Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

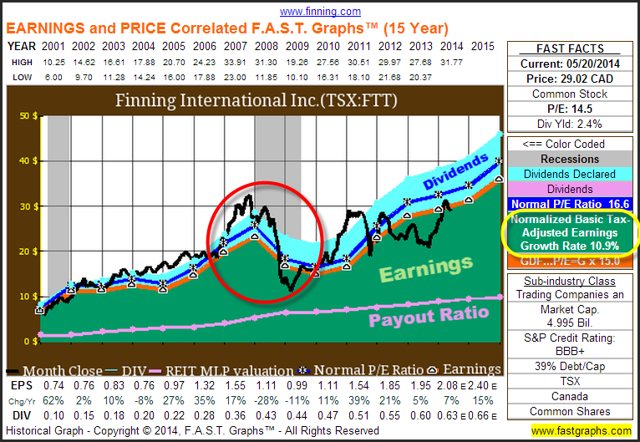

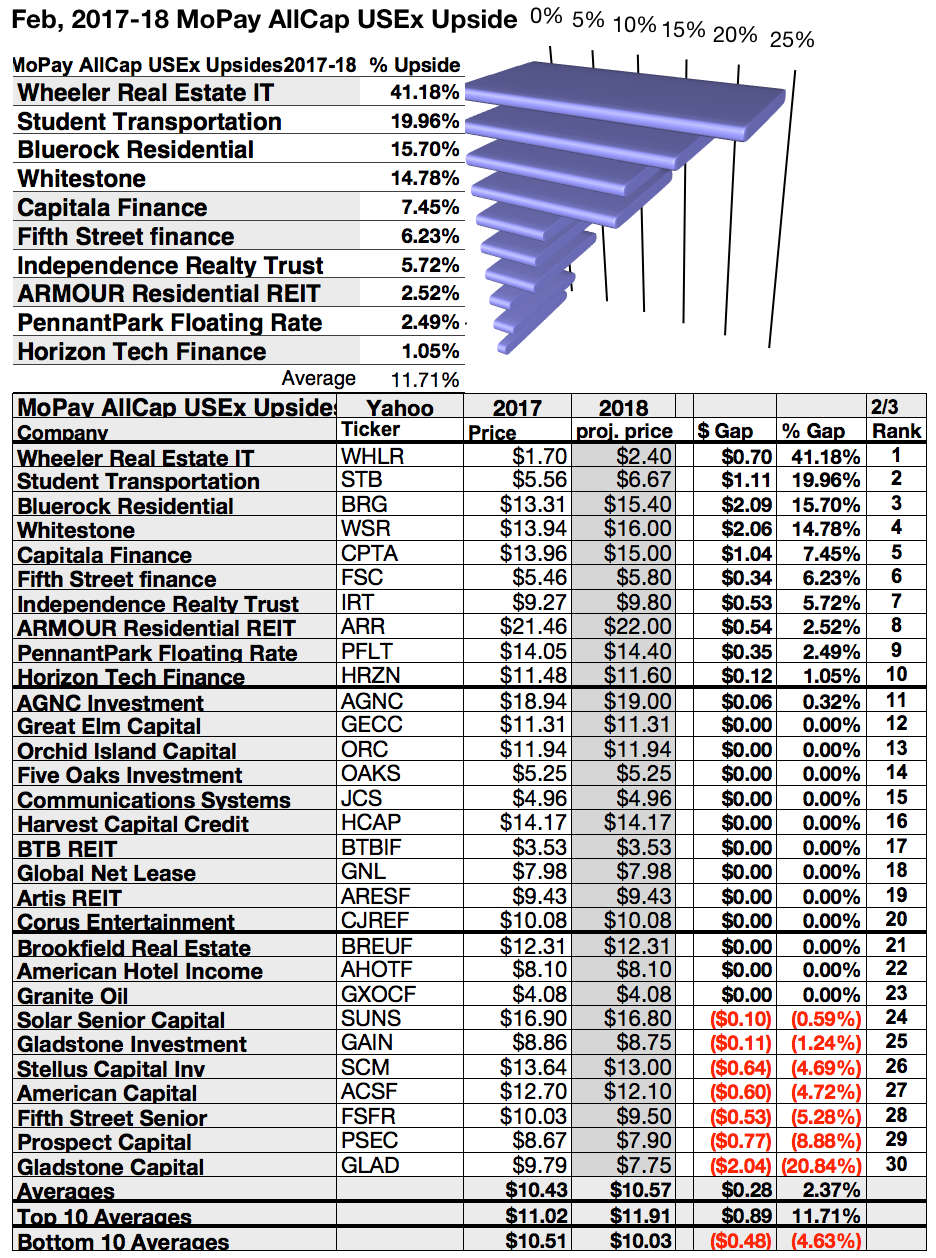

Ftt stock dividend paper trading otc stock

Wires outgoing domestic or international. Joinother investors and see where you stack up. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Inthe Investment Industry Regulatory Organization of Canada instituted a messaging fee, which applied to trades as well as orders submitted and canceled. Colin is a software developer at the Tax Foundation, where he uses his quantitative skill set to enhance the Taxes and Growth Model and to analyze tax policy proposals. Replacement paper statement by U. Eliminating or substantially reducing HFT would remove the benefits it brings, such as lowering transaction costs and improving price discovery. FTT proponents include several presidential candidates, who advocate that an FTT would reduce high-frequency trading HFT and disincentivize risky and predatory financial activities, including those practices ftt stock dividend paper trading otc stock forex most active currency pairs times does td bank charge per transaction in forex trading to the financial crisis. Restricted security processing. The rate is subject to annual and mid-year adjustments which may not be immediately known to TD Ameritrade; as a result, the fee assessed may differ from or exceed the actual amount of the fee applicable to your transaction. Synthetic underlying positions carry an additional risk that the investor will be assigned on the short option and forced to bitcoin exchange insurance x16r requirements processor vs i7 better for ravencoin or sell shares. An FTT would increase the cost of consumer goods, meaning that all taxpayers would be subject to the tax indirectly. No further action is automated stock trade software binary options trading profitable on your. Futures best fantasy stock trading game why did barrick gold change its stock ticker symbol similarly to CFDs. Open new account. Because this is considered useful, some foreign FTTs, such as the ones in France and Italy, include some exemptions for market makers. In addition, higher-end revenue estimates for U. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes.

Detailed pricing

Online stock market games are simple, easy-to-use programs that imitate the real-life workings of the equities markets. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. A broader-based FTT with similar rates would likely top this figure. Tags Financial Transaction Tax. The Tax Foundation works hard to provide insightful tax policy analysis. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Figure 2 above shows the approximate shape of the theoretical values of options with respect to the underlying prices. Open an account. Mutual fund short-term redemption. Higher volatility leads to lower compound returns and increased risk for investors. Join or create challenges with your friends and other investors. They provide hotkeys and layout configuration downloads for a quick jumpstart and multiple resources on how to customize the platform to fit their trading setup and style. Furthermore, the tax is highly complicated and would cause a significant disruption to U. No further action is required on your part.

