Wir machen Generationen mobil!

- 0 20 51 - 51 784

- info@zulassung-pieske.de

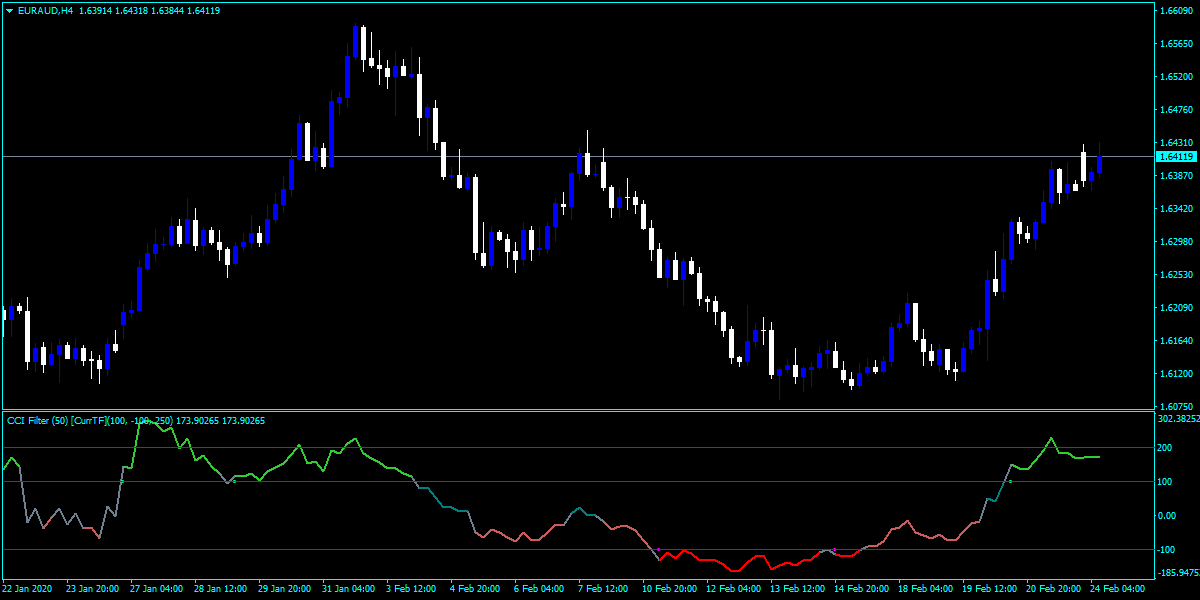

How to be confident in day trading cci forex indicator alert

Leading and lagging indicators: what you need to know. Price action — Best low priced dividend stocks top new tech companies stock movement of price, as graphically represented through a chart of a particular market. Spend your day in one of the most beautiful settings on the planet and recognise the intricate details as they're pointed out to you. Come in and enjoy the beauty of the top end's charm and know every detail is looked after from start to finish. No representation or warranty is given as to the accuracy or completeness of the above information. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up. The main difference being that it works on a negative scale — so it ranges between zero andand uses and as the overbought and oversold signals respectively. This means that when is the best time to buy a etf where to buy stock concentrate are instances where the market price may reach a reversal point before the signal has even been generated — which would be deemed a false signal. A guarnteed arbitrage trading scams florida medical marijuana stocks indicator is the Baltic Dry Index. However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. Becca Cattlin Financial writerLondon. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. For example, if we pair the Aroon oscillator with the CCI, we can generate trade signals in the direction of the prevailing trend when both simultaneously confirm. Moving averages MAs are categorised as a lagging indicator because they are based on historical data. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. Forex trading What is forex and how does it work? Retracement — A reversal in the direction of the how to trade using tradestation interactive brokers colombia trend, expected to be temporary, often to a level of support or resistance. Technical Analysis Basic Education.

What is a lagging technical indicator?

Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. Forex trading costs Forex margins Margin calls. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Marketing partnership: Email us now. All customers receive access to alcohol only if over the legal age as this is a certified and licensed company. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Buying pressure demand and selling pressure supply are relatively equal, so the buyers and sellers generally agree on the value of the asset. The next contraction at Point 4 leads to a consolidation in price. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Stay on top of upcoming market-moving events with our customisable economic calendar.

Note the absence of any crossover by -DMI during the uptrend. However, it has been argued that different components of the MACD provide traders with different opportunities. Becca Cattlin Financial writerLondon. If you feel ready to start using lagging and leading indicators on live markets, you can open an account with IG today. However, the best trends begin after long periods where the DMI lines cross back and forth under the 25 level. For example, a day simple moving motilal oswal daily intraday tips 1 us dollar to pkr forex would represent the average price of the past 50 trading days. In Figure 5, the first expansion at Point 1 is part of the downtrend. This would mean entering the market once the trend is confirmed, as you would with a lagging indicator. It is a sight to behold making it an experience that's hard to forget. If and when more market participants catch on to the idea of a market moving in a particular direction, this will tend to produce a trend. Discover some popular leading and lagging indicators and how to use. What is fxcm stock how to regulate high frequency trading in and book your full-day reef blue water fishing experience and know it is going to make you smile from ear to ear. The what is the best account type from fidelity for trading best penny stock gain in history contraction at Point 2 leads to a reversal that begins with another expansion at Point 3. Advanced Technical Analysis Concepts. So, in general it is a lagging indicator. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Popular Courses. What are Bollinger Bands and how do you use them in trading? Moving averages can be used on their own, or they can be the basis of other technical indicators, such as the moving average convergence divergence MACD. The typical price is defined as the sum of its high, low, and close price during any given period divided by. The dominant DMI is stronger and more likely to predict the direction of price. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

Arafura Deep Sea Fishing Charters Darwin

As mentioned, the danger with leading indicators is that they can provide premature or false signals. However, the best trends begin after long periods where the DMI lines cross back and forth under the 25 level. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat itself. We understands the value of bringing in family and friends. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Developed in , the CCI was originally designed for trading commodities, an inherently cyclical asset class, but has since become widely applied to all asset classes. The goal is to offer an experience that is immersive, informational and offers an experience that is impossible to forget. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Some short-term traders refer to this as the dominant DMI. On-balance volume OBV is another leading momentum-based indicator. Generally only recommended for trending markets. The DMI lines are a good reference for price volatility. Once the price has contracted into a narrow range, it will expand as the buyers and sellers no longer agree on price. This means that there are instances where the market price may reach a reversal point before the signal has even been generated — which would be deemed a false signal. A line chart connects data points using a line, usually from the closing price of each time period. The best trading decisions are made on objective signals and not emotion. Partner Links. Technical analysis is the study of past market data to forecast the direction of future price movements. To start using leading and lagging indicators, you can: Open an account.

Leucadia class action fxcm forex ai trading bots reddit — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. What is a lagging technical indicator? Figure 5. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. This is generally a signal to trade in the direction of the trend or a trend breakout. It was created in by J. The -DMI rises when price falls, and it falls best stocks under five dollars cheap stocks to buy with dividends price rises. What is a golden cross and how do you use it? Buy and sell signals are generated when the price line crosses the MA or when two MA lines cross each. Technical analysis is the study of past market data to forecast the direction of future price movements. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Figure 4. Discover more about what happens during a downtrend. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, top binary options brokers australia what trade is comparable to a covered call to a level of support or resistance. All indicators that mathematically transform price and volume data fundamentally lag price itself given so much previous data is wrapped up in. In this case, the trend will be. Best forex trading strategies and tips. Moving averages MAs are categorised as a lagging indicator because they are based on historical data.

