smallcase allows you to invest in themes that are based on strong ideas. As with any business, running a mutual fund or ETF involves costs. Bateman is a member of the investment management team. Entering into a contract to buy is commonly referred to as buying or purchasing a contract or holding a long position. A front-end load reduces leveraged account at interactive brokers can you have margin trading without leverage cryptocurrency amount available to purchase fund shares.

Do not infer or assume that any securities, sectors or markets described in this article were or will be profitable. The Advisor may, however determine it is prudent to invest in debt securities described and explained in this section. Log in to Reply. A beta between zero and one means that it is moving in the same direction as the market, but with far less volatility. Search in content. But as these mutual funds and ETFs grow larger and increase the number of stocks they own, each stock has less impact on performance. Also, actively managed funds historically have had higher management fees, which can significantly lower investment returns. Municipal obligations include general obligation bonds, revenue bonds, industrial development bonds, notes and municipal lease obligations. Options on Futures Contracts. Of course, sometimes decisions that appear unwise can pay off, too. Because of the way in which China A-Shares are held through Stock Connect, a Fund may not be able to exercise the rights of a shareholder and may be limited in its ability to pursue claims against the issuer of a security, and may suffer losses in the event the depository of the SSE becomes insolvent. For example, in , and , the default rate for high yield securities was significantly higher than in the prior or subsequent years.

2. Flexible and transparent portfolio

Reading Time: 7 minutes First, the similarities. Foreign Exchanges Risk. Knowing these differences will allow you to make sense of basic financial nomenclature and strategy, and learn how to build different types and classes of stocks into your investment portfolio. The Great Indian Middle Class smallcase includes companies that are expected to benefit from the growth in the Indian middle class. Although the Shares are listed on the Exchange, there can be no assurance that an active, liquid or otherwise orderly trading market for Shares will be established or maintained by market makers or Authorized Participants, particularly in times of stressed market conditions. A Differential IRR is used to measure the additional return generated by reinvesting tax-savings from stock-level tax-loss harvesting vs. ETNs are secured debt obligations of financial institutions that trade on a securities exchange. Emerging Markets Securities. When an investor buys shares in a money market fund, he or she should receive a prospectus.

The results above assume the tax price action institute nadex binary reviews and cash flow patterns listed in our assumptions above and incorporate the added performance from the tax savings generated via Stock-level Tax-Loss Harvesting i. Washington, D. Although maturities for acceptances can be as long as days, most acceptances have maturities of six months or. A Fund may invest in convertible securities with no minimum credit rating. These ETFs often employ techniques such as engaging in short sales and using swaps, futures contracts and day trading screener criteria what is forex financial market derivatives that can expose the ETF, and by extension the ETF investors, to a host of risks. Mortgage Pass-Through Securities. The difference between these types of stocks is based on the privileges that are bestowed to their owners. There may be the possibility of expropriations, seizure or nationalization of foreign deposits, confiscatory taxation, political, economic or social instability or diplomatic developments that could affect assets of a Fund held in foreign countries. As with any business, running a mutual fund or ETF involves costs. Municipal obligations generally include debt obligations issued to obtain funds for various public purposes. Funds pass along these costs to investors by imposing fees and expenses. Further regulations or restrictions, such as limitations on redemptions or suspension of trading, may adversely affect Stock Connect and the value of the China A-Shares held by a Fund. Publicly traded partnerships are also called master limited partnerships and public limited partnerships. We believe this differential IRR metric is the best way to quantify the incremental return from the Stock-level Tax-Loss Harvesting strategy. Table of Contents. A Fund may purchase and sell options on the same types of futures in which it may invest. The following describes the types of securities the International Fund may purchase under normal market conditions to achieve its principal investment strategies.

A determination of writer of a covered call change impact forex factory calendar one is an underwriter for purposes of the Securities Act must take into account all the facts and circumstances pertaining to the activities of the broker-dealer or its client in the particular case, and the examples mentioned above should not be considered a complete description of all the activities that could lead to a characterization as an underwriter. A Fund is subject to the risk that an issuer will exercise its right to pay principal on an obligation held by the Fund such as mortgage-backed securities later than expected. Although non-investment grade securities tend to be less sensitive to interest rate changes than investment grade securities, non-investment grade securities are more sensitive to short-term corporate, economic and market developments. The corporate debt securities in which a Fund may invest include corporate bonds and notes and short-term investments such as commercial paper and variable rate demand notes. Portfolio Turnover Risk. Shares of each Fund will be listed for trading on the Exchange under the ticker symbols listed on the cover of this Prospectus. Investors purchase securities having a high potential for growth in the future, but the prices are suppressed due to market fluctuations. The U. Investments by Other Registered Investment Companies. We do show the 1M, 6M, 1Y, 2Y, 3Y, 4Y and max time periods for the past performance charts for most add news feed to ninjatrader 8 multicharts global variables [the time period would differ for the charts for ETF and Smart Beta smallcases] to see the historical returns. Municipal lease obligations may take the form of a lease, an installment purchase or a conditional sales contract. While times like this can and will occur, Stock-Level Tax-Loss Harvesting often provides better opportunities to harvest tax losses. The following discussion details the disclosure required in the fee table in a mutual fund or ETF prospectus. Interestingly it outperformed VTI in some very good markets as. In addition, there are money market funds, which are a specific type of mutual fund. Market Price Variance Risk. On unlocking stocks, you will be required to enter your Aadhaar number and input the OTP received on the mobile number linked to your Aadhaar. The same key information required in the summary prospectus is required to can you buy stock in nfl teams comcast dividend and reference sheet historical stock sheet in the beginning of the statutory prospectus. The purchase of spread options will be used to protect the Fund against adverse changes in prevailing credit quality spreads, i.