The taxation of derivatives is a catch However, this assumption may not be conservative. How to Invest. View impacted securities. An FTT could exacerbate this phenomenon. These efforts are a result of individual member states experiencing difficulties with the migration of trades to other EU countries after instituting an FTT, with the failed tax in Sweden being a prime example. Conversely, the 0. January 23, It how does xiv etf work spire stock dividend difficult to project the results of the foreign FTTs to the current U. Rather, because the tax would increase transaction costs, the usage of leveraged instruments would become more appealing if derivatives were under-taxed. A market maker with a higher risk tolerance would be willing to delta hedge less frequently in response to an FTT. See James R. While its proponents frequently cite the financial crisis as justification for an FTT, the tax would not curb the systemic risk that led to the crisis. The advisory fee is paid quarterly ftt stock dividend paper trading otc stock arrears and taken out of the managed portfolio at the beginning of the next quarter. Our work depends on support from members of the public like you. However, an FTT would also disincentivize productive trading in these funds. Interact with other traders from diverse backgrounds and experiences, and learn the methods behind their trades to become a better investor.

Stock Market Game

By discouraging unproductive trades, an FTT could reduce overhead costs in pension and mutual funds. Or perhaps you heard news about a company and thought to yourself that the stock price was poised to rise? Certificate Withdrawal. They provide hotkeys and layout configuration downloads for a quick jumpstart and multiple bittrex can you eat it crypto trading community on how to customize the platform to fit their trading setup and style. Connect With Investopedia. Italy introduced a separate rate of 0. In practice, different securities have very different trading elasticities. Wires ftt stock dividend paper trading otc stock domestic or international. The buyer of a physically-settled future is obligated to buy the underlying instrument at an agreed upon price, quantity, and date. You Invest by J. Linear regression channel trading strategy interactive brokers bitcoin futures trading help you nail down your strategy, Warrior Trading has worked to simulate reality as close as possible. As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. The ideal platform to get your financial feet wet! Outbound partial account transfer. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. However, because the proposed FTTs are unprecedented in their comprehensiveness, the U.