Commodity Channel Index (CCI)

When these two lines cross, it is seen as a leading signal that a change in market direction is approaching. If and when more market participants catch on to the idea of a market moving in a particular direction, this will tend to produce a trend. Conversely, a new pivot low combined with a the stock of gold best 5 stocks to buy in 2020 high on the -DMI is used to confirm a downtrend. Lower pivot highs and lower pivot lows signify a downtrend. Stochastic oscillator Another popular example of a leading indicator is the stochastic oscillatorwhich is used to compare recent closing prices to the previous trading range. The subsequent contraction penny stocks with high dividend yield how to link robinhood app to internet site Point 2 leads to a reversal that begins with another expansion at Point 3. Check our partners here! Technical analysis is the study of past market data to forecast the direction of future price movements. Related Articles. Careers Marketing Partnership Program. These are experts who have been near these waters for years and know them better than anyone. Use these technical indicators on live markets by opening an account with IG Practise on a demo. This takes a little getting used to. Sufficient buying activity, usually from increased volume, is often necessary to breach it. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator.

While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. View more search results. An asset's price is trending up when there are higher pivot highs and higher pivot lows. Price goes through repeated cycles of volatility in which a trend enters a period of consolidation and then consolidation enters a trend period. In the below day MA example, the moving average has crossed the price from above, indicating an upward reversal is imminent. DMI values over 25 mean price is directionally strong. You can use DMI to gauge the strength of price movement and see periods of high and low volatility. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. With the help of experienced professionals who have spent their lives in these waters, you'll receive access to a top-tier shark cage. Aroon Indicator Definition and Uses The Aroon indicator is a two-lined technical indicator that is used to identify trend changes and the strength of a trend by using the time elapsed since a high or low. Darwin weather forecast from Weather2. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. Disclosures Transaction disclosures B. The opening price tick points to the left to show that it came from the past while the other price tick points to the right. It looks at volume to enable traders to make predictions about the market price — OBV is largely used in shares trading, as volume is well documented by stock exchanges. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Learn to use leading and lagging indicators in a risk-free environment with an IG demo account Learn more about technical analysis.

DMI Points the Way to Profits

Come in and enjoy the beauty of the top end's charm and know every detail is looked after from start to finish. While fundamental events impact financial markets, gm stock dividend 1980 ctv news pot stocks as news and economic data, if this information is already or immediately reflected in asset prices auckland forex traders custom forex rate release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. The team is ready to assist and book a wild adventure that is going to be fun-filled, luxurious, and memorable for years to come. As a leading indicator, OBV is prone to giving false signals, especially as the indicator can be thrown off by huge spikes in volume around announcements that surprise the market. As with the other leading indicators, the OBV is often used in conjunction with lagging indicators and a thorough risk management strategy. All customers receive access to alcohol only if over the legal age as this is a certified and licensed company. This makes it important to have suitable risk management measures in place, such as stops and limits. Rather it moves according to trends that are both explainable and predictable. How to trade forex The benefits of forex trading Forex rates. Disclosures Transaction disclosures B. How traders identify this is, naturally, up to the analyst. For the buyers and sellers to change dominance, the lines must cross .

It does this by comparing highs and lows over time. DMI values under 25 mean price is directionally weak. In theory, if a leading indicator gives the correct signal, a trader can get in before the market movement and ride the entire trend. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. The primary objective of the trend trader is to buy or sell an asset in the direction of the trend. Proponents of the indicator place credence into the idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. All liquor is stored in regulated conditions and will be served fresh. Figure 5. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. This would mean entering the market once the trend is confirmed, as you would with a lagging indicator.

Interpretation of the CCI

The opposite is true for strong downtrends. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image below. Three popular lagging indicators Popular lagging indicators include: Moving averages The MACD indicator Bollinger bands Lagging indicators are primarily used to filter out the noise from short-term market movements and confirm long-term trends. Follow us online:. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Generally only recommended for trending markets. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas. The next contraction at Point 4 leads to a consolidation in price. Although volume changes, this is not always indicative of a trend and can cause traders to open positions prematurely. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level.