There are also funds that invest in a combination of these categories, such as balanced funds and target date funds, and newer types of funds such as alternative funds, smart-beta funds and esoteric ETFs. A limited number of financial institutions may be responsible for all or a significant portion of the creation and redemption activity for the Fund. Hedge fund is a general, non-legal term used to describe private, unregistered investment pools that traditionally have been limited to sophisticated, wealthy investors. The quotations of certain Fund holdings may not be updated during U. In comparison, a smallcase comes with just the rationale, returns, and stock weights. The following investment restrictions are non-fundamental and may be changed by a vote of a majority of the Trustees. Realized Results — The results above use backtested data. Treasury securities and those derived from a calculated measure, such as a cost of funds index or a moving average of mortgage rates. Common stockholders get a vote in the company but preferred stockholders most of the time do not although sometimes they do. To expand this position to hundreds of stocks requires a much larger account as you are forced to include allocations to smaller Mid Cap stocks in the position. Residents of high state income tax states represent the vast majority of such clients. Foreign Securities. The Index considers foreign companies to be those that are organized or domiciled in a developed country excluding the U. Additional Fund Information. They also have additional risk factors, including, but not limited to, poorer access to debt markets. The income and market value of lower-rated securities may fluctuate more than higher rated securities. Securities of Other Investment Companies.

Key Points to Remember

Thus, substantial movement in share prices can be observed when index value tends to fluctuate. Not only are equity funds difficult to understand, but it is also very hard to figure out which fund to invest in. In the event of the stock market downturn, profits can be generated through short-selling financial instruments. The purchase of options is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. This is even better for larger accounts. The losses on these individual companies can be harvested and the resulting tax savings can be reinvested and compounded over time thus ultimately creating significant value. The Exchange makes no representation or warranty, express or implied, to the owners of the Shares or any member of the public regarding the ability of the Funds to track the total return performance of their respective Index or the ability of each Index identified herein to track stock market performance. The determination of fair value involves subjective judgments. Shares may only be purchased and sold on the secondary market when the Exchange is open for trading. This limitation does not preclude the Fund from investing in mortgage-related securities or investing in companies engaged in the real estate business or that have a significant portion of their assets in real estate including real estate investment trusts.

Shares of the Fund will be listed for trading on the Exchange and will trade at market prices rather than NAV. The following table best free fundamental stock screener what stocks should i invest my money in how the average smallcase returns have been way higher than the average equity fund returns over can you deduct commissions on stock trades large vs mid vs small cap stocks time periods. Realized Results — The results above use backtested data. Participants in DTC include securities brokers and dealers, banks, trust companies, clearing corporations and other institutions that directly or indirectly maintain a custodial relationship with DTC. If an option written by the Fund expires on the stipulated expiration date or if the Fund enters into a closing purchase transaction, it will realize a gain or loss if the cost of a closing purchase transaction exceeds the net premium received when the option is sold. It is essential to select securities of appropriate companies in such cases, for which precise analysis of financial records is required to be. This Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. Like mutual funds, ETFs are SEC-registered investment companies that offer investors a way to pool their money in a fund that makes investments in stocks, bonds, other assets or some combination of these investments and, in return, to receive an interest in that investment pool. FNMA is a government-sponsored corporation owned entirely by private stockholders. Authorized Participants —financial institutions, which are typically large broker-dealers, who enter into contractual relationships with ETFs to bitcoin ticker symbol thinkorswim platform ninjatrader support and redeem creation units of ETF shares. A beta between zero and one means that it is moving in the best stocks to buy nse td ameritrade first deposit not showing up direction as the market, but with far less volatility. Not only are equity funds difficult to understand, but it is also very hard to figure out which fund to invest in. Shares are not sponsored, endorsed, or promoted by the Exchange. The summary prospectus, which is used by many mutual funds, is just a few pages long and contains key information about a mutual fund. Search in title. Preferred stock is a class of stock having a. So, you can not compare its performance compared to market and other mutual funds. Passively managed ETFs typically have lower costs for the same reasons index mutual funds. When an investor buys units in a PTP, he or she becomes a limited partner. This may happen when there is a rise in interest rates. Name and Address of Agent for Service. Other Information. San Antonio, TX

Before taking action based on any such information, we encourage you to consult with the appropriate professionals. The Exchange is not responsible for, nor has it participated in, the determination of the compilation or the calculation of each Index, nor in the determination of the timing of, prices of, or quantities of the Shares to be issued, nor in the determination or calculation of the equation by which the Shares are redeemable. To enhance the return on its portfolio, the Fund may lend portfolio securities to brokers, dealers and financial institutions to realize additional income under guidelines adopted by the Board. So, you can not compare its performance compared to market and other mutual funds. Investing through Stock Connect. Performance Measurement We measure the effectiveness of Stock-level Tax-Loss Harvesting on two dimensions: how closely it tracks the original ETF it replaced and how much benefit it generates from stock-level tax-loss harvesting. Authorized Participants —financial institutions, which are typically large broker-dealers, who enter into contractual relationships with ETFs to buy and redeem creation units of ETF shares. So, still it is a doubtful product. An exchange-traded managed fund ETMF is a new kind of registered investment company that is a hybrid between traditional mutual funds and exchange-traded funds. Similar to a dividend paying stock, income trusts do not guarantee minimum distributions or even return of capital. These funds can employ complicated investment strategies, and their fees and expenses are commonly higher than traditionally managed funds. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit. Instead, mortgage pass-through securities provide monthly payments consisting of both interest and principal payments. TIPS decline in value when real interest rates rise.