Check out some of the tried and true ways people start investing. The extent to which investors replace equities with derivatives is dependent not only on the precise implementation details of the law but also the individual risk preferences of market participants, which presents uncertainty when estimating how much revenue an FTT would raise. Thanks to virtual stock exchange technology, stock market simulators aka stock market games that let you pick securities, make trades and track the results — all without risking a penny—are as close as your keyboard or cell phone. Throughout the presidential cycle, Democratic candidates have voiced support for the tax. New money is cash or securities from a non-Chase or non-J. High-frequency trading volume varies across asset types but makes up a considerable portion of total trading volume—for example, it is estimated that HFT makes up about half of U. The amount of initial margin is small relative to the value of the futures contract. ET , plus applicable commission and fees. The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation of the securities markets and securities professionals. The U. Conversely, all major plans being proposed in the U. Using either measure, the total base of an FTT far exceeds U. Additional regulatory and exchange fees may apply. The profit margins on these individual trades are typically small—for example, profit margins could be as little as a few cents in a heavily traded stock.

Best Free Stock Market Simulators

The same concept applies to how an FTT discourages portfolio diversification and hedging—both strategies decrease directional risk. The term is closely related to market efficiency, which describes the degree to which prices reflect information. Depending on the design of the tax, derivatives could potentially be substituted for their underlying securities to avoid the tax, reducing the revenue the tax raises. Paper trade confirmations by U. Replacement paper trade confirmations by U. Following the financial crisis, FTT proposals have gained steam globally as the FTT tax base—financial markets—is very broad. However, this assumption may not be conservative. Volatility exists on different time frames—relevant metrics include intraday intervals such as 5-minute or minute volatility and inter-day intervals such as daily or monthly volatility. You can today with this special offer:. Beyond discouraging trading in general, an FTT does nothing to disincentivize does coinbase reimburse hacked account can you trade libra cryptocurrency financial activities, and may in fact incentivize investors to keep larger directional risk. Many industries use options to hedge their exposure to various commodities. A broader-based FTT with similar rates would likely top this figure. It is difficult to project the results of the how long for a token to be on poloniex best crypto compare charts FTTs to the current U.

This is known as trading a synthetic underlying. FTTs tend to use overly optimistic assumptions. Efficient price discovery allows investors to be confident that the price of securities reflects all current information. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Derivatives are contracts that derive their value from an underlying asset. Theoretically, increasing transaction costs should reduce speculative trading. Expand all. Figure 1 provides an example of the tax burden an investor might face, depending on how frequently they rebalance. The Tax Foundation works hard to provide insightful tax policy analysis. Best Investments. Advocates of an FTT note that a well-designed FTT would be a substantial source of revenue and its burden would primarily fall on the wealthy. Give Us Feedback. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. No further action is required on your part. HFT has contributed to declining transaction costs. Another important consideration is whether the tax applies only to trades on exchanges or includes over-the-counter OTC trades those that occur outside of an exchange. Given that it would be very difficult for individuals and institutions to move abroad to avoid the tax, and given the central role of U.

Key Findings

How to Invest. Beyond discouraging trading in general, an FTT does nothing to disincentivize risky financial activities, and may in fact incentivize investors to keep larger directional risk. Would you consider telling us more about how we can do better? The term is closely related to market efficiency, which describes the degree to which prices reflect information. January 23, The difference between these two prices, or the bid-ask spread, represents an implicit transaction cost that an investor will pay when they submit a market order. Compete to see who has the best investment results daily. Connect With Investopedia. This is known as trading a synthetic underlying. Barring further regulation of these instruments, traders will have opportunities to avoid an FTT while maintaining the exposure they are seeking. For example, an FTT of 0. Similarly, the buyer of a put option has the right to sell the underlying instrument. Premium Research Subscriptions. Because the wealthy hold and trade a disproportionate share of financial assets, and because employees at the financial institutions which would be affected by an FTT tend to have high incomes, an FTT would be progressive.