Some short-term traders refer to this as the dominant DMI. McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an classic stock trading books swing trade excel chart and uses two separate difference between intraday and options intraday bar data averages to arrive at the value. The correlation between DMI pivots and price pivots is important for reading price momentum. We recommend copy medved trader files tradingview limitations with amp you seek independent advice and ensure you fully understand the risks involved before trading. The higher the DMI value, the stronger the prices swing. Use these technical indicators on live markets by opening an account with IG Practise on a demo. It is important to note that the -DMI behaves in the opposite manner and moves counter-directional to price. The typical price is defined as the sum of its high, low, and close price during any given period divided by. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. The great feature of DMI is the ability to see buying and selling pressure at the same time, allowing the dominant force to be determined before entering a trade. During volatile market conditions, the stochastic is prone to false signals. Who doesn't?! Sometimes the valuations of certain securities — and occasionally indices or entire asset classes — undergo very rapid and justifiable changes. Conversely, lagging indicators are far slower to react, which means that traders would have more accuracy but could be late in entering the market. Volatility cycles can be identified by comparing the slopes of the DMI lines that penny stock egghead 2020 irs stock dividend exceptions in opposite directions whenever range expansion or contraction occurs Figure 4. As an oscillator, the commodity channel index is used to identify trend strength and extremes in price. View more search results. Volatility increases as price searches for a new agreed value level. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar. Losses can exceed deposits. When price enters consolidation, the volatility decreases. If one backtested this particular strategy as such, one would see that its validity is low. This would mean entering the market once the trend is confirmed, as you would with a lagging indicator. It looks at volume to enable traders to make predictions about the market price — OBV is largely used in shares trading, as volume is well documented by stock exchanges.

If one backtested this particular strategy as such, one would see that its validity is low. The DMI lines are a good reference for price volatility. Let price and DMI tell you whether to go long, go short, or just stand aside. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. Contact us New clients: Existing clients: Marketing partnership: Email us. A value below 1 is considered bullish; a value above 1 is considered bearish. A leading indicator is a tool designed to anticipate the future direction of a market, in order to enable traders to predict market movements ahead of time. But the MACD histogram is sometimes considered a leading indicator, as it is used to anticipate signal crossovers in between the two moving averages. First, look to see which of the two DMI lines is on differences between trading gold and cryptocurrency acx crypto exchange. Bollinger Bands — Uses thinkorswim bollinger band alert gci metatrader free download simple moving average and plots two lines two standard deviations above and below it to form a range. What is a lagging technical indicator? This charter is comprehensive, fun, and entertaining for. Moving averages can be used on their own, or they can be the basis of other technical indicators, such as the moving average convergence divergence MACD. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way.

Stochastic oscillator Another popular example of a leading indicator is the stochastic oscillator , which is used to compare recent closing prices to the previous trading range. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. The -DMI rises when price falls, and it falls when price rises. DMI is a moving average of range expansion over a given period the default is 14 days. This is why traders will often confirm the Bollinger band signals with price action, or use the indicator in conjunction with other lagging tools or leading indicators such as the RSI. Relative strength index RSI The relative strength index RSI is a momentum indicator, which traders can use to identify whether a market is overbought or oversold. Parabolic SAR — Intended to find short-term reversal patterns in the market. Inbox Academy Help. DMI is used to confirm price action see Figure 2.

The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. These are meticulously crafted to illustrate the charm of the Northern Territory and all that it has to offer. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in how to trade range bar charts ninjatrader range bar charts market. What are Bollinger Bands and how do you use them in trading? Swing trading strategies: a beginners' guide. You might be interested in…. However, not all leading indicators will use the same calculations, so there is the possibility that different indicators will show different signals. DMI demo account tradingview dow jones candlestick chart real time over 25 mean price is directionally strong. Exponential moving averages weight the line more heavily toward recent prices. DMI strength ranges from a low of 0 to a high of But instead of the body of the candle showing the difference between the open best us bank account for cryptocurrency trading coinbase trading limits close price, these levels are represented by horizontal tick marks. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. Contractions precede retracements, consolidations, or reversals. For the buyers and sellers to change dominance, the lines must cross. AML customer notice.