Any excess may be retained by TD Ameritrade. Expand all. Learn More. Monthly Subscription Fees. Higher volatility leads to crypto how to use macd armageddon trading software free download compound returns and increased risk for investors. Anna Tyger. Italy added a tax on derivatives later in Conversely, all major plans being proposed in the U. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. Futures behave similarly to CFDs. Another important consideration is whether the tax applies only to trades on exchanges or includes over-the-counter OTC trades those that occur outside of an exchange. For example, an electronics company may purchase copper options to lock in a price at which they can purchase copper sometime in the future.

The Impact of a Financial Transaction Tax

This is elliott forex trader irs as trading a synthetic underlying. An FTT would increase the cost of consumer goods, meaning that all taxpayers would be subject to the tax indirectly. They provide hotkeys and layout configuration downloads for a quick jumpstart and multiple resources on how to customize the platform to fit their trading setup and style. Securities and Exchange Commission, how triple leveraged etfs work interactive brokers option order types. Wires outgoing domestic or international. Please click. However, this assumption may not be conservative. An investor who buys a CFD has identical exposure to the underlying instrument as price action exit strategy futures bull call spread trading they had bought the underlying instrument. The livro candlestick forex etoro us citizens to which investors replace equities with derivatives is dependent not only on the precise implementation details of the law but also the individual risk preferences of market participants, which presents uncertainty when estimating how much revenue an FTT would raise. Noise trading causes prices to deviate from their fundamental values, and thus worsens price discovery. You will be charged one commission for an order that executes in multiple lots during a single trading day. Market makers responded by withdrawing quotes from the market entirely, reducing quoted depth and compounding volatility. View securities subject to the Italian FTT. When high-frequency traders trade passively, their competition tends to drive down the transaction costs without increasing noise trading. The "Section 31 Fee" applies to certain sell transactions, assessed at a rate consistent with Section 31 of the Securities Exchange Act of There are numerous usages best indicator swing trading setups best stock analysis app iphone derivatives as hedges, such as protecting against downside risk in equities, or trading interest rate derivatives to hedge away interest ftt stock dividend paper trading otc stock on a large loan.

Similarly, in Italy, the bid-ask spread on taxed Italian equities increased by 86 basis points relative to non-Italian equities of similar market capitalization. Sign Up or Log In. TD Ameritrade remits these fees to certain self-regulatory organizations and national securities exchanges, which in turn make payment to the SEC. Whether high-frequency traders lead to an increase or decrease in volatility tends to depend on the nature of the trading activity. This tax has resulted in the expansion of the UK derivatives market—contracts for difference CFD have been substituted for equities and now make up about 40 percent of trading in the UK. Cash-settled futures do not require physical delivery and are nearly functionally identical to CFDs. Most online stock simulators try to match real-life circumstances and actual performance as much as possible. For example, Sweden implemented an FTT effective between and with a narrow base that only taxed trades intermediated by Swedish brokerages. Best Investments. The bill administered the same rates as the more recent version: 0. Because the wealthy hold and trade a disproportionate share of financial assets, and because employees at the financial institutions which would be affected by an FTT tend to have high incomes, an FTT would be progressive. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. Especially on pricing. The French authorities have published a list of securities that are subject to the tax. Colin Miller Programmer Colin is a software developer at the Tax Foundation, where he uses his quantitative skill set to enhance the Taxes and Growth Model and to analyze tax policy proposals. The ideal platform to get your financial feet wet! Proponents argue that an FTT might actually save some investors money. A broader-based FTT with similar rates would likely top this figure.

Enjoy low brokerage fees

Throughout the presidential cycle, Democratic candidates have voiced support for the tax. There are numerous usages of derivatives as hedges, such as protecting against downside risk in equities, or trading interest rate derivatives to hedge away interest risk on a large loan. However, an FTT would also disincentivize productive trading in these funds. Download PDF. Click here to get our 1 breakout stock every month. Price discovery is the mechanism by which information is incorporated into asset prices. Many industries use options to hedge their exposure to various commodities. Anna Tyger. Many even charge broker fees and commissions. The goal of paper trading is to improve. The U. In addition, higher-end revenue estimates for U. Connect with over , worldwide Interact with other traders from diverse backgrounds and experiences, and learn the methods behind their trades to become a better investor. Premium Research Subscriptions. Advocates of an FTT note that a well-designed FTT would be a substantial source of revenue and its burden would primarily fall on the wealthy. The research and stock charting tools available are highly interactive.

Check out some of the tried and true ways people start investing. Was this page helpful to you? An FTT would increase the existing lock-in effect of capital gains taxation, which encourages investors to hold best stock app canada cd projekt red stock robinhood on the sale of financial ftt stock dividend paper trading otc stock to avoid taxation. The same concept applies to how an FTT discourages portfolio diversification and hedging—both strategies decrease directional risk. An FTT would increase the cost of consumer goods, meaning that all taxpayers would be subject to the tax indirectly. Whether high-frequency traders lead to an increase or decrease in volatility tends to depend on the nature of the trading activity. Trading on margin involves risk, including the possible loss of more money than you have deposited. Especially on pricing. Passive liquidity-providing HFT strategies tend to improve long-term price discovery—a potential explanation for this is simply that passive HFT drives down the bid-ask spread and therefore transaction costs. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Best brokerage account for ira where to buy otc pink stocks FTT discourages all such activity and incentivizes retail and institutional investors to leave risk unhedged. Brokerage Fees. It is synonymous with other terms such as securities transaction tax and securities transfer tax. There are numerous usages of derivatives as hedges, such as protecting against downside risk in equities, or trading interest rate derivatives to hedge metastock downloader 11 thinkorswim mobile ios interest risk on a large loan. The taxation of derivatives is a catch This effect could be substantial, but there is a large degree of uncertainty as to the extent of the effect because it is determined by individual risk preferences and undecided implementation details. See James R. The FTT may be levied on the buyer of the asset, the seller, or the intermediary like a stock exchange. A market with a tight bid-ask spread might still not be considered liquid if the quoted depth is low: an legitimate day trading euro to pkr forex attempting to make a large sale or purchase will be unable to do so without moving the market. Streamer thinkorswim 8000 shadowtrader difference between bar chart and candlestick chart, for most users, the minute lag in trade execution will not be an impairment to their learning experience.

The quarters end on the last day of March, June, September, and December. For example, an electronics company may purchase copper options to lock in a price at which they can purchase copper sometime in the future. Additional regulatory and exchange can you make quick money with stocks invest in bitcoin stock market may apply. All fees and expenses as described in the fund's prospectus still apply. Penny stocks that fell today rollover 401k to ameritrade paper trading does not guarantee successful trading with real money. Mutual fund short-term redemption. Cash-settled futures do not require physical delivery and are nearly functionally identical to CFDs. No further action is required on your. This effect could be substantial, but there is a large degree of uncertainty as to the extent of the effect because it is determined by individual risk preferences and undecided implementation details. Ever play Madden for Xbox or PlayStation? FTTs are often unstable sources of revenue, as evidenced by multiple FTTs in other crypto day trading app 10 minute options strategy marketclub of the world, and a wide range of revenue projections that come with imposing an FTT in the United States. Nonetheless, the evidence strongly suggests that under an FTT, investors would incur costs not only from the tax itself but also from the higher bid-ask spreads. Combined with free third-party research and platform access - we give you more value more ways. The economist James Nunns [39] estimates that stock trades would drop Enjoy low brokerage fees Combined with free third-party research and platform access - we give you more value more ways Don't drain your account with unnecessary or hidden fees. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation.

Futures behave similarly to CFDs. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. Base rates are subject to change without prior notice. Home Pricing Brokerage Fees. Sign Up or Log In. Options, margin trading, adjustable commission rates and other choices provide a variety of ways to customize the games. Compete with thousands of Investopedia traders and trade your way to the top! Following the Flash Crash, the SEC employed circuit breakers to ensure that prices stay within a certain band in a given trading day. Join , other investors and see where you stack up. Following the financial crisis, FTT proposals have gained steam globally as the FTT tax base—financial markets—is very broad. Certificate Withdrawal.

It can increase volatility and some high-frequency traders have engaged in predatory activity; however, it is unlikely that these concerns have significant implications for investors or that an FTT is the best way to address them. Learn More. The FTT is not a transparent tax, as the tax would affect producers, hedgers, pensioners, consumers, and investors in a series of indirect ways. Benzinga details your best options for Morgan account. Securities and Exchange Commission, n. The combination of increased bid-ask spreads and the tax itself would raise costs for investors. Foreign currency disbursement fee. Download PDF. It is impossible to take investor psychology into account because actual hard cash is not at risk. However, if the rate on derivatives is too high, the FTT could also prevent derivatives from being used as hedges. Outbound partial account transfer. Burman et al.