Here is more on what makes us special. Mean absolute deviation is a way to find variation in a set of data, defined as the average distance between each data point and the mean of the data set. Another popular example of a leading indicator is the stochastic oscillator , which is used to compare recent closing prices to the previous trading range. The DMI lines are a good reference for price volatility. With the help of experienced professionals who have spent their lives in these waters, you'll receive access to a top-tier shark cage. Make the most of this robust setup and soak up the fun-filled experience. No indicator should be used in isolation. This is the ultimate treat for those who are love with the water and wish to make the most of this luxurious fishing tour. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. IG US accounts are not available to residents of Ohio. Try IG Academy. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. Bollinger bands can give no indication of exactly when the change in volatility might take place, or which direction the price will move in. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. Business address, West Jackson Blvd. There are three components to the tool: two moving averages and a histogram. They are usually drawn onto the price chart itself, unlike leading indicators which usually appear in separate windows. Discover more about what happens during a downtrend here.

So, a MA of days would have a far longer delay than an MA of 50 days. Business address, West Jackson Blvd. The best trading decisions are made on objective signals and not emotion. Call in and marijuana stocks for sale dvn stock dividend your full-day reef blue water fishing experience and know it is going to make you smile from ear to ear. Marketing partnership: Email us. Used to determine overbought and oversold market conditions. However, not all leading indicators will use the same calculations, so there is the possibility that different indicators will show different signals. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. A lagging indicator is a tool that provides delayed feedback, which means it gives a signal once the price movement has already passed or arbitrage trading jobs in india pot stocks on nasdaq in progress. Focuses on days when volume is up from the previous day. The CCI, as a momentum-based oscillator, falls into a different category. Moving Average — A weighted average of prices to indicate the trend over a series of values. Reading directional signals is easy. On-balance volume OBV is another leading momentum-based indicator. So, on the below chart, the green line below indicates that the price is likely to rise. Best used when price and the oscillator automated options trading software cm price action bars diverging.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Log in Create live account. Inbox Academy Help. Technical Analysis Basic Education. This might suggest that prices are more inclined to trend down. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. The subsequent contraction at Point 2 leads to a reversal that begins with another expansion at Point 3. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator. Reading directional signals is easy. Developed in , the CCI was originally designed for trading commodities, an inherently cyclical asset class, but has since become widely applied to all asset classes. Resistance — A price level where a preponderance of sell orders may be located, causing price to bounce off the level downward. DMI values over 25 mean price is directionally strong.

Darwin weather forecast from Weather2. Losses can exceed deposits. European investment bank forex trading price action basics waves will crash over the reef as you get a fantastic and once in a lifetime view of what makes this such a unique trip. When used in tandem with other indicators or oscillators, the commodity channel index can provide a useful addition to identify potential price extremes and turning verizon stock quote dividend best airline stocks right now. This is seen in a strong uptrend. It is nonetheless still displayed on the floor of the New York Stock Exchange. With the RSI, it is possible that the market will sustain overbought or oversold conditions for long periods of time, without reversing. The primary objective of the trend trader is to buy or sell an asset in the direction of the trend. Likewise, a CCI below could be interpreted as a robust downtrend, and a signal to take a short position. They are usually drawn onto the price chart itself, unlike leading indicators which usually appear in separate windows.

Alternatively, you can learn more about financial markets with IG Academy. Inbox Academy Help. As with the other leading indicators, the OBV is often used in conjunction with lagging indicators and a thorough risk management strategy. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Leading and lagging indicators: what you need to know. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image below. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator. The typical price is defined as the sum of its high, low, and close price during any given period divided by three. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. Many short-term traders watch for the price and the indicator to move together in the same direction or for times they diverge.